Steam Autoclaves Market Outlook:

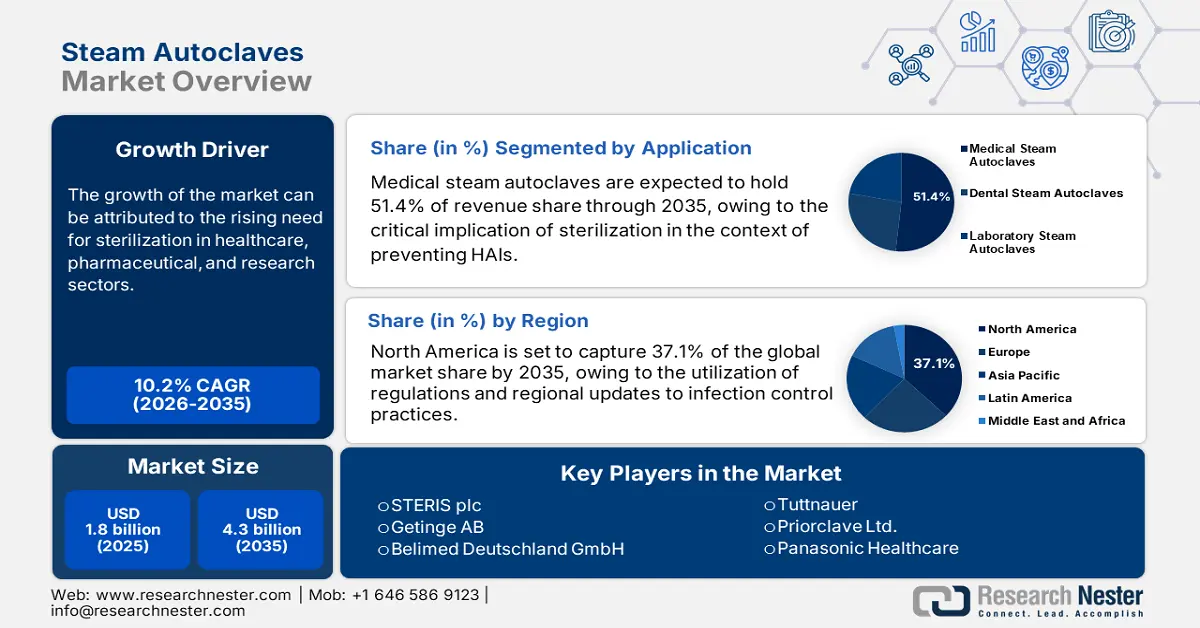

Steam Autoclaves Market size was valued at USD 1.8 billion in 2025 and is projected to reach USD 4.3 billion by the end of 2035, rising at a CAGR of 10.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of steam autoclaves is evaluated at USD 1.9 billion.

The steam autoclaves market is growing explosively on account of the increasing demand for contamination control solutions across healthcare, pharmaceutical, and food processing industries. As a result, the necessity of sterilization and ensuring product safety became a critical growth factor in this sector. Particularly, the increasing cases and severity of healthcare-associated infections (HAIs) are pushing medical systems to adopt more of these devices. In this regard, the World Health Organization (WHO) revealed that, till 2023, approximately 136 million incidence of antibiotic-resistant HAIs were being recorded worldwide every year. Another 2022 report from the WHO established that 70% of the acquired infections can be prevented through good hygiene practices, where steam autoclaves are a crucial asset.

The payers’ pricing standards and trends in the steam autoclaves market are increasingly being shaped by cost-containment pressures, reimbursement policies, and the total cost of ownership considerations. As government health systems, insurance providers, and large institutional buyers prioritize transparency in equipment pricing, tighter margins, and stricter evaluation of lifecycle costs, manufacturers in this sector are pushed to develop greater value-based models to cope with the evolving financial dynamics. Based on this, in 2022, a comparative cost analysis of single-use sterile (SK) versus reprocessed distal radius volar plate sets (RS) was published by the NLM, which underscored that the average cost of sterilization for each surgery stood at USD 39.0 for RS, which was more cost-effective than SK.

