Terpineol Market Outlook:

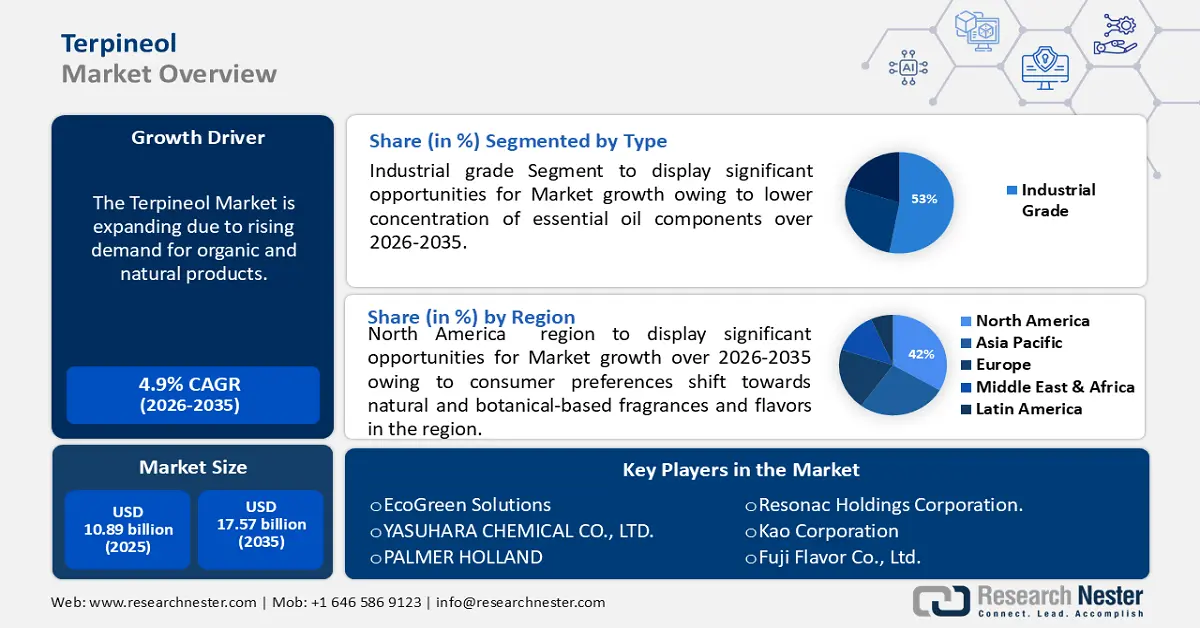

Terpineol Market size was valued at USD 10.89 billion in 2025 and is likely to cross USD 17.57 billion by 2035, expanding at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of terpineol is assessed at USD 11.37 billion.

The demand for terpineol is increasing due to its many applications in various industries. In the fragrance and cosmetics industry, terpineol is a key ingredient because of its pleasant aroma, making it a sought-after component in perfumes, colognes, and personal care products. In addition, the pharmaceutical industry benefits from terpineol's potential therapeutic properties, such as its ability to combat microbes and reduce inflammation, making it valuable in formulating medicines and topical products. Moreover, α-terpineol attracts a great interest as it has a wide range of biological applications as an antioxidant, anticancer, anticonvulsant, antiulcer, antihypertensive, anti-nociceptive compound. In order to improve skin penetration, it is also applied, making it ideal for pharmaceutical sector. Terpineol is also used as a flavoring agent in the food and beverage industry, particularly in products like candies and ice creams, creating market demand.

Moreover, Terpineol is a monocyclic terpene alcohol that has a wide range of uses across several industries. It is known for its pleasant fragrance and is commonly found in perfumes, cosmetics, and personal care products. Additionally, it is also used as a solvent in the manufacturing of resins, varnishes, and lacquers. With the increasing demand for natural products and the growth of the global population, the terpineol market is expected to grow significantly in the coming years.

Key Terpineol Market Insights Summary:

Regional Highlights:

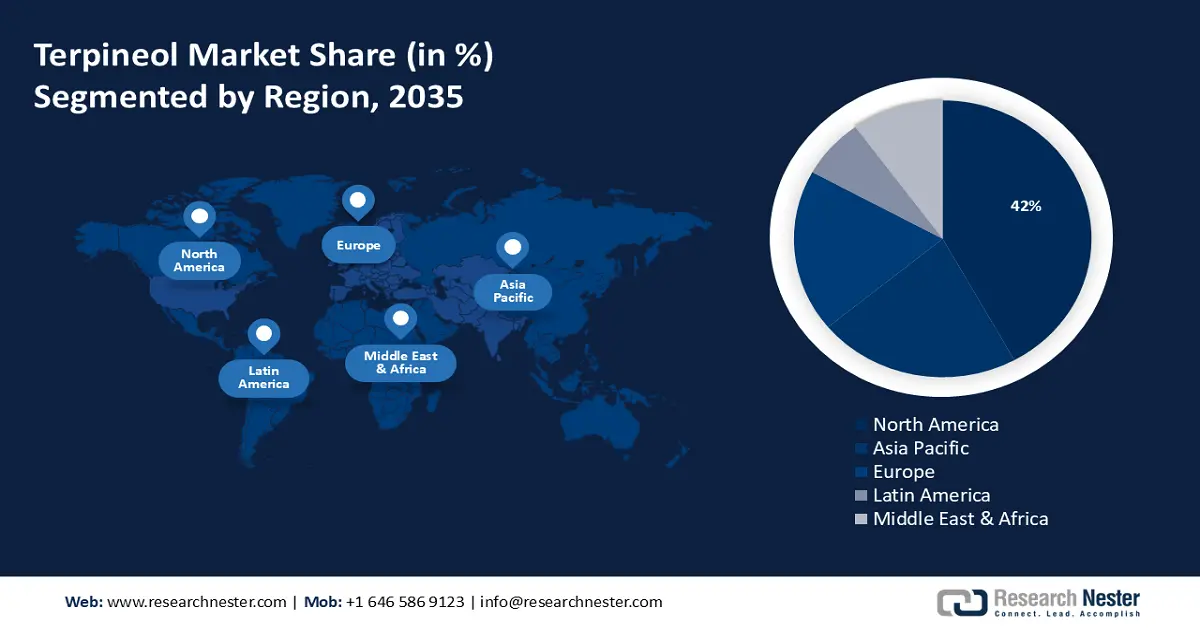

- By 2035, North America in the terpineol market is set to secure a 42% revenue share, propelled by expanding adoption in fragrance, flavor, pharmaceutical, and cosmetic applications.

- By 2035, the Asia Pacific region is expected to capture a substantial revenue share, supported by accelerating urbanization and rising consumption of personal care and home care products utilizing terpineol.

Segment Insights:

- By 2035, the industrial grade segment in the terpineol market is projected to hold a 53% share, reinforced by its cost-effective composition and versatility across industrial applications.

- By 2035, the fragrance segment is anticipated to command a dominant revenue share, sustained by its widespread incorporation in personal care formulations and perfume production.

Key Growth Trends:

- Growth in the Pharmaceutical and Cosmetics Industry

- Rising Demand for Natural and Organic Products

Major Challenges:

- Fluctuating Availability of Raw Materials

Key Players: DRT, Merck KGaA, Alfa Aesar™/, Thermo Fisher Scientific Inc., Santa Cruz Biotechnology Inc., Ernesto Ventós S.A, SKY DRAGON FINE-CHEM. CO., LTD., EcoGreen Solutions, YASUHARA CHEMICAL CO., LTD., PALMER HOLLAND, Workwell.

Global Terpineol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.89 billion

- 2026 Market Size: USD 11.37 billion

- Projected Market Size: USD 17.57 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 1 December, 2025

Terpineol Market - Growth Drivers and Challenges

Growth Drivers

-

Growth in the Pharmaceutical and Cosmetics Industry- Terpineol is valued for its medicinal properties and is used in pharmaceutical formulations, especially in topical medications and cough syrups, due to its expectorant and antiseptic properties, making it ideal for oral antiseptics . Additionally, terpineol finds applications in cosmetics such as skincare products and hair care formulations. The growth of the pharmaceuticals and cosmetics industry fuels the demand for terpineol as an active ingredient.

-

Rising Demand for Natural and Organic Products- With growing awareness about health and environmental sustainability, there is an increasing preference for natural and organic products across various industries. Terpineol, derived from natural sources such as pine oil or terpene-rich plants, aligns well with this trend and is sought as a natural alternative to synthetic chemicals in many applications. Furthermore, the demand is expected to grow at a compound annual growth rate of 5.9% over the period 2035. As natural ingredients are considered to be safe for the environment and human health, consumers increasingly prefer organic or natural products.

-

Agricultural Applications- Terpineol is used in agriculture as a pesticide and insecticide, due to its insecticidal and pesticidal properties. As farmers seek safer and more environmentally friendly alternatives to chemical pesticides, the demand for terpineol-based formulations is expected to increase.

-

Technological Advancements in Production processes- Ongoing advancements in production technologies, such as improved extraction methods and synthesis processes, contribute to the efficiency and cost-effectiveness of terpineol production. These advancements enable manufacturers to meet the growing demand for terpineol and explore new applications in diverse industries.

Challenges

-

Fluctuating Availability of Raw Materials- Terpineol is derived from various natural sources such as pine oil, citrus oils, and terpene-rich plants. Fluctuations in the availability and prices of these raw materials, influenced by factors like weather conditions, agricultural practices, and geopolitical tensions, pose challenges for terpineol manufacturers in maintaining consistent supply and pricing stability.

-

Terpineol faces competition from synthetic alternatives in various applications, especially in the fragrance and flavor industry.

-

Regulatory compliance adds complexity and costs to terpineol production, particularly concerning safety data, labelling requirements, and environmental regulations, restricting the terpineol market growth.

Terpineol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 10.89 billion |

|

Forecast Year Market Size (2035) |

USD 17.57 billion |

|

Regional Scope |

|

Terpineol Market Segmentation:

Type Segment Analysis

Industrial Grade segment in the terpineol market is slated to hold the largest revenue share, of 53% during forecast period. Industrial-grade terpineol is a type of terpene alcohol that has a strong and refreshing scent with floral hints of lavender. One of its advantages is that it is more cost-effective than fragrance and pharmaceutical grades due to its lower concentration of essential oil components. This makes it a popular choice for various industries that require terpineol for their products.

Application Segment Analysis

Fragrance segment in the terpineol market is estimated to garner the majority revenue share over the forecast period. Terpineol is a common ingredient in the fragrance industry, particularly in personal care products such as soaps, lotions, and detergents. It is also an essential component in the creation of perfumes that feature floral or citrus notes, such as those that contain rose oil or orange blossom absolute. Terpenes, on the other hand, are used to enhance the flavor of food products, making them valuable additives in candies and ice creams.

Our in-depth analysis of the global terpineol market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Terpineol Market - Regional Analysis

North American Market Insights

North America industry is set to account for largest revenue share of 42% by 2035. The North American fragrance and flavor industry is a significant consumer of Terpineol, utilizing it as a key ingredient in perfumes, cosmetics, soaps, detergents, and food products. As consumer preferences shift towards natural and botanical-based fragrances and flavors, the demand for Terpineol in North America continues to rise. The United States, with US$8.86 billion in 2024, leads the way compared to other countries worldwide when it comes to generating revenues. Furthermore, in addition, approximately 57% of total fragrance sales will be made up of products other than luxury by 2024. The pharmaceuticals and cosmetics industries in North America utilize Terpineol for its medicinal properties and as an active ingredient in topical medications, cough syrups, skincare products, and hair care formulations. As the population ages and consumer demand for pharmaceuticals and cosmetics products increases, the demand for Terpineol is likely to grow. There is a growing consumer preference for natural and organic products in North America, driven by health and environmental concerns. Terpineol, derived from natural sources such as pine oil or terpene-rich plants, is well-positioned to capitalize on this trend as a natural alternative to synthetic chemicals in various applications.

APAC Market Insights

The Asia Pacific region terpineol market is anticipated to garner significant revenue share over the forecast period. The region is undergoing rapid industrialization and urbanization, leading to an increase in the demand for consumer products such as fragrances, cosmetics, and household cleaners, which utilize Terpineol as a key ingredient. As urban populations grow and living standards improve, the demand for Terpineol in the region is expected to rise. The personal care and home care sectors in Asia Pacific are expanding rapidly due to increasing disposable incomes, changing lifestyles, and urbanization. Terpineol is widely used in products such as shampoos, lotions, soaps, and household cleaners due to its pleasant aroma and antimicrobial properties. The growth of these sectors drives the demand for Terpineol in the region.

Terpineol Market Players:

- DRT

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Alfa Aesar™/ Thermo Fisher Scientific Inc.

- Santa Cruz Biotechnology Inc.

- Ernesto Ventós S.A

- SKY DRAGON FINE-CHEM. CO., LTD.

- EcoGreen Solutions

- YASUHARA CHEMICAL CO., LTD.

- PALMER HOLLAND

- Workwell

Recent Developments

- Firmenich International SA, a global leader in the Flavor & Fragrance industry, is pleased to announce the completion of its acquisition of Les Dérivés Résiniques et Terpéniques ("DRT"). DRT is the world leader in developing and supplying quality ingredients that are both renewable and derived from natural resources. As a result of this acquisition, Firmenich will become a key player in the field of renewable ingredients for perfumery and beyond.

- Palmer Holland, a North American distributor of specialty chemicals and fine additives, announces its expansion into the LANXESS Polymer Additives business. As of August 1, 2023, Palmer Holland will become the national distributor of the KFLEXFLEX line of plasticizers in the United States, as a current distributor of LANXESS in the northern United States.

- Report ID: 5960

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Terpineol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.