Collagen Peptides Market Outlook:

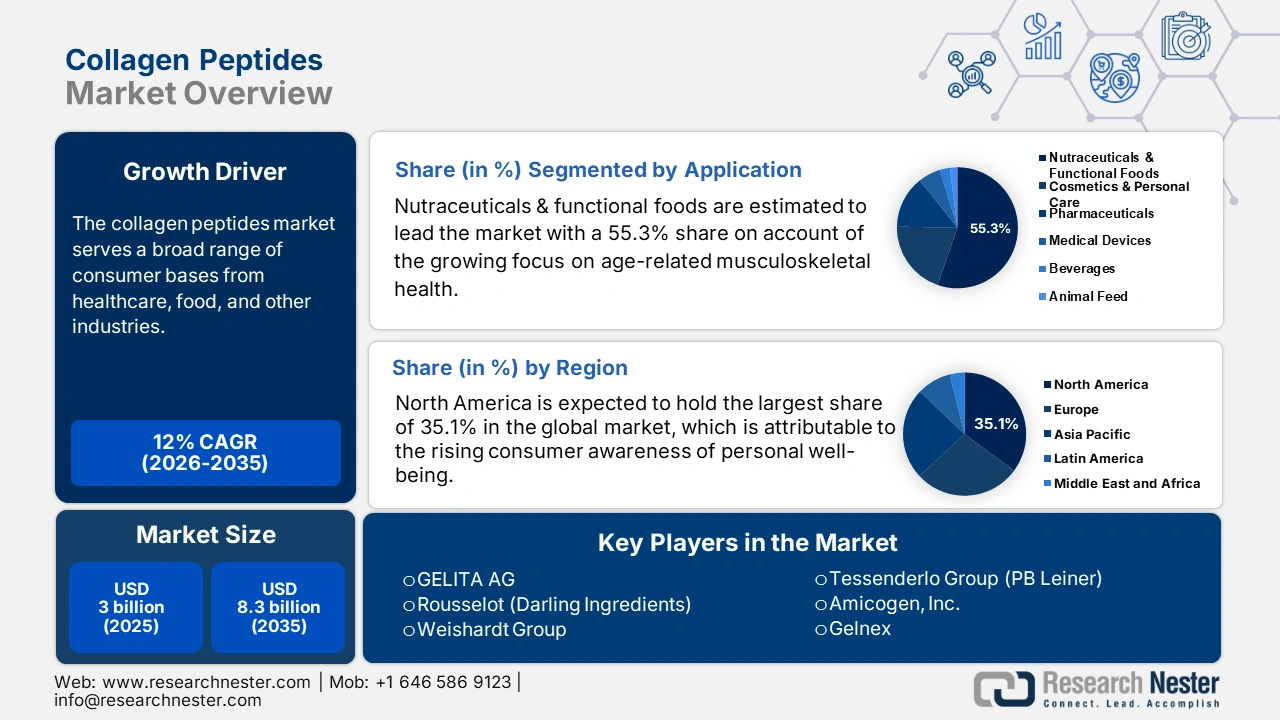

Collagen Peptides Market size was over USD 3 billion in 2025 and is estimated to reach USD 8.3 billion by the end of 2035, expanding at a CAGR of 12% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of collagen peptides is evaluated at USD 3.3 billion.

The market serves a broad range of consumer bases from healthcare, food, and other industries. Particularly in medical applications, the component is widely used to create therapeutics and supplements for its nutritional and curative values. The global rise in the aging population is one of the major contributors to this demography, seeking solutions to restore bodily declines and treat age-related issues such as joint pain, bone density loss, and skin aging. The substantial nature of this epidemiology can further be testified by a report from the World Health Organization (WHO), estimating the number of people aged 60 and over living across the globe to cross 1.4 billion by 2030 and 2.1 billion by 2050.

The global trade dynamics of the market are classified under HS Code 3503 for gelatin and gelatin derivatives, which demonstrated a 1.9% increase between 2022 and 2023, accounting for USD 2.7 billion in total. The values of this category exhibited an annual 7.7% rise over the past 5 years, from 2023, as recorded by the Observatory of Economic Complexity (OEC). On the other hand, the production supply chain of this sector relies on raw material suppliers, providing collagen-rich tissues to specialized manufacturers for hydrolysis, purification, and spray-drying into the final peptide powder. This B2B-focused outsourcing and manufacturing is capital-intensive, which often increases the overall payers’ pricing of the final product.

