Transparent Conductive Coating Market Outlook:

Transparent Conductive Coating Market size was over USD 10.01 billion in 2025 and is projected to reach USD 35.83 billion by 2035, growing at around 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transparent conductive coating is evaluated at USD 11.24 billion.

The growth of the market can be attributed to the growing electronic sector. Further, the rising demand for consumer appliances across the globe is also expected to add to the market growth. In applications for electrical heating, electromagnetic shielding, and cutting-edge displays, transparent conductive coatings are frequently employed. In addition, these can be produced as flexible films, which would increase their functionality and convenience for the creation of newer, more flexible electronics. As of 2027, the consumer electronics industry is anticipated to rise by more than 80%.

In addition to these, factors that are believed to fuel the market growth of transparent conductive coating include the increasing demand for solar products. For instance, the growing environmental worries over carbon emissions and greenhouse gases are predicted to present the potential for market expansion over the projected period. Electrically conductive substances with a comparatively low level of light absorption are known as transparent conducting oxides (TCOs), which are used in transparent contacts for solar cells. Furthermore, transparent conducting oxides (TCO) layers serve as the optically transparent electrode that lets photons enter the solar cells. For instance, Cadmium oxide, the first TCO ever utilized, was employed in solar cells in the early 1900s.

Key Transparent Conductive Coating Market Insights Summary:

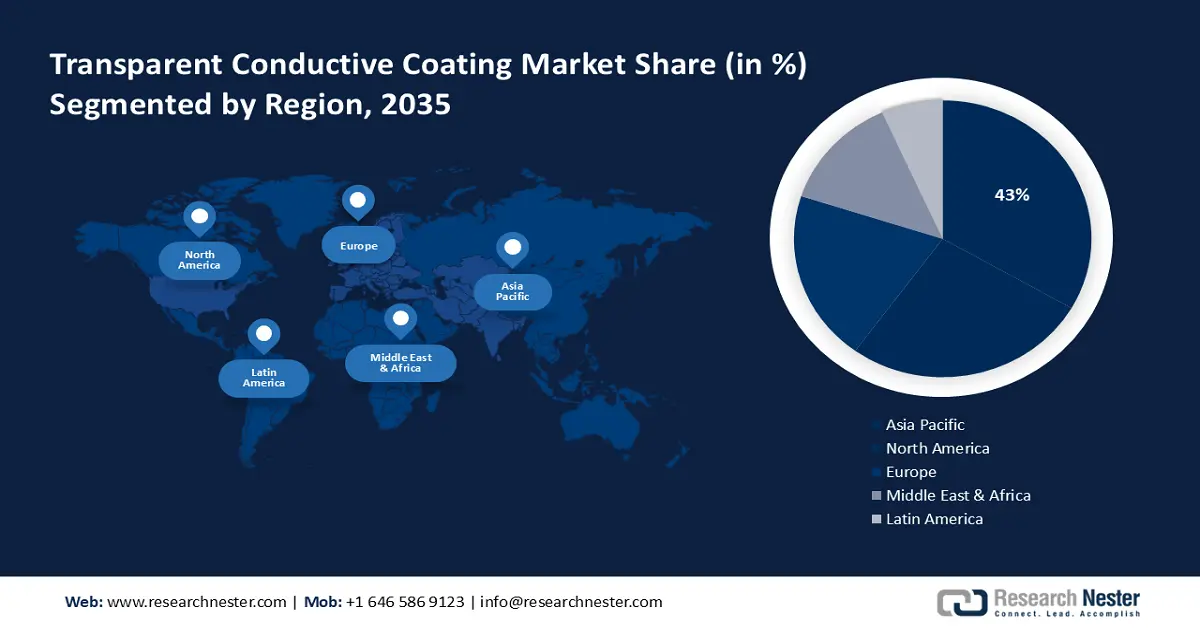

Regional Highlights:

- By 2035, the Asia Pacific region is poised to command a 43% share of the transparent conductive coating market, propelled by escalating demand for smart devices and the rapid expansion of solar power infrastructure.

- The North American market is anticipated to progress at a notable CAGR through 2035, supported by expanding optical applications and rising consumption of smartphones and advanced lenses.

Segment Insights:

- The smart displays segment is projected to hold the dominant share in the transparent conductive coating market by 2035, fueled by rising global smartphone penetration and the essential role of conductive coatings in touchscreen functionality.

- The organic material segment is expected to capture considerable share by 2035, encouraged by the shift toward flexible, eco-friendly materials and increasing need for alternatives to conventional ITO coatings.

Key Growth Trends:

- Rising Usage of Smartphones

- Growing Aviation Industry

Major Challenges:

- Higher Risk of Wear and Tear in Transparent Conductive Coating

- Government Limitations on the Usage of Conductive Polymers

Key Players: PPG Industries, Inc., Koninklijke DSM N.V., Hoya Corporation, Rodenstock GmbH, Penn Optical Coatings, EssilorLuxottica SA, Janos Technology, Honeywell International Inc, Panasonic Corporation, Quantum Coating.

Global Transparent Conductive Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.01 billion

- 2026 Market Size: USD 11.24 billion

- Projected Market Size: USD 35.83 billion by 2035

- Growth Forecasts: 13.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries:India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 19 November, 2025

Transparent Conductive Coating Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Usage of Smartphones – On account of the increasing disposable income, the market is expected to expand more in the upcoming years. According to studies, by the end of 2023, there would be over 6 billion smartphone users globally.

