UV Curable Inks Market Outlook:

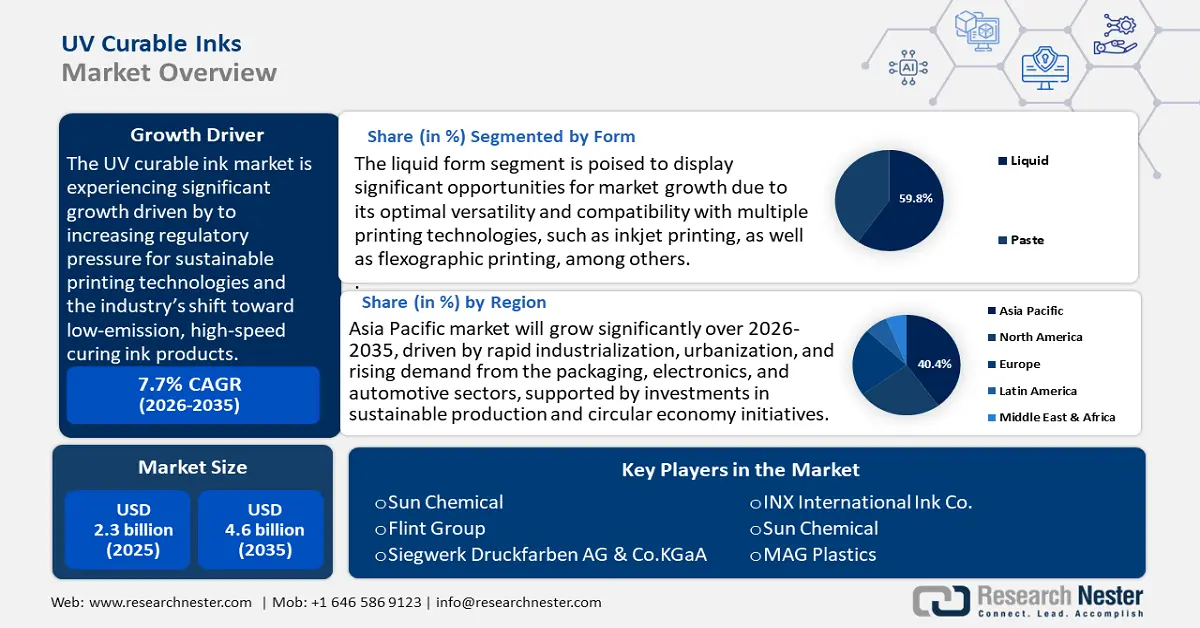

UV Curable Inks Market size was valued at USD 2.3 billion in 2025 and is projected to reach USD 4.6 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of UV curable inks is estimated at USD 2.5 billion.

The global UV curable inks market is expected to grow significantly, primarily attributed to a key longevity factor, which is the mounting regulatory pressure on environmentally sustainable printing technologies and the mounting transition to low-emission, high-speed curing ink products by the industry as a whole. According to the CAS Coatings and Inks Sustainability Report, UV and electron beam (EB) cured coatings and inks significantly reduce volatile organic compound (VOC) emissions compared to traditional solvent-based products, contributing to lower air pollution and energy savings of 75-90%. These radiation-curable coatings offer a sustainable alternative by preventing the escape and leaching of toxic components, underscoring their environmental benefits in meeting stricter regulations and sustainability targets.

Governments are increasingly paying attention to reducing industrial pollution and optimizing energy efficiency, which further contributes to investments in this market. Moreover, other agencies, such as the Department of Energy (DOE), have invested in research programs that demonstrate cost-saving potential for UV binder technologies, resulting in reduced capital and operating costs associated with the coating process. The collective contribution of these regulatory incentives and energy efficiency benefits can be viewed as the foundation of a stable growth rate in the market worldwide.