Key Steam Autoclaves Market Insights Summary:

Regional Insights:

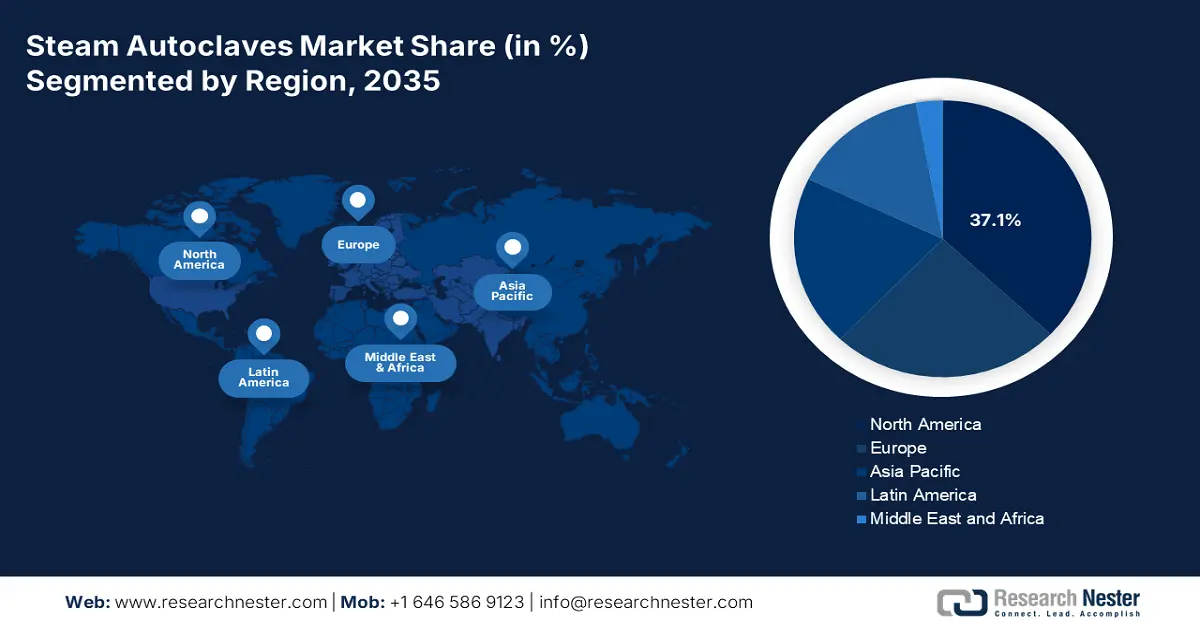

- North America is projected to hold a 37.1% share by 2035, driven by the high utilization of steam autoclaves to meet world-class infection control standards.

- Asia Pacific is expected to grow at the fastest rate by 2035, owing to rising surgical volumes, modernizing medical infrastructure, and expanding infection prevention initiatives.

Segment Insights:

- Medical segment is projected to account for 51.4% share by 2035, propelled by the critical role of sterilization in preventing HAIs.

- Vertical autoclaves are expected to capture the largest share by 2035, owing to their flexibility, cost-efficiency, and suitability for small-scale laboratory and clinical operations.

Key Growth Trends

- Push from governments and regulatory bodies

- Wide use in the pharma and biotech industries

Major Challenges:

- High initial and operating costs of adoption

- Restricted financial backing in emerging markets

Key Players: STERIS plc,Getinge AB,Advanced Sterilization Products (ASP),MELAG Medizintechnik GmbH & Co. KG,Tuttnauer,Belimed AG (Metall Zug Group),Systec GmbH,SHINVA Medical Instrument Co., Ltd.,Matachana Group,3M Company,SANYO Electric Co., Ltd. (Panasonic),Cardinal Health, Inc.,Astell Scientific,PRIMUS Sterilizer Company LLC,ICOS Pharma Group,Cisa Group,Shin Ho Sterilizer Co., Ltd.,Perlong Medical Equipment Co., Ltd.,LTE Scientific Ltd.,MTX Healthcare

Global Steam Autoclaves Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 1.8 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 4.3 billion

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Italy, Japan, France

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 26 September, 2025

Steam Autoclaves Market - Growth Drivers and Challenges

Growth Drivers

- Push from governments and regulatory bodies: Infection control and prevention protocols and strict hygiene standards necessitate consistent sterilization in associated industries. As a result, certified systems available in the market are gaining momentum in procurement as they help meet such compliance benchmarks while optimizing the whole process. On the other hand, failure to comply leads to penalties, product recalls, and legal liability. Thus, related entities are forced to adopt these devices to prevent such financial and reputational losses. This consumer base can be traced through the stable expansion of the global sterile medical packaging industry.

