Urethane Concrete Sealer Market Outlook:

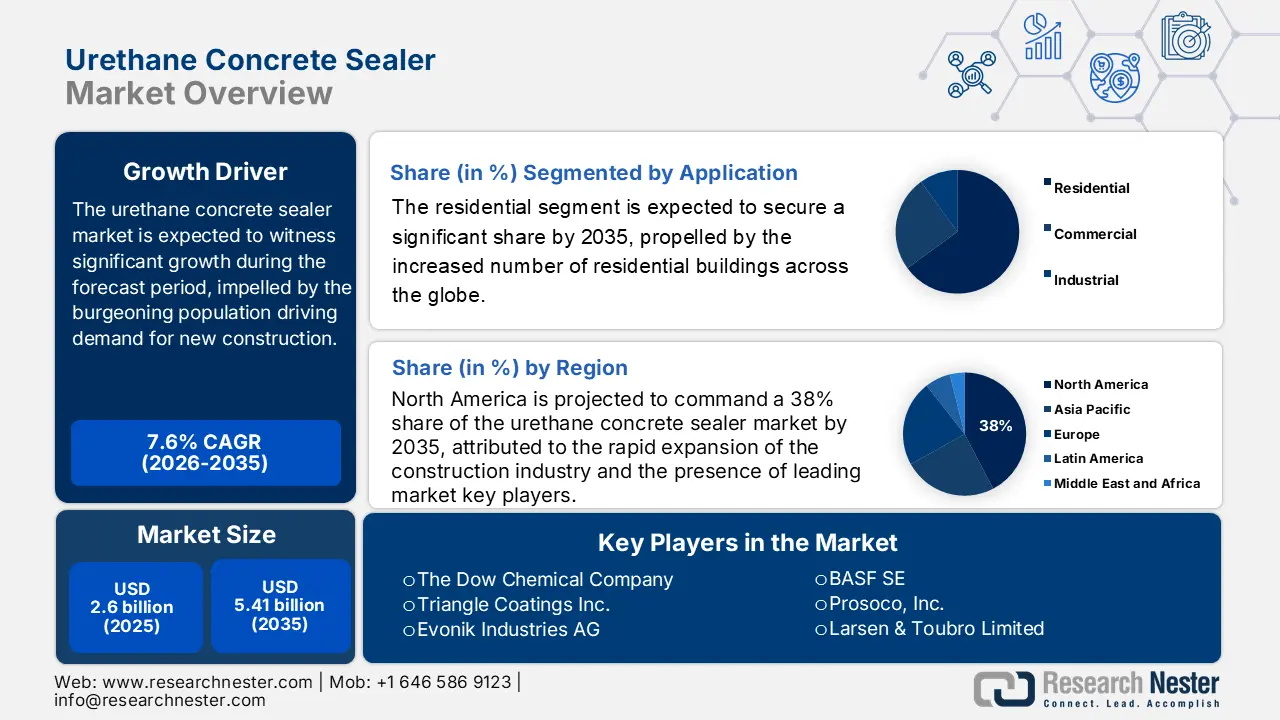

Urethane Concrete Sealer Market size was valued at USD 2.6 billion in 2025 and is likely to cross USD 5.41 billion by 2035, registering more than 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of urethane concrete sealer is assessed at USD 2.78 billion.

The growth of the market can be attributed to the increased adoption of urethane concrete sealers across the construction industry. The recent boom in the construction industry is thus expected to fuel market growth. As per recent statistics, the total spending in the U.S. construction sector totaled to be USD 2 trillion in 2020. Further, the U.S. construction industry accounted for 4.2% of the total GDP in 2021. The higher utilization of urethane concrete sealer in the construction industry is associated with the fact that it increases the lifespan of floors and walls. It prevents cracks and stains and protects them from humidity by making them durable and long-lasting. Hence, this factor is estimated to boost the market growth over the forecast period.

Applied on concrete surfaces, urethane concrete sealer protects from corrosion, staining, and other degrading processes. Urethane concrete sealer adds an impermeable layer that prevents materials from passing or accumulating on concrete surfaces. Urethane concrete sealer is highly durable and has abrasion resistant nature that significantly increases the life of concrete structures. Additionally, it dries up quickly, thus allowing professionals to finish their projects promptly. The increased involvement of the population in the construction sector is expected to expand the construction industry which is further projected to fuel the urethane market growth in the forecast period. As of 2021, there were almost 10 million construction workers in the United States, approximately 8% of the total working population.

