Sterility Indicators Market Outlook:

Sterility Indicators Market size was valued at USD 1.29 billion in 2025 and is likely to cross USD 3.73 billion by 2035, expanding at more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sterility indicators is estimated at USD 1.42 billion.

The primary growth driver of the sterility indicators market is the increasing demand for sterilization in the healthcare and pharmaceutical industries. According to the International Atomic Energy Agency, almost 12 million cubic meters of medical equipment are sterilized by radiation annually, while gamma irradiation is used to sterilize almost 40% of all single-use medical equipment manufactured globally.

Regulatory bodies like the Food and Drug Administration (FDA), World Health Organization (WHO), and International Organization for Standardization (ISO) mandate strict sterility assurance protocols in medical devices, pharmaceuticals, and healthcare facilities, driving the adoption of sterility indicators. Moreover, the growing awareness of healthcare-associated infections (HAIs) emphasizes the importance of sterilization, boosting demand for reliable sterility monitoring tools.

Key Sterility Indicators Market Insights Summary:

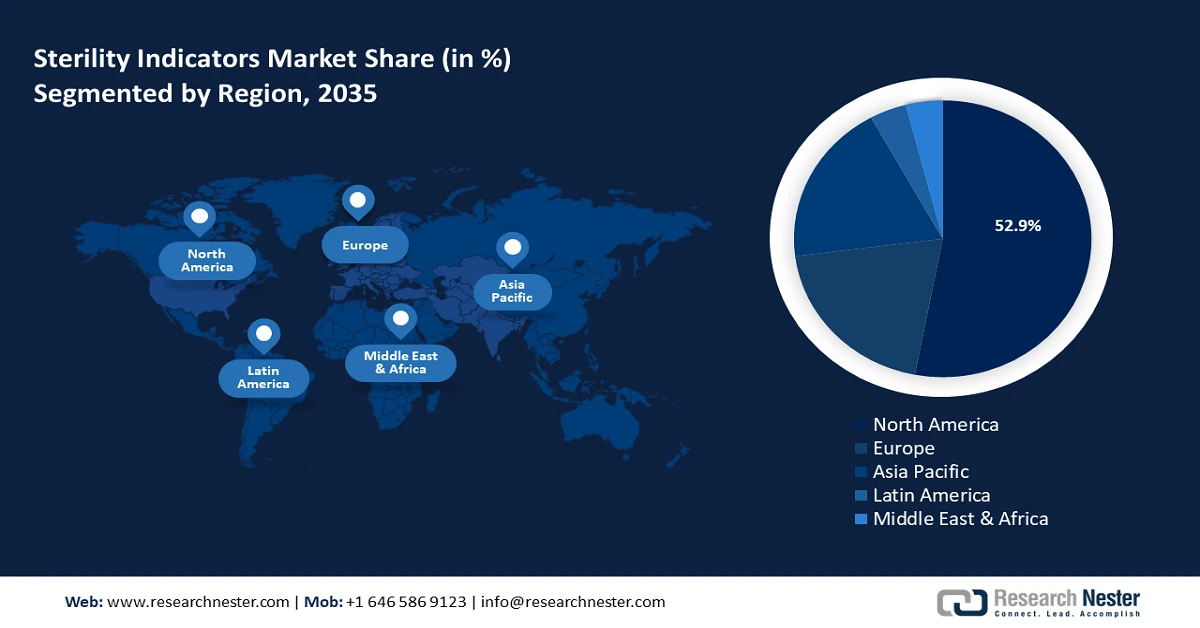

Regional Highlights:

- North America's 52.9% share in the Sterility Indicators Market is propelled by advanced healthcare infrastructure and infection prevention priorities, securing strong growth through 2035.

- Europe’s sterility indicators market is expected to experience rapid growth by 2035, fueled by stringent healthcare regulations and tech adoption.

Segment Insights:

- The Biological Indicators segment of the Sterility Indicators Market is forecasted to achieve a 68.60% share by 2035, propelled by unmatched accuracy, regulatory support, and technological innovations.

