Software Asset Management Market Outlook:

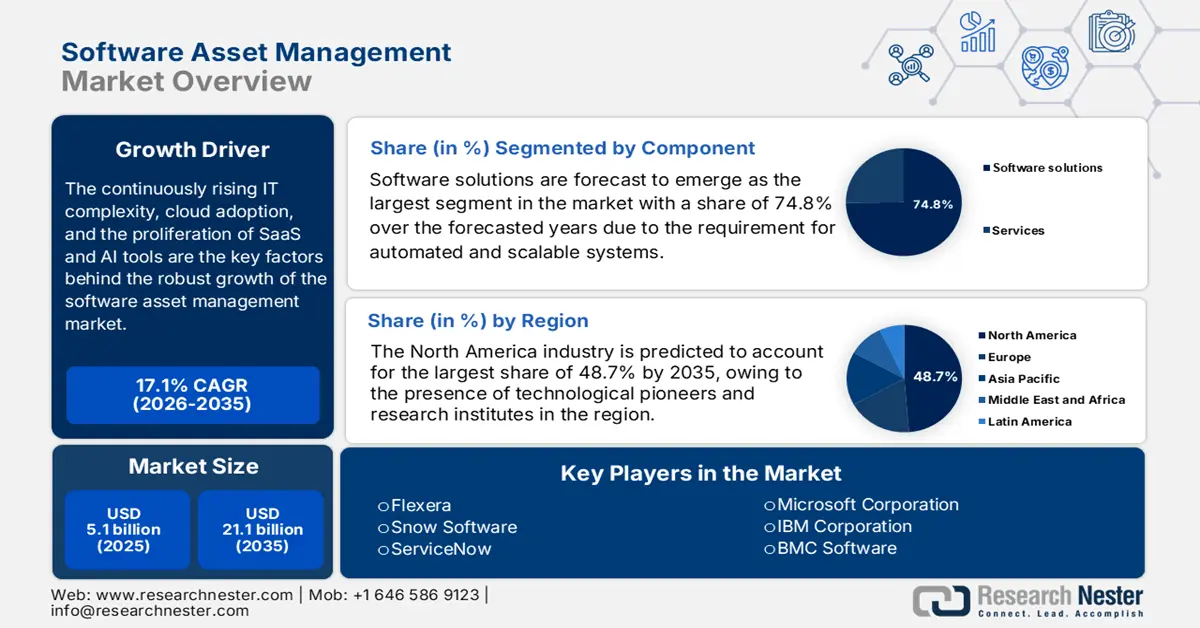

Software Asset Management Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 21.1 billion by the end of 2035, rising at a CAGR of 17.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of software asset management is assessed at USD 5.9 billion.

The continuously rising IT complexity, cloud adoption, and the proliferation of SaaS and AI tools are the key factors behind the robust growth of the software asset management (SAM) market. Simultaneously, enterprises across the globe have recognized the strategic value of SAM other than compliance, using it to optimize software spend, reduce operational risk, and enhance IT governance. In this regard, the GSA CIO 2108.2 directive in December 2025 reported that it established a centralized software license management program by allocating the responsibility for agency-wide oversight, inventory tracking, along compliance with commercial and COTS software. The program also emphasizes optimizing license utilization, reducing redundancy, and implementing proper practices, which reflects structured investment in SAM processes and governance that aligns with enterprise objectives. In addition, this policy highlights reporting, cloud management, and cross-office collaboration, positively impacting the market growth over the years ahead.

Furthermore, the adoption of AI-based analytics, real-time asset discovery, and automated license optimization is expected to accelerate software asset management market growth. Vendors are continuously making innovations in platform integrations, SaaS management, and predictive insights, thereby evolving into a central component of enterprise IT strategy. In April 2025, Xensam announced the launch of its AI-based standalone SaaS management platform, which is especially designed to detect and map over 100,000 SaaS applications across enterprise environments. The firm also mentioned that this platform provides real-time visibility, cost optimization, and compliance control, addressing subscription bloat and underused software in both cloud-native and legacy IT environments. Furthermore, SaaS spending is growing 15% to 20% on a yearly basis, and enterprises are managing an average of 125+ applications. The solution leverages AI agent-based URL tracking for comprehensive discovery without browser extensions.