- Wide use in the pharma and biotech industries: Pharmaceutical and biotechnology industries heavily rely on sterile production environments for drug manufacturing, research, and quality assurance. This indicates an extended field of applications for the steam autoclaves market in these categories. Specifically, the wide usage in sterilizing lab glassware, culture media, and processing equipment is bolstering, as the global trade value of these industries grows. This can be exemplified by 572,401 single-use FDA-cleared medical devices that are commercially available and are subject to steam sterilization processes, as of April 3, 2022, according to the American Journal of Infection Control.

- Improvements in features and cost-effectiveness: Recently developed devices that are compact, energy-efficient, user-friendly, and ecologically sustainable are earning greater consumer engagement in the market. Advanced tools feature touchscreen interfaces, programmable cycles, and remote monitoring, while offering optimized water and steam usage to reduce operational costs and environmental impact. For instance, in July 2024, Midmark launched its next-generation steam sterilizers, M9 and M11, which offer an intuitive user interface, streamlined compliance recordkeeping, enhanced durability, reduced cost of ownership, unique preset cycles, and an option of autofill + auto-drain.

Overview of Payers’ Pricing Dynamics for the Target Demography in the Steam Autoclaves Market

Sterilization Cost of Reprocessed Kits in Surgical Centers (2022)

|

Item |

Estimated cost per tray |

|

Steam indicators |

USD 0.09 |

|

Tray wrap |

USD 1.99 |

|

Washer Cycle |

USD 3.29 |

|

Sterilizer Cycle |

USD 4.51 |

|

Labor |

USD 25/hour |

|

Total |

USD 39.02/tray |

Analysis of Demographic Trends in Key Landscapes of the Steam Autoclaves Market

Recent Statistics of Long-term Care (LTC)-related HAIs in the U.S. (2015-2023)

|

Year |

Number of HAI Cases |

Overall Infection Rate (per 1,000 resident days) |

|

2015 |

31,572 |

1.1 |

|

2016 |

27,420 |

0.9 |

|

2017 |

30,361 |

1.0 |

|

2018 |

30,800 |

1.1 |

|

2019 |

28,256 |

1.0 |

|

2020 |

26,089 |

1.0 |

|

2021 |

17,844 |

0.7 |

|

2022 |

20,812 |

0.8 |

|

2023 |

23,540 |

0.9 |

Source: The Pennsylvania Patient Safety Reporting System (PA-PSRS)

Challenges

- High initial and operating costs of adoption: Steam autoclaves are expensive, and this has a significant detrimental effect on small health facilities, especially in developing regions. The World Health Organization (WHO) has indicated that 40% of medical equipment is never used in low-income countries because of overly high costs of procurement and subsequent operating costs. This is a disadvantage for government-funded hospitals facing budgetary constraints in adopting the technology.

- Restricted financial backing in emerging markets: In many emerging markets, government-sponsored healthcare funding is often flat, and since government budgets for healthcare typically prioritize basic infrastructure for health systems over high-cost sterilization equipment, the remaining budgets become so thin in this space further limiting the adoption in public hospitals serving low-income patients requiring sterilization equipment, since they may have to make out-of-pocket payments that may be prohibitive in cost. For example, in 2024, STERIS worked with state health agencies in the United States to subsidize the costs for autoclave installations.

Steam Autoclaves Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.3 billion |

|

Regional Scope |

|

Steam Autoclaves Market Segmentation:

Application Segment Analysis

The medical segment is poised to dominate the market with a share of 51.4% by the end of 2035. The leadership is a result of the critical implications of sterilization in the context of preventing HAIs, which exhibits a substantial demographic across the globe. The importance and economic significance of this category can further be displayed through the USD 59.9 million allocation to build an East Coast sterilization facility in Burlington by SteriTek. This contained the potential to generate a USD 2.6 million value for North America in terms of annual payroll impact of the new positions employed by the new construction. Moreover, the tightening of regulations from the FDA and the WHO requires sterile surgical instruments, solidifying the segment’s position in this sector.

Product Segment Analysis

Vertical autoclaves are expected to capture the largest share in the market over the assessed period. The dominance is primarily attributable to its ability to offer greater flexibility and functionality during its use in laboratories, small clinics, and research facilities. This also makes the devices ideal for sterilizing small batches of instruments, glassware, and media, making them a gold standard for resource and space-constrained facilities. Furthermore, their ease of operation, lower cost compared to horizontal models, and efficient performance also contribute to their popularity, especially in emerging economies.

End user Segment Analysis

The hospitals & clinics segment is predicted to account for the highest share of 49.5% in the market throughout the discussed timeframe. The elevated sterilization volumes associated with surgical procedures and infection management are the major growth factors in this segment. The growing urge can be justified by the 2022 WHO report on global infection prevention and control, which unveiled that every 7 and 15 out of 100 patients admitted in acute-care hospitals in high-income countries (HICs) and low- and middle-income countries (LMICs) acquire at least one HAI, with 1 in every 10 of these individuals facing death.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Technology |

|

|

Capacity |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Autoclaves Market - Regional Analysis

North America Market Insights

North America is estimated to maintain dominance over the steam autoclaves market by capturing the largest share of 37.1% during the analyzed tenure. High utilization rate of these devices to align with world-class infection control practices and healthcare quality is the primary factor consolidating the region’s forefront position in this sector. Besides, efforts from both public and private organizations to cultivate a greater supply chain of resources to support this cohort are also contributing to the sector’s expansion in North America. As evidence, in May 2024, Crothall Healthcare allied with Ascendco Health to bring a new era for instrument tracking and overall sterile processing quality within healthcare facilities across the U.S. marketplace.

According to a report from the OEC, the U.S. ranked among the top global traders of medical, surgical or laboratory sterilizers in 2023, accounting for USD 145 million and USD 155 million export and import values. This portrays the well-balanced and potentially profitable commercial dynamics of the country in the market, attracting more investors to engage their resources. On the other hand, the U.S. is home to several pioneers in this category, which reflects the presence of a pre-established business atmosphere for new entrants and innovators capitalizing on this field.

The robust infrastructural upgrades in hospitals across Canada are fostering a scope of continuous revenue generation for the steam autoclaves market. Besides, intra-region and cross-border collaboration around medical device certification through Health Canada is also supporting growth and reducing lead time for these tools. This is further allowing manufacturers to deploy systems in a majority of medical settings at a faster pace. The country is also seeing increased public-private investments that are aimed to build centralized sterilization services (CSS), especially in underserved rural areas, expanding the territory of the merchandise in Canada.

APAC Market Insights

The steam autoclave market in the Asia Pacific region is poised to boom at the fastest rate by the end of 2035. The pace of growth in the region is attributed to the amplifying surgical volumes, the unmet needs of infection prevention and control practices, and the rapid modernization of medical infrastructures. Besides, assigned medical services for the aging population that prioritize safety regulations over cost also prompt the deployment of more of this sterilization equipment. Moreover, continuous government spending on steam autoclaves to enable maximum patient safety in hospitals is contributing to market expansion in Asia Pacific.

The increasing volume of patients requiring sterilization-based forms of treatment is making China a prominent consumer base for the steam autoclaves market. Meanwhile, the governing authorities in the country are concentrating their focus on building smart hospitals and the integration of data-driven clinical practices, which is streamlining the inclusion of automatic sterilization systems. On the other hand, the country’s strong emphasis on medical device production and supply also supports greater outcomes from business operations in this category. This can be testified by the 2023 OEC report, positioning China as the 2nd leading exporter of medical, surgical or laboratory sterilizers in the world with a USD 155 million value.

India is emerging as one of the fastest‑growing landscapes in the APAC market, which is backed by the heightened incidences and mortality rates of HAIs. This is pushing hospitals, clinics, and diagnostic labs across the country to adopt such advanced sterilization tools that can deliver workflow efficiency while lowering carbon footprints. Vertical autoclaves are currently the most used subtype in India, while compact table‑top models are witnessing a steady increase in deployment, especially in smaller clinics and outpatient settings.

