- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Industry Overview (1/3)

- Market Overview

- Market Segmentation

- Country Synopsis

- Industry Supply Chain Analysis

- Current & Future Market Share by End-User Segment: Semiconductor Fabrication, Display Manufacturing, Battery Manufacturing, Hydrogen Production & Storage, Advanced Mobility, Aerospace & Defense, Other Industrial and Chemical Applications

- End-User Landscape in Specialty Chemicals

- Country-Wise Sales Analysis of Major Specialty Chemicals Series

- Company Wise specialty Chemicals Sales Data: US

- US Equipment vs. Reagent Sales (2025E)

- OEM Product Development Base Assessment

- Comparative Analysis of specialty Chemicals Types

- Membranes vs. Catalyst Specialty Chemicals

- Application Landscape in Specialty Chemicals: Adhesives and Propellants

- Optical Fiber Coatings & High Frequency Polymers in Specialty Chemicals

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Regulatory Framework

- Competitive Landscape

- BASF

- Albemarle Corporation.

- Clariant, Inc.

- Evonik

- Croda International

- LANXESS

- U.S. Specialty Chemicals Market – Strategic

- Comparison

- Modality Focus in Specialty Chemicals: Benchtop vs. Floor-standing

- Technological Advancements

- Patents Outlook

- Pricing Benchmarking

- Recent Developments

- SWOT Analysis

- Root Cause Analysis (RCA) For The Market

- Porter’s Five Forces

- Industry Risk Assessment

- U.S. Outlook and Projections

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- End User, Value (USD Million)

- Semiconductor Fabrication

- Photolithography

- Etching

- Others

- Display Manufacturing

- OLED materials

- Specialty Coatings

- Others

- Battery Manufacturing

- Cathode materials

- Anode materials

- Others

- Hydrogen Production & Storage

- Membranes

- Catalyst

- Absorbents

- Telecommunication Infrastructure

- Optical fiber coatings

- High-frequency polymers

- Others

- Advanced Mobility

- EV materials

- Lightweight composites

- Thermal management chemicals

- Others

- Aerospace and Defense

- Adhesives

- Propellants

- Others

- Other Industrial and Chemical Applications

- Semiconductor Fabrication

- End User, Value (USD Million)

- About Research Nester

- Our Global Clientele

- We Serve Clients Across the World

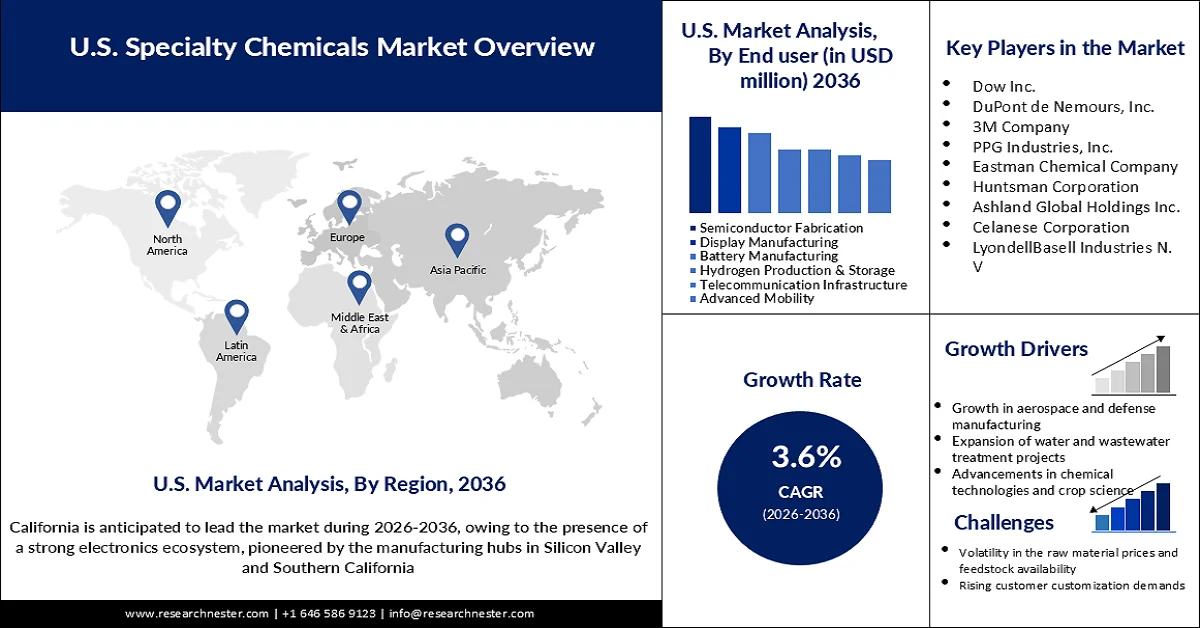

U.S. Specialty Chemicals Market Outlook:

U.S. Specialty Chemicals Market size was valued at USD 145.87 billion in 2025 and is projected to reach USD 217.35 billion by the end of 2036, rising at a CAGR of approximately 3.65% during the forecast period i.e., 2026-2036. In 2026, the industry size of the U.S. specialty chemicals is estimated USD 151.90 billion.

