Level Sensor Market Outlook:

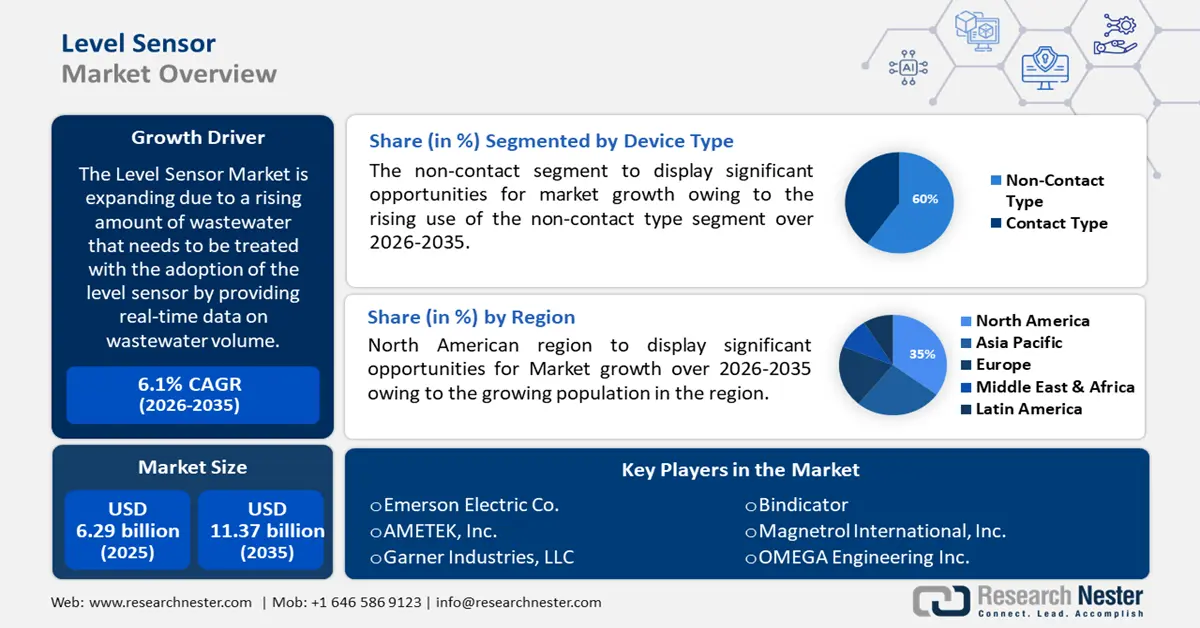

Level Sensor Market size was over USD 6.29 billion in 2025 and is anticipated to cross USD 11.37 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of level sensor is assessed at USD 6.64 billion.

The level sensor technology is constantly exhibiting developments, particularly the integration of radar, ultrasonic, and laser systems for non-contact level measurements. Companies are investing in technologies to provide exact level measurement through touchless monitoring systems while cutting down contamination risks, equipment wear, and extending operational capability into rough conditions. For instance, in April 2024, KISTERS released the HyQuant radar sensor series, which targets hydrological services, agriculture, and water transport applications. Such technological advancements are offering tools for simple and quick installation, along with automatic updates that combine water level and velocity measurement capabilities. This further represents the advanced functionality of modern level sensors.

Manufacturers are also integrating advanced sensor technologies with digital platforms to automate data collection & analysis procedures and attract a wider customer base. Operational efficiency is enhanced as level sensors leverage IO-Link technology to deliver remote parameter settings and monitoring, which makes maintenance more convenient. The connection of advanced sensing systems with digital networks is expanding the operational range of level sensors into sectors such as water treatment, food processing, and chemical manufacturing. The innovations link sensors directly to control systems through seamless communication, establishing efficient operation management and more precise operations, along with shorter downtime periods. The integration is essential for industrial operations as they transition toward automation and data management approaches to reduce human participation.

