Digital Transformation Market Outlook:

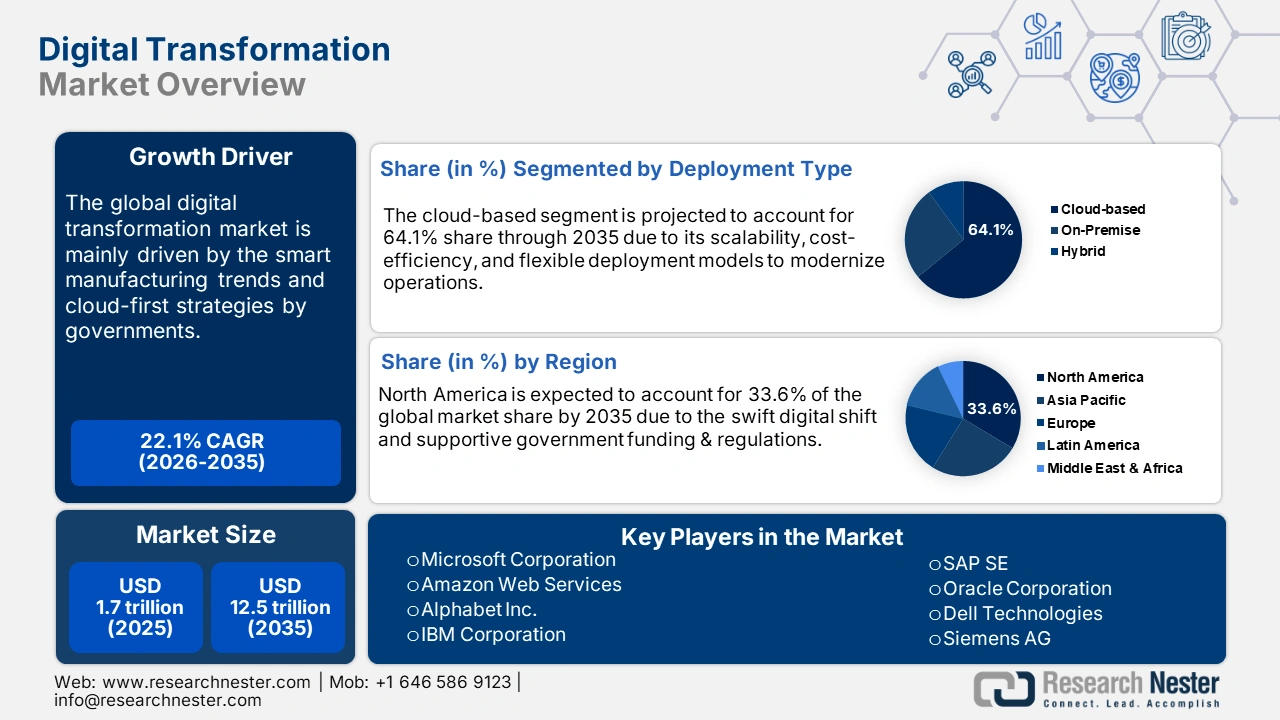

Digital Transformation Market size was USD 1.7 trillion in 2025 and is estimated to reach USD 12.5 trillion by the end of 2035, expanding at a CAGR of 22.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of digital transformation is assessed at USD 2 trillion.

The automation and smart infrastructuring requirements are primarily contributing to digital transformation worldwide. The growth of the semiconductor industry is driving digital transformation, as advanced chips power AI, IoT, 5G, and cloud computing. In turn, the rising adoption of these digital solutions in industries promotes further demand for faster and more efficient semiconductors, building a cycle of mutual growth. This can be observed in the latest Observatory of Economic Complexity (OEC) report, where global trade of semiconductor devices saw a minor rise in 2023, surging by 0.5% to USD 155 billion as compared to USD 154 billion in 2022.

