Vehicle Dynamic Control System Market Outlook:

Vehicle Dynamic Control System Market size was valued at USD 10.1 billion in 2024 and is projected to reach a valuation of USD 65.5 billion by the end of 2037, rising at a CAGR of 10% during the forecast period, i.e., 2025-2037. In 2025, the industry size of vehicle dynamic control systems is assessed at USD 14.9 billion.

The vehicle dynamic control system market is undergoing significant expansion with the convergence of autonomous driving technology, electrification, and software-defined vehicle architecture. Downstream, international semiconductor supply is a major basis of the industry, with the United States continuing to depend on Asia production for advanced chips and components, while increasing domestic investment in key materials and end-stage manufacturing.

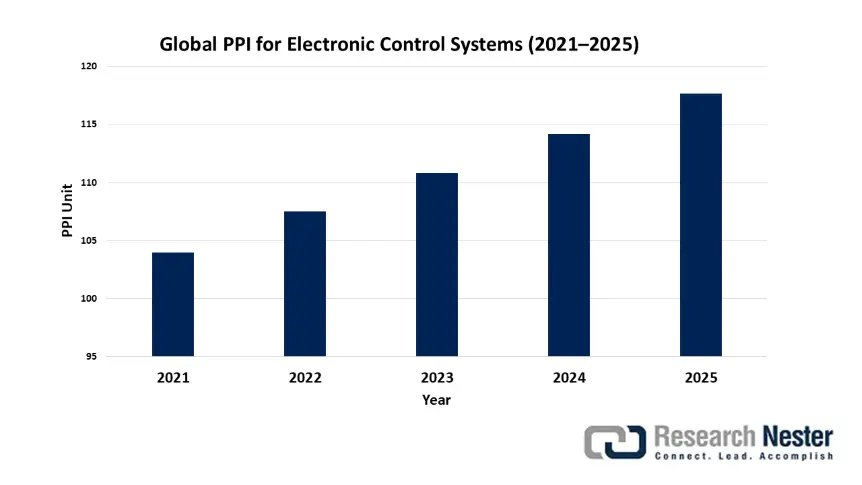

Source: U.S. Bureau of Labor Statistics

Producer Price Index (PPI) and Consumer Price Index (CPI) in electronic control and advanced automotive systems similarly reflect evolving cost patterns within the industry. By mid-2025, the CPI increased 1.7% year-over-year, while the durable goods category, such as vehicle dynamic control units, recorded stable prices owing to continuous supply chain improvements and risk mitigation policies. Plant upgrade investment and smart manufacturing capability become increasingly key with public-private partnerships and global OEMs, especially in the U.S. and Japan, where automated and hybrid man-robot lines are installed in order to enable quick deployment of sophisticated ECUs and sensor suites.

Vehicle Dynamic Control System Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory requirements and safety standards: Global government regulations are mandating the use of advanced vehicle dynamic control systems in new cars, which is creating an enormous market opportunity. In December 2024, China's Ministry of Industry and Information Technology issued updated regulations requiring the adoption of Electronic Stability Control and advanced vehicle dynamic systems on all new energy cars. The demand accelerates local demand for high-end, AI-capable VDCS and continues to stimulate global supply chain innovations. Complementary regulatory systems are being set up in major automobile markets, with governments recognizing the crucial significance of such systems to reduce road crashes and improve automotive safety. The regulatory initiative extends beyond traditional passenger cars to include commercial vehicles, motorbikes, and off-road use, thereby expanding the vehicle dynamic control system market size.

- Autonomous car technology innovation and ADAS uptake: The explosive development in autonomous driving technology is creating record-breaking demand for sophisticated vehicle dynamic control systems. In March 2025, Japan government's Smart Mobility 2030 initiative took effect, subsidizing the country-wide deployment of vehicle dynamic control on software-defined EV and autonomous platforms. The national initiative emphasizes the development of interoperable data infrastructure and regulatory frameworks for achieving Level 3 and 4 autonomy. Vehicle dynamic control systems are increasingly forming the foundation of autonomy-enabling technology for autonomous cars, offering high-precision vehicle movement management, forward-looking road condition response, and autonomous integration with advanced driver assistance systems.

