Stem Cell Assay Market Outlook:

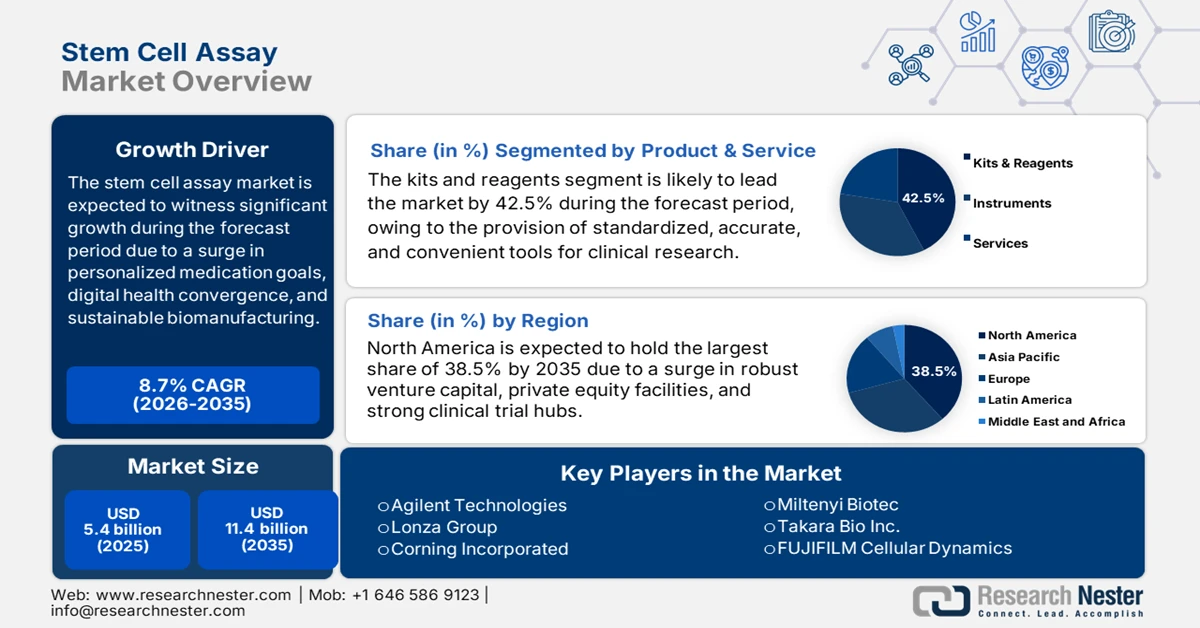

Stem Cell Assay Market size was over USD 5.4 billion in 2025 and is estimated to reach USD 11.4 billion by the end of 2035, expanding at a CAGR of 8.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of stem cell assay is estimated at USD 5.8 billion.

The international stem cell assay market is effectively entering a new phase of growth, driven by unique factors including digitalized health convergence, personalized medicine integration, and sustainability in biomanufacturing. According to official statistics published by NLM in September 2023, a physician computer order entry system (CPOE) diminished 55% of the non-intercepted serious medication errors in a hospital environment in Boston. Besides, the aspect of digitalized health technologies constituted a significant 93% to 96% relative reduction in comparison to visual inspection. In addition, potential adverse drug incidents also dropped from 3.1% to 1.6%. Therefore, these digital trends deliberately reflect the overall industry’s evolution toward patient-centric and advanced innovation.

Furthermore, eco-friendly reagents, green chemistry production, biodegradable assay kits, personalized clinical applications, cloud-based platforms, artificial intelligence-based assay analytics, along with expansion into consumer wellness and health, are other factors uplifting the stem cell assay market globally. As stated in an article published by NLM in August 2025, a clinical study was conducted, wherein 1,017 assay kits were screened during Phase I, and meanwhile, 185 kits were evaluated at Phase II, and 91 at Phase III. Besides, more than 2.5 billion self-test kits have been readily deployed by the government in the UK based on the purchase decisions of customers. Moreover, as per the September 2024 IJID Regions article, in March 2023, SARS-CoV-2 significantly infected more than 761 million people, leading to more than 6.8 million deaths, with ongoing incidents globally, thereby bolstering the market’s growth.

