Sterile Injectable Drugs Market Outlook:

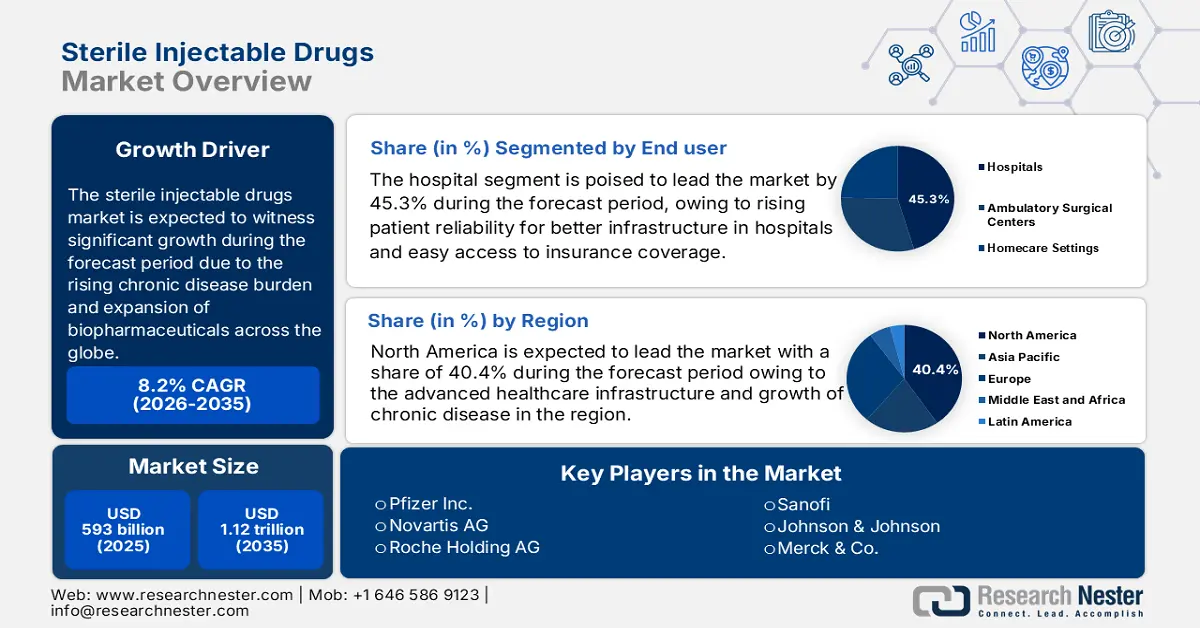

Sterile Injectable Drugs Market size was over USD 593 billion in 2025 and is estimated to reach USD 1.12 trillion by the end of 2035, exhibiting a CAGR of 8.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sterile injectable drugs is assessed at USD 640.7 billion due to the growing demand for biologics and oncology therapies.

Sterile injectable drugs are considered to be important drugs for oncology and other chronic diseases. According to the National Institutes of Health, the United States saw 2,001,140 new cases of cancer and 611,720 cancer-related deaths in 2024. This has raised the demand for sterile injectable drugs. Chemotherapy and immunotherapy have a high adoption rate for sterile injectable drugs. Many chemotherapy and immunotherapy agents are biologics or cytotoxic agents that are unstable, poorly absorbed, or less effective orally. Moreover, many chemotherapy drugs are very potent; they must be dosed precisely and require stable formulations to reduce risk. All of which relies on a sterile injectable unit dosage. This is critical for the treatment of aggressive cancers or certain essential immune responses.

In addition, the growth of the sterile injectable drugs market is being propelled by the increasing use of biologics and biosimilars, the preference for ready-to-use (RTU) injectable alternatives, and the introduction of new manufacturing technologies. Moreover, the market for generic sterile injectables is exploding in the Asia Pacific due to patent expirations and demand for affordable therapies. Pharmaceutical companies increasingly utilize contract manufacturing organizations (CMOs) to produce sterile injectables. These trends reflect a dynamic patient-centered market with highly innovative options for ensuring safety.