On the supply chain and production level, the production of UV curable inks is highly dependent on a network of chemical suppliers specialized in the production of such specialized chemicals as acrylates, epoxies, photo initiators, and oligomers, which, largely, are supplied by North America, Europe, and Asia. The OECD Emission Scenario Document on coatings highlights that manufacturing processes for coatings, including UV curable types, involve precise operations such as pigment grinding, mixing, and filling, which are key to product consistency. It emphasizes significant VOC emissions from solvent-based coatings and the environmental benefits of radiation-curable coatings, which reduce VOC releases and energy consumption. The emission control strategies that support regulatory compliance and sustainability in coatings production align closely with EPA findings on UV technology's role in reducing environmental impact. The trend in global trade in UV curable inks and their raw materials is very significant, with major chemical-producing countries leading, as far as exports are concerned, as is seen by trade data, which indicates that the exportation of radiation-curable materials is sustained over time.

In addition, in Q1 2025, EU chemical exports increased by 1.8%, and producer prices rose by 1.1% year-over-year, indicating positive momentum in the industry. Countries like Belgium saw strong production growth of 9.1%, supporting specialty chemicals such as polysulfone. This export growth and price stability reflect resilient supply chains and growing demand in advanced sectors, driving polysulfone market expansion. Furthermore, government-sponsored projects, including those at New York State Energy Research and Development Authority (NYSERDA), have been initiated to fund R&D activities aimed at enhancing manufacturing processes and commercialization of more environmentally friendly inks with R&D performed on UV/EB curing methods. The investments assist in fast-tracking product innovation and sustaining supply chain resilience and expansion of global assembly lines of UV curable ink products.

Key UV Curable Inks Market Insights Summary:

Regional Highlights:

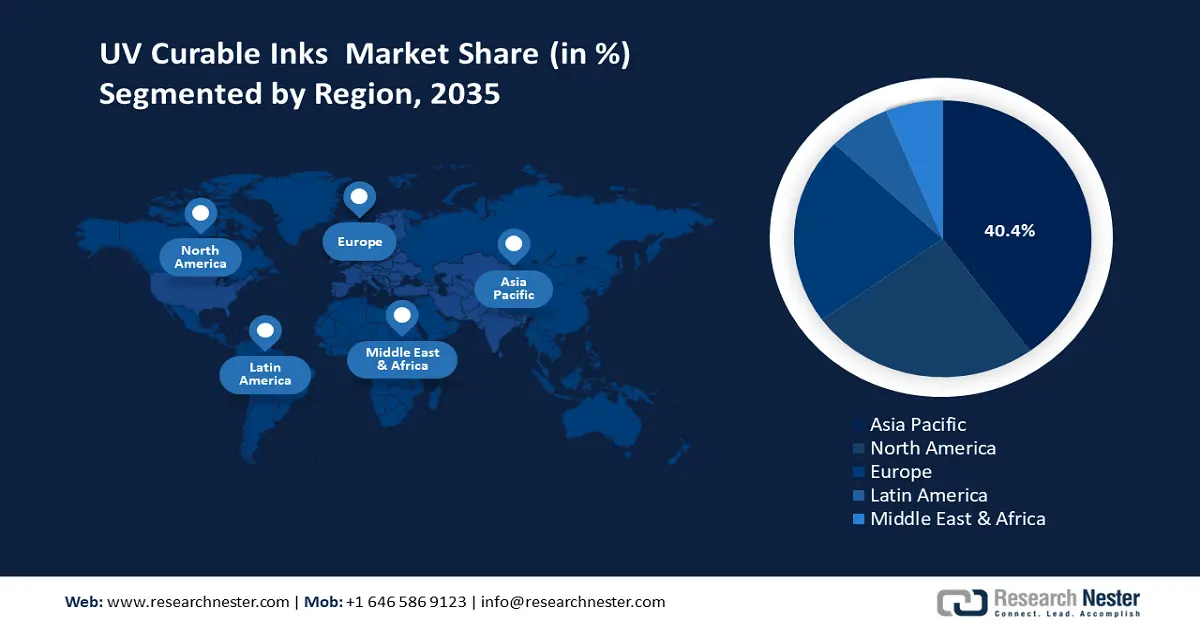

- Asia Pacific is expected to dominate the global UV curable inks market with a 40.4% revenue share by 2035, owing to accelerated industrialization, sustainable manufacturing initiatives, and the rising adoption of energy-efficient printing systems.

