Peptide Synthesis Market Outlook:

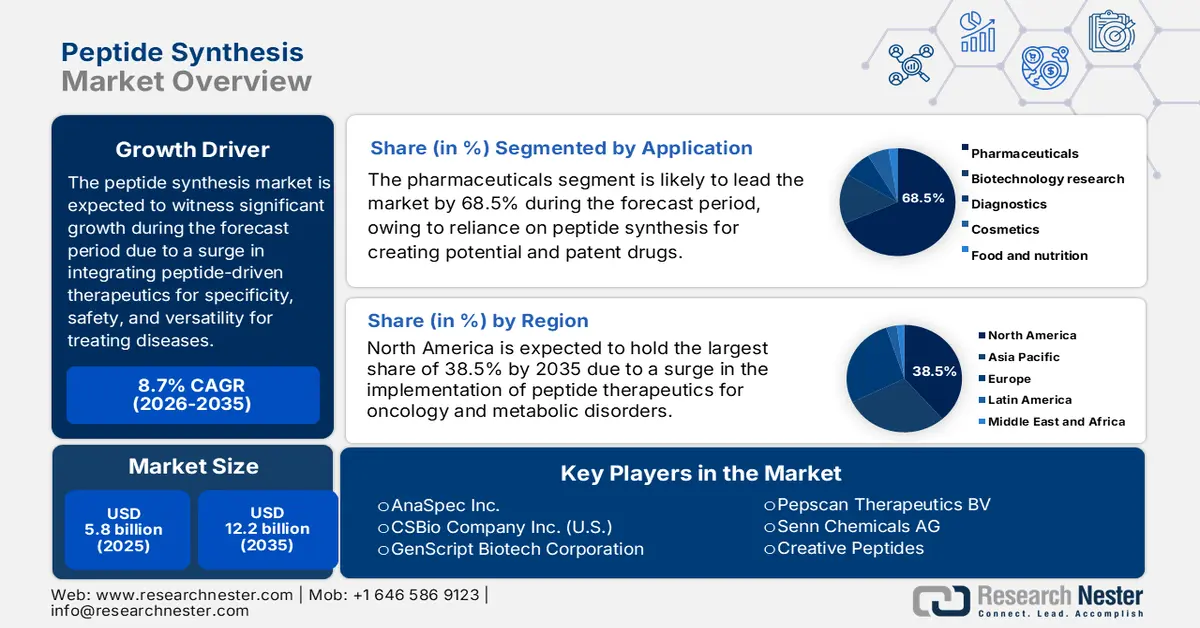

Peptide Synthesis Market size was over USD 5.8 billion in 2025 and is estimated to reach USD 12.2 billion by the end of 2035, expanding at a CAGR of 8.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of peptide synthesis is estimated at USD 6.3 billion.

The worldwide peptide synthesis market is steadily growing and readily supported by a rise in the adoption of peptide-driven therapeutics, research applications, and diagnostics. Besides, peptides have been recognized for their versatility, safety, and specificity, particularly in aiding oncological, cardiovascular, and metabolic diseases. According to an article published by NLM in May 2025, therapeutic peptides, with a molecular weight ranging between 50 to 5,000 Da, outstandingly bridge the barrier between biologics and small molecules through their multifaceted biointerfaces and programmable architectures. Besides, more than 80 peptide drugs have successfully gained international approval as of 2023, with over 200 peptides in clinical development. These particular peptides are focused on cancers, metabolic disorders, autoimmune diseases, and infectious diseases, thus proliferating the market’s exposure.

FDA-Approved and Clinical-Trial Therapeutic Peptides for Aiding Different Pathologies (2025)

|

Disease Type |

FDA-based Peptides |

Clinical Trial-Based Peptides |

|

Metabolic Disorder |

37% |

23% |

|

Cancer |

19% |

35% |

|

Cardiovascular Disorder |

11% |

6% |

|

Antibacterial |

10% |

5% |

|

Gastrointestinal Disorders |

10% |

6% |

|

Pain Management |

5% |

- |

|

Central Nervous System Disorder |

3% |

22% |

|

Respiratory Disorders |

2% |

3% |

|

Renal Disorders |

2% |

- |

|

Others |

1% |

- |

Source: International Journal of Pharmaceuticals

Furthermore, the aspects of high-throughput and automation synthesis, expansion in customized peptide services, integration of digitalized and artificial intelligence tools, green chemistry and sustainability adoption, and diversification into non-pharma applications are other drivers that are fueling the peptide synthesis market globally. In terms of automation, Syngene International, as of October 2025, declared site upgradation to escalate drug discovery as well as development for assisting its consumers to introduce notable therapies to the peptide synthesis market rapidly. This included a state-of-the-art and dedicated peptide laboratory in Bengaluru, comprising cyclic peptides, linear peptides, and peptide-drug conjugates, and readily supports scale for almost 800 mmol. Likewise, in April 2025, Sai Life Sciences Limited successfully inaugurated a standard peptide research center at Hyderabad for supporting biotech organizations and innovative pharmacies with specialized services across peptide synthesis.