Key Stem Cell Assay Market Insights Summary:

Regional Insights:

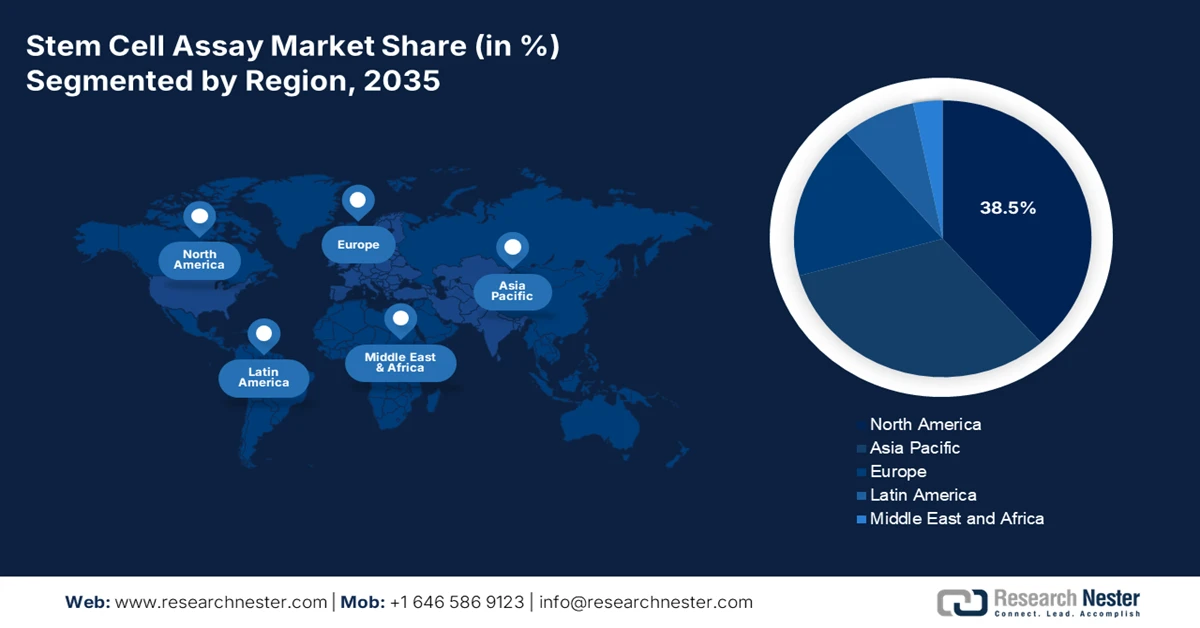

- North America is projected to dominate the stem cell assay market with a 38.5% share by 2035, underpinned by a mature intellectual property environment and strong venture capital funding momentum.

- Europe is forecast to emerge as the fastest-growing region during 2026–2035, reinforced by sustained healthcare budget allocations and innovation-oriented clinical trial infrastructure.

Segment Insights:

- The kits and reagents segment under product and service is projected to command the largest 42.5% share of the stem cell assay market by 2035, supported by widespread adoption of standardized and reliable chemical tools for research and diagnostics, culminating in organizational mergers and acquisitions.

- The regenerative medicine and therapy development sub-segment within the application category is expected to secure the second-largest share by the end of the forecast period, strengthened by its essential role in validating cell safety and efficacy for advanced treatments, culminating in advances in induced pluripotent stem cells and gene-editing technologies.

