Active Aerodynamic Market Outlook:

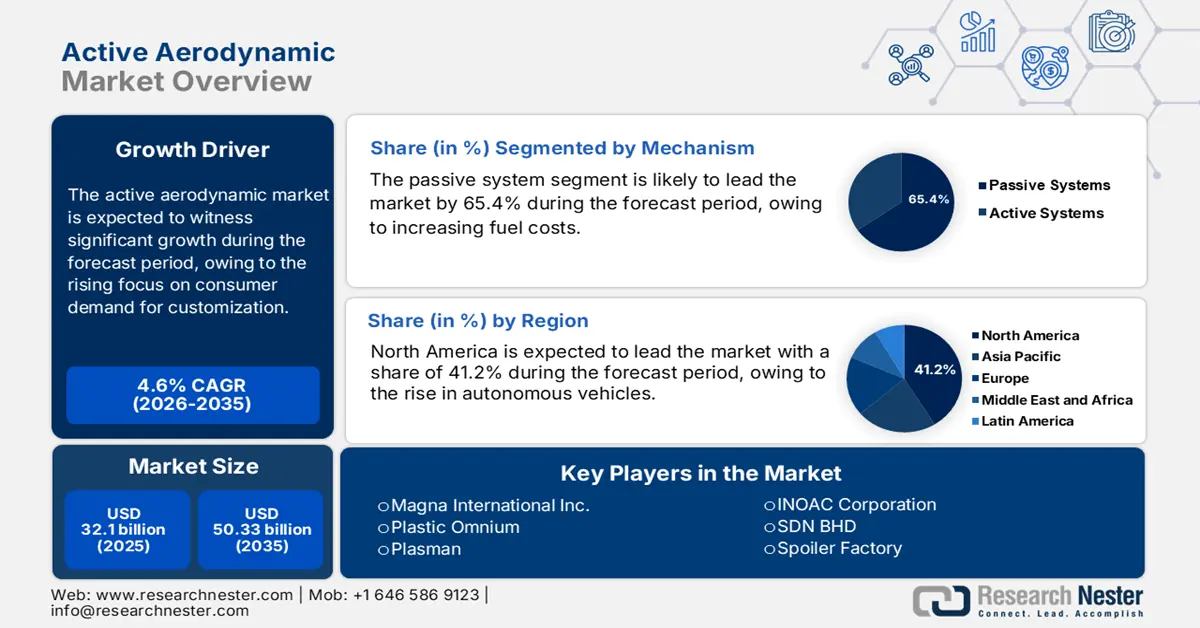

Active Aerodynamic Market size was valued at USD 32.1 billion in 2025 and is set to exceed USD 50.33 billion by 2035, expanding at over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of active aerodynamic is estimated at USD 33.43 billion.

Major automotive producers and Tier-1 suppliers are increasingly focusing on active aerodynamic technology developments for enhanced vehicle performance and reduced energy consumption. Companies are establishing strategic alliances to boost advancements in intelligent vehicle system technologies. For instance, in February 2023, BMW Group and Valeo announced a strategic partnership to co-develop next-generation Level 4 automated parking technologies. The partnership demonstrates the ongoing industrial integration of sensor solutions along with aerodynamic design improvements that drive vehicle efficiency and dynamic control in contemporary automotive engineering.

The active aerodynamics industry is witnessing a significant expansion due to increased demand from OEMs and suppliers. Various companies are opening up manufacturing facilities to cater to the continuously surging demand for aerodynamics. For instance, in January 2025, Ford launched the rolling road wind tunnel, a state-of-the-art facility to enhance its vehicle lineup's aerodynamic efficiency. This innovation is resulting in enhanced passenger comfort and aligns with the guidelines of the global fuel efficiency and emissions.

Key Active Aerodynamic Market Insights Summary:

Regional Insights:

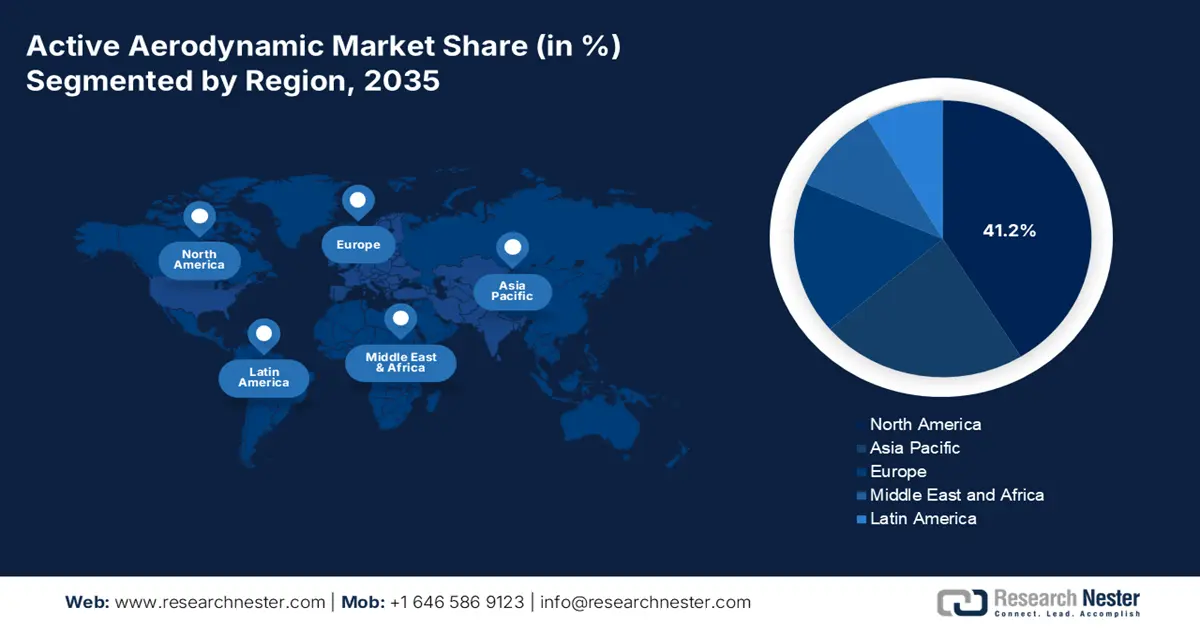

- The North America region in the active aerodynamic market is anticipated to secure a 41.2% share by 2035, grounded in the accelerating adoption of autonomous vehicles.

- The Asia Pacific region is projected to expand at the fastest pace by 2035, stemming from rising consumer demand and vehicle production driving the use of advanced aerodynamic technologies.

Segment Insights:

- The passive system segment in the active aerodynamic market is forecast to capture a 65.4% share by 2035, propelled by heightened emphasis on fuel-efficient vehicle solutions.

- The grille shutter segment is set to record the quickest growth by 2035, supported by governments tightening emission norms and fuel-efficiency requirements.

Key Growth Trends:

- Consumer demand for customization

- Demand for fuel efficiency and reduced emissions

Major Challenges:

- Technology limitations

- Compatibility with existing vehicle platforms

Key Players: Magna International Inc., Rochling SE & Co. KG, Plastic Omnium, SMP Automotive, Valeo, SRG Global, Polytec Holding AG, Plasman, INOAC Corporation, Rehau Group, SDN BHD, HBPO, Spoiler Factory, Airflow Deflector, BMW AG, Audi AG, Ford Motor Company, Daimler Truck Holding AG, Volkswagen, Renault Group, PSA Group, General Motors.

Global Active Aerodynamic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.1 billion

- 2026 Market Size: USD 33.43 billion

- Projected Market Size: USD 50.33 billion by 2035

- Growth Forecasts: 4.6%

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Brazil, Mexico, Thailand, Turkey

Last updated on : 3 December, 2025

Active Aerodynamic Market - Growth Drivers and Challenges

Growth Drivers

- Consumer demand for customization: Active aerodynamic solutions are becoming more prevalent as customers are seeking smart features in connected vehicles along with adaptive technologies. Following this trend, manufacturers are introducing new vehicle models to adapt to evolving requirements, which focus on customization, innovation, and enhanced performance capabilities. In September 2024, Lotus unveiled the Eletre Carbon, a luxury electric hyper-SUV featuring carbon fiber detailing. This model also introduced the Chapman Bespoke customization service in North America, allowing customers to personalize their vehicles extensively. Such improvements in the automotive sector highlight how the industry fulfills consumer needs for devices that combine distinctive designs with high-performance capabilities.

