Trimer Acid Market Outlook:

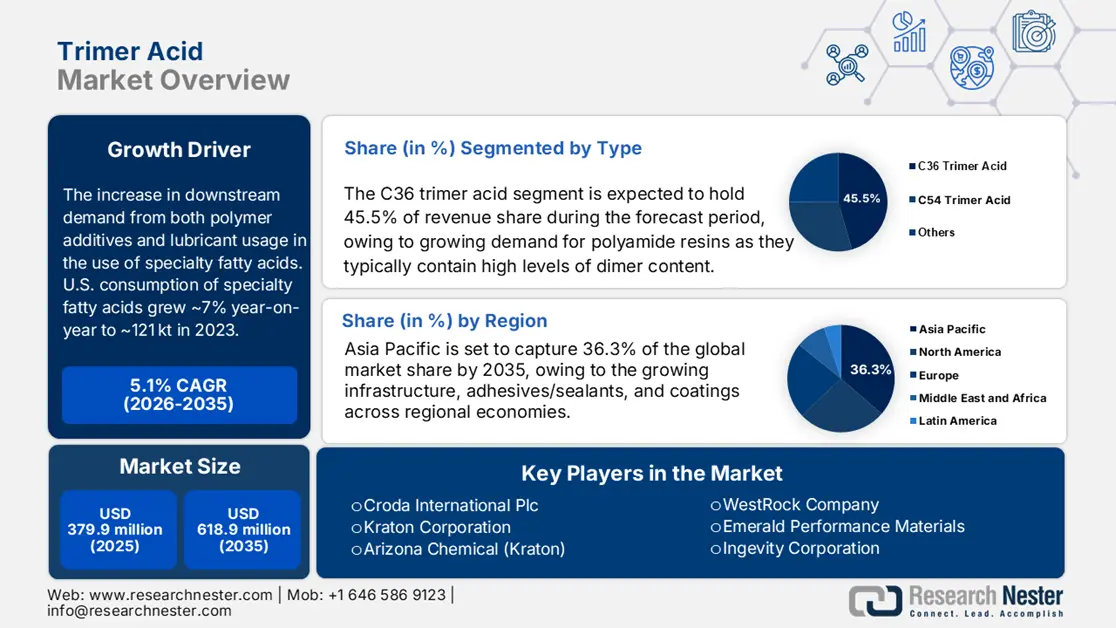

Trimer Acid Market size was estimated at USD 379.9 million in 2025 and is expected to surpass USD 618.9 million by the end of 2035, rising at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of trimer acid is estimated at USD 398.9 million.

Primary growth driver is the commodity-driven shift from petroleum-based intermediary products to bio-based fatty-acid derived intermediates (and feedstocks like vegetable-oil co-products) to comply with procurement requirements, mitigate feedstock risk, and service increasing demand for bio-based lubricants, specialty polymers, and coatings. Government sources demonstrate the size and recent growth of the biobased sector. In 2021, the bioeconomy's biobased products generated $489 billion to the U.S. economy, up from $464 billion in 2020. This is an increase of $25 billion, or 5.1%. This indicates an institutional demand that pulls upstream into oleochemical volumes.

The lubricant base-oil market, valued at around $60 billion according to the EPA, underscores a significant downstream opportunity for trimerized and oligomer fatty-acid intermediates, given their role in producing high-performance, sustainable formulations. The sum of public procurement, downstream demand, and upstream supply chain evidence represents immediate, discrete drivers for classification and quantity of trimer acid demand in industrial and lubricant applications.

Key Trimer Acid Market Insights Summary:

Regional Insights:

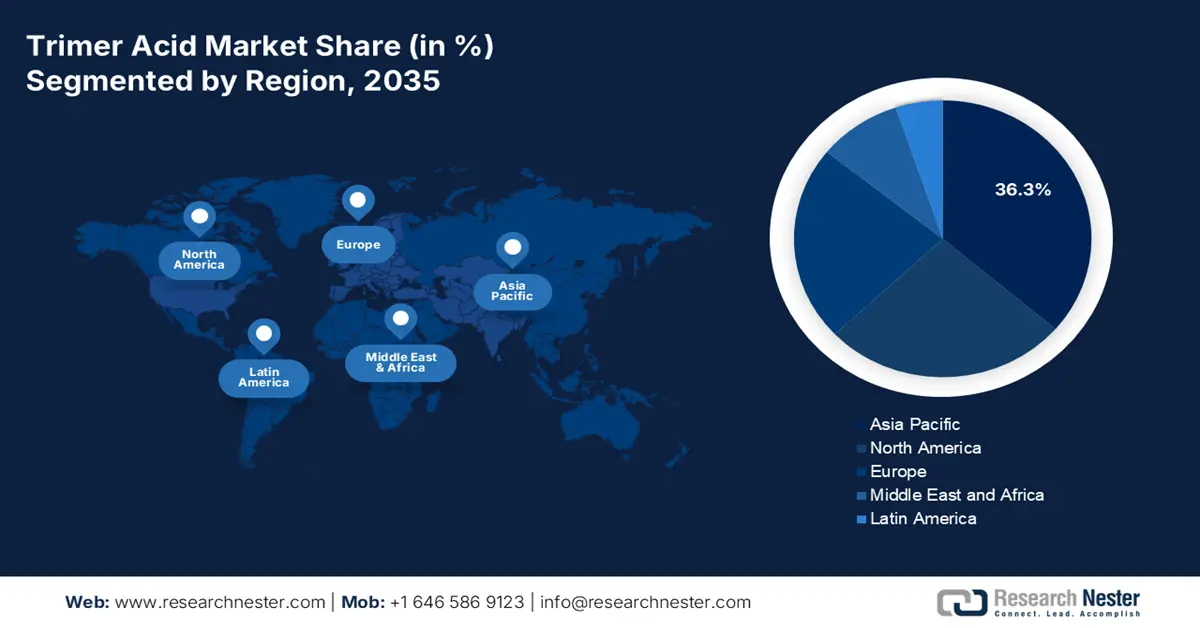

- The Asia Pacific Trimer Acid Market is projected to command a 36.3% share by 2035, attributed to the surging infrastructure development and expanding use of adhesives, sealants, and coatings across emerging economies.

- The North American market is anticipated to account for 26.6% of the share by 2035, supported by growing utilization of polyamide resins and adhesives in automotive and industrial coating applications.

Segment Insights:

- The C36 trimer acid segment is projected to capture a 45.5% share of the Trimer Acid Market by 2035, propelled by the rising demand for polyamide resins with high dimer content and flexibility.

- The adhesives and sealants segment is expected to hold a 37.2% share by 2035, fueled by the increasing application of high-performance adhesives in automotive, aerospace, and construction industries.

Key Growth Trends:

- Growth in sustainable and green chemicals

- Expansion of automotive and aerospace coatings

Major Challenges:

- Limited production capacities

- High manufacturing costs

Key Players: Croda International Plc,Kraton Corporation,Arizona Chemical (Kraton),WestRock Company,Emerald Performance Materials,Ingevity Corporation,Oleon NV (Avril Group),Harima Chemicals Group, Inc.,KLK OLEO (Kuala Lumpur Kepong),Emery Oleochemicals,Aditya Birla Chemicals,BASF SE,Akzo Nobel N.V.,Resinate Materials Group,Dura Chemicals, Inc.

Global Trimer Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 379.9 million

- 2026 Market Size: USD 398.9 million

- Projected Market Size: USD 618.9 million by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: South Korea, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 10 September, 2025

Trimer Acid Market - Growth Drivers and Challenges

Growth Drivers

- Growth in sustainable and green chemicals: The global green chemicals market is driven by sustainability mandates across industries. Trimer acid produced from renewable fatty acids aligns with resin and coating manufacturers’ goals to source bio-based inputs and reduce carbon footprints to meet ESG targets. Its renewable nature supports eco-label certifications, increasing its demand from global manufacturers. An estimated 150 million gallons of raw materials are currently produced annually by biorefineries and used in the production of biobased products. As environmental regulations tighten and consumer preferences shift toward greener materials, the adoption of bio-based trimer acid is set to accelerate significantly across specialty chemical applications.

- Expansion of automotive and aerospace coatings: Trimer acid-based polyamides play an important role in high-performance automotive and aerospace coatings, where superior corrosion resistance and durability are vital. This growth is fueled by rising aircraft production, maintenance activities, and stringent coating performance standards. Trimer acid’s chemical properties enhance coating flexibility and weatherability, positioning it as a preferred intermediate in advanced coating formulations for the aerospace sector worldwide.

- Advancements in chemical recycling and circular economy: The expansion of remanufacturing and chemical recycling industries, alongside investments in circular economy models within specialty chemicals, is boosting the adoption of trimer acid derived from recycled fatty acid feedstocks. Cotton and rayon are among the 74% of textiles made from biobased feedstocks. Approximately 45 million tons of biobased fibers were produced in 2021. These positions trimer acid manufacturers competitively as large global chemical firms pursue ambitious carbon neutrality targets. The integration of recycled inputs lowers environmental impact and enhances supply chain resilience amid growing regulatory pressures for emissions transparency and climate risk reporting.

