Amyloid Peptides Market Outlook:

Amyloid Peptides Market size was over USD 3 billion in 2025 and is estimated to reach USD 6.7 billion by the end of 2035, expanding at a CAGR of 9.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of amyloid peptides is evaluated at USD 3.2 billion.

Being the hallmark for producing biomarkers and targeted therapies, amyloid peptides (AP) are highly desired across the globe for managing patients with chronic neurodegenerative disorders, including Alzheimer's, Parkinson's, and Dementia. Thus, the enlarging afflicted and high-risk patient pool of these ailments is fueling demand in this sector. Evidencing the same, a public report unveiled that the number of people with Alzheimer's disease (AD) around the globe is predicted to surpass 78 million by 2030 and 139 million by 2050. Another study published in 2022 expected the global incidence to cross 152.8 million by 2050, amplified by the growing geriatric population. This is ultimately creating a sustainable consumer base for the amyloid peptides market.

The international supply chain of the amyloid peptides market largely depends on the trade of high-value finished pharmaceuticals, diagnostic kits, advanced intermediates, and specialized raw materials. These characteristics establish the sector as a well-diversified and widely distributed merchandise, creating opportunities for capitalization for both MedTech and pharma pioneers. However, with advancements in associated products, the rising economic burden of required treatment on patients is creating disparities, particularly among underserved regions. This restricts the sector’s reach toward a notable proportion of consumers. Exemplifying the same, in 2025, the Alzheimer's Association revealed that the annual cost of donanemab drugs is set to be priced at around USD 32 thousand.

Key Amyloid Peptides Market Insights Summary:

Regional Highlights:

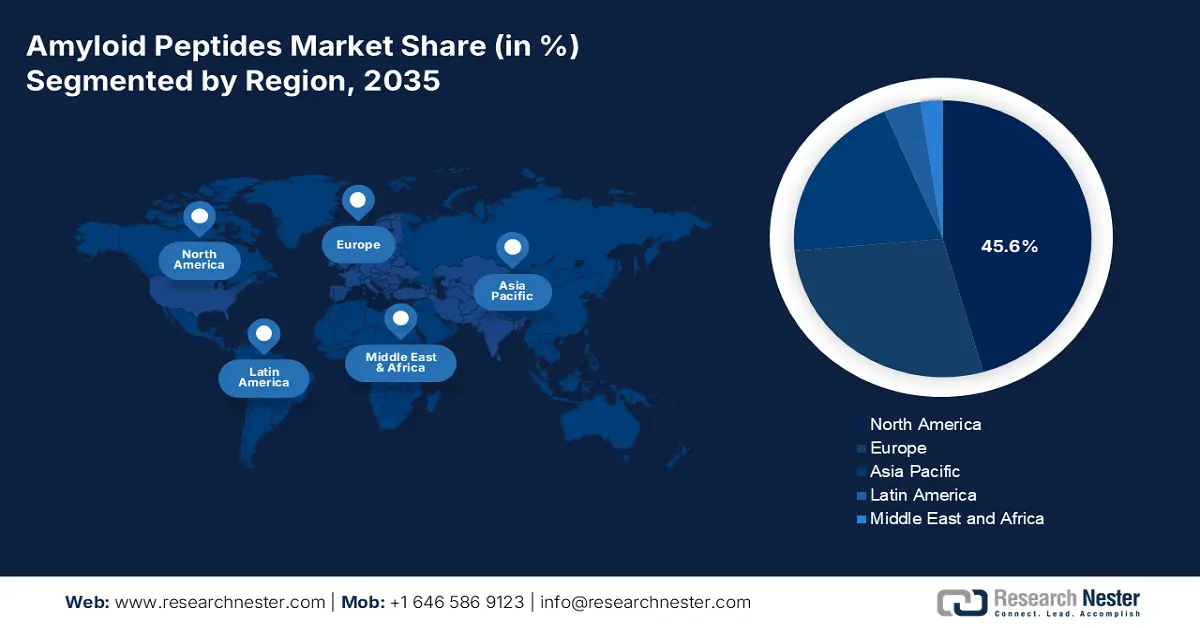

- North America is projected to dominate the amyloid peptides market with a 45.6% share by 2035, attributed to robust research funding, a high incidence of neurodegenerative diseases, and strong presence of pharma and MedTech innovators.