Key Level Sensor Market Insights Summary:

Regional Highlights:

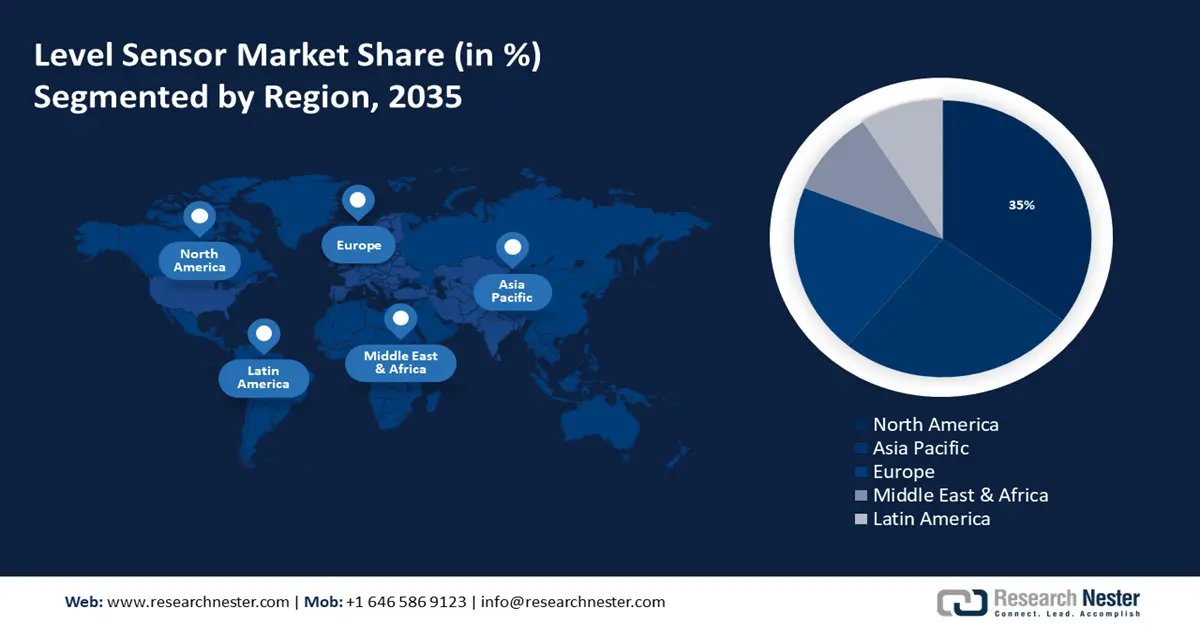

- North America level sensor market will hold more than 35% share, driven by the government’s focus on water preservation and management, forecast period 2026–2035.

- Asia Pacific market will register significant CAGR till 2035, fueled by rapid industrial growth and urbanization in the region.

Segment Insights:

- The non-contact segment in the level sensor market is anticipated to see significant growth through 2035, driven by real-time monitoring, IoT integration, and predictive maintenance.

- The oil & gas segment in the level sensor market is projected to capture a 30% share by 2035, driven by the increased need for precise sensors in hazardous exploration environments.

Key Growth Trends:

- Advancements in wireless communication

- Rising demand for water and wastewater management

Major Challenges:

- Integration complexity

Key Players: Emerson Electric Co., AMETEK, Inc., Garner Industries, LLC, Bindicator, Magnetrol International, Inc., OMEGA Engineering Inc., MTS System, Pepperl+Fuchs Pvt. Ltd., Endress+Hauser Group Services AG, Gems Sensors, Inc.

Global Level Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.29 billion

- 2026 Market Size: USD 6.64 billion

- Projected Market Size: USD 11.37 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Level Sensor Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in wireless communication: The implementation of wireless communication systems, including Bluetooth, Wi-Fi, and LoRaWAN, is fueling the level sensor capabilities by connecting them to remote distributed systems. Level sensor manufacturers are focusing on constant innovations to develop better-performing products to meet the increasing versatility needs in the level sensor market. For instance, in August 2023, Holykell introduced the H2603 wireless water level sensor, a product that integrates LoRa and WiFi communication protocols. The sensor works effectively for industrial environments, including tank monitoring, wastewater treatment, and oil and gas fields, through its data transmission and IoT platform compatibility for remote monitoring and efficient data collection.

