Infrared LED Market Outlook:

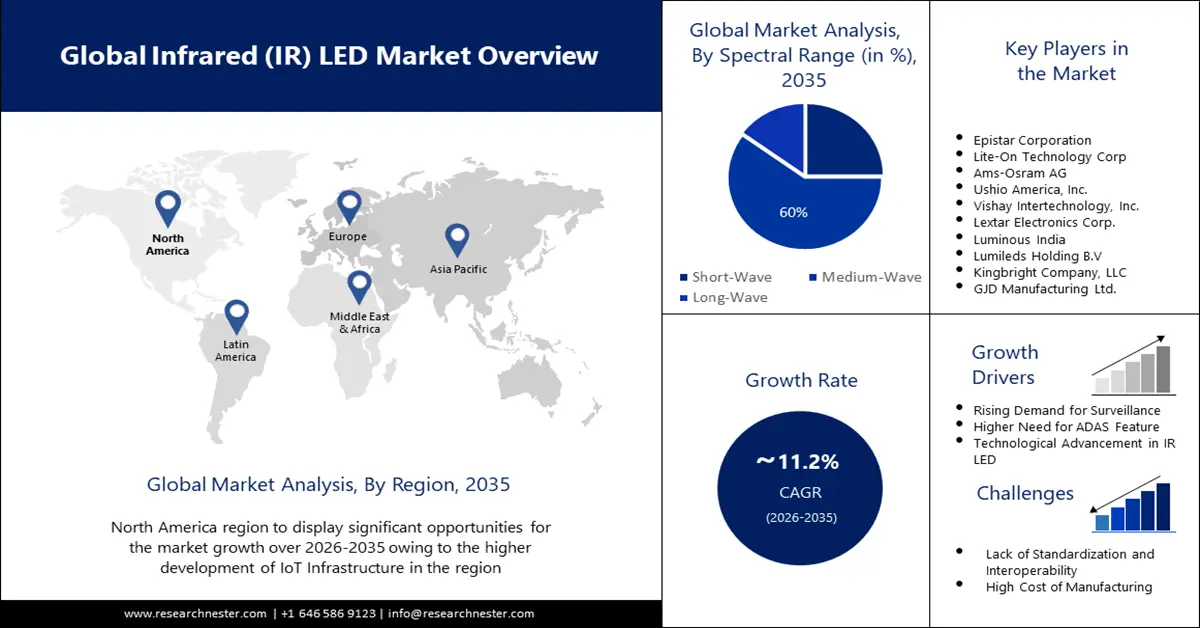

Infrared LED Market size was valued at USD 1.58 billion in 2025 and is set to exceed USD 4.57 billion by 2035, registering over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of infrared LED is estimated at USD 1.74 billion.

The rising deployment of security cameras is the key factor for market growth. As of May 2021, around 770 million security cameras were installed in 150 major cities in the world. Nowadays, security cameras are usually equipped with IR LEDs to capture clear images and videos even in pitch-black darkness. IR LEDs emit infrared light that is invisible to human eyes but can be detected by the camera’s image sensor.

Besides this, the higher use of IR LEDs in medical therapies is also expected to augment the IR LED market growth. IR LED therapy can stimulate collagen production and can penetrate deep into the skin. Therefore, it is used for skin tightening and wound healing for removing wrinkles and acne. IR LED promotes cellular activity and enhances blood circulation, which can result in smoother and youthful-looking skin. Therefore, rising problems of acne and fine lines are driving its demand. Moreover, it is also used to mitigate the pain and inflammation caused by arthritis, ankle tendonitis, knee osteoarthritis, and carpal tunnel syndrome. According to one study, infrared light combined with red light treatment lowered osteoarthritis-related pain by over 50%.

