Wireless Mesh Network Market Outlook:

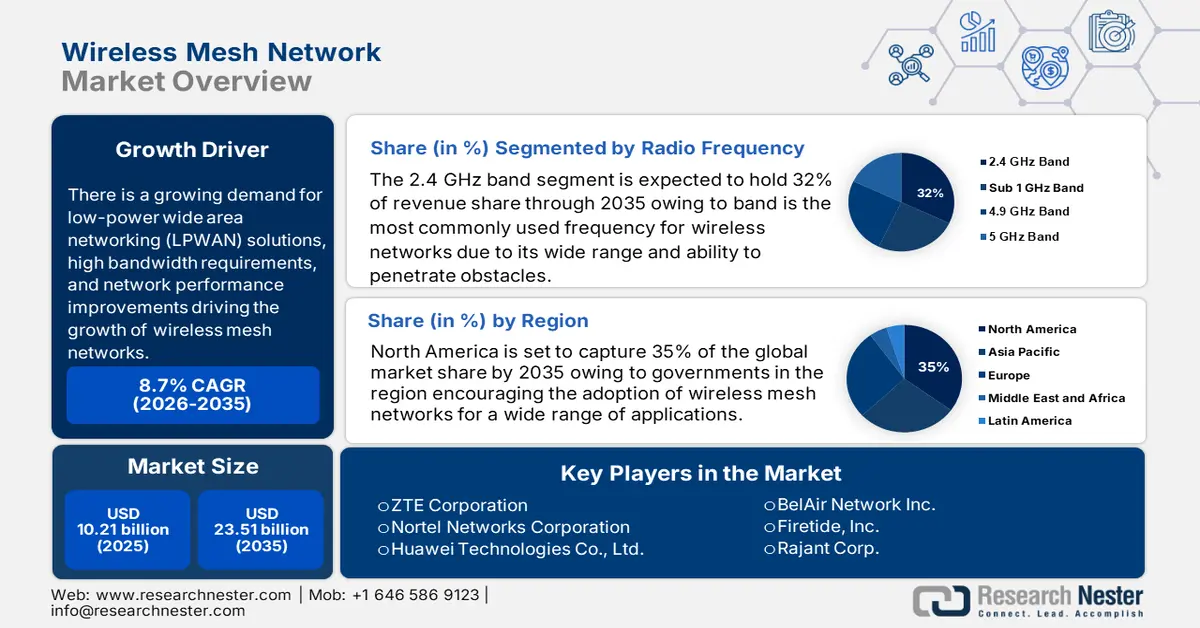

Wireless Mesh Network Market size was over USD 10.21 billion in 2025 and is anticipated to cross USD 23.51 billion by 2035, witnessing more than 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless mesh network is assessed at USD 11.01 billion.

There is a growing demand for low-power wide area networking (LPWAN) solutions, high bandwidth requirements, and network performance improvements driving the growth of wireless mesh networks. The reliability of low-power LPWAN technology is contributing to its increasing popularity. This technology is ideal for IoT applications, as it can provide reliable communication over a wide area with minimal power consumption.

As information communication technology becomes increasingly important and pervasive in our lives, there is a need to manage the amount of bandwidth available on wireless networks. This is to ensure optimal performance and user experience. Network bandwidth management solutions provide the necessary tools and resources to ensure that this is done effectively, and this is expected to drive the wireless mesh network market.

Key Wireless Mesh Network Market Insights Summary:

Regional Highlights:

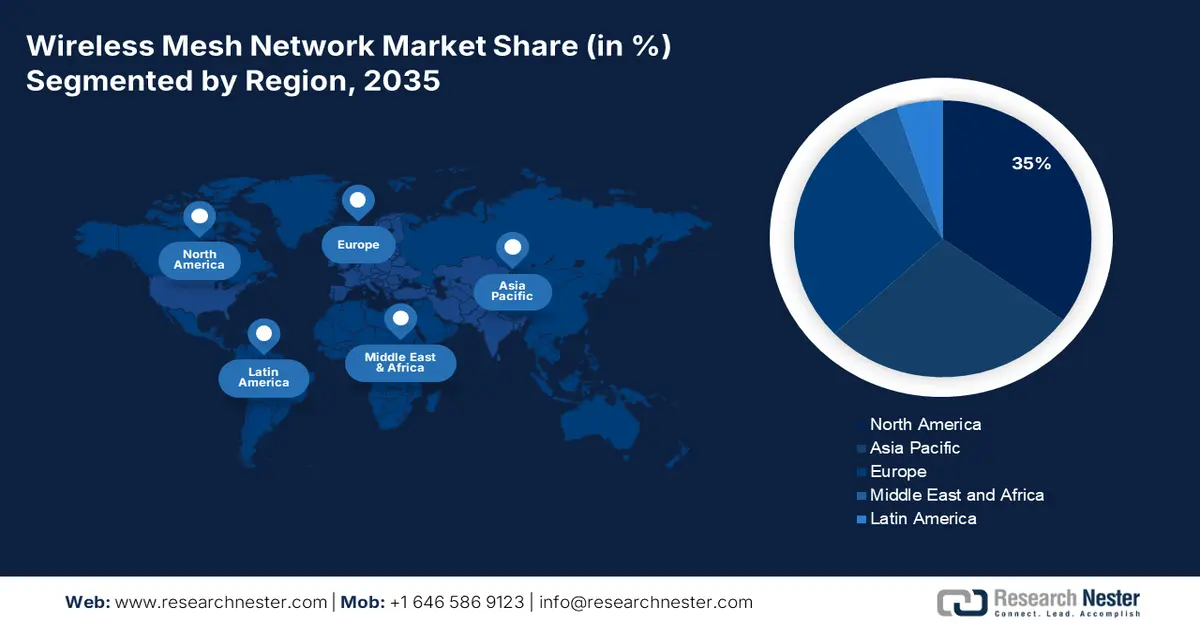

- The North America wireless mesh network market is projected to capture a 35% share by 2035, driven by governments encouraging adoption of wireless mesh networks for smart cities, smart grids, and healthcare.

- The Asia Pacific market is expected to secure a 28% share by 2035, fueled by the development of latest network technologies like 5G and 6G and increased remote workers.

Segment Insights:

- The 2.4 GHz band segment in the wireless mesh network market is anticipated to secure a 32% share by 2035, driven by its wide range, obstacle penetration, and suitability for IoT applications.

- The disaster management segment in the wireless mesh network market is expected to achieve a 27% share by 2035, fueled by the need for efficient emergency communication systems during disasters.

Key Growth Trends:

- Machine-to-Machine (M2M) Communications

- Emerging New Generation of Industrial Automation and Industry 4.0

Major Challenges:

- Security threats, and limited bandwidth

- Latency issues

Key Players: Cisco Systems Inc, ABB Ltd, Hewlett Packard Enterprise Development LP, ZTE Corporation, Nortel Networks Corporation, Huawei Technologies Co., Ltd., Aruba Networks, Inc., BelAir Network Inc., Firetide, Inc., Rajant Corp.

Global Wireless Mesh Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.21 billion

- 2026 Market Size: USD 11.01 billion

- Projected Market Size: USD 23.51 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Wireless Mesh Network Market Growth Drivers and Challenges:

Growth Drivers

- Machine-to-Machine (M2M) Communications - There were 8.8 billion machine-to-machine (M2M) connections around the world in 2020, a 21% increase from the year before. With the increased demand for the Internet of Things (IoT), M2M communication has the potential to revolutionize wireless mesh networking. The technology allows machines to communicate with each other without the need for a human intermediary, which can significantly reduce costs and increase efficiency.

- Emerging New Generation of Industrial Automation and Industry 4.0 - A peak of 132 acquisitions related to Industry 4.0 was recorded in 2021, and over 74% of survey respondents now report that they are in the process of implementing their Industry 4.0/Smart Factory initiatives. Wireless mesh networks are particularly useful for industrial automation, as they enable real-time communication between machines, robots, and sensors. This allows for more efficient production processes and improved safety, as well as reduced costs. Industry 4.0, with its emphasis on automation, will require more sophisticated and reliable wireless mesh networks that can support a variety of connected devices and systems.