- Electric vehicle ubiquity and platform integration: Global adoption of electric vehicles is fundamentally reshaping the vehicle dynamic control system market with new opportunities for integrated solutions. Mercedes-Benz's HYPERSCREEN Suspension system, a debut in AMG electric vehicles, became available in April 2024, featuring predictive hydraulics combined with a millisecond response. The integrated system is available through MB.OS and enters the market in 2025, providing unparalleled vehicle control in demanding driving conditions. Electric vehicles require sophisticated dynamic control systems with the ability to manage regenerative braking, direct torque supply, and unique weight distribution patterns. The integration of vehicle dynamic control with electric powertrains offers optimal energy management, enhanced range, and improved performance, making such systems essential parts of electric vehicle architectures today.

Challenges

- Centralized vehicle architecture challenges: One of the critical challenges facing the industry is the increasing complexity of system integration and the need for standardized vehicle architectures across multiple vehicle platforms. NXP Semiconductors and Rimac partnered in June 2025 to create a centralized vehicle architecture for upcoming software-defined vehicles, with NXP's S32E2 high-performance processor enabling the consolidation of more than 20 control units into three, minimizing complexity and allowing real-time operation of the vehicle. While this integration is desirable, it is also challenging in system verification, safety qualification, and operation fail-safe. Integrating several control functions into centralized units requires sophisticated software architectures and robust cybersecurity methods, hence adding to the complexity of development and putting time-to-market pressure on manufacturers.

- Skills gap in vehicle dynamic control systems: Another significant challenge is the workforce development and skills gap needed to sustain the rapid development of vehicle dynamic control systems. In February 2025, FORVIA HELLA secured an order with a value of over €1 billion for the creation and production of advanced electronic control modules like the ACM and iPDM for global OEMs, to be manufactured in series in 2028. These innovations reduce wiring harness weight and allow real-time power supply, which is critical for fail-operational safety and advanced autonomous driving. However, the development and manufacture of such sophisticated systems require sophisticated technical expertise in software development, systems integration, and functional safety. The industry is faced with recruitment and talent retention issues of qualified individuals with sufficient capabilities to develop, test, and verify these complex systems, which could hinder innovation speed and market growth.

Vehicle Dynamic Control System Market Size and Forecast

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

10% |

|

Base Year Market Size (2024) |

USD 10.1 billion |

|

Forecast Year Market Size (2037) |

USD 65.5 billion |

|

Regional Scope |

|

Vehicle Dynamic Control System Market Segmentation:

Type Segment Analysis

The Type 2 (advanced/ESC) segment is anticipated to command a 68.8% vehicle dynamic control system market share during the forecast period, owing to the strength of regulatory safety requirements and increasing complexity of vehicle stability needs. In October 2023, Bosch collaborated with Mazda to develop the DSC-TRACK system, an ESP software for the motorsport-oriented Roadster Upgraded Model by Mazda, tested in the Roadster Party Race. This system has minimal intervention on high-performance driving and only intervenes when loss of control is detected, a case of technology transfer from the race track to road cars.

Next-generation ESC systems deliver improved vehicle stability control, sophisticated safety features, and superior performance characteristics compared to standard systems. Segment growth is fueled by increasing adoption of electric and hybrid vehicles, which require sophisticated stability control to manage instant torque output and regenerative braking systems properly. Segment growth is also fueled by increased demand for premium vehicles and homogenization of high-end safety features across automotive segments, and hence, advanced ESC systems are essential to maintain a competitive position in the automotive industry.

Application Segment Analysis

The passenger cars segment is set to capture a 62.5% share through 2037, demonstrating the largest volume vehicle dynamic control system market. Passenger cars are the principal field for application of state-of-the-art vehicle dynamics control systems due to the high volume of production, increasing safety requirements, and customers' need for a better driving experience. For instance, Magna International launched its next-generation Intelligent Chassis Control Module in October 2024, an ASIL D-ready, modular unit to facilitate high integration on a flexible vehicle structure. ICCM is designed to be mounted outside the compartment and serves as the foundation for future-proofing vehicle architecture. The expansion in the segment is driven by the boom of electric vehicles, autonomous driving systems, and the installation of high-level advanced driver assistance systems requiring sophisticated vehicle motion control.

End user Segment Analysis

The individual consumer segment is projected to hold a 71.5% share by 2037, driven by the mass vehicle dynamic control system market adoption of advanced safety technology and customer interest in an enhanced driving experience. In January 2024, AISIN Corporation launched its Actuator for Electric Active Stabilizer on premium EV platforms, ensuring faster response and pitch control for enhanced stability and ride comfort. The technology has been adopted by global OEMs in ride comfort and active safety.