Key Sterile Injectable Drugs Market Insights Summary:

Regional Insights:

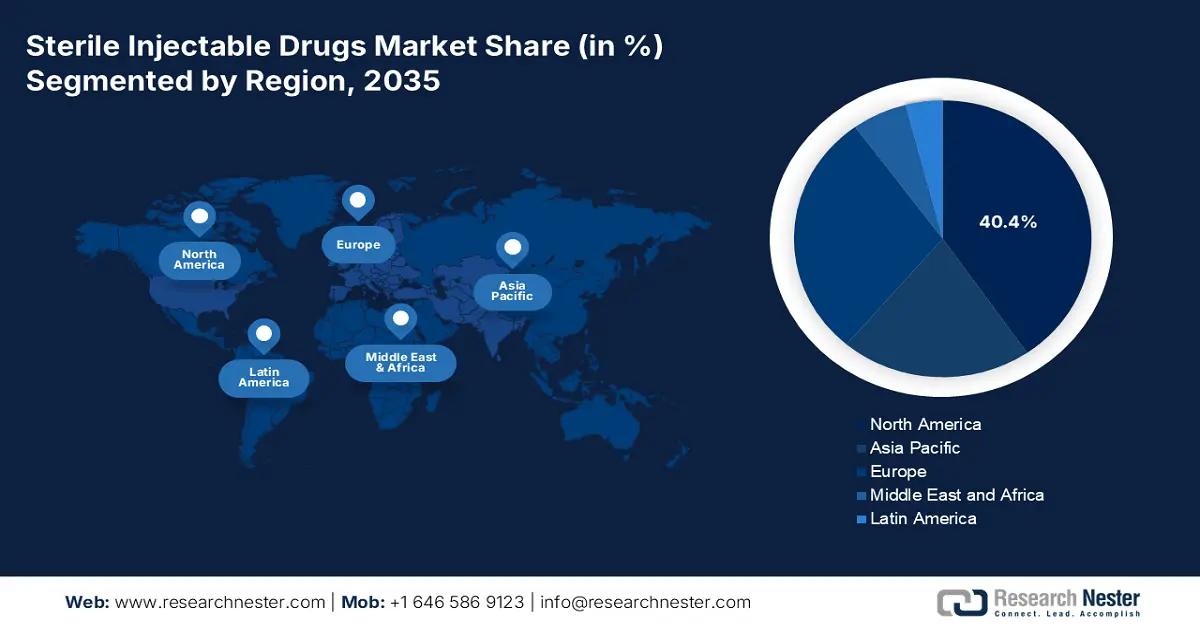

- North America is set to capture a 40.4% share of the sterile injectable drugs market by 2035, supported by heightened government healthcare spending and expanded medical coverage.

- Asia Pacific is projected to secure a 20.8% share by 2035, stimulated by the region’s rapidly rising cancer incidence and strengthened healthcare infrastructure.

Segment Insights:

- The monoclonal antibodies segment in the sterile injectable drugs market is forecast to hold a 25.5% share by 2035, propelled by rising global cancer cases.

- The oncology segment is projected to account for a 30.7% share by 2035, fueled by strong biopharmaceutical dependence for improved survival outcomes.

Key Growth Trends:

- Chronic disease burden

- Expansion in government spending

Major Challenges:

- Price control barrier and limited coverage

- High manufacturing costs and complex production processes

Key Players: Pfizer Inc., Novartis AG, Roche Holding AG, Sanofi, Johnson & Johnson, Merck & Co., GlaxoSmithKline, Eli Lilly and Company, Takeda Pharmaceutical, Bristol-Myers Squibb, Gilead Sciences, Fresenius Kabi, Baxter International, Hikma Pharmaceuticals, Sun Pharmaceutical, Biocon, Samsung Biologics, Pharmaniaga

Global Sterile Injectable Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 593 billion

- 2026 Market Size: USD 640.7 billion

- Projected Market Size: USD 1.12 trillion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 22 August, 2025

Sterile Injectable Drugs Market - Growth Drivers and Challenges

Growth Drivers

-

Chronic disease burden: The World Health Organization (WHO) report highlights that, in 2021, noncommunicable diseases (NCDs) accounted for at least 43 million deaths worldwide, or 75% of mortality not attributable to pandemics. Advancement of diagnosis infrastructure and raised awareness in the global market have raised the number of new cases of chronic diseases. The practice of early diagnosis and seeking appropriate intervention is being developed throughout the world. Demand for sterile injectable drugs has increased with the increase in new cancer patients each year who demand intervention through chemotherapy. Demand for sterile injectable drugs is poised to expand with the constant growth of chronic disease pressure.

-

Expansion in government spending: Availability of adequate financial support is one of the key drivers that leads the market to flourish. Availability of higher coverage through Medicare, the lower to medium income group of people is offered the opportunity to avail the treatment through sterile injectable drugs. Additionally, more government expenditure could support national immunization programs and chronic care management. New government spending could also hasten regulatory approvals and provide incentives to local manufacturing capabilities, decreasing cost and improving supply chain flexibility. Increased government spending will also simultaneously encourage innovation within the sterile injectable drugs segment.

-

Technological advancements in drug delivery and manufacturing: Improvements in production methodologies now make it possible to enhance the safety, quality, and efficiency of sterile injectables through the use of automation, robotics, and continuous production methods. Increasing product types that are being represented in the market, such as prefilled syringes, auto-injectors, and ready-to-use sterile injectables, have gained acceptance as they facilitate administration routes for injectable medications. Not only do these contemporary devices create efficient, higher production levels with less risk of contamination, but they also can create overall greater market author's acceptance to grow more sterile injectables in the hospital and home-care settings.

Challenges

-

Price control barrier and limited coverage: The balance between the cost of production and the price of the market is the most conflicting factor that brings a barrier to market growth. The cost of production rises due to the inflationary impact on the supply chain management. Lowering the price becomes a barrier to the accumulation of capital and conducting further research and development to elevate the efficiency level of sterile injectable drugs. Low Medicaid coverage fails to raise the accessibility of the market and increase the market demand.

-

High manufacturing costs and complex production processes: The production of sterile injectable drugs involves specialized facilities, cleanroom surroundings to minimize contamination risks. All of these factors lead to increased manufacturing costs when compared to manufacturing non-injectable drug forms. Additionally, sterile injectables often have complex processing, which requires skilled personnel and greater time frames for production.

Sterile Injectable Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 593 billion |

|

Forecast Year Market Size (2035) |

USD 1.12 trillion |

|

Regional Scope |

|

Sterile Injectable Drugs Market Segmentation:

Product Type Segment Analysis

The monoclonal antibodies are expected to achieve a market share of 25.5%. The increasing number of new cases of cancer throughout the world has created a significant demand for cancer therapies and autoimmune treatments. As per the study of the National Cancer Institute, pembrolizumab is one of the innovative monoclonal antibodies that is designed to deliver higher outcomes in immunotherapy. Caregiver preference for the monoclonal antibodies is based on better patient outcomes and the broader scope of fast recovery. These addressed factors led to higher demand in the concerned market.

Application Segment Analysis

Oncology is the leading segment and is expected to hold a market share of 30.7% by 2035. Biopharmaceutical dependency, based on its high outcome and expanded period of patient survival, created a significant demand for sterile injectable drugs. According to the report of the World Health Organization, intervention for cancer patients is efficiently conducted through chemotherapy and the application of immunotherapy drugs. This led to expansion in market demand for sterile injectable drugs, specifically within the oncology department, and resulted in the largest application segment worldwide.

End User Segment Analysis

The hospitals are the dominating segment and are poised to hold a market share of 45.3% by 2037. Treatment of oncology and other chronic diseases requires advanced infrastructure that possesses efficient caregivers as well as other storage capacity and risk management capabilities. The majority of patients rely on the hospital pharmacies to access the sterile injectable drugs during the intervention process of chemotherapy. Availability of medical coverage is high and easily achieved through the hospital pharmacies that draw a large number of patients into the addressed distribution channel.

Our in-depth analysis of the global sterile injectable drugs market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sterile Injectable Drugs Market - Regional Analysis

North America Market Insights

North America is the dominating region in the sterile injectable drugs market and is anticipated to accumulate a market share of 40.4% by 2035. High government spending and an expanded rate of medical coverage are one of the main growth-driving factors that accelerated the demand in the concerned market. the U.S. Centers for Medicare & Medicaid Services forecasts predict that in 2023, U.S. health care spending increased by 7.5% to USD 4.9 trillion, or USD 14,570 per person. Medicare coverage is expanded to ensure better coverage for the premium biologics like Keytruda, Humira, and many more, which has led to more accessibility for patients. The presence of advanced health care infrastructure and an oncology pipeline streamlined the diagnosis process and fast intervention, which raised the market demand for sterile injectable drugs in North America.

The U.S. sterile injectable drugs market is the largest in North America. The rise of chronic disease and the expansion of federal funding are the two leading factors that have raised the market performance of sterile injectable drugs. This resulted in high accessibility of the market, and a boost in the demand graph of sterile injectable drugs is experienced in the U.S. market. As per the report of the National Health Commission, monoclonal antibodies are relied on to intervene in oncology patients through chemotherapy or immunotherapy. In addition, innovations in drug-delivery systems like prefilled syringes and auto-injectors are improving patient adherence and safety. The regulatory environment is generally rigorous, although it also supports innovation by facilitating expedited approvals for critical therapies.

The sterile injectable drug market in Canada is flourishing, largely due to increased government spending on healthcare and the growing accessibility of biologic therapies for lifelong and rare diseases. The healthcare system in Canada is focused on enhancing patient outcomes and working to broaden its use of ready-to-use injectable formulations and innovative devices. The level of interest and investment in cancer care and immunotherapy is another significant aspect of growth in the market. Canada has a regulatory climate that supports the development of biosimilars that will make advanced treatments accessible and more affordable.

Asia Pacific Market Insights

The Asia Pacific market is emerging and is anticipated to hold a market share of 20.8% by 2035. Cancer incidence is expanding at a rate of twice comparison of the Western market, creating a high demand for sterile injectable drugs in the oncology department. Government spending accelerated to elevate the healthcare infrastructure in Asia Pacific, which resulted in an increased number of diagnoses and raised awareness within the market. Government-led initiatives for screening increased the number of chronic diseases, and the expansion of insurance coverage created a scope to leverage patient accessibility. Manufacturing of the drug is conducted through the implementation of local sourcing, that made Asia Pacific eligible to offer an affordable price range for the sterile injectable drugs, which has accelerated the demand for the market.

China is the largest regional market shareholder in the sterile injectable drugs market in Asia Pacific, driven by an increasingly older population, a greater prevalence of chronic diseases and infectious diseases, and by a focus on innovative biologics and immunotherapies. The ability of patients to access injectable drugs has improved as a result of the government's efforts to strengthen the healthcare infrastructure and expand insurance coverage. In addition, the regulatory environment is being strengthened in an effort to conform to international standards, stimulating domestic production and exports. The demand for ready-to-use injectables and advanced delivery devices/packaging for use in hospital and home care environments will also contribute to the growth of the market.