Key Growth Trends:

- Increase in cell preservation

- Surge in supply chain diversification

Major Challenges:

- Regulatory complexity and ethical concerns

- High costs of assay development and implementation

Key Players: Thermo Fisher Scientific (U.S.), Merck KGaA (Germany), Bio-Rad Laboratories (U.S.), Becton, Dickinson and Company (U.S.), GE Healthcare (UK), Agilent Technologies (U.S.), Lonza Group (Switzerland), Corning Incorporated (U.S.), Miltenyi Biotec (Germany), Takara Bio Inc. (Japan), FUJIFILM Cellular Dynamics (Japan), Cell Signaling Technology (U.S.), STEMCELL Technologies Inc. (Canada), Beckman Coulter (U.S.), PromoCell GmbH (Germany), Bio-Techne Corporation (U.S.), Sartorius AG (Germany), Cynata Therapeutics (Australia), Medipost Co., Ltd. (South Korea), Reliance Life Sciences (India)

Global Stem Cell Assay Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.4 billion

- 2026 Market Size: USD 5.8 billion

- Projected Market Size: USD 11.4 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: India, Brazil, Mexico, Vietnam, Indonesia

Last updated on : 22 January, 2026

Stem Cell Assay Market - Growth Drivers and Challenges

Growth Drivers

- Increase in cell preservation: This is one of the unique drivers for the stem cell assay market for ensuring scalability and reproducibility. According to official statistics published by NLM in June 2022, there has been the existence of pluripotent stem cells in blastocysts with 50 to 150 cells in mammals that can differentiate into different cell types. Besides, the U.S. has undoubtedly dominated the research field of stem cell precision medicine, accounting for an estimated 30%. Moreover, the continuous growth of private and public biobanking partnerships is also responsible for a surge in cell preservation and research. This has resulted in ensuring a long-lasting supply of stem cells for regenerative medicine and drug discovery, thereby denoting a huge growth opportunity for the market’s upliftment.

10 Most Productive Nations in Stem Cell Precision Medicine Research (2024)

|

Countries |

Single Cell Protein (SCP) |

Multiple Cell Protein (MCP) |

MCP Ratio |

|

U.S. |

124 |

36 |

0.225 |

|

China |

50 |

13 |

0.2063 |

|

Italy |

42 |

17 |

0.2833 |

|

Germany |

20 |

18 |

0.4737 |

|

UK |

11 |

11 |

0.5 |

|

Japan |

19 |

2 |

0.0952 |

|

France |

12 |

4 |

0.25 |

|

India |

13 |

1 |

0.1333 |

|

Canada |

9 |

3 |

0.25 |

|

Korea |

10 |

2 |

0.1667 |

Source: NLM

- Surge in supply chain diversification: Companies across different locations are readily diversifying to diminish dependency on single-country manufacturing facilities, which is facilitating the stem cell assay market’s expansion. As per an article published by the NIH in April 2023, the enzyme-linked immunosorbent assays (ELISAs) are usually performed in polystyrene plates, usually 96-well plates coated to bind protein in a strong way. Besides, the substrate availability in ELISA comprises alkaline phosphate (AP) and horseradish peroxidase (HRP), of which AP deliberately measures nitrophenol within incubation periods of 15 to 30 minutes. Moreover, to carry out detection, there is a continuous supply of clinical trial kits, which is also driving the stem cell assay market’s upliftment internationally.

2023 Clinical Trial Kits Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

U.S. |

294 million |

144 million |

|

UK |

107 million |

- |

|

Germany |

88.6 million |

- |

|

Malaysia |

- |

279 million |

|

China |

- |

74.9 million |

|

Global Trade Valuation |

1.2 billion |

|

|

Global Trade Share |

0.0053% |

|

|

Product Complexity |

0.99 |

|

Source: OEC

- Focus on personalized treatment: The stem cell assay market is focused on increasing its implementation in personalized treatment monitoring, thereby aligning with international healthcare reforms that tend to prioritize patient-specific results. As per an article published by Smart Health in December 2024, the presence of convolutional neural networks (CNNs) tends to enhance lung disorder prediction accuracy and achieves almost 97% through innovative image processing techniques and suitable segmentation methods in medical diagnostics. Simultaneously, the Darknet-53 CNN approach optimizes breast cancer detection accuracy to 95.6% by classifying images as malignant or benign by readily utilizing Contrast-Limited Adaptive Histogram Equalization (CLAHE), thus proliferating the stem cell assay market’s growth.

