IoT Medical Devices Market Outlook:

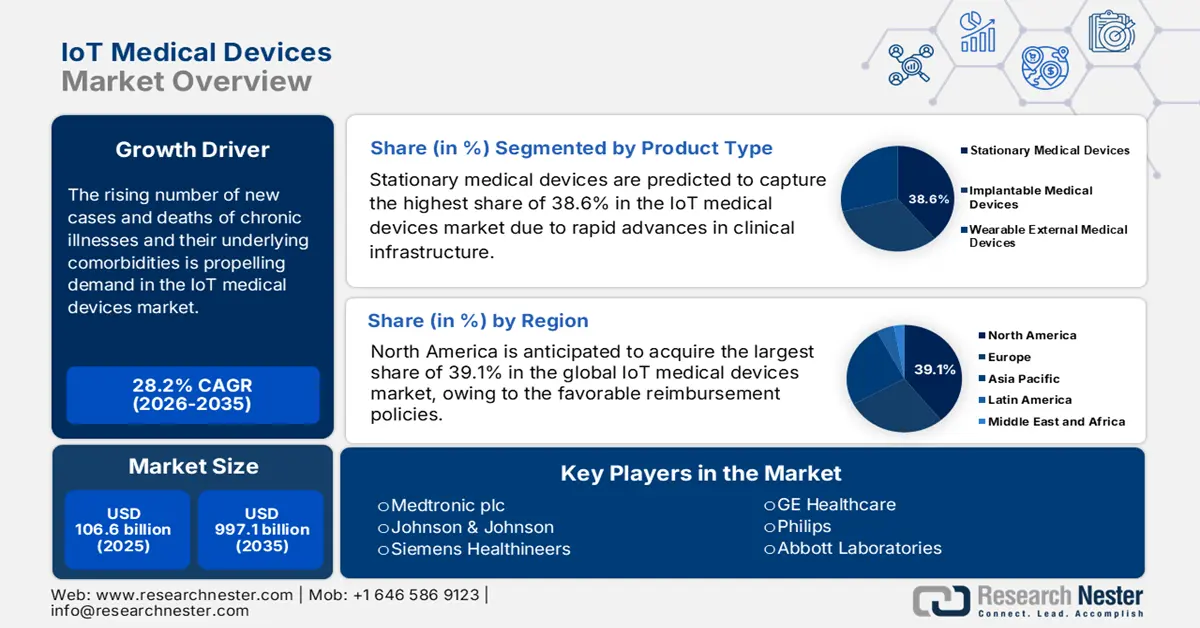

IoT Medical Devices Market size was valued at USD 106.6 billion in 2025 and is projected to reach USD 997.1 billion by the end of 2035, rising at a CAGR of 28.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of IoT medical devices is estimated at USD 136.6 billion.

The rising number of new cases and deaths of chronic illnesses and their underlying comorbidities is creating a worldwide surge for the deployment of advanced and scalable clinical equipment, propelling demand in the market. This substantial nature of the demography can be exemplified by the predicted increase of the total number of adults, aged 20-79 years, with diabetes across the globe from 537 million in 2021 to 643 million and 783 million by 2030 to 2045, as per the National Library of Medicine (NLM). Particularly, the growing need for real-time tracking of vital health parameters to enable early diagnosis and effective disease management is fostering a sustainable consumer base for the merchandise.

Despite the explosive growth in global trade values, the market still witnesses uncertainties from budget constraints in many regions. In this regard, displaying the amplifying economic burden, a 2024 NLM study concluded that the net cost of chronic illness in the world is expected to surpass USD 47 trillion by 2030. To overcome the roadblock, manufacturers are increasingly focusing on enhancing clinical efficacy, interoperability, and long-term cost benefits to secure favorable payers’ pricing and coverage for financial backing. Such efforts to enable flexible pricing models to gain broader adoption in this field further establish a strong foundation for the incorporation of subscription-based and outcome-linked payments for associated services and products.

