Soil Moisture Sensor Market Outlook:

Soil Moisture Sensor Market size was valued at USD 491.9 million in 2025 and is projected to reach USD 1,744 million by the end of 2035, rising at a CAGR of 15.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the soil moisture sensor is estimated at USD 566.1 million.

The coordinated government-driven monitoring programs and long-term investments in infrastructure are reshaping the growth dynamics of the soil moisture sensor market. As per the article published by Drought in December 2024 soil moisture sensor field is properly served by a wide range of in-situ technologies, which include capacitance, impedance, time-domain reflectometry, and transmission line oscillators. It also stated that these sensors infer soil water content by measuring the soil's electromagnetic response, with performance that varies significantly based on soil type, particularly in terms of high-clay or saline conditions. Therefore, for stakeholders in agriculture, water resources, and disaster forecasting, sensor selection needs to align with specific data requirements for depth, accuracy, latency, and spatial representativeness, hence positively impacting market growth.

Furthermore, NIDIS in March 2025 disclosed that Missouri is efficiently expanding its soil moisture monitoring capacity to strengthen early drought and flood warnings, followed by the multi-state recommendations developed after the 2019 flooding. In this regard, state and federal partners, which include the Missouri Department of Natural Resources, the University of Missouri Mesonet, and the U.S. Forest Service, are adding sensors to more than 35 existing stations and building up to 10 new ones as part of the Missouri Soil Monitoring Project. In addition, the project is funded through the American Rescue Plan Act and supports improved hydrologic forecasting by linking rainfall, soil conditions, and landscape responses across Missouri’s multiple terrains, heightening the demand in the soil moisture sensor market.

Key Soil Moisture Sensor Market Insights Summary:

Regional Insights:

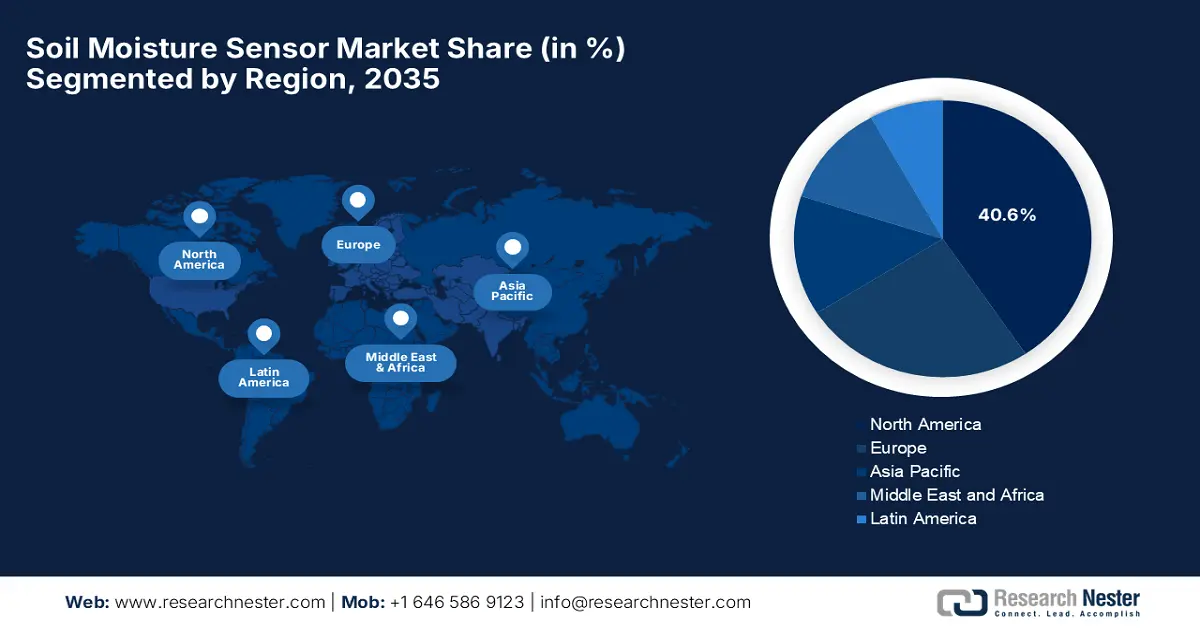

- North America is projected to secure a 40.6% share by 2035 in the soil moisture sensor market, owing to the widespread uptake of precision agriculture and smart irrigation systems.