- Demand for fuel efficiency and reduced emissions: Active aerodynamic systems play a vital role in enhancing fuel economy and reduce emissions in the industry. Technologies, including active grille shutters, spoilers, and diffusers, control airflow based on current driving situations to minimize drag forces. The systems contribute to enhanced aerodynamics, which leads to better fuel efficiency and reduced CO₂ emissions. This enables manufacturers to deliver improved performance results while complying with environmental standards.

The significance of aerodynamic systems is increasing due to the global presence of environmental standards such as the US Corporate Average Fuel Economy standards and European CO₂ emissions standards. In April 2022, the U.S. Department of Transportation’s NHTSA announced new Corporate Average Fuel Economy (CAFE) standards mandating an industry-wide fleet average of approximately 49 miles per gallon for passenger cars and light trucks by model year 2026. Manufacturers are complying with environmental regulations through technology integration, resulting in vehicles that deliver high performance with environmental safety.

Challenges

-

Technology limitations: The electronic and mechanical components used in active aerodynamic systems create difficulties with reliability and durability issues. The installed active aerodynamic systems must endure tough environmental elements involving severe cold climate and fast-moving aerial currents that eventually result in system deterioration. A vehicle system needs complete integration with suspension and powertrain controls to perform optimally. The failure of integrated components or their alliance system has damaging effects on vehicle performance and reduces customer satisfaction, thus inhibiting broader active aerodynamic market penetration.

- Compatibility with existing vehicle platforms: Installing active aerodynamics on current vehicle structures is complicated since design restrictions require many platform modifications. Adapting a vehicle's structure with its control systems and electronics for retrofitting is proven to be difficult, as it requires complex procedures that cost a significant amount of money. The required infrastructure for active systems cannot be provided in older model vehicles, as these models lack the necessary space for new components, along with insufficient power supplies. Vehicle owners seeking active aerodynamic systems without original implementation find it difficult and impractical to make the desired upgrades due to high installation costs.

Active Aerodynamic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 32.1 billion |

|

Forecast Year Market Size (2035) |

USD 50.33 billion |

|

Regional Scope |

|

Active Aerodynamic Market Segmentation:

Mechanism Segment Analysis

The passive system segment in active aerodynamic market is expected to hold the largest revenue share of 65.4% in 2035. Rising fuel costs and environmental concerns are encouraging consumers and manufacturers to focus on fuel-efficient solutions. Passive aerodynamic components, such as grille shutters and passive spoilers, function to decrease drag, which in turn increases fuel economy efficiency without requiring the operational complexity of active system implementations. Vehicle performance enhancement and reduced fuel usage is possible through simple yet effective passive aerodynamic components, which address environmental regulations. Passive aerodynamic solutions are experiencing increasing adoption as fuel-efficient vehicles remain in demand under necessary regulatory standards.

Application Segment Analysis

The grille shutter segment in active aerodynamic market is expected to register the fastest growth in the forthcoming years. Various governments across the globe are strengthening their emission policies and fuel efficiency standards as part of climate change reduction efforts. Automakers are integrating technologies that improve airflow efficiency and fuel economy standards. For instance, in April 2023, Valeo expanded a new manufacturing facility in Fukuoka, Japan. This plant is aimed at producing advanced thermal management systems, including active grille shutters, to enhance vehicle aerodynamics and fuel efficiency. Such developments demonstrate companies’ efforts toward sustainability, aimed at meeting regulatory requirements.

Our in-depth analysis of the global active aerodynamic market includes the following segments:

|

Vehicle Type |

|

|

Application |

|

|

Mechanism |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Aerodynamic Market - Regional Analysis

North America Market Insights

The North America active aerodynamic market is set to dominate the global market, with the highest share of 41.2% during the forecast period, attributed to the rise of autonomous vehicles. According to the April 2024 report of the Autonomous Vehicle Industry Association, the autonomous vehicles are driven nearly 70 million miles on public roads in the U.S. These vehicles need exact aerodynamic control for improving performance, minimizing drag, and maintaining high-speed stability. Automakers and technology firms are developing autonomous driving technologies, which are creating escalating requirements for advanced aerodynamic solutions, fueling the market growth.