- The North American market is projected to account for a 25.3% revenue share by 2035, driven by growing investments in green technologies and increasing demand for low-VOC printing solutions across industrial and commercial sectors.

Segment Insights:

- The liquid form segment is projected to hold the largest 59.8% share of the UV curable inks market by 2035, owing to its versatility and compatibility with multiple printing technologies such as inkjet and flexographic printing.

- The acrylate-type chemistry segment is anticipated to capture a 51.2% revenue share by 2035, propelled by its low viscosity, fast curing capability, and superior substrate adhesion.

Key Growth Trends:

- Targets in package demand and circularity

- Energy efficiency & curing technology migration

Major Challenges:

- High initial capital investment for compliance

- Challenges raw materials sourcing

Key Players: Sun Chemical (USA), Flint Group (Luxembourg), Siegwerk Druckfarben AG & Co.KGaA (Germany), INX International Ink Co. (USA), Sun Chemical (USA), MAG Plastics (India), Winchem (Malaysia) Sdn. Bhd. (Malaysia), DEERS I CO LTD (South Korea), SEANSTARKOREA CO LTD (South Korea), INKTEC CO LTD (South Korea).

Global UV Curable Inks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.5 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Mexico, Brazil

Last updated on : 5 September, 2025

UV Curable Inks Market - Growth Drivers and Challenges

Growth Drivers

- Targets in package demand and circularity: The Circular Economy Action Plan released by the European Union points to an increased emphasis on sustainable packaging. The PPWD is intended to ensure that packaging that is put in the market within the EU is recyclable or reusable in a cost-effective manner. The directive was first introduced in 2004 and amended in 2018, and has a set target of recycling of materials and promotes the use of reusable packaging among member states. The ultimate goal is for 100% of all the EU market packaging to be reusable or recyclable by 2030 as part of the European Green Deal and the Circular Economy Action Plan.

- Measures suggested in the directive include deposit-return systems, the use of recycled content, and harmonized labels to accomplish these things. In addition, the European Environment Agency explains that the EU has set packaging waste recyclability objectives of 65% by 2026. Recent data indicates that there is an even growth in the recycling of packaged waste amongst the member countries, with the EU putting its emphasis on the advancement of recycling systems and sustainable design of packaging. The aggregate effect of these efforts is the expanding demand in the packaging sector of UV curable inks.

- Energy efficiency & curing technology migration: With the International Energy Agency (IEA) citing that energy-intensive industries such as printing consume a large percentage of the world's energy, the industry needs to work towards increasing energy efficiency in its various products and processes. The clean technology manufacturing accounted for 0.7% of global investment in 2023, driving nearly 10% of investment growth. Solar PV and battery manufacturing dominated, making up over 90% of investments. China leads globally, while the US and Europe are rapidly expanding battery production. The U.S. Department of Energy (DOE), through its Advanced Manufacturing Office, also contributes to this transition in that the application of energy-efficient technologies in manufacturing can result in savings of a lot of energy and fewer electricity emissions.

- End-use diversification (functional printing & electronics): The UV curable inks market are gaining more applications and exploding into functional runs of ink in printing. The Horizon Europe program is a seven-year scheme (2021-2027) with an approximate total budget of 95.5 billion. It invests in research and innovation initiatives in one of the major areas, including climate action, digital technologies, and industrial competitiveness. The program funds networking between academia, industry, and the public sector to contribute to sustainable growth and technological improvement of Europe. These efforts are in the quest to build advanced printing technologies that can be used in flexible displays, sensors, and wearables. The printed electronics market is projected to reach USD 82.68 billion by 2034 as research and development continue to improve the materials and printing technologies. This diversification opens up new opportunities for manufacturers of UV curable inks to be innovative to meet the new market.