Key Software Asset Management Market Insights Summary:

Regional Highlights:

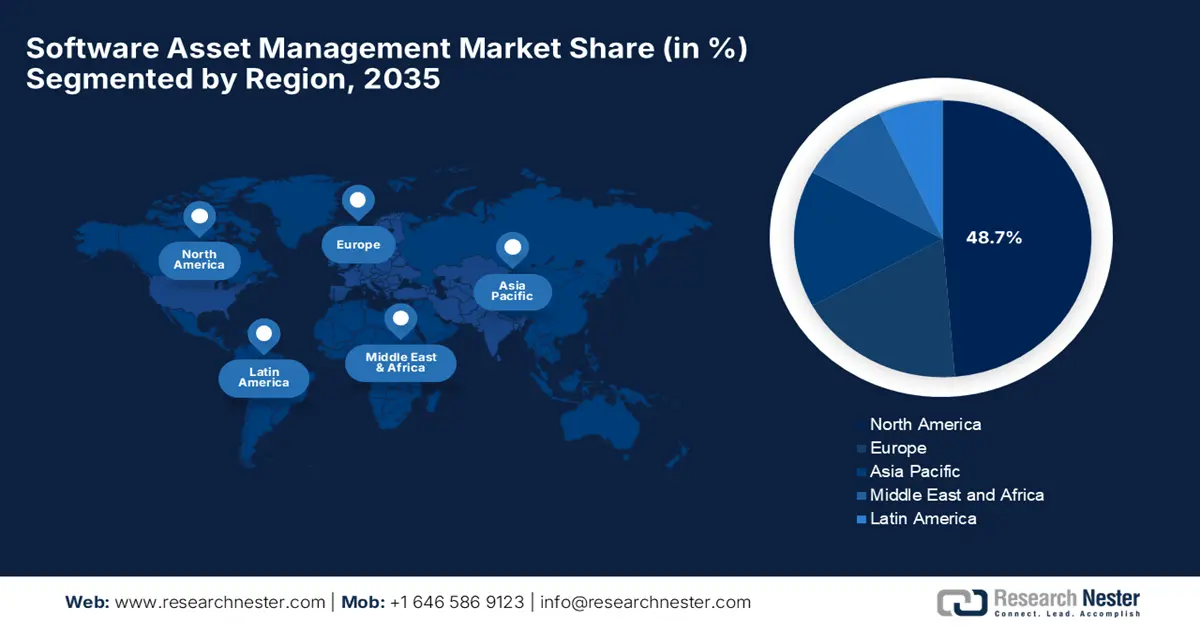

- North America in the software asset management market is anticipated to secure a dominant 48.7% share by 2035, anchored by the concentration of technology pioneers and research institutes and strengthened by stringent data security and licensing compliance mandates fostering sustained adoption.

- Asia Pacific is expected to experience rapid advancement over the 2026–2035 forecast period as accelerated cloud adoption, expanding IT infrastructure, and rising digital governance initiatives across emerging economies stimulate integrated SAM uptake.

Segment Insights:

- Software Solutions segment in the software asset management market is projected to account for a substantial 74.8% share by 2035, reflecting enterprise preference for automated, scalable platforms delivering unified license compliance, entitlement reconciliation, and analytics across complex hybrid environments.

- Cloud-Based SAM segment is set to register strong growth momentum during 2026–2035 as organizations increasingly migrate toward cloud and SaaS licensing models, benefiting from real-time visibility, automated updates, and lower on-premises infrastructure reliance.

Key Growth Trends:

- Increased complexity of software environments

- Cost optimization & license spend control

Major Challenges:

- License compliance and vendor audit pressure

- Managing SaaS sprawl and shadow AI

Key Players: Flexera, Snow Software, ServiceNow, Microsoft Corporation, IBM Corporation, BMC Software.

Global Software Asset Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.9 billion

- Projected Market Size: USD 21.1 billion by 2035

- Growth Forecasts: 17.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 5 January, 2026

Software Asset Management Market - Growth Drivers and Challenges

Growth Drivers

- Increased complexity of software environments: Enterprises utilize many applications across on‑premise, cloud, and hybrid environments. In this context, managing diverse licensing models, updates, and usage across platforms increases the demand for software asset management market for tools that offer centralized visibility and control. In this context, NASA, in January 2023, revealed that NASA manages thousands of software products, each with specific licensing requirements, making software management very complex. It also mentioned that the current decentralized SAM practices expose the agency to operational, financial, and cybersecurity risks, which include more than USD 35 million in unnecessary costs. In addition, the highlighted shortcomings include a lack of a proper centralized SAM tool and inconsistent license tracking. Furthermore, the NASA OIG is recommending enterprise-wide SAM policies, centralized tools, improved compliance, and cybersecurity processes to reduce risks and costs.

