Global LED Lighting Market TOC

- An Introduction to the Research Study

- Preface

- Market taxonomy

- Definition of the market and the segments

- Acronyms and assumptions

- The Research Procedure

- Sources of Data

- Secondary

- Primary

- Calculation and Derivation of Market Size

- Top-down approach

- Bottom-up approach

- Recommendation by Analyst for C-Level Executives

- An Abstract of the Report

- Evaluation of Market Fluctuations and Outlook

- Market Growth Drivers

- Market Growth Deflation

- Market Trends

- Fundamental Market Prospects

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Regulatory & Standards Landscape

- Economic Outlook: Japan

- Limitations to Japan’s Economic Recovery

- Uplifting Policies to Foster the Growth of the Economy

- Future-Outlook and Strategic Move for Sustainable Economy

- Technological Shift and Implementation Analysis

- Impact of Recession on Global and Japan Economy

- Regional Demand Analysis

- Industry Value Chain Analysis

- Industry Growth Outlook

- Recent Technology Outlook in LED Lighting Market

- End User Analysis

- Pricing Analysis

- Start-up Analysis

- Porter Five Forces Analysis

- PEST Analysis

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- Lamps, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Product

- LED Bulb, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- LED Tube Light, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Luminaries, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Downlighting, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Decorative, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Directional, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Luminaries, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Application

- Indoor, Market Value (USD Million) and CAGR, 2023-2036F

- Outdoor, Market Value (USD Million) and CAGR, 2023-2036F

- By Sales Channel

- Retail/Wholesale, Market Value (USD Million) and CAGR, 2023-2036F

- Direct Sales, Market Value (USD Million) and CAGR, 2023-2036F

- E-commerce, Market Value (USD Million) and CAGR, 2023-2036F

- By End-User

- Commercial, Market Value (USD Million) and CAGR, 2023-2036F

- Household, Market Value (USD Million) and CAGR, 2023-2036F

- Industrial, Market Value (USD Million) and CAGR, 2023-2036F

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- North America, Market Value (USD million), Volume (Million Units), and CAGR, 2023-2036F

- Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Asia Pacific Excluding Japan (APEJ), Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Middle East and Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Cross Analysis of Product w.r.t. End-User (USD Million), 2022

- North America LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- Lamps, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Product

- LED Bulb, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- LED Tube Light, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Luminaries, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Downlighting, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Decorative, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Directional, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Luminaries, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Application

- Indoor, Market Value (USD Million) and CAGR, 2023-2036F

- Outdoor, Market Value (USD Million) and CAGR, 2023-2036F

- By Sales Channel

- Retail/Wholesale, Market Value (USD Million) and CAGR, 2023-2036F

- Direct Sales, Market Value (USD Million) and CAGR, 2023-2036F

- E-commerce, Market Value (USD Million) and CAGR, 2023-2036F

- By End-User

- Commercial, Market Value (USD Million) and CAGR, 2023-2036F

- Household, Market Value (USD Million) and CAGR, 2023-2036F

- Industrial, Market Value (USD Million) and CAGR, 2023-2036F

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- US, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Canada, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Europe LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- By Application

- By Sales Channel

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Germany, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- UK, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Italy, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- France, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Spain, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- BENELUX, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Russia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Poland, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Asia Pacific Excluding Japan (APEJ) LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- By Application

- By Sales Channel

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- China, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- India, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Indonesia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- South Korea, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Australia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Singapore, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Malaysia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- New Zealand, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of APEJ, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Japan LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- By Application

- By Sales Channel

- By End-User

- Latin America LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- By Application

- By Sales Channel

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Brazil, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Mexico, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Argentina, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Middle East and Africa LED Lighting Demand Outlook & Projections, 2022 to 2035: A Comprehensive Study for Stakeholders

- Market Summary

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Global LED Lighting Market Outlook & Projections, Opportunity Assessment by Segment

- Year on Year Growth Forecast (%)

- By Product

- By Application

- By Sales Channel

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Combined Gulf Countries, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Israel, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- South Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of MEA, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Comprehensive Analysis of Leading Players in the Market

- Acuity Brands, Inc.

- Cree Lighting

- Dialight

- Digital Lumens, Incorporated.

- Hubbell

- LSI Industries Inc.

- Siteco GmbH

- Signify Holding

- Seoul Semiconductor Co., Ltd.

- Zumtobel Lighting GmbH

Japanese Players

- Panasonic Corporation

- Koizumi Lighting Technology Corp.