Challenges

- High initial capital investment for compliance: UV curable ink market producers experience high barriers to entry due to the high capital investment required to align with environmental regulations. In the U.S, the costs of upgrading production units to include special curing equipment and updating production facilities can be very high, and the EPA estimates that reformulation of products to meet VOC emission requirements costs around USD 87,000 per product. This prohibits access to or expansion in the UV curable inks market by small, medium medium-sized enterprises disproportionately due to the cost of production. Moreover, frequent changes in environmental regulations necessitate the continual injections of finances in employee training, safety modification, and technology augmentation, with these additions to operational costs.

- Challenges raw materials sourcing: Sourcing raw materials for UV curable inks is an important issue, as the U.S. Department of Energy highlights that challenges in raw material sourcing, including critical minerals and components for electrolyzers and fuel cells, pose risks to scaling clean hydrogen technologies. Addressing supply chain vulnerabilities through innovation, recycling, and secure manufacturing is essential to reducing costs and accelerating deployment. These efforts support the growth of a resilient and sustainable clean hydrogen economy focused on decarbonizing hard-to-abate sectors by 2050. Manufacturers can be delayed in the supply of raw materials required to ensure that the materials are compliant and affordable. As an example, new safety standards coming into place in China in 2022 are causing significant delays in the launch of some UV curable ink products, which has an impact on global supply chains. Dependency on such important chemicals ties manufacturers to unappealingly long lead times to supply shipments and a lack of flexibility in operations, as well as disrupting the ability to scale up production or expand to new locations.

UV Curable Inks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

UV Curable Inks Market Segmentation:

Form Segment Analysis

The liquid form segment is expected to grow at the largest UV curable inks market share of 59.8% over the projected years, owing to its optimal versatility and compatibility with multiple printing technologies, such as inkjet printing, as well as flexographic printing, among others. Liquid inks produce high-quality print in many different substrates, including plastics and paperboard, which makes them popular in both commercial and industrial printing. They can also be modified to directly match ink characteristics in terms of flexibility, abrasion, and chemical resistance, broadening their scope in packaging, electronics, and automotive applications. In addition, liquid inks consume less energy during the curing process, which aligns with the regulatory push to reduce environmental impact and energy consumption levels as part of their manufacturing operations.

Ink jet-based technologies use UV curable inks market technology to print large area high-resolution feedstocks on a variety of products, such as textiles, ceramics, and electronics, through direct-to-substrate printing. This is mostly beneficial in the production of complex patterns and designs, as in the case of photochromic dyes, as a result of its flexibility and precision. According to the U.S. National Institutes of Health, UV-based inkjet inks have great adhesion to porous surfaces, and the cross-linked network and the thickness of the printing ink can be carefully adjusted. In addition, inkjet printing enables the manufacture of printed electronics, e.g., solar panels and sensors, via the deposition of functional materials in a complex pattern. Large-Format Printing uses UV-curable ink to print high-resolution, long-lasting materials such as banners, posters, and signs in large formats. Such an application is essential in the industries that require bulk promotional materials and outdoor advertisements. RadTech highlights that UV-curable inks enhance large-format printing by enabling rapid curing, which allows for immediate handling and significantly reduces production time. Moreover, the inks feature outstanding qualities of adhesion to non-absorbent and unprimed surfaces, increasing the potential applications of large-format printing.

Chemistry Segment Analysis

Acrylate-type chemistry segment in the UV curable inks market is likely to rise with a substantial revenue share of 51.2% by 2035, driven by low viscosity, fast curing, and superior substrate adhesion. These attributes enable acrylate inks to be applied in high-end packaging and decoration, mostly in the food industry, beverage, and pharmaceutical fields. Moreover, the acrylate inks have high gloss together with durability that assist manufacturers to meet the high-security standards of compulsory labelling required on products. They also have flexibility in formulation, allowing use in specialty applications, e.g., shrinkable or flexible packaging.

