Thrombophilia Treatment Market Outlook:

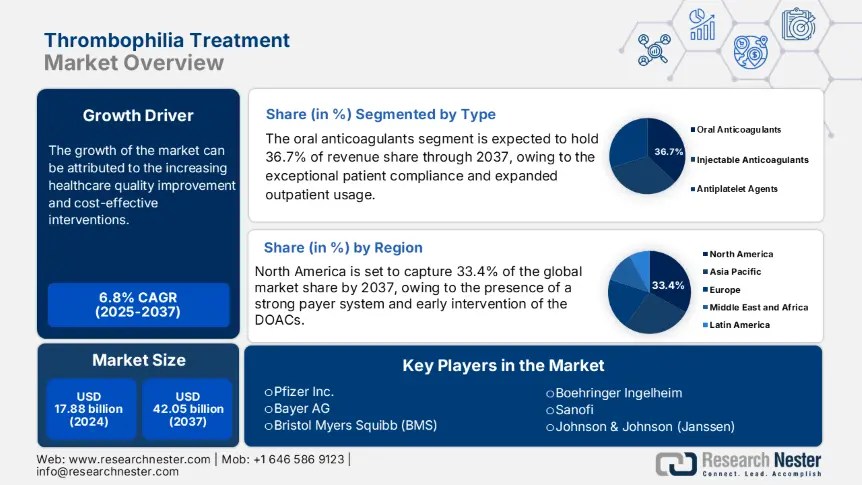

Thrombophilia Treatment Market size was valued at USD 17.88 billion in 2024 and is projected to reach USD 42.05 billion by the end of 2037, rising at a CAGR of 6.8% during the forecast period, i.e., 2025-2037. In 2025, the industry size of thrombophilia treatment is assessed at USD 18.91 billion.

The Centers for Disease Control and Prevention stated that 1/3rd of the venous thromboembolism cases occur post-hospitalization, and it ranked among the preventable in-hospital deaths in the U.S. Also, hereditary thrombophilia subtypes are known to be found in 3.4-8% of individuals of European descent. Other acquired thrombotic disorders affect 1 in 2100 people and cause almost 1.2% events of thrombotic disorders. The market encompasses therapeutics, diagnostics, and various patient management strategies aiming to manage abnormal blood clotting disorders.

The supply chain for the thrombophilia treatment is affected by complexities in the drug manufacturing, various regulatory requirements, and intricate distribution logistics. The producer price index for anticoagulant and associated preparations is covered under a wide category by the Bureau of Labor Statistics, having an annual inflation averaging 2-5% over the last 5 years. Additionally, the research and development investments in the targeted therapies are increasing due to federal funding towards anticoagulation optimization and screening of the genetic risks.

Thrombophilia Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Healthcare quality improvement and cost-effective interventions: According to a study conducted by the Agency for Healthcare Research and Quality in 2022, early intervention can lower hospitalization rates by 22.2%, saving USD 1.31 billion in the U.S. healthcare costs. Hospitals are adopting structured VTE risk models, further driving the demand for early anticoagulation intervention and thrombophilia screening. Also, the early intervention of anticoagulants can eliminate clots and reduce complications. This further lowers the ICR admission cases and mortality rates. Governments are conducting exhaustive thrombophilia screening to identify patients at risk of recurrent VTE.

- Government spending and reimbursement policies: The Medicare spending in the U.S. in 2023 reached USD 2.89 billion on anticoagulants. There has been increased emphasis on the screening and early anticoagulation strategies to prevent exorbitant VTE complications. For instance, the Affordable Care Act in the U.S. incentivizes preventive screening by indirectly boosting the testing procedures. Other than this, India and Brazil are introducing exemplary VTE prevention strategies, further bolstering the demand for thrombophilia tests. The enhanced reimbursement support has raised the test volumes, and various pharmaceutical and diagnostic companies are investing in the research and development of thrombophilia testing.

- The advent of telemedicine and home testing: According to the Agency for Healthcare Research and Quality, 65.4% of the thrombophilia patients utilize INR monitoring, lowering clinic visits by 31%. These innovations are enhancing the patient's access to care and early diagnosis. Telemedicine is allowing patients to consult hematologists without any delay, and virtual follow-ups lower the hospital visits, making long-term more convenient. Also, telemedicine has been widely adopted as it lowers healthcare costs by reducing unnecessary hospitalization and lab testing. Telemedicine-based care is growing exponentially as the cases of deep vein thrombosis are rising.