Country-wise Trading Data for Medical, Surgical, or Laboratory Sterilizers (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Australia |

34.1 million |

26.5 million |

|

Japan |

21.9 million |

49.3 million |

|

Korea Rep. |

21.3 million |

16.5 million |

|

India |

7.8 million |

31.1 million |

|

Thailand |

1.0 million |

13.2 million |

|

Indonesia |

38.8 thousand |

18.2 million |

|

Philippines |

25.5 thousand |

5.4 million |

Source: WITS

Europe Market Insights

Europe is expected to hold a notable share in the steam autoclaves market over the timeline between 2026 and 2035. The well-established healthcare infrastructure, strict regulatory standards, and strong manufacturing capabilities are the major growth factors behind the region’s persistent performance in this field. This can be evidenced by the 2023 OEC report, which positioned Italy as a leader in worldwide exports of medical, surgical or laboratory sterilizers, with USD 193 million worth of shipments. On the demand side, Germany and Russia were the top importers, with imports of USD 52.3 million and USD 48.7 million, respectively.

The UK features a growing emphasis on infection control, particularly in hospitals and research labs, which continues to fuel demand in the market. Besides, ongoing technological innovation and sustainable equipment development are further reinforcing the country's position as both a major consumer and innovator in this field. In this regard, a 2023 government-led survey revealed that the occurrence of HAIs was 15.9% among patients admitted in intensive care units (ICUs). However, only 1% increase in overall figures was detected across the UK since 2016.

Germany is one of the leading landscapes in the Europe steam autoclaves market, which is accomplished through massive support from its robust national medical system and Medtech industry. The government is also contributing to the massive surge in this sector from hospitals and research laboratories, with a greater focus on infection control. On the other hand, Germany is a global hub of precision manufacturing for both medical devices and pharmaceutical products, solidifying its role as a key supplier and consumer base for sterilization equipment within Europe.

Country-wise Trading Data for Medical, Surgical, or Laboratory Sterilizers (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Poland |

59.0 million |

14.1 million |

|

Sweden |

54.0 million |

6.1 million |

|

Spain |

47.1 million |

18.4 million |

|

Switzerland |

34.6 million |

22.2 million |

|

Finland |

31.1 million |

5.0 million |

|

Netherlands |

30.8 million |

28.0 million |

|

Turkey |

24.0 million |

14.9 million |

|

Denmark |

20.2 million |

6.4 million |

|

France |

18.0 million |

48.9 million |

Source: WITS

Key Steam Autoclaves Market Players:

- STERIS plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Getinge AB

- Advanced Sterilization Products (ASP)

- MELAG Medizintechnik GmbH & Co. KG

- Tuttnauer

- Belimed AG (Metall Zug Group)

- Systec GmbH

- SHINVA Medical Instrument Co., Ltd.

- Matachana Group

- 3M Company

- SANYO Electric Co., Ltd. (Panasonic)

- Cardinal Health, Inc.

- Astell Scientific

- PRIMUS Sterilizer Company LLC

- ICOS Pharma Group

- Cisa Group

- Shin Ho Sterilizer Co., Ltd.

- Perlong Medical Equipment Co., Ltd.

- LTE Scientific Ltd.

- MTX Healthcare

The steam autoclave market is largely controlled by the leading companies, STERIS, Getinge, and Belimed, undertaking actions to bolster market presence, such as mergers, acquisitions, and partnerships. For instance, the scientific company Priorclave launched their BASE range in 2021 to assist with weeding out niche needs in laboratories and assist with Exports from the UK. Moreover, new entrants will continue to emerge, such as Accumax India and CELITRON, with affordable solutions to gain access to developing markets or to watch for holes in existing markets. Sustainability is also a new trend emerging to drive innovation

Here is a list of key players operating in the market:

Recent Developments

- In August 2025, ASP introduced the fastest FDA-cleared steam biological indicator system, BIOTRACE, for U.S.-based sterile processing departments. It can deliver a readout in just seven seconds, drastically reducing wait time, minimizing errors, and enhancing clinical workflow efficiency.

- In May 2025, Matachana launched a new device, S1000 STEAM STERILIZER, which is designed to redefine hospital sector standards. This was a step forward for the company towards efficiency, sustainability, and safety by featuring maximized ergonomics, automatic loading, faster connectivity, and greater durability.

- Report ID: 3845

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Autoclaves Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.