Low-viscosity acrylate formulations are critical when high speed and fine detail are required in an application. These combinations enable very fine ink compositions and quick curing, which is very useful in microelectronics and high-definition printing applications. One of the major advantages of low-viscosity inks is that they help reduce energy consumption and enhance efficiency in printing, factors that are in line with the environmental sustainability objectives. High-gloss printing achieved through acrylate-based inks enhances the visual appeal and durability of printed materials. This feature is of particular value in packaging and consumer goods, where the aesthetic value of the products takes preeminence. According to the EPA, high-gloss finishing not only enhances the product appeal but also enhances longevity and resistance of printed surfaces to achieve industry standards of quality and performance.

Technology Segment Analysis

The UV-LED technology segment in the UV curable inks market is predicted to rise at a share of 49.7% from 2026 to 2035, primarily due to high energy efficiency and its long life. Such systems require a lot less electricity, which means that the cost of operations is cut by approximately half in industrial printing applications. UV-LED can also give accelerated curing speed that increases the efficiency and capacity of large printing plants. Moreover, UV-LED systems produce very little heat, and thus they do not require additional cooling systems and can make the workplace safer. Green printing and the use of low-VOC and energy-efficient printing protocols are also fast-tracked by way of environmental regulations.

Our in-depth analysis of the UV curable inks market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Chemistry |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UV Curable Inks Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the global UV curable inks market with the largest revenue share of 40.4% during the projected years. In 2025, at the 12th Regional 3R and Circular Economy Forum in Asia and the Pacific, attention was paid to sustainable production and resource efficiency in the context of a sharp increase in industrialization in this region. Investments of 1,800 crores under the CITIIS 2.0 initiative in 18 cities of 14 states, the Forum supports circular economy ambitions in line with the surging popularity of UV curable inks in the Asia Pacific. This increase is necessitated by efforts at a local level to implement energy-efficient, low-waste printing systems as part of larger goals to become carbon neutral and take steps towards sustainable industrial processes. Packaging, electronics, and automotive industries are the main players in this scenario as they demand fast, durable, and long-lasting inks. Developments in digital printing and advanced technologies in manufacturing help to develop the market. Additionally, market adoption is expanded by urbanising populations and the needs of consumers to obtain high-quality packaging. Trade liberalization and cooperation among the regions also contribute to effective supply chain management in the market.

China’s UV curable inks market is expected to lead the region with the highest revenue share by 2035, driven by a fast-growing market with a huge manufacturing base and rapidly growing packaging, electronics, and automotive sectors. Government policies that are geared towards green chemistry and environmental protection have changed and resulted in additional investments towards sustainable chemical production. The Ministry of Ecology and Environment in China has already imposed strict control over amounts of VOC emissions by establishing national standards of VOC content in coatings, inks, adhesives, and cleaning agents. These measures were issued as part of the Chinese Blue-Sky Campaign and 2020 Volatile Organic Compounds Management Plan and encourage source substitution and limit solvent-based products containing high contents of VOCs. The implementation of these standards adds considerable pressure to finding a substitute, such as UV curable inks, which have low VOCs and are environmentally friendly.

In addition, the China Petroleum and Chemical Industry Federation is very keen on establishing better technology in UV curable inks in the industry through collective efforts. The main work on these is to progress UV LED curing technologies and formulate materials that provide adhesion, flexibility, and environmental friendliness without the use of environmentally hazardous solvents. Market growth is also contributed to by the increasing urbanization and the consumer preference in purchasing products that utilize sustainable packaging. All these are what make China a strong market in APAC in terms of UV curable inks.

