Automated Hospital Beds Market Outlook:

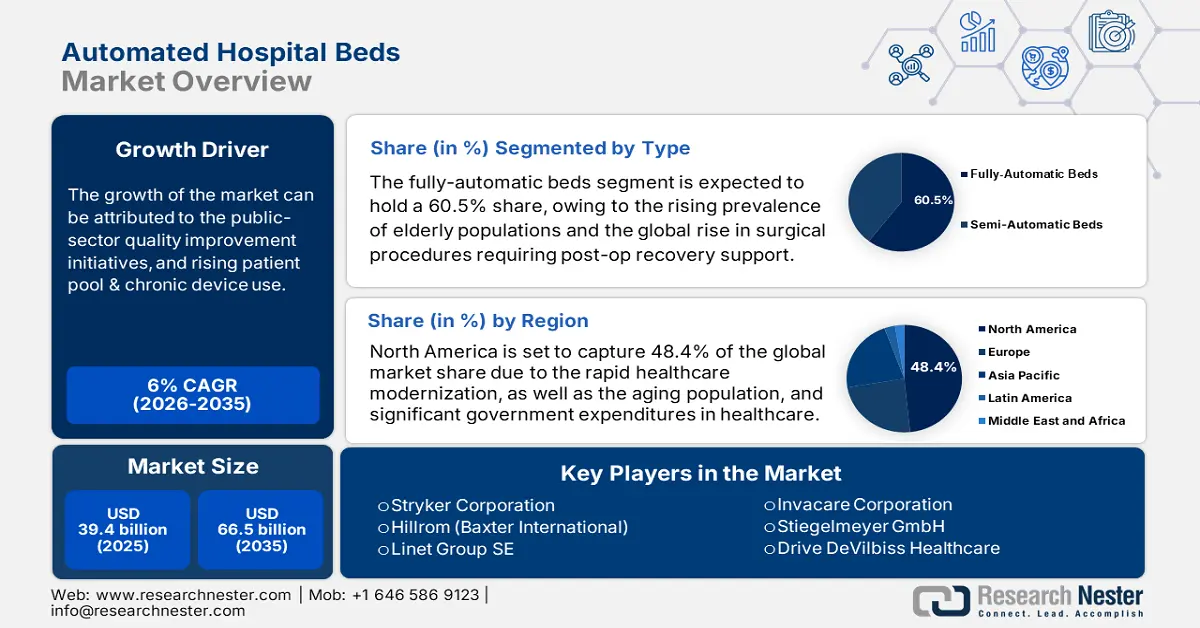

Automated Hospital Beds Market size was valued at USD 39.4 billion in 2025 and is projected to reach USD 66.5 billion by the end of 2035, rising at a CAGR of 6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automated hospital beds is evaluated at USD 41.7 billion.

The primary patient pools of the automated hospital beds market contain geriatric and chronically ill populations worldwide. Particularly, the growing number of hospitalizations due to chronic obstructive pulmonary disease (COPD) and heart failure is creating an urgent need to expand healthcare infrastructure, hence increasing demand in this sector. Besides, rapidly aging demographics across the globe are also contributing to the increasing demand for hospital equipment, including beds. This can be testified by the amplified global trade value of medical furniture, which accounted for USD 5.3 billion in 2023 with a 4.7% annual growth rate, as reported by the Observatory of Economic Complexity (OEC).

The current economic dynamics of the automated hospital beds market indicate a high influence of value-based care models and reimbursement policy upgrades that emphasize cost efficiency and patient outcomes. The cohort of major payers in this sector includes government programs and private insurers, who tend to scrutinize the affordability ratio of automated beds, often linking scale and range of financial backing to patient safety and hospital stays. However, variations in payers’ pricing structures are observed across regional differences, where the trend of public funding and procurement differs. In this regard, a 2022 NLM publication unveiled that the addition of a single bed to the hospital capacity in Sweden holds the potential to deliver 3 quality-adjusted life years (QALYs) at USD 120 thousand.

