Chip-on-Board LED Market Outlook:

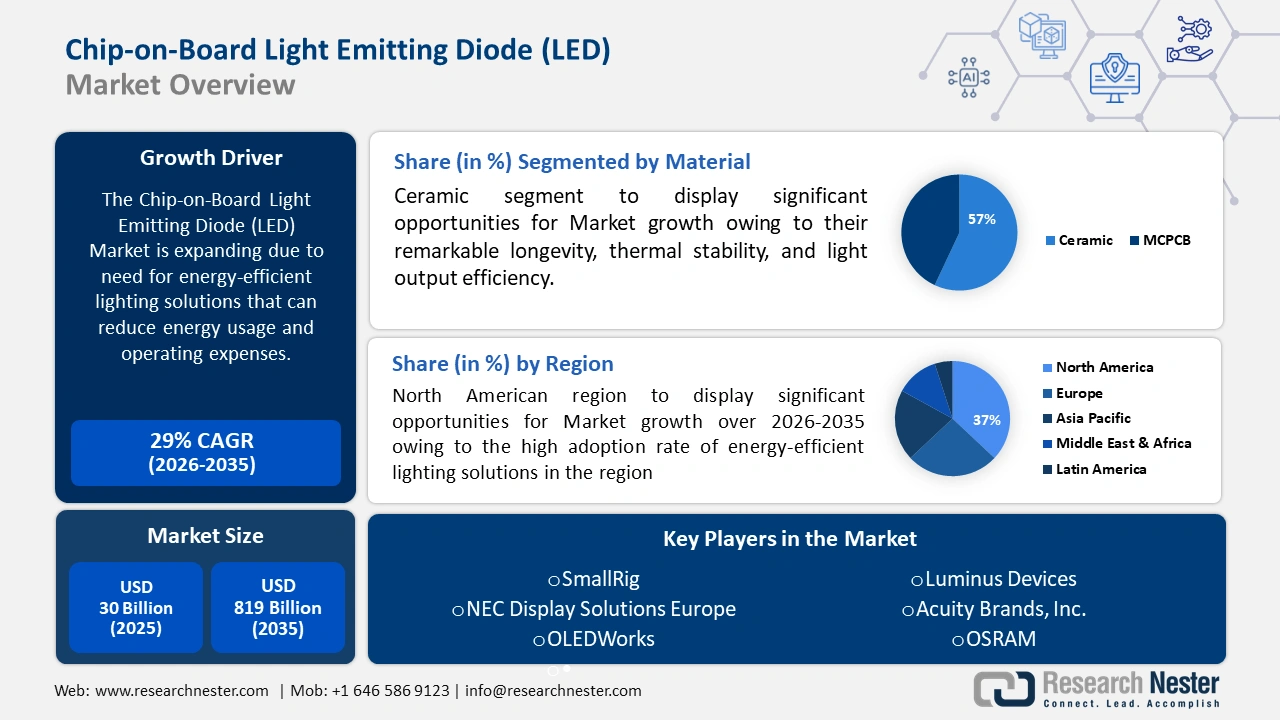

Chip-on-Board LED Market size was over USD 3.25 billion in 2025 and is anticipated to cross USD 13.5 billion by 2035, witnessing more than 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chip-on-board LED is assessed at USD 3.7 billion.

The market for COB LEDs is being driven by the need for energy-efficient lighting solutions that can reduce energy usage and operating expenses.

With the growing focus on sustainability and energy conservation, COB LEDs are finding more use in home, commercial, and industrial lighting, among other applications. As per a report in 2023, 80% less energy is used by LED lights than by conventional incandescent lighting. While several nations started to phase out incandescent bulbs more than a decade ago, many are also starting to do away with fluorescent lighting to make LEDs the industry standard for illumination.

The fact that chip-on-board LEDs require less space is by far their greatest advantage. They save an enormous amount of electricity as well. They are of high quality, have excellent thermal control and long-life expectancy, and are highly reliable. They are suitable for high-power applications too because they offer uniform brightness and high intensity. This kind of LED has become widely used because of the shift from traditional lighting to semiconductor lighting technologies.

Key Chip-on-Board (CoB) LED Market Insights Summary:

Regional Highlights:

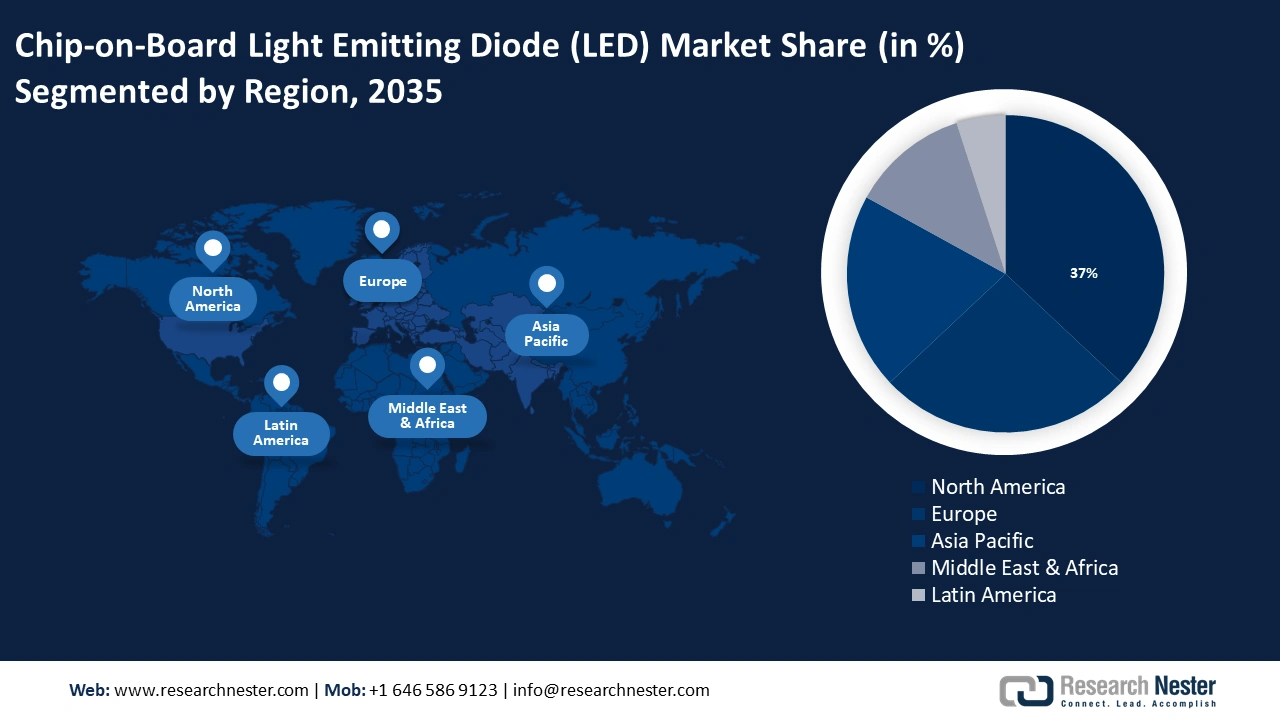

- North America chip-on-board led market will secure over 37% share, driven by high adoption of energy-efficient lighting solutions and rising demand for COB LEDs in automotive and horticultural lighting sectors, forecast period 2026–2035.

- Europe market will capture a 26% share, fueled by the focus on energy conservation and sustainability, supported by government policies promoting energy-efficient lighting solutions, forecast period 2026–2035.

Segment Insights:

- The ceramic segment in the chip-on-board led market is projected to hold a 57% share by 2035, driven by the remarkable longevity, thermal stability, and light output efficiency of ceramic COB LEDs.

- The backlighting segment in the chip-on-board led market is projected to achieve a 44% share by 2035, attributed to the cost-effectiveness and high efficiency of COB LEDs in backlighting applications.

Key Growth Trends:

- Increased government initiatives for the deployment of COB LEDs

- Growing utilization in the automobile sector

Major Challenges:

- High upfront costs of these products

- Repairing these lighting systems is complex which may hamper the growth of the market

Key Players: SmallRig, NEC Display Solutions Europe, OLEDWorks, Luminus Devices, Acuity Brands, Inc., Toyoda Gosei Co., Ltd., OSRAM, Synopsys, Inc. Japan, Nichia Corporation, MARUWA SHOMEI CO., LTD..

Global Chip-on-Board (CoB) LED Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.25 billion

- 2026 Market Size: USD 3.7 billion

- Projected Market Size: USD 13.5 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Chip-on-Board LED Market Growth Drivers and Challenges:

Growth Drivers

- Increased government initiatives for the deployment of COB LEDs - the government’s encouraging assistance are contributing to the exponential expansion of the global CoB LED market. These chips-on-board (COB) LEDs are replacing incandescent and CFL lights, according to the governments of several locations. For instance, the United States is in the process of revising its lighting rules and exploring the possibility of the Federal Government setting an example by acquiring LED products.

Furthermore, state legislative bodies are gradually phasing out fluorescent bulbs. For instance, the sale of 4-foot (1.22-meter) linear fluorescents would cease by 2024 according to a Vermont statute enacted in May 2022. Also, India's bulk purchase schemes have reduced the cost of LED bulbs, making them affordable to low-income people. India's lighting industry organization recently released a strategy called ELCOMA Vision 2024, to switch India's CoB LED market to LEDs by 2024. - Growing utilization in the automobile sector - since cob LEDs perform better and are more efficient than prior lighting technologies, they are also used in car illumination. Because COB LEDs increase road safety and visibility, they are being used more and more in the automotive industry for headlights, taillights, and other lighting applications.

The demand for COB LEDs is also being driven by the growing trend of smart lighting and the rising usage of the Internet of Things (IoT). When combined with sensors and other smart devices, COB LEDs can be utilized to build intelligent lighting systems that are remote-controlled and automatically adjust to changing illumination conditions. - Increased technological advancements in lighting solutions - more effort has been made by COB LED producers to improve the brightness and quality of the light that COB LEDs produce. To provide superior COB LED lighting products, they are implementing new technology. Using COB LEDs with programmable lighting is one example of this. With adjustable lighting, users can alter the color temperature of LED lights. Warm or chilly light can be produced by adjusting or lowering the LED lights.

Tunable lighting systems are becoming more and more common in both commercial and residential settings. For instance, it is anticipated that by 2028, the household penetration rate of smart lighting will have increased from 24.5% in 2024 to 50.6%. These include retail stores, hotels, offices, and other commercial spaces, as well as residences and apartment lobbies. An increasing number of businesses are developing COB LEDs that can be customized for lighting purposes. Growing innovation in COB LEDs is expected to boost the growth of the CoB LED market.

Challenges

- High upfront costs of these products - COB LED lighting solutions are more expensive initially than traditional lighting options like incandescent or fluorescent bulbs and regular LEDs. Because LED lights use less energy and have a longer lifespan, some customers can be discouraged from upgrading due to the higher initial cost. Therefore, this factor may hamper the growth of the chip-on-board (CoB) LED Market.

- Repairing these lighting systems is complex which may hamper the growth of the market

- Limited color range may hinder the CoB LED market growth

Chip-on-Board LED Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 3.25 billion |

|

Forecast Year Market Size (2035) |

USD 13.5 billion |

|

Regional Scope |

|

Chip-on-Board LED Market Segmentation:

Material Segment Analysis

In chip-on-board (CoB) LED market, ceramic segment is poised to hold more than 57% share by 2035 because ceramic-based COB LEDs have remarkable longevity, thermal stability, and light output efficiency, they dominate the COB LED industry. Because ceramic substrates are more thermally conductive than other materials, heat dissipation is more effective and power densities are increased. For COB LED products, this means better performance and a longer lifespan.

Additionally, ceramic-based COB LEDs are great for use in harsh environments since they can withstand high temperatures, humidity, and other environmental factors. Moreover, ceramic-based COB LEDs are perfect for use in high-end lighting applications including commercial and architectural lighting because of their greater color rendering and higher luminous efficiency.

Application Segment Analysis

In chip-on-board (CoB) LED market, backlighting segment is estimated to capture over 44% revenue share by 2035, because CCOB LED chips are more cost-effective per unit of light than traditional lighting systems and have high efficiency, the market for these chips is expected to grow substantially. Because of the higher resolution of these chips, designers can produce visuals that look more lifelike.

Over the projection period, this tendency is anticipated to continue, driving both the automotive and general lighting application segments. COB LEDs are widely utilized in the consumer electronics sector for backlighting displays found in devices like tablets, smartphones, and televisions. According to a report, by 2026, the consumer electronics industry is projected to generate USD 1,210 billion. Also, Apple held a 15.1% global chip-on-board LED market share in smartphone shipments in the first quarter of 2021. Furthermore, the use of COB LEDs for illumination in automotive applications is growing.

Our in-depth analysis of the global chip-on-board LED market includes the following segments:

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chip-on-Board LED Market Regional Analysis:

North American Market Insights

North America industry is likely to hold largest revenue share of 37% by 2035, chip-on-board LED market share. Several notable rivals with regional headquarters, including Cree, Lumileds, and Nichia Corporation, provide a broad selection of COB LED products for a range of uses. The region's chip-on-board (CoB) LED market expansion has also been fueled by the high adoption rate of energy-efficient lighting solutions in North America and the rising demand for COB LEDs in the automotive and horticultural lighting sectors. As per a report, in 2020, North America is expected to generate roughly 13 million light automobiles.

Furthermore, the region's use of COB LEDs has accelerated due to government restrictions and initiatives promoting energy saving. Furthermore, COB LEDs and other advances in LED technology have reduced their cost and increased their availability for North American consumers.

European Market Insights

By 2035, Europe region in chip-on-board LED market is anticipated to hold more than 26% revenue share. Energy conservation and sustainability are major priorities in Europe. By offering effective lighting options that use less energy and have a smaller environmental effect, COB LEDs contribute to the achievement of these objectives.

Furthermore, the local government has put policies and programs in place to promote the adoption of energy-efficient lighting options. The chip-on-board (CoB) LED market expansion in the area has been further sped up by these regulations.

Chip-on-Board LED Market Players:

- SmallRig

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NEC Display Solutions Europe

- OLEDWorks

- Luminus Devices

- Acuity Brands, Inc.

- Toyoda Gosei Co., Ltd.

- OSRAM

Recent Developments

- Using lightweight lighting solutions has been a common practice in the content creation industry, particularly when it comes to making it easier to move around and shoot in a variety of locations, including both indoor and outdoor ones. For creators on the go, SmallRig has released the RC 60B Portable COB LED video light in answer to requests for a small, lightweight, and flexible video light.

- Incisive with chip on board (COB) technology, NEC Display Solutions Europe is introducing the NEC LED FC Series, which dazzles with outstanding energy economy, outstanding endurance in public areas, and great contrast. The new FC Series is straightforward to set up and use; it makes use of the well-established F-design cabinets. All of the components are front-serviceable, making maintenance simple.

- Report ID: 5780

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chip-on-Board (CoB) LED Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.