The smart sensors market is experiencing healthy growth during the forecast period, owing to the ongoing developments that are focused on enhancing communication capabilities and accessibility. Wireless communication systems built into level sensors benefit multiple industrial operations that conduct monitoring tasks in hard-to-reach areas. The implementation of wireless connectivity is providing organizations an access to simplify wiring infrastructure and achieve easier installation and maintenance. The modern evolution of wireless communication technology is creating lucrative deployment opportunities for level sensors throughout different industrial sectors by delivering efficient and cost-effective level monitoring solutions. - Rising demand for water and wastewater management: The level sensor sales are driven by the increasing requirements to handle clean water along with waste management services. Rapid urbanization and the growing global population are primarily fueling a high demand for efficient water treatment systems and infrastructure.

Level sensors are widely used in various industries, including agricultural, chemical & petrochemical, pharma, and energy. These sensors prevent tank overflows, measure fluid amounts, and enable safe water treatment plant operations at optimal efficiency. The integration of advanced technologies, such as IoT and wireless communication, is enabling remote monitoring and improved data analysis, which is further propelling the demand for sophisticated level sensors.

Challenges

- Integration complexity: Advanced-level sensors present implementation issues when integrated with traditional system equipment. The modernization of outdated infrastructure with sensor technologies is becoming expensive as it entails full-scale system replacements. The installation and testing phases are becoming longer due to incompatibilities between contemporary control systems and recently installed sensors. The cost of operations is increasing due to the complexity that forces industries to spend on integration processes, along with potential training needs for their personnel. Some companies are hesitant to purchase advanced sensors due to the lengthy installation period, which results in delays in benefiting from new capabilities in equipment. Overall, the complexity issues are acting as a major challenge for level sensor manufacturers.

Level Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 6.29 billion |

|

Forecast Year Market Size (2035) |

USD 11.37 billion |

|

Regional Scope |

|

Level Sensor Market Segmentation:

Device Type

The non-contact segment in level sensor market is poised to capture over 60% share of the global market by the end of 2035. Smart sensors operate with enhanced capabilities through predictive maintenance, energy optimization features, and precise measurement systems. Real-time data analysis abilities are enhancing sensor capabilities and aiding industries to make better decisions and boost operational performance. The non-contact liquid level sensors are experiencing continuous expansion due to the current trends of Industry 4.0 and IoT applications. The integration of smart systems enables real-time monitoring as well as data analytics and remote management of liquid levels. This enables connectivity, streamlines operations, and decreases operational downtime with advancing predictive maintenance approaches in manufacturing, water treatment, and logistics fields.

Industry

The oil & gas segment in level sensor market is estimated to hold over 30% revenue share throughout the assessed period. Recent industry expansion of oil and gas exploration activities generates essential needs for reliable level sensors within hazardous environments. For instance, the International Energy Agency (IEA) study highlights that in 2025, the worldwide oil demand is anticipated to reach 1.1 mb/d. China is foreseen to dominate the demand, followed by other Asian countries such as India, South Korea, and Japan.

The growing need for strong and precise level measurement solutions is increasing as drilling operations are targeting deeper and more difficult terrains. These sensors are equipped with strong components that integrate advanced modern technology to monitor extreme pressure and temperature conditions, thus supporting companies with regulatory requirements in high-risk environments. The industrial automation trend is also expected to augment the demand for advanced-level sensors in the oil and gas industry.

Our in-depth analysis of the level sensor market includes the following segments:

|

Device Type |

|

|

Industry

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Level Sensor Market Regional Analysis:

North America Market Insights

The North America level sensor market is expected to account for 35% of the global revenue share through 2035. This growth is attributed to the government’s focus on taking effective measures for water preservation and management. The situation regarding water scarcity in drought-prone areas is resulting in an increased emphasis on efficient water use and treatment systems. The level sensors are essential instruments as they help water treatment infrastructure and irrigation operations measure water levels to enhance operational efficiency and cut down on resource usage.