Key Infrared LED Market Insights Summary:

Regional Highlights:

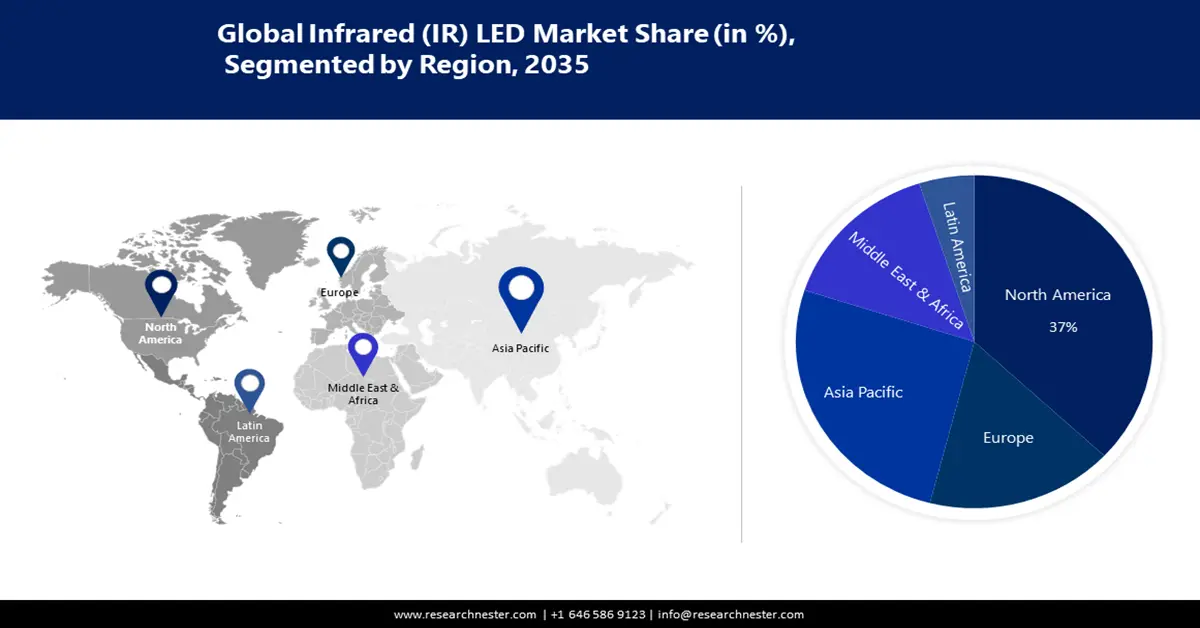

- The North America infrared LED market is projected to capture a 37% share by 2035, driven by the rising development of IoT infrastructure and smart city building advancements.

- The Asia Pacific market is expected to secure a 26% share by 2035, attributed to increased use of cameras for safety and security, boosting demand for infrared LEDs.

Segment Insights:

- The medium-wave segment in the infrared led market is projected to secure a 60% share by 2035, attributed to the rising use of identity verification systems in the defense sector.

Key Growth Trends:

- Growing Demand for Automotives with ADAS

- Growing Demand for Smart Home Devices

Major Challenges:

- Huge Competition from Alternative Technologies

- High Cost of Manufacturing and Procuring

Key Players: GJD Manufacturing Ltd., Epistar Corporation, Lite-On Technology Corp, Ams-Osram AG, Ushio America, Inc., Vishay Intertechnology, Inc., Lextar Electronics Corp., Luminous India, Lumileds Holding B.V., Kingbright Company, LLC.

Global Infrared LED Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.58 billion

- 2026 Market Size: USD 1.74 billion

- Projected Market Size: USD 4.57 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Infrared LED Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Automotives with ADAS– Lane-keep assist feature was installed in 52% of Japanese vehicles in the first half of 2021, 30% in Mainland China, and 63% in the United States. Moreover, around 75 million cars with ADAS features were sold in 2021. Infrared LEDs can be employed in proximity sensors used in ADAS applications. These LEDs emit light and the sensor detects the reflected light.

- Growing Demand for Smart Home Devices– In the world, around 130 million and 73 million households have smart speakers and smart big appliances, respectively. Moreover, by 2027, this number is expected to reach 335 million, and 178 million, respectively. IR LEDs can be integrated into home automation hubs of smart home controllers. These hubs act as central control units for various smart devices in the home, including TV, audio devices, and other IR-enabled devices.