Consumers are more interested in safety features and willing to pay for advanced vehicle dynamic control systems that provide higher stability, safety, and driving performance. The growth in the segment is coming through the democratization of luxury safety technologies, with top-of-the-line ESC systems being fitted as standard equipment in vehicle segments rather than remaining limited to luxury vehicles. As vehicle dynamic control systems become increasingly commoditized and affordable, individual buyers remain the largest end-user market segment.

Our in-depth analysis of the vehicle dynamic control system market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

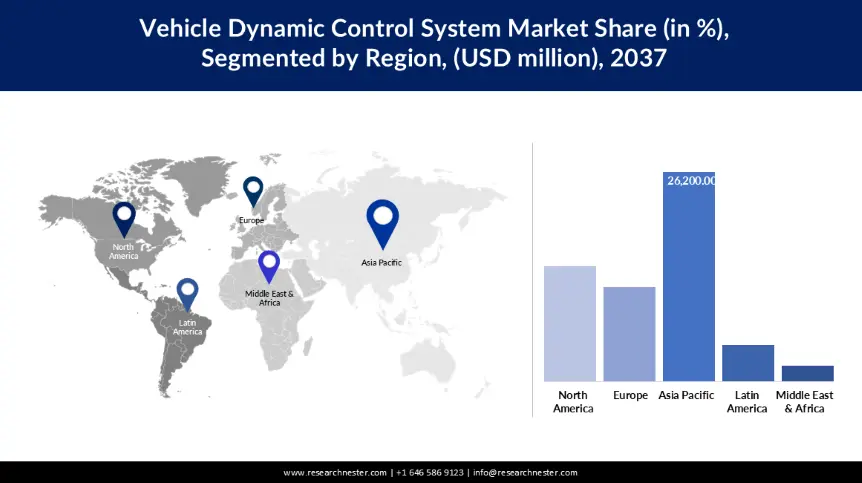

Vehicle Dynamic Control System Market - Regional Analysis

APAC Market Insight

Asia Pacific vehicle dynamic control system market is anticipated to account for a 40.1% share during the forecast period, with rising vehicle production rates, increasing safety awareness, and government mandates for sophisticated safety features. Continental announced the large-scale implementation of its Tire Information System and ContiConnect platform across global fleets in August 2023, with real-time tire monitoring, predictive maintenance, and reduced operating expenses for logistics firms. The region boasts the world's largest automotive production base, a growing middle-class population, and growing levels of vehicle ownership. Asian governments are implementing stringent safety requirements and promoting the adoption of electric vehicles, driving high demand for advanced vehicle dynamic control systems. The region's focus on technology innovation and manufacturing excellence makes it an optimal growth market for vehicle dynamic control technologies.

China is one of the largest vehicle dynamic control system market, driven by government policies, faster take-up of electric vehicles, and massive automotive production capacities. In December 2024, China's Ministry of Industry and Information Technology published updated regulations requiring all new energy vehicles to include Electronic Stability Control and advanced vehicle dynamic systems. This requirement speeds up the need for advanced, AI-integrated VDCS in the home market and continues to push innovations in worldwide supply chains. China automobile market is characterized by rapid technological innovation, strong government subsidies for electric vehicles, and growing consumer demand for safety features. The market boasts a substantial domestic automobile industry, significant investment in autonomous driving technologies, and expanding export opportunities for Chinese automobile firms.

India vehicle dynamic control system market is experiencing aggressive growth driven by increasing vehicle production, increasing safety consciousness, and government promotion of advanced automotive technology. ZF in April 2023 detailed plans to introduce its AxTrax AVE electric portal axle, permitting the integration of electric propulsion and advanced dynamic control in Asian-Pacific and European buses and urban commercial vehicles. The market is driven by rising vehicle ownership, growing disposable income, and government support for electric vehicle adoption. Domestic production schemes and alignment with overseas technology suppliers are expanding the availability of advanced vehicle dynamic control systems. High cost consciousness and increasing demand for safety features characterize market competition, propelling the adoption of advanced vehicle dynamic control technologies across all types of vehicles.

