Sterile Medical Packaging Market Outlook:

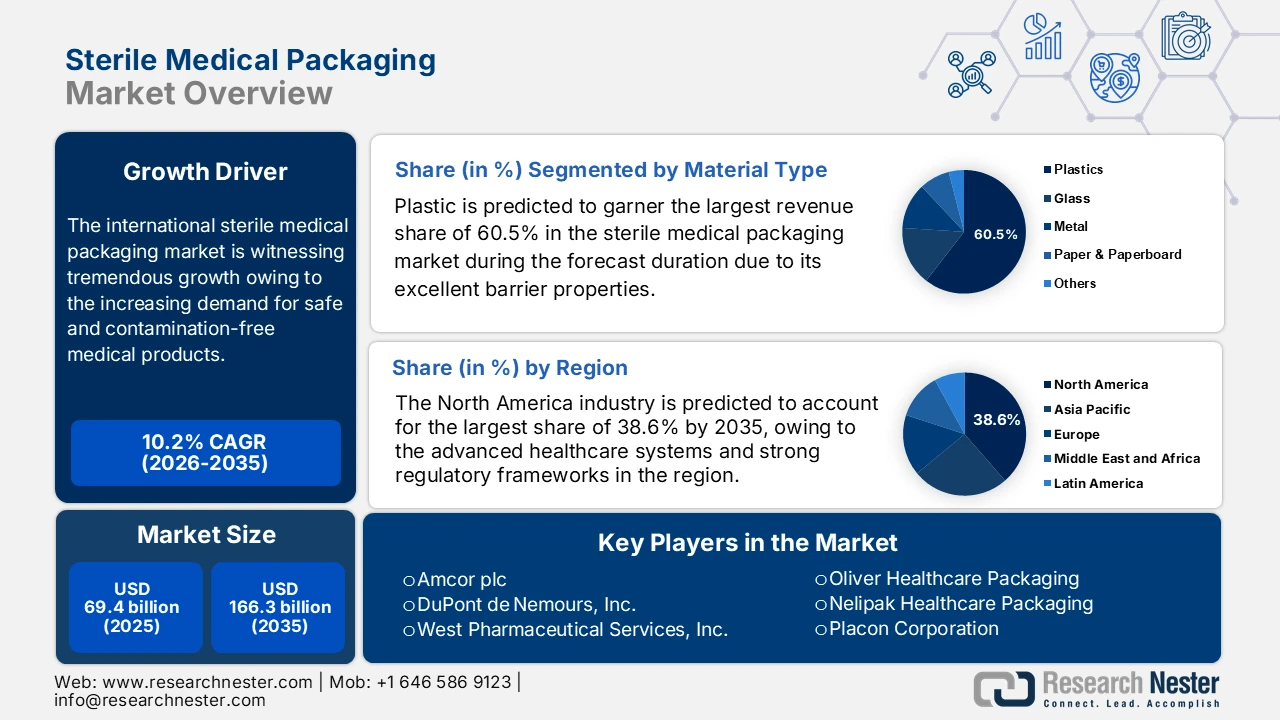

Sterile Medical Packaging Market size was valued at USD 69.4 billion in 2025 and is projected to reach USD 166.3 billion by the end of 2035, rising at a CAGR of 10.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sterile medical packaging is estimated at USD 76.4 billion.

The international sterile medical packaging market is witnessing tremendous growth owing to the increasing demand for safe and contamination-free medical products. Simultaneously, trends such as sustainability, smart packaging, and the integration of tamper-evident and traceability features are shaping the evolution of the market. DuPont, in February 2024, reported that it has launched the Tyvek sustainable healthcare packaging awards program to recognize healthcare and sterile packaging initiatives that demonstrate significant sustainability achievements using Tyvek materials. The company also mentioned that this program is open to medical device and pharmaceutical manufacturers, sterile packaging producers, healthcare facilities, and other stakeholders, with submissions required to show measurable sustainability impact within the prior 18 months. Hence, this supports the company’s broader goals of advancing a circular economy and reducing Scope 3 emissions, positively impacting market growth.