- Europe is expected to secure the second-largest revenue share from 2026 to 2035, supported by its extensive academic research hubs, public-private partnerships, and rising geriatric population driving neurodegenerative disease studies.

Segment Insights:

- The therapeutics segment is projected to account for a dominant 55.7% share of the amyloid peptides market by 2035, propelled by escalating R&D investments in biologic drugs and the premium pricing of FDA-approved monoclonal antibodies.

- The amyloid-beta (Aβ) segment is anticipated to capture a 48.8% share by 2035, supported by its critical role in Alzheimer’s disease pathology and the surge in clinical trials and biomarker studies targeting Aβ accumulation.

Key Growth Trends:

- Improvements in detailed diagnosis

- Increasing research funding and collaborations

Major Challenges:

- Restrictive payer policies and formularies

- High development costs and R&D attrition

Key Players: Eli Lilly and Company, Biogen Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., Novartis AG, Pfizer Inc., AstraZeneca PLC, CSPC Pharmaceutical Group, Bachem Holding AG, Thermo Fisher Scientific Inc., BioLegend, Inc., Sigma-Aldrich (Merck KGaA), PerkinElmer, Inc., GE HealthCare, Siemens Healthineers

Global Amyloid Peptides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 6.7 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Taiwan, Brazil, Singapore

Last updated on : 11 September, 2025

Amyloid Peptides Market - Growth Drivers and Challenges

Growth Drivers

- Improvements in detailed diagnosis: Advancements in diagnostic tools, including imaging techniques and biomarker assays, rely heavily on APs for accurate disease detection. Moreover, the significance of the amyloid peptides market in enhancing the sensitivity and specificity of these diagnoses prompts dedicated organizations to invest more. The shifting consumer preference toward non-invasive intervention is also expanding utility in this sector. Currently, ongoing tech-based progress, such as automation, is opening new avenues for peptide-based diagnostics, making them indispensable in personalized medicine and early intervention.

- Increasing research funding and collaborations: Government, private, and academic entities are increasingly showing interest in investing and participating in extensive R&D for the amyloid peptides market. This support accelerates the discovery of novel formulations and therapeutic approaches, expanding the pipeline in this sector. This can be exemplified by the collaborative study consortium of Vanderbilt University, New Jersey Institute of Technology, Felician University, and Kasetsart University, formed in 2025. This team of researchers was dedicated to developing new amyloid-like peptides using all-atom simulations and AI.

- Unmet needs for diagnosis and treatment: The gaps in access to early detection, intervention, and prevention are highly evident for AD and associated clinical issues. As evidence, a 2023 study unveiled that more than 75% of the global patient population of dementia was undiagnosed. Thus, leaders in the amyloid peptides market have the scope to capitalize on this matter by enabling widespread accessibility for high-risk populations, particularly in low- and medium-income countries (LMICs). Besides, the occurrence of related illnesses is found to be evidently higher among elderly residents, which often translates to lower awareness and diagnoses. Thus, their unmet needs act as a lucrative opportunity for this sector.

Analysis of Current Sources of Capitalization in the Amyloid Peptides Market

Diagnostic and Therapeutic Importance of Amyloid Peptides for AD

(2025)