Key IoT Medical Devices Market Insights Summary:

Regional Insights:

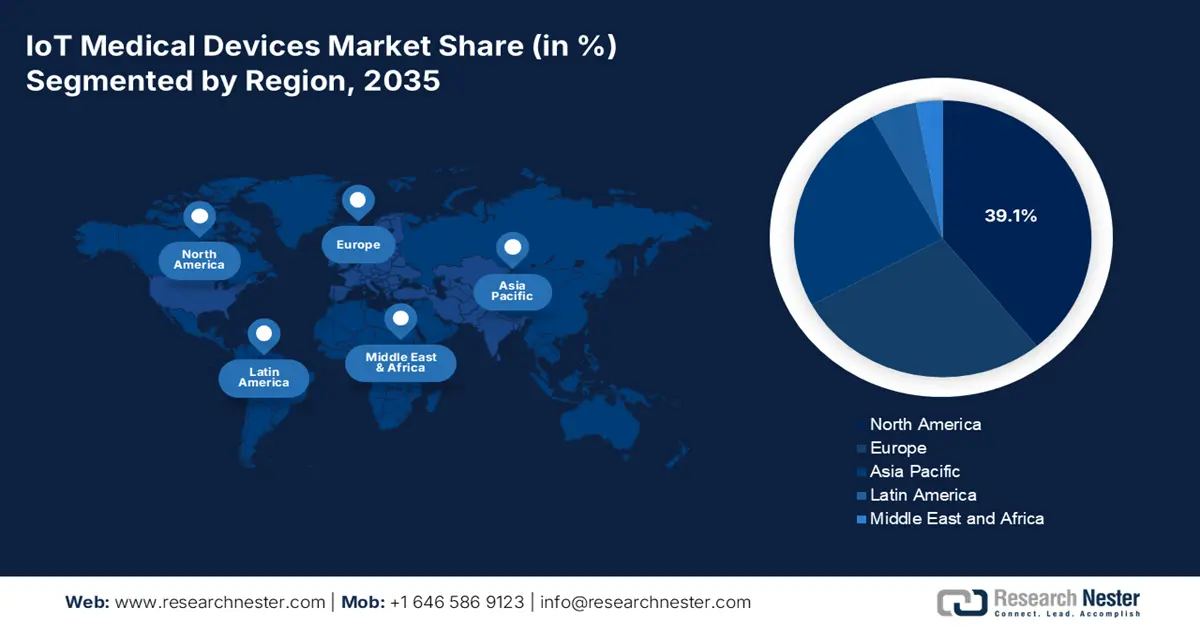

- North America is projected to capture a 39.1% share of the IoT Medical Devices Market during 2026–2035, attributed to high healthcare expenditure, favorable reimbursement policies, and rapid technological adoption.

- Asia Pacific is expected to record the fastest expansion through 2026–2035, propelled by rapid technological advancements, expanding healthcare infrastructure, and government initiatives promoting digital health.

Segment Insights:

- The Stationary Medical Devices segment is projected to command a 38.6% share of the IoT Medical Devices Market by 2035, fueled by advancing technological integration in clinical infrastructure such as connected imaging systems and automated hospital equipment.

- The Hospitals segment is expected to hold a 30.8% share by 2035, sustained by the rising need for real-time patient monitoring, efficient data management, and streamlined clinical workflows.

Key Growth Trends:

- The emerging wave of digitalization

- Demand for remote medical services

Major Challenges:

- Hurdles in strict data-related regulations

- Lack of advanced healthcare infrastructure

Key Players: Medtronic plc, Johnson & Johnson, Siemens Healthineers, GE Healthcare, Philips, Abbott Laboratories, Boston Scientific, Stryker Corporation, Roche, Honeywell Life Sciences, Omron Corporation, Fitbit (Google), Dexcom, ResMed, iRhythm Technologies, Cisco Systems, Samsung Electronics, Biotronik, Tata Consultancy Services, Cochlear Ltd., Elecom Co., Ltd.

Global IoT Medical Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 106.6 billion

- 2026 Market Size: USD 136.6 billion

- Projected Market Size: USD 997.1 billion by 2035

- Growth Forecasts: 28.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 8 October, 2025

IoT Medical Devices Market - Growth Drivers and Challenges

Growth Drivers

- The emerging wave of digitalization: The growing trend of healthcare modernization, specifically in developing economies such as China and India, is boosting the global significance of the IoT medical devices market. This can be testified by the accelerated expansion of the digital health industry. Besides, both patients and governing bodies in potential landscapes are contributing to this cohort by engaging massive resources and investments. Exemplifying the same, a 2025 Economic Survey unveiled that over 17 million and 54 million pregnant women and children in India were registered on the U-WIN portal digitally.