Key Peptide Synthesis Market Insights Summary:

Regional Highlights:

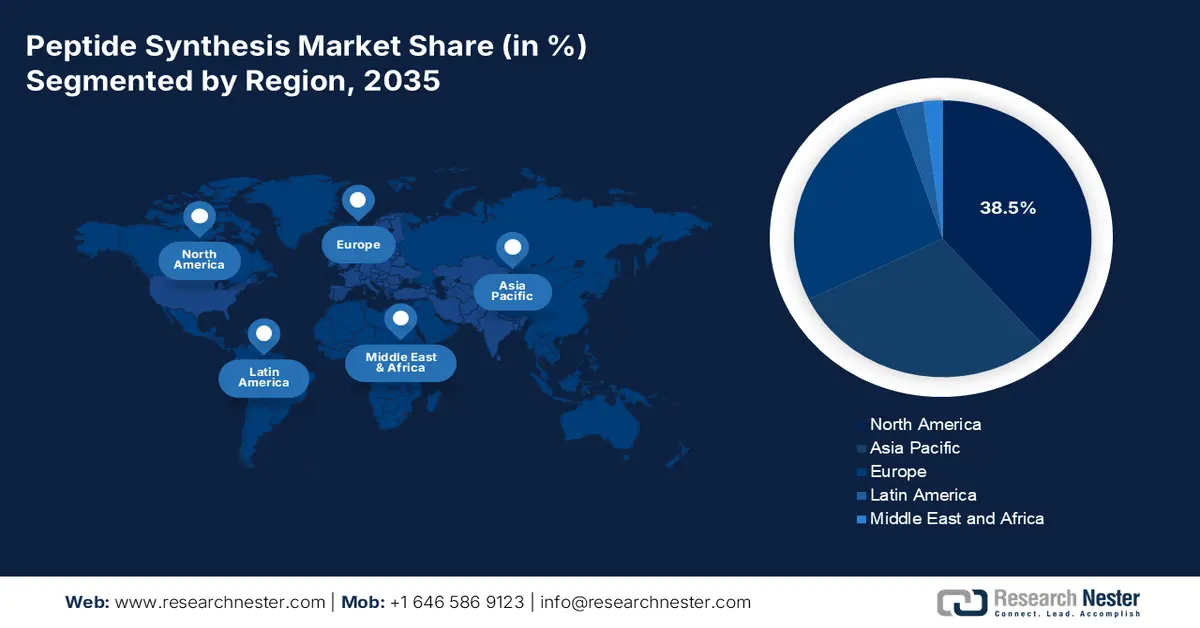

- North America is projected to command a 38.5% share by 2035 in the peptide synthesis market, supported by strong uptake of peptide therapeutics, expanding CDMO capacities, and well-established biopharma ecosystems.

- Europe is poised to register the fastest growth over 2026–2035, reinforced by sustained investments in automated solid-phase peptide synthesis, greener chemistries, and advanced GMP manufacturing infrastructure.

Segment Insights:

- The pharmaceuticals (therapeutics) application segment is expected to dominate with a 68.5% share by 2035 in the peptide synthesis market, underpinned by rising reliance on peptide-based drugs that offer high specificity and biomimetic therapeutic efficacy.

- The solid-phase peptide synthesis (Fmoc) segment is anticipated to secure the second-largest share during the forecast period, favored for its efficiency, scalability, and suitability for automated production of complex and long-chain peptides.

Key Growth Trends:

- Rise in therapeutic demand

- Expansion in chemical manufacturing

Major Challenges:

- Environmental and sustainability risks

- Vulnerabilities in the supply chain

Key Players: Bachem Holding AG, PolyPeptide Group, CordenPharma International, Lonza Group AG, AmbioPharm Inc., AnaSpec Inc., CSBio Company Inc., GenScript Biotech Corporation, Pepscan Therapeutics BV, Senn Chemicals AG, Creative Peptides, AAPPTec LLC, Kinpep Laboratories, Peptide Institute Inc., Mimotopes Pty Ltd, Peptron Inc., KareBay Biochem Inc., JPT Peptide Technologies GmbH, XLabs Peptide Synthesis, Thermo Fisher Scientific Inc.