- Development of Smart cities- By 2030, the globe is predicted to contain 43 megacities with populations of more than 10 million people, the majority of which will be in developing countries. Smart cities aim to improve transportation efficiency, public lighting, and others. IR LEDs can be integrated into smart lighting systems used in smart cities. These LEDs can provide additional functionality, such as motion detection and occupancy sensing which enable energy-efficient lighting solutions

- Advancement in the Technology of IR LED- Scientist of the University of Melbourne, Australian Research Council Centre of Excellence for Transformative Meta-Optical Systems (TMOS), the Lawrence Berkely National Laboratory, and the University of California jointly engineered an IR LED that can be tuned to different wavelengths of light. The device can detect a variety of gases, including possibly hazardous ones, boosting the safety of firefighters, coal miners, the military, and even your neighborhood plumber.

Challenges

- Huge Competition from Alternative Technologies- The IR LED market faces competition from alternative technologies, such as laser diodes, organic LEDs (OLEDs), and quantum dots. These technologies offer unique advantages and are continually advancing, posing a challenge to the growth of IR LEDs.

- High Cost of Manufacturing and Procuring

- Lack of Standardization Leading to Interoperability and Compatibility Issues

Infrared LED Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 1.58 billion |

|

Forecast Year Market Size (2035) |

USD 4.57 billion |

|

Regional Scope |

|

Infrared LED Market Segmentation:

Spectral Range Segment Analysis

The medium-wave segment in the infrared LED market is estimated to gain the largest revenue share of about 60% in the year 2035. The growth of the segment is attributed to the rising use of identity verification systems in the defense sector. Medium wave OR LEDs are used in friend-or-foe identification systems, also known as IFF systems. These systems employ IR LEDs to emit unique identification codes or signals that can be recognized by corresponding IR sensors or receivers. By utilizing medium wave LEDs, military forces can distinguish friendly units from potential threats, enhancing operational coordination and reducing the risk of friendly fire incidents.

Our in-depth analysis of the global infrared LED market includes the following segments:

|

Spectral Range |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Infrared LED Market Regional Analysis:

North American Market Insights

The North America industry is poised to dominate majority revenue share of 37% by 2035. The rising development of IoT infrastructure will drive the region’s market growth. Local governments of America are going to allocate USD 41 trillion over the next two decades for developing their facilities for the Internet of Things. Besides this, the advancement of smart city building followed by higher implementation of smart traffic management systems, and efficient distribution and utilization of energy will also contribute to the industry expansion in the region.

APAC Market Insights

The Asia Pacific infrared LED market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The increased use of cameras in public places for safety and security is driving up demand for infrared (IR) LED in the region. The establishment of security cameras has become mandatory after the implementation of section-144 of CrPC in India on January 2022, so far around 70,000 cameras have been deployed and even more will be installed in the near future. Moreover, in China, there are nearly 700 million CCTV cameras all over the country, which means that for every 2 people, there is one lens. Security cameras often use motion detection algorithms to trigger recording or alert notifications when movement is detected within the camera’s field of view. Infrared LEDs can help improve the accuracy of motion detection, as they can provide additional illumination and enhance the camera’s ability to detect moving objects in low-light environments.

Infrared LED Market Players:

- GJD Manufacturing Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Epistar Corporation

- Lite-On Technology Corp

- Ams-Osram AG

- Ushio America, Inc.

- Vishay Intertechnology, Inc.

- Lextar Electronics Corp.

- Luminous India

- Lumileds Holding B.V.

- Kingbright Company, LLC

Recent Developments

- GJD Manufacturing Ltd., an AVA Group Company announced the launch of Clarius Medium Hybrid IP IR/WL LED illuminator. It combines two technologies of white light and infrared LED technology. Clarius Hybrid has been engineered to work seamlessly with IP cameras to deliver event-triggered lighting to both illuminate and discourage thieves.

- Ams-OSRAM AG has announced the launch of the first product in the line of OSLON Black family of infrared (IR) LEDs. It has wide monitoring in cabin surveillance systems and improves the clarity of the IR images.

- Report ID: 5053

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Infrared LED Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.