- The Asia Pacific region is anticipated to witness the fastest growth from 2026–2035, underpinned by rising awareness of water scarcity and climate-change-driven irrigation modernization.

Segment Insights:

- Agriculture is projected to command a 57.3% share by 2035 in the soil moisture sensor market, sustained by expanding soil-monitoring programs for irrigation scheduling, climate resilience, and drought preparedness.

- The wireless sensors segment is anticipated to secure a 46.7% share by 2035, bolstered by federal prioritization of remote, automated soil-monitoring infrastructure.

Key Growth Trends:

- Rising water scarcity and conservation imperatives

- Precision agriculture and smart farming adoption

Major Challenges:

- Calibration and data accuracy

- Durability, maintenance, and environmental wear

Key Players: METER Group, Inc., Campbell Scientific, Inc., The Toro Company, Irrometer Company, Inc., Delta-T Devices Ltd., Sentek Technologies, and others.

Global Soil Moisture Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 491.9 million

- 2026 Market Size: USD 566.1 million

- Projected Market Size: USD 1,744 million by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Mexico

Last updated on : 26 November, 2025

Soil Moisture Sensor Market - Growth Drivers and Challenges

Growth Drivers

- Rising water scarcity and conservation imperatives: The agriculture sector consumes a large portion of water worldwide, wherein these soil moisture sensors are highly essential to evaluate water efficiency. Testifying, this DNI stated that Water insecurity is projected to intensify globally over the next two decades, in which agriculture will remain the largest consumer of water, with demand expected to rise by 19% by the end of 2050. The article also highlighted that this scarcity threatens economic growth in some Sub-Saharan African, Middle Eastern, and Asian countries could see GDP decline by up to 6% by 2050, public health, and political stability, as inadequate water access reduces productivity and heightens social tensions. Therefore, this rising water scarcity and the associated need for efficient irrigation will drive demand in the soil moisture sensor market to optimize water use.

- Precision agriculture and smart farming adoption: This shift towards precision agriculture is the major driver for the soil moisture sensor market. This is because sensors provide all the essential inputs for site‑specific management, enabling variable rate irrigation, optimized fertilizer application, and improved yields. In September 2025, Precision Development (PxD) announced that it had led the message design, farmer testing, and dissemination for India’s first-ever government-led AI weather forecasting program, which reached 38 million farmers across 13 states, marking one of the largest deployments of AI forecasts to farmers across the globe. It co-designed actionable, farmer-centric messages with highly accurate AI models. The program helped farmers respond to critical weather events, which also included a 20-day monsoon pause, enabling better crop planning and creating lucrative opportunities for soil moisture sensors.

Global Soil Moisture Sensor Innovations and Market Opportunities Overview

|

Event |

Year |

Key Highlight |

Market Opportunity |

|

ICAR–Sugarcane Breeding Institute - Soil Moisture Indicator (SMI) & Digital Soil Moisture Sensor launch + national adoption |

2025 |

SMI/DSMS device awarded and adopted across multiple states |

Expands demand for low-cost field sensors in mainstream Indian agriculture |

|

Government of India - Digital Agriculture Mission & Soil Profile Mapping |

2024 |

Digital ag stack + national soil data infrastructure |

Boosts integration of sensors with digital advisory and national agri-DPI platforms |

|

Clemson University - Sensor-based irrigation income study |

2021 |

Moisture sensors increased farm net income by ~20% |

Drives adoption of ROI-driven precision irrigation sensors in US row-crop farms |