|

Detection Method |

Principle |

Detected Aβ |

Sensitivity & Specificity |

Clinical Application |

Advantages |

Limitations |

|

SIMOA (Single Molecule Array) |

Single-molecule detection |

Aβ40, Aβ42 |

Ultra-high sensitivity |

Yes |

Detects low Aβ levels in plasma |

High cost of equipment and reagents |

|

IP-MS (Immunoprecipitation-Mass Spectrometry) |

Immunoprecipitation of Aβ followed by mass analysis |

Aβ40, Aβ42, fragments |

High specificity and sensitivity |

Yes (clinical studies) |

Can analyze different isoforms |

Expensive, requires specialized equipment |

|

SPR (Surface Plasmon Resonance) |

Detection of refractive index changes upon Aβ binding |

Aβ40, Aβ42 |

High sensitivity |

No (mainly research) |

No need for labeling |

Requires expensive equipment |

|

Nanoparticle-based sensors |

Detection of conductivity or optical changes in nanoparticles |

Aβ40, Aβ42 |

High sensitivity |

No (preclinical research) |

Fast and potentially low-cost |

Still in development |

|

PET (Positron Emission Tomography) |

Radiolabeled ligand binding to amyloid plaques |

Aβ deposits in the brain |

High specificity, does not detect free Aβ |

Yes |

Non-invasive brain amyloid imaging |

Expensive, radiation exposure |

|

Nanowire FET (Field-Effect Transistor Sensors) |

Conductivity changes in nanowires upon Aβ binding |

Aβ40, Aβ42 |

Ultra-high sensitivity, real-time detection |

No (preclinical research) |

Ultra-sensitive, label-free detection |

Variability in fabrication |

|

Nanomechanical Resonators |

Frequency shift upon Aβ interaction |

Aβ40, Aβ42 |

High sensitivity |

No (experimental phase) |

Detects extremely low concentrations |

Limited customization of data analysis |

Source: NLM

Historic Trends in the Patient Pool of the Amyloid Peptides Market

Global Trends in Dementia: Country-Level Insights (1990-2019)

|

Country |

Metrics |

Recorded Data |

|

Australia |

ASPR Trend (EAPC, 95% CI) |

-0.02 (-0.03 to -0.01) |

|

Oceania |

ASPR Trend (EAPC, 95% CI) |

-0.05 (-0.07 to -0.03) |

|

Taiwan, China |

ASPR Trend (EAPC, 95% CI) |

0.78 (0.64 to 0.92) |

|

Japan |

ASPR Trend (EAPC, 95% CI) |

0.77 (0.71 to 0.83) |

|

China |

ASPR Trend (EAPC, 95% CI) |

0.66 (0.57 to 0.75) |

|

Luxembourg |

ASPR Trend (EAPC, 95% CI) |

-0.43 (-0.54 to -0.31) |

|

Nigeria |

ASPR Trend (EAPC, 95% CI) |

-0.34 (-0.48 to -0.19) |

|

Spain |

ASPR Trend (EAPC, 95% CI) |

-0.32 (-0.38 to -0.26) |

|

U.S. and Canada |

ASDR (per 100,000 people) |

20.87 (5.34 to 52.13) |

|

Eritrea |

ASDR Trend (EAPC, 95% CI) |

1.37 (1.19 to 1.55) |

|

Germany |

ASDR Trend (EAPC, 95% CI) |

-0.94 (-1.08 to -0.81) |

|

Philippines |

ASDR Trend (EAPC, 95% CI) |

-0.7 (-0.89 to -0.51) |

Source: Frontiers

Legends:

- ASPR: Age-Standardized Prevalence Rate

- ASDR: Age-Standardized Death Rate

- EAPC: Estimated Annual Percentage Change

- CI: Confidence Interval

Challenges

- Restrictive payer policies and formularies: Despite the favorable updates in regulations, reimbursement for the commodities in the amyloid peptides market is still contingent upon enrollment in a registry-based data collection study. The high treatment cost, including infusion and monitoring expenses, leads to restrictive coverage policies. This, coupled with non-universal public payer thresholds, creates an administrative and affordability barrier for both patients and service providers, limiting adoption in this sector.

- High development costs and R&D attrition: The development cycle for neurodegenerative disease therapies is exceptionally long, costly, and prone to failure. The probability of clinical phase transition for Alzheimer's disease assets is among the lowest in pharmaceuticals, particularly during Phase II to Phase III trials. This inflates the cost of successful drug development, which manufacturers seek to recoup through premium pricing, creating a fundamental tension with payer affordability concerns.

Amyloid Peptides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|

Amyloid Peptides Market Segmentation:

Application Segment Analysis

The therapeutics sub-segment is predicted to dominate the field of applications in the amyloid peptides market with a 55.7% share over the discussed period. The heightening costs of novel biologic drugs targeting amyloid plaques, particularly for AD, are securing an intense cash inflow in this sector. The continuous amplification of biopharmaceutical R&D investments and subsequent premium pricing of FDA-approved monoclonal antibodies are also contributing to the segment’s leadership in this field. As evidence, the net R&D allocations from more than 4.1 thousand global biopharma leaders accounted for USD 276.4 billion in 2021 alone, increased from USD 198 billion in 2020.