- ATEX Co., Ltd.

- Nichia Corporation

LED Lighting Market Outlook:

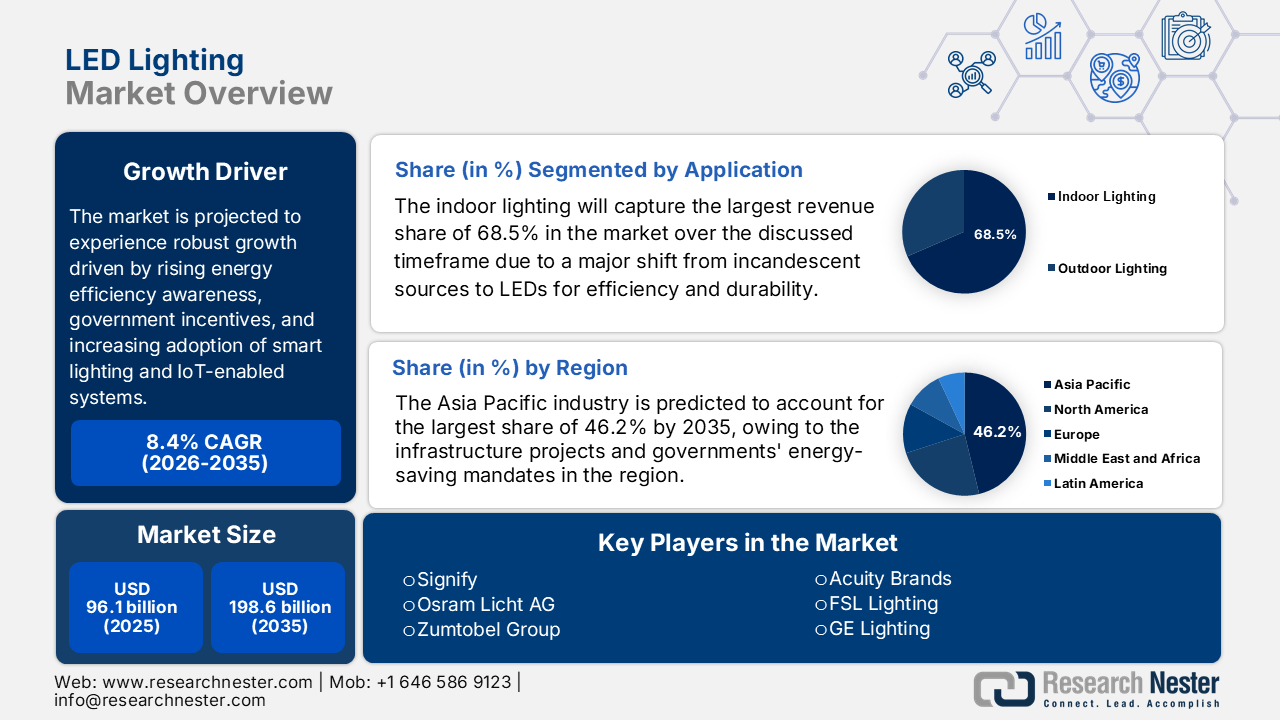

LED Lighting Market size was valued at USD 96.1 billion in 2025 and is projected to reach USD 198.6 billion by the end of 2035, rising at a CAGR of 8.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of LED lighting is estimated at USD 104.1 billion.

The global LED lighting market is projected to experience robust growth over the forecasted years efficiently driven by rising energy efficiency awareness, government incentives, and increasing adoption of smart lighting and IoT-enabled systems. According to the article published by the U.S. Department of Energy in January 2025 its office of Clean Energy Demonstrations awarded more than USD 3.9 million to the East Central Community College solar and lighting upgrades project in Decatur, MS. It also mentioned that this project will upgrade around 3,500 existing light fixtures with energy-efficient LED lighting across 25 facilities, improving illumination and the student learning experience. In addition, these upgrades are expected to reduce the college’s annual energy costs by about USD 170,000, allowing savings to be reinvested into the college and its students.

Furthermore, the sectors such as residential, commercial, and industrial sectors are investing heavily in LED retrofits and new installations to reduce energy costs and carbon footprints, whereas governments across the world are extending their support with substantial funding grants. The government of India in December 2025 reported that India’s UJALA (Unnat Jyoti by Affordable LEDs for All) program has distributed 36.87 crore LED bulbs nationwide, by promoting energy-efficient lighting at affordable prices. The report also underscored that this initiative has generated annual energy savings of 47,883 million kWh, cost savings of ₹19,153 crore (approximately USD 2.31 billion), reduced peak demand by 9,586 MW, and cut CO₂ emissions by 3.88 million tonnes each year, while fostering a competitive landscape for efficient appliances. Hence, such milestones coupled with significant trade activities boost the market by creating mass demand, making LEDs affordable, and fostering a large-scale supply chain.

Global Trade Statistics for LED Lamps (HS6 853950) - 2023

|

Category |

Value (2023) |

|

Global Trade Value |

USD 6.47 Billion |

|

Global Trade Ranking |

581 / 5380 |

|

Share of World Trade |

0.029% |

|

Product Complexity Index (PCI) |

0.41 |

|

Export Growth (2022–2023) |

-13.7% |

|

Top Exporter |

China (USD 5.42 Billion) |

|

2nd Top Exporter |

France (USD 164 Million) |

|

3rd Top Exporter |

Germany (USD 128 Million) |

|

Top Importer |

U.S. (USD 1.61 Billion) |

|

2nd Top Importer |

Germany (USD 369 Million) |

|

3rd Top Importer |

France (USD 288 Million) |

|

Largest Trade Surplus |

China (USD 5.4 Billion) |

|

2nd Largest Trade Surplus |

Saint Barthélemy (USD 2.71 K) |

|

3rd Largest Trade Surplus |

Saint Kitts and Nevis (USD 1.11 K) |

|

Largest Trade Deficit |

U.S. (-USD 1.53 billion) |

|

2nd Largest Trade Deficit |

Japan (-USD 244 million) |

|

3rd Largest Trade Deficit |

Germany (-USD 242 million) |

|

Highest Share of Total Exports |

China (0.16%) |

|

2nd Highest Share of Total Exports |

Bulgaria (0.038%) |

|

3rd Highest Share of Total Exports |

Poland (0.033%) |

Source: OEC

Key LED Lighting Market Insights Summary:

Regional Highlights:

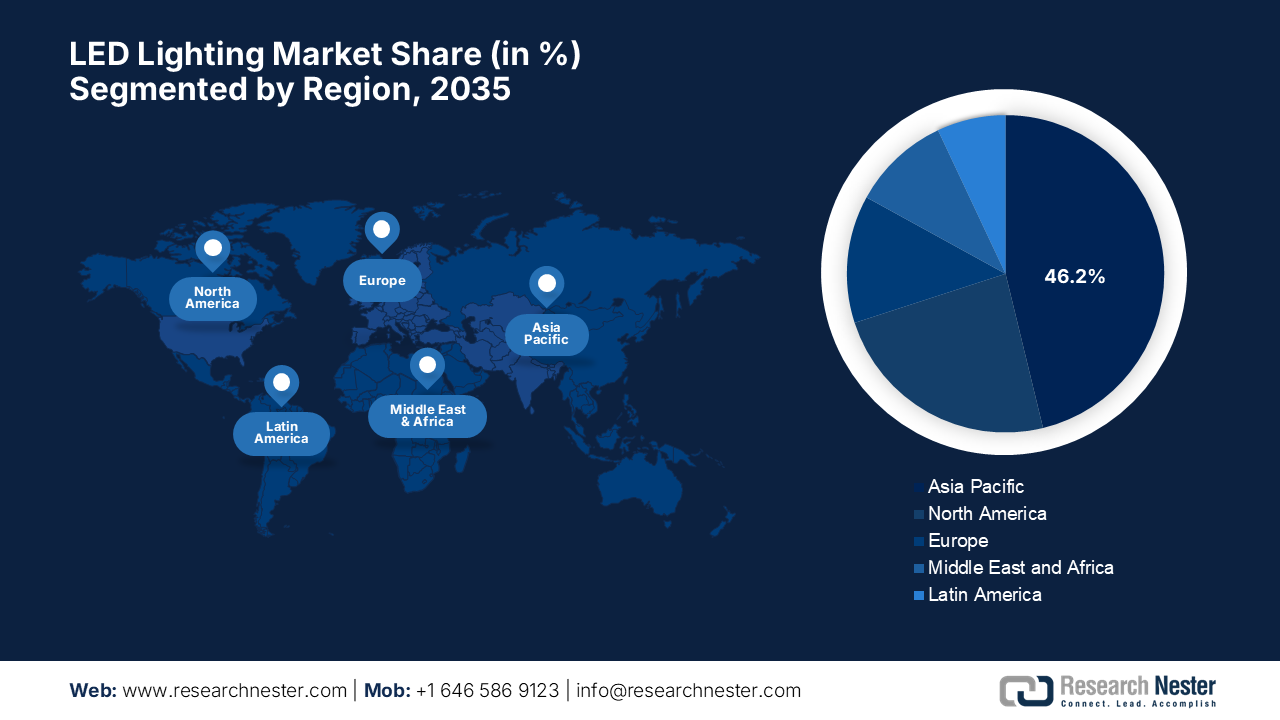

- Asia Pacific is forecast to secure the leading 46.2% revenue share by 2035 in the led lighting market, as large-scale infrastructure development and government-led energy-efficiency mandates across major economies accelerate adoption, underpinned by expanding deployment of smart lighting and connected urban solutions.

- North America is projected to witness steady expansion through 2035, as the strong presence of key manufacturers and rapid rollout of app-enabled, high-efficiency smart lighting systems amplifies market momentum, supported by innovation-driven upgrades in outdoor, industrial, and municipal lighting.

Segment Insights:

- Indoor lighting is anticipated to command a dominant 68.5% revenue share by 2035 in the led lighting market, as widespread adoption across residential and commercial buildings accelerates the transition from incandescent sources for higher efficiency, durability, and reduced heat output, strengthening its market leadership, spurred by large-scale replacement of traditional lighting with energy-efficient LED solutions.

- Luminaries are projected to expand at a notable pace by the end of 2035, as integrated fixture designs offering superior light distribution, longer lifespans, and ease of installation gain strong acceptance across professional and architectural applications, supported by rising demand for high-performance, energy-saving lighting systems.

Key Growth Trends:

- Energy efficiency

- Environmental awareness & carbon reduction goals

Major Challenges:

- Technological complexity and rapid innovation

- Intense market competition

Key Players: Signify, Osram Licht AG, Zumtobel Group, Acuity Brands, FSL Lighting, GE Lighting, Eaton Lighting, NVC Lighting, Zhejiang Yankon Group, Panasonic Lighting, Cree Lighting, Logos Lighting, Toshiba Lighting, Sharp Electronics, Seoul Semiconductor

Global LED Lighting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 96.1 billion

- 2026 Market Size: USD 104.1 billion

- Projected Market Size: USD 198.6 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.2% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 24 December, 2025

LED Lighting Market - Growth Drivers and Challenges

Growth Drivers

- Energy efficiency: LEDs consume low electricity when compared to traditional incandescent or fluorescent bulbs, thereby providing substantial energy savings for households, businesses, and industries. This, in turn, results in low electricity bills, making LEDs an economically attractive option and providing an encouraging opportunity for pioneers to scale in the market. In this regard, Ameresco, in September 2024, announced a LED streetlighting project in Memphis, TN, converting more than 77,000 streetlights to advanced LED fixtures with networked controls, and was recognized by the U.S. Department of Energy’s 2024 integrated lighting campaign. It also stated that this project is expected to save more than 37 million kWh in a year, reduce greenhouse gas emissions by above 26,000 metric tons, and reduce energy costs by approximately 55%, thus enhancing both sustainability and public safety.

- Environmental awareness & carbon reduction goals: There has been a growing global concern about climate change and sustainability, which drives consistent demand for LEDs, and produces lower carbon emissions when compared to conventional lighting. In February 2025, Transport for London (TfL) reported that it had upgraded 6,000 lights at King’s Cross St Pancras Tube station to LEDs that are efficient, thereby making the station brighter with very low power utilization. It also underscored that this project is expected to save 1,400 MWh annually, cut nearly 300 tonnes of CO₂ emissions, and save up to £455,000 (approximately USD 600,000) in operational costs, hence supporting TfL’s goal of a net-zero carbon network by the conclusion of 2030, thereby contributing to LED lighting market growth. Further, this upgrade also improves passenger comfort and safety, with over 40% of the Tube network now converted to LED lighting.