Key Collagen Peptides Market Insights Summary:

Regional Highlights:

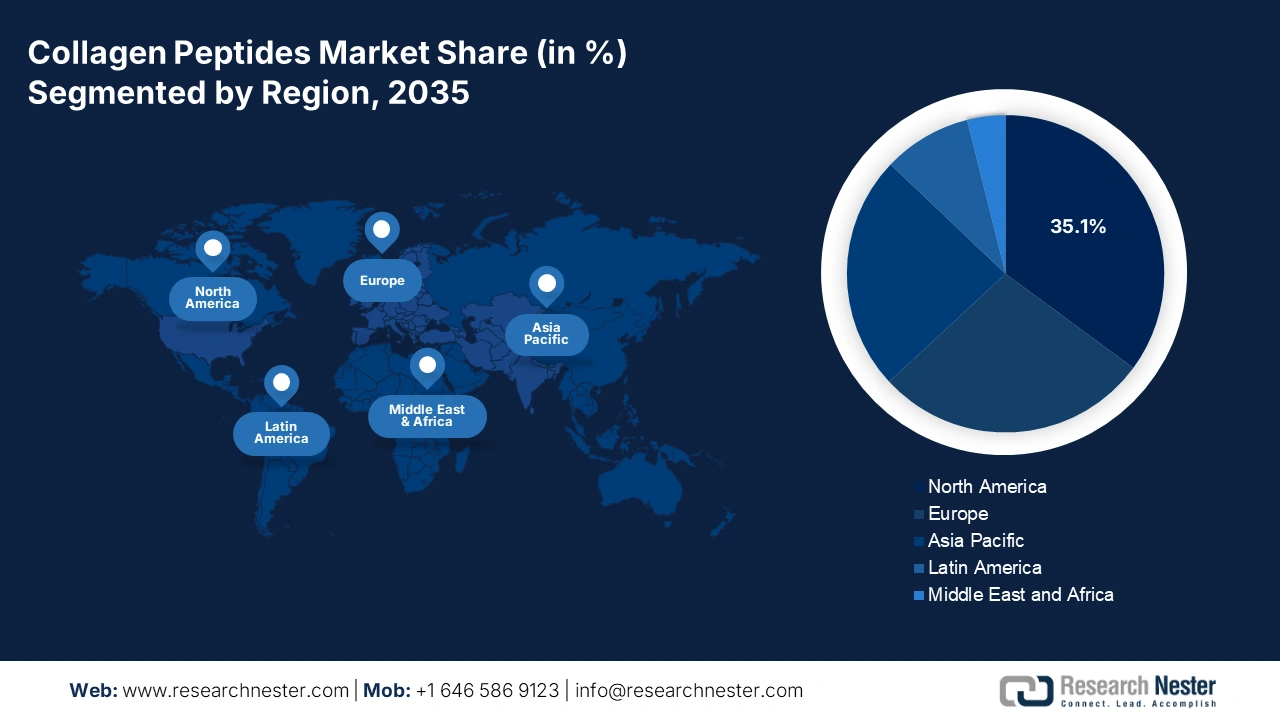

- North America collagen peptides market is projected to command a 35.1% share by 2035, supported by rising consumer awareness toward wellness and the expanding nutraceutical industry.

- Asia Pacific is expected to record the fastest growth through 2026–2035, propelled by increasing disposable incomes, beauty-conscious consumers, and rapid urbanization.

Segment Insights:

- The nutraceuticals & functional foods segment in the collagen peptides market is estimated to capture a 55.3% share by 2035, driven by the growing prevalence of age-related chronic conditions and increasing R&D validation for collagen’s wellness benefits.

- The bovine source segment is projected to hold a 45.8% share by 2035, owing to its cost efficiency, high yield, and broad applicability in large-scale collagen peptide production.

Key Growth Trends:

- Increased awareness of preventive healthcare

- Advancements in extraction and processing

Major Challenges:

- Reimbursement and payer hesitation

- Price controls and reference pricing

Key Players: GELITA AG, Rousselot (Darling Ingredients), Weishardt Group, Tessenderlo Group (PB Leiner), Amicogen Inc., Gelnex, Vital Proteins LLC, BHN (Basic Health Nutrition), Holista CollTech, Ewald-Gelatine GmbH, Lapi Gelatine S.p.a., Junca Gelatines S.L., India Gelatine & Chemicals Ltd., SELO B.V., ConnOils LLC, NutraFoods, Protein S.A.S, Mibelle Biochemistry, Nitta Gelatin Inc., Nippi Inc., Jellice Group, Fuji Foods & Pharma Co. Ltd.

Global Collagen Peptides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 billion

- 2026 Market Size: USD 3.3 billion

- Projected Market Size: USD 8.3 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: India, South Korea, Brazil, Indonesia, Australia

Last updated on : 1 October, 2025

Collagen Peptides Market - Growth Drivers and Challenges

Growth Drivers

- Increased awareness of preventive healthcare: The healthcare industry is experiencing a notable surge in early diagnosis and intervention to prevent the severity or progression of deadly chronic illnesses. In addition, the increasing economic burden of these diseases on both public and private payers is forcing them to promote and adopt maximum preventive measures. In this regard, an NLM study predicted the total healthcare cost of chronic disease worldwide to surpass USD 47 trillion by 2030. Many novel formulations from the market are increasingly being recognized as crucial parts of such regimens, particularly for bone and joint, cardiovascular, and skin health.

- Advancements in extraction and processing: Innovations in extraction and hydrolysis technologies are helping the market produce more bioavailable, effective, and safe products. New medical-grade components are now improving therapeutic outcomes, making it easier for professionals to recommend their use. Moreover, enhanced affordability, solubility, and digestibility increase patient compliance, as processing becomes more sustainable and efficient. These technological strides are making these elements, specifically eternal collagen peptide protein, highly utilized in various clinical settings.

- Clinical research supporting efficacy: An increasing number of peer-reviewed studies are validating the extensive health benefits of products from the collagen peptides market in various medical applications. Researcher are highlighting their role in robust skin regeneration, bone density improvement, cartilage repair, and even cardiovascular health. This scientific backing is encouraging more doctors and dietitians to prescribe collagen peptides (CPs) as part of evidence-based treatments. For instance, a randomized, double-blind trial published in 2025 unveiled that daily supplementation of 3,000 mg of low-molecular-weight CP for 180 days can deliver greater improvement in joint pain and functions in patients with KL grade I or II knee osteoarthritis than placebo.

Key Clinical Studies Investigating Collagen Peptide Applications in Healthcare Applications

Recent and Ongoing Clinical Trials on CPs in Healthcare

|

Clinical Trial Title |

Year/Status |

Population/Focus |

Intervention Details |

Outcome Measures |

|

Collagen Peptide Supplementation and Physical Exercise in Older Adults |

2024 - ongoing |

Adults over 55 years |

10 g/day collagen peptides or placebo for 12 weeks |

Physical function tests, lean body mass, bone markers, quality of life |

|

Low-Molecular Collagen Peptide Supplementation and Body Fat Control |

Completed 2022 |

Older adults aged ≥ 50 years |

15 g/day collagen peptide for 12 weeks |

Body fat changes, bioelectrical impedance analysis |

|

Clinical Improvement in Skin Collagen and Hydration with Collagen Supplement |

Published 2023 |

General adult population |

Collagen supplement daily or every 48 hours for 12 weeks |

Improvement in skin and hair hydration, collagen levels |

Historic Demographic Trends in the Market

Trend Analysis in Knee Osteoarthritis (KOA) Incidence Rates (1990-2019)

|

Country |

Incidence Metrics |

Trend Description |

|

Republic of Korea |

ASIR = 474.85 |

Highest Rank in 2019 |

|

Brunei Darussalam |

ASIR = 456.99 |

2nd Highest Rank in 2019 |

|

Singapore |

ASIR = 453.43 |

3rd Highest Rank in 2019 |

|

Tajikistan |

ASIR = 228.81 |

Lowest Rank in 2019 |

|

Thailand |

EAPC = 0.5 |

Highest increase (1990-2019) |

|

Burundi |

EAPC = 0.04 |

Smallest increase (1990-2019) |

|

U.S. |

EAPC = −0.14 |

Stable / Slight decrease (1990-2019) |

|

Democratic Republic of the Congo |

EAPC = 0.01 |

Stable (1990-2019) |

Legends:

- ASIR = Age Standardized Incidence Rate

- EAPC = Estimated Annual Percentage Change

Challenges

- Reimbursement and payer hesitation: As per a majority of government health systems and private insurers, products from the market still fall under the personal wellness category rather than a medically necessary treatment. This status severely limits reimbursement approvals, with only a fraction of patients receiving any third-party coverage. This is ultimately limiting access to both lower and higher-income populations. To bridge this gap, larger and more robust randomized controlled trials (RCTs) are required that can establish alignment with the evidence threshold of payers.

