Carbon Nanotubes Market Outlook:

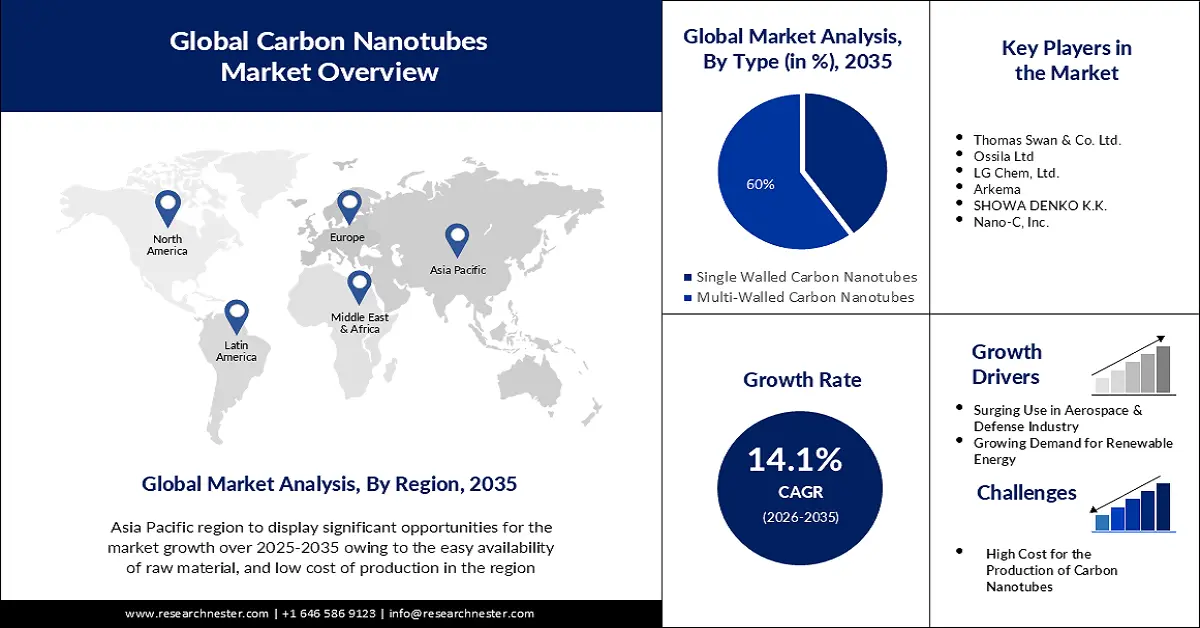

Carbon Nanotubes Market size was over USD 5.68 billion in 2025 and is poised to exceed USD 21.24 billion by 2035, growing at over 14.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon nanotubes is estimated at USD 6.4 billion.

The market is experiencing robust growth driven by the need for lightweight, high-strength materials, superior electrical and thermal conductivity, and miniaturization in electronics. Growth in electric vehicles, renewable energy, and aerospace sectors, along with sustainability goals and advanced material innovations, further accelerates CNT market expansion globally. CNTs are highly valued for their superior electrical conductivity, exceptional strength-to-weight ratio, and nanoscale versatility, making them ideal for applications that demand both high performance and miniaturization. In the electronics and semiconductor industries, CNTs are enabling next-generation devices with improved speed and energy efficiency. Meanwhile, the rise of nanomedicine has opened new avenues in biomedical applications, including targeted drug delivery systems and biosensors.

A significant factor influencing the carbon nanotubes market is the increasing demand for materials that are both lightweight and durable. Industries like aerospace and automotive are incorporating CNTs into composite materials to reduce weight while maintaining or enhancing structural integrity. For instance, in April 2024, engineers at MIT developed a revolutionary “nano stitching” method using vertically aligned CNTs to reinforce carbon fiber laminates. This innovation increased crack resistance by 60%, offering significant benefits in spacecraft and aircraft construction by improving safety and fuel efficiency.

Another key trend shaping the carbon nanotubes market is the focus on sustainable production. In September 2023, Huntsman initiated the construction of a 30-ton pilot facility in Texas aimed at producing MIRALON carbon nanotube materials. This facility employs methane gas to produce both carbon nanotubes and clean hydrogen, demonstrating the industry's shift towards sustainable manufacturing practices. Such technological breakthroughs and green initiatives are reinforcing the strategic value of CNTs across industries, positioning them as critical components in the development of advanced, sustainable, and high-performance materials.