NASA FY 2021 Software License Compliance Penalties and Settlements

|

Software Vendor |

NASA Center |

Penalty Finding (USD) |

Settlement Amount (USD) |

Status |

|

Ansys |

Agency |

959,051.00 |

0.00 |

Completed |

|

Dassault |

Agency |

1,201,223.44 |

90,000.00 |

Completed |

|

OpenText |

Langley |

8,300.00 |

8,300.00 |

Completed |

|

PTC Windchill |

Agency |

3,500,000.00 |

0.00 |

Completed |

|

SAP |

Goddard |

415,054.15 |

415,054.15 |

Payment in process |

|

SAP |

Marshall |

205,000.00 |

0.00 |

Completed |

|

SUSE |

Ames |

7,000,000.00 |

3,846,736.32 |

Completed |

|

Total Settlement |

- |

- |

4,360,090.47 |

- |

Source: NASA

- Cost optimization & license spend control: Organizations face constant pressure to reduce software waste and optimize spending, which is driving consistent business in the software asset management (SAM) market. In this context, SAM best helps to identify any type of unused, under‑utilized, or redundant licenses, in turn enabling substantial cost savings. In January 2025, Microsoft reported that it had implemented ServiceNow software asset management to centralize and optimize its third-party software licensing across a very complex enterprise environment. It also mentioned that by consolidating licenses such as Adobe Creative Cloud and integrating with tools called SCCM, SharePoint, and Azure AD, Microsoft has efficiently improved visibility, control, and compliance by reducing excess licenses. Furthermore, this unified system streamlined software requisition, allocation, and lifecycle management by delivering cost-effectiveness and a more efficient experience for employees.

- Compliance & audit risk mitigation: The existence of strict regulatory requirements and frequent software vendor audits increases financial and legal risk for non-compliance. Therefore, organizations are opting for the software asset management market since the tools help ensure compliance with licensing agreements and internal policies. In December 2024, the City of Toronto reported that it spent USD 44 million on software acquisitions and USD 34 million on maintenance in 2023, for managing more than 7,500 software titles, which also includes 1,200 paid applications. In addition, the audit revealed around USD 11 million in unused or underutilized licences, highlighting inefficiencies in tracking, deployment, and lifecycle management. Therefore, these findings underscore the extensive need for proper software asset management practices to optimize software usage, reduce costs, and mitigate compliance and financial risks, hence denoting a wider SAM market scope.

City of Toronto: Cost of Unused Software Licences and Subscriptions (2020-2024)

|

Software |

Cost of Unused Licences (USD) |

Cost Assigned to Former/Long-term Leave Employees (USD) |

Total Cost of Unused Licences (USD) |

|

Microsoft M365 |

6,896,597 |

1,046,795 |

7,943,392 |

|

SAP S/4 HANA |

1,932,376 |

- |

1,932,376 |

|

SAP ECC on-premises |

20,080 |

296,341 |

316,421 |

|

Public Digital Access |

657,177 |

- |

657,177 |

|

Adobe Acrobat |

119,800 |

14,550 |

134,350 |

|

Total |

9,626,030 |

1,357,686 |

10,983,716 |

Source: The City of Toronto

Challenges

- License compliance and vendor audit pressure: Ensuring license compliance is a persistent obstacle for organizations, which is severely impacting adoption in the software asset management (SAM) market. Currently, software licensing models are becoming complex, in which the metrics are based on users, cores, consumption, subscriptions, and cloud usage. The audits conducted by vendors are exposing organizations to financial penalties, legal risks, and reputational damage if any compliance gaps are identified. Also, most of the organizations lack the internal expertise to interpret licensing terms accurately or to align usage data with contract entitlements. In addition, the aspects of incomplete discovery, poor contract management, and insufficient governance processes exacerbate the issue, as a result, limiting its effectiveness as a strategic cost-optimization function.

- Managing SaaS sprawl and shadow AI: The rapid growth of SaaS applications and AI tools represents yet another major challenge in the software asset management market. Employees more often adopt SaaS and free AI tools without IT approval, which in turn leads to shadow IT and shadow AI. In this context, the traditional financial-based discovery methods can often fail to detect unsanctioned applications, thereby creating blind spots in asset visibility. This lack of control drives redundant spending, data security risks, and compliance violations, negatively affecting adoption in this sector. Additionally, subscription-based pricing models make it difficult to track usage efficiency and optimize licenses in real time. Furthermore, as SaaS and AI adoption are readily accelerating, organizations must overcome governance, visibility, and cultural challenges.

