Strand Displacement Amplification Market Outlook:

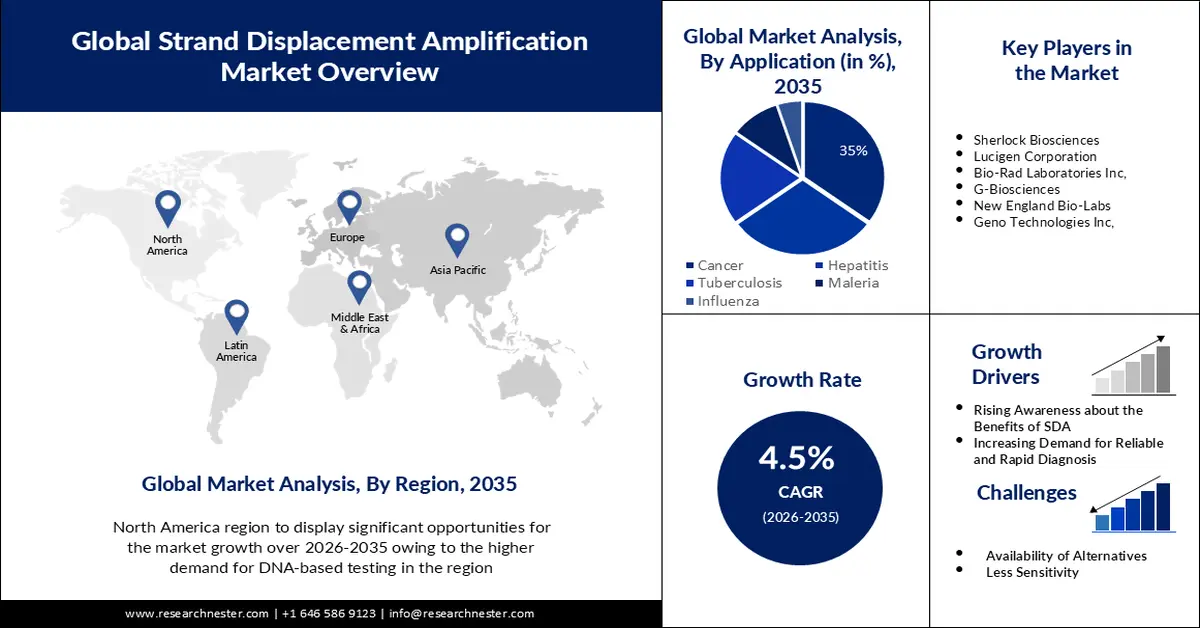

Strand Displacement Amplification Market size was over USD 1.61 billion in 2025 and is anticipated to cross USD 2.5 billion by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of strand displacement amplification is assessed at USD 1.68 billion.

The growth of this market can be attributed to the increasing prevalence of infectious and chronic diseases such as cancer, hepatitis, tuberculosis, and more. As per a report, around 350 thousand people specimen in China were diagnosed with influenza diagnosis out of which 49,260 cases were found positive.

Besides this, escalating demand for point-of-care genetic testing is predicted to drive the market growth as this testing process highly demands strand displacement amplification which is expected to drive the market further. For instance, as per the reports, it was found that point-of-care testing is receiving high traction as a tool as it offers immediate test results, and its implementation is rising day by day all across the globe.

Key Strand Displacement Amplification Market Insights Summary:

Regional Highlights:

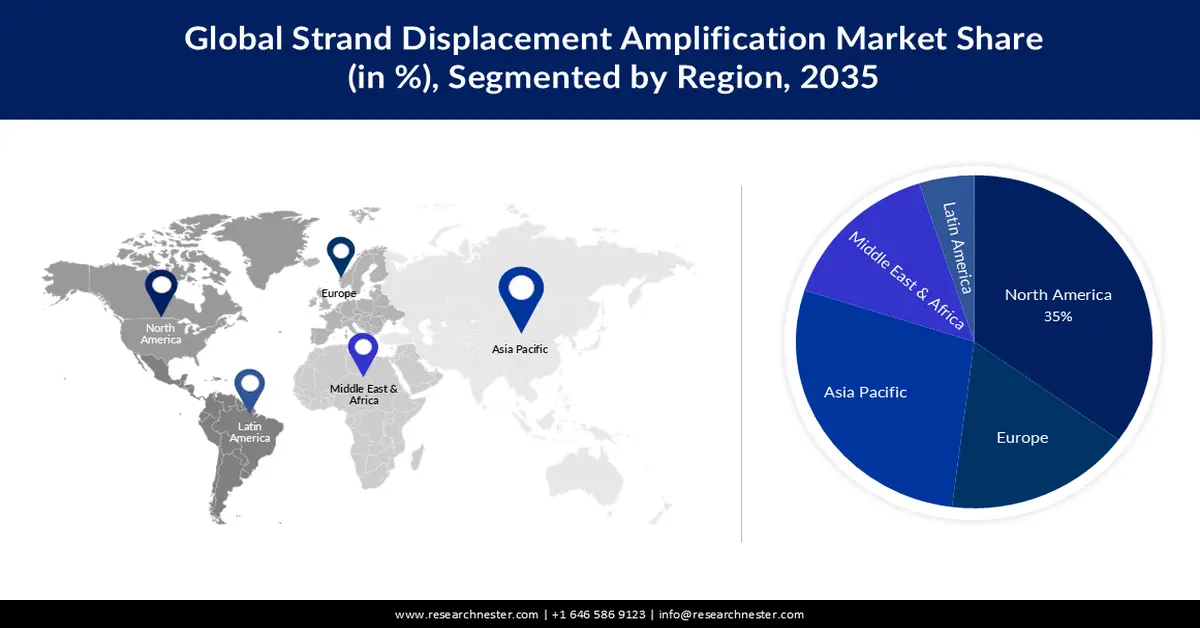

- North America is anticipated to command a 35% share by 2035 in the strand displacement amplification market, underpinned by rising demand for DNA-based testing and adoption of advanced gene-mutation detection technologies.

- The Asia Pacific region is expected to expand significantly through 2035, bolstered by continual improvements in strand displacement technology that enhance sensitivity, specificity, and usability.

Segment Insights:

- The cancer segment is projected to secure a 35% share by 2035 in the strand displacement amplification market, propelled by the rising global incidence of cancer.

- The diagnostic laboratories segment is expected to hold the largest share during 2025–2035, supported by the increasing values of nucleic acid amplification in the healthcare domain.

Key Growth Trends:

- Increasing Demand for Rapid and Reliable Diagnostics Tests

- Increasing Awareness about the Benefits of SDA

Major Challenges:

- Low Sensitivity

- Availability of Alternatives

Key Players: Sherlock Biosciences, Lucigen Corporation, Bio-Rad Laboratories Inc., G-Biosciences, New England Bio-Labs, Geno Technologies Inc.

Global Strand Displacement Amplification Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.68 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 4.5%

Key Regional Dynamics:

- Largest Region: North America (35% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 25 November, 2025

Strand Displacement Amplification Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand for Rapid and Reliable Diagnostics Tests – Strand displacement amplification is a fast and easy diagnostic technology that can detect minute range of DNA in a sample. Therefore, owing to this strand displacement amplification has become a popular choice for rapid testing of diseases such as tuberculosis, cancer, influenza, and others. According to research, from 2010 to 2020, 3.1 billion fast diagnostic test kits for malaria were sold worldwide, with sub-Saharan African nations accounting for about 81% of these sales.

- Increasing Awareness about the Benefits of SDA – Well there is quite an awareness about the benefits of strand displacement amplification among healthcare professionals and patients. However, the higher awareness about the benefits it offers such as high sensitivity, rapid results, and ease of use are factors driving the growth of this market.

- Increasing Use in New Applications – Food testing, environmental testing, forensics, and other testing are a few varied range of applications that demand strand displacement amplification. The rising use of strand displacement amplification in various applications drives the growth of the market in the forecast period.

Challenges

- Low Sensitivity – Strand displacement amplification is less sensitive than other amplification methods, such as polymerase chain reaction. This means that it may not be able to detect small amounts of DNA or RNA. This is expected to restrict the market expansion in the upcoming future times.

- Availability of Alternatives

- Disadvantages Associated with Strand Displacement Amplification

Strand Displacement Amplification Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Strand Displacement Amplification Market Segmentation:

Application Segment Analysis

Strand displacement amplification market from the cancer segment is set to observe the highest revenue share of 35% by the end of 2035. One of the key elements fuelling the segment's expansion is the rising incidence of cancer in the world. For instance, China is seeing a higher prevalence of malignancies, according to the data released in March 2022. The number of instances of new cancer in China in 2022 was predicted to be 4,820,000, with lung cancer being the most prevalent type.

End User Segment Analysis

In terms of end users, the diagnostic laboratories segment is poised to account for the largest market share during the time period. The growth of this segment can be ascribed to the increasing values of nucleic acid amplification in the healthcare domain. Additionally, strand displacement amplification technology is being utilized by research laboratories majorly by forensic labs, and is expected to boost the segment growth in the future times.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Strand Displacement Amplification Market - Regional Analysis

North America Market Insights

The strand displacement amplification market in theNorth America industry is anticipated to hold largest revenue share of 35% by 2035. The growth of this market in the region can be ascribed to the increasing demand for DNA-based testing and the implementation of advanced technologies that could detect and target specific gene mutations that can lead to diseases such as cancer, and other infectious diseases. As per the 2023 latest report, around 1.9 million new cases of cancer were recorded in the Unted States.

APAC Market Insights

The market in the Asia Pacific region is estimated to grow substantially during the forecast timeframe. There have been significant advancements in strand displacement technology in recent times in the Asia Pacific region which have made it more sensitive specific and easy to use. This is making strand displacement amplification more appealing to researchers and clinicians in the APAC region as a result driving the strand displacement amplification market expansion in the Asia Pacific region in the future times.

Strand Displacement Amplification Market Players:

- Lucira Health Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sherlock Biosciences

- Lucigen Corporation

- Bio-Rad Laboratories Inc

- G-Biosciences

- New England Bio-Labs

- Geno Technologies Inc

- Nippon Genetics Co, Ltd.

- Proteon Pharmaceuticals

- Hopan Fine Chemicals

Recent Developments

- To achieve its objective of making diagnostics simple to use, inexpensive, disposable, and environmentally friendly, Sherlock Biosciences purchased Sense Biodetection in February 2023. Products for SDA-based diagnostics are offered by Sense Biodetection.

- The FDA received an emergency use authorization request from Lucira Health, Inc. in January 2023 for the OTC use of their straightforward, at-home molecular COVID-19 and flu test, which makes use of SDA technology.

- Report ID: 5259

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.