Key Carbon Nanotubes Market Insights Summary:

Regional Highlights:

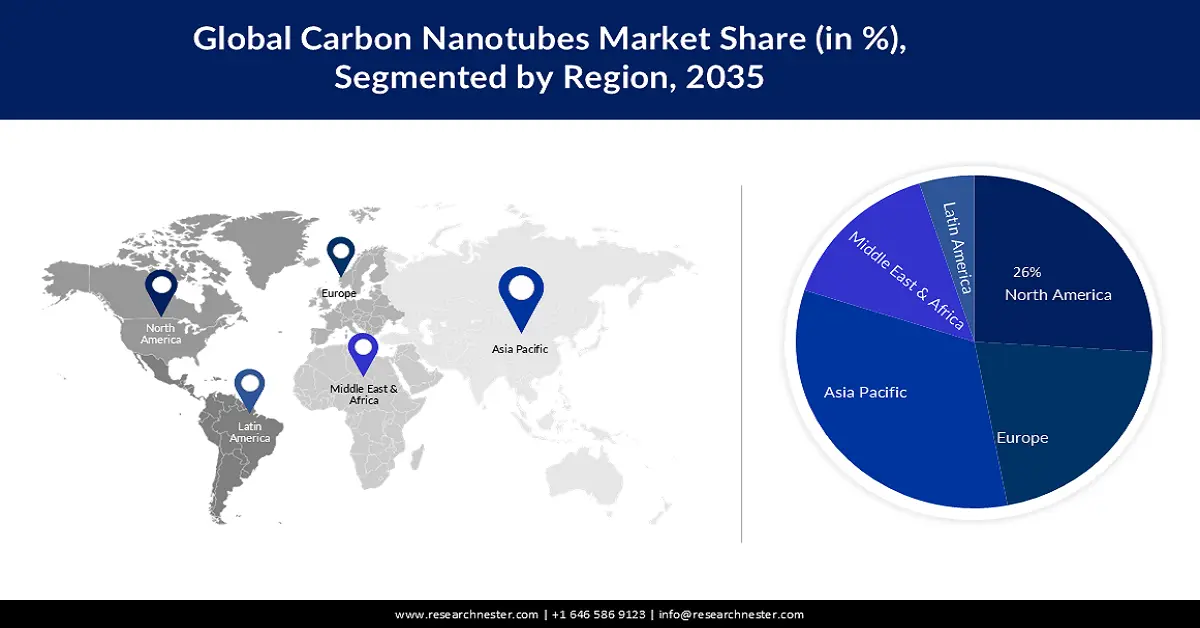

- Asia Pacific carbon nanotubes market will secure around 36.40% share by 2035, driven by rapid industrialization and R&D investments in key countries.

- North America market will achieve the fastest growth during the forecast timeline, driven by advanced CNT use in 5G, EVs, and composites with strong R&D.

Segment Insights:

- The multi-walled carbon nanotubes segment in the carbon nanotubes market is projected to hold a 95.80% share by 2035, attributed to MWCNTs’ exceptional mechanical strength, superior electrical conductivity, and excellent thermal stability.

Key Growth Trends:

- Expanding need for high-strength & lightweight materials

- Expanding semiconductor & electronics industry

Major Challenges:

- High production costs

- Limited large-scale manufacturing capabilities

Key Players: Hanwha Solutions Chemical Division Corporation, Arry International Group Limited, Carbon Solutions, Inc., Jiangsu Cnano Technology Co., Ltd, Arkema, CHASM, Cabot Corporation, Nanocyl SA, Continental Carbon Nanotechnologies, Inc..

Global Carbon Nanotubes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.68 billion

- 2026 Market Size: USD 6.4 billion

- Projected Market Size: USD 21.24 billion by 2035

- Growth Forecasts: 14.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, South Korea, Thailand, Brazil

Last updated on : 11 September, 2025

Carbon Nanotubes Market Growth Drivers and Challenges:

Growth Drivers

- Expanding need for high-strength & lightweight materials: The carbon nanotubes market is experiencing consistent growth, primarily fueled by the increasing need for lightweight and high-strength materials essential across multiple industries, where the demand for durable yet lightweight solutions is critical for maximizing performance and efficiency. Their high tensile strength, low density, and resilience to fatigue and stress make CNTs ideal for advanced composite materials, contributing to weight reduction without compromising structural integrity.