Key Growth Trends:

- Increasing healthcare needs and infection control

- Rise in infectious diseases

Major Challenges:

- High cost of advanced sterility indicators

- Growing adoption of alternative sterilization methods

- Key Players: 3M, Cardinal Health, MATACHANA group, Mesa Labs, Inc., Andersen Sterilizers, PMS Healthcare Technologies.

Global Sterility Indicators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.29 billion

- 2026 Market Size: USD 1.42 billion

- Projected Market Size: USD 3.73 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Sterility Indicators Market Growth Drivers and Challenges:

Growth Drivers

- Increasing healthcare needs and infection control: The growing number of surgeries and invasive medical procedures necessitates strict infection control measures. Sterility indicators play a critical role in ensuring that sterilization processes for surgical instruments and equipment are effective, reducing the risk of postoperative infections. HAIs pose a major challenge to healthcare systems worldwide. According to WHO, HAIs typically impact 1 out of 10 patients; however, in low- and middle-income nations and among high-risk patients, such as those in intensive care units, the frequency can be significantly greater.

The COVID-19 pandemic underscored the importance of infection prevention and control, leading to heightened awareness and adoption of sterilization protocols. This has significantly boosted the sterility indicators market as healthcare facilities prioritize effective sterilization. - Rise in infectious diseases: Global health agencies report a surge in diseases such as tuberculosis (TB), influenza, and emerging viral infections. According to the Centers for Disease Control and Prevention (CDC), in 2023, the 50 U.S. states and the District of Columbia provisionally reported 9,615 tuberculosis cases, up 1,295 cases (16%) from 8,320 cases reported in 2022 and up 8% from the 2019 prepandemic case count (8,895). Overall, the U.S. tuberculosis rate rose by 15%, from 2.5 per 100,000 people in 2022 to 2.9 by 2023.

In regions with limited access to healthcare, infectious diseases remain a major concern. Increased awareness and investment in healthcare infrastructure in areas like the Asia Pacific are driving demand for sterility solutions, including indicators. - Growth in healthcare infrastructure: Developing countries are heavily investing in building hospitals, clinics, and diagnostic labs. This expansion requires robust infection control solutions, driving the adoption of sterility indicators to ensure safety and compliance. Enhanced infrastructure supports a higher volume of surgical procedures and diagnostic tests, which depend on sterile environments. Sterility indicators ensure the effective sterilization of instruments and devices used in these processes, fostering sterility indicators market growth.

Modernized facilities adopt advanced medical technologies and equipment requiring rigorous sterilization. Sterility indicators are integral to monitoring and validating these processes, ensuring compliance with stringent healthcare regulations.

Challenges

- High cost of advanced sterility indicators: Advanced sterility indicators, such as rapid biological indicators and automated systems with traceability features, are costly to manufacture and purchase. These costs can be prohibitive for smaller healthcare facilities or organizations in low-income regions. Healthcare facilities in developing countries often operate under tight budgets, prioritizing essential equipment over sterility monitoring tools. This limits the adoption of high-end sterility indicators, despite their effectiveness in ensuring safety.

- Growing adoption of alternative sterilization methods: Chemical sterilants, such as ethylene oxide (EtO), hydrogen peroxide, and peracetic acid, are gaining popularity due to their ability to sterilize heat-sensitive instruments. These methods often include integrated sterilization validation processes, reducing reliance on separate sterility indicators.

Sterility Indicators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 1.29 billion |

|

Forecast Year Market Size (2035) |

USD 3.73 billion |

|

Regional Scope |

|

Sterility Indicators Market Segmentation:

Type (Chemical Indicators and Biological Indicators)

By type, the biological indicators segment is likely to account for around 68.6% sterility indicators market share by 2035. The market growth is driven by biological indicators’ unmatched accuracy, regulatory backing, and technological innovations. Biological indicators are widely regarded as the gold standard for sterilization validation. They use highly resistant bacterial spores to verify the efficacy of sterilization processes such as steam, ethylene oxide, and radiation sterilization. Their accuracy and reliability in detecting sterilization failures make them essential in the healthcare and pharmaceutical industries.

The increasing focus on infection prevention in hospitals and healthcare facilities has boosted the use of biological indicators as part of quality assurance programs for sterilization processes. The development of rapid-readout biological indicators has significantly reduced the time needed to confirm sterilization efficacy, making them more practical for routine use. This has enhanced their adoption in hospitals and industrial settings.