Key Automated Hospital Beds Market Insights Summary:

Regional Highlights:

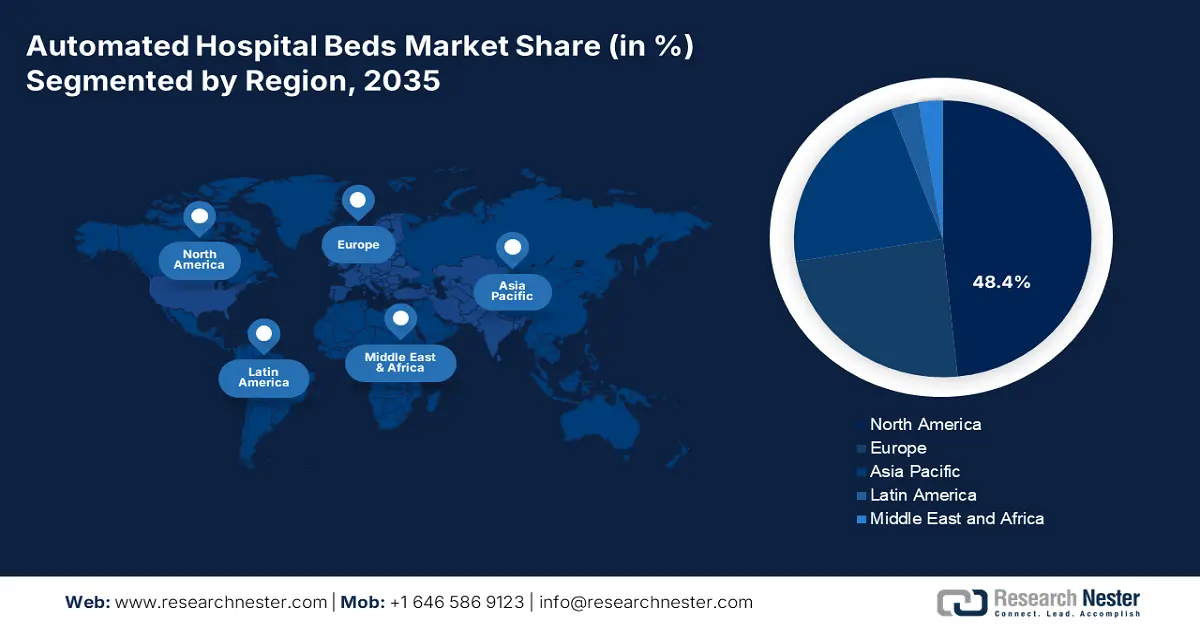

- North America is anticipated to hold a 48.4% share by 2035, owing to progressive healthcare systems, strict patient safety regulations, and high nurse workload.

- Asia Pacific is expected to witness the fastest growth during the forecast period, impelled by healthcare digital transformation, aging population, and increased government expenditures.

Segment Insights:

- The fully-automatic beds segment is projected to capture 60.5% share by 2035, driven by the rising chronic disease burden, aging populations, and workforce shortages.

- The general beds segment is expected to hold 35.8% share by 2035, propelled by versatility, essential functionality, and wide adoption across healthcare settings.

Key Growth Trends:

- Increasing investments in capacity amplification

- Trend of medical system modernization

Major Challenges:

- Lack of initial capital and financial backing

- Regulatory hurdles related to data security

Key Players: Hill-Rom Holdings (Baxter), Getinge AB, Invacare Corporation, LINET Group SE, Paramount Bed Holdings, Arjo, Medline Industries LP, Joerns Healthcare LLC, Stiegelmeyer GmbH & Co. KG, Juvare.