Lighter vehicles and aircraft not only improve fuel efficiency and lower emissions but also enhance overall system performance and payload capacity. In aerospace and automotive engineering, CNT-reinforced composites are used to manufacture body panels, structural reinforcements, and interior components. These composite materials enhance the impact resistance, thermal conductivity, and overall durability of the end products. Moreover, in military applications, carbon nanotubes provide improved protection and communication systems.

A notable instance is NanoRide Materials, a U.S.-based company specializing in CNT-enhanced composites. The firm has collaborated with defense contractors and aerospace organizations to develop lightweight ballistic materials and high-performance structural components, showcasing the transformative potential of CNTs in critical sectors. As global industries strive for more efficient and sustainable solutions, CNTs are positioned at the forefront of next-generation material innovation.

- Expanding semiconductor & electronics industry: Carbon nanotubes possess outstanding electrical conductivity, thermal stability, and nanoscale dimensions, making them suitable for advanced electronics components, transistors, sensors, and flexible displays. Their unique one-dimensional structure allows electrons to move with minimal resistance, enabling faster signal transmission and reducing energy consumption in circuits. These properties position CNTs as promising alternatives to traditional materials in applications such as transistors, interconnects, sensors, and flexible electronics displays.

As the demand for smaller, faster, and more efficient devices continues to grow, particularly in consumer electronics, wearables, and IoT technologies, CNTs are becoming an essential component in next-generation semiconductor innovation. Their flexibility and strength also support the development of bendable and stretchable electronics, opening new opportunities in smart textiles and foldable devices.

A leading instance is IBM, which has been actively researching CNTs for transistor fabrication. IBM’s work demonstrated that CNT transistors could outperform silicon-based alternatives at smaller nodes, offering a viable path beyond traditional scaling limits in semiconductor technology. This highlights CNT’s potential to revolutionize future electronic devices.

Challenges

- High production costs: Producing high-purity, defect-free CNTs involve complex and energy-intensive synthesis techniques such as chemical vapor deposition (CVD), arc discharge, and laser ablation. These processes require specialized equipment, precise control of reaction conditions, and extensive post-processing, all of which contribute to high operational expenses. As a result, the cost of CNT production significantly limits large-scale commercialization and market competitiveness, particularly in price-sensitive industries. Addressing these cost barriers through process optimization and the development of low-cost feedstocks is essential for the broader adoption and industrial scalability of CNT technologies.

- Limited large-scale manufacturing capabilities: Most CNT production is still limited to pilot or small-scale facilities. Scaling up while maintaining consistency, quality, and performance remains a technical hurdle for manufacturers. Variability in purity, diameter, and chirality during scale-up can impact performance in end-use applications. These technical hurdles, combined with high capital investment requirements, restrict the ability of manufacturers to meet growing demand across sectors. Advancements in scalable production methods are essential for unlocking the full commercial potential of CNTs.

Carbon Nanotubes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 5.68 billion |

|

Forecast Year Market Size (2035) |

USD 21.24 billion |

|

Regional Scope |

|

Carbon Nanotubes Market Segmentation:

Product Segment Analysis

The Multi-Walled Carbon Nanotubes (MWCNTs) segment is predicted to gain the largest market share of 95.8% during the projected period. This strong market presence is attributed to MWCNTs’ exceptional mechanical strength, superior electrical conductivity, and excellent thermal stability, which make them suitable for a wide range of applications. Industries such as electronics, energy storage, and advanced composites have increasingly adopted MWCNTs to enhance product performance and durability. Their ability to reinforce polymers, metals, and ceramics has proven valuable in creating lightweight and high-strength materials for automotive, aerospace, and construction applications.

Additionally, the scalability of MWCNT production and its relatively lower cost compared to single-walled carbon nanotubes (SWCNTs) have further boosted their commercial viability. A leading instance is LG Chem, which has actively invested in the development and mass production of high-quality MWCNTs. The company has expanded its manufacturing capacity to support applications in lithium-ion batteries and conductive materials, reinforcing its position in the growing global MWCNT market.

Application Segment Analysis

The polymer segment is expected to hold a substantial segment in the carbon nanotubes market during the forecast period. This dominance is highly driven by the rising demand for high-performance materials across various key sectors. CNTs significantly enhance the mechanical strength, thermal conductivity, and electrical performance of polymers, making them ideal for advanced composite applications. Their ability to reinforce lightweight materials without compromising strength or durability is particularly beneficial in weight-sensitive industries, where energy efficiency and structural performance are paramount. As industries increasingly seek materials that offer durability, conductivity, and environmental sustainability, CNT-reinforced polymers have emerged as a preferred solution.