The surge in trade of semiconductor devices is prominently speeding up the growth of the U.S. specialty chemicals market. The development of semiconductor devices is highly dependent on modern and high-purity chemical inputs, driving the higher adoption across the U.S. semiconductor ecosystem. This directly propels the demand for specialty chemicals for wafer processing. The rising activities in trade are also catalyzing the investments in the next-generation facilities, where strict standards of purity demand cutting-edge facilities. Furthermore, the rising production of semiconductors for applications such as AI and data centers is fostering the demand for customized chemical formulations.

U.S. Semiconductor Devices Exports (2024)

|

Export Destination |

Export Value (USD Billion) |

|

Mexico |

1.10 |

|

China |

1.06 |

|

Malaysia |

0.56 |

|

Thailand |

0.43 |

|

Germany |

0.39 |

|

Total U.S. Exports |

6.91 |

Source: OEC

A vast number of private and local companies are significantly investing in the market in the U.S. The widespread expansion of modern manufacturing sectors, such as pharmaceuticals and renewable energy, is developing a sustained demand for modern chemical formulations. The country provides a well-established ecosystem for the protection of intellectual property, enabling faster innovation. Furthermore, stringent environmental regulations are speeding the transition towards opening new revenue streams for various agile companies. Cumulatively, these factors, coupled with reliable infrastructure, are fostering the sustained investment from private and domestic firms.

Key U.S. Specialty Chemicals Market Insights Summary:

Regional Highlights:

- The California region is projected to capture a notable share of the U.S. specialty chemicals market by 2036, propelled by a robust electronics ecosystem anchored in Silicon Valley, accelerating EV adoption, renewable energy deployment, and strong pharmaceutical clusters.

- The region is anticipated to maintain its dominance by 2036, stimulated by its leadership in the medical device ecosystem and rising demand for low-temperature specialty chemicals suited for freeze-thaw conditions.

Segment Insights:

- The semiconductor fabrication sub-segment of the U.S. specialty chemicals market is forecast to secure 18% share by 2036, fueled by expanding domestic semiconductor manufacturing capacity backed by federal investments under the Science and CHIPS Act.

Key Growth Trends:

- Growth in aerospace and defense manufacturing

- Expansion of water and wastewater treatment projects

Major Challenges:

- Volatility in the raw material prices and feedstock availability

- Rising customer customization demands

Key Players: Dow Inc., DuPont de Nemours, Inc., 3M Company, PPG Industries, Inc., Eastman Chemical Company, Huntsman Corporation, Ashland Global Holdings Inc., Celanese Corporation, LyondellBasell Industries N. V.

Global U.S. Specialty Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 145.87 billion

- 2026 Market Size: USD 151.90 billion

- Projected Market Size: USD 217.35 billion by 2036

- Growth Forecasts: 3.65% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: California

- Fastest Growing Region: California

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Brazil, Mexico, Indonesia

Last updated on : 11 February, 2026

U.S. Specialty Chemicals Market - Growth Drivers and Challenges

Growth Drivers

- Growth in aerospace and defense manufacturing: The surge in defense and aerospace manufacturing is acting as a significant propellant for the growth of the market in the U.S. Various specialty chemicals, such as high-temperature polymers and performance adhesives, are crucial in lowering weight and enhancing corrosion resistance. As the defense budget in the U.S. is climbing, OEMs are speeding up the production of next-generation fighter jets, satellites, etc. These require superior material performance while meeting sustainability and regulatory requirements. Additionally, trends such as modern manufacturing techniques, including 3D printing, require custom resins, further propelling market growth. According to data published by the U.S. government in 2024, the budget request for fiscal year 2025 reached 849.8 billion for the Department of Defense.

- Expansion of water and wastewater treatment projects: In the U.S., there has been a rapid expansion of wastewater treatment projects, which are shaping the U.S. specialty chemicals market landscape. Various utilities are transitioning from conventional treatment to modern oxidation and water reuse systems, which depend significantly on cutting-edge specialty chemicals to eradicate heavy metals and other micro pollutants. Furthermore, the climate-driven obstacles, such as extreme rainfalls, are compelling utilities to invest in modular treatment facilities, creating high demand for process-specific additives. The surge in emphasis on operational reliability is also pushing treatment operators to include specialty chemicals that enhance sludge dewatering. According to the data published by the Environmental Protection Agency in November 2025, in the United States, almost 34 billion gallons of wastewater are treated every day, further augmenting the U.S. specialty chemicals market growth.