- Price controls and reference pricing: Many developed landscapes in the market employ strict price control mechanisms to enable affordability. However, in contrast, these efforts may potentially limit the scope and scale of profitability for premium-priced commodities available in this sector. This also discourages investment in high-quality, clinical-grade products by making it difficult to justify the initial investment for market entry. Currently, pioneers are navigating the problem through partnership formation with national health agencies and research institutions.

Collagen Peptides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 8.3 billion |

|

Regional Scope |

|

Collagen Peptides Market Segmentation:

Application Segment Analysis

Nutraceuticals & functional foods are estimated to lead the field of application in the collagen peptides market with a share of 55.3% by the end of 2035. The segment's leadership in this sector is primarily backed by the growing focus on age-related chronic conditions such as OA, obesity, and diabetes. These products are also gaining evidential support from worldwide R&D cohorts due to their proven role in enhancing overall wellness among older individuals, earning greater financial backing. As evidence, in October 2024, a Ph.D. candidate of nutritional sciences, Nick Kuhlman, received funding from the National Strength and Conditioning Association (NSCA) Foundation to support his efforts to prove the effectiveness of CP supplements in maintaining bone metabolism and tendon health.

Source Segment Analysis

Bovine is poised to remain the predominant source for the supply chain of the collagen peptides market by capturing the highest share of 45.8% over the assessed tenure. The cost-effectiveness and high yield of this raw material make it the gold standard for high-quality and large-scale CP extraction. The segment’s amplifying dominance is also supported by stringent oversight and favorable recognition from regulatory bodies. Its wide availability and applicability further ensure its position in this sector as a consistent and reliable raw material source for manufacturers targeting mass production of Type I and Type III collagen.

Form Segment Analysis

The powder form is predicted to dominate the collagen peptides market with a 65.3% share throughout the analyzed timeframe. The subtype’s massive applicability and versatility enable convenience for incorporating CPs into edible products such as smoothies, coffee, and soups. This form also assists in precise dosage control and longer shelf life compared to liquid or capsule forms, while enabling users to tailor their collagen intake according to individual health goals. Moreover, the explosive industry value of dietary supplements is fueling consistent growth in this segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Source |

|

|

Form |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Collagen Peptides Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 35.1% in the global collagen peptides market by the end of 2035. The rising consumer awareness of personal health and wellness and the growing demand for functional foods and dietary supplements are the major growth factors in this sector. The region also benefits from its well-established nutraceutical industry, increasing aging population, and a trend toward preventive healthcare. Besides, North America is home to several leading biotech pioneers who bring advancements to extraction technologies. This is further complemented by a favorable regulatory framework, solidifying the region's dominant position in this market.

According to a report from the OEC, the U.S. positioned itself as the top consumer of gelatin in the world, which accounted for a USD 376 million import value in 2023. This testifies to the large demand base in the market in the U.S., making it a prominent contributor to the regional landscape. The nationwide utilization of CP-based products in health, beauty, and fitness products is largely attributable to their efficacy in joint health, skin care, and muscle recovery properties.

The augmentation of Canada in the market is primarily fueled by the popularity of supplements across various demographics. The country's robust nutraceutical and functional food industries, combined with a strong government focus on elderly well-being and innovation in product formulations, further support the future progress of the merchandise in the country. Additionally, a proactive approach to preventive healthcare and rising interest in clean-label, protein-rich products continue to boost CP consumption in Canada.

APAC Market Insights

Asia Pacific is anticipated to rank as the fastest-growing region in the global collagen peptides market during the assessed tenure. The increasing disposable incomes, personal health awareness, and beauty products demand are collectively propelling the pace of growth of the region in this field. Rapid urbanization and shifting lifestyles are also supporting this progress with a large demography of metabolic disorder-afflicted patients, seeking functional foods and dietary supplements. On the other hand, the region's strong emphasis on a holistic approach to skin care and anti-aging solutions, along with expanding e-commerce channels, is accelerating the adoption of collagen-based products.

The growing capacity of local manufacturers is strengthening the position of China in the APAC collagen peptides market by heavily investing in innovation and pipeline expansion. The country's strong traditional focus on skin health and holistic well-being aligns well with the benefits of CP, encouraging more domestic and foreign companies to invest in this sector. Exemplifying the same, in September 2025, Rousselot acquired a patent for Colartix from the National Intellectual Property Administration of China. This consolidated the company's significance in the joint care industry of China.