Challenges

- Regulatory complexity and ethical concerns: The stem cell assay market is heavily regulated due to the sensitive nature of stem cell research, particularly involving embryonic stem cells. Regulatory frameworks differ widely across regions, creating barriers for global commercialization. For example, while the U.S. FDA has established clear guidelines for advanced therapy medicinal products, Europe and the Asia Pacific countries often impose stricter ethical restrictions, slowing approvals. Ethical debates surrounding embryonic stem cell use further complicate market expansion, as public opposition can lead to funding cuts or policy reversals. Companies must navigate diverse compliance requirements, including safety validation, clinical trial approvals, and ethical review boards, which increase costs and delay product launches.

- High costs of assay development and implementation: Developing and implementing stem cell assays is capital-intensive, requiring advanced instruments, specialized reagents, and highly skilled personnel. Flow cytometry systems, high-content screening platforms, and PCR technologies represent substantial upfront investments, often exceeding millions of dollars. Additionally, consumables such as reagents and assay kits must be purchased repeatedly, creating ongoing operational expenses. Smaller biotech firms and academic institutions often struggle to afford these costs, limiting their participation in cutting-edge research. High costs also restrict adoption in emerging markets, where healthcare budgets are constrained. Furthermore, assay validation and reproducibility demand rigorous quality control, adding to expenses, thus causing a hindrance in the stem cell assay market globally.

Stem Cell Assay Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 5.4 billion |

|

Forecast Year Market Size (2035) |

USD 11.4 billion |

|

Regional Scope |

|

Stem Cell Assay Market Segmentation:

Product & Service Segment Analysis

The kits and reagents segment, which is part of the product and service, is anticipated to garner the largest share of 42.5% in the stem cell assay market by the end of 2035. The segment’s upliftment is highly fueled by the provision of accurate, convenient, and standardized chemical tools for research, diagnostics, and scientific analysis. This has readily enabled quantification and precise detection of substances from medicines to environmental evaluation. Based on this, in April 2025, Shimadzu merged its reagent company, Alsachim SAS, and modified its name to Shimadzu Chemistry and Doagnostics SAS. This deliberately consolidated the business of BMO and ALC within a single entity to enhance developmental functions that cater to consumer demands. Therefore, organizational mergers and acquisition is one of the driving factors for the segment’s growth and expansion.

Application Segment Analysis

By the end of the forecast period, the regenerative medicine and therapy development sub-segment, part of the application segment, is projected to account for the second-largest share in the stem cell assay market. The sub-segment’s growth is highly driven by its role as one of the critical tools for validating cell viability, differentiation, and therapeutic potential, ensuring the safety and efficacy of treatments before clinical use. The rising prevalence of chronic diseases such as cardiovascular disorders, neurodegenerative conditions, and diabetes has accelerated demand for regenerative therapies, where stem cell assays play a pivotal role in quality control and patient-specific treatment design. Advances in induced pluripotent stem cells (iPSCs) and gene-editing technologies have further expanded the scope of regenerative medicine, requiring sophisticated assays to monitor genetic stability and functional outcomes.

End user Segment Analysis

The pharmaceutical and biotechnology companies segment as an end user is expected to hold the third-largest share in the stem cell assay market during the stipulated timeline. The segment’s development is highly attributed to the dependence on assays for drug discovery, toxicology testing, and clinical validation, integrating them into every stage of product development. Stem cell assays enable high-throughput screening of candidate compounds, reducing time-to-market and improving success rates in clinical trials. Biotechnology companies, in particular, use assays to explore regenerative therapies, gene therapies, and advanced biologics, where cell viability and differentiation testing are essential. The growing pipeline of cell-based therapies has intensified demand for reliable assay platforms, with firms investing heavily in automation, AI-driven analytics, and advanced instrumentation.