- Advancements in chemical technologies and crop science: The U.S. is witnessing advancements in chemical technologies, which are playing a pivotal role in speeding the growth of the market. The innovations in formulation chemistry have resulted in the development of precision agrochemicals such as advanced adjuvants and controlled-release fertilizers. Similarly, advancements in crop science and seed trait engineering are raising the need for customized chemical inputs, mainly for specific crops. Specialty chemicals are widely utilized to aid in stress tolerance and yield optimization, mainly in the U.S., to support farmers in response to climate variability.

U.S. Chemicals Trade by the Numbers (2025)

|

Indicator |

Value |

|

Total U.S. Chemical Exports |

USD 161 Billion |

|

Share of Total U.S. Goods Exported |

9% |

|

Growth in Chemical Exports (Past Decade) |

26% |

|

Share of Petrochemicals & Derivatives in Exports |

51% |

|

Exports Between Companies & Subsidiaries |

37% |

|

Imports Between Companies & Subsidiaries |

55% |

|

Share of Chemical Shipments Exported Globally |

24% |

|

U.S. Chemical Trade Surplus |

USD 26 Billion |

|

Largest Export Markets |

Canada (USD 27B), Mexico (USD 26B) |

Source: American Chemistry Council

Challenges

- Volatility in the raw material prices and feedstock availability: The production of specialty chemicals in the U.S. is significantly dependent on various specialty intermediates and petrochemical derivatives, many of which are susceptible to volatility in prices. Furthermore, there is restricted availability of certain specialty feedstocks, which raises the dependency on imports, exposing manufacturers to risks in supply chains. Other than this, the specialty chemicals market needs continuous investment in research and process optimization.

- Rising customer customization demands: Across the prominent end-users, such as pharmaceuticals, electronics, automotive sectors, etc., the demand for tailor-made chemical solutions is rising. However, the customization increases the value creation, but it also raises the complexity in the production, resulting in increased lead times. Manufacturers are facing difficulties in cost efficiency, which remains a prominent challenge for manufacturers.

U.S. Specialty Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

3.65% |

|

Base Year Market Size (2025) |

USD 145.87 billion |

|

Forecast Year Market Size (2036) |

USD 217.35 billion |

|

Regional Scope |

U.S. (Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming) |

U.S. Specialty Chemicals Market Segmentation:

End-user Segment Analysis

The semiconductor fabrication sub-segment is predicted to garner 18% of the total market by 2036, showcasing a significant surge in its contribution. The strong growth of the U.S. specialty chemicals market can be primarily driven by the widespread expansion of local semiconductor manufacturing capacity. The expansion of the capacity is supported by the significant federal investments under the Science and CHIPS Act. The construction of modern wafer fabrication plants is increasing the demand for electronic wet chemicals and specialty gases, which are crucial for chip manufacturing. Other than this, the rising utilization of semiconductors across artificial intelligence and data centers is driving the chip demand, thereby strengthening the importance of specialty chemicals.

Also, in the U.S., there is a surge in the concentration of fabs operated by domestic players, which is prominently raising the demand for high-purity electronic chemicals. The country is focusing on local sourcing to lower the risk in the supply chain and benefit U.S.-based specialty chemical suppliers with modern purification capabilities. The country is also witnessing strong collaboration between equipment suppliers and chemical manufacturers. These types of collaborations are speeding the innovation in next-generation photoresists and low-defect materials customized for modern nodes.

Our in-depth analysis of the U.S. specialty chemicals market includes the following segments:

|

Segment |

Subsegments |

|

End-user Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

U.S. Specialty Chemicals Market - Regional Analysis

California Market Insights

The market in California is expanding on the back of the presence of a strong electronics ecosystem, pioneered by the manufacturing hubs in Silicon Valley and Southern California. The presence of fabless semiconductor firms and chip design companies is driving the steady demand for electronic-grade solvents and specialty gases. Other than this, California is leading in electric vehicle adoption and renewable energy deployment. The state is giving significant emphasis on zero-emission vehicle mandates, which are boosting the demand for specialty chemicals utilized in power electronics. Also, the growth of the U.S. specialty chemicals market is driven by the state’s dominant position in pharmaceutical clusters, mainly in San Diego and the San Francisco Bay Area, generating a significant demand for solvents and reagents.