- Demand for remote medical services: The enlarging patient pool of chronic ailments and high-risk of mortality increases workload pressure on conventional medical settings, where remote patient monitoring and services, such as telemedicine, can deliver a personalized experience in real-time. Testifying to the same, an NLM article identified the potential of telehealth in achieving a global industry value of USD 3.4 trillion by 2028, where revenue from telemedicine alone is expected to cross USD 893.7 billion by 2032. This is pushing a majority of large-scale hospitals and dedicated medical centers to adopt widely connected systems that can handle such an immense volume of patient data, creating new opportunities for the IoT medical device market.

- Advances in connectivity and technologies: As the general public and healthcare professionals become more aware of the clinical and economic advantages of implementing preventive measures, the demand for continuous surveillance solutions increases. This is redirecting a lucrative cash inflow towards the market. Particularly, the growing adoption of smart diagnostic and monitoring equipment and better networking systems is garnering greater opportunities for this sector by prompting innovations in vital platforms and other components. As evidence, in February 2025, Validic launched its AI-powered health IoT and remote patient management solutions for AWS Marketplace users.

Current/Recent Demographic Trends in the IoT Medical Devices Market

Annual Number of Prevalent Type 1 Diabetes Cases in Children & Adolescents (0-19 years) (2021-2045)

|

Country or territory |

Number of Children & Adolescents with Type 1 Diabetes (in thousands) |

|

India |

229.4 |

|

U.S. |

157.9 |

|

Brazil |

92.3 |

|

China |

56 |

|

Algeria |

50.8 |

|

Moroccoi |

43.3 |

|

Russian Federation |

38.1 |

|

Germany |

35.1 |

|

UK |

31.6 |

|

Saudi Arabia |

28.9 |

Source: NLM

Key Commercial Milestones Driving Innovation in the IoT Medical Devices Market (2023-2025)

|

Date |

Company |

Milestone |

Region/Focus |

|

March 2023 |

Fujitsu |

Launched a cloud-based platform for securely collecting and utilizing health-related data to drive digital transformation in healthcare. |

Japan / Digital Health Platform |

|

February 2025 |

ELECOM (Ministry of Economy, Trade and Industry, Japan) |

Adopted a subsidy-supported project for a lifestyle disease prevention platform in India, exploring its implementation. |

India / Lifestyle Disease Prevention |

|

July 2025 |

SEALSQ Corp |

Completed cryptographic toolbox validation for QS7001 post-quantum hardware platform, enhancing security for devices like pacemakers. |

Global / IoMT Security & Compliance |

|

June 2025 |

SEALSQ Corp |

Expanded capabilities for IoMT with strengthened security and Edge AI integration using post-quantum technology. |

Global / IoMT Security & Edge AI |

|

November 2024 |

Elemental Machines |

Launched a new product for improved monitoring and communication in shared lab environments, enhancing data-driven control. |

Global / Smart Lab Environments |

|

July 2024 |

KORE |

Released the mCareWatch 241, a wearable emergency alarm with a connectivity platform enabling remote patient monitoring in homes and facilities. |

Global / Wearables & Remote Monitoring |

Challenges

- Hurdles in strict data-related regulations: Integration of IoT-enabled healthcare systems involves the generation, sharing, and processing of massive sensitive patient data, triggering the necessity of compliance with stringent privacy and security regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). Moreover, the heightening risk of incidence and financial loss of breaching often hinders consumer trust by underscoring the vulnerability of connected systems. This forces manufacturers in the market to embed security-by-design, which increases development costs and complexity.

- Lack of advanced healthcare infrastructure: The value of products available in the market is often contingent on their ability to seamlessly integrate with existing electronic health record (EHR) systems, hospital workflows, and other digital health platforms. Further, the absence of universal standards associated with this aspect creates a major interoperability issue, particularly in resource-constrained settings in lower- and middle-income countries (LMICs). This ultimately imposes pressure from budget overflow on pioneers in this field, as they must invest in developing numerous custom interfaces and infrastructure before regional expansion.

IoT Medical Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28.2% |

|

Base Year Market Size (2025) |

USD 106.6 billion |

|

Forecast Year Market Size (2035) |

USD 997.1 billion |

|

Regional Scope |

|

IoT Medical Devices Market Segmentation:

Product Type Segment Analysis

Stationary medical devices are predicted to capture the highest share of 38.6% in the IoT medical devices market by the end of 2035. The amplifying surge in technological advancement for clinical infrastructure, including automated hospital beds, connected imaging systems, and infusion pumps, is consolidating the segment’s leading position in this sector for the upcoming years. The dominance is also established through the global recognition of these commodities in enhancing the overall institution’s operational efficiency and workflow while supporting their basic necessities.

End user Segment Analysis

Hospitals are estimated to represent themselves as prominent end users in the market over the discussed period, while accounting for a 30.8% share. Their position in this sector is empowered by the growing need for real-time patient monitoring, efficient data management, and improved clinical workflows. Particularly, the increasing volume of patient admissions in critical care units, post-operative monitoring, and chronic disease management is fostering a substantial demand base for continuous tracking of vital signs and seamless integration with EHRs in hospitals. Moreover, the government expenditure on healthcare infrastructure modernization is securing a strong capital influx in this segment.

Application Segment Analysis

Remote patient monitoring (RPM) is poised to show dominance in the IoT medical devices market with a 35.9% share throughout the assessed timeframe. This is primarily induced by the rising need for cost-effective long-term care delivery outside clinical settings for chronic disease-afflicted individuals. RPM directly addresses this worldwide surge by enabling continuous management of conditions, such as diabetes and hypertension, by reducing the volume of unnecessary hospital admissions. The urgent need to adopt RPM can be evidenced by the 2022 NLM findings, which established that the number of inappropriate admission days and the direct cost to the patients in hospitals account for 1490 days and USD 66,848.1 every year.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Product |

|

|

Connectivity |

|

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Medical Devices Market - Regional Analysis

North America Market Insights

North America is anticipated to acquire the largest share of 39.1% in the market from 2026 to 2035. This is a result of high healthcare expenditure, favorable government reimbursement policies, and rapid technological adoption. The presence of major MedTech leaders is also a growth engine in this landscape, where the national insurance regulations support massive allocations and financial backing for value-based remote care models. Key trends in North America include the integration of IoT data into EHRs. and a strong focus on cybersecurity protocols for patient data protection.

In the U.S., 50.4% of males and 43.0% of females aged 20 years or older are affected by hypertension, which has a high risk of converting into an epidemic of cardiovascular disease (CVD) incidence and deaths. Thus, in search of solutions to implement wider adoption of early prevention, New York University Langone Health conducted a remote patient monitoring for hypertension (RPM-HTN) program for 100 patients from the cardiology division. This resulted in an average USD 330 per patient cost, 22.2% return on investment (ROI), and 55% patient compliance, opening a new window of revenue generation for the IoT medical devices market.

The Canada market is evolving through a province-led approach to digital health integration, guided by federal investment and deployment strategy. This trend of modernization among nationwide health systems can be exemplified by the USD 26.6 million allocation by the government of Canada to advance integrated health care in October 2023. Further, to incorporate IoT and virtual care into the mainstream clinical practice, initiatives such as the Digital First for Health strategy in Ontario are heavily investing in advanced products and services available in this sector.

APAC Market Insights

Asia Pacific is expected to emerge as the fastest-growing region in the market during the analyzed tenure. Rapid technological advancements, expanding healthcare infrastructure, and increasing government initiatives to support digital health are collectively empowering this landscape with a demanding consumer base and strong capital influx. The region's enlarging geriatric and chronically ill population is also accelerating the adoption of smart healthcare solutions, fueling demand for connected medical devices. Furthermore, the trend of AI integration in diagnostics and remote patient monitoring is positioning APAC as a key growth hub for the merchandise.

China plays a pivotal role in the Asia Pacific market, which is largely fueled by its strong hardware manufacturing capabilities, robust digitalization, and policies promoting smart healthcare. In addition, the increasing burden of chronic diseases, such as CVD, is fostering substantial demand for continuous monitoring, wearable devices, and AI-driven diagnostics. In this regard, a 2024 analysis report from the China Academy of Commerce Industry Research revealed that more than 3,000 internet hospitals were already established across the nation in 2022, where telemedicine services were benefiting over 25.9 million residents.