Key Urethane Concrete Sealer Market Insights Summary:

Regional Insights:

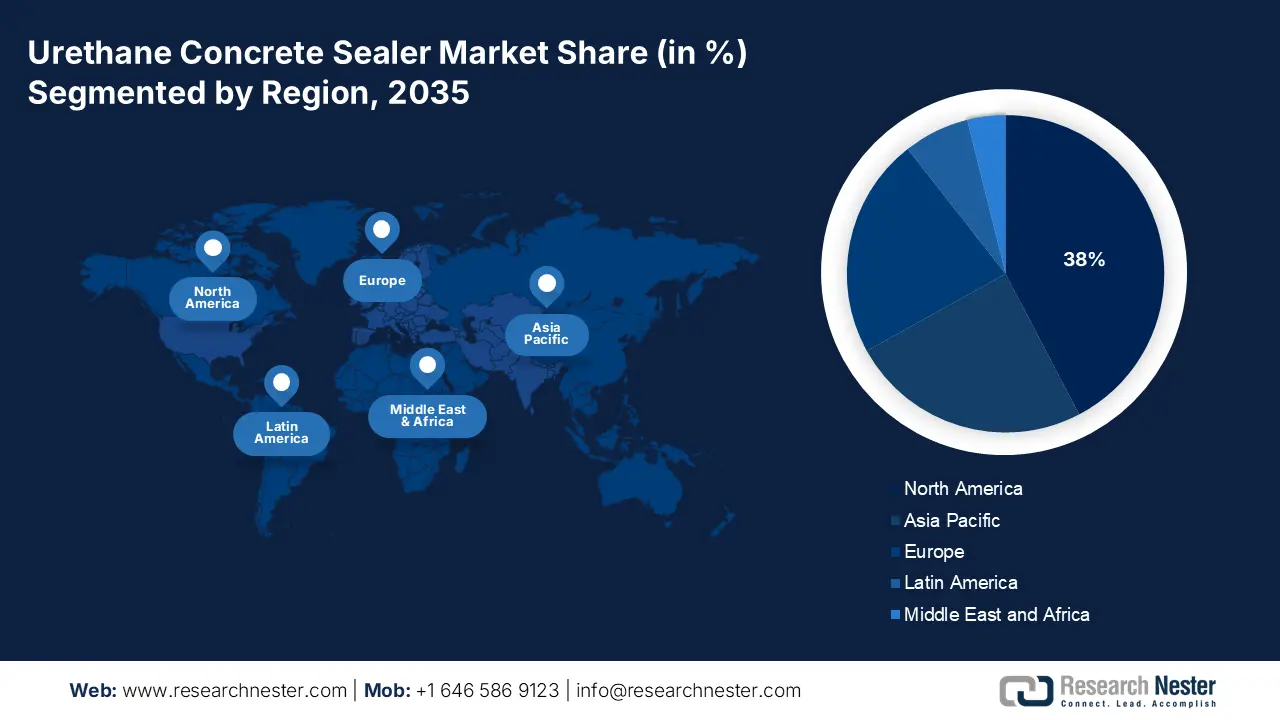

- North America is projected to capture a 38% share of the urethane concrete sealer market by 2035, bolstered by the swift expansion of the regional construction sector and the strong presence of prominent industry players.

- The Asia Pacific region is anticipated to exhibit notable growth by 2035, underpinned by accelerating urbanization and rising demand for rapid residential and commercial construction.

Segment Insights:

- The residential segment is expected to secure a significant share in the urethane concrete sealer market, supported by the rising volume of global residential building development fueled by population growth.

- The commercial construction segment is projected to attain the second-largest share by 2035, reinforced by increasing global investments in commercial infrastructure and expanding business activity.

Key Growth Trends:

- Burgeoning Population to Escalate the Demand for the Construction of New Buildings

- Rise in Residential Construction to Boost the Market Growth

Major Challenges:

- Presence of the Substitute Material of Urethane Concrete in the Market

- Fluctuating Costs of Raw Materials

Key Players: Perma Inc., The Dow Chemical Company, Triangle Coatings Inc., Evonik Industries AG, BASF SE, Prosoco, Inc., Larsen & Toubro Limited, LATICRETE International, Inc., W. R. Meadows, Inc., Key Resin Company.

Global Urethane Concrete Sealer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.78 billion

- Projected Market Size: USD 5.41 billion by 2035

- Growth Forecasts: 7.6%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 21 November, 2025

Urethane Concrete Sealer Market - Growth Drivers and Challenges

Growth Drivers

- Burgeoning Population to Escalate the Demand for the Construction of New Buildings – As per the World Bank, the total population in the world stood at 7.76 billion in 2021, up from 7.09 billion in 2012. The growth of the population is expected to rise the demand for housing and other buildings for survival. Furthermore, a notable number of people are migrating to the urban areas in search of livelihood or to live a luxurious life has also triggered the demand for rapid construction of new buildings. On the other hand, there has been a significant boom in the construction of commercial buildings backed by rising government initiatives to constitute smart cities. The increased need for construction is further anticipated to fuel the demand for urethane concrete sealers and expand the market size.