Country Specific Insights

|

Country/Region |

2038 Revenue Share (%) |

Unique Technology Focus |

Key Growth Driver |

Notable Project/Initiative |

|

Japan |

20.5 |

Seismic-responsive stability control |

Autonomous vehicle validation |

Toyota e-Palette Dynamic Shield |

|

China |

30.0 |

AI-predictive rollover prevention |

EV SUV market explosion |

BYD Cloud-Chassis Initiative |

|

India |

17.0 |

Low-cost monsoon traction systems |

Compact car safety mandates |

Tata Nano 2.0 Safety Upgrade |

|

South Korea |

9.5 |

5G-connected torque vectoring |

Performance EV exports |

Hyundai Ioniq N Race Control Suite |

|

Australia |

8.0 |

Off-road articulation algorithms |

Mining vehicle safety regulations |

Outback Terrain Response 2030 |

|

Indonesia |

3.0 |

Flood-wading stability protocols |

Island logistics vehicle demand |

20k Islands ADAS Adoption Program |

|

Malaysia |

3.5 |

ASEAN tropical condition calibration |

Cross-border ride-hailing standards |

Grab Fleet Safety Enhancement |

|

Rest of APAC |

2.5 |

Volcano-ash traction control |

Disaster response vehicle readiness |

Pacific Ring of Fire Mobility Project |

North America Market Insights

North America vehicle dynamic control system market is expected to expand at a CAGR of 7.5% from 2025 to 2037, driven by stringent safety regulations, early adoption of technology for autonomous driving, and a strong focus on vehicle electrification. In September 2024, Bosch launched the Vehicle Motion Management platform with Vehicle Dynamics Control 2.0 at the North America Mobility Experience event, in collaboration with Powernet Guardian, in response to regional demand for robust, predictive chassis control, which is growing rapidly. North American automotive companies are investing heavily in electric vehicle platforms and autonomous drive technology, creating a healthy demand for advanced vehicle dynamic control systems. The region's technology leadership and early adoption of new automotive technologies make it an ideal growth market for advanced vehicle dynamic control solutions.

The U.S. vehicle dynamic control system market offers strong regulatory support and early adoption of advanced vehicle technologies, including high levels of investment in electric vehicle infrastructure and autonomous driving technology. In June 2023, ZF introduced a TRW-branded Electronic Brake Booster for the EV aftermarket, originally designed for the Volkswagen Group, consisting of regenerative and friction braking with advanced pressure control algorithms. This product provides high-performance braking capability to the independent repair market, meeting the growing aftermarket demand for advanced vehicle dynamic control systems. The U.S. market has a large population of vehicles, high vehicle replacement rates, and strong consumer demand for safety and performance capability. Governmental and state regulations supporting vehicle electrification and autonomous driving technology continue to drive market growth.

Canada vehicle dynamic control system market is experiencing consistent growth driven by harmonized safety regulations with the U.S. and increasing acceptance of electric vehicles. In May 2024, ZF Friedrichshafen revealed its SCALAR EVO Cast telematics solution, linking real-time vehicle health data with cloud connectivity for commercial fleets across Europe and North America. This facilitates predictive maintenance and active management of VDC, which can be availed by Canadian fleet operators. The market is supported by incentives provided by the government towards the adoption of electric vehicles and the construction of infrastructure, boosting demand for high-level vehicle dynamic control systems. Consumers in Canada are strong proponents of safety features and early adopters of high-level automotive technology, supporting the growth of advanced vehicle dynamic control systems.

Europe Market Insights

Europe vehicle dynamic control system market is likely to experience substantial growth between 2025 and 2037, owing to strong safety laws, eco-norms, and the continent's leadership in automotive innovation. Valeo registered record sales in its Powertrain Systems business unit in August 2024, owing to strong demand for combined VDC and efficiency modules for hybrid and electric vehicles across the world, with module VCU for motorbikes and off-road platforms also introduced. European automotive companies are leaders in the development of electric vehicles and autonomous driving technologies, generating significant demand for high-end vehicle dynamic control systems. The emphasis on sustainability and innovation in the region ensures the ongoing development of vehicle dynamic control technology.

A significant Europe vehicle dynamic control system market is Germany, due to its position as a world leader in automobile technology and its home to high-end automobile brands. Continental and Nisshinbo established a joint venture in Gurugram in March 2022 to manufacture valve blocks for Electronic Brake Systems, critical to ESC and ABS, and have produced more than 7.3 million units of EBS, indicating the growing scale and localization trend of advanced safety technology. German automakers are making significant investments in electric vehicle platforms and autonomous driving technologies, which require sophisticated vehicle dynamic control systems. The market is also supported by strong research and development capabilities, advanced manufacturing facilities, and robust customer demand for premium motor vehicle technology. Germany's leadership in automotive innovation and engineering continues to drive market growth and technology advancement.

