Micro-Inverter Market Outlook:

Micro-Inverter Market size was valued at USD 6.2 billion in 2025 and is projected to reach USD 40.2 billion by the end of 2035, rising at a CAGR of 23.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of micro-inverter is estimated at USD 7.6 billion.

The micro‑inverter market is vigorously growing due to the global dynamics influenced by the continuing transition toward distributed solar generation. As distributed photovoltaic (PV) deployments, especially small-scale rooftop systems, expand, micro-inverters also tend to offer a compelling value through module-level power electronics. As per an article published by NREL in September 2022, microinverters were solidifying their dominance in the residential solar sector in the first quarter of 2022, and market share increased over recent years. It also underscored that this trend was reflected in NREL's Q1 2022 benchmark, which modeled a representative 7.9-kWdc residential system exclusively using microinverters, moving away from the weighted average of inverter types used in previous years. The modeled market price for the microinverter itself was USD 0.53/Wac, while the minimum sustainable price was estimated at USD 0.36/Wac, highlighting the cost impact of short-term market distortions and tariffs on the prevailing market price.

Furthermore, the U.S. Department of Energy in February 2022 revealed that the microinverter and module-level power electronics sector is one of the most important segments for distributed solar, which is led by key players such as Enphase and SolarEdge. It also stated that the supply chain for these components is globally dispersed, wherein the manufacturing is primarily located in China, Mexico, Hungary, and Vietnam to optimize production costs. Therefore, this global footprint underscores the segment's importance for residential and commercial applications, highlighting a supply chain concentrated among a few firms dependent on international manufacturing hubs. This geographic concentration emphasizes the need for strategic investments in domestic manufacturing and assembly capabilities, benefiting the micro inverter market, thereby enhancing supply resilience and reducing exposure to international trade disruptions.

Key Micro Inverter Market Insights Summary:

Regional Highlights:

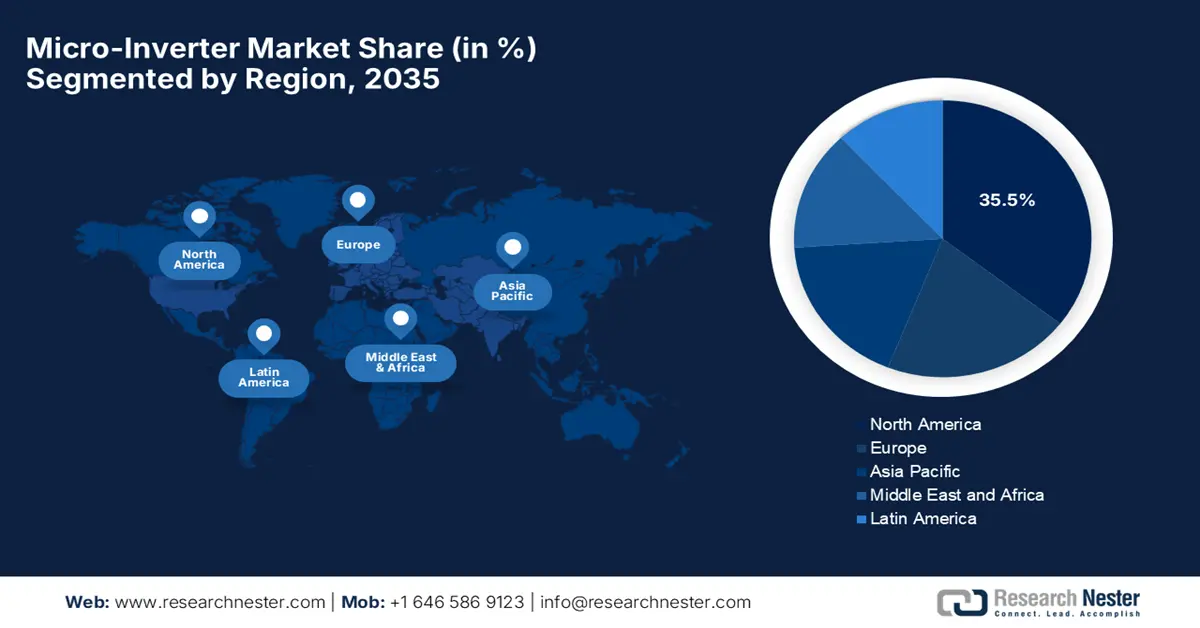

- By 2035, North America is projected to secure a 35.5% share in the micro-inverter market, bolstered by favorable tax incentives, stringent safety codes, and rising preference for module-level electronics.