India market is growing rapidly as a result of a growing population, increasing prevalence of chronic diseases, and a growing need for advanced therapies such as biologics and vaccines. The Indian pharmaceutical sector is witnessing significant investment in healthcare facilities. The growing middle class and growing awareness towards developing new healthcare means access to sterile injectable treatments is growing. The growth of CMOs and an increasing market for generic injectables, and growing production capability and ability to sell treatments at lower price points. Regulatory changes made in government and agencies have encouraged faster drug approvals, which further enable reduced time to market for new sterile injectable products.

Europe Market Insights

The sterile injectable drugs market in Europe is currently demonstrating consistent demand growth, due in part to an aging population, increasing prevalence of chronic diseases, and increasing use of complex biologics and biosimilars. Furthermore, governments and insurance systems around Europe are investing in strategies to improve patient access to innovative injectable medicines. The door is also being opened for mixing sterile ingredients to create a sterile injectable in the outpatient or home setting. Various trade organizations are supporting this new change and cultural shift. Innovations in manufacturing technologies and adherence to consistent and definitive regulatory processes provide consistent quality in sterile injectable production. Finally, the trend towards sustainability and digital health solutions will help continue the growth of the market in Europe and around the globe.

The sterile injectable drugs market in France is consistently growing, supported by a robust healthcare system and high demand for advanced therapies. Part of this growth is due to government priorities to improve patient access to innovative treatment options and more government spending on healthcare. France also sees higher utilization of ready-to-use injectable products that increase safety and ease of use. Because of the government's significant investment in healthcare infrastructure, advanced medical treatments are now widely available in hospitals and clinics across the country. This accessibility fuels the need for injectable drugs used in a range of therapeutic areas.

With a strong pharmaceutical and healthcare system, Germany remains among the most significant markets for sterile injectable drugs in Europe. The demand for manufactured injectable biologics and biosimilars has increased as the comorbidities, due to the increased prevalence of chronic disease, and the aging population, increase. In addition, the regulatory environment in Germany provides for ease of innovation with a relatively uncomplicated process of providing early access to much-needed critical therapies. The growth of outpatient care and self-administration of medication via the increased reliance on auto-injectors and pre-filled syringes is also contributing to enhanced patient adherence.

Key Sterile Injectable Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Roche Holding AG

- Sanofi

- Johnson & Johnson

- Merck & Co.

- GlaxoSmithKline

- Eli Lilly and Company

- Takeda Pharmaceutical

- Bristol-Myers Squibb

- Gilead Sciences

- Fresenius Kabi

- Baxter International

- Hikma Pharmaceuticals

- Sun Pharmaceutical

- Biocon

- Samsung Biologics

- Pharmaniaga

The highly competitive market of sterile injectable drug market is led by the top five key players that hold approximately 52% of the market share. The leading strategies that delivered a competitive edge include biosimilar expansion, oncology focus, expansion in the emerging market, collaboration, and many more. For instance, Pfizer and Novartis focus on product innovation and have expanded into biosimilar expansion. Roche and Merck focused on the oncology market niche and introduced products like Keytruda and Herceptin. Sun Pharma controlled the cost of production and expanded its business in the emerging market of India. A collaboration strategy is implemented by AstraZeneca with Samsung Biologics to promote collaborative manufacturing to achieve a competitive edge.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, The Noramco Group announced an investment in Halo Pharma to create sterile injectable manufacturing capabilities for ready-to-use syringe, cartridge, and vial filling. The upgrades will help alleviate severe capacity shortages in the U.S. injectable supply chain, and pharmaceutical companies need a reliable domestic sterile manufacturing partner to meet the needs of their customer base. The improvements will include the addition of a high-speed Groninger UFVN FlexFill syringe, cartridge, and vial filling line.

- In April 2025, PCI Pharma Services – a global contract development and manufacturing organisation (CDMO) announced the acquisition of Ajinomoto Althea, a US-based sterile fill-finish CDMO and 100% subsidiary of Japan-based Ajinomoto. The acquisition provides PCI with its first North America manufacturing site for prefilled syringes and cartridges.

- Report ID: 3050

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sterile Injectable Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.