Chloroacetic Acid Market Outlook:

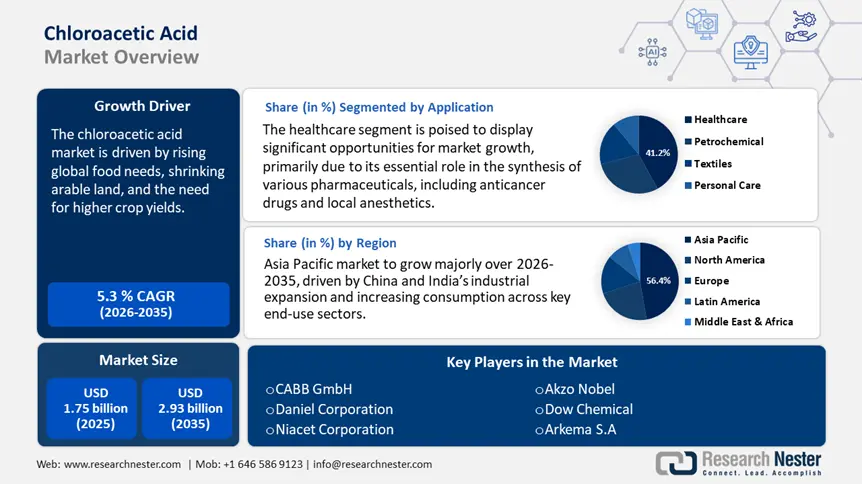

Chloroacetic Acid Market size was over USD 1.75 billion in 2025 and is anticipated to cross USD 2.93 billion by 2035, witnessing more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chloroacetic acid is assessed at USD 1.83 billion.

The chloroacetic acid market is experiencing significant transformations due to the rising demand for sustainable and bio-based alternatives. Environmental concerns and the global shift towards greener chemical solutions have propelled the interest in bio-based chloroacetic acid, especially in regions with strong regulatory frameworks for sustainable manufacturing. Businesses are allocating resources towards research and development to create chloroacetic acid from renewable resources, including agricultural biomass, food waste, and various organic materials. These efforts align with growing consumer and industrial preferences for eco-friendly products across sectors like agrochemicals, pharmaceuticals, and personal care.

In addition to bio-based initiatives, the market is experiencing rapid technological advancements in chloroacetic and production. Innovations such as flow chemistry and microwave-assisted synthesis have enabled more efficient and cost-effective production processes. These technologies reduce energy consumption, minimize waste, and improve yield, which is critical for meeting large-scale industrial demand while maintaining environmental responsibility.

Nouryon, previously known as AkzoNobel Functional Chemicals, is at the forefront of creating sustainable and high-purity chloroacetic acid solutions for international markets. In 2023, the company became the first to receive ISCC PLUS certification for its green monochloroacetic acid (MCA), produced at its Delfzijil facility in the Netherlands. This certification indicates that Nouryon's MCA is produced from sustainably sourced raw materials through the mass-balance method, resulting in a notable decrease in the carbon footprints of the product while ensuring superior quality and performance.

The company has consistently focused on cleaner production techniques and has explored integrating renewable feedstocks in its chemical processes. As the need for biodegradable and less toxic chemical alternatives rises, the adoption of bio-based chloroacetic acid is expected to accelerate. Coupled with innovations in production, these trends are likely to shape the future growth and competitiveness of the chloroacetic acid market.

Key Chloroacetic Acid Market Insights Summary:

Regional Highlights:

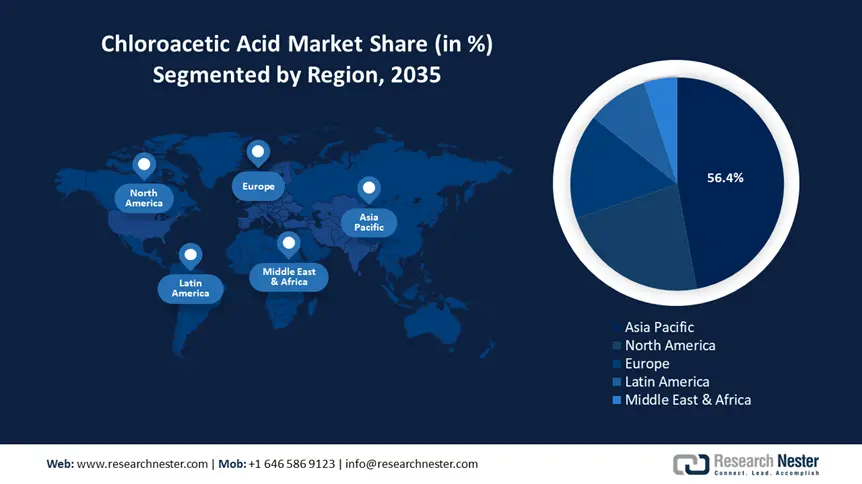

- Asia Pacific leads the Chloroacetic Acid Market with a 56.4% share, propelled by China and India’s industrial expansion and chemical consumption growth, sustaining strong growth through 2026–2035.

- North America's chloroacetic acid market is projected for the fastest growth by 2035, driven by advanced chemical manufacturing and diversified end-use sectors.

Segment Insights:

- The Monochloroacetic Acid segment is anticipated to hold a substantial market share by 2035, driven by its use in producing CMC, herbicides, and surfactants across multiple industries.

- The healthcare application segment is anticipated to secure a 41.6% share by 2035, driven by its use as an intermediate in pharmaceutical synthesis and demand for chronic disease treatment.

Key Growth Trends:

- Growing agrochemical demand

- Biobased and sustainable chemicals

Major Challenges:

- Toxicity and corrosiveness

- Variations in raw materials costs

- Key Players: CABB GmbH, Daicel Corporation, Niacet Corporation, Akzo Nobel N.V., Dow Chemical.

Global Chloroacetic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.75 billion

- 2026 Market Size: USD 1.83 billion

- Projected Market Size: USD 2.93 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Chloroacetic Acid Market Growth Drivers and Challenges:

Growth Drivers

- Growing agrochemical demand: The growing agrochemical demand is driven by rising global food needs, shrinking arable land, and the need for higher crop yields. Additionally, increased adoption of modern farming practices and herbicide-resistant crops, especially in emerging economies, boosted the use of herbicides like glyphosate, thereby increasing the need for chloroacetic acid. These herbicides are widely used in modern agricultural practices due to their effectiveness in weed control, which enhances crop yield and productivity.

With the global population growing and demand for food security increasing, the need for efficient agricultural chemicals continues to rise, subsequently driving the need for chloroacetic acid. Emerging economies such as India, Brazil, and China are significantly contributing to this growth as they expand their agricultural output and adopt modern farming techniques. CABB Group GmbH, located in Germany, is a leading international manufacturer of high-purity monochloroacetic acid, employed by agrochemical producers around the globe. This company plays a significant role in the production of chloroacetic acid for agricultural applications.

The company supplies MCA and its derivatives to major agrochemical manufacturers worldwide, supporting the production of herbicides like 2,4-D and MCPA. CABB maintains advanced production facilities located in Gersthofen and Knapsack in Germany, as well as in Jining, China, thereby guaranteeing a strong and dependable supply chain for its customers. The company emphasizes safe, sustainable production processes to meet the increasing market demand of the agrochemical sector.

- Biobased and sustainable chemicals: The increasing global emphasis on sustainability and environmental responsibility has accelerated the demand for bio-based and eco-friendly chemicals, including chloroacetic acid. Traditionally derived from petrochemical sources, chloroacetic acid is now being explored through renewable feedstocks such as biomass and waste materials. Companies are investing in research and development to create greener synthesis pathways that reduce carbon emissions and toxic byproducts. This shift not only addresses regulatory pressure but also aligns with consumer and industry demand for more sustainable manufacturing processes.