Source: Official Press Releases

- Government support: This, coupled with supportive regulatory frameworks across all nations, is consistently driving growth in the soil moisture sensor market. The aspect of

Policies and incentives that are aimed at promoting sustainable water management and smart agriculture directly support market expansion. In this regard U.S. EPA, in February 2021, approved IAPMO R&T to certify soil moisture-based irrigation controllers under the WaterSense program, thereby promoting efficient water use in landscaping. It also stated that these sensors can save an average home over 15,000 gallons of water on a yearly basis, with potential savings of 390 billion gallons if it is widely adopted. Furthermore, this regulatory endorsement supports the widespread adoption of soil moisture sensors, driving business growth through water efficiency incentives.

Challenges

- Calibration and data accuracy: Maintaining accuracy in terms of measurement remains a major challenge for the soil moisture sensor market since the sensors often necessitate calibration, which is specific to soil type, texture, salinity, as well as bulk density. In this context, variations in organic matter, compaction, and temperature can cause measurement drifts, making this difficult in different types of field environments. Users are reporting variations between field readings and laboratory-validated soil moisture levels, highlighting the need for continuous recalibration. In addition, the long-term deployments expose sensors to environmental stress such as corrosion, soil acidity, and moisture saturation, all of which degrade accuracy over time, hence hindering widespread adoption in this sector.

- Durability, maintenance, and environmental wear: This is yet another factor causing an obstacle to the expansion of the soil moisture sensor market. These sensors must withstand harsh environments, which include waterlogging, freeze–thaw cycles, salinity, microbial activity, and abrasive soil types. Also, moisture ingress into electronics, connector corrosion, and cable fatigue are among the most common failure points reported in long-term field installations. Therefore, for large monitoring networks, the cost and labor associated with routine inspection, retrieval, cleaning, and redeployment can be substantial, creating hesitation among small-scale manufacturers to make investments in this field. Furthermore, environmental wear also introduces data gaps and inconsistencies, which create operational challenges for users who rely on continuous data streams for irrigation decisions, resource management, or climate research.

Soil Moisture Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 491.9 million |

|

Forecast Year Market Size (2035) |

USD 1,744 million |

|

Regional Scope |

|

Soil Moisture Sensor Market Segmentation:

Application Segment Analysis

Agriculture is expected to lead this segment, capturing the largest revenue share of 57.3% in the soil moisture sensor market by the end of the forecast duration. The programs that expand soil moisture monitoring for irrigation, scheduling, climate resilience, and drought preparedness are the key factors solidifying this leadership. Also, federal investments in terms of drought-resilient agriculture, soil conservation, and water efficiency initiatives are propelling sensor deployment across farms. In addition, the rising adoption of smart irrigation systems is driving demand, as farmers are looking to optimize crop yields by minimizing water usage. On the other hand, the integration of soil moisture sensors with IoT platforms and AI-based analytics is enhancing real-time decision-making and predictive farming. Consequently, the agriculture sector is all set to remain the dominant application segment in the soil moisture sensor industry.

Connectivity Segment Analysis

By the conclusion of 2035, the wireless sensors segment based on connectivity is likely to attain a lucrative revenue share of 46.7% in the soil moisture sensor market. The growth in the segment is highly subject to the federal agencies, which are prioritizing remote, automated soil monitoring infrastructure. In April 2024, GroGuru announced the launch of the first-ever fully integrated wireless soil sensor probe for continuous root zone monitoring of annual field crops by combining its patented WUGS technology with AquaCheck capacitance probes. Besides this innovation also provides farmers with real-time, actionable data on soil moisture and temperature, thereby enabling optimized irrigation practices, increased crop yields, and cost savings through the company’s AI-enabled cloud platform, caked InSites. Furthermore, by simplifying installation, improving data quality, and offering year-round monitoring, the integrated probe expands the complete scope for precision irrigation management.

