Adaptive Cruise Control System Market Outlook:

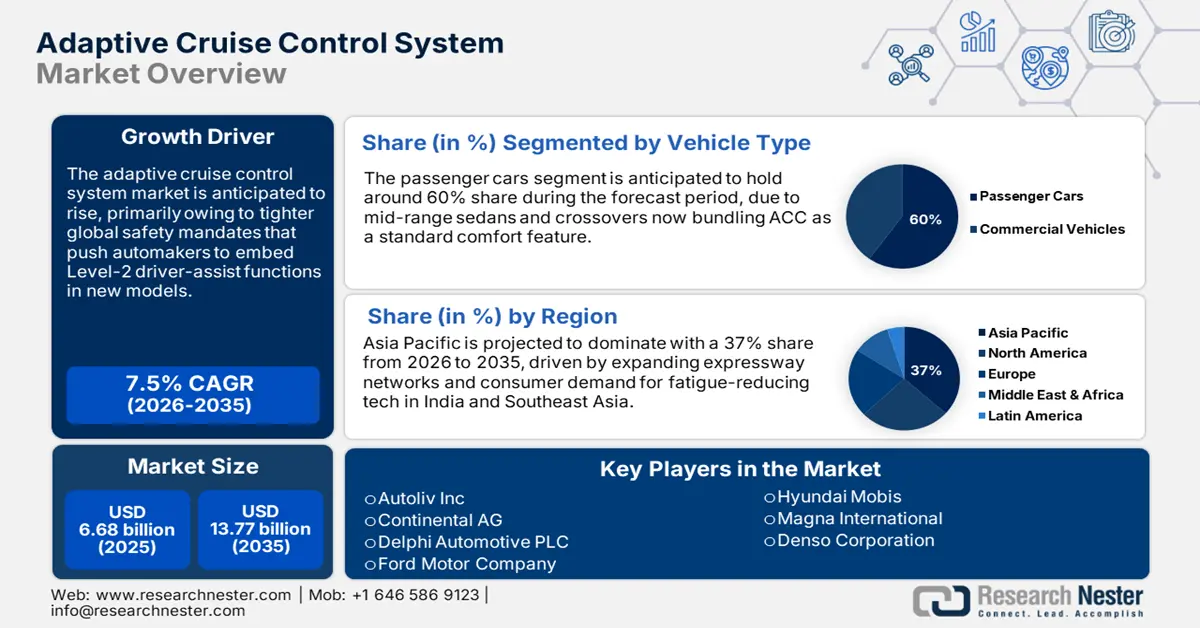

Adaptive Cruise Control System Market size was over USD 6.68 billion in 2025 and is poised to exceed USD 13.77 billion by 2035, growing at over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of adaptive cruise control system is estimated at USD 7.13 billion.

The adaptive cruise control system market is anticipated to rise, primarily owing to the increasing popularity of driver-assist systems in cars of all classes. In March 2025, Magna and NVIDIA further expanded their partnership to improve the adaptive cruise control systems by using AI technologies. Car manufacturers are focusing on adding semi-autonomous features to their vehicles to meet safety and comfort demands. ACC systems are already emerging as important competitive features in new car launches in segments ranging from electrified vehicles to premium SUVs. Legal requirements for safety and the increased popularity of ADAS in various markets are also contributing to a quicker growth rate. ACC is now being incorporated into mainstream vehicles, making safety technologies more affordable and accessible to a wider audience. Moreover, the increasing population of cities around the world increases the need for intelligent traffic navigation systems.

Adoption of connected vehicle technologies and trends towards electrification are driving adaptive cruise control implementation. In March 2024, Rivian unveiled a new hands-free driving system with advanced adaptive cruise control capabilities for future EV models. Real-world testing programs like Waymo show that ACC systems are becoming more advanced in realizing highway autonomy. Furthermore, the ACC is being widely used in the commercial vehicle segment for fuel efficiency and logistics safety improvement. Rules on the use of AVs, such as the U.K.’s recently finalized AV use regulation, encourage ACC standardization. Globalization of ACC system investments is being supported by the three pillars of sustainability, autonomy, and safety.

