Diagnostic Imaging Market Outlook:

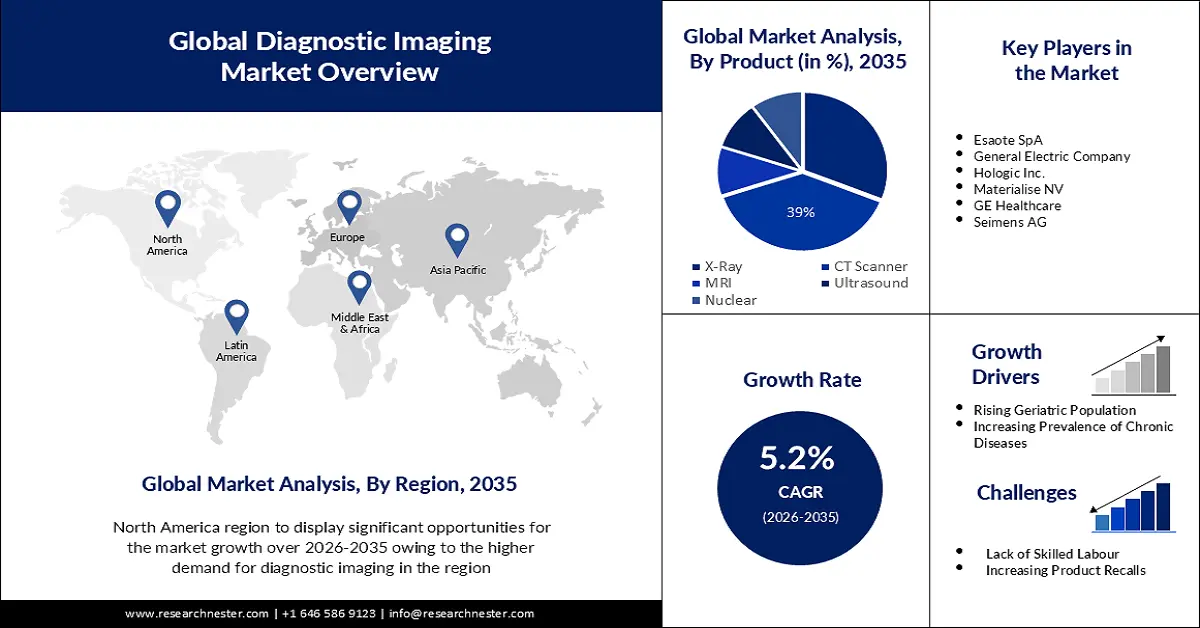

Diagnostic Imaging Market size was valued at USD 39.58 billion in 2025 and is expected to reach USD 65.71 billion by 2035, registering around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diagnostic imaging is evaluated at USD 41.43 billion.

The growth of the market can be attributed to the increasing incidence of chronic diseases such as cardiovascular, neurology disorders combined with the realigning healthcare systems have led to an increase in emphasis on early diagnosis. According to the Centers for Disease Control and Prevention (CDC), coronary artery disease (CAD) affects an estimated 18.2 million adults each year in the U.S. forecast estimates, and much alone. These factors are estimated to contribute to the growth of the market in the forecast period.

In addition to these, factors that are believed to fuel the market growth of diagnostic imaging include the rise in investments and collaboration between major key players. Developing and emerging countries are experiencing an increase in the number of medical imaging centers.

Key Diagnostic Imaging Market Insights Summary:

Regional Highlights:

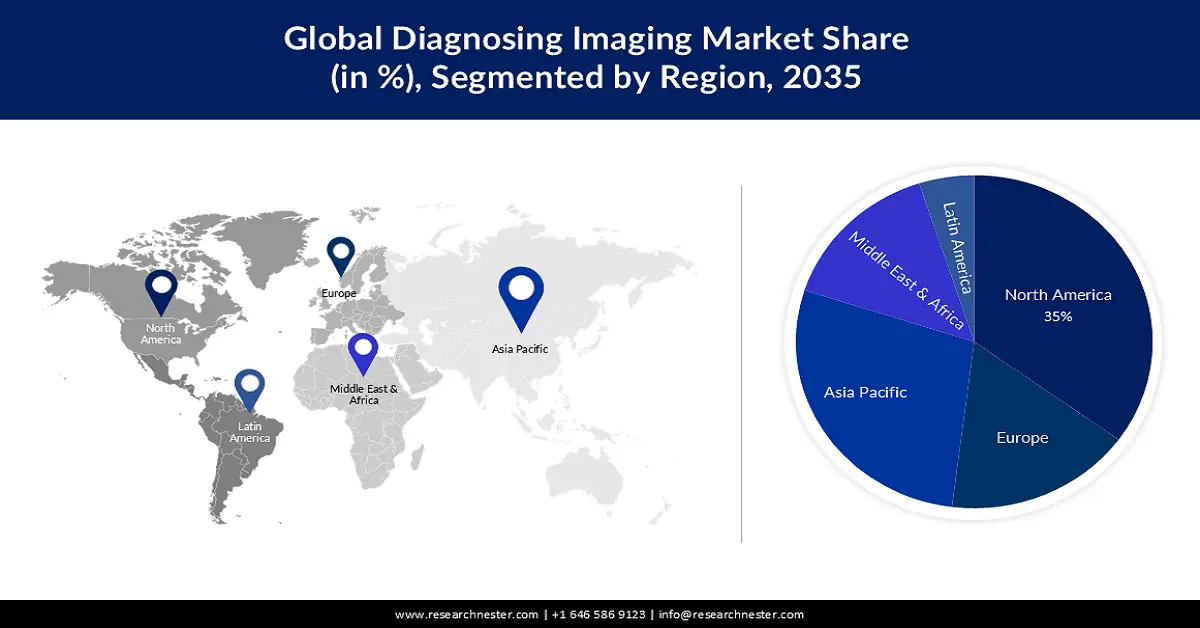

- The North America diagnostic imaging market is projected to capture a 35% share by 2035, driven by technical progress, affordability, and rising diagnostic procedures.

Segment Insights:

- The ct scanners segment in the diagnostic imaging market is anticipated to secure a 39% share by 2035, driven by new product launches and increased demand from the COVID-19 pandemic.

Key Growth Trends:

- Rising Advanced Diagnostic Imaging Technology Systems

- Rising Geriatric Population

Major Challenges:

- Technical Limitations associated with standalone imaging modalities

- Lack of skilled and trained professionals is expected to hamper the market growth

Key Players: of CANON INC., Carestream Health, Inc., Esaote SpA, General Electric Company, Hitachi Ltd, Hologic, Inc., Materialise NV, Planmeca Oy, Seimens AG,.

Global Diagnostic Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.58 billion

- 2026 Market Size: USD 41.43 billion

- Projected Market Size: USD 65.71 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 11 September, 2025

Diagnostic Imaging Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Advanced Diagnostic Imaging Technology Systems - One of the major factors contributing to growth in this market is the introduction of modern technology devices and a growing healthcare industry in Asia. For instance, in May 2020 Fujifilm Corporation launched a new technology based on artificial intelligence to detect lung nodules. In order to assist in lung cancer diagnosis, this technology is used for detecting pulmonary nodules during CT scans of the chest.

-

Rising Geriatric Population — The elderly population is more prone to chronic and age-related diseases such as Alzheimer, Parkinson's, and arthritis, and the rising need for the elderly population to get diagnostic imaging is estimated to drive market growth.

- Increasing Al Enabled Medical Imaging Equipment - One of the most important factors that are expected to contribute to a growing product demand for medical imaging and visualization system during the forecast period is an increased use in developed countries of automated instruments capable of rapid diagnosis and analysis. For instance, in December 2020, Hologic Inc. announced that the United States Food and Drug Administration has approved its Genius Al detection technology to detect breast cancer at an earlier stage.

Challenges

-

Increasing Product Recalls – The increasing product recalls associated with diagnostic imaging is one of the major factors predicted to slow down the market growth.

-

Technical Limitations associated with standalone imaging modalities

- Lack of skilled and trained professionals is expected to hamper the market growth

Diagnostic Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 39.58 billion |

|

Forecast Year Market Size (2035) |

USD 65.71 billion |

|

Regional Scope |

|

Diagnostic Imaging Market Segmentation:

Product Segment Analysis

The CT scanners segment is estimated to account for 39% share of the global diagnostic imaging market in the year 2035. The growth of the segment can be attributed to the new product launches in the field. For instance, in January 2020, Allergen, in collaboration with Canon Medical Systems Corporation, introduced a new CT scanner in the market, the ACUTOM 32, which is a 32-slice CT scanner featuring a wide bore gantry of 32 cm, about a 2.0 MHU X-ray tube, and about 0.75 seconds of rotation time. In January of 2022, the Port Perry Hospital Foundation, PPHF succeeded in reaching its USD 4 million goal to purchase a CT scanner and other critical items for Scugog Health Center. Moreover, the prevalence of COVID-19 and the pandemic has increased the demand for diagnostic imaging which contributed to the growth. Due to the rapid increase in COVID-19 cases, Samsung NeuroLogica added a 32-slice mobile BodyTom CT scanner in February 2020.

Application Segment Analysis

Diagnostic imaging market from the oncology segment is expected to garner a significant share during the time period. The demand for oncology imaging is driven by an increase in the number of cancer cases around the world, together with a growing emphasis on finding and detecting cancers before they develop. This segment of the oncology application is expected to be driven by increasing access to healthcare facilities and diagnostic imaging centers in emerging economies along with a relatively higher compound annual growth rate.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diagnostic Imaging Market Regional Analysis:

North American Market Insights

The diagnostic imaging market in North America is projected to be the largest with a share of about 35% during the projected period. The growth of the market in the region can be attributed majorly to the increasing technical progress, an increase in the level of affordability within the population, and a rise in diagnostic procedures each year can be attributed to growth. Moreover, given that there are well-established medical facilities and increasing demand for high-quality health systems from an aging population as well as a growing incidence of chronic disease, this market is expected to grow over the forecast period. Market growth is also projected to be driven by an increasing number of neurological disorders, such as brain tumors. An estimated 83,750 people in the United States were diagnosed with brain and other central nervous system tumors in 2021, according to an article published in the American Cancer Society Journal in 2022.

APAC Market Insights

The Asia Pacific diagnostic imaging market is estimated to grow significantly by the end of 2035. The growth of the market can be attributed majorly to the growing demand for diagnostic imaging techniques in the region. Moreover, market players are offered a lucrative opportunity in the region of Asia where there is an extensive and aging existing base of imaging equipment. The demand for new medical imaging systems is expected to be driven by this as well as a rapidly developing healthcare and hospital infrastructure in the region over the forecast period.

Diagnostic Imaging Market Players:

- CANON INC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carestream Health, Inc

- Esaote SpA

- General Electric Company

- Hologic Inc.

- Materialise NV

- GE Healthcare

- Seimens AG

- Planmeca Oy

- Mindray

Recent Developments

- Somatom X.ceed has been launched by Seimens Healthcare GmbH, The company has launched an efficients version of Somatom X.cite which was first introduced in 2019.

- Two new permanent magnetic resonance imaging systems APERTO were launched by Hitachi Ltd. The Lucent Plus is a 0.4T permanent open MRI, the AIRIS Vento Plus is a 0.3T in Europe, Congess of Radiology.

- Report ID: 4927

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diagnostic Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.