Regulatory convergence with European norms, as well as increased rates of take-up of electric vehicles, are driving growth in the UK market. In January 2023, Bosch made Vehicle Dynamics Control 2.0 available to the public for the first time at CES Las Vegas, which shows how the shift from legacy, reactive body control systems is happening to end-to-end vehicle motion management, with VDC 2.0 being the enabling technology for software-defined vehicles. The UK market has a strong automotive aftermarket and increasing consumer awareness of safety technologies. Government incentives for the adoption of electric vehicles and autonomous driving technology create the opportunity for advanced vehicle dynamic control systems. Early new technology adoption and high consumer willingness to pay for advanced safety features characterize the market.

Country Specific Insights

|

Country |

2038 Revenue Share (%) |

% of Auto Safety Budget (2025) |

Key Insights |

|

United Kingdom |

20.0 |

9.5 |

AI-curve speed adaptation, BREXIT-compliant systems, motorsport-derived tech |

|

Germany |

25.5 |

8.8 |

48V active anti-roll bars (Mercedes/Porsche), 40% premium OEM share |

|

France |

17.5 |

6.2 |

Snow-mode vectoring (Alpine EVs), Stellantis platform integration |

|

Italy |

12.0 |

7.5 |

Hypercar drift control algorithms (Ferrari), heritage road calibration |

|

Spain |

10.0 |

4.5 |

Rally-derived gravel control (SEAT), Morocco-EU testing corridors |

|

Nordics |

10.0 |

7.0 |

Black ice prediction systems, 100% EV torque management by 2030 |

|

Rest of Europe |

5.0 |

4.0 |

Eastern EU cost-optimized systems, EU General Safety Regulation compliance |

Source: Euro NCAP

Key Vehicle Dynamic Control System Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Siemens AG

- Denso Corporation

- Toyota Motor Corporation

- Nissan Motor Corporation

- BMW AG

- Hyundai Mobis

- Subaru Corporation

- ADVICS Co. Ltd.

- Knorr-Bremse AG

- LS Automotive

- IPG Automotive GmbH

- Tata Motors

- Proton Holdings

The vehicle dynamic control system market is highly competitive, with dominant automotive suppliers and technology companies vying for market share through innovation, technological advancements, and strategic partnerships. A significant recent development was in April 2025, when Bosch reported 2024 revenue of USD 97.8 billion, attributing growth to sustained demand for adaptive ECU and control structures across mobility solutions, as well as industrial technology. Bosch intensified investment in embedded AI and cyber-physical VDC platforms, illustrating a dedication to next-generation vehicle dynamic control technologies. Here are some leading companies in the vehicle dynamic control system market:

Recent Developments

- In April 2025, Nuro raised USD 106 million in Series E funding, continuing its growth as a premier autonomous vehicle technology provider. Total funding reached $2.2 billion, with this round intended to scale Nuro’s platform and expand its commercial partnerships. This investment signals strong confidence in the value of highly automated mobility services.

- In February 2025, WeRide was included in Nvidia’s AI investment portfolio, leading to a surge in its stock price. WeRide’s Level 4 AV technology, tested in over 30 cities in nine countries, is positioned as a reference point for AI-driven vehicle dynamics platforms in the race for scalable, safe, and automated mobility.

- In November 2024, Continental introduced a motorsports-grade brake control system for the Bugatti Bolide hypercar, integrating advanced ABS, ES

- C, and TCS technologies. Developed through Continental Engineering Services, this system pushes performance limits by enabling rapid adaptation in extreme driving conditions. The innovation demonstrates Continental’s engineering leadership in high-performance applications and raises global benchmarks in vehicle dynamics for luxury and motorsport segments.

- In October 2024, Bosch inaugurated a 300,000 sqm R&D facility in Suzhou, China, dedicated to new energy vehicles and autonomous driving systems. This advanced hub consolidates vehicle dynamics control, core electronics, and intelligent driving technologies, beginning mass production at the end of 2024. The investment dramatically increases China’s domestic capability in advanced control systems and bolsters local EV technology supply chains.

- Report ID: 7979

- Published Date: Aug 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert