Steam Turbine MRO Market Outlook:

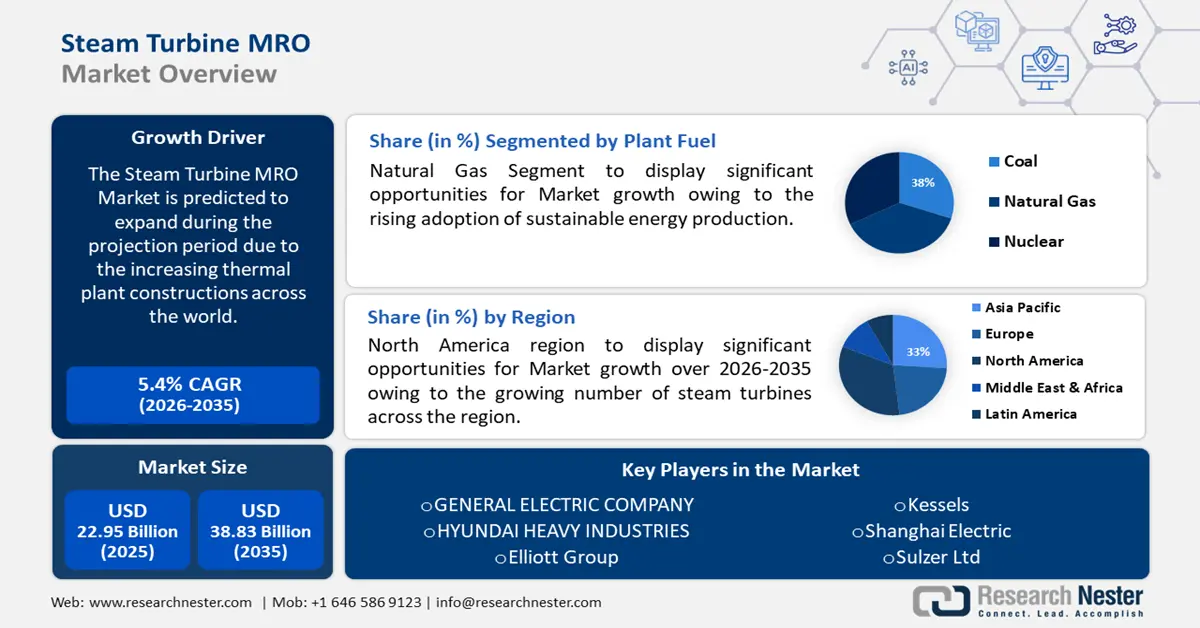

Steam Turbine MRO Market size was valued at USD 22.95 billion in 2025 and is likely to cross USD 38.83 billion by 2035, registering more than 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam turbine MRO is estimated at USD 24.07 billion.

Steam and gas-fired turbomachinery technologies have gained major traction owing to their ability to withstand harsh environmental conditions. Steam and gas-fired turbines are established energy technologies that constitute 80% of the total U.S. electricity production today, of which combined-cycle gas turbines (CCGT) contribute 34%. Combined or cogeneration heat and power (CHP) plants also have a pivotal role to play in heat generation for heavy-duty industries. Typically, CHP systems have energy efficiencies of 60-80%. Presently, R&D efforts are being undertaken to develop components that can withstand environmental stressors such as high temperatures, dust, acidic and corrosive chemicals, irradiation, hydrogen exposure, mechanical stresses, and particulate-laden fluids.

The steam turbine MRO market supply chain comprises primary raw materials including steel alloys, steel, and nickel alloys. The global trade dynamics of these materials shape the steam turbine MRO industry landscape. The world trade value of powder, alloy steel was USD 840 million in 2022, with Japan (USD 185 million) being the top exporter and China (USD 129 million) the top importer. ASEAN steel imports remained elevated in 2023 and stood at 50 MMT. Looking at the country-wise breakdown, Thailand’s imports were 14.7 MMT, Vietnam's was 12.3 MMT, and Indonesia's was 13.3 MMT respectively. Japan’s steel exports were stable in 2023 and registered a modest rise in imports despite weak demand. Furthermore, a strong decline in flat products exports to China was observed (-32% annual vs 2022) and this was compensated by a significant spike in exports to Korea (+30.7%), and Türkiye (+5.5%).

The United States was the second-largest importer of steel in the world in 2023, according to the International Trade Administration (ITA). The United States imported 25.6 MMT of steel in 2023, a decline of 8.7% from 2022's 28.0 million metric tons. In 2023, the country imported steel from 79 nations and territories. The comparative yearly analysis of the U.S. production, imports, and the leading five producers are mentioned below.

U.S. Overall Production and Import Penetration

|

|

2020 |

2021 |

2022 |

2023 |

|

Production Volume |

72.7M |

85.8M |

80.5M |

81.4M |

|

Apparent Consumption |

86.6M |

106.8M |

100.9M |

98.8M |

|

Import Volume |

20.0M |

28.6M |

28.0M |

25.6M |

|

Import Penetration |

23.10% |

26.74% |

27.76% |

25.90% |

Source: ITA

U.S. Top Producers in 2023

|

Rank |

Company |

Production (MMT) |

Key Products |

|

1 |

Nucor |

17.40 |

Bars, sheets, beams, plate |

|

2 |

Cleveland Cliffs |

13.30 |

Hot-rolled, cold-rolled, stainless, electrical, plate, tinplate, long, and tubul |

|

3 |

US Steel Corp. |

12.40 |

Hot-rolled, cold-rolled, coated sheets, tubular products |

|

4 |

Steel Dynamics |

9.60 |

Flat-rolled, structural, bars, rails |

|

5 |

Commercial Metals Company |

4.10 |

Rebar, bars, sections, billets |

Source: ITA

Steam turbines thermodynamically reach an isentropic efficiency of 20-70%, which equates to low electricity generation costs. Moreover, backpressure turbines offer electricity production at often lower than USD 0.04/kWh. Apart from electricity savings, criteria pollutant reduction and ancillary benefits from onsite electricity recover the initial capital outlay. Back-pressure turbogenerator’s capital expenditure complete with electrical switchgear ranges from USD 900 kW for a small system to less than USD 200/kW for a larger system with capacity over 2,000 kW. Despite the recoup of capex, MRO holds potential opportunities as a result of rapid expansion of industrial processes and the adoption of steam turbines.

A steam turbine has several moving components, such as rotors, discs, blades, pins, and shrouds; stationary components, such as blades, nozzles, and vanes; and additional components, such as seals, pedestals, casings, and hoods. They are made from a variety of metals. These consist of titanium alloys, cobalt alloys, nickel superalloys, carbon steels, stainless steels, and alloy steels. Over time, fatigue breakdowns result from the spinning parts' exposure to strong centrifugal forces, cyclical loads, and temperature variations. Additional significant issues with steam turbines include pitting, flow-accelerated corrosion, corrosion fatigue of blades, and stress corrosion cracking of rotors and discs.

Design considerations and corrosion control techniques can reduce (but not completely eliminate) the many corrosion mechanisms that are active in steam turbines. These processes include leaching, galvanic, fretting, intergranular assault, erosion, and crevices. Steam impurity levels, pH control, flow, and velocity management are significant elements that contribute to the environment's corrosiveness. According to EPRI, steam turbine corrosion costs the US economy more than USD 1 billion a year, thereby fueling the steam turbine MRO market.

Key Steam Turbine MRO Market Insights Summary:

Regional Highlights:

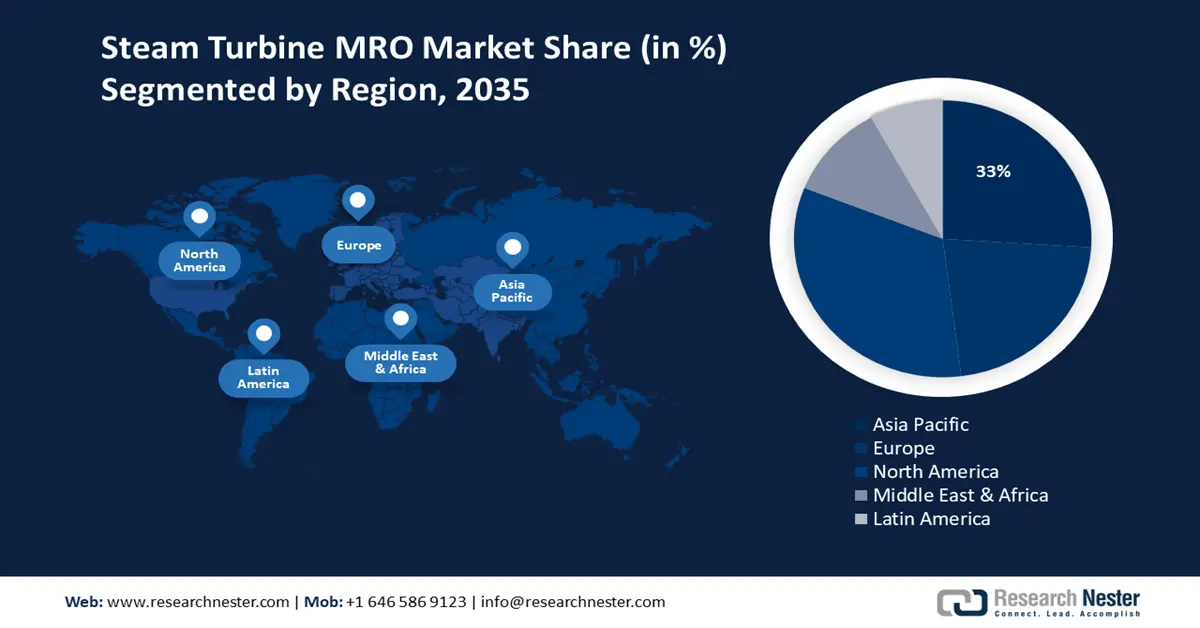

- North America steam turbine MRO market will hold around 33% share by 2035, driven by the increasing use of steam turbines in combined heat and power systems, boosting electricity generation efficiency.

- Europe market will register significant growth during the forecast timeline, driven by the rising upgradation of systems to enhance power energy capacity and turbine performance.

Segment Insights:

- The original equipment manufacturers segment in the steam turbine mro market is expected to capture a 46% share by 2035, driven by long-term agreements between OEMs and power producers.

- The natural gas segment in the steam turbine MRO market is expected to secure a 38% share by 2035, driven by the rising adoption of sustainable power generation using natural gas turbines.

Key Growth Trends:

- Steam turbine for rotating equipment drives MRO costs and energy savings

- Technological developments for potential efficiency gains

Major Challenges:

- Increasing use of solar energy for the generation of power

- Skilled labor shortages

Key Players: GENERAL ELECTRIC COMPANY, HYUNDAI HEAVY INDUSTRIES TURBOMACHINERY Co., Ltd., Mitsubishi Power, Ltd., Ansaldo Energia S.p.A., Elliott Group, Kessels, Shanghai Electric, Stork Technical Services Holding B.V., Sulzer Ltd, Siemens AG.

Global Steam Turbine MRO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.95 billion

- 2026 Market Size: USD 24.07 billion

- Projected Market Size: USD 38.83 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Steam Turbine MRO Market Growth Drivers and Challenges:

Growth Drivers

- Steam turbine for rotating equipment drives MRO costs and energy savings: Steam turbines are prime movers for driving air compressors, forced or induced-draft fans, boiler feedwater pumps, blowers, and other rotating equipment. A 300-hp steam turbine, as per DOE estimates, has a43% isentropic efficiency of 43% and a steam rate of 26 lb/hp-hr as a result of the introduction of 600-pounds-per-square-inch-gauge (psig)/750°F steam for a 40-psig/486°F exhaust. Given the natural gas price of USD 8.00/MMBtu and an 80% boiler efficiency, the steam turbine operation cost is USD 8.00/hr. A 300-hp motor with a full-load efficiency of 95% would require energy of 235.6 kWh/hr and a steam turbine drive can save costs when electricity price exceeds 3.4 cents/kWh.

A facility's energy costs and feedwater pump annual operational hours have a significant impact on the overall annual energy savings. The table below shows the annual energy savings for different electrical rates and pump maintenance, repair, and operation schedules. Steam turbine maintenance costs should be compared to electric motor maintenance costs in addition to operational cost savings.

Annual Energy Savings when Using a Steam Turbine Feedwater Pump Drive*, (Costs in USD)

|

Electricity Costs, $/kWh |

Feedwater Pump Annual Operating Hours |

||||

|

2,000 |

4,000 |

6,000 |

7,000 |

8,760 |

|

|

0.04 |

2,830 |

5,650 |

8,480 |

9,900 |

12,380 |

|

0.05 |

7,540 |

15,080 |

22,620 |

26,390 |

33,020 |

|

0.075 |

19,320 |

38,640 |

55,960 |

67,620 |

84,620 |

*Savings are based upon operation of a 300-hp steam turbine drive with a steam rate of 26 lb/hp-hr. A natural gas cost of $8.00/MMBtu is assumed.

Source: U.S. DOE

- Technological developments for potential efficiency gains: Multiple design, technological integration, and operation and maintenance (O&M) factors influence the efficacy of stationary combustion turbine electric generating units (EGU) including steam turbines.

Comparison Of Various Turbine Technological Upgrades

|

Combustion Turbine Upgrade Option |

MW Increase (%) |

Heat Rate Impact (%) |

Capital Cost ($/kW) |

|

Comprehensive Upgrade |

10-20 |

1-5 |

150-250 |

|

High-Flow Inlet Guide Vanes |

4.5 |

1 |

<100 |

|

Hot Section Coatings |

5-15 |

0.5-1 |

50-100 |

|

Compressor Coatings |

0.5-3 |

0.5-3 |

50 |

|

Inlet-Air Fogging |

5-15 |

1-5 |

50-100 |

|

Supercharging Plus Fogging |

15-20 |

4 |

200 |

Source: EPA

Maintenance and repair of heat recovery steam generator (HRSG) components affects turbine performance. Contaminants such as ammonium bisulfate can accumulate in the HRSG and lead to pressure losses. According to the 2023 EPA report, GE removed 14 tons of debris, reducing the turbine back pressure by 8 inches in the water column and annual fuel savings netted the at USD 500,000. Similarly, condensers require regular maintenance and repair to ensure optimized performance. Turbine overhauls of USD 2 to USD 12 million for 200-MW steam turbines can render heat rate improvements of up to 300 Btu/kWh. Furthermore, correct O&M practices have the potential to limit heat rates by 30-70 Btu/kWh, which is about 0.7% of the steam cycle. Feed pump repair and retrofits enhance steam cycle heat rates by 0.25-0.5% for costs of USD 250,000 to USD 350,000.

Challenges

- Increasing use of solar energy for the generation of power: The high investment in solar energy owing to the increasing adoption of natural energy sources is estimated to hamper the steam turbine MRO market growth and pose a threat of substitution. The rising installations of solar power plants in many residential and commercial buildings are hindering market growth in the coming years.

- Skilled labor shortages: The MRO sector is experiencing a dearth of qualified technicians and engineers proficient in-stream turbine maintenance. This shortage can lead to increased labor costs and potential delays in maintenance schedules, affecting overall operational efficiency.

Steam Turbine MRO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 22.95 billion |

|

Forecast Year Market Size (2035) |

USD 38.83 billion |

|

Regional Scope |

|

Steam Turbine MRO Market Segmentation:

Plant Fuel Segment Analysis

The natural gas segment is estimated to gain the largest steam turbine MRO market share of about 38% by 2035, owing to the rising adoption of sustainable power generation. The adoption of natural gas turbines for water heating in industries is propelling the segment's expansion. The rising oil and gas industry is estimated to increase the use of small steam turbines is another factor driving growth.

Service Provider Segment Analysis

The original equipment manufacturers (OEM) segment in steam turbine MRO market is expected to garner a significant share of around 46% during the projected timeline. The segment proliferation is attributed to the long-term agreements between OEMs and power producers. The availability and use of original parts for a good value are projected to positively impact the segment growth. According to an April 2022 report by the U.S. DOE Office of Scientific and Technical Information (OSTI), OEMs such as GE, along with service providers are upgrading last stage buckets (LSBs) and packing rings with traditional manufacturing methods.

The proposed additive manufacturing (AM)-based repair is estimated to benefit steam turbine plant operators. In a typical outage steam turbine centralized power plants lose USD 150,000-USD 500,000 daily. Often, maintenance outages last 4-8 weeks. This has led to an emergent need for LSB upgrades, offering significant financial benefits to plant operators and allowing them to repair affected parts. Moreover, swapping the existing nonaffected or affected parts for higher-efficiency alternatives to upgrade overhaul in the outage window, improves maintenance and operational efficiencies.

Our in-depth analysis of the global steam turbine MRO market includes the following segments:

|

Plant Fuel |

|

|

Capacity |

|

|

Service Provider |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Turbine MRO Market Regional Analysis:

North America Market Insights

North America steam turbine MRO market is expected to account for the largest revenue share of 33% by 2035. The growing applications in combined heat and power systems are also estimated to propel the market growth. The increasing use of steam turbines is attributed to the fact that the by-product of steam turbines generates electricity which increases the efficiency and benefits high electricity consumption of the region thereby it is estimated to propel the steam turbine MRO market growth during the forecast period. The worldwide steam turbine trade was USD 3.62 billion and was the 637th most traded item of 1218 products. The U.S. was among the top five exporters, with a worth of USD 322 million, and accounted for 9.16% of all exports. In terms of import value, Canada held a value of USD 86.4 million (2.38% share) and the U.S. was at USD 211 million inbound trade (5.81% share).

The steam turbine MRO market in the U.S. is driven by the high electricity consumption in residential and commercial sectors. As of 4th February 2025, the hourly U.S. demand was 410,326 mega watthours (MWh), according to the EIA. Electricity demand for end users including data centers has exhibited a staggering rate, reaching 176 TWh in 2023, contributing to 4.4% of the overall electricity consumption. GPU-accelerated servers in the country, if estimated to be operating at 50% capacity, will generate roughly 580 TWh in 2028 for data center operations. This represents a forecasted 6.7% to 12.0% of electricity consumption in 2028. The hourly demand for electricity in Connecticut on 29th January 2025 was 3,741 MWh, 1,647 MWh in Maine, 1,628 MWh in New Hampshire, 3,211 MW in Northeast Massachusetts, 1,045 MW Rhode Island, 1,903 Southeast Massachusetts, and 2,171 Western/Central Massachusetts.

Europe Market Insights

Europe region is likely to register significant growth till 2035, attributed majorly to the rising upgradation of systems to enhance power energy capacity, and the performance of turbines in the region is estimated to positively influence the steam turbine MRO market. Germany and Italy emerged as the top exporters of steam turbines with trade values of USD 516 million and USD 222 million in 2022. The United Kingdom was among the top five importers with an inbound worth of USD 183 million in 2022, finds OEC.

In October 2024, the UK produced 23.4 TWh of net electricity, a 1.2% year-over-year increase over the same month, of the previous year. Of the total electricity mix, 51.3% came from renewable sources, and 36.2% came from fossil fuels. Gas continued to be the main fossil fuel, accounting for 34.5% of the total electricity mix. As the final coal-fired power plant closed in the fall of 2024, coal's contribution fell to zero.

UK Net Electricity Production, Trade, Usage, & Loss, in October 2024 (GWh)

|

Product |

Value (in GWh) |

|

Electricity |

23350.0795 |

|

Nuclear |

2917.9964 |

|

Hydro |

528.643 |

|

Total Combustible Fuels |

12171.15 |

|

Coal, Peat, and Manufactured Gases |

10.7661 |

|

Oil and Petroleum Products |

98.5727 |

|

Natural Gas |

8058.803 |

|

Combustible Renewables |

3719.975 |

|

Other Combustible Non-Renewables |

283.0326 |

|

Solar |

681.9569 |

|

Other Renewables |

0.9342 |

|

Total Renewables (Hydro, Geo, Solar, Wind, Other) |

11980.91 |

|

Total Imports |

3130.749 |

|

Total Exports |

610.26 |

|

Used for pumped storage |

199.0015 |

|

Distribution Losses |

2556.154 |

|

Final Consumption (Calculated) |

23115.41 |

Source: IEA

Steam Turbine MRO Market Players:

- GENERAL ELECTRIC COMPANY

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HYUNDAI HEAVY INDUSTRIES TURBOMACHINERY Co., Ltd.

- Mitsubishi Power, Ltd.

- Ansaldo Energia S.p.A.

- Elliott Group

- Kessels

- Shanghai Electric

- Stork Technical Services Holding B.V.

- Sulzer Ltd

- Siemens A

The steam turbine MRO market players are capitalizing on the O&M demand by strategically engaging in collaborations, mergers and acquisitions, development of new manufacturing facilities, and product launches. Furthermore, the high adoption rate in heavy-duty industries showcases promising opportunities for the companies operating in the steam turbine MRO market. Some of them include:

Recent Developments

- In September 2024, Mitsubishi Power completed constructing the eighth and final M701JAC unit of a 5,300MW natural gas-fired power plant project in Thailand.

- In August 2024, Mitsubishi Power received an order from Samsung C&T Corporation Saudi Arabia for providing its M501JAC combined-cycle (CCGT) hydrogen-ready gas turbine for a new industrial steam and electricity cogeneration plant project in Saudi Arabia.

- In April 2024, under EU State aid rules, the European Commission announced the approval of USD 1.03 billion in Greek measures intending to support two projects for the generation and storage of renewable energy in Greece contributing to achieving the objectives of the European Green Deal and 'Fit for 55' package, by enabling the integration of renewable energy sources in the Greek electricity system.

- Report ID: 3326

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Turbine MRO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.