India’s UV curable inks market is projected to rise at a steady pace during the forecast years, owing to Industrialization in India and the government's interest in sustainable factories. In India, the Technology Development Board (TDB) provides funds to develop innovations to develop green chemistry, sustainable processes, and minimization of waste. TDB has financed numerous firms in chemicals to reinforce the production of biobased chemicals, renewable feedstocks, and superior process technologies. With this initiative, the aim is to increase the competitiveness of the chemical industry of India as well as increase production in sustainable and environmentally friendly ways, and thus improve the growth of the market.

Green technology ideas are funded by the Department of Science & Technology to assist adoption of sustainable technology. The Federation of Indian Chambers of Commerce & Industry of India is proactive in the promotion of clean chemical processes in industries. Describing its growing interest in UV curable inks are the packaging and automotive industries, according to the Indian Chemical Council. It can be seen that government incentives and regulatory bodies attempt to lower the output of VOCs and create a more environmentally conscious production. This develops a conducive environment in the growing UV curable inks market of India.

North America Market Insights

The North American UV curable inks market is anticipated to grow at a substantial revenue share of 25.3% during the projected years by 2035, attributed to the large demand for sustainable and low-VOC printing products in industrial and commercial applications. The region enjoys a major investment in green technologies as well as regulatory frameworks that are meant to cut down the negative effects on the environment. UV-curable inkjet inks are rapidly gaining popularity in industrial printing due to their instantaneous curing upon UV exposure, allowing immediate handling and packaging without drying delays. The inks demonstrate excellent adhesion to a variety of substrates, including plastics, glass, ceramics, and metals, and are formulated to provide excellent durability and moisture resistance with modified formulations including hybrid cationic/free-radical systems.

UV curable inks that have EPA DfE endorsement emissions of VOCs, hazardous air pollutants, and support cleaner flexographic printing. They encourage energy and resource savings and staying within the standards of regulations. The EPA CTSA underlines its performance and environmental advantages, which contribute to sustainable manufacturing. The industry has good infrastructure and a chain of distribution that would catalyze innovation and entry into the market. North American chemical industry investment in advanced coating technologies is expected to grow on an annual basis, leading to long-term competitive superiority in the UV curable ink sector.

The U.S. UV curable inks market is expected to dominate the North American region and grow with a significant CAGR over the forecast years, driven by increasing demand in the packaging, automotive, and electronics sectors. In addition, the adoption is also encouraged as the regulations are aimed at reducing VOC emissions and promoted by the EPA's green chemistry. In 2022, over USD 8 billion specifically for clean hydrogen and sustainable chemical manufacturing as part of the Bipartisan Infrastructure Law (also known as the Infrastructure Investment and Jobs Act) was allocated by the U.S. Department of Energy. This funding supports regional clean hydrogen hubs, manufacturing R&D activities to advance clean energy technology, and decarbonization in industrial sectors. The production in the UV curable inks market is increasing notably in a year-to-year comparison in 2023. UV-LED technologies for curing advancements increase efficiency and reduce costs.

By 2035, the Canadian UV curable inks market is projected to grow at a steady pace in the North American region, owing to the demand in packaging and health care, focusing on the need to be more sustainable. Canadian laws are similar to U.S. ones, which fosters the development of the market. Progress is constant in supporting low-carbon hydrogen as a vital element of Canada's shifting its to clean energy sources as per the Hydrogen Strategy Progress Report. Since 2020, around 80 low-carbon hydrogen projects, potentially involving investment worth more than USD 100 billion, have been announced with a focus on ramping up an annual production of above 5 million tonnes. The Canadian government encourages this growth with a program such as the Clean Hydrogen Investment Tax Credit, which generates an estimated USD 17.7 billion in tax credits by 2035. Chemical safety and waste reduction are actions by the public-private partnerships. UV curing technology adoption is subsidized by taxes and grants.