Sensor Type Segment Analysis

The capacitance sensors are expected to gain a considerable share of 38.8% in the soil moisture sensor market over the analyzed tenure. Their adoption in national climate and soil monitoring networks is the key factor propelling this growth. The existence of government programs that are demanding continuous multi-depth measurements is also readily driving the subtype’s growth. In November 2023, Delta-T Devices announced a partnership with SAF Tehnika to integrate its WET150 multi-parameter soil sensor into the Aranet wireless network solution for commercial horticulture. The company also underscored that the SDI-12-enabled WET150 measures soil moisture, temperature, as well as electrical conductivity. Further, this collaboration enables crop growers to remotely monitor conditions in real time, thereby reducing water waste and supporting sustainable farming practices, denoting a positive segment outlook.

Our in-depth analysis of the soil moisture sensor market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Connectivity |

|

|

Sensor Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Soil Moisture Sensor Market - Regional Analysis

North America Market Insights

North America in the soil moisture sensor market is expected to lead the entire global landscape, capturing the largest revenue share of 40.6% during the analyzed timeframe. The dominance of the region in this field is effectively attributable to the widespread adoption of precision agriculture practices as well as smart irrigation systems. Both government programs and private initiatives in the region are promoting efficient water management in farming, prompting a profitable business environment for the market. In this context, GAO in January 2024 disclosed that foreign investment in U.S. agricultural land has grown significantly, reaching 43.4 million acres in 2022, influenced largely by foreign-owned wind companies and other investors. Therefore, this growth in the agricultural land can readily drive the adoption of soil moisture sensors as investors are opting for efficient irrigation and sustainable farm management practices, hence suitable for overall market growth.

In the U.S., the soil moisture sensor market is growing exponentially on account of federal and state-level initiatives, which are promoting water conservation along with drought-resistant farming techniques. The country’s market also benefits from the integration of soil moisture sensors with AI, IoT, and cloud platforms, with a collective goal of optimizing irrigation scheduling. In this regard, Smart Rain in 2023 introduced its smart rain soil sensor for commercial irrigation, designed to improve efficiency and precision. It is also reported that the sensor wirelessly pairs with the Smart Rain SmartController, which offers a range of up to 1 mile, and eliminates the need for trenching across large properties. Furthermore, it comprises dual moisture sensors that measure soil moisture at different depths, a temperature gauge to optimize watering based on soil and weather conditions, a water depletion calculator to track how much moisture the soil is losing, and a pH monitor to detect potential pollutants.

Canada has gained huge exposure in the soil moisture sensor market in recent years, since there has been an increasing adoption in areas with variable precipitation and water-intensive crops. On the other hand, the strong focus on sustainable agriculture and climate adaptation strategies is also encouraging the use of soil monitoring systems. In June 2024, the country’s government announced that Agriculture and Agri-Food Canada highlighted how B.C. farmers are adopting advanced technologies through the B.C. On-Farm Technology Adoption Program to boost production and strengthen food security. It also highlighted that the program readily supports automation, robotics, and innovative growing and storage solutions, thereby helping farms reduce labour costs. The program was funded through the Sustainable Canadian Agricultural Partnership and provides up to USD 150,000 per farm to enhance productivity, profitability, as well as environmental sustainability.

APAC Market Insights

The soil moisture sensor market in the Asia Pacific is expected to register the fastest growth from 2026 to 2035. This rapid growth is extensively facilitated by an increasing awareness of water scarcity and climate change impacts. Governments across the region, such as Australia, Japan, and South Korea, are proactively promoting modern irrigation technologies. In addition, the heightened demand for higher crop yields and efficient resource management in highly populated agricultural regions is also enhancing market development. This fast-growing industry is also witnessing significant investments in agritech startups, wherein the partnerships between technology providers and domestic farmers are boosting sensor deployment. Furthermore, government subsidies and incentive programs for water-efficient technologies are expected to sustain long-term expansion in this field.