Global Peptide Synthesis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.8 billion

- 2026 Market Size: USD 6.3 billion

- Projected Market Size: USD 12.2 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Singapore, Ireland

Last updated on : 19 December, 2025

Peptide Synthesis Market - Growth Drivers and Challenges

Growth Drivers

- Rise in therapeutic demand: Peptide drugs are eventually gaining traction in infectious, metabolic, and oncological diseases, with numerous EMA and FDA approvals driving the peptide synthesis market adoption. According to a data report published by the IFPMA in 2023, researchers constitute the ability to identify a single standard compound among 5,000 to 10,000 screened. Besides, there has been the launch of 53 new medicines, and meanwhile, over 9,000 compounds are at various developmental stages internationally. Moreover, the number of drugs in development for certain diseases includes 3,148 for cancer, 1,677 for immunology, 1,668 for neurology, and 1,488 for infectious diseases. Therefore, the aspect of in-depth research and development is readily uplifting the market’s growth.

- Expansion in chemical manufacturing: The manufacturing industry, particularly in India and China, is gradually upscaling the peptide production capacity, which in turn, is driving the peptide synthesis market’s exposure. This upscaling has been possible by leveraging cost benefits, along with governmental incentives to cater to the international requirement. For instance, according to the January 2024 ITA data report, the chemical industry in India readily covers more than 80,000 commercial products that are eventually categorized into fertilizers, polymers, agrochemicals, petrochemicals, specialty chemicals, and bulk chemicals. Besides, the country’s chemical sector is valued at USD 220 billion and is further expected to grow at 9% to 12% every year and successfully reach USD 300 billion, thereby making it suitable for expanding the peptide synthesis market.

- Advancements in peptide synthesis: The peptide synthesis market comprises different technologies, and solid-phase peptide synthesis technology is one of the dominating ones. This particular technology comprises advancements in Fmoc chemistry, thereby enabling increased yields, as well as scalability for GMP production globally. As per an article published by Green Chemistry in 2022, peptides have successfully achieved importance in the overall pharmaceutical arena, with an overall 22 acceptances over the past 6 years. Besides, more than 120 peptides have significantly reached the current marketplace for aiding different diseases, including HIV, cancer, diabetes, and others. Therefore, with the continuous approval of different peptides, there is a huge growth opportunity for SPPS in the peptide synthesis market.

Challenges

- Environmental and sustainability risks: The peptide synthesis market is considered to be resource-intensive, consuming large volumes of organic solvents and generating significant chemical waste. Solid-phase synthesis, in particular, has a high process mass intensity (PMI), meaning the amount of waste generated per gram of peptide is disproportionately high. This creates environmental concerns and increases disposal costs, especially under stricter environmental regulations in Europe and North America. Agencies such as the EPA and ECHA are tightening rules on hazardous waste management, forcing companies to adopt greener chemistries and invest in solvent recovery systems. However, implementing sustainable practices often requires expensive upgradation to equipment and processes, which can be prohibitive for smaller firms.

- Vulnerabilities in the supply chain: The peptide synthesis market depends on complicated international supply chains for raw materials, reagents, and specialized equipment. Disruptions such as geopolitical tensions, trade restrictions, or pandemics can severely impact production timelines and costs. For instance, reliance on specific amino acid derivatives or resins sourced from limited suppliers creates bottlenecks and price volatility. Transportation delays and rising logistics costs further exacerbate supply chain fragility, particularly for companies dependent on imports from Asia or Europe. Smaller firms are disproportionately affected, as they lack the bargaining power to secure priority access to scarce materials. Additionally, supply chain vulnerabilities extend to skilled labor shortages, with peptide synthesis requiring highly trained chemists and technicians.

Peptide Synthesis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 12.2 billion |

|

Regional Scope |

|

Peptide Synthesis Market Segmentation:

Application Segment Analysis

The pharmaceuticals (therapeutics) segment, which is part of the application, is anticipated to hold the largest share of 68.5% in the peptide synthesis market by the end of 2035. The segment’s upliftment is highly attributed to its dependence on peptide synthesis to develop highly potent and specific drugs, such as GLP-1 agonists for antimicrobials and diabetes, constituting tailored properties that tend to mimic natural body functions. According to an article published by NLM in November 2023, domestic manufacturers usually contribute 80% of pharmaceutical units purchased in countries, out of which only 33% of the value, and the average price of imported medicines is 8 times higher than produced medicines. Besides, in terms of research and development funding, USD 240 billion has been spent in total, of which 89%, that is USD 214 billion, has been invested across high-income countries, and 11%, that is USD 26 billion, caters to low and middle-income nations, thereby deliberately fueling the segment’s growth.

