Long Chain Dicarboxylic Acid Market Outlook:

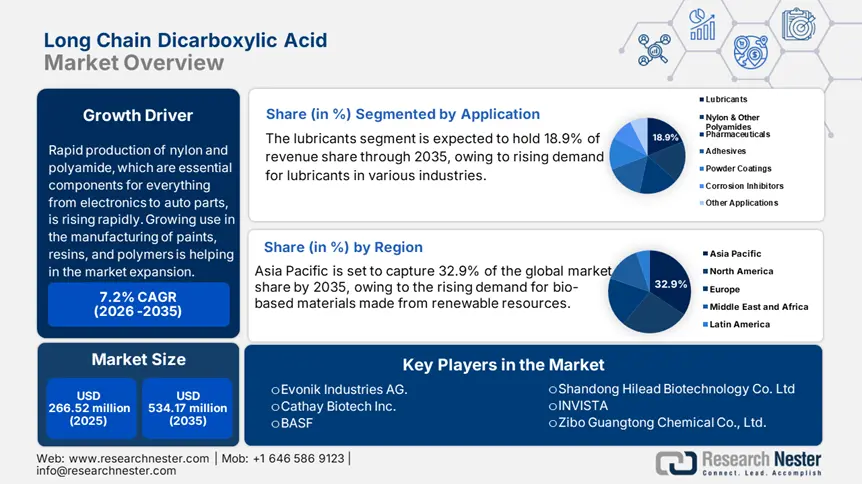

Long Chain Dicarboxylic Acid Market size was valued at USD 266.52 million in 2025 and is likely to cross USD 534.17 million by 2035, expanding at more than 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of long chain dicarboxylic acid is assessed at USD 283.79 million.

The market for long chain dicarboxylic acids is expanding due to the growing use in the manufacturing of paints, resins, and polymers. These acids are helpful building blocks in the production of specialty materials due to their long carbon chain, which also adds to their distinctive chemical characteristics. Rapid production of nylon and polyamide, which are essential components for everything from electronics to auto parts, is rising rapidly. The long chain dicarboxylic acid market is expanding due to consumers' increasing demand for powder coatings, which are valued for their strength and aesthetic appeal on furniture and appliances.

The production of long chain dicarboxylic acids has rapidly transformed due to advancements in chemical synthesis and biotechnology. Traditional petrochemical methods are gradually being replaced or enhanced by bio-based processes that use renewable feedstocks such as vegetable oils and microbial fermentation. The primary drivers of this shift are reducing industrial carbon emissions and dependence on fossil fuels. Fermentation has attracted attention in particular due to its ability to produce high-purity, structurally diverse LCDAs, which are necessary for high-performance applications. Developments in metabolic and genetic engineering are increasing the yield and efficiency of bio-based production methods, opening up new possibilities for the cost-effective and environmentally benign synthesis of LCDA.

Key Long Chain Dicarboxylic Acid Market Insights Summary:

Regional Highlights:

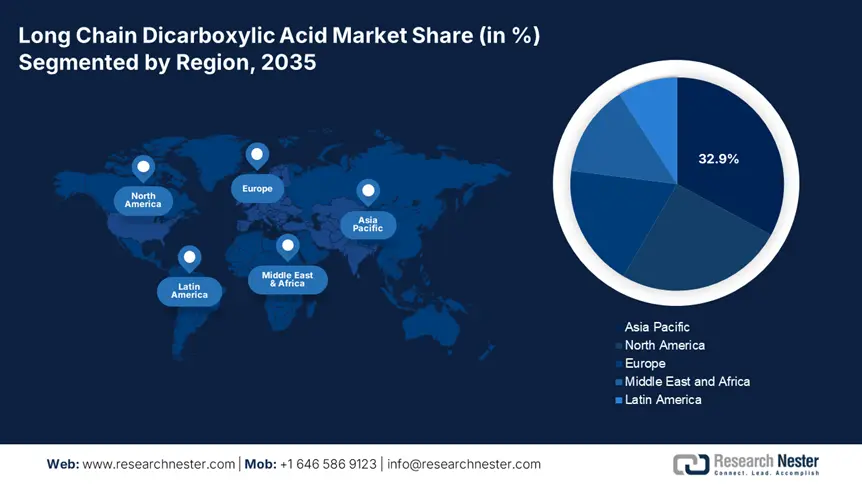

- Asia Pacific holds a leading 32.9% share in the Long Chain Dicarboxylic Acid Market, fueled by extensive output, consumption, and growing industrial sector, positioning it for significant growth through 2035.