Furthermore, the rising awareness of infection control, coupled with the expansion of healthcare infrastructure and the growing adoption of minimally invasive procedures, is fueling the need for advanced sterile packaging solutions. In July 2025, Demetra announced that it had acquired OrthoFundamentals, LLC, which is a U.S.-based company providing sterile-packed, single-use instrument kits for sacroiliac joint fusion procedures, and launched Demetra Spine, a new global business unit focused on spinal surgery. Besides, this move builds on Demetra’s prior acquisitions of GetSet Surgical and Bespoke Technologies by adding sterile-packed single-use spine procedure kits and 3D-printed titanium implants for ACDF procedures. Hence, the acquisition emphasizes infection control and minimally invasive procedures, thereby supporting outpatient surgical settings with ready-to-use, sterile solutions that reduce infection risk, driving growth in the market.

Key Sterile Medical Packaging Market Insights Summary:

Regional Highlights:

- North America is projected to command a 38.6% revenue share by 2035 in the sterile medical packaging market, underpinned by advanced healthcare infrastructure, robust regulatory oversight, and widespread utilization of sterile-packaged medical devices.

- Asia Pacific is expected to register the fastest expansion through 2035, fueled by rapid capacity expansions, localization of sterile packaging capabilities, and rising demand from pharmaceutical and medical device manufacturers.

Segment Insights:

- In the material type segment, plastic is estimated to secure a 60.5% share by 2035 in the sterile medical packaging market, supported by its superior barrier performance that preserves sterility against microbial contamination and moisture ingress.

- In the product type segment, thermoform trays are set to gain significant traction by 2035, benefitting from their ability to deliver enhanced protection and sterility retention for high-value and complex medical devices.

Key Growth Trends:

- Infection control & patient safety emphasis

- Technological advancements in packaging materials

Major Challenges:

- Rising raw material costs and supply chain volatility

- Regulatory compliance

Key Players: Amcor plc, DuPont de Nemours Inc., West Pharmaceutical Services Inc., Oliver Healthcare Packaging, Nelipak Healthcare Packaging, Placon Corporation, Berry Global Inc, Tekni-Plex, Sonoco Products Company, Wipak Group, Constantia Flexibles, Gerresheimer AG, BillerudKorsnäs AB, UFP Technologies Inc., Riverside Medical Packaging Company Ltd, Technipaq Inc., SGD Pharma, SCHOTT AG, Adeera Packaging Pvt. Ltd., Wipak Medical / Wiicare

Global Sterile Medical Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 69.4 billion

- 2026 Market Size: USD 76.4 billion

- Projected Market Size: USD 166.3 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 30 January, 2026

Sterile Medical Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Infection control & patient safety emphasis: The prime focus on reducing healthcare-associated infections drives hospitals and clinics to adopt sterile packaging solutions to ensure products remain uncontaminated until use. According to the study published by WHO in November 2024, it highlighted slow progress in infection prevention and control (IPC) worldwide, noting that only 6% of countries met minimum IPC requirements in 2023 to 2024, leaving patients, especially in low- and middle-income countries, at a higher risk of healthcare-associated infections (HAIs). The report also emphasized that strengthening IPC, which includes proper sterilization and safe handling of medical products, is highly essential to reduce HAIs, antimicrobial resistance, and prevent unnecessary deaths. In addition, WHO underscored the urgent investment in IPC programs and resources to protect patients and healthcare workers and improve patient safety, hence increasing the potential for the market.

Global Diabetes Burden and Implications for Sterile Medical Packaging Demand

|

Category |

Statistic |

Year |

|

Global Prevalence |

Number of people living with diabetes |

200 million (1990) → 830 million (2022) |

|

Adult Prevalence (18+) |

Percentage of adults living with diabetes |

7% (1990) → 14% (2022) |

|

Treatment Coverage |

Adults (30+) with diabetes not taking medication |

59% (2022) |

|

Mortality – Direct Diabetes |

Deaths directly caused by diabetes |

1.6 million (2021) |

Source: WHO

- Technological advancements in packaging materials: Innovation in terms of materials such as high‑barrier films, biodegradable plastics, and smart packaging with sensors or tamper‑evidence readily enhances sterility assurance, attracting market growth. In October 2025, Amcor announced the launch of its AmSecure thermoformed trays and rollstock as part of its HealthCare portfolio. This APET-based packaging provides the durability, clarity, and sterilization compatibility of PETG by also being more cost-effective and sustainable, supporting recyclability. It is designed for medical and pharmaceutical applications, enhancing sterility assurance and supply chain reliability, demonstrating how innovative materials are driving growth in the market.