Technology Segment Analysis

The solid-phase peptide synthesis (Fmoc) segment in the peptide synthesis market is expected to account for the second-largest share during the forecast timeline. The segment’s growth is highly driven by the aspect of providing high efficiency, scalability, and compatibility with automation, making it the preferred method for both research and commercial peptide production. This particular technique involves sequential addition of amino acids to a growing peptide chain anchored to a resin, with the Fmoc group serving as a temporary protective group that can be removed under mild conditions. This reduces side reactions and enhances purity compared to Boc chemistry. Fmoc-SPPS is particularly advantageous for synthesizing long and complex peptides, including therapeutic APIs, due to its ability to achieve high yields with minimal degradation.

Scale of Operation Segment Analysis

By the end of the stipulated timeline, the commercial segment is projected to garner the third-largest share in the peptide synthesis market. The segment’s development is effectively fueled by the transition from laboratory-scale research to industrial-scale GMP manufacturing. Commercial peptide synthesis involves producing kilogram-scale batches of APIs and reagents for pharmaceutical companies, biotechnology firms, and CDMOs. This segment is driven by rising demand for peptide-based therapeutics, including GLP-1 analogs for diabetes and obesity, peptide vaccines, and oncology treatments. Commercial operations require advanced infrastructure, automated synthesizers, and stringent quality control systems to meet regulatory standards set by agencies such as the FDA and EMA. Investments in large-scale SPPS facilities, solvent recovery systems, and continuous manufacturing technologies have improved efficiency and reduced costs.

Our in-depth analysis of the peptide synthesis market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Technology |

|

|

Scale of Operation |

|

|

End user |

|

|

Product Type |

|

|

Peptide Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Peptide Synthesis Market - Regional Analysis

North America Market Insights

North America in the peptide synthesis market is anticipated to hold the largest share of 38.5% by the end of 2035. The market’s upliftment in the region is primarily attributed to an increase in the adoption of peptide therapeutics across metabolic disease and oncology, aggressive CDMO capacity, and the presence of mature biopharma ecosystems. According to an article published by the EPA Government in September 2025, more than 1.5 million tons of hazardous wastes have been managed by recycling solvent, metals, and other recoveries, which positively contributes to the market’s upliftment. Besides, the overall municipal solid waste has been recorded to be 292.4 million tons, which is 4.9 pounds per person per day. Of this total generation, an estimated 69 million tons have been successfully recycled, while 25 million tons have been composted, thereby denoting a reduction in hazardous chemical generation, which is uplifting the peptide synthesis market’s growth.

Total Municipal Solid Waste Generated by Material in America (2025)

|

Material Type |

Generation |

|

Paper and Paperboard |

23.0% |

|

Food |

21.5% |

|

Plastics |

12.2% |

|

Yard Trimmings |

12.1% |

|

Metals |

8.7% |

|

Wood |

6.1% |

|

Textiles |

5.8% |

|

Glass |

4.1% |

|

Rubber and Leather |

3.1% |

|

Other |

1.5% |

|

Miscellaneous Inorganic Wastes |

1.3% |

Source: EPA Government

The U.S. in the peptide synthesis market is growing significantly due to the clinical momentum, sustainability pull, the presence of industrial decarbonization, advanced manufacturing, chemical safety, along with investment and stewardship. As per an article published by the CATF in October 2025, the industrial sector in the country significantly employs more than 12 million workers and has generated USD 852 billion in the yearly payout. Simultaneously, it is also responsible for an estimated 12% of harmful air pollutants, along with 23% of greenhouse gas emissions. However, to combat this, the U.S. Department of Energy (DOE) has allocated USD 6.3 billion for the Industrial Demonstrations Program to effectively support the demonstration of emerging technologies. Moreover, USD 2.5 billion has been provided for carbon capture demonstration projects, thereby fueling the market’s growth in the country.

