Global Micro LED Market

- An Outline of the Global Micro LED Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

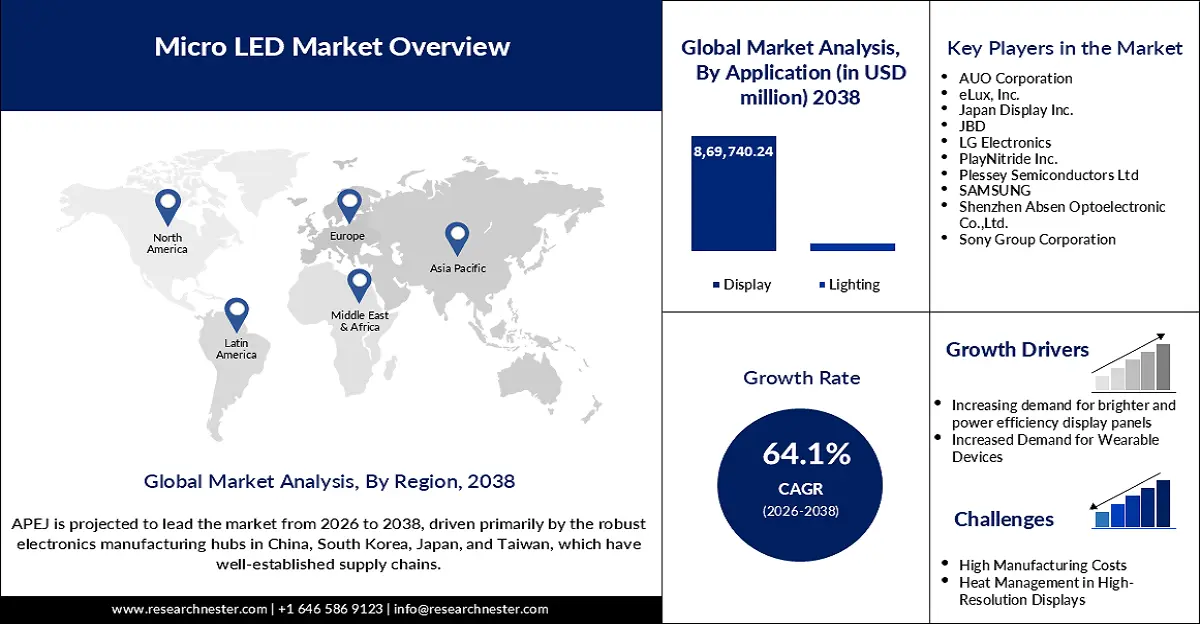

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Ongoing Advancements

- Growth Outlook

- Risk

- Pricing Benchmarking

- SWOT

- Regional Demand

- End-User Segment Analysis of the Global Micro-LED Market

- Growth Potential for End-User of Micro LED Market

- Strategic Overview of Micro-LED Manufacturing Process

- Global Hotspots of Micro-LED Fabrication Excellence

- Emerging Technologies in Micro-LED Fabrication

- Cost & Capability Breakdown for Micro-LED Fabrication

- Root Cause Analysis (RCA) for discovering problems of the Micro LED Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitive Landscape: Key Players

- Competitive Model

- Market Share of Company, 2024

- Company Profile

- AUO Corporation

- eLux, Inc.

- Japan Display Inc.

- JBD

- LG Electronics

- PlayNitride Inc.

- Plessey Semiconductors Ltd

- SAMSUNG

- Shenzhen Absen Optoelectronic Co.,Ltd.

