Vacuum Cleaner Market Outlook:

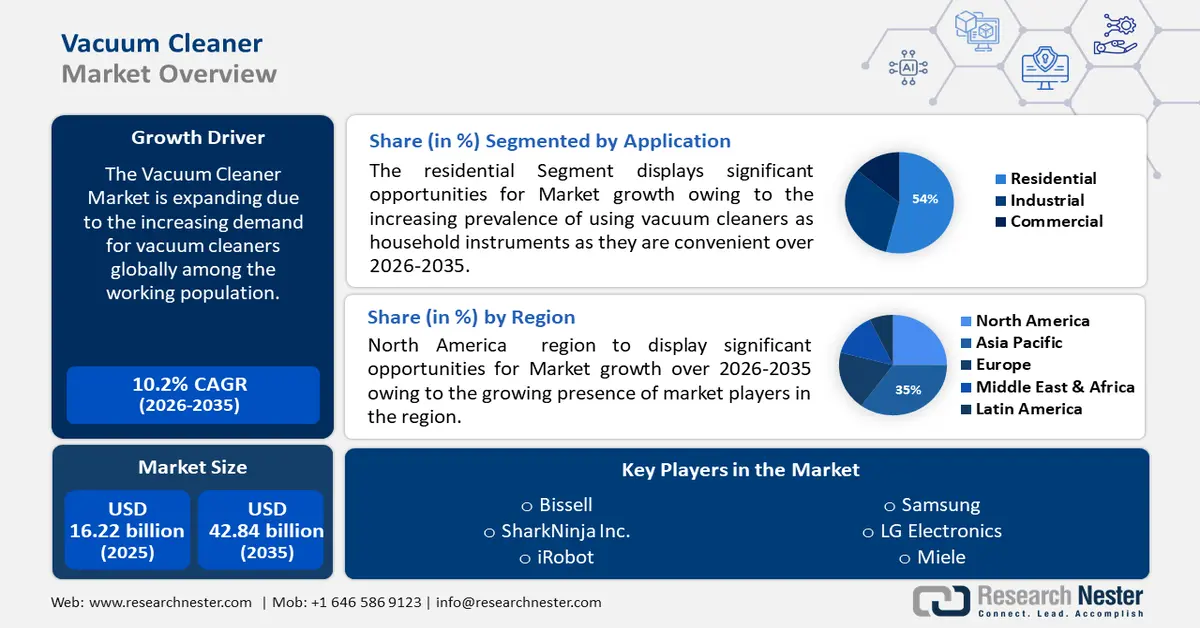

Vacuum Cleaner Market size was valued at USD 16.22 billion in 2025 and is set to exceed USD 42.84 billion by 2035, registering over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vacuum cleaner is estimated at USD 17.71 billion.

The increasing demand for vacuum cleaners globally as it consumes very little time to clean a house will exponentially help the market grow in the upcoming years. For instance, 89% of individuals worldwide vacuum for less than an hour, and of them, 43% do so for less than thirty minutes. Vacuum cleaners are necessary home appliances for cleaning various surfaces such as upholstery, carpets, and floors. These devices are essential for every home since they use suction to remove dirt, dust, and other material from surfaces.

In addition to that, the rising demand for automated and time-saving cleaning solutions will play another crucial role in pushing the vacuum cleaner market to garner its predicted revenue share. Recent years have seen tremendous developments in robotic technology, which is visible in the commercial cleaning industry. Modern robotic technology is now available to cleaning services businesses, revolutionizing the way cleaning jobs are carried out. These cutting-edge robots have sophisticated features and skills that enable them to clean with unparalleled accuracy and efficiency. Intelligent sensor and algorithm utilization is one of the main developments in robotic technology for commercial cleaning recently.