Canada in the peptide synthesis market is also growing, owing to government funding for clean chemical production, green chemistry and sustainability approaches, advanced biotech and manufacturing clusters, and chemical industry transformation. As per a data report published by the OECD in 2022, the country has notified a target to reduce greenhouse gas emissions by 40% to 45% by the end of 2030, along with legislating c standard commitment to reach net zero emissions by the end of 2050. Besides, the federal government has significantly proposed the country’s Strengthened Climate Plan, which comprises 64 latest measures, as well as CAD 15 billion in investments. Furthermore, the Atlantic Loop constitutes an approximate CAD 3 billion and an estimated greenhouse gas reduction potential, accounting for 2.6 million tons per year, thereby denoting a positive impact for the market’s growth.

Predicted Canada Greenhouse Gas Emissions in 2030 (2022)

|

Trajectory Plan |

Projected GHG Emissions (Million Tons) |

|

2030 Trajectory |

815 |

|

2030 Trajectory After Measures Declared in Pan-country Framework on Clean Growth and Climate Change |

588 |

|

2030 Trajectory After Measures Notified in A Healthy Environment and a Healthy Economy |

503 |

|

2030 Trajectory After Budget 2021 Measures and Additional Action, Including Continued Alignment with the U.S. |

468 |

Source: OECD

Europe Market Insights

Europe in the peptide synthesis market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by sustained research and development investment in automated solid-phase peptide synthesis, along with greener chemistries, innovative GMP manufacturing, and robust biopharma clusters. According to an article published by NLM in June 2023, the chemical industry in the region significantly depends on fossil fuels, eventually making it the source of 5.6 Gt carbon dioxide per year, in comparison to an estimated 10% of the international anthropogenic greenhouse gas emission. Besides, the Haber–Bosch process, which is considered an energy-intensive procedure, readily operates at demanding conditions, with 150 to 250 bar and 350 to 550-degree Celsius, thus suitable for bolstering the peptide synthesis market’s exposure.

Germany in the peptide synthesis market is gaining increased traction, owing to sustained investment in GMP and automation capacity, advancement in process engineering, and the presence of the integrated chemicals and pharma base. As per an article published by the ITA in August 2025, the advanced manufacturing field in the country accounts for USD 991,050 million in total exports, followed by USD 721,621 million in total imports, USD 36,753 million for imports from the U.S., USD 269,429 million for trade surplus, and 1.0 the EUR-USD exchange rate. Besides, the 2024 CEFIC Organization article stated that the chemicals, along with pharmaceutical organizations in the country, comprise research activities and research and development expenditure reaching nearly EUR 14 billion as of 2023, thereby making it suitable for fueling the market’s demand and growth.

France in the peptide synthesis market is also developing, owing to an increase in the adoption of greener processes and automated synthesizers, a surge in the CDMO capacity, and the presence of string biopharma clusters. As stated in a data report published by OECD in 2025, the health expenditure in the country accounted for 11.5% of the gross domestic product (GDP) as of 2023. In addition, the private and public compulsory health insurance funded 84.4% of the overall health spending in the country. Moreover, the out-of-pocket payments share catered to 9.3%, and meanwhile, the voluntary health insurance accounted for 6.3% of the overall spending. Besides, the overall life expectancy upsurged by 1.4 years as of 2024, based on which there is a huge demand for peptide synthesis in the country’s healthcare industry.

APAC Market Insights

The Asia Pacific in the peptide synthesis market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by green chemistries, process intensification, and an increase in the adoption of SPPS. Besides, according to an article published by the UNICEF Organization in July 2025, 94% of infants from South Asia received the third dose of Diphtheria, Tetanus, and Pertussis (DTP) vaccine as of 2024, deliberately marking a 2% point increase since 2023. In the same year, there has been an increase in children receiving the first dose of DTP from 93% to 95%. Furthermore, there has been a reduction in zero-dose children in India by 43%, that is 23,000 as of 2023 to 11,000 in 2024. Therefore, the increased focus on vaccination is readily driving the market’s growth in the overall region.

The peptide synthesis market in China is gaining increased exposure due to policy support for advanced manufacturing and clean production processes, integrated chemicals and pharma supply chains, and scale benefits. As per an article published by the State Council in March 2024, the Ministry of Industry and Information Technology, along with the National Development and Reform Commission indicated that the output from green factories is poised to account for more than 40% of the overall country’s manufacturing sector by the end of 2030. Besides, the country has readily outlined the national target to peak its carbon dioxide emissions by the end of the same and achieve carbon neutrality by the end of 2060. Based on this objective, the nation’s manufacturing industry, which accounts for 31.7% of the country’s GDP as well as 30% of the international manufacturing, significantly contributed to 45% of the nation’s carbon emissions.