Our in-depth analysis of the stem cell assay market includes the following segments:

|

Segment |

Subsegments |

|

Product & Service |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Cell Type |

|

|

Assay Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stem Cell Assay Market - Regional Analysis

North America Market Insights

North America stem cell assay market is anticipated to garner the largest share of 38.5% by the end of 2035. The market’s growth in the region is highly driven by advanced intellectual property frameworks, strong venture capital and private equity ecosystems, integration with artificial intelligence and big data platforms, robust clinical trial infrastructure, and collaborations between industry and academia. According to official statistics published by the NVCA in 2026, the U.S.-based venture capital ecosystem comprised 3,417 venture capital firms, with a cumulative 13,608 deals worth USD 170.6 billion. These firms effectively raised USD 66.9 billion across 474 funds and ended the year successfully with USD 311.6 billion, along with USD 1.2 trillion. Therefore, with an increase in the fund provision through venture capital, the market is poised to grow further in the region.

The stem cell assay market in the U.S. is growing significantly due to reimbursement frameworks as well as robust federal healthcare allocations. As per an article published by the KFF Organization in February 2025, the country is considered the largest donor government of global health assistance as of 2023, amounting to USD 23 billion. Out of this total amount, the country accounts for 42%, followed by the UK with 12%, 8% for Germany, and 7% for each of Japan and France. Besides, the country also accounts for 28.8% of donor governments with the largest share of development assistance internationally. Moreover, in 2024, the domestic funding for worldwide health amounted to USD 13.4 billion in terms of request and USD 12.4 billion in terms of enacted. Likewise, the domestic international health funds for regular appropriations are also fueling the market’s growth in the country.

U.S. Global Health Funding for Regular Appropriations (2015-2025)

|

Year |

Fund Amount (USD Billion) |

|

2015 |

10.4 |

|

2016 |

10.4 |

|

2017 |

10.7 |

|

2018 |

10.7 |

|

2019 |

10.9 |

|

2020 |

11.2 |

|

2021 |

11.6 |

|

2022 |

12.2 |

|

2023 |

12.9 |

|

2024 |

12.4 |

|

2025 |

12.2 |

Source: KFF Organization

The stem cell assay market in Canada is also growing, owing to the presence of both provincial and federal healthcare investments. Based on government estimates published by the Government of Canada in May 2024, the country’s government allocated USD 200 billion for more than 10 years to strengthen public healthcare, and in this regard, territories and provinces received USD 52.1 billion from the federal government through Canada Health Transfer payments. Besides, the Budget 2024 readily invested USD 77.1 million for more than 4 years for nurses and doctors to contribute towards optimizing the public healthcare system within the country. In addition, the budget also invested USD 50 million for 2 years between 2024 and 2025 to significantly streamline the Foreign Credential Recognition Program for healthcare professionals, thereby making it suitable for the market’s upliftment.

Europe Market Insights

Europe stem cell assay market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by innovative clinical trial infrastructure and robust healthcare budget provisions. According to official statistics published by the Europe Commission in December 2025, the region’s EU4Health Programme has allocated the primary health fund, amounting to €4.4 billion. This particular funding program requires almost 20% of the budget allocation to disease prevention and health promotion. Besides, the Europe Social Fund Plus (ESF+) was initiated in social and people inclusion, including a suitable health strand of €413 million. This readily supports best practices implementation, health system reform, and crisis preparedness for health-based disease prevention, thus denoting an optimistic outlook for the stem cell assay market.