Bio-based chloroacetic acid offers a competitive edge in sectors like agrochemicals, pharmaceuticals, and personal care, where environmental compliance is crucial. For instance, Anugrah In-Org (P) Ltd, an Indian chemical manufacturer specializing in chloroacetic acid and its derivatives. The company is increasingly focusing on sustainable practices and eco-friendly production methods. Anugrah’s initiatives in exploring bio-based feedstocks and maintaining a low-carbon footprint make it a relevant player in the sustainable chloroacetic acid space.

Challenges

- Toxicity and corrosiveness: Chloroacetic acid poses significant difficulties owing to its extreme toxicity and corrosive nature, which present substantial hazards to human health and the environment. These hazards require stringent handling, storage, and transportation measures, thereby increasing operational costs for manufacturers. Furthermore, the manufacturing of chloroacetic acid is significantly reliant on essential raw materials, including acetic acid and chlorine.

Fluctuations in the costs of these vital inputs can significantly influence production costs and profit margins. Furthermore, the industry faces strict environmental and safety regulations aimed at minimizing exposure and ecological impact. Compliance with these regulations often demands costly upgrades and limits market expansion, collectively restraining growth.

- Variations in raw materials costs: The chloroacetic acid market heavily relies on acetic acid and chlorine. Additionally, the production of chloroacetic acid is greatly influenced by the availability and pricing of acetic acid and chlorine. These prices can vary significantly due to shifts in global supply and demand, geopolitical conflicts, and fluctuations in energy expenses. Any disruption or price increase in these raw materials can directly impact on the overall production cost, thereby affecting the profitability of manufacturers. This unpredictability poses financial planning difficulties and may also lead to inconsistent supply chains. To mitigate these risks, companies must explore alternative sourcing strategies, diversify suppliers, or invest in long-term procurement agreements.

Chloroacetic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 1.75 billion |

|

Forecast Year Market Size (2035) |

USD 2.93 billion |

|

Regional Scope |

|

Chloroacetic Acid Market Segmentation:

Application (Healthcare, Petrochemical, Textiles, and Personal Care)

The healthcare segment is expected to hold a substantial share of 41.6% in the global chloroacetic acid market during the forecast period, primarily serving as an essential intermediate in the synthesis of various pharmaceuticals, including anticancer drugs and local anesthetics. The escalating prevalence of chronic disease and the growing emphasis on personalized medicine have intensified the demand for such medication, thereby propelling the need for chloroacetic acids.

Its chemical properties make it indispensable in producing active pharmaceutical ingredients, underscoring its significance in modern therapeutic developments. In the pharmaceutical industry, chloroacetic acid is utilized to produce compounds like glycolic acid and methacrylate esters. Glycolic acid finds applications in skincare products and industrial cleaning agents, while methacrylate esters are fundamental in manufacturing polymers and resins. The expansion of the petrochemical sector, driven by industrial growth and the demand for advanced materials, further amplifies the consumption of chloroacetic acid.

Celanese, a global frontrunner in technology and specialty materials. Celanese is recognized as the world’s leading producer of acetic acid and its derivatives, which are crucial in the production plants and research centers across North America, Europe, and Asia. Celanese is well-positioned to cater to the increasing demand of both the healthcare and petrochemical industries. The company’s commitment to innovation and sustainability ensures the delivery of high-quality chemical solutions that align with evolving industry requirements.

Product Type (Monochloroacetic Acid, Trichloroacetic Acid, and Dichloroacetic Acid)

The monochloroacetic acid segment is expected to hold a substantial share of the global chloroacetic acid market during the forecast period, primarily due to its extensive use in the production of carboxymethylcellulose (CMC), herbicides, and surfactants. CMC serves as a thickening and stabilizing agent across multiple industries, such as food, pharmaceuticals, and cosmetics. The increasing demand for these products is expected to boost MCA consumption throughout the forecast period. Additionally, MCA’s role in herbicide production supports the expanding agriculture sector.