India is becoming an epicenter of profitable investment in the market, empowered by its expanding digital health ecosystem. Growing awareness about adopting wearable and remote health evaluation systems is also promoting the broad expansion of this sector, particularly through the unmet medical needs in rural areas in India. On the other hand, the explosive penetration of telemedicine, internet access, and smartphones is speeding up the pace of IoT-enabled medical solutions deployment in the country.

Feasible Opportunities in Key Landscapes

|

Country |

Key Notes |

Timeline |

|

China |

The digital healthcare market reached USD 27.3 billion, while exhibiting an average annual growth rate of 30% |

2022 |

|

India |

The National Institute of Technology (NIT) launched M.Tech in medical devices to boost healthcare innovation in Raipur |

2025 |

|

South Korea |

The AI-driven digital healthcare market is expected to experience an annual growth rate of 45%, with a revenue of USD 1.7 billion |

2021-2025 |

|

Australia |

Launched the Medical Science Co-investment Plan, outlining investment opportunities for the medical device and digital health industry |

2024 |

Source: NLM, PIB, and DISR Australia

Europe Market Insights

Europe is poised to maintain the position of second-largest shareholder in the market by the end of 2035. Well-equipped medical settings, strict healthcare data-handling protocols, and amplifying focus on personalized treatment are cumulatively contributing to the consistent performance of the region in this sector. The lucrative future of the landscape is also being shaped by the growing popularity and acceptance of remote monitoring in chronic disease management and elderly care. Additionally, investments in digital health innovation cohorts, including the European Health Data Space, are fostering a favorable environment for the integration of IoT technologies.

The UK is contributing to a notable proportion of revenue generation in the Europe IoT medical devices market, which is primarily backed by its strong focus on digital health evolution. With initiatives such as the NHS Long Term Plan emphasizing the use of technology to improve patient outcomes, the adoption of connected infrastructure and telehealth is rapidly increasing. On the other hand, the UK is home to a vibrant health tech start-up ecosystem and a supportive regulatory framework that are collectively fostering the development and deployment of cutting-edge IoT medical solutions.

Germany is a prominent force in the Europe market, built in support of its robust healthcare system, strong MedTech industry, and commitment to digital transformation in healthcare. The growing emphasis of the country on precision medicine and telemedicine is also propelling the need for IoT-integrated clinical tools, where the Digital Healthcare Act (DVG) is crafting a viable commercial environment for innovative IoT solution suppliers. Moreover, the rapidly aging population is also positively affecting the surge, where more than 18.6 million people in Germany were aged 65 and over in 2022, as per the NLM.

Incidence Rates of Type 1 Diabetes in Children (0-14 years) (2021)

|

Country |

Incidence rates(per 100,000 population per year) |

|

Finland |

52.2 |

|

Sweden |

44.1 |

|

Norway |

33.6 |

|

UK |

28.1 |

|

Ireland |

27.5 |

Source: NLM

Key IoT Medical Devices Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- Siemens Healthineers

- GE Healthcare

- Philips

- Abbott Laboratories

- Boston Scientific

- Stryker Corporation

- Roche

- Honeywell Life Sciences

- Omron Corporation

- Fitbit (Google)

- Dexcom

- ResMed

- iRhythm Technologies

- Cisco Systems

- Samsung Electronics

- Biotronik

- Tata Consultancy Services

- Cochlear Ltd.

- Elecom Co., Ltd.

The commercial dynamics of the IoT medical devices market are largely characterized and controlled by the strong presence of both established MedTech manufacturers and innovative startups. The cohort of these pioneers, including Medtronic, GE Healthcare, Philips, and Siemens Healthineers, is highly focused on leveraging individual global reach and R&D capabilities to develop more advanced connected solutions for a wide range of applications, such as diagnostics, monitoring, and therapeutics. Further, companies in emerging marketplaces are capitalizing on niche IoT-based wearable devices, remote monitoring, and AI integration.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, Elecom formed an alliance with MediBuddy to run the online medical treatment platform, medibadi, in India on a larger scale. This pushed the company’s aim to further accelerate the pace of cross-border reinforcement and expansion in the IoT-powered healthcare industry.

- In January 2025, Boston acquired Bolt Medical against an upfront payment of approximately USD 443 million for the 74% stake not yet owned and up to USD 221 million upon achievement of selected regulatory milestones. This acquisition strengthened the company’s IoT portfolio with the inclusion of Bolt’s IVL system.

- Report ID: 8177

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Medical Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.