Solar Pump Market Outlook:

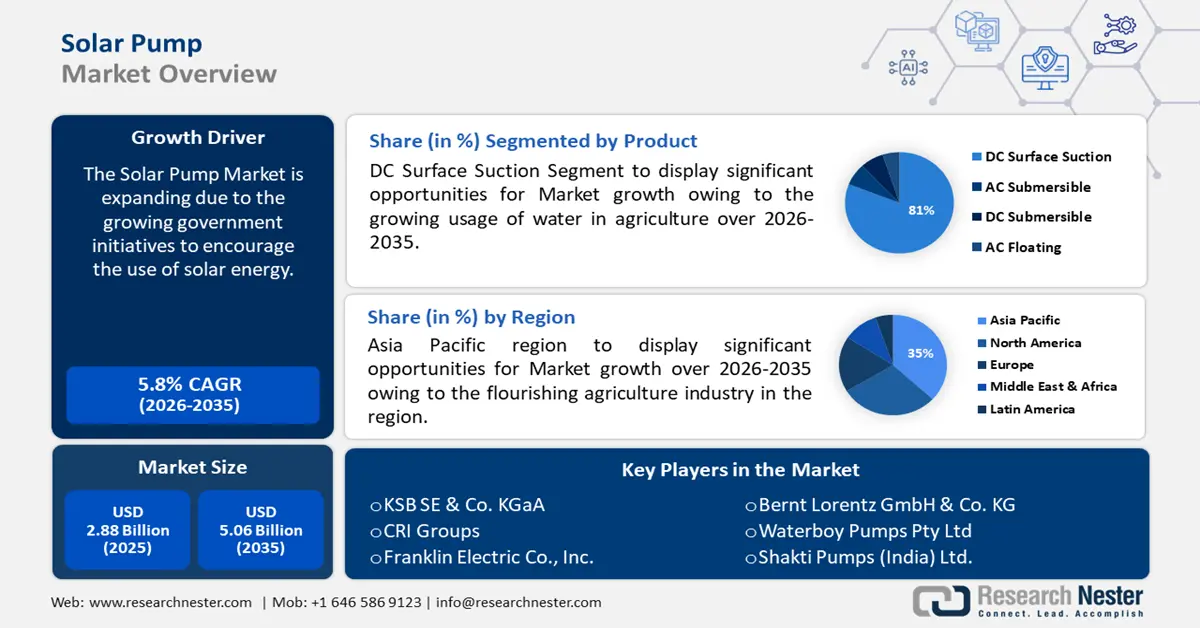

Solar Pump Market size was valued at USD 2.88 billion in 2025 and is likely to cross USD 5.06 billion by 2035, registering more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar pump is assessed at USD 3.03 billion.

Governments around the world are aggressively encouraging the use of solar energy through a range of incentives, feed-in tariffs, and subsidies, making solar pump installations financially feasible, and alluring to farmers, which propels market expansion. Moreover, farmers seeking to purchase solar pump systems are offered government grants other direct financial support, making investing in these systems simpler. According to the International Energy Agency’s data, since 2020, governments have increased their funding for clean energy investment to USD 1.34 trillion.

Key Solar Pump Market Insights Summary:

Regional Highlights:

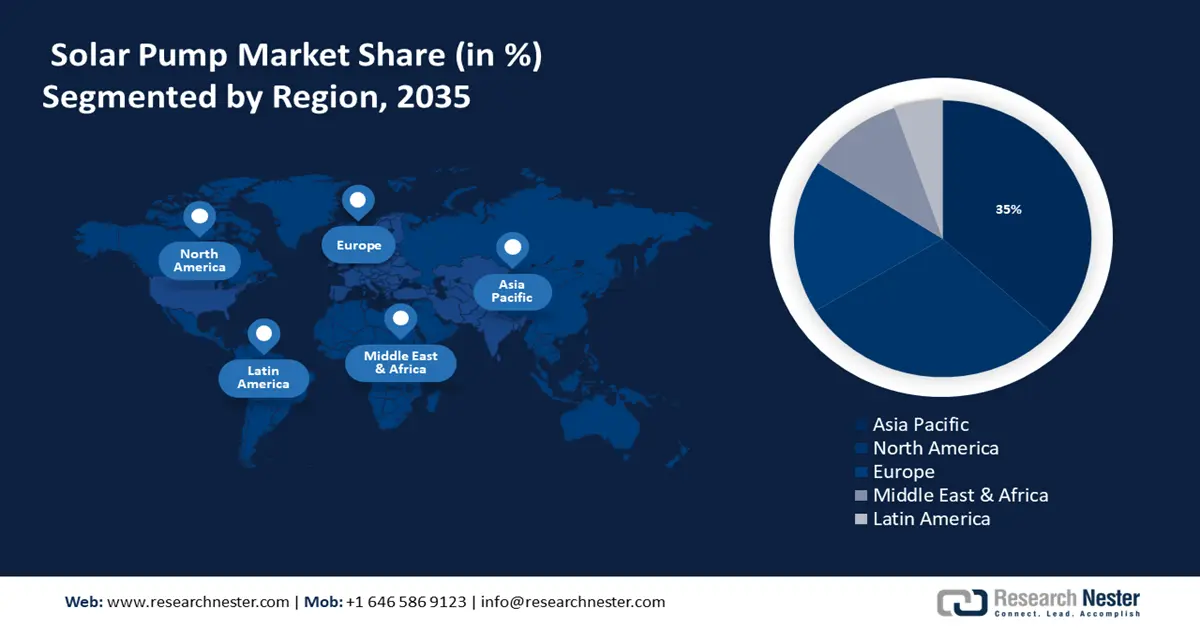

- The Asia Pacific solar pump market will secure over 35% share by 2035, driven by flourishing agriculture and solar pump adoption supported by government incentives.

Segment Insights:

- The dc surface suction segment in the solar pump market is expected to dominate by 2035, fueled by growing water usage in agriculture.

- The agriculture segment in the solar pump market is projected to exhibit a staggering CAGR through 2035, driven by the shift from fossil fuels to affordable solar solutions.

Key Growth Trends:

- Growing concerns about environmental sustainability

- Rising integration of Internet of Things (IOT)

Major Challenges:

- Dearth of awareness about the benefits associated with solar pumps

- Dependence on weather conditions

Key Players: KSB SE & Co. KGaA, CRI Groups, Franklin Electric Co., Inc., Bernt Lorentz GmbH & Co. KG, Waterboy Pumps Pty Ltd, Shakti Pumps (India) Ltd., Grundfos, Stanley Black & Decker, Inc., Kirloskar Brothers Limited, Glynncorp Electrical.

Global Solar Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.88 billion

- 2026 Market Size: USD 3.03 billion

- Projected Market Size: USD 5.06 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: China, India, Thailand, Indonesia, Malaysia

Last updated on : 17 September, 2025

Solar Pump Market Growth Drivers and Challenges:

Growth Drivers

-

Growing concerns about environmental sustainability - Increasing awareness of environmental sustainability and decreasing carbon footprints has stimulated the adoption of clean and renewable alternatives such as solar pumps. As per the International Groundwater Resources Assessment Centre, installing a solar-powered system could potentially cut greenhouse gas emissions by 95-97% when compared to diesel pumps.

-

Rising integration of Internet of Things (IoT) - IoT enables remote monitoring and control of solar pumps. Sensors mounted on pumps can collect real-time performance measurements and transmit them through the internet to centralized platforms or mobile applications. This enables operators to monitor the function, discover problems early, and optimize performance without physically being present on the site. A 2021 report by the International Data Corporation (IDC) estimated that there will be 55.7 billion connected IoT devices (or “things”) by 2025, capable of generating almost 80B zettabytes of data.

- Reduction in the cost of solar panels and related components - The reduced cost of solar panels makes solar pumps more affordable to farmers, particularly those in poor countries or rural areas with limited financial resources. This affordability is expected to foster widespread adoption of solar-powered pumps. As per the statistics published by Our World in Data, solar panel prices have dropped by around 20% every time global cumulative capacity doubled.

Challenges

-

Dearth of awareness about the benefits associated with solar pumps - Many farmers in rural areas still use diesel-powered pumps due to lack of awareness of solar pump technology. In addition, lack of government initiatives to provide training programs and capacity building for technicians and users will limit market expansion over the projected period.

-

Dependence on weather conditions - Weather conditions have a significant impact on the growth of the solar pump market. Heavy rain or prolonged cloudy climate can reduce the effectiveness of solar panels and restrict the functioning of solar-powered pumps. Therefore, understanding and responding to local weather trends is critical for the long-term growth of the market.

Solar Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.88 billion |

|

Forecast Year Market Size (2035) |

USD 5.06 billion |

|

Regional Scope |

|

Solar Pump Market Segmentation:

Product Segment Analysis

DC surface suction segment is poised to account for more than 81.0% solar pump market share by the end of 2035 on account of the growing usage of water in agriculture. The International Atomic Energy Agency states that the growing food demands will result in a 50% rise in the global water requirement for agriculture by 2050.