A notable instance is the collaboration between Nouryon and Atul Ltd, which established a joint venture in Gujarat, India, to produce MCA, aiming to meet the rising demand in agriculture, personal care, and pharmaceutical markets. The rising global population increased agricultural activity, and demand for processed foods and personal products is all contributing to the growth in MCA consumption.

Additionally, MCA is cost-effective and highly reactive, making it ideal for the synthesis of a broad range of chemical compounds. In addition, trichloroacetic acid is widely used in cosmetic and pharmaceutical applications for chemical peels and wart removal, while dichloroacetic acid is explored for potential cancer therapies and metabolic treatments.

Our in-depth analysis of the global chloroacetic acid market includes the following segments:

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chloroacetic Acid Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific chloroacetic acid market is projected to gain the largest share of 56.4% by 2035. This dominance is driven by China and India’s industrial expansion and increasing consumption across key end-use sectors. In China, robust domestic manufacturing capacity, coupled with significant government support for the chemical industry, has positioned the country as a global leader. The rising demand for chloroacetic acid in pharmaceuticals, agrochemicals, and textiles is further supported by the country’s growing export base. Chongqing Prominent Chinese firms, including Chongqing Seayo Chemical Industry Co., Ltd., are essential in fulfilling both domestic and global demand.

On the other hand, India is witnessing consistent growth in the personal care and healthcare sectors, creating a strong downstream demand for chloroacetic acid. The country’s expanding pharmaceutical manufacturing base and rising investments in specialty chemicals support this growth trajectory. Companies like Jubilant Ingrevia Ltd. are instrumental in scaling production and innovation, helping to meet both local and global requirements for chloroacetic acid. Together, China and India form a high-growth corridor for the chloroacetic acid market in Asia Pacific.

North America Market Analysis

North America has rapidly emerged as the fast-growing chloroacetic acid market, driven by the U.S. and Canada’s advanced chemical manufacturing capabilities and diversified end-use industries. In the U.S., the demand is propelled by the thriving pharmaceutical, personal care, and agrochemical sectors. The country’s strong focus on innovation and compliance with stringent environmental regulations encourages the adoption of high-purity chloroacetic acid in formulation processes. Companies such as CABB Group, with production facilities in the U.S., play a significant role in supplying high quality chloroacetic acid to domestic and international markets.

In Canada, the chloroacetic acid market benefits from a stable chemical manufacturing environment, supported by government initiatives aimed at sustainable industrial practices. The rising focus on bio-based products and specialty chemicals has led to increased application of chloroacetic acid in research and niche formulations. Canadian chemical firms and research institutions continue t collaborate on improving production efficiency, thereby enhancing the region’s competitiveness in the global market.

Key Chloroacetic Acid Market Players:

- Arkema S.A

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CABB GmbH

- Daicel Corporation

- Niacet Corporation

- Akzo Nobel N.V

- Dow Chemical

- Eramet

- Ferroglobe

- Denak Co. Ltd.

- MCAA

Key players in the chloroacetic acid market use advanced production technologies such as high-efficiency chlorination systems, closed-loop processing for reduced emissions, and continuous flow reactors. These innovations enhance product purity, operational efficiency, and environmental compliance, allowing companies to meet stringent quality standards and maintain a competitive edge in global chloroacetic acid markets.

Recent Developments

- In December 2021, it is anticipated that the value stream of the chlorine industry will have significantly increased, attributed to the establishment of the new ultra-pure MCAA manufacturing facility by PCC MCAA Sp. in 2016. MCAA, a novel compound utilized in the production of betaine within our Surfactants division, facilitates backward vertical integration. While ultra-pure MCAA finds applications in the food, pharmaceutical, and agricultural sectors, its primary role remains as an intermediary in the production of personal care products.

- In October 2021, Akzo Nobel received a patent for an innovative process for the production of monochloroacetic acids. This innovative process involves the use of acetic acid and chlorine in conjunction with an acid catalyst. Compared to traditional reactors, this method and the associated reactive distillation apparatus are simpler in design. Additionally, they yield monochloroacetic acids with a reduced amount of chlorinated byproducts.

- Report ID: 7624

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chloroacetic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.