Global Automated Hospital Beds Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.4 billion

- 2026 Market Size: USD 41.7 billion

- Projected Market Size: USD 66.5 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, Canada, France

- Emerging Countries: India, China, Brazil, South Korea, Mexico

Last updated on : 29 September, 2025

Automated Hospital Beds Market - Growth Drivers and Challenges

Growth Drivers

- The expanding global geriatric population: The rising count of individuals aged 60 and over worldwide, potentially surpassing 1.4 billion by 2030 and 2.1 billion by 2050, strengthens the foundation of the consumer base in the automated hospital beds market. This demographic shift translates to a higher admission volume in hospitals, nursing homes, and assisted living centers across the globe. Moreover, the necessity of long-term care and mobility assistance for this population requires furniture advancements to meet the unmet needs of user comfort and patient safety.

- Increasing investments in capacity amplification: The rapid increase in public spending on inpatient facilities and services creates greater revenue opportunities for manufacturers in this sector. Such an infrastructural capacity expansion trend can be evidenced by the explosive trade value in the global hospital beds and supporting equipment industry. Besides, both government and foreign investors are increasingly engaging resources in bulk procurement of advanced medical equipment. Such budget allocation to strengthen the medical systems in developed and emerging economies facilitates sustainable capital influx in the automated hospital beds market.

- Trend of medical system modernization: The growing interest in streamlining healthcare workflows, particularly among developing nations, prompts greater adoption in the automated hospital beds market. Recently introduced features, such as remote-control adjustments, patient monitoring, and emergency alert systems, align perfectly with the trend of IoT integration and automation in the medical field. Moreover, the national programs that promote smart hospitals are evidently fueling the surge in this sector. The utilization of this opportunity can be exemplified by the launch of the SmartMedic platform in India by Stryker in February 2023.

Historic Trends in Key Demographics in the Automated Hospital Beds Market

Hospital Admission Rates for COPD and Asthma by Age Group in England and Wales (1999-2020)

|

Age Group |

Proportion of Total Hospital Admissions (in %) |

Hospital Admission Rate in 1999 (per 100,000) |

Hospital Admission Rate in 2020 (per 100,000) |

Change in Admission Rate during 1999-2020 (in %) |

|

Below 15 years |

8.8% |

278.8 |

199.3 |

-28.5% |

|

15-59 years |

23.5% |

146.3 |

287.2 |

96.3% |

|

60-74 years |

33.0% |

1025.3 |

1363.3 |

33.0% |

|

75 years and above |

34.7% |

1681.0 |

2586.2 |

53.8% |

Overview of Global Trade in the Automated Hospital Beds Market

Top Exporters and Importers of Medical Furniture (2023)

|

Rank |

Exporters |

Export Value (in USD) |

Importers |

Import Value (in USD) |

|

1 |

China |

1.3 billion |

U.S. |

1.1 billion |

|

2 |

U.S. |

757 million |

Germany |

340 million |

|

3 |

Germany |

709 million |

Canada |

333 million |

Challenges

- Lack of initial capital and financial backing: Installing equipment from the automated hospital beds market requires high upfront capital due to its association with next-generation technologies and specialized materials. As a result, the budget may not fit several small- and medium-sized medical facilities and service providers, particularly in resource-constrained regions. Moreover, this affordability gap, coupled with additional maintenance and servicing expenses, makes procurement decisions more complex and slower.

- Regulatory hurdles related to data security: Navigating strict international quality standards of patient safety and equipment reliability often restricts the globalization of the automated hospital beds market. The time-consuming and expensive testing and documentation for these commodities may result in delays or failures in compliance and new launches in this sector. Additionally, the increasing cyber threats compromise patient confidentiality, which further leads to legal disputes and reputation damage.