- Urbanization & infrastructure development: Urbanization and growth in infrastructure projects, such as smart cities, highways, and commercial complexes, readily increase the demand for energy-efficient lighting, which in turn is fueling the market growth. In October 2025, Malta’s Ministry for the Environment, Energy, and Public Cleanliness announced that it had launched a residential street lighting retrofit project to replace more than 34,000 conventional luminaires with energy-efficient LED fittings by the end of 2028. It also stated that this €13 million (approximately USD 14.17 million) project is expected to save more than 60% in energy, reduce 3,000 tonnes of CO₂ emissions on a yearly basis, and lower maintenance costs for local councils. In addition, the initiative also improves public safety, minimizes light pollution, and supports sustainable urban infrastructure across Malta’s towns and residential areas.

Challenges

- Technological complexity and rapid innovation: The LED lighting market is witnessing fast-paced technological improvements, which include smart lighting, IoT integration, tunable white solutions, and high-efficiency modules. Since the presence of continued innovation is driving market growth, it also adds challenges for manufacturers, distributors, and end users to keep aligned with evolving standards and compatibility issues. In this context, companies need to make investments in R&D that can be highly resource-intensive, whereas older product lines risk rapid obsolescence. In addition, end users might find it challenging with interoperability, installation, and maintenance complexities, particularly for smart lighting systems. Hence, the rapid innovation cycle increases pressure on supply chains, negatively impacting market progression.

- Intense market competition: The LED lighting market is highly competitive, in which numerous multinational and regional players are constantly vying for market share. Also, the competition is based on price, product performance, energy efficiency, smart features, and brand recognition. The price erosion can be common in this field, particularly in terms of commoditized segments, which in turn compels manufacturers to optimize production costs without any compromise on quality. Therefore, smaller companies face challenges entering mature markets, which are dominated by established players, whereas the intellectual property and patent disputes can also complicate market entry. Thus, maintaining differentiation through innovation, branding, is highly essential to navigate this competitive landscape.

LED Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 96.1 billion |

|

Forecast Year Market Size (2035) |

USD 198.6 billion |

|

Regional Scope |

|

LED Lighting Market Segmentation:

Application Segment Analysis

In the application segment, indoor lighting will capture the largest revenue share of 68.5% in the LED lighting market over the discussed timeframe. The residential and commercial buildings are making a major shift from incandescent sources to LEDs for efficiency, durability, and lower heat output, propelling the dominance of the subtype. Hikvision India, in October 2025, introduced energy-efficient LED display modules, which include regular, soft, and cut-edge variants, especially designed to deliver high-performance visual solutions across diverse commercial environments. The launch is efficiently backed by in-house manufacturing, strong R&D capabilities, and power-saving algorithms that reduce energy consumption by more than 20%. Besides, these new LED modules support creative installations and reliable performance for applications such as retail spaces, large indoor screens, billboards, and building façades, thereby reinforcing Hikvision’s leadership in innovative commercial display solutions.

Product Type Segment Analysis

By the end of 2035, luminaries will grow at a considerable rate in the LED lighting market owing to their capabilities in energy savings, installation convenience, and functional advantages. These integrated fixtures allow better light distribution and longer lifetimes, attracting a wider audience group. Vari-Lite, a Signify brand, in December 2024 announced that it has launched the VL600 Acclaim+ Series, which is a high-output theatrical luminaire range especially designed for professional stage, theatre, and large-venue lighting applications. The firm also notes that this new series delivers enhanced brightness, color accuracy, and optical performance to meet the demanding requirements of live entertainment environments. In addition, the product has a 305W LED engine for over 15,000 lumens of output, and it delivers improved efficiency, thereby reinforcing the segment’s leadership in advanced professional lighting solutions.

End use Segment Analysis

The commercial sub-type based on end use will grow at a lucrative rate in the market, owing to the high usage intensity, regulatory efficiency standards, and heightened demand for energy cost savings. Upgrading to LEDs in offices, retail, and institutional spaces cuts down the electricity and maintenance costs, which is one of the key factors supporting the promotion of LEDs to reduce energy consumption in commercial buildings. In addition, advancements in terms of smart lighting controls and IoT integration are readily enhancing operational flexibility in this sector. Also, there has been a growing awareness of sustainability and green building certifications, which are driving adoption in commercial sectors. Furthermore, the increasing availability of high-quality, durable LED luminaires that are suitable for large-scale commercial applications is also contributing to market growth over the discussed timeframe.