A prominent instance is Arkema, a global specialty chemicals company that offers CNT-based polymer solutions under its Graphitestrength product line. Arkema’s CNT-enhanced thermoplastics and thermosets are widely used in automotive and electronics applications, providing improved conductivity and mechanical strength while supporting innovations in lightweight, efficient component design. This strategic focus positions Arkema at the forefront of CNT-polymer integration.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Nanotubes Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific carbon nanotubes sector is poised to hold a 36.4% share in the carbon nanotubes market, driven by rapid industrialization, strong manufacturing ecosystems, and substantial research & development investments in countries such as China, Japan, South Korea, and India. The region serves as a hub for key industries such as electronics, automotive, aerospace, and energy that extensively use CNTs to improve conductivity, durability, and lightweight properties in advanced materials and components. China leads the regional market due to its large-scale manufacturing capabilities, technological advancements, and strategic government support for nanotechnology innovation.

Meanwhile, India is emerging as the fastest-growing carbon nanotubes market, propelled by industrial development and rising demand for high-performance materials in renewable energy, electronics, and automotive sectors. Government-backed initiatives like “Make in India” and increased research & development funding further support CNT adoption. For instance, Ad-Nano Technologies, a leading manufacturer and supplier of high-purity multi-walled carbon nanotubes, single-walled carbon nanotubes, and CNT-based dispersions. The company serves diverse industries, including electronics, energy storage, polymers, and coatings, by offering customized nanomaterials for advanced applications. Their innovative approach supports the increasing domestic demand for high-performance and lightweight materials in various renewable energy sectors.

North America Market Insights

North America is poised to be the fastest-growing region in the carbon nanotubes market by holding a substantial share in the market during the forecast period. This growth is underpinned by rapid technological advancements, substantial investments in research & development, and a robust demand across various key sectors. The U.S. has established itself as a global leader in CNT innovation, driven by its strong research ecosystem and advanced manufacturing capabilities. The rising use of CNTs in electric vehicles, 5G infrastructure, and lightweight composite materials reflects a market shifting toward high-performance, sustainable solutions.

Canada is also emerging as a key contributor to the carbon nanotubes market growth, leveraging its focus on clean technologies and innovation. Investments in nanotechnology are fostering the development of CNT applications in energy storage, where lightweight reduction and efficiency are critical. Nano-C Inc., a U.S.-based nanomaterials company, is a prominent player in the CNT market. The company specializes in producing fullerenes, single-walled CNTs, and related derivatives, supporting applications in semiconductors, batteries, and solar cells. Nano-C's dedication to innovation enhances North America's position as a leader in advanced carbon nanotube solutions.

Carbon Nanotubes Market Players:

- Resonac Holdings Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hanwha Solutions Chemical Division Corporation

- Arry International Group Limited

- Carbon Solutions, Inc.

- Jiangsu Cnano Technology Co., Ltd

- Arkema

- CHASM

- Cabot Corporation

- Nanocyl SA

- Continental Carbon Nanotechnologies, Inc.

- Cargill, Incorporated

- Procter & Gamble

Key players in the carbon nanotubes leverage advanced synthesis technologies like chemical vapor deposition, plasma-enhanced CVD, and catalytic processes to produce high-purity CNTs at scale. These companies invest heavily in functionalization techniques to tailor CNT properties for specific applications, enhancing compatibility with polymers, metals, and other matrices. Automation, precision quality control, and integration into high-demand sectors further position these players at the forefront. Strategic collaboration and research & development innovations help them maintain competitiveness in a growing and technologically demanding market.

Recent Developments

- In March 2024, CHASM Advanced Materials, Inc. established a collaboration with Ingevity to improve the availability of carbon nanotubes (CNT) for the electric vehicle battery sectors in North America and Europe. This alliance is intended to address the increasing demand and facilitate the growth of the electric vehicle sector in these areas.

- In May 2023, LG Chem revealed plans for a new manufacturing facility at its Daesan site in South Korea, which is expected to be completed by 2025. This expansion will increase the company's annual carbon nanotube (CNT) production capacity to 6,100 tons, thereby improving its product range.

- Report ID: 4956

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Nanotubes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.