The favorable government investments are also supporting the growth of digital infrastructure. For instance, the CHIPS Act is significantly accelerating the growth of the digital transformation market on a global scale by strengthening the U.S. semiconductor ecosystem, a critical component for modern digital technologies. The CHIPS Act embarks on the largest federal commitment to the U.S. semiconductor sector to date, assigning USD 13 billion over five years for R&D initiatives. Of this, USD 11 billion is directed through the Department of Commerce and USD 2 billion through the Department of Defense. The funding assures a steady supply of advanced chips necessary for AI, IoT, cloud computing, industrial automation, and other next-generation digital solutions. This large-scale federal investment not only bolsters domestic innovation but also encourages international technology partnerships and supply chain resilience, creating a ripple effect that drives the adoption of digital transformation initiatives worldwide.

Key Digital Transformation Market Insights Summary:

Regional Highlights:

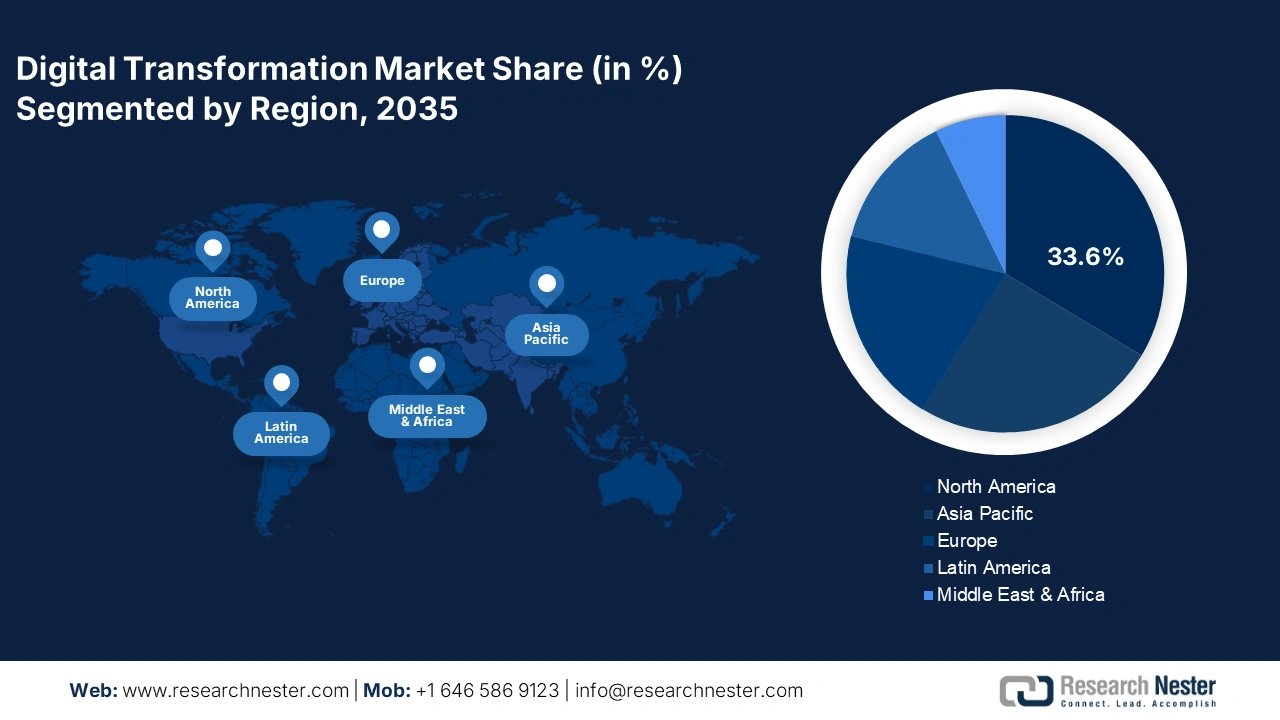

- North America is projected to lead the digital transformation market with a 33.6% share by 2035, owing to advanced digital infrastructure, innovation ecosystems, and supportive government programs.

- Europe is expected to maintain a substantial share by 2035, driven by strategic investments and policy initiatives supporting digital transition and business digitalization.

Segment Insights:

- The BFSI segment is projected to hold 24.9% share by 2035 in the digital transformation market, driven by the rapid adoption of digital payments, AI-powered financial services, and fintech innovations.

- The cloud-based segment is expected to account for 64.1% share by 2035, propelled by scalable, cost-efficient deployment models and the integration of AI and real-time analytics.