Automated Hospital Beds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 39.4 billion |

|

Forecast Year Market Size (2035) |

USD 66.5 billion |

|

Regional Scope |

|

Automated Hospital Beds Market Segmentation:

Type Segment Analysis

The fully-automatic beds segment is predicted to capture the largest share of 60.5% in the automated hospital beds market over the assessed period. The leadership is largely empowered by the rising worldwide burden of chronic diseases and rapid aging among populations. On the other hand, the continuously amplifying surgical volumes are fostering a surge in post-operative recovery support, fueling demand for scalable and streamlined infrastructure. Moreover, the worldwide workforce crisis in mainstream healthcare is creating critical demand for fully automated recovery beds. In this regard, the WHO estimated a global shortfall of 11 million health workers by 2030.

Application Segment Analysis

The general beds segment is expected to dominate the market with a 35.8% share by the end of 2035. The wide use across various healthcare settings, including hospitals, clinics, and long-term care facilities, makes it the biggest field of application in this sector. Besides, the versatility and essential functionality delivered through adjustable positioning and ease of patient transfer of available options in this field address basic patient care needs efficiently. Furthermore, having relatively lower complexity compared to specialized beds contributes to the continued prioritization of this segment among suppliers.

End user Segment Analysis

Hospitals are poised to represent themselves as the primary end users in the automated hospital beds market throughout the discussed timeline, while acquiring a 65.3% revenue share. The large volume of admissions in these facilities requires streamlined clinical workflows across various departments, including intensive care units, general wards, and emergency rooms. The high patient turnover and the need for efficient resource management also make hospitals the biggest investors in this sector. Additionally, the increasing focus on minimizing patient injuries further reinforces their preference as end users in this category.

Our in-depth analysis of the global automated hospital beds market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Functionality |

|

|

Technology |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Hospital Beds Market - Regional Analysis

North America Market Insights

North America is anticipated to register the highest share of 48.4% in the automated hospital beds market by the end of 2035. The presence of a progressive and adaptive medical system is the primary growth factor in this region. On the other hand, the strict regulations for patient safety and the massive nurse workload collectively garner a large demand base in North America for these advanced infrastructural solutions. Furthermore, the region’s internationally dominating emphasis on MedTech evolution and AI integration is solidifying its position in this sector.

According to the 2022 National Hospital Ambulatory Medical Care Survey, approximately 17.8 million emergency department visits in the U.S. resulted in hospital admission. Besides, the U.S. Bureau of Labor Statistics unveiled that the country is predicted to demand more than 275,000 additional nurses from 2020 to 2030. These figures reflect the urgent need for workload reduction solutions in nationwide healthcare facilities. In response, the combined support from federal, state, and local industry programs is highlighting the effectiveness of automated hospital systems, securing a stable cash inflow in this landscape.

The Canada market is following a consistent pace of growth with promising federal commitments and provincial infrastructural reinforcements. As evidence, between 2022 and 2023, support and nursing inpatient services accounted for 33.6-50.1% of the total hospital spending across provinces in the country, as per the C.D. Howe Institute. Besides, in July 2024, the government of Canada dedicated USD 25 billion of its USD 200 billion over 10 years funding to quenching unique health system needs, including workforce empowerment and modernization through digital equipment.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the automated hospital beds market during the analyzed tenure. The accelerated growth of the region is attributed to the robust digital transformation of healthcare infrastructure, which is further accompanied by the aging population and increased government expenditures in healthcare. Besides, technological advances in medical devices are also gaining traction in APAC, empowering the incorporation of sensor-based mobility tracking and automated patient management features in the beds used across hospital settings.

Japan is one of the prominent innovation hubs in the APAC market, which is accomplished through the country’s strong emphasis on the development and utilization of AI-powered medical infrastructure. On the other hand, the nation’s enlarging geriatric population fosters a substantial consumer base for the merchandise. In this regard, a 2022 study from the Journal of Aging and Health Research predicted more than 1.6 million deaths to take place every year in Japan between 2030 and 2065 due to old age. This is pushing the governing authorities to accommodate more cutting-edge equipment in nationwide hospitals.

