Revenue Cycle Management Market Outlook:

Revenue Cycle Management Market size was valued at USD 163.8 billion in 2025 and is expected to reach USD 486.48 billion by 2035, registering around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of revenue cycle management is evaluated at USD 180.75 billion.

The growth of the market can be attributed to the rising need for structured healthcare services together with the adoption of such systems that integrate administrative data such as a patient's identity, insurance plan, and others for quick value-based reimbursement owing to the growing pool of patients worldwide. For instance, as per recent updates, there were over 2,00,700 patients admitted at the general hospitals of Norway in 2022.

In addition to these, factors that are believed to fuel the market growth of the revenue cycle management market include the rise in healthcare spending worldwide which is responsible for the growing need for unifying the overall healthcare system through the active deployment of various IT solutions such as RCM, that enables healthcare facilities to track patient care episodes from registration and appointment scheduling to the final payment of a balance. According to the statistics by the World Bank, the current health expenditure around the globe as a share of GDP rose from 8.63% in the year 2000 to 9.84% in the year 2019. Hence, the growing patient footfall in hospitals owing to the widespread of various types of chronic diseases globally and elevated spending is predicted to present the potential for market expansion over the projected period.

Key Revenue Cycle Management Market Insights Summary:

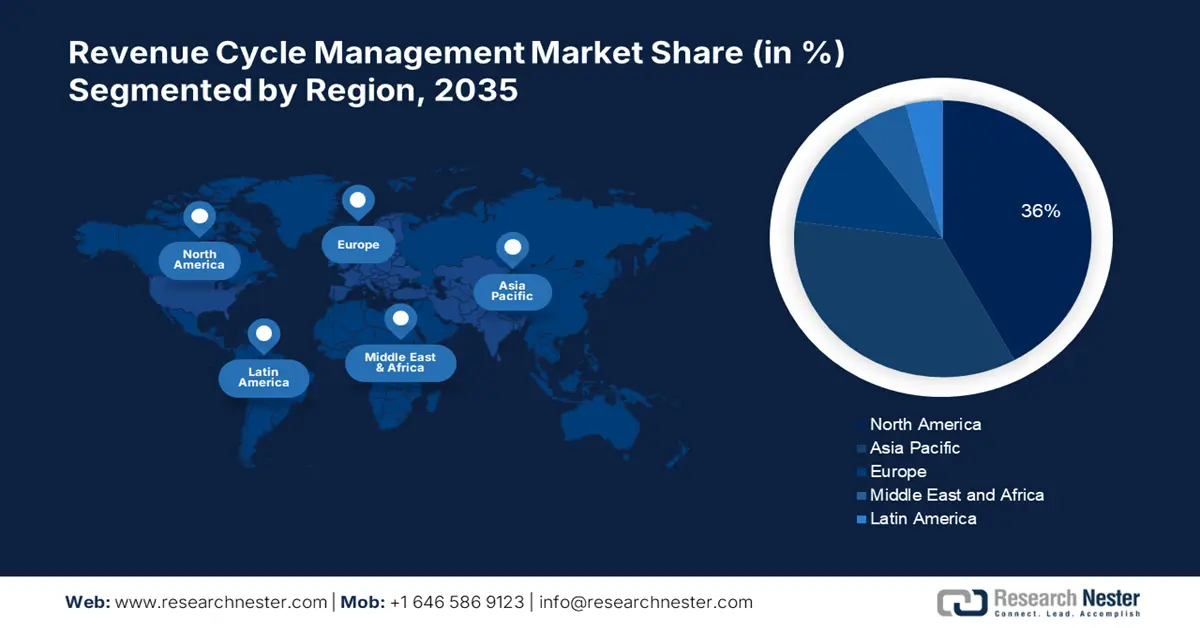

Regional Highlights:

- North America revenue cycle management market achieves a 36% share by 2035, driven by digital transformation in healthcare.

- Asia Pacific market will capture a 26% share by 2035, driven by favorable government initiatives.

Segment Insights:

- The cloud-based segment in the revenue cycle management market is expected to hold a 70% share by 2035, driven by the healthcare sector's reliance on flexible and efficient cloud computing services.

- The hospital segment in the revenue cycle management market is anticipated to capture a 54% share by 2035, driven by the expanding healthcare infrastructure and hospitals’ focus on financial transparency and advanced care.

Key Growth Trends:

- Rising Trend of Outsourcing Financial Process

- Growing Coverage of Health Insurance Program

Major Challenges:

- Reluctancy to switch over to the latest management model

- Lack of standardization

Key Players: The SSI Group, LLC, R1 RCM Inc., Experian Information Solutions, Inc., athenahealth, Inc., AllScripts Healthcare, LLC, Epic Systems Corporation, NXGN Management, LLC, CareCloud Corporation, McKesson Corporation, Quest Diagnostics, Inc., Cerner Corporation.

Global Revenue Cycle Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 163.8 billion

- 2026 Market Size: USD 180.75 billion

- Projected Market Size: USD 486.48 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 10 September, 2025

Revenue Cycle Management Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding Opportunities for Medical Billing Software & Medical Billing Companies - The rising need for healthcare service providers to improve workflow efficiency, along with the adoption of practices that save time and money for healthcare facilities with a lower number of denied claims and make it possible for patients to make payments online, is expected to promote the adoption of these advanced RCM systems. Currently, there are little less than 300 medical billing companies operating in the United States alone.