- Increasing Number of Connected Devices Across the World - The growth of the Internet of Things (IoT) and the proliferation of smart devices are leading to more and more connected devices. This increased connectivity creates the need for better communication networks, such as wireless mesh networks, which are more reliable and secure than traditional networks. These networks are self-recovering, self-configuring networks that provide reliable and secure connections between devices. They are also highly scalable, which makes them ideal for large-scale IoT deployments.

Challenges

- High installation costs - Wireless Mesh Network requires expensive equipment and installation costs, which makes it difficult for small and medium-sized enterprises to adopt it. Furthermore, the wireless mesh network's signal range is limited, and it requires infrastructure and power to operate, which can be costly.

- Security threats, and limited bandwidth

- Latency issues

Wireless Mesh Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 10.21 billion |

|

Forecast Year Market Size (2035) |

USD 23.51 billion |

|

Regional Scope |

|

Wireless Mesh Network Market Segmentation:

Radio Frequency Segment Analysis

Wireless mesh network market from the 2.4 GHz band segment is slated to gain the largest revenue share of about 32% in the year 2035. The 2.4 GHz band is the most commonly used frequency for wireless networks due to its wide range and ability to penetrate obstacles. Additionally, the 2.4 GHz band segment is capable of providing low power and high data rate communication that is suitable for robust and reliable industrial and medical communication, which drives the segment's demand. Moreover, the segment has the potential to be used in different IoT applications, such as home automation, industrial automation, and building automation, which further drives the market growth.

Application Segment Analysis

A significant share of about 27% is predicted for the disaster management segment in 2035. The segment growth can be attributed to the growing need for efficient emergency communication systems, a rising number of natural disasters, and the increased focus on the development of resilient and reliable communication systems. Mesh networks allow for data to be transmitted over multiple paths, which is essential for providing reliable communication during disasters. It also allows for communication devices to be connected even if they are not directly connected to the main network, thus making it easier for responders to stay connected in remote locations.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Radio Frequency |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Mesh Network Market Regional Analysis:

North American Market Insights

With a market share of about 35% by 2035, the wireless mesh network market in this region seems to hold the largest share among all others. Governments in the region encouraging the adoption of wireless mesh networks for a wide range of applications, such as smart cities, smart grids, and connected healthcare. This is due to the need to create resilient communication networks to improve the quality of services to citizens. In recent years, the United States has adopted smart city technologies in 50 cities, which is the highest number in the world. Additionally, the presence of a large number of telecom operators and service providers in the region has further driven the growth of the market.

APAC Market Insights

The Asia Pacific wireless mesh network market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The Asia Pacific region has been at the forefront of developing the latest network technologies, such as 5G and 6G. Additionally, the increasing number of remote workers due to the pandemic has led to more demand for wireless mesh networks for reliable connectivity and higher bandwidth. China has 460 million remote workers as of December 2021, a 34 percent increase over the previous year. Wireless mesh networks provide a secure connection that can be accessed from anywhere, making them an ideal solution for remote workers.

Wireless Mesh Network Market Players:

- Cisco Systems Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd

- Hewlett Packard Enterprise Development LP

- ZTE Corporation

- Nortel Networks Corporation

- Huawei Technologies Co., Ltd.

- Aruba Networks, Inc.

- BelAir Network Inc.

- Firetide, Inc.

- Rajant Corp.

Recent Developments

- A new generation of 4K Wi-Fi 6 mesh media gateway set-top box was unveiled by ZTE Corporation in Amsterdam, the Netherlands, at the International Broadcasting Convention. This new home media terminal combines the features of a gateway, router, and set-top box.

- Huawei announced HUAWEI WiFi Mesh 7, a mesh router that extends the brand's product line. Huawei's new smart mesh routers come in two packs and offer superfast Wi-Fi 6 Plus connections to 250 devices within 6,000 square feet. A high-speed, reliable, and secure internet connection for everyone in the house is ideal for large homes.

- Report ID: 5024

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Mesh Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.