- Asia Pacific is anticipated to expand rapidly through 2026–2035, supported by accelerating rooftop solar uptake and strong government emphasis on distributed generation.

Segment Insights:

- The below 500 W segment is forecast to command a 70.6% share by 2035 in the Micro-Inverter Market, underpinned by rising module wattage within unchanged residential PV form factors.

- The residential segment is projected to capture a 65.4% share by 2035, supported by the demand for module-level optimization to address shading and mismatch issues on rooftops.

Key Growth Trends:

- Adoption of smart grids

- Advancements in micro-inverter technologies

Major Challenges:

- Supply Chain complexities

- Limited standardization

Key Players: Enphase Energy (U.S.),Altenergy Power Systems, Inc. (China),Hoymiles (China),Deye Inverter (China),Chilicon Power, LLC (U.S.),AEconversion GmbH & Co. KG. (Germany),Envertech (China),Zhejiang Benyi New Energy Co, Ltd. (China),Solar Panel Plus (U.S.),CyboEnergy (U.S.),Sparq Systems (Canada),Sungrow (China),HiQ Solar (U.S.)

Global Micro Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.2 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 40.2 billion by 2035

- Growth Forecasts: 23.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Netherlands

Last updated on : 21 November, 2025

Micro-Inverter Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of smart grids: Connected infrastructure requires power components that integrate with IoT platforms and grid-interactive systems, driving consistent business growth in the market. In June 2024, Sungrow introduced its new iHomeManager microinverter at Intersolar Europe 2024, which is an AI-powered home energy management system especially designed to optimize solar usage, storage, and household consumption. The product uses Sungrow’s AI-based strategy with advanced prediction and deep reinforcement learning, which can boost household renewable-energy income by 10% or more by intelligently scheduling ESS charging, leveraging market price variations, and maximizing daytime solar utilization. This microinverter is easy to install, and it offers 72-hour forecasting, wireless connectivity, and broad device compatibility, positioning it as the smart energy brain for future AIoT-enabled homes.

- Advancements in micro-inverter technologies: The Emergence of technologies in terms of GaN-based and SiC-based semiconductors, higher module support enables micro-inverters to deliver efficacious and improved thermal stability, benefiting the overall micro-inverter market growth. In November 2024, Hoymiles announced that it had officially released its powerful MiT-5000-8T super microinverter to the Asia Pacific market, delivering an industry-leading 5,000 W output with the ability to support up to eight modules simultaneously. The product is especially designed for commercial, industrial, and large residential use. It offers exceptional durability with a 25-year lifespan, enhanced safety with low-voltage DC operation, and superior performance through four MPPTs. It also has a long-range Sub-1G communication and a plug-and-play three-phase FLEX cable system, which allows an easier installation and higher energy yield.

- Rooftop solar expansion: The increasing deployment of residential and small commercial rooftop PV systems is one of the important drivers for the market since they help maximize output even when panels are shaded or oriented differently. In this context, IEA disclosed that solar PV is on track to become the world’s largest renewable electricity source by the end of 2029, influenced by rapidly falling costs, strong policies, and surging installations, which tripled between 2018 and 2023. From 2024 to 2030, solar is expected to deliver 80% of all renewable capacity growth, supported by both utility-scale projects and rapidly expanding rooftop adoption. Furthermore, to stay aligned with net-zero 2050 goals, annual additions must double by the end of 2030, along with stronger efforts in grid integration.

Challenges

- Supply Chain complexities: The micro-inverter market faces severe complexities in terms of supply chain, wherein it relies on components such as semiconductors, capacitors, and packaging sourced from a few international hubs, including China, Mexico, Hungary, and Vietnam. Moreover, the disruptions caused due to any sort of geopolitical tensions, logistics delays, or natural disasters can negatively impact production timelines and cost structures as well. In addition, the dependency on limited suppliers increases vulnerability to price fluctuations. Therefore, companies must carefully manage inventory, diversify sourcing, and focus on domestic assembly options to maintain a consistent supply, thus raising hesitation among players to make investments in this field.