Europe Market Insights

The Europe UV curable inks market is anticipated to grow at a significant CAGR during the forecast period, 2026 to 2035, owing to the demand in the packaging, commercial printing, and labeling segment The European Green Deal has been able to mobilize recent adoption and growth of cleantech after creating a robust regulatory framework in 2019, which promoted innovation and the implementation of clean technologies throughout Europe. By targeting the scale-up of 6 key technologies: solar PV, wind, batteries, heat pumps, electrolysers, and CCS, the EU is taking steps to bridge a geographical difference of around Euro 50 billion.

Europe UV curable inks market is leading and has the potential to lead sustainability in cleantech manufacturing, with emergent success stories such as H2 Green Steel and Verkor. Multiple strict VOC laws and the assistance of the European Chemical Industry Council (CEFIC) have fast-tracked this transition to UV technology. For instance, the EU Chemicals Industry Transition Pathway in 2023 aims to collaborate between industry and governments. In 2024, more than 110 initiatives devoted to critical directions, such as energy access, had been filed. This is facilitated by the national roadmaps, where competitiveness is captured through the Antwerp Declaration, which is signed by 1300 leaders across 25 sectors. The circular economy is also providing impetus to the market through innovation and regulatory support, especially in France and Germany. These state-led programs on innovation and sustainability are strong drivers for the chemical industry as a whole, making Europe a leader in adopting UV curable inks.

Key UV Curable Inks Market Players:

- Sun Chemical (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Flint Group (Luxembourg)

- Siegwerk Druckfarben AG & Co.KGaA (Germany)

- INX International Ink Co. (USA)

- Sun Chemical (USA)

- MAG Plastics (India)

- Winchem (Malaysia) Sdn. Bhd. (Malaysia)

- DEERS I CO LTD (South Korea)

- SEANSTARKOREA CO LTD (South Korea)

- INKTEC CO LTD (South Korea)

The UV curable inks market is moderately consolidated with the presence of dominant industry players, including Sun Chemical, Flint Group, DIC Corporation, and TOYO INK SC HOLDINGS, to capture a considerable market share. Japanese manufacturers have a significant position with innovative products with an emphasis on sustainability and eco-friendly inks, following the trends in regulations. Meanwhile, the USA and European companies invest in the extension of their product lines, as well as integrating UV LED curing, thus also improving the energy efficiency ratio while minimizing VOC emissions. The companies of South Korea and Malaysia are expanding almost continuously, specializing in niche applications and the nearby markets. Key strategic moves such as mergers and acquisitions, joint ventures, research and development investments into sustainable formulations, and forays into new economic markets are placed to drive the industry to high levels of growth in the world UV curable inks market.

Top Global UV Curable Ink Manufacturers in the UV Curable Inks Market:

Recent Developments

- In July 2025, Sun Chemical unveiled the SunCure Advance ECO UV sheetfed inks, which focus on folder carton applications. The inks are 25-30% bio-renewable, and they have been certified by the American Soybean Association for their soy content. The product allows high press speed of more than 20000 impressions every hour and excellent color stability. It also minimises waste in printing, making its production efforts more sustainable. The launch is part of Sun Chemical's strategy to market environmentally friendly UV ink technologies. The demand in the packaging industry has increased due to a greener alternative to regular ink that does not compromise the quality of the print. The initiative also boosts Sun Chemical's position in the market for sustainable ink solutions.

- In July 2025, INX International launched INXJet MDLM, an inkjet ink, UV curable ink specially developed to run on beverage cans and packaged metal. The ink has high durability and fast curing capabilities that bolster the efficiency and the eco-friendliness of the printing process. This launch is directly responding to the increased market demand for UV-curable inks that are food-safe and are conducive to metal packaging. The new product offered by NX has helped the company attract widespread representation in the packaging industry. It helps the manufacturers in fulfilling the regulatory and consumer needs of safe, performance packaging material that is sustainable. INXJet MDLM ink continues current global tendencies toward functional, sustainable chemical advances in printing.

- Report ID: 8055

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UV Curable Inks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.