Medical Coding Market Outlook:

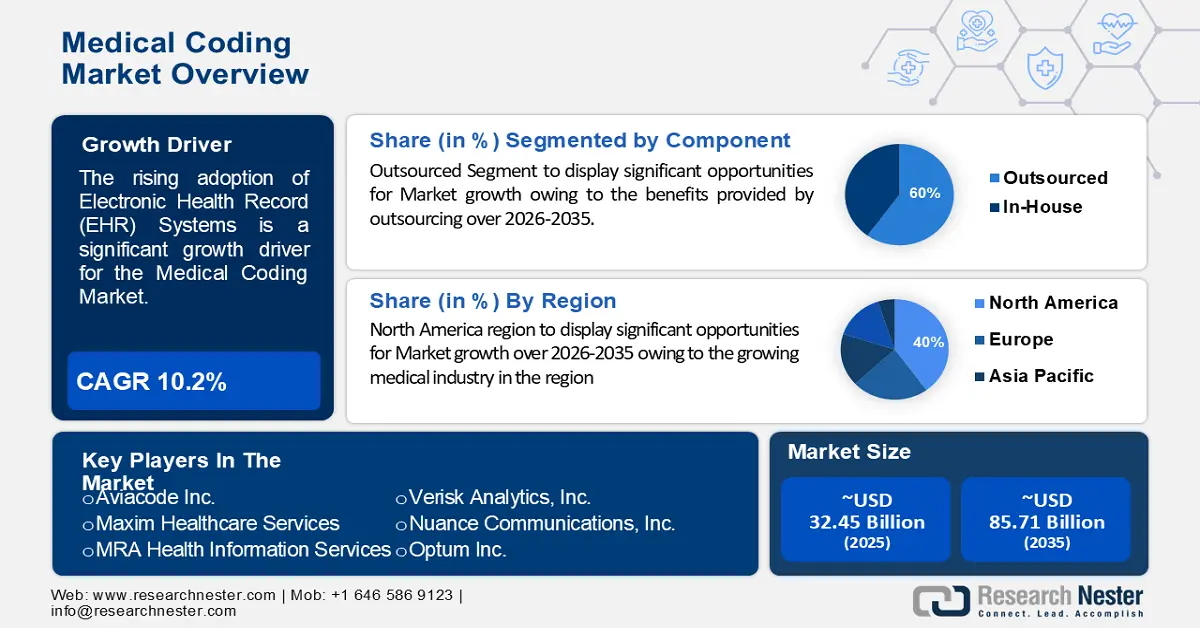

Medical Coding Market size was over USD 32.45 billion in 2025 and is anticipated to cross USD 85.71 billion by 2035, witnessing more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical coding is assessed at USD 35.43 billion.

The reason behind the growth is due to the growing healthcare spending across the globe. Healthcare spending is steadily growing faster than GDP as a result of general inflation, rising prices for prescription drugs, higher wages for healthcare providers, an aging population, lifestyle, and several other factors.

According to estimates, global health spending is estimated to increase by more than 35% between 2018 and 2022, reaching around USD 10 trillion.

The growing technological advancements are believed to fuel the market growth. AI-based medical coding systems enable real-time medical coding that leverages machine learning to automate the medical coding process, which aids in improving medical billing and coding accuracy, reduces the risk of medical coding errors, and can assist human programmers with real-time medical coding by providing recommendations that can significantly improve accuracy, and productivity.

Key Medical Coding Market Insights Summary:

Regional Highlights:

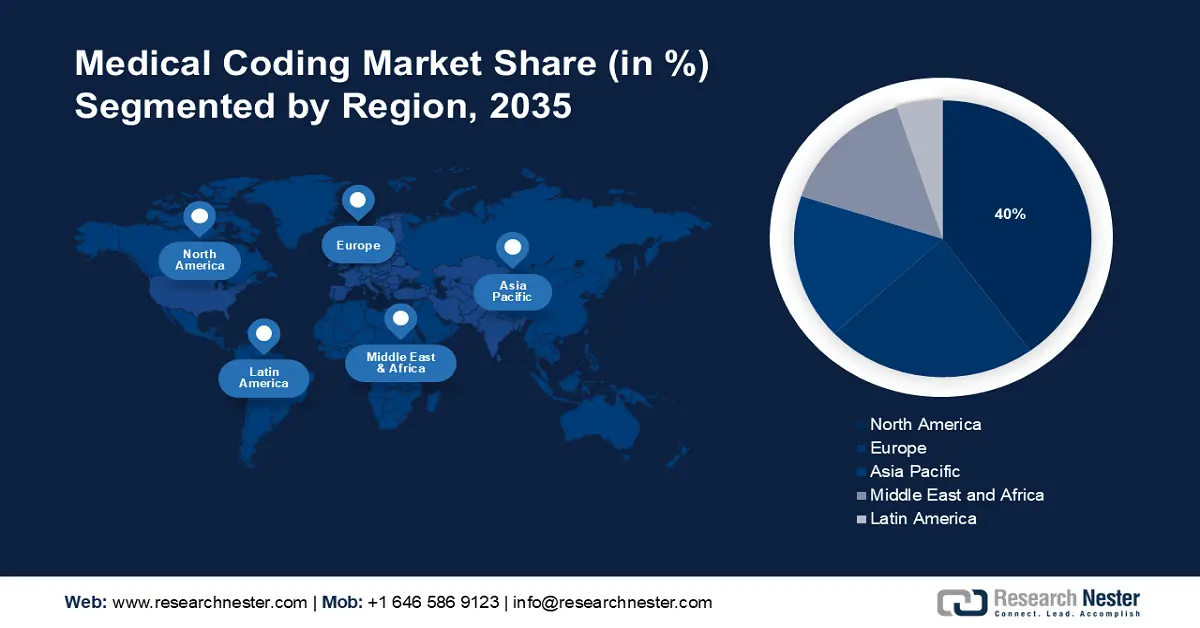

- The North America medical coding market will dominate around 40% share by 2035, driven by the growing medical industry and healthcare spending.

- The Europe market will hold the second largest share by 2035, attributed to growing health awareness and adoption of E-Health technologies.

Segment Insights:

- The outsourced segment in the medical coding market is projected to hold a 60% share by 2035, fueled by the benefits provided by outsourcing and increased coding accuracy.

- The icd (medical coding) segment in the medical coding market is expected to hold a notable revenue share by 2035, driven by the global standardization and diagnostic accuracy offered by ICD.

Key Growth Trends:

- Rising Adoption of Electronic Health Record (EHR) Systems in Healthcare

- Surging Need for Universal Language in Healthcare

Major Challenges:

- Data security and privacy concerns

- Lack of standardization owing to varying healthcare systems and regulations across several regions.

Key Players: Aviacode Inc., Maxim Healthcare Services, MRA Health Information Services, Oracle, Verisk Analytics, Inc., Nuance Communications, Inc., Optum Inc., Outsource Strategies International, VertMarkets, Inc., S&P Global, AltuMED, Coding Network.

Global Medical Coding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.45 billion

- 2026 Market Size: USD 35.43 billion

- Projected Market Size: USD 85.71 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, India, Germany, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 16 September, 2025

Medical Coding Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Adoption of Electronic Health Record (EHR) Systems in Healthcare– EHR Systems is an electronic version of a patient's medical record, which is designed to automate many tasks and make it easier for medical billers and medical coders to work efficiently and store patient information, medical images, and test results.

-

Growing Digital Transformation- Digitalization of billing systems has increased the need for medical coding around the world as digitized bills are accurate and can be customized with patient medical information, including location, medical history, diagnosis, and other relevant information.

-

Surging Need for Universal Language in Healthcare- Medical codes are the universal language of communication between payers and healthcare providers, that allow healthcare professionals, organizations, and systems around the world to communicate effectively and efficiently.

Challenges

-

Data security and privacy concerns - Medical records have become a valuable asset for hackers since security issues with electronic health records can pose problems for data security, patient safety, and regulatory compliance, which is a major concern for both telemedicine professionals and patients.