-

Rising Trend of Outsourcing Financial Process – With healthcare providers thriving towards improving the patient experience with the delivery of high-quality care and lower costs, most other processes are being outsourced nowadays. Also, as per findings, the average error rate in self-compiled claims is nearly 30% but this number is anticipated to drop to less than 1% with the outsourcing of medical billing to any reputable firm. This, as a result, is expected to boost market growth in the upcoming years.

- Growing Coverage of Health Insurance Program – For instance, as per data, approximately 60 million individuals, or 18.2% of the U.S. population were enrolled in Medicare in 2021 while many individuals were covered by private health insurance. The increasing number of insured patients, medical records, and growing usage of codes assist the insurance company in determining coverage and the medical necessity of the services is expected to boost the adoption of systems such as revenue cycle, patient engagement, and care coordination service.

- Rapidly Changing Healthcare Sector – The growing digital transformation of the healthcare sector and the use of information technology together with the rapidly increasing incorporation of artificial intelligence (AI) and machine learning in the delivery of high-quality care, enhancing the patient experience is estimated to propel the market growth. As per investigations, the total spending on digital transformation globally reached over USD 1.3 trillion in 2022 and is growing at a rate of over 10% year on year.

Challenges

-

Reluctancy to switch over to the latest management model – Many healthcare divisions still rely on conventional methods of revenue management and are reluctant to adopt such technologies as they involve a lengthy and time-consuming process, which is attributed to hamper the market growth in the near future. Moreover, the lack of proper IT infrastructure in many underdeveloped and developing countries as well as the lack of proper technical guidance for the smooth switch is further anticipated to restrict the industry growth over the forecast period.

-

Lack of standardization

- Stringent regulatory framework

Revenue Cycle Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 163.8 billion |

|

Forecast Year Market Size (2035) |

USD 486.48 billion |

|

Regional Scope |

|

Revenue Cycle Management Market Segmentation:

Deployment Model Segment Analysis

The revenue cycle management market is segmented and analyzed for demand and supply by deployment model into on-premise and cloud-based. Out of the two types of deployment models of revenue cycle management, the cloud-based segment is estimated to gain the largest market share of about 70% in the year 2035. The growth of the segment can be attributed to the growing reliability of the healthcare sector on cloud-based services and cloud computing owing to their flexibility and increased performance and efficiency that helps to lower overall IT costs. According to a survey, more than 82% of healthcare organizations were already using cloud services worldwide and these cloud infrastructure services are surging with each passing year.

End-user Segment Analysis

The global revenue cycle management market is also segmented and analyzed for demand and supply by end-user into hospitals, specialty clinics, laboratories, and others. Amongst these given segments, the hospital segment is expected to garner a significant share of around 54% in the year 2035. The growth of the segment can be attributed to the radically expanding global healthcare infrastructure with the burgeoning pool of patients worldwide. Moreover, the increasing focus of hospitals to improve financial viability, transparency, and profitability together with the provision of advanced medical facilities to their patients is expected to boost the market growth within this segment. On the other hand, the specialty clinic segment is projected to witness a massive CAGR during the forecast period, owing to the growing popularity of these clinics with supporting factors like increasing disposable income and rising demand for convenient and better treatment. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global revenue cycle management market includes the following segments:

|

By Deployment Model |

|

|

By Service |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Revenue Cycle Management Market Regional Analysis:

North American Market Insights

The share of revenue cycle management market in North America, amongst the market in all the other regions, is projected to be the largest with a share of about 36% by the end of 2035. The growth of the market can be attributed majorly to the growing digital transformation in the healthcare industry as well as the rising healthcare IT spending besides increasing adoption of the latest IT solutions such as revenue cycle management systems in the healthcare sector to enhance efficiency and improve value-based care reimbursement. As per a survey, in the United States alone 75% of hospitals and health systems deployed revenue cycle management (RCM) technology during the COVID-19 pandemic. Moreover, the presence of well-established healthcare facilities as well as favorable regulations for the key market players in the region is predicted to create lucrative growth opportunities for the market region.

APAC Market Insights

The Asia Pacific revenue cycle management market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the growing efforts to improve care delivery quality as well as rising favorable government initiatives of emerging economies to promote digital transformation in the healthcare sector resulting in the increasing adoption of healthcare IT solutions. Moreover, the rising digital literacy as well as advancing healthcare infrastructure along with a growing pool of patients being covered by various types of insurance is further anticipated to propel the market growth in the upcoming years.

Middle East & Africa Market Insights

Middle East & Africa region is anticipated to register substantial growth through 2035. The growing pool of patient base, as well as the surging demand for quality healthcare facilities as well as increasing adoption of healthcare policies and plans such as medical insurance along with continuous digital transition in the healthcare sector, are some factors promoting the adoption of market in the region.

Revenue Cycle Management Market Players:

- The SSI Group, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- R1 RCM Inc.

- Experian Information Solutions, Inc.

- athenahealth, Inc.

- AllScripts Healthcare, LLC

- Epic Systems Corporation

- NXGN Management, LLC

- CareCloud Corporation

- McKesson Corporation

- Quest Diagnostics, Inc.

- Cerner Corporation

Recent Developments

- The SSI Group, LLC, a leader in financial performance solutions for providers and payers, announced its partnership with RCxRules, a leading provider of automated billing solutions for healthcare organizations’ population health and revenue cycle operations.

- R1 RCM Inc., a leader in technology-enabled revenue cycle management (RCM) services to healthcare providers, announced that Rush University System for Health (RUSH), an academic health system entered into a strategic partnership to achieve revenue cycle performance excellence and accelerate innovation in healthcare.

- Report ID: 4849

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Revenue Cycle Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.