India is establishing itself as a hub of localized manufacturing and innovation for the collagen peptides market with its strong, ancient roots in Ayurveda. Particularly, the CP-based supplements segment is gaining momentum across the country as urban consumers become aware of their health benefits. Moreover, the recent boom in e-commerce and social media-driven health trends is fostering a sustainable consumer base for the merchandise in India. Attracted by such a lucrative environment, in 2024, Nitta Gelatin commenced its CP expansion project in Kochi with a USD 5.2 million investment and a target of achieving an annual 1150 MT production capacity.

Country-wise Export-Import Data for Gelatin: HS4 35.03 (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

China |

245 million |

35 million |

|

Australia |

15.2 million |

50.1 million |

|

Malaysia |

63040.6 thousand |

8.3 million |

|

Bangladesh |

4.0 million |

2.8 million |

|

Nepal |

247 thousand |

52.7 thousand |

Source: OEC

Europe Market Insights

Europe is estimated to showcase steady progress in the global collagen peptides market during the timeline between 2026 and 2035. The region is maintaining a strong position in this sector by being a leading landscape for both large production houses and consumer bases. The rapidly aging population, combined with increasing interest in joint health, skin rejuvenation, and fitness nutrition, is also amplifying the uptake volume of CP-based supplements. Moreover, the growing focus on clean-label, sustainably sourced, and scientifically backed products is encouraging innovation and investment in Europe. This can be also testified by the patent acquisition of Colartix from the European Patent Office under the number EP4465823B1 in September 2024.

The UK is one of the key landscapes within the Europe market, which is primarily backed by the growing consumer focus on beauty-from-within and personal wellness. Spreading awareness about the health benefits of CP, combined with an expanding cosmetics industry and biomedical research, is translating to a notable increase in demand for related supplements and functional foods. The UK market is also characterized by a shift in preference toward clean-label and naturaceuticals, which is accompanied by enhanced product accessibility.

The proactive approach to preventive healthcare and fitness trends continues to support the steady growth of Germany in the collagen peptides market. The country is leading the regional territory with leadership in both production and consumption. Additionally, as the population of the nation ages rapidly, it witnesses an explosive surge in anti-aging supplements and skin-care products, fueling demand in this sector. Evidencing this demographic expansion, the AARP International estimated the proportion of people aged 65 and over in Germany to surpass 41% by 2050.

Country-wise Export-Import Data for Gelatin: HS4 35.03 (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Germany |

256 million |

315 million |

|

Spain |

57.6 million |

86.2 million |

|

France |

216 million |

126 million |

|

Luxembourg |

11.1 million |

2.2 million |

|

Romania |

650 thousand |

35.6 million |

|

Denmark |

18 million |

28.8 million |

|

Finland |

104 thousand |

4.9 million |

|

Switzerland |

43.9 million |

70.6 million |

|

Turkey |

149 million |

23.9 million |

|

Belarus |

1.2 million |

518 thousand |

Source: OEC

Key Collagen Peptides Market Players:

- GELITA AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rousselot (Darling Ingredients)

- Weishardt Group

- Tessenderlo Group (PB Leiner)

- Amicogen, Inc.

- Gelnex

- Vital Proteins LLC

- BHN (Basic Health Nutrition)

- Holista CollTech

- Ewald-Gelatine GmbH

- Lapi Gelatine S.p.a.

- Junca Gelatines S.L.

- India Gelatine & Chemicals Ltd.

- SELO B.V.

- ConnOils LLC

- NutraFoods

- Protein S.A.S

- Mibelle Biochemistry

- Nitta Gelatin Inc.

- Nippi Inc.

- Jellice Group

- Fuji Foods & Pharma Co., Ltd.

The commercial dynamics of the market for collagen peptides are experiencing a remarkable surge in participation and diversification. Several established lifestyle brands from the healthcare and nutrition industries are now extending product lines in this category to maintain their relevance with the evolving consumer needs for natural supplements. For instance, in March 2024, ISOPURE launched its new range, Collagen Peptides, for people seeking solutions to enhance joint, skin, hair, and immune health. Each scoop of the product contains 20 grams of CP, which comes with two options: refreshing lemonade and unflavoured.

Recent Developments

- In January 2025, Mibelle launched a revolutionary bio-optimized collagen peptide-based product, CollPerfect P6, which is designed to improve skin structure and firmness, helping you achieve a more youthful and radiant look. The encapsulated bioactivating hexapeptide effectively rejuvenates the skin and improves overall appearance.

- In May 2024, Rousselot introduced an innovative platform of specific collagen peptide compositions, Nextida, at Vitafoods. The product stands as a trusted solution to support the body’s balance naturally, with new targeted health benefits and the ability to reduce the post-meal sugar spike.

- Report ID: 8149

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Collagen Peptides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.