The active aerodynamic market in the U.S. is witnessing a robust expansion. The aerodynamic technologies are becoming increasingly popular for installation in heavy commercial vehicles throughout the country. Active grille shutters are also experiencing a growing use in the industry as they decrease aerodynamic drag and improve fuel economy. Transportation firms are adopting active aerodynamic solutions to address environmental standards, fueling the demand for these solutions used in commercial vehicles.

The advancement in autonomous driving technologies is fostering the growth of Canada active aerodynamic systems. Autonomous vehicles need optimized aerodynamic performance for the coexistence of efficiency and safety during their high-speed autonomous drive functions. These vehicles obtain enhanced performance while minimizing energy usage through active aerodynamic systems that comprise dynamic spoilers as well as adjustable air intake components. The market is experiencing expansion as self-driving technologies are continually developing.

Asia Pacific Market Insights

The Asia Pacific active aerodynamic market is projected to register the fastest growth during the stipulated timeframe. This growth is led by rising consumer demand and vehicle production, driving automakers to adopt advanced technologies such as aerodynamics to boost vehicle performance, efficiency, and satisfy stringent environmental standards. Due to rising customer requirements for eco-friendly vehicles with high fuel efficiency, various manufacturers are integrating spoilers and grille shutters when designing their vehicles.

The local government is implementing various policies along with incentives to boost the adoption of green technologies, particularly electric vehicles and fuel-efficient transportation methods, fueling the growth of the China active aerodynamic market. The government is committed to lowering pollution and emissions while supporting automakers to incorporate active aerodynamic systems for their models. The sustainable automotive industry’s development demands align with active aerodynamic systems that optimize fuel efficiency and decrease drag while benefiting the broader industry goals. Automakers are switching to these technologies as regulations and consumer choice require eco-friendly vehicles.

The active aerodynamic market in India is expected to grow at a rapid pace between 2026 and 2035. The local government is coming out with initiatives and is setting targets to reduce its carbon footprint. One such initiative is the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles, which is aimed at lowering greenhouse gas emissions while decreasing dependency on fossil fuels. Such programs are encouraging manufacturers to adopt sustainable technologies through their environmental policies. The aerodynamic components act as crucial elements that enhance vehicle energy efficiency and driving range, specifically designed for electric vehicles.

The automakers are significantly investing in these technologies to develop fuel-efficient, high-performance vehicles that consumers demand. The rise of fuel costs and developing environmental awareness among consumers is making them increasingly focused on vehicle fuel economy. The transformation in consumer preferences is driving automakers to incorporate active aerodynamic components in their new vehicle models. The aerodynamic systems are boosting fuel efficiency and addressing consumer demands for environmentally conscious vehicles.

Active Aerodynamic Market Players:

- Magna International Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rochling SE & Co. KG

- Plastic Omnium

- SMP Automotive

- Valeo

- SRG Global

- Polytec Holding AG

- Plasman

- INOAC Corporation

- Rehau Group

- SDN BHD

- HBPO

- Spoiler Factory

- Airflow Deflector

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler Truck Holding AG

- Volkswagen

- Renault Group

- PSA Group

- General Motors

The competitive landscape of the active aerodynamic market is characterized by the presence of several key players, including automotive giants like Continental AG, Magna International, and Valeo, which are heavily investing in R&D to develop advanced aerodynamic solutions. These companies are focusing on expanding their product portfolios, with innovations such as adjustable spoilers, active grille shutters, and air flaps. Strategic partnerships and collaborations, such as those between automakers and technology providers, are further enhancing active aerodynamic market growth. Additionally, the increasing adoption of electric vehicles and autonomous driving technologies is intensifying competition among companies to deliver high-performance, energy-efficient solutions. Here are some key players operating in the global active aerodynamic market:

Recent Developments

- In October 2024, Denso Corporation and Quadric announced a collaboration to develop a neural processing unit (NPU), a semiconductor specialized for the arithmetic processing of AI. This partnership aims to co-develop high-performance automotive semiconductors, enhancing the integration of AI technologies in automotive applications.

- In June 2024, FIA introduced the 2026 Formula One car concept, featuring new active aerodynamics in both the front and rear wings. This design replaces the drag reduction system with a manual override engine mode, aiming to enhance performance and safety.

- Report ID: 7648

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Aerodynamic Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.