- The Long Chain Dicarboxylic Acid Market in North America is forecasted to maintain stable growth by 2035, attributed to rising demand for bio-based materials and industrial sector expansion.

Segment Insights:

- The Lubricants segment is expected to achieve over 18.9% market share by 2035, fueled by rising demand in automotive and industrial equipment sectors.

Key Growth Trends:

- Rising demand for high-performance polymers

- Increasing adoption in cosmetics and personal care products

Major Challenges:

- Government Strict Regulation

- High cost of raw materials

- Key Players: INVISTA, Zibo Guangtong Chemical Co., Ltd., Evonik Industries AG, and Xiamen Aeco Chemical Industrial Co., Ltd.

Global Long Chain Dicarboxylic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 266.52 million

- 2026 Market Size: USD 283.79 million

- Projected Market Size: USD 534.17 million by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Long Chain Dicarboxylic Acid Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for high-performance polymers: These acids are essential raw ingredients in the synthesis of specialty polymers such as nylon and polyester, and the growing need for high-performance polymers across a range of industries, including automotive, electronics, and packaging, is fueling long chain dicarboxylic acid market expansion. High-performance polymers are increasingly being used as component materials in a variety of applications. Compared to conventional polymers, these polymers are perfect for a wide range of applications due to their remarkable mechanical and thermal properties. In addition, LCDA gives these polymers the building blocks they need to function, allowing producers to produce materials that are resistant to harsh environments and offer improved product longevity and performance.

- Increasing adoption in cosmetics and personal care products: The long chain dicarboxylic acid market is expanding owing to the growing use of LCDA in a variety of cosmetics and personal hygiene products. Due to their calming qualities, these acids help to improve the texture and moisturize skin and hair care products. Thus, they can provide positive effects that meet consumer requirements while also improving the experience of items. In addition, a favorable market outlook is being provided by consumers' growing demand for attractive and efficient personal care products. Customers are becoming more conscious of the role ingredients play in product quality. In addition, LCDA in formulations raises the value of products and satisfies the exacting criteria of cosmetics.

Challenges

- Government Strict Regulation: Complex laws create barriers and hinder the long-chain dicarboxylic acid market. For novel long-chain dicarboxylic acid applications, onerous regulations and drawn-out testing procedures create a bureaucratic labyrinth that inhibits innovation and slows market expansion. The complex regulatory environment creates obstacles for producers eager to launch long-chain dicarboxylic acid products of the future.

- High cost of raw materials: Petrochemical feedstocks are typically used to create long chain dicarboxylic acids. In addition to being costly and reliant on the price of crude oil, this approach is chemically complex. Paraffin hydrocarbons are one such basic material that is utilized. Petroleum and natural gas both include significant amounts of paraffin hydrocarbons. Therefore, the long chain dicarboxylic acid market for long-chain dicarboxylic acid is slowed down and presented with difficulties by volatility or a lack of crude oil. The cost of raw materials contributes significantly to the total cost of production.

Long Chain Dicarboxylic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 266.52 million |

|

Forecast Year Market Size (2035) |

USD 534.17 million |

|

Regional Scope |

|

Long Chain Dicarboxylic Acid Market Segmentation:

Application (Lubricants, Nylon & Other Polyamides, Pharmaceuticals, Adhesives, Powder Coatings, Corrosion Inhibitors, and Other Applications)

Lubricants segment is anticipated to dominate over 18.9% long chain dicarboxylic acid market share by 2035. This is due to rising demand for lubricants in various industries. There is a rise in the need for lubricants in the transportation, automotive, and industrial equipment manufacturing sectors, among other end-user industries. Lubricants give the equipment a high load-carrying capacity, help reduce friction, and preserve thermal stability. For the forecast period, these factors are anticipated to have a favorable influence on the market.

Powder coatings are another significant application for LCDA. The purpose of LCDA is to enhance powder coatings by increasing their durability and functionality. It improves the coatings' ability to adhere to surfaces and withstand corrosion. The size of LCDA's market share indicates how important it is to the production of premium powder coatings. Long chain dicarboxylic acids also showed a significant market share in nylon and polyamides, which were identified as important applications. LCDA's substantial position in this market was facilitated by its function in the synthesis of nylon and polyamides, which are necessary components for the manufacture of textiles, automobile components, and other consumer goods.