The peptide synthesis market in India is also growing due to the existence of supportive government programs in industrial and chemical research and development, CRO services, and an expansion in the pharma manufacturing. According to an article published by the IBEF in May 2025, the pharma sector in the country has been continuously growing at a 7.8% year-on-year (YoY) basis. In addition, the sector is regarded as the largest generic medicines supplier, offering 20% of the international supply, with turnover amounting to ₹4,17,345 crore at 10% yearly growth for the past 5 years. Besides, smart schemes by government is also fueling the market’s demand, with the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) operating 15,479 Jan Aushadhi Kendras providing generic medicines at 80% lower prices in comparison to branded medicines, thus suitable for the market’s welfare.

Key Peptide Synthesis Market Players:

- Bachem Holding AG (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PolyPeptide Group (Sweden)

- CordenPharma International (Germany)

- Lonza Group AG (Switzerland)

- AmbioPharm Inc. (U.S.)

- AnaSpec Inc. (U.S.)

- CSBio Company Inc. (U.S.)

- GenScript Biotech Corporation (China)

- Pepscan Therapeutics BV (Netherlands)

- Senn Chemicals AG (Switzerland)

- Creative Peptides (U.S.)

- AAPPTec LLC (U.S.)

- Kinpep Laboratories (India)

- Peptide Institute Inc. (Japan)

- Mimotopes Pty Ltd (Australia)

- Peptron Inc. (South Korea)

- KareBay Biochem Inc. (U.S.)

- JPT Peptide Technologies GmbH (Germany)

- XLabs Peptide Synthesis (Malaysia)

- Thermo Fisher Scientific Inc. (U.S.)

- Bachem Holding AG is widely recognized as a global leader in peptide synthesis, offering GMP-grade APIs and custom synthesis services. With more than 50 years of expertise, it dominates the market alongside Thermo Fisher and Merck, leveraging automation and scale to serve pharma and biotech worldwide.

- PolyPeptide Group is one of the major CDMOs, specializing in peptide-based APIs, with facilities across Europe, the U.S., and India. In 2025, it announced the doubling of solid-phase peptide synthesis (SPPS) capacity at its Malmö site, reinforcing its position as a high-volume supplier to global pharma.

- CordenPharma International significantly offers integrated peptide API manufacturing from early-stage development to commercial supply. The company has invested over €1 billion in peptide expansion, including new facilities in Switzerland and Germany, positioning itself as a leading European supplier of injectable and oral peptide therapeutics.

- Lonza Group AG is a diversified CDMO with strong peptide synthesis capabilities, particularly at its Visp site in Switzerland. It has invested CHF 24 million to expand peptide manufacturing, aligning with its broader biologics and advanced therapeutics portfolio.

- AmbioPharm Inc. is a full-service CDMO specializing in custom peptide APIs, with headquarters in South Carolina and additional facilities in Shanghai. It partners with pharma and biotech firms to accelerate late-stage peptide development, leveraging scalable GMP manufacturing and green chemistry approaches.

Here is a list of key players operating in the global market:

The international peptide synthesis market is extremely competitive and highly dominated by established organizations in the U.S. and Europe, with emerging contributions from the Asia-Pacific. Companies such as Bachem, PolyPeptide, and Lonza leverage scale, GMP compliance, and automation to secure leading market shares. U.S. firms, such as AmbioPharm and Thermo Fisher, focus on expanding custom synthesis services, while players in Asia, including GenScript, Peptide Institute, and Peptron, drive innovation through cost-effective manufacturing and advanced technologies. Besides, in January 2024, WuXi AppTec effectively notified the commissioning of its very own two newest peptide manufacturing facilities, at the Changzhou facility and another at the newest Taixing site in China. This particular expansion has surged the organization’s solid-phase peptide synthesis overall reactor volume to 32,000 liters, thereby significantly addressing the increasing international need for peptide therapeutics.

Corporate Landscape of the Peptide Synthesis Market:

Recent Developments

- In April 2025, Granules India Limited declared its significant acquisition of Senn Chemicals AG, marking a tactical milestone in Granules’ transformation into an innovative and science-based organization and expanding its capabilities into fast-growing peptide therapeutics industry.

- In September 2024, Cambrex announced that Snapdragon Chemistry, which operates under the company, has effectively created the latest liquid phase peptide synthesis technology that readily utilizes conventional active pharmaceutical ingredient (API) batch reactors and ongoing flow.

- Report ID: 4800

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Peptide Synthesis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.