The stem cell assay market in Germany is gaining increased traction due to clinical trial leadership and robust healthcare expenditure. As stated in an article published by the Health Policy and Technology in June 2023, cell, gene, and product type therapy products are effectively dominating in the country, with 30 medically-engineered products. Besides, there exist more than 250 advanced therapy medicinal products (ATMP) in the whole of Europe, with nearly 65% of these firms being small and medium-sized enterprises (SMEs). In addition, there are 20 ATMPs in Germany, along with Sweden, with increased focus on tissue engineering products. Moreover, the collaboration between Novartis and Fraunhofer Institute for Cell Therapy and Immunology IZI led to the availability of over 500 CAR-T cells that have already been produced, thus boosting the market’s exposure in the country.

The stem cell assay market in the UK is also developing, owing to the existence of robust budget allocations, along with the support availability by the NHS integration of stem cell assays. As stated in an article published by the Office for National Statistics in April 2025, the nominal healthcare spending in the country was approximately £317 billion as of 2024. In addition, between 2023 and 2024, the overall healthcare expenditure surged by 6.5% after making adjustments for inflation by 2.4%. Moreover, the spending as a share of the gross domestic product (GDP) accounted for 11.1% as of 2024, which is similar to the level as of 2023. Likewise, the government-backed healthcare also makes up the majority of healthcare spending in the country, amounting to £258 billion in 2024, denoting a rise by 2.5% from 2023.

Nominal and Real Healthcare Expenditure Analysis in the UK (2014-2024)

|

Year |

Nominal Spending (£ Billion) |

Real Spending (£ Billion) |

|

2014 |

186 |

249 |

|

2015 |

191 |

254 |

|

2016 |

197 |

257 |

|

2017 |

202 |

259 |

|

2018 |

211 |

265 |

|

2019 |

223 |

275 |

|

2020 |

255 |

299 |

|

2021 |

276 |

324 |

|

2022 |

280 |

312 |

|

2023 |

298 |

310 |

|

2024 |

317 |

317 |

Source: Office for National Statistics

APAC Market Insights

The Asia Pacific stem cell assay market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by support provision from governmental spending and an increase in patient demand. According to official statistics published by NLM in October 2025, there has been the conduction of 206 cell therapy trials by the end of 2024 in China. In this regard, 51.4% cater to T cells, which is followed by 34.05 of stem cells, and 4.9% of progenitor cells. Additionally, in terms of clinical phase distribution, 64.1% were part of Phase I, 32.5% in Phase II, and 3.4% in Phase III, with 86.4% of cell therapy trials available and 9.7% completed trials. Besides, based on geographical analysis, 31.6% of trails have been conducted in Shanghai, 20.4% in Beijing, and 9.2% in Jiangsu, thereby making it suitable for proliferating the market’s growth in the region.

The stem cell assay market in China is gaining increased exposure due to the presence of government-based industrial policy, clinical trial volume, massive patient base, and infrastructure expansion in biotech parks. As per an article published by NLM in December 2025, the country’s population aged above 60 years reached 280 million by the end of 2023, which represented more than 19% of the overall population. Simultaneously, there has been a rise in chronic diseases, accounting for over 80% of the national disease burden. Besides, the floating population has exceeded 240 million, with an increase in acute health risks, and meanwhile, an estimated 85 million citizens are suffering from disabilities that urgently require standard health services. Therefore, with a continuous increase in the patient population, along with diseases, there is a huge growth opportunity for the stem cell assay market in the country.

The stem cell assay market in India is also growing, owing to export orientation, cost-effective manufacturing, public and private healthcare partnerships, as well as research and academic-based innovation. As stated in an article published by the PIB Government in June 2025, since its launch, the Ayushman Bharat- Pradhan Mantri Jan Arogya Yojana (PM-JAY) targeted 40% of the population in the country, and this particular scheme readily covers an estimated 12.3 crore families. Moreover, in October 2024, the country’s government also introduced Ayushman Vay Vandana, which readily benefited all senior citizens aged more than 70 years. Under this particular scheme, more than 58 lakh senior citizens have successfully enrolled, with over 2.6 lakh treatments amounting to ₹496 crore, thereby denoting an optimistic outlook for the market’s expansion in the country.