- Sony Group Corporation

- Global Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

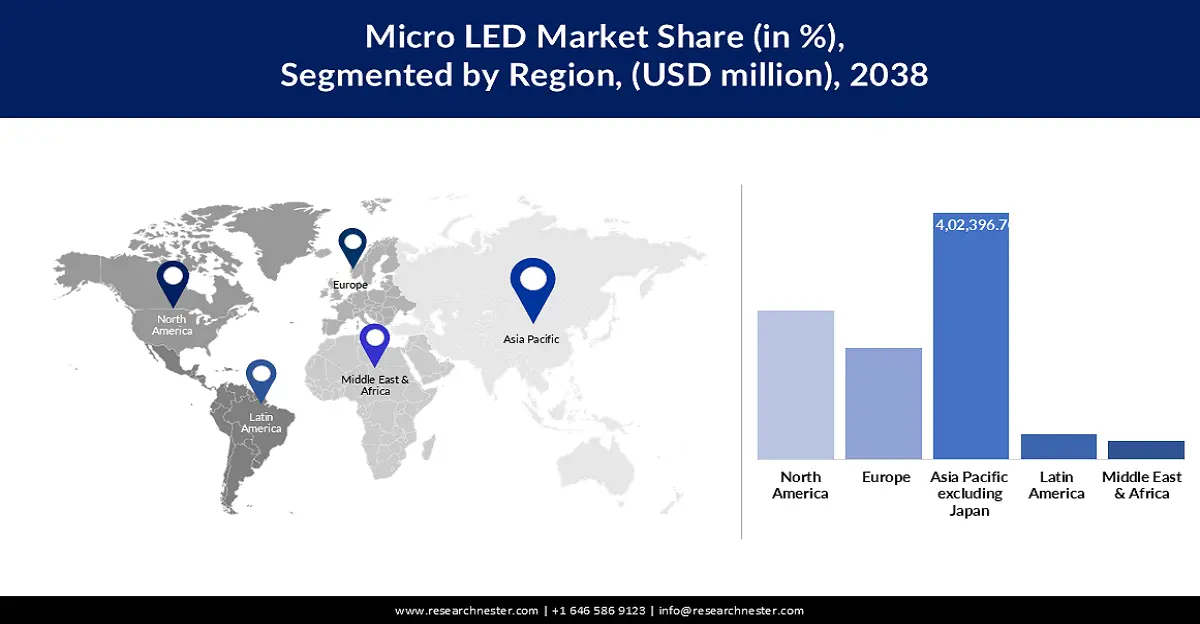

- By Region

- North America, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Europe, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Asia Pacific excluding Japan, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Japan, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Latin America, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Middle East and Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- North America Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Country

- U.S., Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Canada, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Europe Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Country

- UK, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Germany, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- France, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Italy, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Spain, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- BENELUX, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Poland, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Russia, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Rest of Europe, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Asia Pacific Excluding Japan Micro LED Market Outlook

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific excluding Japan Micro LED Market Segmentation Analysis (2025-2038)

- Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Country

- China, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- India, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Indonesia, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- South Korea, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Malaysia, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Australia, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Singapore, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Vietnam, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- New Zealand, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Rest of APEJ, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Japan Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Japan Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Latin America Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Country

- Brazil, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Argentina, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Mexico, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Rest of Latin America, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Middle East & Africa Micro LED Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Micro LED Market Segmentation Analysis (2025-2038)

- By Application

- Display, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Lighting, Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Panel Size

- Micro Display, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Small and Medium-sized Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Large Panel, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By End user

- Consumer Electronics, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Advertising, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Aerospace and Defense, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Healthcare, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- Others, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Country

- GCC, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Israel, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- South Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR, 2025-2038F

- By Application

- Cross Analysis of Application W.R.T. End User (USD Million), 2025-2038

- Global Economic Scenario

- About Research Nester

Micro LED Market Outlook:

Micro LED Market size was valued at USD 1.4 billion in 2025 and is projected to reach a valuation of USD 937.9 billion by the end of 2038, rising at a CAGR of 64.1% during the forecast period, i.e., 2026-2038. In 2026, the industry size of micro LED is assessed at USD 2.4 billion.

The micro LED market is experiencing rapid growth, driven by global demand for next-generation display technology that offers improved brightness, efficiency, and a longer lifetime. Samsung unveiled its 2024 microLED TV lineup in China in March 2024, unveiling a new 76-inch model, strengthening its position in the premium home entertainment market, and signaling a strategic move to accelerate microLED adoption. This is underpinned by significant R&D advancements and increasing government incentives. For instance, governments are also unveiling new policies to drive innovation in new domains, namely microLED and advanced display technologies, to support its domestic supply chain and tech sovereignty.

Key Micro LED Market Insights Summary:

Regional Insights:

- The Asia Pacific excluding Japan Micro LED Market is anticipated to secure a 42.8% share by 2035, sustained by strong policy incentives, large-scale manufacturing capacity, and a deeply integrated supply ecosystem.