Irrigation is the primary use of water in agriculture, which is often drawn from rivers or lakes of stored surface water, or it can be pumped from groundwater reserves. This has led to a rise in the need for several high-suction solar DC water pump models that utilize direct current (DC) electricity to pump water from shallow sources, including ponds or rivers for irrigation in agriculture, and are made to descend further and raise water to the surface.

End-user (Agriculture, Water Management)

The agriculture segment is foreseen to expand at a staggering CAGR in the coming years, attributed to the rapid rise in the cost of fossil fuels. According to the data released by the Organization for Economic Co-operation and Development (OECD) and the International Energy Agency (IEA), the cost of global support for fossil fuels in 82 economies nearly doubled to USD 1,481.3 billion in 2022, up from USD 769.5 billion in 2021. Therefore, to reduce the need for costly fossil fuels in agriculture, low-cost solar pumps are being used by small farmers in hot, dry areas to irrigate their fields, for agricultural spraying, and livestock watering.

Operation Segment Analysis

The AC pump segment is projected to generate significant revenue in the solar pump market over the coming years. The majority of rural communities across the globe continue to face difficulties in obtaining a consistent and sustainable supply of water, leading to a higher demand for AC solar-powered pump systems.

AC solar pumps have gained traction for domestic and commercial applications, especially in supplying drinking water in rural areas, mountain villages, or wilderness campsites. The National Library of Medicine stated that approximately 844 million people worldwide still lack access to clean water sources, with 79% of them living in rural areas.

Our in-depth analysis of the global market includes the following segments:

|

Capacity |

|

|

Product |

|

|

Operation |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Pump Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 35% by 2035, due to the flourishing agriculture industry. In consequence, there is a huge amount of land being irrigated in the region, which may boost the need for solar pumps. As per the United Nations Environment Program, farming contributes significantly to the rural economy in many regions of Asia Pacific, making up about 29% of GDP and 65% of all jobs.

In India, the installation of solar pumps during the previous five years is seen as beneficial to farmers and has the potential to generate income. Recently, under the PM-KUSUM project, India has built more than 290,000 solar water pumps for farmers to lessen environmental pollution while offering farmers access to affordable decentralized solar electricity and water security.

Additionally, the government of Japan in tends to grant future-generation flexible solar panels priority status by providing installation cost subsidies and incentives, which may drive the market demand.

The market in China may witness lucrative growth owing to the presence of the World’s top solar pump manufacturers including LARENS, WHC SOLAR, and WASSERMANN.

North America Market Insights

The North America in solar pump market is also predicted to have notable growth in the coming years. The need for effective water management strategies in rural and agricultural areas, growing concerns about environmental sustainability, and growing awareness of renewable sources are the main factors driving the market expansion in the region. Solar pumps are becoming more and more popular throughout the region as solar energy gets more dependable and affordable.

The solar pump landscape in the United States will expand significantly as groundwater is considered significant in many parts of the country. In particular, nearly 25% of the water supply in the United States comes from groundwater, from which more than 80 billion gallons of water are pumped to the surface every day. A report by the Government of Canada states that one third of all the Canadians and about 80% of the rural population consumes water provided by ground water.

Solar Pump Market Players:

- Tata Power Solar

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KSB SE & Co. KGaA

- CRI Groups

- Franklin Electric Co., Inc.

- Bernt Lorentz GmbH & Co. KG

- Waterboy Pumps Pty Ltd

- Shakti Pumps (India) Ltd.

- Grundfos

- Stanley Black & Decker, Inc.

- Kirloskar Brothers Limited

- Glynncorp Electrical

- ABB

In addition to investing money in R&D to create robust and effective solar pump systems, many significant players in the solar pump market are constantly collaborating, expanding, making agreements, and taking part in joint ventures to fortify their positions in the industry.

Recent Developments

- ABB announced the launch of a new ACQ80 variable speed drive (VSD) that provides integrated pumping functions including flow computation and works with both extremely efficient permanent magnet-aided synchronous reluctance (SynRM) motors in surface and submersible pumps.

- Kirloskar Brothers Limited introduced ANNIKA-II and ANISA-II pumps with 0.5 HP enhanced with cutting-edge security measures, and are designed to require less maintenance, especially in isolated areas.

- Report ID: 6265

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.