Software Asset Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 21.1 billion |

|

Regional Scope |

|

Software Asset Management Market Segmentation:

Component Segment Analysis

Software solutions are forecast to emerge as the largest segment in the software asset management (SAM) market with a share of 74.8% over the forecasted years. The software-centric SAM tools, such as license tracking, entitlement reconciliation, and compliance modules, will dominate since the organizations require automated and scalable systems to manage complex hybrid portfolios. Enterprises across the globe are preferring integrated license compliance and analytics capabilities in a single software suite, contributing to a wider segment scope. Ankura Consulting in May 2022 announced that it has launched the Ankura SAM manager, which is a technology-enabled software asset management tool especially designed to help clients manage complex software infrastructures and optimize license usage. This platform automates inventory discovery, monitors software consumption, tracks purchase history, and identifies compliance gaps, enabling cost optimization and risk mitigation, hence denoting a wider segment scope.

Deployment Mode Segment Analysis

In the software asset management market, the cloud-based SAM segment is expected to showcase lucrative growth opportunities during the forecast period. The major shift towards cloud and SaaS licensing is efficiently driving cloud-based SAM adoption, owing to the real-time visibility, automatic updates, and reduced on-premises infrastructure costs. Trimble in June 2024 announced that it has launched Trimble Unity, which is an end-to-end asset lifecycle management software suite that centralizes data and digital workflows for capital projects and public infrastructure. Besides, this platform integrates construction management, enterprise asset management, permitting, and connected data environments, thereby enabling organizations to optimize processes and ensure regulatory compliance. Furthermore, by providing a single subscription for all capabilities, the instance exemplifies the growing demand for cloud-centric, integrated SAM solutions that improve visibility.

Organization Size Segment Analysis

By the end of 2035, the large enterprises segment is anticipated to capture a significant revenue share in the software asset management (SAM) market. The growth of the segment is highly attributable to their vast, complex software estates, higher regulatory audit exposure, and greater license spend, creating strong demand for advanced SAM solutions to ensure compliance, reduce waste, and govern global software usage. These enterprises mostly operate across multiple geographies and utilize a wide range of on-premises, cloud, and hybrid software environments, which in turn increases the complexity of license management. The advanced SAM solutions help these organizations to achieve centralized visibility, automate license tracking, and optimize software utilization. In addition, the integration of analytics and reporting tools enables better forecasting of software needs and budget allocation. Further, as the regulatory scrutiny intensifies, large enterprises rely on SAM tools to mitigate audit risks, avoid penalties, and maintain operational efficiency across their global IT infrastructure.

Our in-depth analysis of the software asset management market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software Asset Management Market - Regional Analysis

North America Market Insights

With the presence of technological pioneers and research institutes, North America is expected to secure a commanding 48.7% share of the software asset management (SAM) market by the end of 2035. The strict frameworks for data security and licensing compliance are also propelling continued growth in the region’s market. In March 2025, FEDRAMP revealed that it underwent a major overhaul to create a streamlined, automation-driven compliance framework with a prime focus on enabling faster and more secure cloud adoption across U.S. federal agencies. This introduction of FedRAMP 20x allows continuous, cloud-native validation of security and licensing compliance, reducing bureaucracy and improving efficiency. Furthermore, such instances highlight North America’s regulatory push, driving organizations to adopt robust software asset management to meet strict federal standards.

The U.S. in the software asset management market is growing on account of large-scale enterprises that are leveraging SAM tools to optimize IT spending and improve operational efficiency. Simultaneously, the stronger emphasis on audit preparedness and risk mitigation is one of the major factors driving SAM adoption across major industries. In May 2025, the U.S. Department of Veterans Affairs achieved complete visibility into its software license inventory by covering 4,433 commercial off-the-shelf products and 224 SaaS offerings, addressing previous GAO concerns about tracking and accountability. Besides, the agency is now centralizing software license management to improve lifecycle oversight, reduce redundancies, and ensure cost-effective usage. In addition, the ongoing efforts focus on assigning accountable owners for each software title and optimizing overlapping tools to streamline procurement and operations across the department, contributing to a wider SAM market expansion.

Canada has a strong exposure in the software asset management market due to increased adoption to streamline software procurement and support sustainability initiatives by reducing any type of software waste. The country’s market also benefits from the public sector entities, including healthcare and municipal services, which are focusing on transparent software usage reporting and lifecycle management. In June 2025, Arcadis announced that it had been awarded a multiyear contract with the City of Calgary to implement its enterprise decision analytics platform, making Calgary the first municipality in the country to deploy the software across multiple infrastructure asset types. The firm also underscores that this platform will consolidate data, streamline asset management, and enable data-driven decisions to optimize spending, extend asset lifecycles. In addition to the initial two-year term, EDA aims to improve regulatory compliance, predict infrastructure failures, and support resilience goals.

APAC Market Insights

Asia Pacific is all set to witness unprecedented growth in the software asset management (SAM) market from 2026 to 2035. The region’s growth in this field is highly attributable to rapid cloud adoption and the expansion of IT infrastructure in emerging nations. Simultaneously, the ever-increasing investment in digital services and e-governance initiatives is also boosting demand for integrated SAM solutions in this region. HENNGE K.K. in May 2025, announced that it has integrated SS1cloud, which is a cloud-based IT asset management tool from the prominent firm DOS Co., Ltd., into its HENNGE one platform to enable organizations to centralize management and proper visibility of assets in IT. Moreover, this integration supports single sign-on, access control, and multi-factor authentication, efficiently strengthening both security and compliance. Furthermore, this cloud-based solution helps organizations in Japan to optimize software and hardware management and improve overall productivity in hybrid work environments.

In China, the SAM Market is effectively growing owing to the presence of constant regulatory pressure on software licensing and rising penalties for any type of non-compliance. These aspects, in turn, are encouraging organizations to opt for software asset management systems. Large enterprises and government bodies in this country are making continued investments in centralized software monitoring platforms to ensure operational continuity and compliance with both domestic and international software standards. In December 2025, Petrofac announced that CB&I acquired its asset solutions business, thereby securing the future of employees and integrating Petrofac’s asset management capabilities into the operations of CB&I. Besides, this acquisition strengthens CB&I’s service offerings and geographic reach while supporting continuity for clients and staff, hence representing lucrative growth opportunities for players in this field.

The software asset management market in India is backed by the aspects of rising digitization, increased adoption of SaaS platforms, and the expansion of the IT and IT-enabled services sectors at a rapid pace. The country’s market also benefits from companies utilizing SAM solutions to manage licensing across on-premises and cloud platforms, and even optimize subscription costs. In this regard, in January 2025, Infosys Finacle, which is a part of EdgeVerve Systems, announced that it had launched its Finacle asset liability management solution in the country to provide banks with an enterprise-wide view of liquidity and interest rate risks. The firm also stated that this solution emphasizes AI-infused analytics, stress testing, and scenario modeling to optimize funding, asset allocation, as well as compliance reporting. Furthermore, Jammu and Kashmir Bank opted for this platform to enhance risk management, streamline ALM operations, hence making it suitable for standard SAM market growth.

Europe Market Insights

Europe is yet another dominant force in the international software asset management market since the regional organizations are continuously making investments to comply with stringent GDPR and software licensing regulations. Also, the regional emphasis on cross-border operations and multi-country licensing management efficiently drives SAM adoption. In July 2025, Xensam, a well-established Sweden-based leader in AI-based software asset management, announced that it had expanded its operations in London and Bucharest to meet growing demand for its SaaS-native SAM platform in Europe. The company enhanced its workforce and product suite, which includes the Xupervisor, SaaS management platform, and DataBridge, allowing organizations to manage both on-premise and cloud software with greater visibility and control. Furthermore, this expansion supports enterprises in optimizing software spend, ensuring compliance.

Germany in the software asset management market has a stronger scope to capitalize, attributable to the emphasis on industrial and manufacturing sectors, wherein the SAM tools help manage extensive enterprise software portfolios and ensure compliance with strict software audits. In this context, Germany’s Federal Ministry of the Interior selected Raynet’s RaySAMi in June 2024 as its central software asset management solution, which is implemented through a Deloitte-led consortium and is supported by HiSolutions AG. The firm also stated that this platform provides federal authorities with enhanced visibility, automation, and control over software inventories, thereby improving cost efficiency and minimizing compliance risks. Furthermore, this deployment marks a major step toward modernized, transparent license management across approximately 90 federal agencies, hence attracting more players to make investments in the country’s SAM market.

In the U.K., the software asset management market is propelled by the presence of both private and public sector initiatives, which are focused on digital transformation and cybersecurity. Organizations are opting for SAM solutions for license optimization, cost control, and audit preparedness, by also integrating cloud-based and hybrid software environments into management frameworks. In this context, Pentagon Solutions in September 2023 entered into a partnership with Accruent by integrating EMS and Accruent's observe energy management into its portfolio, with a prime focus on enhancing facility and energy management for construction and manufacturing sectors. The firm also notes that this collaboration leverages digital tools such as Meridian EDM and maintenance connection to streamline asset lifecycle management and reduce costs. In addition, this strategic move strengthens the Pentagon’s capability to deliver innovative solutions across the design, construction, and operation phases of physical assets.

Key Software Asset Management Market Players:

- Flexera (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Snow Software (Sweden)

- ServiceNow (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- BMC Software (U.S.)

- Ivanti (U.S.)

- Oracle Corporation (U.S.)

- Micro Focus International plc (UK)

- Certero (UK)

- Aspera Technologies (Germany)

- ManageEngine (part of Zoho Corporation, India)

- Symantec (Broadcom) (U.S.)

- Matrix42 AG (Germany)

- Lansweeper NV (Belgium/Netherlands)

- Flexera is one of the most established leaders in SAM, which is consistently offering a broad technology spend and risk intelligence platform that covers software, cloud, and SaaS asset discovery and optimization. The company leverages the Flexera One suite, which provides deep hybrid IT visibility, AI-driven analytics, and license compliance tools. Furthermore, Flexera’s strategic acquisitions are allowing it to expand its product portfolio to enhance its capabilities in ITAM, FinOps, and SaaS management.

- Snow Software is a specialized player in this field, which is offering comprehensive discovery, normalization, and optimization of software and SaaS assets across complex enterprise environments. The firm’s solutions, such as Snow Atlas, provide real-time visibility into software usage and compliance to manage costs and mitigate audit risk. In addition, Snow has a significant global presence and is recognized for its agentless discovery technologies that support both on-premises and cloud assets.

- ServiceNow is yet another dominant force in this field, which extends its core IT service management platform into SAM with integrated workflow automation that helps organizations manage software licenses, inventory, and compliance. It also manages broader IT operations, and ServiceNow’s SAM modules benefit from tight coupling with ITSM, security, and procurement processes, enabling unified governance and automation at scale.

- IBM Corporation is identified as a prominent player in this field that delivers SAM capabilities as part of its wider enterprise IT and AIOps portfolio, focused on automation, performance optimization, and compliance, particularly for large organizations with complex licensing needs. IBM’s tools, such as ILMT for IBM software, efficiently help enterprises prepare for audits and optimize software spend across hybrid infrastructures.

- Microsoft Corporation enhances SAM through native management and governance features that are embedded within Windows, Azure, and Microsoft 365 ecosystems. The firm’s platform integrations simplify license tracking and optimization for Microsoft products by also supporting hybrid and cloud asset management, hence aligning software governance with broader identity and cloud operations.

Below is the list of some prominent players operating in the global SAM market:

The software asset management market is hosting both large enterprise software vendors along specialized SAM and ITAM providers. Exclusive platform capabilities, integrations with IT service management and cloud ecosystems, and analytics such as AI-driven optimization are a few strategies opted for by the top players to secure the prominent SAM market position. Flexera, in February 2024, announced that it had completed the acquisition of Snow to strengthen its product portfolio and deliver greater technology value optimization across hybrid IT environments. This combination brings together the ITAM and FinOps expertise, advanced technology intelligence, and unified visibility to help organizations manage spend, reduce risk, and optimize software investments. Further, Flexera will continue to support and innovate both in terms of Flexera and Snow solutions, thereby providing customers and partners with expanded capabilities across cloud, SaaS, on-premises, and emerging AI technologies.

Corporate Landscape of the Software Asset Management Market:

Recent Developments

- In December 2025, ServiceNow announced that it had agreed to acquire Armis for USD 7.75 billion to expand cyber exposure management and security across IT, OT, medical devices, and critical infrastructure worldwide. The combination will create a unified, AI-native, end-to-end security exposure and operations stack.

- In July 2025, Flexera announced the launch of Flexera One SaaS management, which is a unified next-generation solution that combines Flexera and Snow capabilities to deliver SaaS discovery, optimization, and control. The platform improves visibility into SaaS applications and shadow AI, helping organizations reduce costs, manage risk.

- Report ID: 1318

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software Asset Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.