Oral Antiseptics Market Outlook:

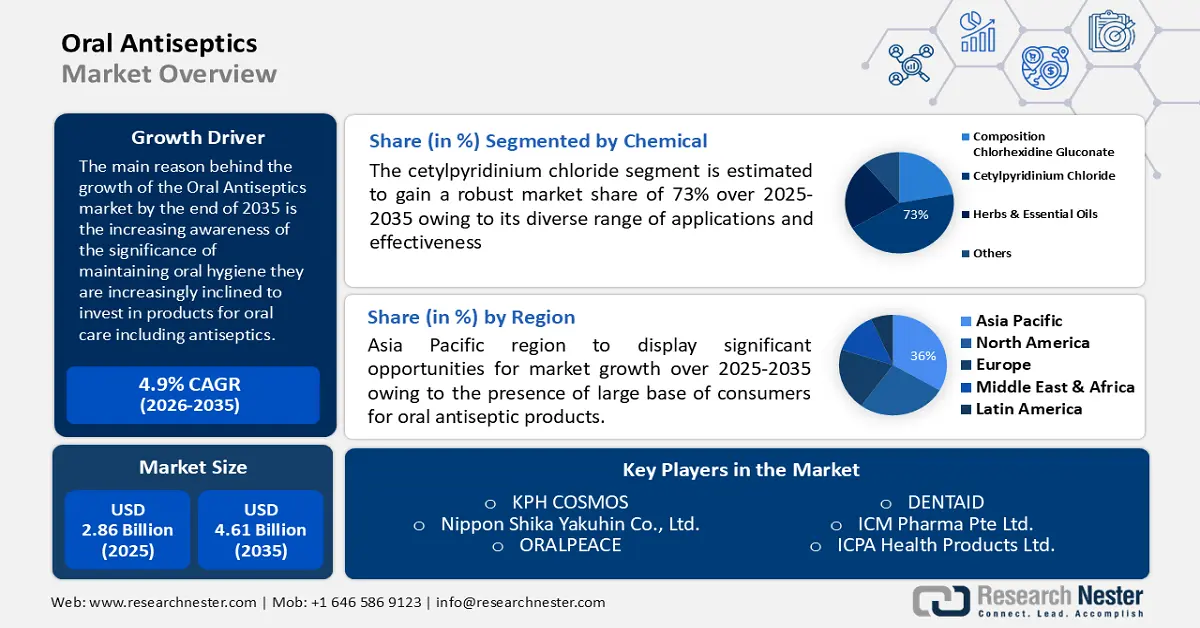

Oral Antiseptics Market size was valued at USD 2.86 billion in 2025 and is likely to cross USD 4.61 billion by 2035, expanding at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oral antiseptics is assessed at USD 2.99 billion.

As people become more aware of the significance of maintaining oral hygiene they are increasingly inclined to invest in products for oral care including antiseptics. Consequently, there has been an increase in the demand for oral antiseptics especially among individuals dealing with dental issues like gum disease and cavities. World Health Organization reports that there have been over 2 billion cases of caries in teeth globally, with an estimated average prevalence rate of 29%.

Over the counter oral antiseptics are readily accessible making them convenient for individuals to include in their oral hygiene regimen. These antiseptics are quite effective in eradicating bacteria in the mouth that may lead to cavities, gingivitis and unpleasant breath. Moreover, they come in forms, like mouthwashes and toothpastes allowing users to combine them with brushing and flossing for improved oral care.

Key Oral Antiseptics Market Insights Summary:

Regional Insights:

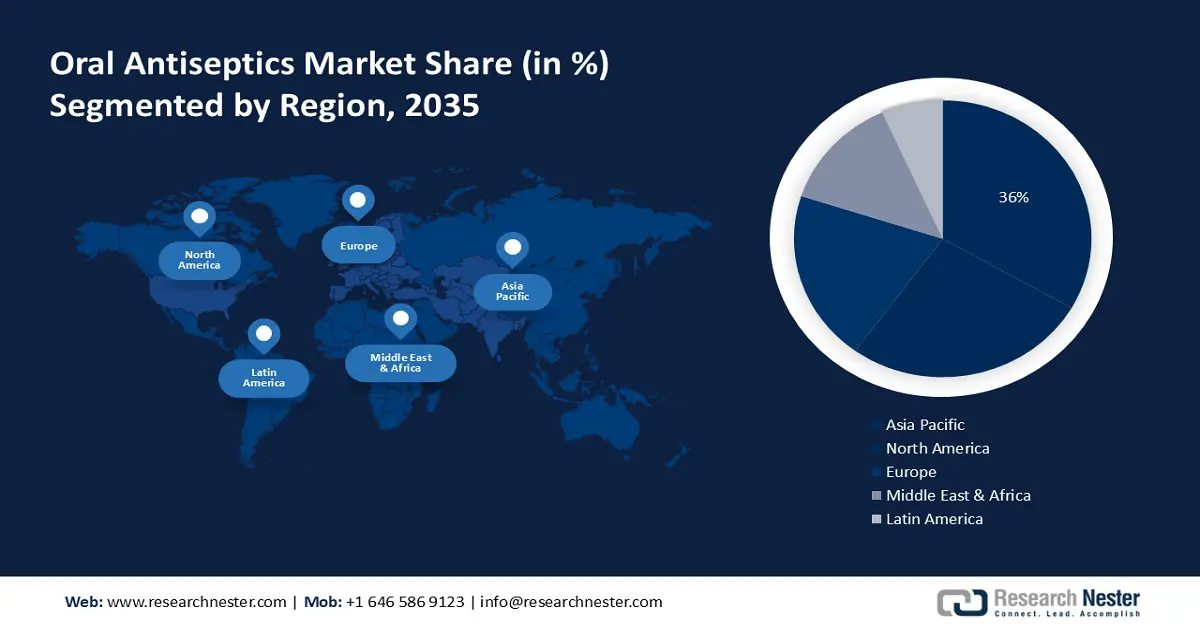

- The Asia Pacific region in the oral antiseptics market is anticipated to secure about a 36% share by 2035, underpinned by the presence of a large base of consumers for oral antiseptic products.

- North America is projected to capture a 36% share by 2035, attributed to the surging incidence of oral cancer in the region.

Segment Insights:

- The cetylpyridinium chloride segment in the oral antiseptics market is projected to hold nearly a 73% share by 2035, supported by its diverse range of applications and effectiveness.

- The prevention segment is expected to attain a significant share by 2035, bolstered by the rising adoption of oral antiseptics among youth for preventing oral infections.

Key Growth Trends:

- Growing Awareness of Oral Health

- Expansion of Dental Tourism Platforms

Major Challenges:

- Side Effects Associated With Oral Antiseptics Containing Alcohol

- High out of pocket expenditures for oral health care

Key Players: Procter & Gamble, Colgate-Palmolive Company, Johnson & Johnson Consumer Inc., OraCare, Church & Dwight Co., Inc., Avrio Health L.P., DENTAID, ICM Pharma Pte Ltd., ICPA Health Products Ltd., KPH COSMOS, Nippon Shika Yakuhin Co., Ltd., ORALPEACE.

Global Oral Antiseptics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.86 billion

- 2026 Market Size: USD 2.99 billion

- Projected Market Size: USD 4.61 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 24 November, 2025

Oral Antiseptics Market - Growth Drivers and Challenges

Growth Drivers

- Growing Awareness of Oral Health- In times there has been a growing realization that maintaining good oral hygiene goes beyond just having a beautiful smile. It is now widely understood that oral health plays a role in overall well being and physical health. This increased awareness has created a need for improved antiseptics that can assist individuals in preserving their oral health. Recent studies have revealed the connection between oral hygiene and various serious health conditions like heart disease, diabetes and even dementia. This knowledge is inspiring people to prioritize the care of their teeth and gums leading to an increased demand, for effective oral antiseptics.

- Expansion of Dental Tourism Platforms- For instance, consider the growth in dental services provided by Vietnam Dental Tourism. This platform was established in 2018 with the aim of enhancing the experience for patients who travel for dental treatments. Vietnam Dental Tourist, co founded by a team of professionals and experts from the tourism industry connects international patients to a network of 26 dental clinics spread across various provinces. Their goal is to ensure a journey, from the moment patients arrive until their departure.

- Rising Trend for Natural Oral Antiseptics- Natural herbal oral rinses are considered options for individuals with dry mouths (xerostomia) diabetics, pregnant women and children between the ages of two and twelve. You can find a variety of natural mouthwash brands in the market. Some are private label products with limited distribution while others are more well known and widely available globally. For example, the Natural Dentist and Toms of Maine are brands that have been recognized by the American Dental Association. These mouthwashes have undergone testing and shown to effectively eliminate germs reduce gingivitis and bleeding gums, as well, as soothe irritated or swollen gums and sore throats.

Challenges

- Side Effects Associated With Oral Antiseptics Containing Alcohol - Oral antiseptics products typically contain a high concentration of alcohol, usually ethanol or isopropanol, as the active ingredient. Even the oral antiseptics' maker acknowledges that it depends on the concentration. For instance, wines have an alcohol content of 718%, whereas spirits have a minimum alcohol content of 30%. On the other hand, the drugstore's disinfecting alcohol contains 70-99% alcohol.

- High out-of-pocket expenditures for oral health care

- Active ingredient shortages owing to global economic factors

Oral Antiseptics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 2.86 billion |

|

Forecast Year Market Size (2035) |

USD 4.61 billion |

|

Regional Scope |

|

Oral Antiseptics Market Segmentation:

Chemical Segment Analysis

The cetylpyridinium chloride segment in the oral antiseptics market is estimated to gain the largest market share of about 73% in the year 2035. The segment growth can be attributed to its diverse range of applications and effectiveness. Cetylpyridinium chloride is anticipated to exert a mechanism of action that reduces new dental plaque growth, reduces or removes existing dental plaque, diminishes the growth of pathogenic bacteria, and inhibits the production of virulence factors when added to mouthwashes, toothpaste, tablets, or mouth sprays. As per the reported study, mouthwash, and toothpastes with cetylpyridinium chloride counteract the virus that causes COVID-19 by 99 percent.

Application Segment Analysis

The prevention segment in the oral antiseptics market is estimated to gain the significant share in the year 2035. The segment growth can be attributed to the rising adoption of oral antiseptics among youth for preventing oral infections. An antibacterial mouthwash can effectively reduce and control plaque and gingivitis. Moreover, clinical studies have shown that even without mechanical teeth cleaning, an Octenident antiseptic can temporarily lower the bacterial load in the oral cavity and prevent plaque formation

Our in-depth analysis of the global market includes the following segments:

|

Chemical |

|

|

Application |

|

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Antiseptics Market - Regional Analysis

APAC Market Insights

Oral antiseptics market in Asia Pacific, amongst the market in all the other regions, is anticipated to hold the largest with a share of about 36% by the end of 2035. The market growth in the region is also expected on account of the presence of large base of consumers for oral antiseptic products. The Asia Pacific region also offers significant opportunities for companies well positioned to meet the market's demands and provide high-quality oral antiseptics to customers. Moreover, the COVID-19 pandemic has led to an increased focus on health and wellness, and consumers have been seeking products to help them stay healthy and protect themselves against the virus. This has driven demand for oral antiseptics and oral health monitors that are marketed as being effective against viruses and bacteria. For instance, a pre-procedure mouthwash containing oxidizing agents, such as 1% hydrogen peroxide or 0.2% povidone-iodine, is advised since SARS-CoV-2 is susceptible to oxidation. This will help to lower the microbial load in saliva and the potential for SARS-CoV-2 transmission.

North American Market Insights

North America industry is poised to dominate majority revenue share of 36% by 2035. The market’s expansion can be attributed majorly to the surging incidence of oral cancer in the region, which is increasing the demand for oral antiseptics. Furthermore, the rising e-cigarettes trend among the youth in countries such as U.S is further expected to drive the growth of the market in the region. In addition, the North America region has large supermarkets, and drug stores that distribute oral antiseptics to the consumers. Hence, all these factors are predicted to rise the market’s growth in the region.

Oral Antiseptics Market Players:

- Procter & Gamble

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Colgate-Palmolive Company

- Johnson & Johnson Consumer Inc.

- OraCare

- Church & Dwight Co., Inc.

- Avrio Health L.P.

- DENTAID

- ICM Pharma Pte Ltd.

- ICPA Health Products Ltd.

- KPH COSMOS

- Nippon Shika Yakuhin Co., Ltd.

- ORALPEACE

Recent Developments

- Avrio Health L.P. a subsidiary of Purdue Pharma L.P. Purdue), announced the launch of Betadine Antiseptic Oral Rinse Active Ingredients 0.5% Povidone Iodine or PVP-I), an oral antiseptic preoperative rinse.

- Colgate-Palmolive Company acquired oral care company Hello Products LLC “hello”) for USD $351 million in cash. The acquisition was financed with a combination of debt and cash. The acquisition is part of the company's focus strategy on the high-growth segments of Oral Care, Personal Care, and Pet Nutrition.

- Report ID: 4774

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Antiseptics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.