India is emerging as a growth engine for the Asia Pacific automated hospital beds market on account of rapid healthcare infrastructure development and increasing public investments. Testifying to the capital influx, the IBEF reported that government-led budget allocation to the development, maintenance, and enhancement of the country's healthcare system increased by 9.7% from 2024 to 2025. Additionally, the country presents a demand for an additional 3.6 million hospital beds by 2034 to meet global healthcare standards, reflecting the potential of this landscape as a lucrative investment opportunity.

Country-wise Export Data for Medical or Surgical Furniture (2023)

|

Country |

Export Value (in USD) |

|

Vietnam |

58.7 million |

|

Japan |

40.3 million |

|

Australia |

39.4 million |

|

Indonesia |

21.3 million |

|

India |

20.3 million |

|

Thailand |

7.2 million |

|

Korea, Rep. |

6.1 million |

|

Malaysia |

5.6 million |

Source: WITS

Europe Market Insights

The Europe automated hospital beds market is estimated to garner a notable industry value over the timeline between 2026 and 2035. The region’s consistent performance in this category is primarily backed by the aging populations, rising admissions to intensive care units (ICUs), and national policies for the modernization of healthcare infrastructures. Further, the European Health Data Space (EHDS) and EU4Health Programme are equally contributing to this cohort as accelerators in the automation of technologies by placing sufficient funds.

The National Health Service (NHS) in the UK is continuing to extend the coverage of financial backing for recovery from surgery and long-term care, which is enabling a continuous flow of cash in the automated hospital beds market. As evidence, the gross expenditure on medical infrastructure in the country rose from USD 3.5 trillion to USD 4.0 trillion between 2022 and 2023, as per the 2025 report from the Office for National Statistics. Other government initiatives aimed at modernizing healthcare equipment and integrating smart technologies are also fueling growth in this landscape.

The nationwide implementation of the Hospital Future Act is the major driving factor in the Germany automated hospital beds market. Besides, high standards for medical service and equipment quality in the country set a benchmark for infrastructural reinforcement, which creates a surge in continuous advances in the MedTech industry. On the other hand, an aging population and increasing occurrence of chronic diseases create sustained demand in this sector, shaping both domestic supply and international trade dynamics.

Country-wise Export Data for Medical or Surgical Furniture (2023)

|

Country |

Export Value (in USD) |

|

Netherlands |

245.1 million |

|

Poland |

220.5 million |

|

France |

144.3 million |

|

Italy |

129.3 million |

|

UK |

112.2 million |

|

Turkey |

83.8 million |

|

Spain |

82.6 million |

Source: WITS

Key Automated Hospital Beds Market Players:

- Stryker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hill-Rom Holdings (Baxter)

- Getinge AB

- Invacare Corporation

- LINET Group SE

- Paramount Bed Holdings

- Arjo

- Medline Industries, LP

- Joerns Healthcare LLC

- Stiegelmeyer GmbH & Co. KG

- Juvare

The current automated hospital beds market is characterized by a blend of established regional players. Key players have recommitted to multi-pronged strategies involving collaborations, products, and R&D to leverage emerging smart concepts in mobility and remote monitoring. While leveraging profitable markets worldwide, companies continue to expand into new and emerging markets, particularly in Asia and Latin America. M&A, localization, and public-private partnerships that support joint value creation facilitate sustainability and long-term viability in this rapidly evolving market.

Below is the list of some prominent players operating in the market:

Recent Developments

- In July 2025, Juvare launched a powerful new software solution, BedSync, designed to automate healthcare facility bed capacity. It enables real-time and API-driven reporting while maintaining alignment with the CDC’s NHSN Connectivity Initiative, reducing workloads from clinical and administrative teams.

- In February 2025, Stryker introduced the ProCeed hospital bed, offering simplicity while enhancing care across various regions. This helps keep clinicians and patients in medical settings safe by allowing for an efficient and easy-to-use platform with support for patient mobility and reduced risks of injury from falls.

- Report ID: 3892

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Hospital Beds Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.