Key Adaptive Cruise Control System Market Insights Summary:

Regional Highlights:

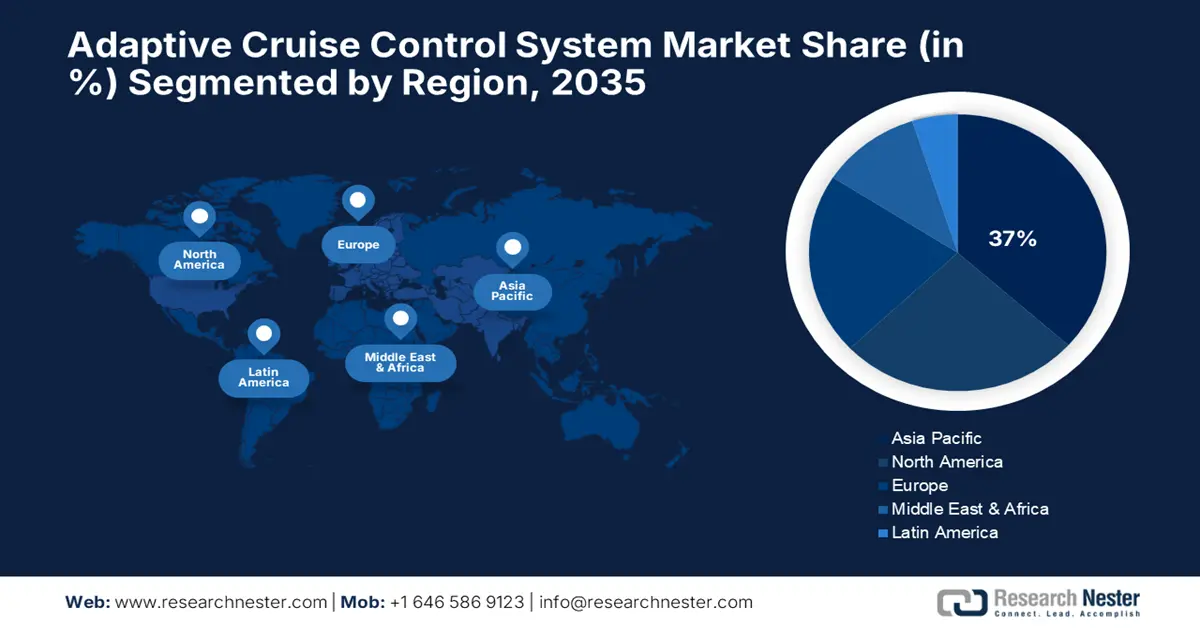

- Asia Pacific leads the adaptive cruise control system market with a 37% share, fueled by a growing population density, increased purchasing power, and an embrace of technology, supporting strong growth prospects through 2035.

- North America's Adaptive Cruise Control System Market is set for moderate growth through 2026–2035, attributed to the increased adoption of ADAS and modernized commercial fleets.

Segment Insights:

- Passenger Cars segment are projected to hold over 60% share by 2035, fueled by demand for safety and semi-autonomous driving features.

- The Radar segment is projected to hold over a 40% share by 2035, driven by its superior object detection accuracy and performance in adverse weather conditions.

Key Growth Trends:

- Increase in the use of advanced driver assistance systems (ADAS)

- Electrification and smart vehicle development

Major Challenges:

- Integration challenges in cost-sensitive markets

- Sensor reliability and harsh environmental conditions

- Key Players: Delphi Automotive PLC, Denso Corporation, Autoliv Inc, Continental AG, Ford Motor Company, Hyundai Mobis, Magna International.