Key Stem Cell Assay Market Players:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories (U.S.)

- Becton, Dickinson and Company (U.S.)

- GE Healthcare (UK)

- Agilent Technologies (U.S.)

- Lonza Group (Switzerland)

- Corning Incorporated (U.S.)

- Miltenyi Biotec (Germany)

- Takara Bio Inc. (Japan)

- FUJIFILM Cellular Dynamics (Japan)

- Cell Signaling Technology (U.S.)

- STEMCELL Technologies Inc. (Canada)

- Beckman Coulter (U.S.)

- PromoCell GmbH (Germany)

- Bio-Techne Corporation (U.S.)

- Sartorius AG (Germany)

- Cynata Therapeutics (Australia)

- Medipost Co., Ltd. (South Korea)

- Reliance Life Sciences (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Thermo Fisher Scientific is a leading global player in life sciences, offering a wide portfolio of stem cell assay kits, reagents, and instruments. The company’s strong focus on drug discovery and regenerative medicine has positioned it as a dominant supplier in North America and globally.

- Merck KGaA, through its MilliporeSigma division, provides advanced stem cell assay solutions, including reagents and cell culture technologies. Its emphasis on innovation and collaborations with biotech firms has strengthened its role in Europe’s growing regenerative medicine sector.

- Bio-Rad Laboratories specializes in precision instruments and reagents for stem cell assays, particularly in flow cytometry and PCR-based applications. The company’s products are widely used in academic research and pharmaceutical development, supporting cell viability and differentiation studies.

- Becton, Dickinson and Company, a division of Becton, Dickinson, is a major provider of flow cytometry systems and cell analysis tools for stem cell assays. Its technologies are critical for cell identification and purification, making BD a key supplier for clinical and research institutions.

- GE Healthcare offers stem cell assay technologies integrated with imaging and high-content screening platforms. The company’s solutions are widely adopted in drug discovery and regenerative medicine, with a strong presence in Europe and global collaborations.

Here is a list of key players operating in the global stem cell assay market:

The international stem cell assay market is highly competitive, with dominance by U.S. and Europe-based players such as Thermo Fisher, Merck, and BD Biosciences, alongside strong contributions from Japan and emerging firms in the Asia Pacific. Strategic initiatives include mergers, acquisitions, and collaborations with research institutions to expand assay portfolios. Companies are investing heavily in automation, AI-driven analytics, and sustainable reagent production to strengthen market positioning. Regional players in India, Malaysia, and South Korea are leveraging cost-effective manufacturing and government-backed research and development programs to capture niche markets. Besides, in July 2024, Bioserve India announced the introduction of its innovative stem cell products in India, with the ultimate objective to support advancement in drug development and scientific research, thus making it suitable for uplifting the stem cell assay market globally.

Corporate Landscape of the Stem Cell Assay Market:

Recent Developments

- In January 2026, Syngene International declared the expansion of its long-lasting tactical collaboration with Bristol Myers Squibb till 2035. This expansion deal is poised to broaden the scope of integrated services across the drug development procedure, along with translational sciences, pharmaceutical development, and clinical trials.

- In January 2026, Axol Bioscience Ltd. notified that it has successfully gained USD 2.8 million in funding, which has been led by life sciences specialist, BoradOak Capital Partners in the U.S.

- In May 2025, REPROCELL has launched StemEdit Human iPSC non-HLA class ½ (B2M/CIITA Homo double KO) as well as StemEdit Human iPSC non-HLA class 1 (B2M Homo KO) cell lines for research utilization, which has been derived from temRNA Clinical induced pluripotent stem cells (iPSCs).

- Report ID: 8361

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stem Cell Assay Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.