- Regulatory requirements & quality standards: Stringent regulations impose mandates in terms of proper sterile packaging for medical products, which in turn compels manufacturers to adopt compliant solutions and make investments in quality systems. In this regard, in December 2023, the U.S. FDA recognized ISO 11607‑1 second edition 2019‑02, by including Amendment 1:2023, as a standard for the packaging of terminally sterilized medical devices. It also notes that this standard specifies requirements for materials, sterile barrier systems, and packaging processes to make sure that the devices remain sterile until use, thereby guiding manufacturers in design, testing, and quality compliance. Also, the recognition enforces compliance with international regulatory and quality standards, compelling medical device companies to update sterile packaging systems and validation practices by December 2026, hence increasing adoption in the market.

Challenges

- Rising raw material costs and supply chain volatility: The market relies on high-performance materials such as Tyvek, medical-grade films, plastics, and papers, which are highly subject to price fluctuations. Therefore, volatility in terms of global supply chains, i.e., exacerbated by geopolitical tensions, natural disasters, and pandemic-related disruptions, negatively impacts material availability and costs. Also, any type of delay in sourcing raw materials can disrupt production schedules, especially for just-in-time manufacturing models. Manufacturers face pressure to secure reliable suppliers while maintaining cost efficiency and quality standards. In addition, fluctuations in energy prices and transportation costs strain operational budgets. The presence of these challenges compels companies to adopt strategic sourcing, diversify supplier bases, and explore sustainable alternatives without compromising sterility compliance.

- Regulatory compliance: This is the major hurdle for the market since it is highly regulated, wherein the manufacturers must comply with strict international standards such as ISO 13485, FDA regulations, and EU MDR requirements. In this context, ensuring sterility, biocompatibility, and barrier integrity by meeting these standards is a very complex and costly process, making it challenging for companies from price-sensitive regions. On the other hand, the frequent updates in regulatory guidelines, especially for new combination products or innovative medical devices, increase these compliance burdens. Therefore, companies must make continuous investments in quality assurance, validation, and documentation systems, as well as employee training. Hence, balancing innovation with regulatory adherence remains a major obstacle for packaging manufacturers which thrive for global presence.

Sterile Medical Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 69.4 billion |

|

Forecast Year Market Size (2035) |

USD 166.3 billion |

|

Regional Scope |

|

Sterile Medical Packaging Market Segmentation:

Material Type Segment Analysis

In the material type segment, plastic is predicted to garner the largest revenue share of 60.5% in the sterile medical packaging market during the forecast duration. The dominance of the segment is effectively attributable to the excellent barrier properties that protect against microbial contamination, moisture ingress, and physical damage, which is critical for sterile products. Nelipak Healthcare Packaging, in January 2023, reported that it began using Eastman’s medical-grade Eastar Renew 6763 to produce rigid thermoformed sterile barrier packaging for Class II and III medical devices. This plastic material provides durability, safety, and excellent barrier properties to protect against microbial contamination and moisture by maintaining sterility. In addition, the use of Eastar Renew supports sustainability goals by diverting plastic waste from landfills, demonstrating the prominence of high-performance plastics in real-world sterile medical packaging.

Product Type Segment Analysis

By the end of 2035, the thermoform trays will grow at a considerable rate in the market. These trays provide superior protection and sterility retention for high-value devices, surgical kits, and device components, positioning them at the forefront to generate revenue in this sector. In May 2022, Nefab announced the launch of a range of thermoformed trays and cushioning solutions made primarily from recycled and fully recyclable plastics, supporting multiple industries, including medical, electronics, and aerospace. These solutions are especially designed for high protection, compliance with regulations, and compatibility with automated handling, by enabling sustainable circular flows that reduce CO₂ emissions and optimize logistics. Furthermore, Nefab’s worldwide thermoforming capabilities in the Americas, Europe, and Asia position the company to meet growing demand for eco-friendly sterile packaging solutions.