Global Adaptive Cruise Control System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.68 billion

- 2026 Market Size: USD 7.13 billion

- Projected Market Size: USD 13.77 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 12 August, 2025

Adaptive Cruise Control System Market Growth Drivers and Challenges:

Growth Drivers

- Increase in the use of advanced driver assistance systems (ADAS): Today, car manufacturers are incorporating ADAS features steadily to meet the increasing regulatory and consumer requirements for secure driving. In April 2024, Toyota initiated a new ADAS platform for vehicles, making advanced changes to the adaptive cruise control feature across classes. Consumers place a high value on safety and driver comfort, which is why OEMs are increasingly integrating ACC into new models. Thus, standardizing ACC even in mid-segment vehicles increases volume growth in all markets. Modern regulatory safety ratings such as Euro NCAP now encourage the use of active cruise control. Government measures aimed at enhancing the safety of vehicles globally enhance the position of ACC in preventing accidents. Further integrating ACC as a basic functionality, the expansion of ADAS ecosystems is continuing.

- Electrification and smart vehicle development: The increase in the production of electric vehicles has pushed the integration of adaptive cruise control. In January 2025, BYD said that it would install adaptive cruise control in all of its electric vehicles by the end of 2025 to improve the automation of driving safety. EVs prefer composition with lighter, software-based driver assistance systems, which are consistent with ACC system designs. Advanced ACC algorithms are used in the context of autonomous driving research and within highway pilot projects. Smart city concepts and connected transportation frameworks, which focus on coordinating traffic patterns, are advantageous to ACC adoption. Automotive original equipment manufacturers are now using LIDAR, radar, and AI sensors to improve the accuracy of longitudinal control. Technological advancements such as electrification and intelligent mobility are the key factors that have been driving the advancement of adaptive cruise systems.

- Commercial vehicle safety and fleet optimization needs: Adaptive cruise control is gaining popularity among commercial fleets to achieve safer and more efficient transportation. In February 2024, Trans.Info researchers revealed that ACC could be used to enhance the active safety and fuel efficiency of fleet vehicles. The regulatory requirements for the safety of commercial drivers push up the pace of ACC system demands. Fleet operators appreciate ACC for its effectiveness in reducing fatigue, collision, and liability hazards. Efficiency improvements in this control system are critical as fuel costs continue to rise. The uptake of Commercial ACC is prevalent in the long-haul trucking, public transport, and urban delivery industries. The perceived roles of ACC systems have shifted among business models, where they are seen as operational cost-reduction instruments.

Challenges

- Integration challenges in cost-sensitive markets: The use of adaptive cruise control systems in cost-sensitive markets poses design and affordability challenges. ACC entails the use of sensitive sensors, processing units, and calibration, which translates to increased costs for the vehicle. Mid-tier and low-tier automobile makers weigh the rates of adoption against the price sensitivity of consumers. Compared to the luxury segments, the Tier-2 and Tier-3 markets have a relatively slower penetration rate. Automakers need to develop cost-efficient sensor fusion and efficient software architecture on which self-driving systems should be built. To extend the availability of access to ACC across global vehicle markets, it is imperative to overcome affordability barriers.

- Sensor reliability and harsh environmental conditions: Adaptive cruise control relies on sensors, and these can be affected by weather conditions, therefore making the system vulnerable. Radar and camera sensors are affected by various environmental conditions such as rain, fog, snow, and dust storms. The failures in sensors can have impacts on safety and necessitate complex fusion algorithms. Continuous calibration and redundancy systems add to the costs and maintenance requirements. OEMs are adopting multiple sensors for applications to achieve performance reliability across various environments. Another area that requires attention is sensors, as their reliability affects the expansion of ACC in emerging and extreme-weather areas.