Growth in Lubricating Products Trade

Lubricating products trade plays a key role in driving the trimer acid market, as trimer acids are critical intermediates in synthetic esters used for high-performance lubricants. Rising cross-border demand for premium lubricants increases the need for consistent trimer acid supply, pushing producers to scale capacity. Trade flows also influence regional pricing, with strong lubricant imports creating pull-through demand for trimer acids in downstream hubs. As global lubricant trade expands, it directly stimulates growth and competitiveness in the trimer acid market.

Global Lubricating Products Trade (2023)

|

Leading Exporters |

Export Value (USD) |

Leading Importers |

Import Value (USD) |

|

Germany |

$2.25 B |

China |

$1.68 B |

|

United States |

$2.19 B |

Germany |

$664 M |

|

Japan |

$1.21 B |

Mexico |

$470 M |

Source: OEC

Challenges

- Limited production capacities: Trimer acid is produced by a limited number of companies (e.g., Croda, Oleon, Kraton), and the capacity to produce it remains less than 100 kilo tons globally, which resulted in supply tightness when demand surged. The demand for polyurethane adhesives has grown steadily, while the expansion of trimer acid production capacity has lagged, creating a supply-demand imbalance. Very limited back integration further restricts a class of suppliers from ramping up operations efficiently, limiting overall competitiveness in the mid- and long term.

- High manufacturing costs: The production of trimer acid also uses a lot of energy as the process involves thermal polymerization at elevated temperatures of up to 230–280°C. The Department of Energy has announced a $25 million investment in research on polymer upcycling to reduce the waste of plastics. Adding to this is the cost of the specialized reactors and purification system for the production of trimer acid, which is a major investment upfront, so the small manufacturer does not exit the market. This initial cost limits profitability, which adds to having limited impacts on adaptability for use in more cost-sensitive applications, such as construction chemicals.

Trimer Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 379.9 million |

|

Forecast Year Market Size (2035) |

USD 618.9 million |

|

Regional Scope |

|

Trimer Acid Market Segmentation:

Type Segment Analysis

The C36 trimer acid segment is predicted to gain the largest trimer acid market share of 45.5% during the projected period by 2035, due to growing demand for polyamide resins as they typically contain high levels of dimer content and because they have ease of flexibility. The National Renewable Energy Laboratory (NREL) expects that bio-based chemical feedstock, including derivatives of C36, will be the primary form of specialty chemical production and consumption by 2034. This reflects a growing demand for renewable high-performing intermediates to develop adhesives, coatings, and engineered polymers around the world.

Application Segment Analysis

The adhesives and sealants segment is anticipated to constitute the most significant growth by 2035, with 37.2% trimer acid market share, mainly due to growing usage of high-performance adhesives in automotive and aerospace industries, and for use during construction projects increases the growth and demand for trimer acids as consumers look for enhanced bonding strength and thermal stability. As noted in the U.S. Department of Energy report on materials, lightweight and durable materials are important for automotive efficiency and function. In order to meet performance and safety specifications and durability expectations across multiple industries, reliance on newer technology with durable materials or performance with welding and adhesion to advanced adhesives comprising more trimer acids is going to become more pervasive.

End use Segment Analysis

The automotive segment is anticipated to constitute the most significant growth by 2035, with 32.3% trimer acid market share, mainly due to a shift towards new fuel economy vehicle products and electric vehicles. Production demands expanding innovative coatings, lubricants, polymers, and adhesives derived from all brands of trimer acids. As per the IEA in the STEPS, EV sales share increases from 15% in 2023 to nearly 40% in 2030 and more than 50% in 2035. In the coming years, the requirements for high-performance materials utilizing trimer acids will be especially important to automotive, aerospace, and construction for thermal resistance, durability, or a combination of both when a high-volume manufacturing efficiency is required.

Our in-depth analysis of the trimer acid market includes the following segments:

| Segment | Subsegment |

|

Type |

|

|

Application |

|

|

Form |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trimer Acid Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 36.3% of the trimer acid market share. Demand is driven by infrastructure, adhesives/sealants, and coatings across regional economies. China is by far leading in consumption due to new and existing scale in construction and industrial growth. The region's growing acceptance of bio-based product offerings and related additive technologies is also enabling growth in APAC. It is expected that by 2035, the region will maintain that growth precipitated by sustained urbanization and continued investment in industrialization.

China’s trimer acid demand is expected to grow due to high use in construction and infrastructure projects, part of continued rapid urbanization, and associated use by coatings, sealants, adhesives, and polyamide resins, which are driving demand up sharply. Environmental regulation pushes the adoption of bio-based chemistries, too. The country’s urbanization rate is projected to rise, with temporary megaprojects providing short-term support for this trend through 2035.