Challenges

-

Pricing caps and regulatory approval delays: Numerous health systems impose stringent price controls on the anticoagulants to put constraints on the budget. In Germany, the Arzneimittelpreisverordnung incorporates reference pricing limits for direct oral anticoagulants. These factors force the manufacturers to negotiate steep discounts to handle access.

-

Exorbitant costs for the patient: The expenses demotivate patient adherence, lowering the screening rates and restricting the treatment accessibility. Genetic and lab tests can cost up to USD 210- USD 1510 without insurance. Numerous insurers don’t cover thrombophilia screening until the presence of recurrent DVT is present, leaving asymptomatic patients at risk.

Thrombophilia Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.8% |

|

Base Year Market Size (2024) |

USD 17.88 billion |

|

Forecast Year Market Size (2037) |

USD 42.05 billion |

|

Regional Scope |

|

Thrombophilia Treatment Market Segmentation:

Type Segment Analysis

The oral anticoagulants are projected to garner 36.7% of the thrombophilia treatment market share by 2037, owing to their superior patient compliance and expanded outpatient usage. According to the Centers for Disease Control and Prevention, anticoagulants are the most frequently prescribed drug class, especially in the U.S. The usage of direct oral anticoagulants such as apixaban has garnered dominance as they are eradicating the requirement for frequent blood monitoring. Additionally, oral anticoagulants are getting approval, and patients are witnessing widespread availability of the medicine in oral form.

Drug Class Segment Analysis

The direct oral anticoagulants segment is anticipated to garner 32% of the thrombophilia treatment market share by 2037. The growth of the market can be attributed to its unmatched convenience and superior safety profiles. The traditional options, such as warfarin or injectable heparins, render fixed-dose regimens, eliminating the need for routine blood tests. Also, there has been an expansion in approval from the FDA or EMA for the treatment of thrombophilia conditions. As the healthcare systems are prioritizing outpatient care and opting for DOACs for value-based treatment.

Our in-depth analysis of the global thrombophilia treatment market includes the following segments:

| Segment | Subsegment |

|

Type |

|

|

Drug Class |

|

|

Route of Administration |

|

|

End user |

|

|

Distribution Channel |

|

|

Application |

|

|

Trade Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thrombophilia Treatment Market - Regional Analysis

North America Market Insights

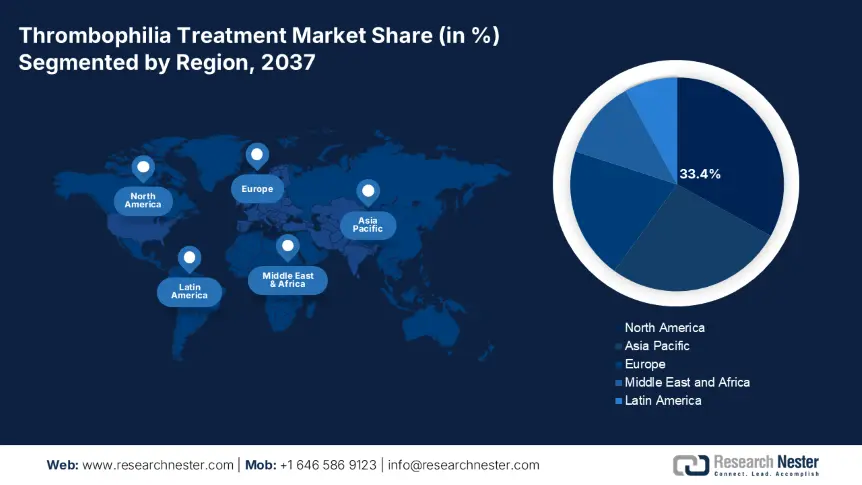

The North America market is anticipated to maintain its dominance, registering 33.4% revenue share by the year 2037. The growth of the thrombophilia treatment market in the region can be attributed to the presence of a strong payer system and early intervention of the DOACs. The region is witnessing wide Medicaid coverage and Medicare reimbursements and a surge in the adoption of molecular diagnostics. In 2023, the U.S. allocated 9.1% of the federal health budget, that is USD 5.2 billion, for the treatment of thrombophilia. Also, in 2024, the Medicaid support reached USD 1.21 billion to allow the treatment coverage.

Moreover, Canada allocated 8.1% of the federal health budget for the treatment of thrombophilia. The Canadian Institute for Health Information has given preference to thrombophilia care under the VTE prevention guidelines. Ontario has also raised the funding by almost 17% over the last 5 years. Under the national pharmacare strategy, there will be an improvement in the DOAC affordability and access in the country. Latest programs such as Ontario’s eConsult have enhanced specialist access, lowering the time-to-treatment for the patients of thrombophilia.