- The North America region is projected to expand at a CAGR of 63.6% from 2026 to 2038, impelled by government-backed initiatives supporting advanced manufacturing and innovation-led research programs.

Segment Insights:

- The display segment in the Micro LED Market is projected to command a robust 92.7% share by 2035, propelled by superior vision performance enabling advanced high-end TVs and innovative automotive screen applications.

- The small and medium-sized panel segment is anticipated to capture a 46.2% share through 2038, fueled by escalating demand for high-performance displays across automotive, AR/VR devices, and wearable technologies.

Key Growth Trends:

- Supply chain maturity and mass production

- Technological advancements in miniaturization and luminosity

Major Challenges:

- Micro LED mass production challenges and cost

- Strategic and financial challenges in adopting micro LED technology

Key Players: Samsung Electronics Co., Ltd., Apple Inc., LG Electronics, Nichia Corporation, Signify (Philips Lighting), Lumileds Holding B.V., OSRAM GmbH, Sony Corporation, Wolfspeed, Inc., Konka Group, Refond Optoelectronics, Panasonic Corporation, JBD, AUO Optronics, Epistar.

Global Micro LED Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 19.3 billion by 2038

- Growth Forecasts: 64.1% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (42.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: India, Taiwan, Singapore, France, United Kingdom

Last updated on : 23 September, 2025

Micro LED Market - Growth Drivers and Challenges

Growth Drivers

- Supply chain maturity and mass production: One of the key drivers is a significant advancement in the mass production of large-scale micro-LEDs and establishing the worldwide supply chain. AUO and PlayNitride announced a historic strategic alliance in November 2023 to build the world's largest microLED fab line, a move intended to expedite commercialization for both companies. This investment in large-scale epiwafer factories and high-end production lines is critical to reducing costs to enable micro LED technology to be profitable in mass markets, including wearables, automotive displays, and consumer TVs.

- Technological advancements in miniaturization and luminosity: The market growth is being fueled by aggressive innovation in chip technology, which provides record levels of brightness and pixel density in compact packages. In March 2024, Innovision announced it had demonstrated an XGA resolution vertically-stacked full-color display with a brightness of over 500,000 nits. Such developments are enabling new applications for AR/VR devices, high-end portable displays, and other areas of use where miniaturization and high-end performance are needed. Such developments are essential to pushing past existing limitations and enabling new applications.

- Strong government support and strategic investment: Governments of the globe, particularly of Asia, are providing robust policy and financial support to facilitate micro LED growth and attain technological autonomy. China's Ministry of Industry and Information Technology (MIIT) and the State Administration for Market Regulation released a plan in September 2025 to stabilize growth in the electronic information manufacturing sector for 2025-2026. Such measures, such as grants on innovation and supply chain diversification incentives, are providing a conducive setting for R&D and mass production, generating a steady flow of innovation and investment.

Challenges

- Micro LED mass production challenges and cost: One of the significant challenges may be the cost and complexity of producing in large quantities, particularly for mass transfer and assembly of micro LED chips. In October 2024, Morphotonics unveiled its Nano Imprinting Lithography technology to enable cost-efficient mass-manufactured complex optics for next-gen micro LED displays. Even though such technology is meant to break cost barriers, the need for high-yield, high-precision manufacturing processes is the greatest obstacle that hinders the technology's growth from high-end niche markets to consumer electronics overall.

- Strategic and financial challenges in adopting micro LED technology: Another major challenge is the cost and strategic burden of transitioning from established display technologies to micro LED. In August 2023, Innolux announced the closure of a number of mainland China fabs to reallocate resources to micro LED and advanced packaging technology development. This strategic decision, aimed at securing future orders from high-margin European customers, reflects the significant capital investment and operational restructuring required.

Micro LED Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

64.1% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2038) |

USD 937.9 billion |

|

Regional Scope |

|

Micro LED Market Segmentation:

Application Segment Analysis

The display segment in the micro LED market is expected to hold a strong 92.7% share during the forecast period, led by the superior vision performance of the technology used for high-end TVs and revolutionary automotive screens. In May 2024, AUO showcased its newest microLED display prototypes at SID DisplayWeek, such as flexible, transparent, and high-durability screen ideas. These developments are an indicator of the industry's efforts to transition beyond traditional displays and develop new user experiences in consumer electronics, automotive interiors, and digital signage, establishing the display segment's dominance. Segment growth is also spurred on by the deeper penetration of micro LED applications into niche areas like medicine and environmental monitoring.

Panel Size Segment Analysis

The small and medium-sized panel segment in the micro LED market is expected to account for 46.2% share through 2038, spurred by surging demand for high-performance displays in automotive, AR/VR products, and wearables. The micro LED panel with higher brightness, efficiency, and lifespan is best suited to these demanding segments where thinness and high resolution are critical. In November 2023, AUO reaffirmed its plan to mass-produce microLED smartwatch displays and work on other automotive projects, demonstrating strong confidence in the growth of the segment. The segment momentum is also supplemented by innovations that simplify manufacturing and improve performance for next-generation wearables.

End user Segment Analysis

The consumer electronics segment is projected to account for a 64.6% share by 2038, reflecting the penetration of technology in high-end TVs, smartwatches, and AR/VR headsets. In August 2024, Samsung organized a large press conference in China to unveil its new microLED TV series, a strategic move to reclaim its market leadership and stimulate demand in the luxury consumer display market. The enhanced visual quality and design versatility of micro LED technology are making it an increasingly appealing option for consumers looking for high-end home entertainment and personal device experiences. The expansion of the segment is also being driven by innovations that are making micro LED technology more economical and versatile for a broader range of consumer applications.

Our in-depth analysis of the micro LED market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Panel Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Micro LED Market - Regional Analysis

APEJ Market Insights

Asia Pacific excluding Japan micro LED market is anticipated to hold a 42.8% market share through the forecast period. This is fueled by a very strong mix of policy incentives, huge manufacturing capability, and a highly integrated supply base. In January 2024, AUO confirmed that it would start producing core microLED components for Samsung, demonstrating the rich partnerships in the consumer tech ecosystem of the region. This collaborative setting, coupled with policy direction, is fueling innovation and ensuring APAC leadership.

China micro LED market is expanding exponentially with robust government policies to fuel technology independence and supply chain supremacy. In 2024, the Chinese government drew up many critical policies, including the Implementation Opinions on Promoting the Innovation and Development of Future Industries, which aim to push the development of microLED and other next-generation display technologies. Such strategic support, coupled with a mammoth manufacturing base and continually expanding domestic market, is making China the center of world micro LED manufacturing and R&D.

India micro LED market is becoming one of the major growth markets for micro LED technology, based on increasing consumer demand for premium electronics and the establishment of an indigenous supply chain. In August 2023, Samsung launched its ultra-premium 110-inch Micro LED TV in India with its vision to revolutionize the luxury display experience in India. This was preceded by TCL's June 2024 announcement of the rollout of micro LED TVs with new backlight technologies. Additionally, in March 2024, an Indian display maker Nopo Nanotechnologies, announced a new micro LED wafer fab in Bengaluru, a big boost for the local supply chain and India's Make in India initiative.

North America Market Insights

North America micro LED market is anticipated to expand at a CAGR of 63.6% from 2026 to 2038, fueled by strong government support for advanced manufacturing and a robust ecosystem of innovation. In December 2024, the US Department of Energy released new micro LED research grants for the development of low-power, energy-efficient display panels for the defense, public infrastructure, and signage sectors. The grant provides patent support and technology transfer support, reflecting the US government's commitment to next-generation display technology development and strengthening the domestic supply chain.

The U.S. micro LED market is a hub of micro LED innovation, with emphasis placed on both fundamental research and commercialization. In November 2023, Photonic Inc. raised $100 million in a new investment round to support the development of its quantum technology. This cross-border technology transfer is accelerating the micro LED adoption in the North America market. The U.S. is also increasingly becoming a host to more startups and research centers that are focusing on creating new materials and manufacturing processes, further solidifying the country's position as a global market leader.

Canada micro LED market is emerging as a leading hub for micro LED innovation, driven by strategic government investment and a growing cluster of specialized startups. In March 2023, the governments of Canada and Ontario announced a joint investment of $10.5 million in VueReal Inc., a startup located in Waterloo, Ontario. The funding was provided to support a $40 million project aimed at boosting VueReal's manufacturing capabilities for next-generation displays. Further, companies like VueReal are empowering Canadian electronics businesses with reference design kits that facilitate prototyping and integration, making the country a central part of the North America micro LED ecosystem.

Europe Market Insights

Europe micro LED market is expected to drive substantial growth from 2026 to 2038, with a strong emphasis on car technology, future technology adoption, and advanced manufacturing. Europe boasts a lively research institution and enterprise ecosystem driving micro LED performance and adoption to record levels. In July 2025, Aledia made a declaration regarding the readiness of its 3.5-micron microLED product family for direct-view panels and AR glasses for consumer markets in 2026–2027. This action underscores Europe's ability to drive cutting-edge research to the market, making the continent a major player in the global display market.

Germany micro LED market is leading the way, backed by its globally dominant automotive sector and robust emphasis on precision engineering. Fraunhofer IZM and Ams Osram were awarded Germany's prestigious German Future Prize in November 2024 for their LED matrix technology innovation, enabling automotive headlights to also function as high-resolution projectors. This is a major milestone for automotive-grade micro LED adoption in Germany. Cooperative efforts are also being encouraged through programs like the MicroLED Alliance, launched in October 2024, to spur R&D and commercialization for medical, automotive, and wearables use.

The UK micro LED market is building a successful micro LED ecosystem through prudent government investment and focus on next-generation applications. In December 2024, Smartkem, a UK company, was granted a £900,000 Innovate UK grant to support R&D on flexible micro LEDs for applications in augmented reality, wearable electronics, and automotive electronics. Concurrently, in March 2024, the UK government invested £1.5 million in piloting smart public infrastructure projects on multi-purpose micro LED modules for signage, Wi-Fi, and EV charging. It points to the UK's interest in using micro LED technology not only for economic growth but also for city renewal.

Key Micro LED Market Players:

- Samsung Electronics Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc.

- LG Electronics

- Nichia Corporation

- Signify (Philips Lighting)

- Lumileds Holding B.V.

- OSRAM GmbH

- Sony Corporation

- Wolfspeed, Inc.

- Konka Group

- Refond Optoelectronics

- Panasonic Corporation

- JBD

- AUO Optronics

- Epistar

The micro LED market is intensely competitive, with the involvement of veteran display giants, semiconductor companies, and tech startups competing for supremacy. Industry giants like Samsung, Apple, LG, AUO, Nichia, and Sony are leading the battle charge through huge R&D spending, strategic alliances, and capacity expansions. The players are willing to tackle the significant challenges of mass transfer and cost reduction, enabling the micro LED technology to be utilized to its fullest potential in a wide range of applications, from large TVs to miniature AR displays.

One significant development that demonstrates the competitive environment was in November 2024, when AUO revealed noteworthy advancements in scaling up microLED production with a new 4.5-Gen automotive line. At the same time, the firm signed a deal with PlayNitride to construct a $21.5 million 6-inch epiwafer microLED factory. This dual strategy of adding existing lines and constructing future capacity is a testament to the aggressive, tactical strategy necessary to succeed in the market growth.

Here are some leading companies in the micro LED market:

Recent Developments

- In January 2025, Aledia introduced its FlexiNova industrial micro LED chip format at Display Week, with samples set for the second half of 2025. FlexiNova is built for smartwatches, automotive dashboards, and luxury TVs, utilizing 200-mm GaN-on-silicon wafers. It delivers ultra-small chips tailored for each application. The new facility in France will manufacture two micro LED product lines targeting displays and AR glasses.

- In January 2025, AUO showcased its latest automotive microLED technologies at CES under its Smart Cockpit 2025 platform. AUO demonstrated transparent and flexible microLED displays for virtual sky canopies and interactive automotive windows. This aligns with the company’s strategy to scale microLED production for automotive and wearable devices by 2026.

- In November 2024, Lumileds began large-scale production of micro LED chips for OEM clients from its Texas facility. By leveraging advanced XDC MicroIC transfer technology, the company enabled micro LED integration for automotive lighting and high-resolution consumer panels. Industry experts cite this as a major step in transitioning from prototyping to commercial supply for North America.

- In August 2024, Innovision introduced a mass-production full-color XGA micro LED micro-display chip, boasting over 500,000 nits of brightness. This achievement is pivotal, given the complexity of stacking full-color pixels and brings micro LEDs closer to mainstream AR and professional imaging deployment.

- Report ID: 7994

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Micro LED Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.