Moreover, several leading companies are driving the sterility indicators market by providing advanced biological indicators for sterilization. For instance, STERIS Life Sciences provides high-quality biological indicators in various forms to the pharmaceutical, medical device, and biotechnology industries. STERIS biological indicators come in two types of spores: Bacillus atrophaeus for ethylene oxide (EO) and dry heat applications, and Geobacillus stearothermophilus for steam sterilization applications. STERIS also provides custom sterilization indicators customized to specifications.

Technique (Heat sterilization, Low-temperature sterilization, Filtration sterilization, Radiation sterilization, and Liquid sterilization)

By technique, the heat sterilization segment in sterility indicators market is poised to register a profitable revenue share during the forecast period. Steam sterilization, a common form of heat sterilization, is one of the most reliable and cost-effective methods for ensuring sterility in medical instruments and pharmaceutical products. It is widely used in hospitals, surgical centers, and laboratories due to its effectiveness against a broad range of microorganisms, including spores.

Regulatory authorities, such as the FD and ISO, mandate the use of heat sterilization in many sterilization processes, particularly in the pharmaceutical and medical device industries. Innovations in heat sterilization equipment, such as automated autoclaves with integrated monitoring systems, are driving demand for sterility indicators that support these advanced devices.

Our in-depth analysis of the sterility indicators market includes the following segments:

|

Type |

|

|

Technique |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sterility Indicators Market Regional Analysis:

North America Market Forecast

North America industry is predicted to account for largest revenue share of 52.9% by 2035. The market growth can be attributed to the region’s advanced healthcare infrastructure, a rising prevalence of hospital-acquired infections, and stringent regulatory requirements for sterilization in healthcare facilities and pharmaceutical production. Hospitals remain the dominant end users in the North America market due to the increasing number of surgical procedures and the prioritization of infection prevention.

In the U.S. sterilization using ethylene oxide is a critical driver for the sterility indicators market, given its widespread application in healthcare and industrial sectors. Ethylene oxide sterilization is particularly important for materials and devices that cannot tolerate high heat or moisture. According to the U.S. FDA, ethylene oxide sterilization is used for about 50% of all medical devices, making it one of the most prevalent methods in the industry.

Additionally, increased R&D investments are driving advancements in sterility indicators, enhancing their accuracy, reliability, and adaptability to modern sterilization processes. This trend ensures the market’s continued expansion as healthcare and pharmaceutical industries prioritize innovation and regulatory compliance.

In Canada, the sterility indicators market is witnessing growth driven by increasing demand from the healthcare, pharmaceutical, and biotechnology sectors. The robust pharmaceutical industry is a significant contributor to market growth. Sterility indicators are critical in ensuring the safety and efficacy of drugs and medical devices during manufacturing.

Europe Market Analysis

The sterility indicators market of Europe is poised to register the fastest revenue growth by 2035. The market growth in Europe is due to the increasing focus on healthcare quality and infection control. The market is driven by stringent regulatory frameworks, the rising number of surgical procedures, and the growing adoption of advanced sterilization methods in healthcare facilities and pharmaceutical industries. Within Europe, leading countries like Germany, France, and the UK contribute significantly due to their well-established healthcare systems and substantial investment in medical technologies.

Key Sterility Indicators Market Players:

- STERIS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Cardinal Health

- MATACHANA group

- Mesa Labs, Inc.

- Andersen Sterilizers

- PMS Healthcare Technologies.

- Propper Manufacturing Co., Inc.

- Liofilchem S.r.l.

Key players driving the sterility indicators market include major healthcare and pharmaceutical companies that provide products to ensure sterilization effectiveness. These companies focus on innovating and expanding their portfolios in response to growing sterilization standards and regulatory requirements. Ongoing investment in research and development also plays a crucial role in shaping market growth.

Here are some key players in the sterility indicators market:

Recent Developments

- In April 2024, MATACHANA introduced a unique format for combining chemical indicators targeted at increasing environmental sustainability in the sterilizing sector. With a specific focus on decreasing carbon footprints, MATACHANA redefines resource management efficiency, setting new standards for medical sustainability.

- Report ID: 6750

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sterility Indicators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.