Application Segment Analysis

Pharmaceuticals & biologics based on application are expected to capture a significant revenue share in the market over the discussed timeframe. The explosive growth in biologic drugs, vaccines, and injectable therapies requires ultra-secure sterile barrier systems. Also, these products are highly sensitive to contamination, making sterile barrier systems essential to maintain efficacy and patient safety. In this context, packaging solutions such as pre-filled syringes, vials, blister packs, and nested trays are used to protect biologics throughout storage, transportation, and administration. Regulatory requirements from agencies also enforce strict sterility and quality standards for these applications. Furthermore, innovations in terms of high-barrier plastics, sustainable materials, and tamper-evident designs are being adopted to meet both safety and environmental considerations, fueling segment growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Material Type |

|

|

Product Type |

|

|

Application |

|

|

Sterilization Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sterile Medical Packaging Market - Regional Analysis

North America Market Insights

North America sterile medical packaging market is forecasted to emerge with the largest revenue share of 38.6% during the discussed timeframe. Advanced healthcare systems, strong regulatory frameworks, and high adoption of sterile-packaged medical devices mainly propel the region’s dominance in this field. In July 2025, Mubadala Investment Company reported that it made a significant reinvestment in PCI Pharma Services, which is a global CDMO specializing in biotherapies, to support both organic and inorganic growth initiatives. The funding will expand PCI’s sterile fill-finish capabilities, high-potency, and specialized manufacturing capacity, particularly in the US, strengthening critical pharmaceutical supply chains. Hence, this strategic move underscores the growing demand for advanced sterile manufacturing solutions, positively influenced by biologics and specialized drug therapies.

The U.S. sterile medical packaging market is growing exponentially on account of increasing healthcare expenditure and increased demand for single-use devices. The country’s growth is also fueled by the extensive need for materials such as plastics, paper, and foils for medical devices, pharmaceuticals, and surgical supplies. For instance, in February 2023, West Pharmaceutical Services, Inc. announced that it had launched West Ready Pack with Corning Valor RTU vials, which is a sterile, ready-to-use containment solution for injectable drugs and diagnostics. The company also notes that this product integrates sterilized elastomer components and glass vials into a single-use packaging system, thereby addressing growing healthcare demand for contamination-free, ready-to-fill solutions. Hence, such instances reflect increasing U.S. healthcare expenditure and the rising need for sterile packaging materials for pharmaceuticals and medical devices.

Canada sterile medical packaging market has gained increased exposure owing to the heightened demand for infection prevention and advancements in terms of sustainable, recyclable materials and specialized barrier technologies. The country’s market is also driven by the increasing prevalence of chronic diseases and the need for sterile packaging to maintain the integrity of medical implants, instruments, and consumables. In July 2025, Winpak Ltd. announced that its Winnipeg, Manitoba, Canada site is now an authorized converter of DuPont Tyvek healthcare packaging, expanding its ability to produce sterile barrier packaging for medical devices and pharmaceuticals in Canada and North America. Winpak combines its MedForm DT films with Tyvekto deliver high-performance, contamination-resistant packaging that maintains sterility throughout the product lifecycle under the Wiicare brand.

APAC Market Insights

The Asia Pacific sterile medical packaging market is expected to register the fastest growth over the discussed timeframe. Manufacturers and service providers are focused on expanding local capabilities and technologies to serve the growing needs of pharmaceutical and medical device companies. In this context, Nelipak Healthcare Packaging in April 2025 announced an expansion of its direct services and partner network in the Asia Pacific, thereby enhancing access to its custom sterile barrier medical packaging solutions. The company’s offerings include flexible pouches, bags, coated papers and films, rigid thermoformed trays, and tray sealing machines, which are tailored to meet the unique technical requirements of healthcare companies in the region. Hence, the company is strengthening regional expertise, resources, and innovative packaging technologies, aiming to streamline processes and deliver value while supporting evolving customer needs.

China sterile medical packaging market maintains a central position in the regional landscape, primarily fueled by the expansion of pharmaceutical manufacturing and regulatory emphasis on quality and compliance. This, in turn, is prompting both national and international players to adopt high-barrier materials and automation in sterile packaging production to meet both local healthcare demand and export-oriented standards. In this context, in September 2024, Nais Medical Packaging Technology (Shenzhen) Co., Ltd. stated that it participated in the 90th China International Medical Devices Expo by showcasing its aseptic packaging solutions for medical devices. Besides, the company emphasizes innovation in sterile medical packaging and serves both domestic and international Class II and III medical device manufacturers with high-quality solutions. In addition, by engaging in such major exhibitions, Nais represents a strong focus on advancing sterile packaging technologies and strengthening connections within the country’s medical device supply chain.