North America Market Insights

The North American trimer acid market is expected to hold 26.6% of the market share by 2035, due to its increased demand for polyamide resins and adhesives for automotive and industrial coatings. The growing opportunities in oilfield chemicals, paints, and construction materials. There is also a strong push to increase trimer acid-based bio-based and bio-feedstock feedstocks from R&D efforts. The North America trimer acid market continues to gain momentum from increased adoption of lightweight automotive components and strong consumption of trimer acid-based adhesives in manufacturing clusters in the U.S. and Canada.

The U.S. expansion is expected to continue due to substantial consumption rates in existing adhesives and coatings manufacturing, construction, energy infrastructure, and transportation sectors. Growing trimer acid consumption for corrosion inhibitors, particularly in pipelines and offshore drilling, is increasing trimer acid demand and consumption levels. About 2% of all dry natural gas production and 15% of all crude oil production in the United States in 2022 came from the Federal Offshore Gulf of America. About 97% of all oil and gas production in the OCS occurs in the Gulf of Mexico, which is a hub to the great majority of federal offshore oil and gas wells. In addition, favorable regulatory activities at the U.S. federal level (EPA) continue to promote low-VOC chemicals to support PEP and business development. There is also an important expansion in domestic U.S. bio-based chemical production, specifically for trimer acid source points in Louisiana and Texas, which is providing a necessary domestic supply for cost-competitive and performance-based chemical expansion.

Europe Market Insights

The European trimer acid market is expected to hold 22.9% of the market share by 2035, due to the demand for trimer acid is set to increase due to increasing use in adhesives, coatings, and as a building block in the manufacture of polyamides. Germany and the UK are the largest consumers, given the strong specialty chemicals industry. Europe is set to see increased imports from Asia and regulatory requirements evolving with ECHA REACH amendments that will drive compliance costs. Additionally, stricter carbon reduction targets are reshaping industry practices, compelling manufacturers and importers to balance sustainability goals with growing demand, ultimately influencing competitiveness and operational strategies across the European market.

The built environment accounts for 25% of the UK’s total carbon footprint, and this sector will be crucial in meeting national emission reduction targets, according to a report by the UK Environmental Audit Committee. The UK Government aims to achieve net zero by 2050, positioning the UK among the most ambitious climate change efforts worldwide. This target will be legally binding and states that, by 2032, it will reduce Scope 1 emissions by 50%, with a 75% reduction expected by 2037. This means the UK will be over three-quarters of the way toward net zero by 2037. As the delivery organization for the UK Government's office and warehouse portfolio strategies, the Government is committed to reducing Scope 1 emissions by 50% by 2027 and 78% by 2035 for government buildings, exceeding the government’s targets.

Key Trimer Acid Market Players:

- Croda International Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kraton Corporation

- Arizona Chemical (Kraton)

- WestRock Company

- Emerald Performance Materials

- Ingevity Corporation

- Oleon NV (Avril Group)

- Harima Chemicals Group, Inc.

- KLK OLEO (Kuala Lumpur Kepong)

- Emery Oleochemicals

- Aditya Birla Chemicals

- BASF SE

- Akzo Nobel N.V.

- Resinate Materials Group

- Dura Chemicals, Inc.

The global trimer acid market is moderately consolidated and has a few important players of note, like Croda International, Kraton Corporation, and Arizona Chemical. Overall, companies are diversifying into bio-based and sustainable products to comply with stricter environmental, health, and safety regulations and greater green chemistry trends. Within the industry, companies are undertaking strategic initiatives such as mergers and acquisitions, Kraton Corporation completed the acquisition of Arizona Chemical, Inc. in 2016, capacity expansions, research and development investments to commercialize high-purity specialty trimer acids in adhesives, coatings, and polymer industries. Global players within Asia the companies from Malaysia and South Korea specifically, are leveraging efficient production to be competitive in many export markets. Conversely, the focus has been on incorporating biopolymer strategies also at the European players' level for greater presence in the sector.

Some of the key players operating in the trimer acid market are listed below:

Recent Developments

- In 2025, BASF launched an environmentally friendly range focused on adhesives and coatings made from renewable tall-oil feedstocks. The bio-based chemicals market was expected to increase from $349.5 million in 2025, a 4.7% increase from 2024. This launch raised BASF's adhesives market share (29.4%) and supported their ESG goals, which forced competitors to focus on their renewable solutions and contributed to the trimer acid market's expected 5.0% CAGR to 2035.

- In January 2024, Oleon doubled trimer acid production capacity at the Ertvelde, Belgium, plant to offer coatings and lubricant-grade products. The expansion responded to the growing demand for high-performance coatings, especially in East Asia. By 2025, adhesives and coatings were expected to account for ~30% of the segment share. This move enhanced Oleon's presence in the region, secured stability of supply, and avoided challenges related to the volatility of raw-material prices in global markets.

- Report ID: 4232

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trimer Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.