Our in-depth analysis of the LED lighting market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product Type |

|

|

End use |

|

|

Technology |

|

|

LED Type |

|

|

Industry |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

LED Lighting Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to capture the largest revenue share of 46.2% in the global market over the forecasted years. The region’s dominance in this field is supported by infrastructure projects across prominent countries and governments' energy-saving mandates. Also, the expanded utilization of smart home solutions is fostering a profitable business environment for pioneers in this field. In November 2025, Itron, Inc. announced that it had partnered with Connected Lighting Solutions (CLS) in Australia to expand smart lighting infrastructure through the Itron Engage sales channel partner program. In this regard, CLS will leverage its domestic expertise in LED street lighting to deploy Itron’s networked lighting controller hardware and CityEdge software platform, thereby enabling advanced capabilities such as remote monitoring, adaptive schedules, and real-time outage detection. In addition, this collaboration also aims to improve urban lighting efficiency, reduce emissions, and support councils and utilities in transitioning to connected smart streetlights nationwide.

China is representing strong dominance over the regional landscape of the LED lighting market since it hosts extensive infrastructure investments, governmental focus on phasing out inefficient lighting. The country also benefits from its massive manufacturing ecosystem that supports both domestic deployment and export of LED products on an international scale. Signify, in August 2023, announced that it had inaugurated its largest LED lighting manufacturing facility in Jiujiang, China, through its joint venture with Klite, which is producing high-quality LED lamps and luminaires for both domestic and international markets. Besides, the company also highlighted that this is a 200,000-square-meter factory that hosts advanced manufacturing, automation, and intelligent logistics to enhance both innovation and sustainability in production. Hence, this strategic expansion strengthens Signify’s global supply chain, supports China’s sustainability goals, and reinforces the company’s leadership in the market.

India market is efficiently growing due to the presence of national programs such as the Smart Cities Mission and energy efficiency campaigns such as UJALA, which have significantly increased LED adoption in households and public projects. On the other hand, rising residential construction and demand for affordable LED fixtures across urban and rural areas are also propelling a profitable business environment. According to the article published by the Ministry of Commerce & Industry in January 2025, the country’s government under the PLI Scheme for White Goods has selected 24 companies in the third round to invest Rs. 3,516 crore (approximately USD 423.37 million) in manufacturing components for ACs and LED lights, thereby enhancing domestic production capabilities. Besides, this initiative is a part of a broader program involving 84 companies with total investments of Rs. 10,478 crore (approximately USD 1.26 billion) that are collectively aiming to strengthen the component ecosystem, boost domestic value addition, and integrate the country into global supply chains.

Applicants Provisionally Selected in the 3rd Round of PLI Scheme for White Goods (LED Lights) with Committed Investment in INR and USD FY 2021‑23

|

Applicant Name |

Eligible Products |

Committed Investment (Rs. Crore) |

Committed Investment (USD Million) |

|

Ikio Solutions Private Limited |

LED Modules, Mechanical Housing, LED Transformers, LED Light Management Systems (LMS), LED Engines, LED Drivers, Heat Sinks, Diffusers |

41.00 |

493.98 |

|

Lumax Industries Limited |

LED Drivers |

60.00 |

722.89 |

|

Neolite ZKW Lightings Private Limited |

LED Modules |

23.66 |

285.06 |

|

Dhruv Industries Limited |

Metallized film for capacitors |

16.00 |

192.77 |

|

Uno Minda Limited |

LED Drivers, PCB including Metal Clad PCBs, LMS, Ferrite Cores, Diffusers, Heat Sinks, Drum Cores, Wire Wound Inductors, Mechanical Housing, LED Modules, LED Engines, LED Chips |

19.82 |

238.67 |

|

HQ Lamps Manufacturing Co. Private Limited |

LED Drivers, Mechanical Housing |

10.00 |

120.48 |

|

Intelux Electronics Private Limited |

LED Driver, LED Modules, LED Engines, PCB including Metal Clad PCBs, LED Light Management System, LED Transformers |

51.50 |

620.48 |

|

Hella India Automotive Private Limited |

LED Drivers |

17.84 |

214.94 |

Source: Ministry of Commerce & Industry

North America Market Insights

North America is efficiently growing in the global LED lighting market owing to the presence of key market players who are introducing smart lighting solutions. These smart solutions are automated, and they can be monitored through mobile applications or additional connected devices, thereby enabling remote operations as well. In this regard, Lumileds in September 2024 announced that it has launched the LUXEON 5050 HE Plus LEDs, which deliver 199 lumens per Watt and reduce power consumption by over 18% for outdoor and industrial lighting applications. The firm notes that these high-efficiency LEDs support sustainability goals by reducing material usage in heatsinks and drivers, and enabling low-carbon or off-grid lighting solutions. The product also features advanced thermal management, precise flux binning, and robust packaging, wherein the LUXEON 5050 HE plus offers superior performance for municipal, commercial, and industrial lighting.