India sterile medical packaging market is showcasing notable progress owing to the rising production of injectable pharmaceuticals and biosimilars. This, in turn, is encouraging the packaging equipment and solutions providers to support aseptic processing and traceability in both medical device and pharmaceutical packaging. In August 2025, SCHOTT Glass India reported that it became the first company in India to locally produce high-precision syringe and cartridge glass tubing at its Gujarat facility, supporting the growing demand for GLP-1-based injectables such as semaglutide. Also, this expansion strengthens the country’s sterile pharmaceutical packaging supply chain, enabling consistent, high-quality production for prefillable syringes and cartridges at the same time advancing aseptic processing capabilities. It is aligned with the Make in India initiative, whereas SCHOTT’s investment reinforces local pharmaceutical self-reliance.

Europe Market Insights

Europe sterile medical packaging market is reshaped by stringent regulations such as the EU Medical Device Regulation (MDR), and sustainable packaging mandates wherein the manufacturers are incorporating eco-friendly materials and designs to comply. The presence of leading market pioneers and their strategic steps also fosters a favorable business ecosystem in the region. In June 2023, Oliver Healthcare Packaging announced that it had acquired EK-Pack Folien GmbH in Germany, which is a prominent manufacturer of high-quality film and foil laminations for sterile barrier packaging. The company also notes that this acquisition adds 23,000 square meters of manufacturing space with 8 production lines, thereby allowing it to insource materials and innovate new healthcare packaging products. This move further complements Oliver’s recent investments in the region, including expanding its Venray, Netherlands facility and adding automation and converting equipment to enhance regional support in the upcoming years.

Germany sterile medical packaging market is growing significantly due to a strong pharmaceutical and medical device manufacturing base. The country’s precision packaging and compliance with high regulatory standards drive local providers to innovate continuously in terms of sterile barrier systems and support integration with automated production lines. In this context, Recipharm in February 2025, Recipharm notified the launch of a modular sterile filling system at its Wasserburg, Germany, facility, which is especially designed for process development, pilot scale, and clinical supply projects under GMP-compliant Grade A isolator conditions. This system supports various containers such as syringes and vials, and optimizes small-batch production, making it suitable for advanced therapies and rare disease pharmaceuticals. Hence, this addition complements Recipharm’s existing sterile development and commercial capabilities, significantly enhancing flexibility and efficiency for both biotech and pharmaceutical clients.

Germany Sterile Medical Device Sub-Sectors Driving Packaging Demand (2024-2030)

|

Sub-Sector |

2024 Revenue (USD / EUR) |

2030 Forecast (USD / EUR) |

CAGR (%) |

|

Disposable Syringes |

– |

USD 1 billion / EUR 861.4 million |

13.2 |

|

Prefilled Syringes |

USD 480.8 million/ EUR 414.1 million |

USD 1.04 billion / EUR 895.8 million |

14.1 |

|

Disposable Catheters (Cardiovascular) |

– |

USD 4.86 billion/ EUR 4.2 billion |

6.4 |

|

Suction Catheters |

– |

USD 52.7 million / EUR 45.4 million |

10.5 |

Source: ITA

The UK sterile medical packaging market is also developing due to the increasing adoption of single-use medical devices and the heightened demand for injectable pharmaceuticals. Rising healthcare infrastructure development and stringent regulatory standards for aseptic packaging are driving manufacturers to invest in advanced sterilization and barrier technologies. For instance, Sterimed in June 2024 finalized the acquisition of Riverside Medical Packaging, which is a leading provider of sterilization packaging systems and contract packing services in the country for the medical device industry. Riverside leverages 12 cleanrooms and specialized thermoforming capabilities and is recognized for its aseptic solutions. This acquisition strengthens Sterimed’s operations in the UK and expands its service offerings for medical device manufacturers, accelerating progress into pharmaceutical packaging applications.

Key Sterile Medical Packaging Market Players:

- Amcor plc (Australia/Switzerland)

- DuPont de Nemours, Inc. (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Oliver Healthcare Packaging (U.S.)

- Nelipak Healthcare Packaging (U.S.)

- Placon Corporation (U.S.)

- Berry Global Inc (U.S.)