- Limited standardization: The aspect of technical and regulatory challenges due to variations in grid codes, safety standards, and certification requirements across different countries and regions has slowed growth in the micro-inverter market. Also, each economy may impose specific safety, rapid-shutdown, and communication protocol standards, requiring manufacturers to adapt designs or conduct multiple certification processes. Therefore, these compliance requirements increase engineering complexity, development time, and overall production costs, making it restrictive for small-scale manufacturers. Meanwhile, for global players, maintaining a flexible product portfolio that meets divergent standards while optimizing cost-efficiency is extremely complex. Furthermore, this lack of standardization can slow international expansion, create barriers to entry for smaller manufacturers.

Micro-Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23.1% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 40.2 billion |

|

Regional Scope |

|

Micro-Inverter Market Segmentation:

Power Rating Segment Analysis

Within the forecast period, below 500 W based on power rating is expected to garner the largest stake of 70.6% in the market. This subtype aligns with the power output of mainstream residential PV modules. As the module efficiency increases, the power per module also rises, wherein the form factor remains suited for sub-500W micro-inverters. Moreover, the cell and module technologies are advancing, especially with higher-efficiency mono-PERC, TOPCon, and heterojunction panels. The per-module wattage is gradually rising, yet the physical form factor and mounting conventions remain compatible with sub-500 W micro-inverter architectures. Therefore, this factor makes the segment highly scalable and cost-efficient for residential rooftop deployments, where homeowners prioritize ease of installation, module-level monitoring, and rapid shutdown compliance.

Application Segment Analysis

The residential segment is expected to acquire a share of 65.4% in the micro-inverter market, owing to the critical need for module-level optimization to mitigate shading and mismatch issues common on rooftops. As per the NREL report published in May 2024, after the passage of the Investment Tax Credit, the U.S. residential solar segment has showcased explosive growth, wherein the number of annually installed PV systems has increased by around 36% per year, which is over 250 times the initial figure. The report also underscored that by the end of 2023, SEIA estimated around 4.7 million residential PV systems nationwide, in which 3.3% of all households (or 5.3% of single-family detached homes) had adopted solar. Therefore, the presence of these incentives, coupled with the grid-tie policy structures, supports residential systems, thereby favoring the utilization of micro inverters.

System Type Segment Analysis

In the market single-phase subtype is expected to lead the system type segment, capturing 58.4% revenue share by the end of 2035. Its standard role for electrical grids powering homes and small businesses across most of the nations is fueling the leadership. In this regard, research published in the Journal of Electronic Science and Technology in 2025 revealed that a single-phase, non-isolated multi-input microinverter has been developed to address key challenges such as leakage current and power fluctuation in PV systems. It also stated that this design utilizes a common-ground structure and only four active switches to eliminate leakage current, supporting multiple PV inputs for operation under partial shading. Furthermore, validation of a 1-kW Gallium Nitride (GaN)-based prototype reported the topology's robustness as well as cost-effectiveness, with an efficiency of 94.8% hence encouraging widespread adoption.

Our in-depth analysis of the micro-inverter market includes the following segments:

|

Segment |

Subsegments |

|

Power Rating |

|

|

Application |

|

|

System Type |

|

|

Connectivity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Micro-Inverter Market - Regional Analysis

North America Market Insights

By the conclusion of 2035, North America is predicted to hold the highest share of 35.5% in the market. The growth of the market in this region is effectively propelled by supportive policies such as tax credits and strict safety codes that favor module-level electronics. The region’s population values micro‑inverters for their enhanced safety, module-level optimization, and compatibility with battery storage systems and smart energy setups. In January 2025, GE Vernova announced its plans to invest nearly USD 600 million in U.S. factories and facilities over the next two years to meet rising global electricity demand. The company also has plans to invest around USD 10 million in its Pittsburgh, PA, facility to expand capabilities across its Electrification segment, which also includes a domestic manufacturing line for the company’s FLEXINVERTER, hence suitable for overall market growth.

The U.S. is gaining huge popularity in terms of the micro-inverter market, owing to the strong domestic investment in local production, helped by incentives such as investment tax credits. Also, the trend toward home energy storage and smart-grid integration accelerates micro‑inverter uptake, making them a key component in solar-plus-storage systems. In May 2025, Enphase Energy reported that it had shipped over 6.5 million IQ microinverters and 50 MWh of IQ batteries from U.S. manufacturing facilities, with around one million units containing higher domestic content to qualify for the domestic content bonus credit. The company also underscored that its production, including IQ8HC, IQ8X, and IQ8P-3P models from Texas and South Carolina, supports more than 300,000 homes in the country and represents about 80% of all Enphase microinverter shipments.

Canada is growing strongly in the regional landscape of the micro-inverter market, particularly in terms of the residential and off-grid segments. The country’s cold climate and longer distribution lines make micro‑inverters advantageous, since they reduce transmission losses and provide better module-level performance. For instance, in June 2022, Eguana Technologies announced that it received the first microinverter order from the Omega Group, totaling nearly 26,000 units worth over USD 7 million, including single, dual, and quad configurations. Hence, this move will allow the company to meet growing demand for integrated solar and energy storage solutions, delivering up to 15% more energy on a yearly basis when compared to competing products. The company has around two decades of experience in high-performance residential and commercial energy storage systems, to provide reliable, grid-edge power electronics for solar self-consumption, EV infrastructure, as well as demand charge applications.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the market owing to the expansion of rooftop solar across urban centres in countries such as China, India, and Japan. Governments across the region are proactively promoting distributed generation through favorable solar policies, subsidies, and smart-city initiatives, making MLPE (module-level power electronics) more attractive. On the other hand, technology providers in most countries are localizing production to reduce costs and designs to regional grid nuances. Furthermore, integration with energy storage, IoT-based home energy management, and scalable deployment across residential and commercial rooftops are major growth levers in this diverse and fast-evolving market. Strong investment from both private and public sectors is expected to accelerate adoption in this field.

China is expected to lead the regional micro-inverter market on account of rising electricity needs and the presence of manufacturers who are scaling up to meet the domestic demand. Moreover, the integration with storage and smart inverters is gaining ground, as users increasingly deploy hybrid systems. In July 2022, Zhejiang Benyi Electric Co., Ltd. announced that it had launched a new micro-inverter series for residential and commercial PV systems, which offer rated power outputs of 550 VA, 700 VA, and 2,800 VA. The devices contain a high efficiency, with up to 97.5% overall, along with module-level MPPT for optimized power output, low night-time consumption, and IP67-rated enclosures. All models come with a 25-year performance warranty and a 10-year product warranty, supporting scalable residential and commercial solar deployments with reliable, long-lasting performance.

The micro-inverter market in India is witnessing rapid growth, primarily fueled by the country’s push toward renewable energy adoption and government initiatives that promote distributed generation, along with incentives, net metering policies, which are encouraging consumers to adopt widespread adoption. In November 2025, the Competition Commission of India announced that it had approved the acquisition of certain shareholding in IL JIN Electronics Private Limited by ChrysCapital Fund X, Two Infinity Partners, and Raptor Investments. IL JIN is a well-known provider of electronic manufacturing services, producing products including PCBs, micro-inverters, smart meters, and energy solutions such as solar inverters, battery storage systems, and EV chargers. Furthermore, the acquisition involves equity and compulsorily convertible preference shares, marking a strategic investment by private equity firms in India.

Europe Market Insights

Europe market is expected to grow notably, backed by the presence of a strong regulatory framework around decentralized energy, rapid shutdown, and grid safety. Countries in the region are focused on energy self-sufficiency, smart homes, and efficient rooftop systems, encouraging more firms to make investments in the region. In July 2025 Enphase Energy announced that it has expanded its presence in Europe with the launch of its IQ8P microinverters in Italy as well as Switzerland, which offers 480 W peak AC power to support high-powered solar modules up to 670 W DC. These microinverters, paired with Enphase IQ batteries, provide homeowners with a fully integrated solar and storage solution with enhanced energy monitoring, and performance. The launch is expected to boost the country’s market, delivering more advanced, customer-focused clean energy solutions and strengthening its leadership in the regional landscape.

Germany is a key country for the micro-inverter market in Europe, driven by the presence of strong environmental policies and advanced grid infrastructure. The country also benefits from the rise of balcony solar and plug-and-play kits in cities, enabling renters and apartment dwellers to access solar energy with module-level electronics. In February 2023, TSUNESS announced that it had established a new branch in Frankfurt, Germany, strengthening its presence in the regional microinverter sector, thereby accelerating global expansion. It also offers a full range of residential microinverters (300–3000 W peak), including the TITAN series, the world’s largest single-phase microinverters, along with energy storage and solar kits. Furthermore, the company aims to provide faster deliveries, improved after-sales service, and continue innovating to deliver safe, efficient, and low-carbon solar solutions across the region.

The U.K. is also considered to be the frontrunner in the regional micro-inverter market, highly attributable to the broader distributed energy and smart-home movement. Since there have been rising energy prices and an increasing push for renewables, homeowners are turning to rooftop solar + storage systems. In this context, micro-inverters provide modularity, clarity in power production, and enhanced safety, all helping to make small-scale systems more attractive. On the other hand, regulatory support, coupled with the presence of young, technology-savvy markets, aids adoption. Furthermore, micro‑inverters help meet building regulations and rapid shutdown needs, making them a compelling choice for residential and small commercial solar. Therefore, all of these factors position the U.K. as one of the key growth contributors for the industrial expansion in Europe.

Key Micro-Inverter Market Players:

- Enphase Energy (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altenergy Power Systems, Inc. (China)

- Hoymiles (China)

- Deye Inverter (China)

- Chilicon Power, LLC (U.S.)

- AEconversion GmbH & Co. KG. (Germany)

- Envertech (China)

- Zhejiang Benyi New Energy Co, Ltd. (China)

- Solar Panel Plus (U.S.)

- CyboEnergy (U.S.)

- Sparq Systems (Canada)

- Sungrow (China)

- HiQ Solar (U.S.)

- Enphase Energy emerged as the global leader in micro-inverter technology and module-level power electronics. The company established itself as a pioneer in integrated solutions for residential and commercial solar systems, combining micro-inverters with energy storage and software-based monitoring platforms. The company emphasizes a vertically integrated supply chain and a strong global distribution network, which has solidified its market leadership at a notable rate.

- Altenergy Power Systems, Inc., based in China, focuses on cost-effective micro-inverter solutions and leverages large-scale production capabilities and R&D investments to deliver high-efficiency micro-inverter products. The company emphasizes modularity and scalability in its designs, suitable for international markets. Its strategy includes partnerships with regional distributors and installers to enhance market penetration, particularly in the Asia-Pacific.

- Hoymiles specializes in micro-inverters and hybrid power conversion solutions. It has a strong presence in residential solar sectors across most nations, emphasizing cost-efficiency, performance, and long-term reliability. The company is readily making investments in research and development, introducing innovative multi-module micro-inverter designs that improve energy harvest and safety. The company operates multiple manufacturing facilities, and expansion into large-scale deployments and hybrid energy solutions reflects its commitment to addressing both residential and commercial requirements.

- Deye Inverter provides a range of inverters, which includes micro-inverters, string inverters, and hybrid systems. The company focuses on technological innovation, integrating IoT-enabled monitoring and smart energy management features into its micro-inverter products. Deye emphasizes cost-effective, high-efficiency solutions suitable for residential and small commercial installations. Strategic initiatives include enhancing product reliability, optimizing production processes, and developing partnerships to support large-scale deployments while addressing diverse grid standards.

- Chilicon Power, LLC develops high-efficiency micro-inverters and module-level power electronics, and it capitalizes on innovative designs that simplify installation and enhance energy yield. The company has a strong focus on advanced R&D, producing scalable, reliable, and software-integrated solutions for distributed solar applications. The company is expanding domestic manufacturing capabilities and forming partnerships with solar integrators to broaden market reach.

Below is the list of some prominent players operating in the global market:

The global market is characterized by a dynamic and diverse competitive landscape in which the leading players, such as Enphase Energy, maintain dominance through vertically integrated manufacturing, mature micro‑inverter platforms, and strong global distribution. Other firms are competing in terms of multi-module micro-inverter solutions, offering cost-effective MLPE to a broad installer base. In February 2024, Sparq Systems announced that it had entered a long-term technology partnership with Jio Things to support the large-scale manufacturing of microinverters. The collaboration aims to leverage Parq’s technology leadership, software-centric design, and Jio’s scale to develop advanced applications. Hence, this partnership is positioned to accelerate innovation and deployment of next-generation microinverter solutions in the global dynamics, thereby encouraging more players to operate in this field.

Corporate Landscape of the Micro-Inverter Market:

Recent Developments

- In August 2025, SolaX Power showcased its latest clean energy solutions at The Smarter E South America, highlighting its next-generation X1-Micro 4 in 1 G2 microinverter, which is a plug-and-play unit supporting up to four modules, designed to maximize efficiency and energy yield.

- In January 2025, Enphase Energy announced that it had expanded into Vietnam and Malaysia, shipping its IQ8P microinverters for residential and commercial solar systems, followed by its prior market entries in Thailand and the Philippines. The microinverters feature 480 W peak output and compatibility with solar modules up to 640 W DC, and offer high efficiency.

- Report ID: 8261

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Micro Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.