Key Growth Trends:

- Smart manufacturing & Industry 4.0 adoption

- Rising demand in the health sector

Major Challenges:

- Infrastructure readiness gaps

- Strict data protection regulations

Key Players: Microsoft Corporation, Amazon Web Services (AWS), Alphabet Inc. (Google Cloud), IBM Corporation, SAP SE, Oracle Corporation, Dell Technologies, Siemens AG, Samsung SDS, Accenture PLC, Capgemini SE, Tata Consultancy Services (TCS), Infosys Limited, DXC Technology, Axiata Digital Services, NEC Corporation, Fujitsu Limited, Hitachi Ltd., NTT Data Corporation, Panasonic Connect Co., Ltd.

Global Digital Transformation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 trillion

- 2026 Market Size: USD 2 trillion

- Projected Market Size: USD 12.5 trillion by 2035

- Growth Forecasts: 22.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: India, China, South Korea, Singapore, Australia

Last updated on : 9 October, 2025

Digital Transformation Market - Growth Drivers and Challenges

Growth Drivers

- Cloud-first government policies driving growth: Governments across the world are mainly focusing on cloud-first strategies to boost their digital infrastructure. The favorable cloud policies are fueling public-private investments to accelerate the growth of the digital transformation sector. For instance, the Indian government's adoption of a cloud-first approach is bolstering the growth of the sector. This approach not only improves public sector efficiency but also promotes private sector investments, thereby speeding up the adoption of next-generation digital technologies. The Ministry of Electronics and Information Technology (MeitY) has introduced several initiatives to boost digital infrastructure. These involve the establishment of over 5.84 lakh Common Service Centres (CSCs) in October 2024, the implementation of DigiLocker for paperless governance, and the creation of more than 67 million Ayushman Bharat Health Account (ABHA) numbers. These developments create a strong foundation for cloud-based services, facilitating the growth of cloud infrastructure and services in the public sector.

- Smart manufacturing & Industry 4.0 adoption: The growing smart manufacturing trend and the rise in Industry 4.0 adoption are projected to drive the sales of next-gen digital technologies. Technologies, such as digital twins, IoT-enabled machinery, and industrial automation, are expected to exhibit a high demand in North America, Germany, and East Asia to enhance their manufacturing systems. The World Robotics Report 2024 states that Germany holds the fourth position, with 429 robots deployed for every 10,000 employees. High robot density is a strong indicator of mature automation and Industry 4.0 adoption. This level of automation pushes demand for robotics, IoT, AI, and control systems. This highlights the importance of digital technologies in transforming the GDP of the country.

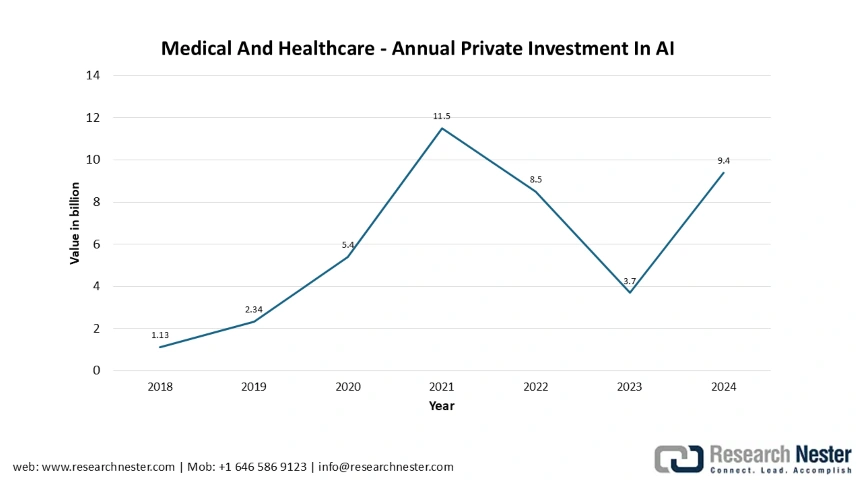

- Rising demand in the health sector: The demand for digital transformation in healthcare is significantly driving the growth of the global digital transformation market. AI is at the forefront of this shift, offering transformative possibilities in diagnostics, treatment, and operational efficiencies. The WEF report 2025 states that with 4.5 billion people lacking access to essential healthcare and a projected shortfall of 11 million health workers by 2030, AI holds the capability to close this gap and transform healthcare worldwide. AI technologies are already assisting healthcare professionals in detecting early signs of diseases, triaging patients, and analyzing complex medical data, thereby improving patient outcomes and reducing treatment costs.