LCDA also has a significant application in adhesives. The capacity of LCDA to improve bonding strength and endurance makes it a popular ingredient in adhesives used in a variety of industries, including packaging, automotive, and construction. The importance of LCDA in creating strong and efficient adhesive solutions is indicated by its market share in the adhesives category.

LCDA is employed in the pharmaceutical industry due to its effectiveness and adaptability in the production of medications. LCDA is crucial for the production of pharmaceutical products, while not have the largest market share. In addition to other uses, LCDA is utilized in corrosion inhibitors. This demonstrates that LCDA is a flexible component in a wide range of devices and is helpful in numerous industries. Its numerous uses and functions in halting corrosion demonstrate its significance across a range of industries.

The market dynamics of long chain dicarboxylic acid, in summary, show a varied landscape with lubricants at the top, followed by significant contributions from pharmaceuticals, powder coatings, nylon, polyamides, adhesives, corrosion inhibitors, and other applications. The adaptability of LCDA and its crucial significance in numerous industries are highlighted by this categorization.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Long Chain Dicarboxylic Acid Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in long chain dicarboxylic acid market is expected to capture over 32.9% revenue share by 2035, owing to its extensive output and substantial consumption. A promising market forecast for the region is provided by the expanding use of LCDA as a result of the growing industrial sector. In addition, the market is expanding as a result of rising demand for bio-based materials made from renewable resources. Additionally, the region's market is expanding due to the presence of significant firms in the chemical industry.

China has been expanding due to the flourishing pharmaceutical business as well as a notable rise in the nylon and polyamide sectors. The government has put regulations in place to promote investment in the building and construction industry, which is fueling its expansion. Products for exterior building and construction, such as expansion joints, seals, and glazing, require high-performance nylon.

India also has a role in the market, especially due to increasing demand from the manufacturing of industrial equipment and end-use industries such as construction and automobiles. The market is additionally benefited by the availability of trained labor and raw materials, as well as the low cost of manufacturing. In the anticipated period, the market will experience a large growth in demand for nylon and other polyamides, lubricants, and adhesives that use long-chain dicarboxylic acid (LCDA).

North America Market Analysis

North America is expected to experience a stable CAGR during the forecast period. The largest contributors in North America are the U.S. and Canada, whose expanding populations have increased consumer demand for bio-based materials. The market is expected to grow as a result of its rising industrial sector.

The U.S. growing population and the growth of sectors including nylon and polyamide, which are vital components for everything from electronics to auto parts, are being produced at a rapid rate. The market for long chain dicarboxylic acid in the country is further boosted by the growing government initiatives in the building and construction industry.

Canada is expected to expand further in this area over the projection year due to the growing emphasis on environmental rules and sustainability. In addition, the industry is expanding due to growing consumer preferences for high-quality items. Long chain dicarboxylic acid is in high demand in this region for a variety of applications, including lubricants, adhesives, medicines, nylon and other polyamides, powder coatings, corrosion inhibitors, and more.

Key Long Chain Dicarboxylic Acid Market Players:

- INVISTA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cathay Biotech Inc.

- Shandong Hilead Biotechnology Co., Ltd

- Zibo Guangtong Chemical Co., Ltd.

- Evonik Industries AG.

- Xiamen Aeco Chemical Industrial Co., Ltd.

- BASF

- Henan Junheng Industry Group Biotechnology Co., LTD

The market for long chain dicarboxylic acids is anticipated to rise steadily due to their adaptable qualities and rising demand in several industries, especially in advanced manufacturing, nylon, and pharmaceutical sectors. Future market expansion will depend on resolving issues with competition, raw material availability, and environmental concerns while taking advantage of new market possibilities and technical developments.

Here are some leading players in the long chain dicarboxylic acid market:

Recent Developments

- In June 2023, Cathay Biotech Inc. successfully raised further funds and formed a substantial strategic cooperation with China Merchants Group (CMG). CMG has agreed to buy bio-based polyamides produced by Cathay as part of the partnership, with a minimum volume of 10,000 tons anticipated in 2023. For both businesses, this partnership represents a major advancement in the market for bio-based products.

- In June 2021, the Asia Innovation Center at the Shanghai International Chemical New Materials Innovation Center (INNOGREEN) at SCIP was unveiled by INVISTA. This state-of-the-art facility is committed to meeting the unique application requirements of engineering polymers in vital sectors such as electrical and electronics and the automotive industry.

- Report ID: 7578

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Long Chain Dicarboxylic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.