Testosterone Injectable Market Outlook:

Testosterone Injectable Market size was valued at USD 2.3 billion in 2025 and is expected to reach USD 3.37 billion by 2035, registering around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of testosterone injectable is assessed at USD 2.38 billion.

The testosterone injectable is one of the most commonly found and popular types of hormone injection therapy all across the world. Owing to increased awareness about the advantages and efficiency of testosterone replacement therapy, the market is anticipated to gain more approval and recognition among patients and consumers.

The high healthcare expenditure with improved healthcare infrastructure is one of the major factors estimated to drive testosterone injectable market expansion during the forecast period. As per the Centers for Medicare & Medicaid Services (CMS), healthcare spending in the United States grew by 9.7% in 2020, reaching a value of USD 4.1 trillion. As a share of the nation’s Gross Domestic Product (GDP), health spending accounted for about 19.7%.

Key Testosterone Injectable Market Insights Summary:

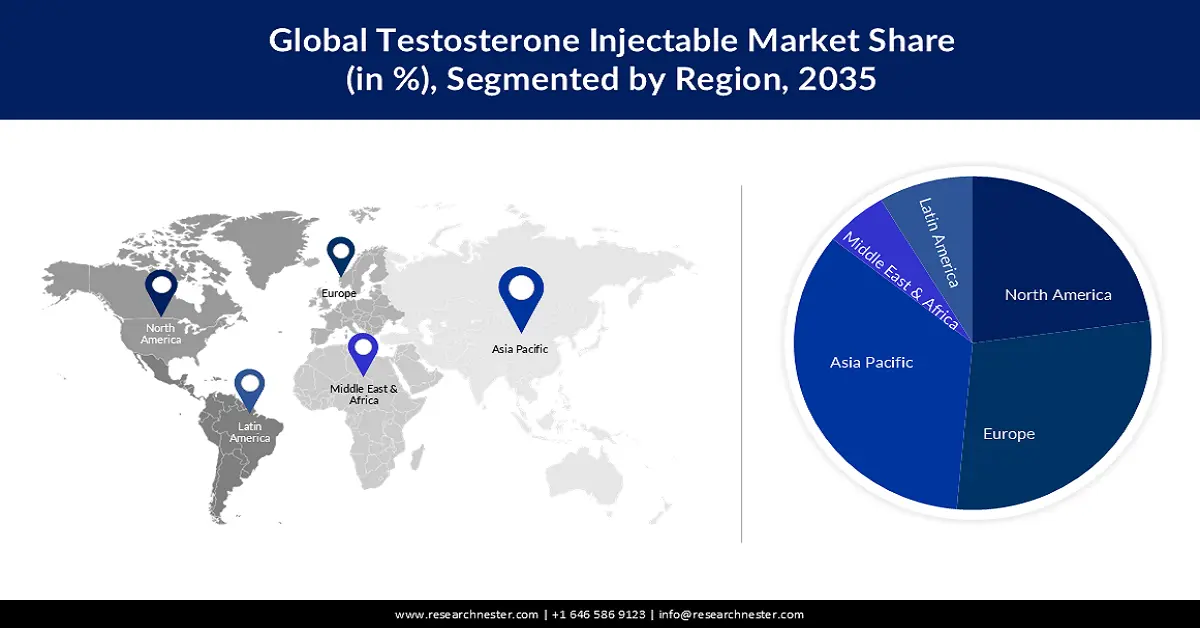

Regional Insights:

- North America is projected to secure the largest revenue share by 2035 in the testosterone injectable market, invigorated by the widespread availability of advanced medical centers and expanding government-led healthcare initiatives.

- Europe is anticipated to capture a notable share by 2035, reinforced by accessible treatment infrastructure and supportive governmental efforts across developed nations such as the United Kingdom.

Segment Insights:

- The hospital segment in the testosterone injectable market is expected to command a 45% share by 2035, bolstered by increasing healthcare spending, broader insurance coverage, and the prominent role of hospitals in administering testosterone therapies.

- The hypogonadism segment is projected to witness substantial gains by 2035, fueled by the rising prevalence of testosterone deficiency and the growing reliance on injectable therapies to restore hormonal balance.

Key Growth Trends:

- Rapidly Growing Geriatric Population Across the World

- High Incidence of Testosterone Deficiency Among People Globally

Major Challenges:

- Side Effects Associated with Testosterone Injectables

- Availability of Substitute Treatment Options

Key Players: Bayer AG, Endo Pharmaceuticals Inc., Eli Lilly & Company, Kyowa Kirin International plc, Mylan N.V., Novartis AG.

Global Testosterone Injectable Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.38 billion

- Projected Market Size: USD 3.37 billion by 2035

- Growth Forecasts: 3.9%

Key Regional Dynamics:

- Largest Region: North America (Largest Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: India, China, Brazil, South Korea, Mexico

Last updated on : 20 November, 2025

Testosterone Injectable Market - Growth Drivers and Challenges

Growth Drivers

-

Rapidly Growing Geriatric Population Across the World – The growth in the aging population is giving rise to the testosterone injectable market expansion of testosterone injectables since testosterone organically reduces with the growing age and a lot of old people experience the symptoms of low testosterone. As per the statistics, the incidence of lower testosterone in men above the age of 60 years was 21.67%.

-

High Incidence of Testosterone Deficiency Among People Globally – Besides the aging population low testosterone can also appear in the younger generation too. Owing to various factors such as obesity, chronic illness, excessive lifestyle change, and environmental factors. The growing existence of testosterone deficiency among different age groups has propelled the demand for testosterone injectables. As per statistics, the prevalence of testosterone in young men, middlemen, and old men was 22.6%, 35.85%, and 35% respectively.

- Availability to Various Treatment Centers – The accessibility to multiple diagnostics imaging centers, and treatment services in the past few years especially in emerging countries.

Challenges

-

Side Effects Associated with Testosterone Injectables – With advantages testosterone injectables do have a few side effects on the human body such as reduced sperm production, acne, skin reactions, sleep problem, hair loss, mood swings, and others. These side effects may limit the market value in the upcoming times.

-

Availability of Substitute Treatment Options

- Regulatory Challenges

Testosterone Injectable Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.37 billion |

|

Regional Scope |

|

Testosterone Injectable Market Segmentation:

End Users Segment Analysis

The hospital segment in the testosterone injectable market is assumed to witness the largest revenue share of 45 % by the end of 2035. Hospitals play a vital role in the distribution and administration of testosterone injectables among people. Most endocrinologists, urologists, and general practitioners from hospitals prescribe testosterone injections to patients. Besides, hospitals also do have a proper environment for the administration of testosterone injectables. In addition, the hospital bed and supporting equipment have been increasingly used for the treatment of patients. Moreover, factors such as increasing spending on healthcare, insurance coverage, and prescribing practices are growth-driving factors for this segment. Spending on Medicaid increased by 9.2% to $734.0 billion in 2021. Spending on private health insurance increased by 5.8% to $1,211.4 billion in 2021.

Dosage Form Segment Analysis

Testosterone injectable market from the hypogonadism segment is set to witness the highest gain in the near future. Hypogonadism is one type of testosterone deficiency and it can be treated with the help of testosterone injectables which after entering the body increases the level of testosterone in a male body and brings it to normal range. Also, untreated hypogonadism can lead to health conditions such as heart disease or fatality. Therefore, the increasing prevalence of hypogonadism is estimated to propel the segment expansion in the projected period.

Our in-depth analysis of the global testosterone injectable market includes the following segments:

|

Dosage Form |

|

|

Age Group |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Testosterone Injectable Market - Regional Analysis

North American Market Insights

North America industry is estimated to account for largest revenue share by 2035, propelled by presence of various medical centers, and rising government initiatives in the region.The factors such as growing disposable income, evolving lifestyle, and large access to developed healthcare services are estimated to boost the growth of the market in the region. Moreover, there has been a presence of advanced testosterone treatment in the countries such as the United States. According to a study, the frequency of testosterone treatment in the US has increased by 1.8 to 4-fold over the past 20 years.

European Market Insights

Moreover, the testosterone injectable market in Europe is also projected to acquire a notable share during the estimated period. This can be propelled by the presence of various medical centers, and rising government initiatives. Moreover, there is easy access to various treatment facilities in developed countries such as the UK, which is further forecasted to surge the market’s growth in the region.

Testosterone Injectable Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Endo Pharmaceuticals Inc.

- Eli Lilly & Company

- Kyowa Kirin International plc

- Mylan N.V.

- Novartis AG

Recent Developments

- January 2022- Endo Pharmaceuticals Inc. declared the release of data from a population pharmacokinetic (PK) modeling and simulation study, assessing the potential dosing flexibility of AVEED, a testosterone undecanoate, in hypogonadal men.

- June 2021- Novartis AG announced that 177Lu-PSMA-617 upgraded entire survival and radiographic progression-free survival for men suffering from metastatic castration-resistant prostate cancer.

- Report ID: 3973

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Testosterone Injectable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.