China is solidifying its dominance over the regional landscape of the soil moisture sensor market, owing to the national efforts to modernize agriculture and enhance water use efficiency. The emergence of smart farming initiatives and large-scale deployment of advanced systems in both the crop and horticulture sectors has also led to a favourable business environment. In November 2024, Honde Technology Co., Ltd. introduced an innovative soil sensor to support agricultural digital transformation, which provides accurate soil monitoring of moisture, temperature, as well as pH levels. The company also underscored that this sensor features a user-friendly interface with a mobile app, thereby enabling farmers to easily access and analyze data for a more smarter decision-making. Furthermore, the product is especially designed for durability and adaptability, and it helps optimize crop growth and readily promotes sustainable agriculture across various climate conditions.

India in the soil moisture sensor market is undergoing significant transformations owing to the presence of initiatives that are proactively promoting digital agriculture, especially in water-stressed places. The country’s market also benefits from government-led programs and partnerships with NGOs, which are supporting smallholder farmers in implementing sensor-based irrigation systems. In February 2024, ISRO announced that it had launched a high-resolution operational soil moisture product using the EOS-04 (RISAT-1A) satellite's C-band SAR, which offers a detailed 500-meter spatial resolution that greatly improves soil moisture monitoring for agriculture. It was developed by SAC/ISRO, and is freely accessible as Analysis Ready Data on the Bhoonidhi portal, supporting better irrigation scheduling, crop management, and yield forecasting. The sensor showcased 92% retrieval accuracy validated by field data, and it helps in drought detection, flood monitoring, and enhances agro-hydrological models.

Europe Market Insights

The soil moisture sensor market in Europe has acquired a prominent position in the global dynamics, influenced by strict government regulations and the presence of key market players. Countries in the region are increasingly adopting precision irrigation, whereas the collaborative approaches between agriculture research institutions and technology providers are leading to a strong adoption of soil monitoring solutions. In April 2022, Sensoterra announced the launch of its depth wireless soil moisture sensors, which are designed to advance the sector of precision agriculture. The company also stated that these new sensors feature significantly enhanced LoRaWAN signal strength, improved durability to withstand harsh conditions, and higher accuracy through upgraded firmware and expanded calibration, which is based on extensive research. Hence, this launch provides farmers with extremely reliable, real-time soil moisture data, enabling smarter water management, hence denoting a positive market outlook.

Germany is one of the largest and most influential markets for the regional soil moisture sensor market, influenced by the emphasis on sustainability, energy efficiency, and smart water management. Local innovation in sensor technology and integration with farm management software is providing farmers with encouraging opportunities for better crop productivity. In March 2024, the German Meteorological Service (DWD) announced that it had expanded its Soil Moisture Viewer to include soil moisture data under forests, along with grassland and arable land, using land-use-differentiated soil profiles. On the other hand, the update incorporates main tree species such as beech, oak, spruce, and pine, and leverages the BÜK1000N soil overview map from the Federal Institute for Geosciences and Natural Resources for more accurate calculations, hence denoting a market outlook.

The U.K. holds a strong position in the regional soil moisture sensor market, owing to the presence of initiatives to improve water efficiency and address the climate-related risks. The Partnerships between government agencies, technology providers, and universities are also propelling continuous growth in the country’s market. In October 2023, Delta-T Devices announced that it had partnered with the country’s National Physical Laboratory to develop the WET150, which is a multi-parameter digital soil sensor especially designed for research-grade performance. In addition, the WET150 is reported to measure soil moisture, temperature, and electrical conductivity, providing deep insights into plant growth and nutrient levels. Furthermore, NPL contributed to the project by helping calibrate the sensor with reference standards and developing dielectric fluids that mimic real soil properties, enabling reliable measurements for various horticultural applications.

Key Soil Moisture Sensor Market Players:

- METER Group, Inc. -U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Campbell Scientific, Inc. -U.S.

- The Toro Company -U.S.

- Irrometer Company, Inc. -U.S.

- Delta-T Devices Ltd. -U.K.

- Sentek Technologies -Australia

- Acclima, Inc. -U.S.

- Stevens Water Monitoring Systems, Inc. -U.S.