- Tekni‑Plex (U.S.)

- Sonoco Products Company (U.S.)

- Wipak Group (Finland)

- Constantia Flexibles (Austria)

- Gerresheimer AG (Germany)

- BillerudKorsnäs AB (Sweden)

- UFP Technologies, Inc. (U.S.)

- Riverside Medical Packaging Company Ltd (UK)

- Technipaq Inc. (U.S.)

- SGD Pharma (France)

- SCHOTT AG (Germany)

- Adeera Packaging Pvt. Ltd. (India)

- Wipak Medical / Wiicare (Finland/Canada)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor plc is a global leader in packaging solutions that has a strong presence in sterile medical packaging through its healthcare division. The company specializes in terms of flexible and rigid sterile barrier systems, such as pouches, trays, and blister packaging, which are especially designed to maintain product sterility across pharmaceutical and medical device applications. In addition, Amcor’s competitive advantage arises from its international manufacturing footprint, focus on sustainability, and innovative materials that improve sterility retention.

- DuPont de Nemours, Inc. is a key player in the market, which is leveraging its proprietary Tyvek material to produce high-performance sterile barrier systems. The company, through its Spectrum Plastics Group subsidiary, offers extruded tubing, catheter assemblies, and sterile packaging solutions that meet stringent ISO and FDA standards. Additionally, DuPont’s strategy is mainly focused on integrating materials innovation with full-service manufacturing, which includes laser processing, additive manufacturing, and precision molding.

- West Pharmaceutical Services, Inc. is yet another major player in this field, which is best known for the injectable drug delivery components and sterile packaging solutions. The company produces vials, prefilled syringes, stoppers, and specialized containers that ensure product integrity and sterility. Development of elastomeric materials and collaborations with pharmaceutical and biotech companies to accelerate the commercialization of injectable therapies, biologics, and vaccines are a few strategies adopted by the firm to strengthen its market position.

- Oliver Healthcare Packaging is a specialist in terms of high-quality sterile barrier systems for pharmaceuticals and medical devices. Besides, the firm’s product portfolio spans blister packs, pouches, clamshells, and trays, which are especially designed to optimize sterility, usability, and supply chain efficiency. Oliver differentiates itself through customized engineering solutions, cleanroom manufacturing, and digital design capabilities that efficiently streamline product-to-market timelines.

- Nelipak Healthcare Packaging is based in the U.S. and is focused mainly on custom sterile barrier solutions for medical devices, pharmaceuticals, and diagnostic products. The company produces pouches, trays, blister packs, and specialized kit packaging that meet ISO 13485 and FDA requirements. Furthermore, Nelipak’s competitive edge lies in cleanroom capabilities, rapid prototyping, and collaborative partnerships with healthcare innovators, thereby enabling fast scaling of new product lines and reducing market debuts for critical sterile medical products.

Below is the list of some prominent players operating in the global market:

The global sterile medical packaging market is being dominated by the integrated packaging and materials companies. Major players such as Amcor plc and DuPont de Nemours, Inc. lead in terms of their international footprint, proprietary materials such as Tyvek, and sustainable solutions. Facility investments, continued product innovations for sterilization compatibility, mergers & acquisitions are a few strategies opted by the leading pioneers in this field to strengthen their market positions. For instance, Sterimed, in May, 2025, reported that it welcomed IK Partners and a consortium of new investors, along with longstanding backers including Sagard, to support its next growth phase. Besides, the company has more than 1,500 employees across 14 production sites and 24 offices, and it has expanded internationally through eight strategic acquisitions, serving medical device manufacturers, hospitals, and specialized packaging companies.

Corporate Landscape of the Sterile Medical Packaging Market:

Recent Developments

- In October 2025, SteriPack was rebranded as Ensera and expanded its capabilities across design, manufacturing, assembly, and packing for pharmaceutical and medical device clients globally. The company will be offering integrated services from product design to sterile barrier system packing, secondary packing, labeling, sterilization management, and supply chain support.

- In June 2025, DuPont announced that it had expanded its healthcare manufacturing facility in Heredia, Costa Rica, adding 16,000 square feet to produce sterile packaging for the global medical device industry and increasing extruded tubing capacity enables production of Tyvek-based pouches, header bags, and lids.

- Report ID: 4285

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sterile Medical Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.