Key Vacuum Cleaner Market Insights Summary:

Regional Highlights:

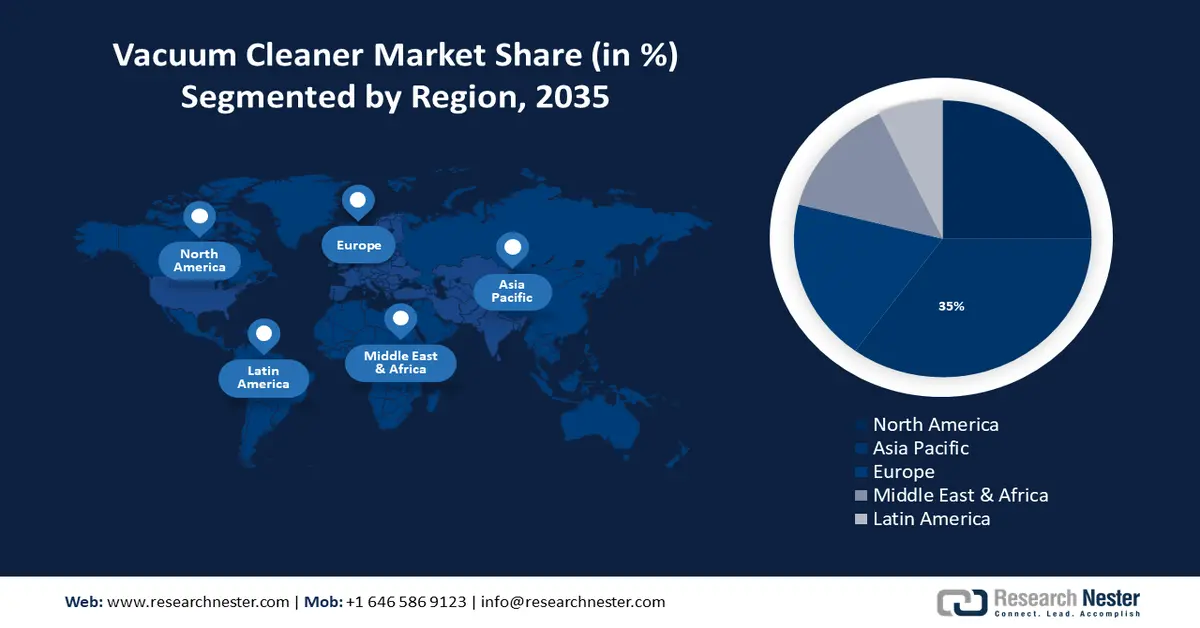

- Asia Pacific vacuum cleaner market will hold more than 35% share by 2035, driven by increasing awareness about cleanliness and government hygiene guidelines.

- North America market will attain a 25% share by 2035, attributed to advancement in robotic and industrial vacuum cleaners with smart applications.

Segment Insights:

- The online segment in the vacuum cleaner market is projected to achieve robust growth till 2035, driven by the widespread availability of vacuum cleaners on global e-commerce platforms.

- The canister segment in the vacuum cleaner market is forecasted to achieve a 25% share by 2035, driven by portability, ease of use, and effectiveness in cleaning various surfaces.

Key Growth Trends:

- The changing lifestyle across the world

- Increasing working population across the world

Major Challenges:

- Rigorous rules and demands

Key Players: Dyson, Bissell, SharkNinja Inc., iRobot, Samsung, LG Electronics, Miele, Hoover, Electrolux, Philips.

Global Vacuum Cleaner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.22 billion

- 2026 Market Size: USD 17.71 billion

- Projected Market Size: USD 42.84 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Thailand, Indonesia, Malaysia

Last updated on : 17 September, 2025

Vacuum Cleaner Market Growth Drivers and Challenges:

Growth Drivers

- The changing lifestyle across the world - In a fast-paced society, finding effective and efficient answers to everyday problems is essential. By making use of intelligent house cleaning's advantages, people may alter the way they take care of their living space and make it easier, more sensible, and ultimately more enjoyable.

- Increasing working population across the world - In line with the vacuum cleaner market demand, the scenario for performing household cleaning may be greatly impacted by changes in the working-age population. As per recent research, there are more than 53 % employment-to-population ratios across the globe.

- Rise in home and business sanitation - The world has been reminded by the global pandemic that one of the simplest and most affordable ways to combat infectious diseases like COVID-19 is through water, sanitation, and hygiene (WASH). Nonetheless, approximately 215 million individuals in the Asia Pacific area continue to lack access to basic sanitary amenities, and an additional 39 million lack a toilet altogether, forcing them to relieve themselves in public areas. In partnership with the Asian Institute of Technology (AIT), Siam Cement Group (SCG), and the Thai Chamber of Commerce, UNICEF EAPRO organized a virtual Regional Sanitation Expo from June 23 to 25, 2021, to exchange creative sanitation solutions and insights from Thailand's and other nations' swift advancements.

Challenges

- Rigorous rules and demands - The vacuum cleaner industry may be subject to stringent regulatory regulations. Governments all over the world impose regulations on the vacuum cleaner sector, pressuring producers to use less energy and make more environmentally friendly goods. For instance, the European Commission has made vacuum cleaners subject to higher energy efficiency and lower carbon emission requirements. The maximum permitted power for vacuum cleaners is now 900 watts instead of 1,600 watts, as per the European Union's energy label guidelines. The regulation caps the decibel output of noisy vacuum cleaners at 80. The guidelines for producing energy items in an environmentally responsible manner are now available.

- Although cordless vacuum cleaners are convenient, their short battery life hurts the market. Short battery runtimes may be unpleasant for customers with larger homes or more demanding cleaning requirements, which could result in interrupted cleaning sessions and discontent. Lack of technicians to rectify vacuum cleaners

Vacuum Cleaner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 16.22 billion |

|

Forecast Year Market Size (2035) |

USD 42.84 billion |

|

Regional Scope |

|

Vacuum Cleaner Market Segmentation:

Product Segment Analysis

The canister segment is expected to hold 25% of the revenue share because of their high demand driven by their skill to clean different surfaces blend in tight spaces, and operate across impediments. The fact that a canister vacuum is more portable around a building is another justification for using one. Because of the vacuum cleaner's wheels, a person may drag the vacuum behind them while cleaning rather than lifting and moving it. Additionally, the cleaner will have less strain because, depending on the type, both upright and backpack vacuums can become hefty. Canister vacuums do not have to give up their capacity to compensate for their lightweight nature. This means that, in comparison to an upright or backpack vacuum, a person can clean a bigger area with certain canister vacuums.

Distribution Channel Segment Analysis

The online segment in the vacuum cleaner market is predicted to account for 70% of the revenue share by 2035 on account of the extensive accessibility of vacuum cleaners in e-commerce platforms globally. For instance, regarding the amount of time spent on vacuum cleaning and the number of online vending of vacuum cleaners, individuals in the two Portuguese-speaking nations of Brazil and Portugal are the most diligent worldwide. Compared to the global average of 10%, 22% and 20% of persons in these two nations, respectively, spend 1.5 hours vacuuming.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

Distribution Channel |

|

|

Power Source |

|

|

End-Use Industry |

|

|

Cord Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vacuum Cleaner Market Regional Analysis:

APAC Market Insights

The vacuum cleaner market in the Asia Pacific region will have the biggest growth of 35% through 2035. This growth will be noticed owing to the increasing awareness among the people of this region about cleanliness. The world's most frequent vacuum cleaners are Koreans. Eleven percent of Koreans (global average: 3%), and twenty-nine percent (global average: 13%), vacuum more than once a day. Of Chinese people, 16% say they vacuum at night (the global average is 2%), and another 11% say they do it in the evening. Moreover, governments in numerous nations released guidelines on personal hygiene for the general public to prevent the spread of the novel coronavirus (COVID-19) pandemic.

North American Market Insights

The North America region is projected to hold almost 25% vacuum cleaner market share by 2035 driven by the increasing advancement in robotics vacuum cleaning and industrial vacuum cleaners in this region. In addition to their intelligent functions, numerous robotic vacuum cleaners include specific mobile applications. These applications offer customers a practical interface for controlling and keeping an eye on the gadgets from a distance. Maps of their living areas can be saved, viewed, and edited by users. Furthermore, some programs provide you the option to designate regions to avoid cleaning or establish special cleaning modes for extremely filthy areas.

Vacuum Cleaner Market Players:

- Dyson

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bissell

- SharkNinja Inc.

- iRobot

- Samsung

- LG Electronics

- Miele

- Hoover

- Electrolux

- Philips

Recent Developments

News

- Dyson, an international technology organization declared its appearance in Colombia and the first accessibility of its full hair care material lineup and high-executing cord-free vacuum cleaners. This newest spending highlights the organization’s dedication to bringing its revolutionary technology to more customers around Latin America.

- SharkNinja, Inc., an international material design and technology organization began in 2024 performing its three-pillar expansion planning with the launch of material creation in new and existing categories. The organization also declared that 17 additional Shark and Ninja materials will be coming to the EMEA (Europe, Middle East, and Africa) region at the time of the first half of 2024.

- Report ID: 6026

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vacuum Cleaner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.