Product Type Segment Analysis

The amyloid-beta (Aβ) segment is estimated to hold the largest share of 48.8% in the amyloid peptides market throughout the assessed timeframe. This proprietorship primarily originates from the pivotal role of Aβ peptides in the pathology of AD, making them a central focus in both diagnostic assessments and therapeutic developments. As a result, extensive clinical trials and biomarker studies targeting Aβ accumulation are predominantly controlling the field of revenue generation from this sector. Moreover, advancements in imaging agents and antibody therapies targeting Aβ further reinforce the sector’s strong position in this sector.

End user Segment Analysis

The pharmaceutical & biotechnology companies are poised to remain the biggest end users in the amyloid peptides market by the end of 2035, by attaining a 65.3% revenue share. Being the primary entities conducting R&D on this category, manufacturing complex biologics, and commercializing the therapies, these organizations are the largest source of revenue generation in this sector. This can be evidenced by a report from the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), recording more than 9 thousand biopharma compounds to be under development in 2022 alone. Another survey conducted by Johnson & Johnson unveiled that, in 2021, 583 global biopharma companies generated over USD 1022.1 billion against their R&D investment.

Our in-depth analysis of the amyloid peptides market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amyloid Peptides Market - Regional Analysis

North America Market Insights

North America is anticipated to stand strong as the dominant region in the amyloid peptides market during the analyzed tenure by capturing a 45.6% share. Robust research funding and a high prevalence of neurodegenerative diseases are the major growth factors behind the region’s augmentation in this sector. The intense concentration of internationally leading pharma pioneers and MedTech innovators also amplifies the cash inflow in peptide-based diagnostics and therapeutics development. Additionally, widespread awareness and early adoption of innovative treatment and prevention measures solidify the forefront position for North America in this category.

As per the 2024 Johnson & Johnson report, the U.S.-based companies accounted for approximately 55% of the biopharma-associated R&D investments from around the world. This demonstrates the nationwide progressive culture that prompts innovation in the amyloid peptides market. Such a lucrative landscape is also affiliated with a favorable regulatory framework, which accelerates the pace of commercialization and adoption rate by enabling fast-track approvals. For instance, in July 2024, the FDA gave marketing clearance to a 350 mg/20 mL once-monthly injection for IV infusion of donanemab-azbt administration for treating early symptomatic AD.

Canada also contributes to a notable proportion of revenue generation in the North America amyloid peptides market. The nation’s accomplishments in this sector are backed by the growing focus on neurodegenerative disease-related research and a strong public healthcare system. Besides, federal funding for innovative diagnostic tool deployment and therapeutic solution procurement is steadily increasing demand in this category. Displaying the massive influx of capital in this sector, in July 2025, the government of Canada announced a total allocation of USD 40.3 million to empower clinical studies on prevention, diagnosis, treatment, and care for people with dementia.

APAC Market Insights

Asia Pacific is predicted to become the fastest-growing region in the amyloid peptides market by the end of 2035. The rapidly aging populations and magnifying unmet needs of diagnostic and therapeutic solutions foster a substantial consumer base for the merchandise. The region’s predominant demographic expansion is further complemented by the rising healthcare expenditures, expanding research infrastructure, and growing awareness about early diagnosis. Currently, emerging economies, including Japan, China, and Taiwan, are fueling this growth with massive investments in biotechnology and pharmaceutical R&D.

China is establishing a strong emphasis on the amyloid peptides market with the efforts of governing bodies to improve healthcare access and initiatives. Their concentration on developing precision medicine to combat aging-related diseases is accelerating expansion in this sector, making the country a key hotspot for innovation and opportunity within APAC. The progressive business atmosphere across the nation can be further evidenced by the launch of Leqembi in China for AD-related MCI and dementia in January 2024 after gaining marketing approval from the regulatory body.

India is presenting lucrative opportunities for investments in the amyloid peptides market with its continuously expanding biopharmaceutical industry. The country also benefits from its growing capabilities in peptide synthesis and contract research and manufacturing services, which are also supported by government initiatives to strengthen domestic medical resources. For instance, in January 2025, a team of researchers at the Bose Institute in Kolkata discovered a method to produce chemically synthesized peptides to combat amyloid beta aggregation in several neurodegenerative diseases, including AD.