- IMKO Micromodultechnik GmbH -Germany

- Spectrum Technologies, Inc. -U.S.

- Soilmoisture Equipment Corp. -U.S.

- Pessl Instruments GmbH -Austria

- Husqvarna Group -Sweden

- CropX Technologies -Israel

- METER Group, Inc., formerly Decagon Devices, is a research-grade instrumentation leader that combines high-precision capacitance soil moisture sensors (TEROS, ECH₂O) with data-loggers and cloud software (ZENTRA). The company differentiates through very low‑power designs, rugged build (10+ year field lifespan), and a custom calibration service that allows users to improve accuracy to ±1% for challenging soils. Their go-to-market strategy relies on deeply embedded applications in scientific research, agronomy, and hydrology.

- Campbell Scientific, Inc. is known for its robust environmental monitoring instruments, especially the CS655, which measures soil moisture, temperature, and bulk electrical conductivity with SDI-12 output. The company deeply emphasizes reliability and integration with its powerful data loggers. Their strategic initiative focuses on delivering smart and rugged sensors for remote, long-term deployments; they also support precision agriculture through partnerships with irrigation and research institutions.

- The Toro Company is identified as one of the major irrigation and turf-management companies, which integrates soil moisture sensing into its smart irrigation platforms. Also, the company bundles its soil sensor technology with controllers to help landscapers and water‑managers optimize irrigation schedules. Toro is best known for its turf and golf-course irrigation, whereas its soil moisture business strengthens the company’s value proposition in water conservation, thereby enabling cross-selling with its controller ecosystem.

- Irrometer Company, Inc. is a pioneer in terms of tensiometer-based soil moisture measurement. The company has decades of experience in analog and digital tensiometers, which makes it one of the trusted names in both agricultural and research settings. On the other hand, Irrometer’s strategy lies around field-proven simplicity, low maintenance, and integration into irrigation decision-making systems. Their rugged sensor design and long track‑record give them recognition in markets where reliability is more critical than connectivity.

- Delta‑T Devices Ltd. specializes in environmental and agronomic sensors and data loggers. In soil moisture, they provide high‑accuracy probes such as SM150T and multi-parameter loggers, drawing the interest of a wider group of audience. Their business model is research- and environment–science–oriented, focusing heavily on academic collaborations and quality certification (ISO 9001). Maintaining a network of distributors while investing in R&D to develop next-generation sensing technologies is the strategy opted for by the company to grab a lucrative business opportunity.

Below is the list of some prominent players operating in the global market:

The soil moisture sensor market is fragmented in nature, which is a mix of legacy scientific-instrument firms such as METER Group and Campbell Scientific, and irrigation-focused players such as Acclima, Toro, and Irrometer, who are competing head-to-head. Most of the manufacturers are expanding their global reach through partnerships and improved connectivity. For instance, in February 2025, Toro and TerraRad announced that they had entered into a strategic partnership to launch Spatial Adjust, which is a precision irrigation software integrated with Toro’s Lynx Central Control platform. The company also underscored that the software uses TerraRad’s smart turf sensors to map soil moisture in real time, providing automated sprinkler adjustments and individualized irrigation recommendations. Furthermore, this innovation enables golf course superintendents to optimize water usage, reduce labor, and maintain turf quality with greater efficiency and sustainability, hence contributing to overall market growth.

Corporate Landscape of the Soil Moisture Sensor Market:

Recent Developments

- In November 2025, Internet Initiative Japan Inc. and Sony Semiconductor Solutions Corporation announced that they had agreed to form a joint venture to provide high-precision soil moisture sensors and irrigation navigation services for smart agriculture.

- In November 2025, Reinke Manufacturing and CropX Technologies announced an integration of their platforms, creating a unified farm management experience through Rein Cloud 3. The integration allows farmers to access CropX’s soil moisture sensors, weather stations, and agronomic data directly within Reinke’s pivot irrigation system interface.

- Report ID: 639

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Soil Moisture Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.