Challenges

- Infrastructure readiness gaps: Many developing countries are witnessing a lack of proper digital infrastructure due to limited budgets. This gap limits the sales of digital technologies in the price-sensitive markets and hampers the producers' profit margin. However, the supportive government policies and initiatives aimed at digital transformation are projected to offer gainful returns to leading companies in the coming years.

- Strict data protection regulations: The strict data protection regulations are affecting the digital transformation growth across the world. The EU’s GDPR, India’s DPDP Act (2023), and China’s Cybersecurity Law, focusing on the protection of personal data of individuals, are limiting the flow of cross-border information. The strict compliance with this law slows the innovation process and delays new market entries, hampering the profits of global producers.

Digital Transformation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.1% |

|

Base Year Market Size (2025) |

USD 1.7 trillion |

|

Forecast Year Market Size (2035) |

USD 12.5 trillion |

|

Regional Scope |

|

Digital Transformation Market Segmentation:

End use Segment Analysis

The BFSI segment is estimated to capture 24.9% in the digital transformation market throughout the forecast period, powered by the rapid shift toward digital payments, online banking, and AI-powered financial services. With over 95% of banking payment transactions in India already digital and fintech platforms expanding at nearly 30% annually, the sector is investing in advanced technologies to improve customer experience, bolster risk management, and optimize operations. The adoption of AI, cloud services, and blockchain is supporting banks and insurers to grant secure, scalable, and personalized solutions. A recent example is the RBI's launch of the Public Tech Platform for Frictionless Credit in August 2023, which uses digital infrastructure to offer faster and highly inclusive lending. Such initiatives indicate how BFSI is leading digital adoption, making it a key end user of the industry.

Deployment Type Segment Analysis

The cloud-based segment is projected to account for 64.1% of the market share through 2035. The segment is experiencing strong growth as organizations adopt scalable, cost-efficient, and flexible deployment models to modernize operations. Cloud platforms allow real-time data processing, smooth integration of AI and analytics, and faster innovation cycles as compared to traditional on-premises systems. Businesses in several industries are using cloud solutions to support remote work, enhance cybersecurity, and provide personalized customer experiences.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Solution Type |

|

|

Deployment Type |

|

|

End use |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Transformation Market - Regional Analysis

North America Market Insights

North America is expected to hold 33.6% of the market share by 2035. The growing need for advanced digital infrastructure, the boom in innovation ecosystems, and the progressive government programs are accelerating the production and commercialization of digital technologies. The smart infrastructure investments by public and private entities are accelerating the sales of digital technologies.

The U.S. digital transformation market is estimated to expand rapidly by the end of the forecast period, owing to semiconductor growth and rising internet adoption. According to the Semiconductor Industry Association Report 2024, the U.S. is projected to triple its semiconductor manufacturing capacity to 203% by 2032, ensuring a steady supply of chips essential for cloud computing, AI, and connected devices. At the same time, the NTIA Internet Use Survey 2024 points out that 13 million more internet users were added between 2021 and 2023, broadening the digital ecosystem and increasing demand for online services. Together, these developments are positioning the U.S. as a global leader in digital transformation, with robust infrastructure and an expanding digital user base.

The Canada market is poised to register a remarkable share throughout the study period. The quick shift of small and medium-sized enterprises towards digitalization is opening lucrative opportunities for digital technology producers. Canada market is expanding rapidly, supported by the USD 4 billion Canada Digital Adoption Program (CDAP), which provides grants, advisory services, and interest-free loans to help SMEs modernize. By lowering the cost burden, CDAP helps businesses to upgrade from legacy systems to advanced technologies such as AI, cloud solutions, and e-commerce platforms. This is propelling huge adoption of digital tools across various industries, bolstering productivity and competitiveness.