-

Growing Aviation Industry – An increase in the need for jets and helicopters to transport medical supplies across the globe is estimated to drive market growth. Further, transparent conductive coatings are used for aircraft canopies, windscreens, and windows. As per statistics, in the US, the aviation sector generated over USD 120 billion in 2020 globally.

-

Increasing Demand for Optical Coating – According to the most recent expenditure data, globally over 2 billion individuals use eyeglasses of some kind.

-

Surging Demand for LCDs – Conductive coatings are useful for liquid crystal displays (LCDs) owing to qualities such as transparency. Over the next five years, the global demand for liquid crystal display (LCD) Televisions is anticipated to expand at an average annual rate of more than 20%.

Challenges

- Higher Risk of Wear and Tear in Transparent Conductive Coating - The increasing concern amongst individuals for the risk associated with the deterioration of transparent conductive coating is one of the major factors predicted to slow down the market growth. For instance, ITO has been shown to deteriorate over time as a result of mechanical stress. Many people are switching to more practical alternatives owing to easy breakage.

- Government Limitations on the Usage of Conductive Polymers

- Exorbitant Price of Indium Tin Oxide (ITO)

Transparent Conductive Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 10.01 billion |

|

Forecast Year Market Size (2035) |

USD 35.83 billion |

|

Regional Scope |

|

Transparent Conductive Coating Market Segmentation:

Application Segment Analysis

The global transparent conductive coating market is segmented and analyzed for demand and supply by application into solar cells, solar panels, smart displays, induction, OLEDs, LCDs, and photovoltaic devices. Out of the five applications, the smart displays segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for smartphones across the globe. The phone's touch screen depends on clear and electrically conductive coatings. For instance, transparent conductive coatings are commonly used in touchscreens as they are transparent and electrically conductive, which not only eliminates any static charge that has built up on a screen or a glass panel but also keeps dust from adhering to the screen's surface. According to research, more than 60% of adults in the United States own a smartphone.

Material Segment Analysis

The global transparent conductive coating market is also segmented and analyzed for demand and supply by material into inorganic and organic materials. Amongst these two segments, the organic material segment is expected to garner a significant share. When compared to inorganic transparent conductive coatings such as indium tin oxide (ITO), organic transparent conductive coatings are more effective and flexible, owing to which there is a growing trend among industries around the world for greener solutions that emit less or no harmful gases. Moreover, industries all around the world are searching for more environmentally friendly choices that release fewer or no hazardous emissions. Furthermore, a replacement for the ITO is necessary to create flexible optoelectronic devices with better performance. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Structure |

|

|

By Material |

|

|

By Layers |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transparent Conductive Coating Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 43% by 2035. The growth of the market can be attributed majorly to the growing demand for electronic devices. For instance, owing to the onset of digitization, several nations in the Asia Pacific region are experiencing an increase in demand for smart gadgets. A variety of appliances and optoelectronic devices frequently utilize transparent conductive coatings (TCC). They provide high thermal stability and are ideal choices for applications including touchscreen displays, security and camera lenses, and water level sensors. All these factors will lead to an increase in demand for transparent conductive coating in the area. In addition, the region's expanding solar power sector is also anticipated to boost market growth during the forecast period. According to estimates, Indian domestic electronics output has increased by over USD 60 billion in 2021.

North American Market Insights

The North American transparent conductive coating market, amongst the market in all the other regions, is projected to grow with a satisfactory CAGR during the forecast period. The growth of the market can be attributed majorly to the rising demand for opticals in the region. For instance, to prevent cataracts, macular degeneration, and pterygium from being caused by prolonged sun exposure, the majority of people in the area use sunglasses. The widespread usage of transparent conductive coatings in optical applications will increase their demand in the region. The transparent conductive coatings on the wearer's glasses improve sight by reducing undesired reflections from a variety of objects, allowing for a clear view of their eyes. Further, the rising demand for smartphones and lenses is also anticipated to contribute to market growth in the region.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the growing consumer electronics industry. For instance, owing to increasing living standards of customers, and rising technical improvements in smart appliances including air conditioners, washing machines, and microwave ovens are also anticipated to contribute to the market growth in the region. Moreover, transparent conductive coatings can be utilized in consumer electronics such as tablet PCs, cellphones, televisions, monitors, all-in-one computers, OLEDs, touchscreens, and photovoltaics, this has increased demand for transparent conductive coatings in European regions.

Transparent Conductive Coating Market Players:

- PPG Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke DSM N.V.

- Hoya Corporation

- Rodenstock GmbH

- Penn Optical Coatings

- EssilorLuxottica SA

- Janos Technology

- Honeywell International Inc

- Panasonic Corporation

- Quantum Coating

Recent Developments

-

PPG Industries, Inc. introduced PPG STEELGUARD 951 coating, which is created to provide high durability and edge retention qualities. Further, in the event of a fire, the coating transforms from a thin, lightweight film into a thick, foam-kind layer that protects the steel and preserves its structural integrity.

-

Panasonic Corporation developed a double-sided, full-wiring transparent conductive sheet that combined high transmissivity with low resistance. The conductive sheet provides high coordinate precision with more flexibility, and also satisfies consumer demands for a touch display with improved image quality, increased size, and little environmental effect.

- Report ID: 2753

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.