The U.S. is the powerhouse of innovations in the market, which strongly benefits from a vast consumer base. The country’s consumer pool prefers smart home systems that are compatible with different platforms. In December 2025, Cree LED announced that it had partnered with SANlight to integrate its J series LEDs into SANlight’s new STIXX-Series horticulture luminaires, delivering up to 3.1 μmol/J efficiency and lifetimes exceeding 53,000 hours. The modular, space-saving fixtures also feature advanced optics, uniform light distribution, and IP68-rated protection for a very reliable performance in diverse growing environments, including vertical farming. In addition, this collaboration combines Cree LED’s technology leadership with SANlight’s expertise in photobiology to optimize plant growth and yield for commercial and home growers, hence contributing to overall market growth.

Canada has a huge opportunity to capitalize on the regional LED lighting market effectively, attributable to government policies requiring energy efficiency labeling. Urban infrastructure projects in major cities and increasing integration in various sectors, including agriculture, support the rising demand for LED lighting. In August 2025, Aelius LED, which is a Canada-based horticultural lighting company, announced that it had launched a rebate kick-back program for licensed cultivators in British Columbia and Ontario, offering up to 10% extra per rebated fixture through provincial energy rebate programs such as BC Hydro, FortisBC, and Save on Energy. This program allows participants to receive benefits as cash, future credits, additional fixtures, or pass the value to their customers, with no cap on total rewards. The program ran until November 7, 2025, and the initiative aimed to help growers maximize rebates, invest in energy-efficient LED lighting, hence indicating a positive market outlook.

Europe Market Insights

Europe is yet another dominant force in the global LED lighting market that is constantly promoting energy conservation. The region focuses on reducing e-waste, wherein the market is positively influenced by stringent regulations and eco‑design directives that phase out inefficient lighting technologies. According to the article published by the government of the UK in January 2023, under the Department for Business, Energy & Industrial Strategy, it announced a few proposals to raise minimum energy performance standards for lighting across Great Britain. The initiative aims to make homes and businesses more energy-efficient by ensuring only high-efficiency lighting, such as LED bulbs, is available, potentially saving households around £2,000-£3,000 (approximately USD 2,400 to 3,600) over the bulbs’ lifetime. The government expects reductions in energy usage and up to 1.7 million tonnes of carbon emissions by 2050. These proposals complement broader energy efficiency programs, including the ECO4 and ECO+ schemes, the public sector decarbonisation scheme, and the It all adds up campaign.

In Germany, the LED lighting market benefits from environmental standards and industrial leadership in technology innovation. The aspects of high electricity costs drive fast retrofits in commercial infrastructure, whereas the smart building deployments and energy performance contracting enhance LED integration in industrial as well as residential segments. In this context, LEDVANCE in January 2025 announced the acquisition of Germany-based lighting company loblicht to enhance its portfolio with high-quality design luminaires for workspaces, offices, and public spaces. Besides, this move strengthens the firm’s project expertise and global brand offerings, leveraging loblicht’s reputation for innovation and lighting solutions. Furthermore, Loblicht will benefit from LEDVANCE’s international footprint and customer network, hence creating new growth opportunities.

In the U.K., the LED lighting market is backed by green building practices and domestic government initiatives, which are encouraging LED replacements and smart lighting networks. Commercial modernization projects and urban lighting upgrades in the country also contribute to a dynamic market landscape. For instance, in July 2025, Anglia Components announced that it had entered into a franchise agreement with Lifud Technology, which is one of the most prominent manufacturers of high-quality LED drivers. Besides, this partnership allows Anglia to pair its LED lighting products with Lifud’s wide range of driver modules, thereby promoting both energy efficiency and sustainability. In addition, Anglia represents its commitment to green initiatives, including reduced product miles, recyclable packaging, and smart premises facilitation, whereas Lifud highlighted its focus on technology, quality, and building a collaborative ecosystem.

Key LED Lighting Market Players:

- Signify (Netherlands)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Osram Licht AG (Germany)

- Zumtobel Group (Austria)

- Acuity Brands (U.S.)