Adaptive Cruise Control System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 6.68 billion |

|

Forecast Year Market Size (2035) |

USD 13.77 billion |

|

Regional Scope |

|

Adaptive Cruise Control System Market Segmentation:

Component Type (LiDAR, RADAR, Image Sensor, Ultrasonic, Infrared Sensor)

Radar segment is expected to capture adaptive cruise control system market share of over 60% by 2035. Compared to optical sensors, RADAR has better object detection accuracy, especially in adverse weather conditions. Its low-light performance ensures safe longitudinal vehicle control under low visibility conditions. In September 2024, the Audi Q6 e-tron SUV was launched with the new centralized radar-enhanced adaptive cruise control architecture. Front grille-mounted RADAR modules have evolved to be small in size, cheaper to manufacture, and install. Highway safety standards are pressuring the automotive manufacturers to increase their interest in RADAR-based solutions. Radar technology remains the workhorse of scalable, high-volume ACC system installations around the world.

Vehicle Type (Passenger Cars, Commercial Vehicles)

In adaptive cruise control system market, passenger cars segment is set to dominate revenue share of over 60% by 2035. There is a growing demand for safety, comfort, and semi-autonomous driving that is driving ACC inclusion. Manufacturers are increasingly integrating ACC in cars right from the luxury class to mid-segment passenger vehicles. In April 2023, Ford Europe’s Kuga Graphite Tech Edition introduced new technologies of intelligent adaptive cruise control that are suitable for urban and motorway use. Many premium sedans, crossovers, and compact SUVs now come with ACC as a standard feature or a popular option. Passenger cars dominate the market in terms of vehicle sales volumes, thereby increasing the large-scale implementation of ACC. These regulatory factors further endorse ACC’s mainstream adoption in new passenger cars.

Our in-depth analysis of the global adaptive cruise control system market includes the following segments:

|

Component Type |

|

|

Vehicle Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Adaptive Cruise Control System Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific adaptive cruise control system market is likely to capture revenue share of over 37% by 2035. In March 2024, MG began the sales of the updated ZS EV in India, which comes with a full suite of ADAS, including adaptive cruise control. Demand for ADAS is fueled by a growing population density, increased purchasing power, and an embrace of technology in Asia Pacific. The growth of the Electric Vehicle market in China and the development of smart cities in Japan are key drivers for ACC system adoption. Government regulations on vehicle safety drive OEMs to invest more in driver-assist technologies. There is an increase in awareness among consumers in matters concerning crash prevention systems. Asia-Pacific remains the primary driver of future ACC technological advancement globally.

China continues to lead the global adaptive cruise control system market in terms of the widespread usage of adaptive cruise control systems due to the increased development of electric vehicles and smart cities. In November 2024, Dongfeng Nissan launched the N7 EV sedan with state-of-the-art ADAS, such as adaptive cruise control. Increased integration rate of ACC systems in new vehicles due to government regulations that require the inclusion of ADAS. Local manufacturers and multinationals continue to engage in a battle of wits when it comes to intelligent features. This scale allows for rapid iteration of sensor technologies and continuous improvement of software. Expanding highway systems enable semi-autonomous driving pilots within provinces. The robust China market for electric vehicles and the country’s AV plans guarantee sustained leadership in ACC adoption.

The adaptive cruise control system market in India is expanding with factors such as premiumization, traffic conditions in urban areas, and new EV policies. In March 2024, Honda Cars India released new City and City e:HEV variants with Honda Sensing, which includes the adaptive cruise control. Government policies such as those that aim at reducing import duties on EVs are likely to increase the penetration of ADAS-equipped models. The increased traffic density and the development of highways contribute to the adoption of ADAS. Low-cost car makers are now integrating ACC systems into a wider market to cater to the growing demand. The increase in middle-class income expectations for higher-end features is evident even in the compact car segment. This market development indicates that the future outlook for adaptive cruise control technologies in India.