-

Lack of standardization owing to varying healthcare systems and regulations across several regions.

-

Lack of skilled professionals may hamper the medical coding market growth.

Medical Coding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 32.45 billion |

|

Forecast Year Market Size (2035) |

USD 85.71 billion |

|

Regional Scope |

|

Medical Coding Market Segmentation:

Component Segment Analysis

The outsourced segment is predicted to account for 60% share of the global medical coding market during the forecast period owing to the benefits provided by outsourcing. Accurate medical coding is important to all healthcare providers therefore outsourcing medical coding has gained immense importance and is quite common among healthcare providers since it allows facilities to better manage their coding needs., and provides instant relief from uncertainty regarding the original claimant's retirement, and can suggestively improve the accuracy of the coding decisions.

Outsourcing medical coding has proven to be more cost-effective since it reduces the need for office supplies, paper consumption, and the cost associated with infrastructure development. Moreover, it allows healthcare providers to make better use of their time, providing superior patient care and increasing overall satisfaction.

Medical billing allows us to earn more revenue with far less effort, eliminate overhead administrative tasks, increase cash flow, while reducing costs and billing errors, improve compliance, and also allow staff to connect with patients without the stress of discussing bills.

In addition, hospital medical billing is the process of overseeing billing and coding policies within a medical facility or clinic, which necessitates office space, technical support, and a dedicated team, that can further increase an employee's already stressful initial workload.

Classification Type Segment Analysis

The international classification of diseases (ICD) segment in medical coding market is set to garner a notable share shortly. The International Classification of Diseases (ICD) was developed by the World Health Organization (WHO) as a globally recognized diagnostic tool, which is intended to facilitate international comparisons and convert diagnoses of diseases and other health problems from text to alphanumeric codes. The ICD classification is one of the oldest and most important classifications in medicine, which involves several components that provide detailed information about a specific health condition or procedure that is widely used by clinical coders around the world for clinical coding in administrative health databases.

In addition, the Healthcare Common Procedure Coding System (HCPCS) is a standardized coding system required for healthcare providers, which is used to facilitate the processing of health insurance claims by Medicare Medicaid, and several other insurance companies. HCPCS Healthcare Common Procedure Coding System "HCPCS" is a code set developed by the Centers for Medicare and Medicaid Services (CMS), established in 1978, which is usually used as a billing standard for representing medical procedures, and makes medical bills clearer for patients.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Classification Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Coding Market Regional Analysis:

North American Market Insights

Medical Coding market in North America is predicted to account for the largest share of 40% by 2035 impelled by the growing medical industry. The medical field is one of the fastest-growing industries in the United States, as people spend more on healthcare in the region than in any other country in the world. This has led to an increase in the amount of data, leading to higher demand for medical coding. For instance, U.S. health spending increased by more than 4% in 2022.

European Market Insights

The European medical Coding market is estimated to be the second largest, during the forecast timeframe led by growing health awareness. Europe's health and fitness industry has experienced marvelous growth, owing to the increasing awareness of the importance of health and well-being, and the implementation of E-Health to advance healthcare delivery and accessibility. In addition, European countries are using electronic health records (EHRs) to improve healthcare as funding and allow citizens to quickly access and share their health data with medical professionals. This is expected to drive the demand for medical coding in the region.

Medical Coding Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aviacode Inc.

- Maxim Healthcare Services

- MRA Health Information Services

- Oracle

- Verisk Analytics, Inc.

- Nuance Communications, Inc.

- Optum Inc.

- Outsource Strategies International

- VertMarkets, Inc.

- S&P Global

- AltuMED

- Coding Network

- PAREXEL International Corporation

- Startek

- GeBBS Healthcare Solutions

Recent Developments

- GeBBS Healthcare Solutions announced the acquisition of Aviacode Medical Coding & Coding Audit Services to position itself as a leader in the RCM/HIM space, and to meet the market demand.

- Oracle announced to launch of generative AI tools integrated with HER to automate note-taking during visits with patients and allow physicians to send information to patients through chat in the patient portal, such as reminding patients to bring test results.

- Report ID: 5899

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Coding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.