Terminal Sterilization Market Outlook:

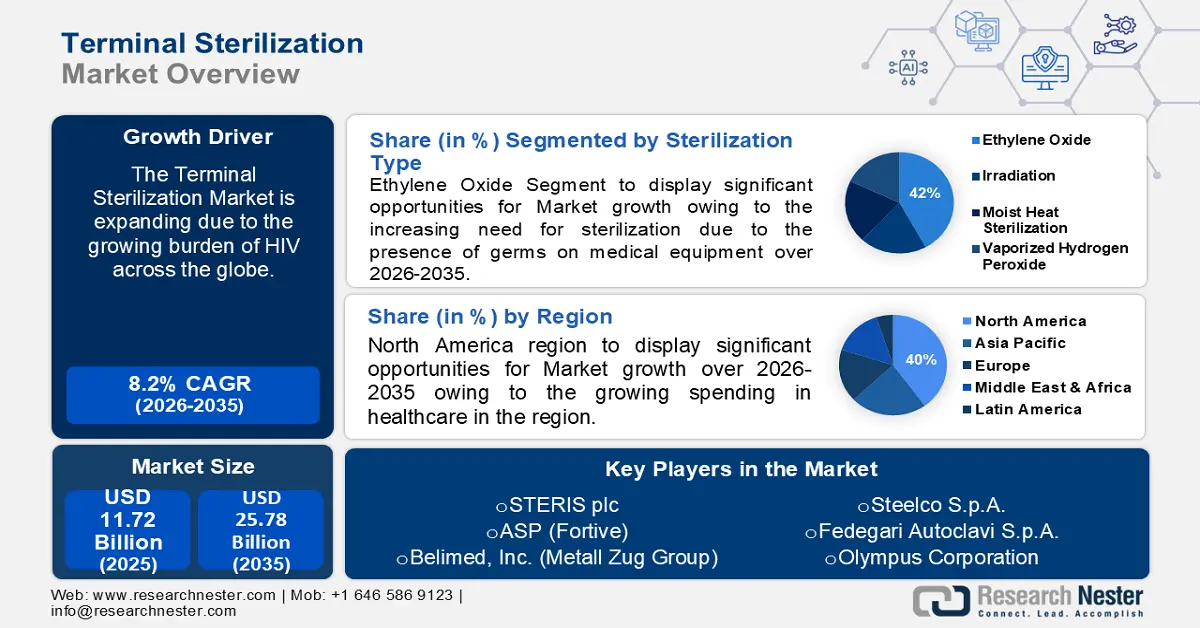

Terminal Sterilization Market size was over USD 11.72 billion in 2025 and is projected to reach USD 25.78 billion by 2035, witnessing around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of terminal sterilization is evaluated at USD 12.58 billion.

The market is flourishing as a result of the rising burden of HIV across the globe. One of the most significant health and development issues facing the globe today is HIV, which could potentially lead to greater demand for terminal sterilization methods to ensure the sterility of medical equipment. For instance, in 2022, there were more than 35 million HIV-positive individuals in the world.

In addition to these, factors that are believed to boost the business growth of terminal sterilization market include growing innovation in the sterilization process. For instance, in February 2024, to encourage manufacturers' use of low-temperature vaporized hydrogen peroxide, and improve sterilization process innovation, the FDA recognized several consensus standards on sterilization techniques.

Key Terminal Sterilization Market Insights Summary:

Regional Highlights:

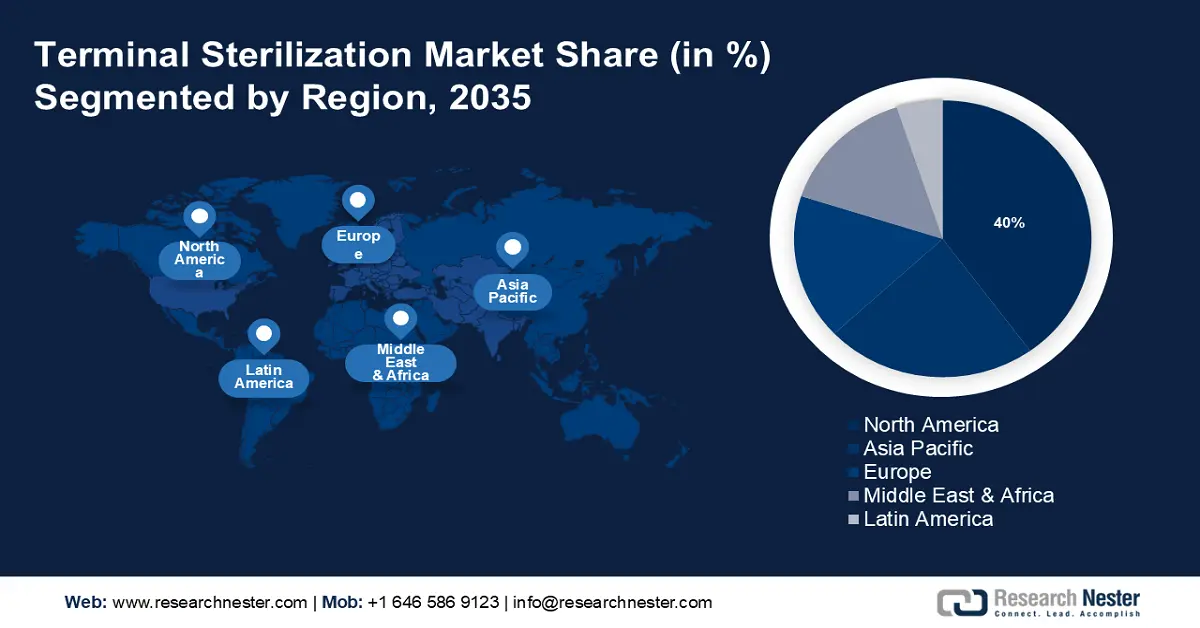

- North America terminal sterilization market will dominate around 40% share by 2035, driven by rising healthcare spending and increasing establishment of medical facilities.

- Asia Pacific market will secure the second largest share by 2035, driven by rising medical tourism, especially in India.

Segment Insights:

- The ethylene oxide segment in the terminal sterilization market is expected to hold a 42% share by 2035, influenced by the increasing necessity for sterilization due to medical equipment contamination.

Key Growth Trends:

- Rising number of surgical procedures

- Growing geriatric population

Major Challenges:

- Requirement of appropriate sterilization method.

- Expensive and time-consuming procedure, which may impact overall production.

Key Players: 3M, STERIS plc, ASP (Fortive), Belimed, Inc. (Metall Zug Group), Sterigenics U.S., LLC - A Sotera Health Company, Fedegari Autoclavi S.p.A., Andersen Sterilizers, Steelco S.p.A.

Global Terminal Sterilization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.72 billion

- 2026 Market Size: USD 12.58 billion

- Projected Market Size: USD 25.78 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Terminal Sterilization Market Growth Drivers and Challenges:

Growth Drivers

- Rising number of surgical procedures - Sterile tissues or objects that come into direct touch with the bloodstream including surgical gloves and tools should be sterilized utilizing terminal sterilization cycles inside stiff sterilization containers, wrappers, or primary packaging to preserve the instruments' sterility and enable them to be preserved for later use. Therefore, a rise in surgical procedures corresponds to an increase in the usage of terminal sterilization. As per estimates, more than 300 million major surgical procedures are carried each annually worldwide.

- Growing geriatric population - Older adults have weakened immune systems which makes them more vulnerable to infections, leading to a higher demand for terminal sterilization to ensure that medical devices are free from viable microorganisms. According to the World Health Organization (WHO), the number of individuals 60 years of age and over will reach 2.1 billion worldwide by 2050.

- Increasing prevalence of chronic-infectious diseases - Terminal sterilization services will become more in demand as a result of the increased prevalence of autoimmune illnesses, cancer, diabetes, and infectious diseases. This is particularly true as the need for terminal sterilization will rise as the prevalence of infectious diseases like bacterial and viral infections rises. For instance, the age-standardized total diabetes prevalence is predicted to rise by over 59% globally between 2021 and 2050.

- Surging need for vaccines - Pharmaceutical infusions and injections are terminally sterilized in an industrial setting using saturated steam at 121 °C to guarantee the absence of microbiological contaminants such as bacteria or fungi when the product is utilized.

Challenges

- Stringent rules and regulations - The manufacturer who manufactures sterile pharmaceutical products using terminal sterilization should adhere to the standards for efficient quality recognized by the FDA, which can be demanding and costly.

- Requirement of appropriate sterilization method - Sterilizing goods in their final container is known as terminal sterilization; however, certain containers run the risk of rupturing, distorting, or becoming unstable while being sterilized at the terminal, which may result in prolonged delays and increased expenses for producers.

- Expensive and time-consuming procedure, which may impact overall production.

Terminal Sterilization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 11.72 billion |

|

Forecast Year Market Size (2035) |

USD 25.78 billion |

|

Regional Scope |

|

Terminal Sterilization Market Segmentation:

Sterilization Type Segment Analysis

The ethylene oxide segment in the terminal sterilization market is estimated to gain a revenue share of about 42% by the year 2035. The increasing necessity for sterilization due to contamination of medical equipment has contributed to the segment's rise. The smallest molecule in the oxirane family is ethylene oxide which manifests as a transparent, colorless gas with a faint, ethereal smell and is mostly employed in the synthesis of other compounds and is also utilized as a sterilizer.

Healthcare facilities utilize ethylene oxide for the terminal sterilization of important goods that are heat- or moisture-sensitive and cannot be steam-sterilized, and this procedure is known to be extremely regulated, safe, and essential for avoiding infections and guaranteeing that patients receive safe procedures and medical care. Products can be sterilized and made completely germ-free with the use of ethylene oxide, or ETO which uses a mix of vacuum, humidity, temperature, and gas.

Moreover, ethylene oxide terminal sterilization is one of the procedures that are most commonly employed in the medical device sector to eliminate living germs from products that are present in many common healthcare items, including curtains and gowns, as well as implantable medical devices, such as heart valves, bare metal stents, and vascular closure devices, as well as items utilized during implantation operations, such as catheters and guidewires.

Additionally, the process of steam sterilization, which uses moist heat to sterilize objects, is quick, easy, and affordable and coagulates and denaturates structural proteins and enzymes, destroying bacteria irreversibly.

Besides this, one well-known technique for sterilizing pharmaceutical items is irradiation which is an economical and safe way to sterilize single-use medical supplies such as surgical gloves and syringes. For instance, nowadays, radiation sterilization is used in the production of more than 45% of disposable medical devices made in wealthy nations.

End-users Segment Analysis

The hospitals segment in the terminal sterilization market is set to garner a notable share shortly. The growth of the segment can be credited to the growing risk of hospital-acquired infection. Healthcare-associated infections (HAI), sometimes referred to as hospital-acquired infections (HAI), brought on by bacterial, fungal, and viral pathogens; bloodstream infections (BSI), pneumonia, urinary tract infections (UTI), and surgical site infections (SSI) are the most prevalent forms that typically occur 48 hours following hospital admission. This has fueled the demand for terminal sterilization to prevent the transmission of infectious agents among patients and healthcare providers.

Our in-depth analysis of the terminal sterilization market includes the following segments:

|

Sterilization Type |

|

|

Technology |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Terminal Sterilization Market Regional Analysis:

North American Market Insights

The terminal sterilization market in North America is slated to hold a share of about 40% by the end of 2035. The sector growth in the region is driven by the growing spending in healthcare. The expense of healthcare is currently rising in the United States, and the nation will likely spend more than USD 6 trillion on healthcare by 2028, making up over 15% of the country's GDP. Particularly, in 2022, US healthcare spending increased by around 4%. As a result, there might be an increasing establishment of healthcare facilities, leading to a greater need for terminal sterilization in the region.

APAC Market Insights

The Asia Pacific region will also encounter substantial growth for the terminal sterilization market during the forecast period and will hold the second position led by the rising rate of medical tourism. India is home to several super specialty hospitals and is more affordable than other countries as a result the country has seen a sharp increase in medical tourism in recent years.

Moreover, India's medical tourism sector has grown significantly, and the country is striving to become the world's top destination for medical tourism. For instance, India is a well-liked medical tourism destination, drawing over a million patients from more than 75 different countries each year.

Terminal Sterilization Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- STERIS plc

- ASP (Fortive)

- Belimed, Inc. (Metall Zug Group)

- Sterigenics U.S., LLC - A Sotera Health Company

- Fedegari Autoclavi S.p.A.

- Andersen Sterilizers

- Steelco S.p.A.

Recent Developments

- 3M announced the introduction of New Sterilization Solutions to enable groups to standardize, streamline, and safely simplify processes, lower the possibility of human error, enhance team productivity, expedite the crucial sterilizing process, standardize operations, and monitor each load to improve the standard of care.

- STERIS plc announced to purchase of surgical instrumentation, laparoscopic instrumentation, and sterilization container assets including V. Mueller, Snowden-Pencer, and Genesis branded products to offer cutting-edge dental, life sciences, and healthcare goods and services, and to enhance, supplement, and broaden its product portfolio.

- Report ID: 5730

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Terminal Sterilization Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.