North America Market Analysis

North America adaptive cruise control system market is expected to witness sustainable growth through 2035, attributed to the increased adoption of ADAS. In September 2024, GM added new features to Super Cruise, making the ACC system more usable on 750,000 miles of U.S. roads. Semi-autonomous driving features are becoming important for consumers in the U.S., and they want more of them in the vehicles they buy. The safety standards set by NHTSA compel the OEMs to offer adaptive cruise control even in the lower price segments. Both premium and EV brands actively promote ACC-equipped models as the carmakers’ selling point. Strategies to modernize commercial fleets enhance the deployment of ACC in logistics vehicles. The long-term growth of the ADAS market in North America remains stable due to local leadership in innovation.

The U.S. continues to lead the demand for adaptive cruise control systems. In January 2025, Rivian announced plans for Level 3 “eyes-off” highway driving that will revolve around the improved adaptive cruise control system. The increased interest in convenience and safety has led to the high acceptance of ACC across the passenger cars and SUV segments. Federal infrastructure modernization initiatives foster connected and semi-autonomous driving conditions. Technological advancement in the field of ACC enables precise distance-keeping and accurate positioning within the lanes. EV growth supports the adoption of the next-generation driver-assist technologies. Strategic collaborations with original equipment manufacturers and suppliers ensure the application of advanced ACC technology adapted to American highway environments.

Canada adaptive cruise control system market is gradually rising with the increased production of SUVs and EVs. In April 2023, Ford began rolling out BlueCruise hands-free motorway driving in Europe, which can be seen as a precedent for market growth. Consumers value safety, product durability, and winter driving performance, all of which are features that ACC provides. Government safety ratings encourage vehicles with active cruise features more and more. ADAS support systems are integrated into urban mobility projects in large cities. Promoting EV incentives increases the introduction of ACC-equipped new models. As more consumers in Canada opt for premium vehicles, the market has a promising prospect for increased integration of adaptive cruise control.

Key Adaptive Cruise Control System Market Players:

- Autoliv Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Delphi Automotive PLC

- Ford Motor Company

- Hyundai Mobis

- Magna International

The adaptive cruise control system market is highly competitive, and the focus of the players in terms of product development is on accuracy, reliability, and costs. Some of the major players in the market are Delphi Automotive PLC, Denso Corporation, Autoliv Inc., Continental AG, Ford Motor Company, Hyundai Mobis, and Magna International. These firms use radar, LIDAR, AI, and sensor fusion as key components of their autonomous driving systems. The partnerships between car manufacturers and technology companies continue to foster rapid advancements. Ongoing research and development are directed toward improving perception capabilities, decision-making, and integration of the vehicle control system. The competition in the global market will shift from establishing the first level of autonomous driving to creating solutions that are accessible at affordable costs worldwide.

Nexteer Automotive launched the EMB by Wire system in April 2024, which improves the future integration of ADAS features such as adaptive cruise control. The technology helps to create safer and more energy-efficient car architectures. Automotive companies are increasingly deploying 360-degree sensing suites that integrate radar and camera technologies. Manufacturers are also developing low-cost RADAR systems for use in entry-level cars. Strategic partnerships with original equipment manufacturers help technology adoption across a range of vehicle types. The major competitive factors that will define competition in the future are going to be cost, precision, and the ability to adapt to changing regulations. Leadership in the ACC system landscape is further defined by strategic positioning in emerging EV and autonomous mobility ecosystems.

Here are some leading players in the adaptive cruise control system market:

Recent Developments

- In February 2025, Mercedes-Benz revealed its Level 3 Drive Pilot expansion, emphasizing adaptive cruise control as a critical layer in achieving hands-off autonomous functionality. The Drive Pilot system allows drivers to take their hands off the wheel in certain conditions, relying on advanced sensors and software to control the vehicle's speed and steering.

- In September 2024, Bosch announced a major investment in its Hungary facility to expand e-mobility and automated driving solutions, including adaptive cruise control technologies. The expansion aims to meet the growing demand for advanced driver assistance systems and electric vehicle components. This investment reinforces Bosch's commitment to shaping the future of mobility.

- Report ID: 7565

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.