- Rise in Residential Construction to Boost the Market Growth– As per the United States Census Bureau, till June 2021, there were 142,153,010 housing units in the U.S. Further the building permit in the same period was 1,736,982 units.

- High Investment in Real Estate Globally– As per recent estimates, the revenue of real estate companies worldwide stood at USD 9.5 billion in 2021.

- Expansion of Commercial Building Construction – The data released by the Commercial Buildings Energy Consumption Survey (CBECS), estimated that there were approximately 5.9 million U.S. commercial buildings in 2018. Further, the number of commercial buildings increased by 6% since the CBECS was last conducted in 2012.

Challenges

- Presence of the Substitute Material of Urethane Concrete in the Market

Some people and architects don’t prefer urethane concrete owing to the convenient availability of other substitutes such as. Acrylic, film-forming sealers, epoxy, and others. Epoxy concrete sealers are heavily used in indoor flooring since it is the most durable material. Additionally, there are several groups of urethanes which are comprised of polyurethane as well.

- Fluctuating Costs of Raw Materials

- Stringent Rules by the Government

Urethane Concrete Sealer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 5.41 billion |

|

Regional Scope |

|

Urethane Concrete Sealer Market Segmentation:

Application Segment Analysis

The global urethane concrete sealer market is segmented and analyzed for demand and supply by end-user into residential, commercial, and industrial construction. Amongst these three segments, the residential segment is expected to garner a significant share. The growth of the market can be ascribed to the increased number of residential buildings across the globe. As per estimations, in 2020, there were almost 100 million single-family homes in the U.S. Further, there were around 5.2 million multifamily residential buildings in the same period. Residential construction is expected to dominate the market as there is an ample amount of increased population. In 2020, it was calculated that 90% of the buildings in the U.S. were single-family homes, with approximately 200 billion square feet. Therefore, all these factors are expected to hike the market growth over the forecast period.

Sales Channel Segment Analysis

Furthermore, the commercial construction segment is also expected to obtain the second-largest share of the market over the forecast period. Commercial construction includes renovating, designing, and building new commercial structures based on demand. The segment is projected to grow on the back of rising funding for construction and a surge in business activities across the globe. The properties comprised of the commercial building are retail spaces, office space, multi-family retail, and industrial use. Urethane concrete can also be combined composites manufactured with several materials such as cement and many more. In commercial construction, a person can find hotels, office buildings, medical & shopping centers, warehouses, and others. As of 2018, approximately 6 million commercial buildings in the USA took around 95 billion square feet in the United States.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urethane Concrete Sealer Market - Regional Analysis

North American Market Insights

North America industry is likely to hold largest revenue share of 38% by 2035, attributed to rapid expansion of the construction industry and the presence of leading market key players. The growth of the market can be attributed majorly to the rapid expansion of the construction industry and the presence of leading market key players. In the U.S. economy, the construction industry has more than 745,000 employers and over 7.6 million employees. Further, the burgeoning population of the region is expected to increase the spending on building construction. The total U.S. spending on construction amounted to around USD 1 trillion in 2019. Furthermore, in the same period, the U.S. private, public, and commercial sector construction totaled USD 977 billion, USD 329 billion, and USD 29 billion.

APAC Market Insights

Furthermore, the market in the Asia Pacific region is also expected to grow at a notable pace over the forecast period. Growth in urbanization boosting the demand for more buildings for people to dwell in is estimated to expand the market size in the region over the forecast period. For instance, it was estimated that around 50% of the population of Asia will migrate to urban areas by 2030. Additionally, the growing real estate industry in the Asia Pacific region has also spurred the demand for rapid building construction whether it’s commercial or residential. Hence, all these factors are expected to boost the market growth over the forecast period.

Urethane Concrete Sealer Market Players:

- Perma Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- Triangle Coatings Inc.

- Evonik Industries AG

- BASF SE

- Prosoco, Inc.

- Larsen & Toubro Limited

- LATICRETE International, Inc.

- W. R. Meadows, Inc.

- Key Resin Company

Recent Developments

-

Evonik Industries AG has successfully acquired German biotech company JeNaCell. This acquisition is projected to expand the company’s biomaterials portfolio to provide biotechnologically derived cellulose. The company further plans to double its share in Nutrition & Care system solutions by 2030. JaNaCell has made a material based on natural ingredients for utilization in dermatology.

-

The Dow Chemical Company has joined Shell to develop ethylene steam crackers, which supplies chemicals used to make products that are used by customers every day. Additionally, the company has completed the manufacturing of an e-cracking furnace which is being utilized at Energy Transition Campus Amsterdam.

- Report ID: 4223

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urethane Concrete Sealer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.