Furthermore, California has a dense concentration of research institutes and start-ups, which is creating a significantly innovative-oriented environment for specialty chemicals. The state is witnessing continuous collaboration between technology firms and research labs, propelling the collaboration between research labs and chemical producers. The region has an environmentally conscious consumer base with stringent packaging regulations, which are speeding the adoption of specialty chemicals utilized in barrier coatings and eco-friendly packaging solutions. The presence of major ports such as Long Beach enhances the region’s role as an export hub, aiding specialty chemical distribution to U.S. specialty chemicals market in the Asia Pacific.

Minnesota Market Insights

The region dominates the medical device ecosystem, which has created localized demand for alternatives based on ethylene oxide and low-residue cleaning agents. The requirement of sterilization in device-centric compliance, where repeated sterilization cycles need modern formulations that maintain material integrity. Also, extreme cold weather conditions create a significant demand for low-temperature specialty chemicals. Manufacturers in the state are giving importance to formulations that can retain performance under freeze-thaw cycles, and further placing the region as a development ground for specialty chemical solutions.

Other than this, Minnesota is identified as “Land of 10,000 Lakes”; it enforces stringent environmental control standards on water discharge. This drives regional innovation in biodegradable corrosion inhibitors and phosphate-free water treatment chemicals. Various specialty chemical companies operating in Minnesota are developing products customized to freshwater ecosystem protection. The adoption of alternative specialty chemical formulation is significantly high in the country due to a strong push for the PFAS phase-outs.

Key U.S. Specialty Chemicals Market Players:

- Dow Inc.

- DuPont de Nemours, Inc.

- 3M Company

- PPG Industries, Inc.

- Eastman Chemical Company

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Celanese Corporation

- LyondellBasell Industries N. V

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Dow Inc. is one of the most influential players in the U.S. specialty chemicals market, leveraging its strong expertise in materials science, formulation chemistry, and large-scale manufacturing. The company offers a broad portfolio of specialty products, including performance plastics, specialty polymers, coatings materials, adhesives, sealants, elastomers, and functional additives that serve key end-use industries such as packaging, automotive, construction, electronics, and healthcare.

- DuPont de Nemours, Inc. is a leading force in the U.S. specialty chemicals market, known for its deep technological capabilities and strong focus on innovation-driven, high-performance materials. The company’s specialty chemical portfolio spans advanced polymers, electronic materials, specialty resins, adhesives, films, and protection solutions that cater to high-growth sectors such as semiconductors, electronics, automotive, aerospace, healthcare, and industrial manufacturing. DuPont plays a critical role in the U.S. semiconductor ecosystem by supplying high-purity materials, photoresists, and process chemicals essential for advanced chip fabrication.

- 3M Company is a prominent participant in the U.S. specialty chemicals market, distinguished by its strong emphasis on science-based innovation and diversified application expertise. The company develops and supplies a wide range of specialty chemical solutions, including performance coatings, advanced adhesives, sealants, abrasives, fluorochemical alternatives, and specialty additives that serve industries such as electronics, automotive, healthcare, industrial manufacturing, and consumer goods. 3M’s specialty chemicals are integral to surface protection, bonding, thermal management, filtration, and precision finishing applications.

- Eastman Chemical Company is a major player in the U.S. specialty chemicals market, recognized for its strong capabilities in advanced materials, specialty additives, and functional intermediates. The company’s specialty portfolio includes performance polymers, specialty plastics, coatings, additives, plasticizers, and specialty solvents that serve key industries such as automotive, construction, packaging, healthcare, and consumer goods.

Below is the list of the most dominant key businesses in the U.S. specialty chemicals market:

The U.S. specialty chemicals market is distinguished by a highly innovation-driven landscape, and the trailblazing players are continuously reinforcing their technological capabilities to maintain differentiation. Companies are emphasizing application-specific formulations, focusing on sustainability to meet evolving end-use requirements. Also, the market participants are investing significantly in green chemistry and bio-based alternatives, positioning specialty chemicals as value-adding and regulation-compliant solutions rather than commoditized inputs.

Corporate Landscape of the U.S. Specialty Chemicals Market:

Recent Developments

- In September 2025, PPG Industries, Inc. showcased a broad suite of its latest industrial finishing innovations at FABTECH 2025, the premier North American sheet metal manufacturing trade show. PPG is committed to delivering high-performance coatings that safeguard assets and extend their lifespan.

- In September 2025, Huntsman Corporation’s Advanced Materials division has unveiled a newly reformulated line of ARALDITE epoxy adhesives designed to meet evolving regulatory and sustainability expectations while maintaining the high performance the brand is known for.

- Report ID: 8392

- Published Date: Feb 11, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

U.S. Specialty Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.