APAC Market Insights

The Asia Pacific market is projected to register a rapid CAGR between 2026 and 2035. The countries, including India, China, Japan, and South Korea, are at the forefront of digitalization. Several public-private investment strategies are fueling the trade of digital solutions in the region. The automation and Industry 4.0 trends are also backing the installation of digital technologies in several enterprises.

The China digital transformation market is experiencing major growth, driven by substantial government support and increasing industry demand. In 2024, the country's digital sector achieved a 5.5% year-on-year growth, reaching USD 4.907 trillion in revenue, propelled by advancements in cloud computing, AI, and electronics manufacturing. The State Council of China has created a national action plan to proliferate digital technologies across business operations by 2026, showcasing the government's commitment to modernization. This initiative is complemented by major transformations in public services, finance, and manufacturing, as China strives to scale digital platforms across different sectors.

India’s market is rising at a remarkable pace, driven by government initiatives and advancements in digital infrastructure. The Digital India program has been a key in improving internet connectivity, with broadband connections surging from 6.1 crore in 2014 to 94.92 crore in 2024. The digital economy's contribution to India's GDP increased from 11.74% in 2022-23 to 13.42% in 2024-25, powered by advancements in AI, cloud computing, and digital infrastructure. The integration of mobile connectivity, with more than 120 crore telephone connections as of April 2025, has further increased digital adoption. These developments underscore India's commitment to becoming a digitally empowered society and knowledge economy.

Europe Market Insights

The digital transformation market in Europe is witnessing substantial growth, driven by strategic investments and policy initiatives. In 2024, the European Union earmarked USD 241.90 billion to digital transition efforts, including USD 70.9 billion for e-government and USD 46.8 billion for business digitalization. This funding helps the EU's Digital Decade goals, aiming to improve digital infrastructure, skills, and services across member states.

The market in Germany is expected to register rapid growth during the forecast period. The efforts towards digital advancements are evident through the Digital Agenda initiative, which targets to advance broadband infrastructure and support Industry 4.0 technologies. Germany is also investing in the Manufacturing-X program to support digital and sustainable transformation in the industrial sector. These efforts are considered to improve Germany's competitiveness and technological sovereignty in the digital landscape.

UK market is bolstered by substantial investments in AI and digital infrastructure. In 2024, the UK's AI sector revenue rose by approximately 68% to USD 31.86 million, with a 33% rise in AI-related employment. Additionally, the government has pledged USD 26.66 billion into research and development by 2024-25, emphasizing the importance of innovation in the digital economy. These investments are likely to support businesses in the UK and encourage them to adopt new digital technologies rapidly and more effectively. This also highlights the country's focus on becoming a prominent leader in AI and digital innovation.

Key Digital Transformation Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services (AWS)

- Alphabet Inc. (Google Cloud)

- IBM Corporation

- SAP SE

- Oracle Corporation

- Dell Technologies

- Siemens AG

- Samsung SDS

- Accenture PLC

- Capgemini SE

- Tata Consultancy Services (TCS)

- Infosys Limited

- DXC Technology

- Axiata Digital Services

- NEC Corporation

- Fujitsu Limited

- Hitachi Ltd.

- NTT Data Corporation

- Panasonic Connect Co., Ltd.

The digital transformation business is mainly led by the giant players owing to their dominance in innovation. The leading companies are continuously investing in research and development activities to introduce innovative solutions. Many small and medium-sized companies are forming strategic collaborations with top players to increase their market reach and profits. New companies are also developing next-gen technologies to stand out in the crowd. The global market is mainly dominated by the EU and American companies.

Here is a list of key players operating in the market.

Recent Developments

- In September 2025, Cloudflare, Inc., a connectivity cloud provider, launched NET Dollar, a U.S. dollar-backed stablecoin built to enable fast and secure transactions on the agentic web. The initiative is intended to support a new internet economy that promotes originality, sustains creative work, and drives innovation in a technology-driven landscape.

- In September 2025, Citi Group and Dandelion, a subsidiary of Euronet Worldwide, Inc., announced a partnership to improve cross-border payments by combining Citigroup’s WorldLink Payment Services with Dandelion’s extensive digital wallet network. Through this partnership, Citi’s institutional clients can make near-instant, full-value payments to digital wallets across the globe, with close to continuous availability.

- Report ID: 3624

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Transformation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.