- FSL Lighting (China)

- GE Lighting (U.S.)

- Eaton Lighting (U.S.)

- NVC Lighting (China)

- Zhejiang Yankon Group (China)

- Panasonic Lighting (Japan)

- Cree Lighting (U.S.)

- Logos Lighting (China)

- Toshiba Lighting (Japan)

- Sharp Electronics (Japan)

- Seoul Semiconductor (South Korea)

- Signify was formerly called Philips Lighting, is the world’s largest LED lighting manufacturer, that is offering a wide range of energy-efficient lighting products, connected systems, and smart city solutions. The company is leading in this market with innovations in IoT-enabled lighting, sustainable technologies, and global distribution, serving commercial, industrial, and residential sectors. In addition, Signify’s strategy emphasizes digital transformation, strategic partnerships, and expansion into emerging markets.

- Acuity Brands is one of the most prominent firms in the LED lighting market, which is focused on commercial and industrial applications. The company is best known for integrating lighting systems with building management and smart controls, and it delivers solutions for complex infrastructure projects. Acuity makes heavy investments in energy-saving innovations and software platforms that enhance building efficiency, positioning itself as a predominant leader in this sector.

- ams OSRAM AG is formed from OSRAM Licht and is yet another key player in optoelectronics and LED technologies that has a very strong global footprint. The company is focused mainly on R&D investments to advance high-efficiency LEDs, connected systems, and sensor-based lighting solutions. Besides the firm’s diversified portfolio and global supply network, it is efficiently reinforcing its competitiveness in a fragmented market.

- Cree Lighting is a part of SMART Global Holdings, specializing in terms of high-performance LED components and lighting systems for commercial, industrial, and outdoor applications. The company has a strong reputation for innovation in chip and luminaire technology, and it emphasizes high brightness, energy efficiency, and reliability. Expanding product portfolios into smart lighting systems and partnerships to enhance market penetration are a few strategies opted for by Cree, which has positioned itself as a leading firm in this sector.

- Seoul Semiconductor is a frontrunner in this sector that is best known for its high-brightness LED products across general illumination, automotive, and specialty lighting. Besides, the company holds an extensive patent portfolio and focuses on technology-driven differentiation, which includes exclusive chip designs and efficiency improvements. Further, Seoul’s global expansion efforts and legal actions to protect its IP underscore its stronger emphasis on innovation and presence in the market.

Below is the list of some prominent players operating in the global market:

The global LED lighting market is highly competitive and is dominated by multinational firms that blend strong brand reputation with rapid innovation. Continuous investments in R&D to enhance energy efficiency and sustainable lighting solutions are a few strategies opted for by the key pioneers, thereby expanding global distribution networks. Mergers & acquisitions, and partnerships with leading organizations, also help companies to streamline their product portfolios and enter adjacent smart‑lighting and IoT ecosystems. In this context, Fusion Optix in April 2025 announced that it had acquired Vermont-based three lighting companies, LEDdynamics, Prolume Lighting, and LEDSupply, with a focus on strengthening its presence in standard, custom, and outdoor LED lighting, driver technologies, and e-commerce. Also, the acquisitions enhance Fusion Optix’s technical expertise, manufacturing capacity, and service capabilities, bolstering U.S.-based operations, supporting sustainable innovation.

Corporate Landscape of the LED Lighting Market:

Recent Developments

- In December 2025, Bridgelux, Inc. and Lumitech GmbH announced that they had entered a strategic patent cross-licensing agreement to advance next-generation tunable white and RGBW lighting solutions. The partnership combines the firm’s four-color-in-one RGBW LED technology with Lumitech’s PI-LED expertise, enabling fully tunable white light.

- In July 2025, Luminus Devices introduced the MP-5050-240P and MP-5050-810P high-power LEDs for demanding outdoor and commercial lighting, offering 244 lm/W efficiency, long lifespan, and excellent thermal performance.

- In May 2025, Signify announced that it launched an LED lighting tube that is made with 40% post-consumer recycled plastic, including materials from fishing nets, water jugs, and car headlights, marking Europe’s first of such type.

- In May 2025, Kyocera launched the G7A Series, which is a new air-cooled UV LED light source that combines compact design with high curing performance for ink, resin, and adhesion applications. The G7A Series features the highest irradiance in its class, a 62% smaller footprint than previous models, and customizable irradiation widths.

- Report ID: 5269

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

LED Lighting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.