The level sensor sales are also exhibiting rapid growth, owing to the increasing adoption of automation across the manufacturing, pharmaceutical, and chemicals industries. Level sensors are playing a fundamental role in maintaining process reliability and consistent product quality, as companies need them for their operational efficiency objectives and reduced human interaction. Advanced sensors are gaining popularity due to automation trends as they deliver precise real-time information, further fostering the level sensor market growth.

The demand for level sensors in the U.S. is primarily driven by their increasing applications in the renewable energy sector. The use of efficient monitoring systems in solar, wind bioenergy plants is increasing due to sustainability and clean energy initiatives. The U.S. Energy Information Administration (EIA) states that around 4,178 billion kilowatthours (kWh) of energy were produced at utility-scale in 2023, wherein renewable energy sources accounted for 21.0% of the share and nuclear energy 19.0%.

The rising regulatory standards regarding safety and environmental compliance are boosting the applications of lever sensors across multiple industrial sectors. The accurate measurement of levels operates as an essential requirement in the oil and gas industry, the food and beverage sector, and chemicals to prevent hazardous material handling, leaks, and spills. The local companies are using sophisticated level sensors to fulfill tighter environmental regulations and safety guidelines.

Asia Pacific Market Insights

The Asia Pacific level sensor market is also projected to exhibit significant growth in revenue over the forecast period, led by rapid industrial growth and urbanization. The swiftly expanding oil and gas, manufacturing, and chemicals sectors, with increasing need for accurate and reliable level measurement solutions, are creating a lucrative space for level sensor producers. The demand for efficient monitoring systems is continually increasing in China, India, and Japan as these countries require effective systems in their manufacturing plants, water treatment facilities, and energy generation operations. Environmental sustainability and the increasing popularity of smart water management systems are other factors fueling the demand for level sensors. The region is witnessing stricter regulations over water utilization and waste disposal by governments and industries, which is anticipated to fuel the sales of sophisticated level sensing devices.

The rapid advancements in automation and smart manufacturing systems are set to uplift the position of China in the global landscape. The end users are adopting manufacturing standards of Industry 4.0, and creating an expanded requirement for real-time monitoring systems, including level sensors. These sensors are essential components that enhance automated system precision while improving operational efficiency throughout the automotive sectors, electronics production, and food manufacturing facilities.

The country is also actively focusing on renewable energy infrastructure development, which is likely to increase the demand for level sensors during the foreseeable period. Modern solar and wind power plants, as well as hydroelectric power plants, need reliable monitoring systems as they must maximize resource management and prevent critical system breakdowns. The analysis by the IEA highlights that the 14th Five-Year Plan of the country is expected to boost the renewable energy capacity in the years ahead. In 2023, around 350 GW were added to renewable electricity capacity.

Level Sensor Market Players:

- Emerson Electric Co.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AMETEK, Inc.

- Garner Industries, LLC

- Bindicator

- Magnetrol International, Inc.

- OMEGA Engineering Inc.

- MTS System

- Pepperl+Fuchs Pvt. Ltd.

- Endress+Hauser Group Services AG

- Gems Sensors, Inc.

The level sensor market is highly competitive, with key players focusing on innovation, product diversification, and strategic partnerships to enhance market share. The leading companies, such as Murata Manufacturing Co., Ltd., TDK Corporation, Samsung Electro-Mechanics, and Yageo Corporation, offer a wide range of level sensor technologies and cater to the diverse demands of industries such as automotive, telecommunications, consumer electronics, and industrial systems. The industry giants are also investing heavily in advanced manufacturing techniques, miniaturization, and high-capacitance solutions to meet the growing demand for compact, high-performance components. Additionally, strategic collaborations and acquisitions are set to expand production capacities and market reach.

Some of the key players include:

Recent Developments

- In December 2023, Baumer introduced the PL240 capacitive point level switch, designed to detect fill levels even in challenging conditions, such as when films or residues adhere to tank walls. This launch of non-contact sensor technology is boosting the position of the company in the competitive landscape.

- In September 2023, AutomationDirect added the Endress+Hauser Micropilot FMR10 series pulsed radar liquid level sensor to its product lineup. This non-contact sensor is configurable via Bluetooth using the SmartBlue mobile app.

- Report ID: 5738

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Level Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.