Country-wise Government Provinces

|

Country |

Initiative/Allocation |

Timeline |

|

India |

Includes expanded services for dementia under the National Programme for Health Care of the Elderly (NPHCE) |

2022-2024 |

|

China |

Nationwide campaign to promote the prevention and treatment of AD |

2023-2025 |

|

Australia |

The government invested USD 295 million in 126 dementia, ageing, and aged care research projects |

2015-2024 |

Source: NITI Aayog, Government of China, and MRFF

Europe Market Insights

Europe is estimated to maintain a steady growth in the amyloid peptides market while capturing the second-largest revenue share during the timeline between 2026 and 2035. The region’s presence in this sector is primarily bolstered by strong academic research hubs and public-private partnerships (PPPs). Besides, the enlarging geriatric populations in established countries, such as Germany, the UK, and France, are attracting investments in advancing clinical trials and biomarker development for neurodegenerative diseases. Evidencing the epidemiology, the estimations believe the number of people with dementia to double from 2020 to 2050, totaling 14.3 million in the European Union (EU) and 18.8 million in the wider European region.

The UK is fostering scope for affordable therapeutic manufacturers in the amyloid peptides market. As the expensive treatments, including lecanemab and donanemab, could not secure reimbursements from the National Health Service (NHS), even after the regulatory approvals, the indications reflect the country’s focus on making curatives equally accessible. This is subsequently attracting generic producers and innovators, who are seeking therapeutic developments that are cost-effective and efficient in treating long-term neurodegenerative diseases.

Germany stands out as the leading contributor in the Europe amyloid peptides market, which is empowered by the presence of global MedTech and biopharmaceutical pioneers. The country’s leadership in precision manufacturing also makes it an epicenter of large-scale peptide synthesis and contractual production. Such a lucrative landscape is also encouraging foreign developers to capitalize on its domestic opportunities, which can be exemplified by the launch of LEQEMBI in Germany in September 2025. This was a result of Eisai and Biogen considering the country to be the focus of Europe market.

Patient Pools that Garner Opportunities for the Market

|

Country |

Prevalence of Dementia (2022) (in %) |

Estimated Proportion of Dementia in the Total Population (2050) (in %) |

|

Austria |

6.8 |

3.1 |

|

Germany |

5.3 |

3.4 |

|

Greece |

14.0 |

3.9 |

|

France |

6.0 |

3.3 |

|

Spain |

22.7 |

3.9 |

|

Sweden |

5.0 |

2.6 |

|

Netherlands |

5.7 |

3.1 |

|

Portugal |

21.1 |

3.8 |

|

Denmark |

5.3 |

2.6 |

|

Italy |

11.6 |

4.1 |

Source:NLM and Alzheimer Europe

Key Amyloid Peptides Market Players:

- Eli Lilly and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biogen Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Johnson & Johnson

- AbbVie Inc.

- Novartis AG

- Pfizer Inc.

- AstraZeneca PLC

- CSPC Pharmaceutical Group

- Bachem Holding AG

- Thermo Fisher Scientific Inc.

- BioLegend, Inc.

- Sigma-Aldrich (Merck KGaA)

- PerkinElmer, Inc.

- GE HealthCare

- Siemens Healthineers

The competitive landscape of the amyloid peptides market is highly dynamic, featuring a mix of major pharmaceutical giants, specialized biotech firms, and peptide synthesis vendors. Leading pharmaceutical players, such as Pfizer, Eli Lilly, Biogen, Roche, Merck, Amgen, Novartis, and Johnson & Johnson, are capitalizing largely on diagnostic and therapeutic innovation, specifically for targeted therapies and diagnostics, leveraging significant R&D budgets and clinical trial capacity.

Here is a list of key players operating in the market:

Recent Developments

- In August 2025, Biogen, in collaboration with Eisai, attained approval for a Biologics License Application (BLA) for its once weekly lecanemab-irmb subcutaneous injection, LEQEMBI IQLIK, from the FDA. The anti-amyloid therapy is designed to offer at-home maintenance dosing to treat early Alzheimer's after initial treatment of 18 months.

- In July 2025, Eli Lilly and Company gained FDA clearance for a label update with a new recommended titration dosing schedule for its Kisunla (donanemab-azbt). This once-monthly therapy is intended to treat adults with early symptomatic Alzheimer's disease (AD), with confirmed amyloid pathology.

- Report ID: 8027

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amyloid Peptides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.