Asia-Pacific Market Insights

The Asia Pacific thrombophilia treatment market is the maximum growth acquiring region with 7.3% of the CAGR during 2025-2037. The growth in the region is driven by rising disease awareness and expanding public health coverage. Also, there is a growing healthcare investment and rising efforts for policy-driven initiatives. For instance, in China, there is a 15.4% increase in the thrombophilia-related spending during 2020-2025, and the National VTE Prevention Guidelines impose the screening in 51+ prominent hospitals. Also, the telemedicine platforms are enhancing rural access to improve patient care.

Additionally, in India, the Ayushman Bharat program covers screening of 500,000 beneficiaries for thrombophilia. The National Health Mission has infused USD 24.4 million for the prevention programs for VTE in 2024. According to the National Accreditation Board for Testing and Calibration Laboratories in India, almost 1510 labs are now offering thrombophilia tests. Moreover, the eSanjeevani platform allows remote anticoagulation monitoring for 100,000 patients. Also, AI-enabled VTE risk prediction pilots are in operated in Tata hospitals and AIIMS.

Country-wise Thrombophilia Treatment Market Analysis & Government Spending

|

Country |

Govt. Spending (Latest Year) |

Patient Coverage |

Spending Growth (Last 10 Years) |

Major Initiatives |

|

Japan |

USD 3.2 billion (2024) |

~1.3 million patients |

↑12% since 2022 |

National Screening Initiative |

|

Malaysia |

USD 300 million (2023) |

>650,000 patients (public sector) |

↑20% since 2013 |

Public formulary expansion, subsidized diagnostics in MoH-run hospitals |

|

South Korea |

USD 360 million (2023) |

~900,000 patients (NHI-covered) |

↑16% since 2014 |

Inclusion in National Health Insurance (NHI), Cancer-associated thrombosis program |

|

Australia |

USD 410 million (2023) |

~720,000 patients (across public/private) |

↑15% since 2015 |

PBS (Pharmaceutical Benefits Scheme) reimbursement of DOACs, VTE care guidelines |

Europe Market Insights

The thrombophilia treatment market in Europe is projected to witness remarkable growth driven by a rising aging population and increased awareness of genetic clotting disorders. There has been regulatory harmonization by the European Medicines Agency (EMA), which has enhanced access to direct oral anticoagulants (DOACs). Also, USD 2.6 billion was allocated under the Horizon Europe program to upgrade the research and development in coagulation disorders. Various initiatives are enhancing the real-time monitoring and upgrading the early diagnosis. These factors are propelling the thrombophilia treatment market growth during the forecasted period.

In 2023, government in UK has allocated 8.1% of the national healthcare budget for upgrading the treatment of thrombophilia. The increase in budget reflects a constant surge of patient volume and rising usage of long-term anticoagulants. Additionally, there are almost 450,100 patients are receiving adequate treatment annually. The adoption of e-health records and the huge inclusion of precision medicine are projected to propel the demand for the treatment. Additionally, in Germany, there has been a surge in public investment in the latest biologics to lower the exorbitant costs of the medicines for the thrombophilia treatment.

Key Thrombophilia Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- Bristol Myers Squibb (BMS)

- Boehringer Ingelheim

- Sanofi

- Johnson & Johnson (Janssen)

- Daiichi Sankyo

- AbbVie Inc.

- Roche Diagnostics

- Takeda Pharmaceutical

- Novartis AG

- Dr. Reddy's Laboratories

- CSL Limited

- LG Chem

- Cadila Healthcare (Zydus)

- Aurobindo Pharma

- Biocon Biologics

- Daewoong Pharmaceutical

- Hovid Berhad

- Aspen Pharmacare

The competitive landscape of the thrombophilia treatment market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Top 20 Global Manufacturers in the Thrombophilia Treatment Market:

Recent Developments

- In April 2024, Bayer AG launched Xarelto Pediatric Formulation oral suspension for the prevention of venous thromboembolism (VTE). Bayer's quarterly report stated that the launch contributed to a 6.4% increase in global Xarelto sales in Q2 2024, especially in strengthening Bayer's position in the EU pediatric anticoagulant segment.

- In January 2024, Sanofi launched its FDA-approved biosimilar version of Lovenox (enoxaparin sodium) under a new brand name, Inhixa, in the U.S. The company achieved a 12% market share in hospital-based anticoagulant prescriptions after the launch.

- Report ID: 3706

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thrombophilia Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert