Skin Biopsy Market Outlook:

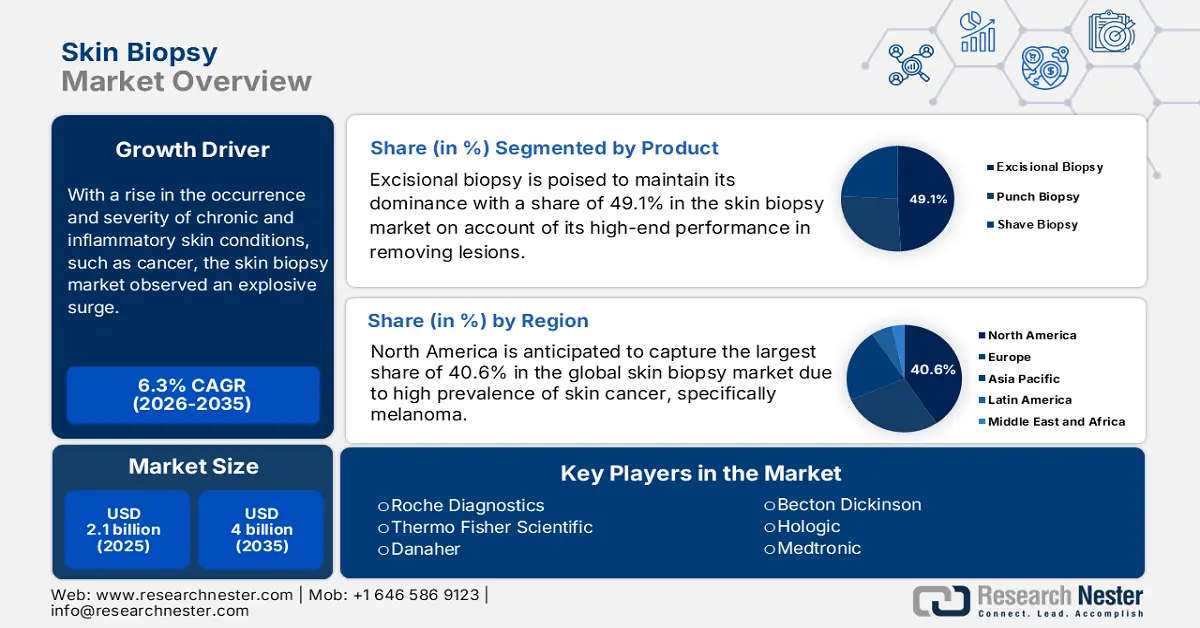

Skin Biopsy Market size was over USD 2.1 billion in 2025 and is estimated to reach USD 4 billion by the end of 2035, expanding at a CAGR of 6.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of skin biopsy is evaluated at USD 2.3 billion.

With a rise in the occurrence and severity of chronic and inflammatory skin conditions, such as cancer, the market observed an explosive surge. Evidencing the same, the GLOBOCAN survey unveiled that more than 331.7 thousand people around the globe were identified to be living with melanoma in 2022, with 58.6 thousand deaths. It also calculated the same figures for non-melanoma skin cancer to be 1234.5 thousand and 69.4 thousand, respectively. This demography underscores the growing need for essential pathological tools, including punches, blades, and pathology reagents, to conduct detailed disease analysis and treatment prognosis, fueling substantial expansion in this sector.

The effectiveness of early detection in protecting both patients and healthcare systems from financial exhaustion due to the inflationary payers’ pricing is also contributing to the widespread adoption in the market. In this regard, a study published in May 2023 revealed that the total cost of skin cancer management ranged between £14.3 million and £26.2 million in Northern Ireland. It also mentioned that the inflation rates in 2022 are expected to result in a budget requirement of approximately £6.4 million by 2040. Such an economic burden can be minimized and optimized through the use of early-stage diagnosis and prevention, securing a continuous rise in demand in the sector.

Key Skin Biopsy Market Insights Summary:

Regional Insights:

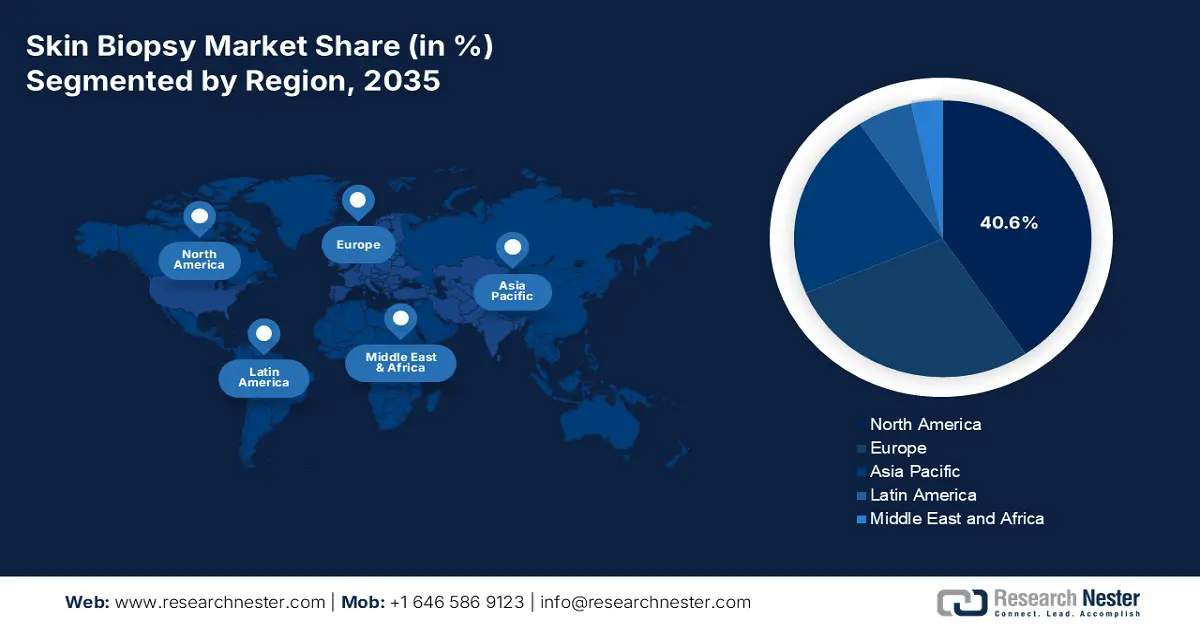

- North America is projected to command a 40.6% share of the global Skin Biopsy Market by 2035, sustained by advanced healthcare infrastructure, strong awareness of early detection, and supportive reimbursement policies.

- Europe is expected to hold a significant share by 2035, bolstered by a growing elderly population, rising skin cancer incidence, and expanded preventive screening initiatives.

Segment Insights:

- The Excisional Biopsy segment is forecast to dominate the Skin Biopsy Market with a 49.1% share by 2035, driven by its superior diagnostic accuracy and comprehensive lesion removal capability.

- The Cancer Diagnosis segment is set to lead the market by 2035, owing to the rising global incidence of melanoma and non-melanoma skin cancers and expanding government screening programs.

Key Growth Trends:

- Initiatives to spread awareness and promote solutions

- Rapidly aging populations worldwide

Major Challenges:

- Limitations from regulations

- Inconsistency in financial backing

Key Players: Becton Dickinson (U.S.), Roche Diagnostics (Switzerland), Thermo Fisher Scientific (U.S.), Danaher (U.S.), Hologic (U.S.), Medtronic (Ireland), Siemens Healthineers (Germany), Qiagen (Germany), Agilent Technologies (U.S.), Cardinal Health (U.S.), Sonic Healthcare (Australia), SD BIOSENSOR (South Korea), Trivitron Healthcare (India), HLL Lifecare (India), BP Healthcare (Malaysia), F. Hoffmann-La Roche (Switzerland), Merck KGaA (Germany), GeneCentric Therapeutics (U.S.), CND Life Sciences (U.S.).

Global Skin Biopsy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 5 September, 2025

Skin Biopsy Market - Growth Drivers and Challenges

Growth Drivers

- Initiatives to spread awareness and promote solutions: As people around the world gain more knowledge about the available diagnostic, curative, and preventive options, the consumer base in the market expands. In this regard, both public and private organizations are dedicating their efforts to make individuals understand the importance of routine check-ups and through initiatives for associated cancer screening programs. For instance, in June 2025, M42, in collaboration with AstraZeneca and SOPHiA GENETICS, formed a consortium to transform cancer care in the UAE with advancements and launches of liquid biopsy.

- Rapidly aging populations worldwide: The relationship of aging with the gradual rise in the volume of the high-risk population also indicates continuous enlargement of the pool of eligible patients in the market. Moreover, as elderly people are more susceptible to developing skin disorders and malignancies, the rapidly growing count of geriatric individuals across the globe is emphasizing the significance of this sector. This epidemiological amplification can be evidenced by the WHO predictions, estimating that every 1 in 6 people in the world to be aged 60 and over by 2030, while accounting for 2.1 billion by 2050.

- Advancement in techniques and products: The ongoing research cohorts and exploration projects are extending both the field of application and the range of options in the market. With the shifting preference toward less invasive and more precise diagnostic techniques, the sector is evolving its pipeline with suitable features and extensive offerings to maintain relevance with the changing needs. Exemplifying the same, in March 2024, a team of researchers at Beth Israel Deaconess Medical Center (BIDMC) proved the efficacy of skin biopsy in identifying Parkinson’s and other neurodegenerative diseases. This simple, minimally invasive testing method detects an abnormal form of alpha-synuclein to deliver more accurate diagnoses and accelerate clinical trials.

Historic Demographic Trends Observed in the market

Incidence of Skin Cancers in 1990 and 2021

|

Cause of Skin Cancer |

Number of Cases in 1990 |

Number of Cases in 2021 |

Annual Incidence Rate Change (1990-2021) |

|

Malignant Skin Melanoma |

124,320 |

303,105 |

0.65% |

|

Non-melanoma Skin Cancer |

1,661,644 |

6,336,846 |

2.02% |

|

Basal-cell Carcinoma |

1,196,532 |

4,436,939 |

2.01% |

|

Squamous-cell Carcinoma |

465,112 |

1,899,907 |

2.06% |

Source: NLM

Cost Variation in Diagnosis, Treatment, and Care Impacting the market

Cost Consequences of Skin Cancer Diagnosis, Treatment, and Care in Northern Ireland

|

Category |

Value (£) |

|

Non-Melanoma Skin Cancer (NMSC) Cases (2018) |

4,142 |

|

Malignant Melanoma (MM) Cases (2018) |

423 |

|

Average New Patients per Trust Weekly |

17.5 |

|

Total Cost for Managing NMSC |

1,815,936 |

|

Total Cost for Managing MM |

12,364,220 |

|

- Procurement, Administration, Chemotherapy Drug Use (MM) |

8,792,208 |

|

Total Healthcare Provider Spending on Skin Cancer Care |

17,024,115 |

|

Diagnostic Cost - Lower Bound (Based on referral volume) |

3,061,524 |

|

Diagnostic Cost - Upper Bound (Based on referral volume) |

11,212,183 |

|

Estimated Total Cost if Rates Rise by 9% (2040) |

18,100,000 |

|

Estimated Total Cost if Rates Rise by 28% (2040) |

20,400,000 |

Source: NHS Reference

Challenges

- Limitations from regulations: The tightening of cybersecurity and pathological standardization criteria across different regulatory frameworks is a major roadblock for innovators in the market. Particularly, the integration of AI and other next-generation technologies is often restricted due to the increased risk of and incidents cyber breaches. This is subsequently hampering the potential profitability gain from these advancements, discouraging companies from investing in R&D.

- Inconsistency in financial backing: The absence of adequate reimbursement coverage that ensures equitable patient access is also impacting the overall adoption rate in the market. Region-wise differentiation in insurance policies also creates disparities among dedicated service providers and consumers, particularly in underserved areas. To bridge the gap, favorable updates and coverage extensions are needed, where companies may also benefit by attaining compliance with the cost-effectiveness threshold through innovation.

Skin Biopsy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 4 billion |

|

Regional Scope |

|

Skin Biopsy Market Segmentation:

Product Segment Analysis

Excisional biopsy is poised to maintain its dominance with a share of 49.1% in the skin biopsy market over the assessed timeline. The high-end performance in detecting and completely removing suspicious lesions makes the product a gold standard for thorough histopathological examination. Specifically for non-superficial basal cell carcinoma (BCC) and early-stage melanoma, this method is also evidently favored for its accuracy in margins and staging. Furthermore, its higher diagnostic accuracy compared to less invasive techniques makes it the preferred choice among dermatologists and oncologists, particularly in cases where malignancy is suspected in older individuals.

Application Segment Analysis

Cancer diagnosis is the leading field of application in the market, which is backed by the rising global incidence of skin cancers, particularly melanoma and non-melanoma types. Being an essential and widely used tool for confirming malignancy, while enabling early and accurate detection, this method of diagnosis has become crucial for effective treatment and improved patient outcomes in modern cancer care. Moreover, as the efforts from governments to commence screening programs increase, this segment attracts more companies to invest and participate in this category. Following the same pathway, in May 2022, Labcorp introduced a new skin cancer testing method, Lymphocyte-activation gene 3 (LAG-3), which has the potential to expand treatment options for melanoma.

End user Segment Analysis

Hospitals are estimated to represent themselves as the dominant end users in the market by the end of 2035. Equipped with advanced medical infrastructure, skilled professionals, and pathology labs, these facilities are the first point of contact for patients with suspected skin conditions, especially cancer. Besides, continuous public investments in the modernization of the regional primary healthcare systems directly consolidate the segment's leadership in this sector. In addition, the ability of hospitals to perform various biopsy techniques, manage complications, and provide follow-up care makes them the highly preferred setting for both patients and healthcare providers.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Technique |

|

|

Application |

|

|

End user |

|

|

Sample Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Skin Biopsy Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the largest share of 40.6% in the global skin biopsy market throughout the discussed timeframe. High prevalence of skin cancer, advanced healthcare infrastructure, and widespread awareness of early detection are the foundational pillars of this dominance. The supporting epidemiology consists of more than 104.9 thousand new and 8.4 thousand death cases of melanoma in the U.S. alone, as recorded by the 2025 American Cancer Society report. Furthermore, the region places a strong emphasis on quality through the enactment of strict diagnostic protocols, while enabling access to cutting-edge biopsy technologies with adequate reimbursement policies backing frequent screening and follow-up care.

U.S. is the primary growth engine of the North America market, empowered by the increasing incidence of skin cancer, including basal and squamous cell carcinomas. This can be testified by the 2025 NLM study analyzing global trends of skin cancer, which revealed that the country spends more than USD 4.8 billion on non-melanoma and USD 3.3 billion on melanoma skin cancer every year. Further, the country’s advanced healthcare system, widespread access to dermatologists, and increased volume of routine skin screenings collectively contribute to the substantial demand for biopsy procedures.

Canada also plays a pivotal role in the expansion of the North America market in support of its publicly funded healthcare system and growing focus on oncological R&D. Despite having a lower incidence rate of skin cancer, the rigorous efforts to improve nationwide elderly care and ongoing screening initiatives are resulting in a remarkable adoption volume in this sector. Besides, the availability of skilled dermatologists, expanding teledermatology services in rural areas, and investment in modern diagnostic technologies further leverage the country's capacity in innovation and scalability.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the global skin biopsy market during the timeline between 2026 and 2035. The rising awareness of chronic skin conditions, modernizing healthcare infrastructure, and improving access to dermatological services across emerging economies are the major propelling factors behind the region's progress in this field. Besides, developing countries, such as China, India, and South Korea, are witnessing a remarkable surge in skin disease diagnoses due to lifestyle changes, pollution, and greater UV exposure. Thus, governing bodies are also showing interest in the cultivation of domestic supply chains to support the wide availability of skin biopsy assessments.

China leads the Asia Pacific skin biopsy market as the major producer and supplier of medical-grade reagents and clinical instruments. Besides, the increasing incidence of severe dermatological ailments, originating from rapid urbanization and lifestyle changes, has led to greater exposure for both domestic and foreign companies operating in this field. Evidencing the same, in 2022, the GLOBOCON survey unveiled that the count of new and death cases of melanoma in China accounted for approximately 8.7 thousand and 5.3 thousand, respectively, where the 5-year prevalence surpassed 29 thousand. This is further prompting public and private investors to invest and participate in such a diagnostic evaluation.

Australia holds a prominent position in the Asia Pacific skin biopsy market. The frequent occurrence of skin cancer in the country testifies to its enlarging consumer base, where the age-standardized incidence rate was 70 cases per 100,000 persons in 2024 alone, as per the Cancer Australia findings. Thus, the country has proactively implemented public campaigns, screening programs, and sun safety initiatives as a part of its early detection efforts and biopsy procedures. This is attracting more companies to invest, which can be exemplified by the launch of Melaseq Melanoma Genomic Testing in December 2024 by the alliance of Australian Clinical Labs and Geneseq Biosciences.

Country-wise Government Provinces (2025)

|

Country |

Government Initiative |

Key Focus |

|

Australia |

National Targeted Skin Cancer Screening Program |

$10 million allocation for advances |

|

Indonesia |

National Action Plan for Zero Leprosy 2030 |

Conducting screening and early detection of leprosy and disability cases |

|

India |

National Leprosy Eradication Programme |

Accomplish integration of leprosy services with General Health Care System (GHS) |

Source: Melanoma Institute Australia, NLM, and Government of NCT

Europe Market Insights

Europe is poised to maintain a strong position in the global skin biopsy market by the end of 2035. The aging population, increasing incidence of skin cancer, and public efforts in early diagnosis and preventive care are collectively solidifying the region's significance in this field. The well-established healthcare systems also support the merchandise through cultivating a large volume of routine dermatological screenings and biopsies. Moreover, rising public awareness, enhancements in biopsy techniques, and research allocations are enabling higher diagnostic accuracy and efficiency in this category. Specifically, continuous R&D funding from the European Union’s Horizon initiative empowers this cohort of innovation in Europe.

UK is a hub of innovations for the Europe skin biopsy market, which is attributable to the initiatives commenced by the National Health Service (NHS). As these assessments are routinely performed in both primary and secondary care settings, the support from referral pathways and public awareness campaigns remains consistent. The country’s massive investments in digital pathology and teledermatology are also escalating both R&D progress and patient access, particularly in underserved regions. Moreover, with continuous improvements in clinical guidelines and screening programs, the demand for skin biopsy procedures in the UK continues to rise.

Switzerland plays a considerable role in the Europe skin biopsy market on account of its robust healthcare infrastructure and strong presence in the global pharmaceutical industry. Exemplifying the same, in October 2022, Roche disclosed the commercial launch of its Anti-PRAM Rabbit Monoclonal Primary Antibody to help enable helps enable more informed clinical decisions. It was designed to detect PRAME protein expression in melanoma tissue samples. Besides, the ongoing development of tools enhances the accuracy of diagnosis through biopsies, reinforcing the nation’s position as a leader in adopting advanced diagnostic technologies.

Country-wise Melanoma Incidence Rates

|

Country |

Matrics |

Incidence Rate |

|

Spain |

Cases per 100 000 people-years |

8.82 |

|

New Zealand |

Diagnoses every year |

7 thousand |

|

UK |

Annual count of diagnoses |

15.4 thousand |

Source: ScienceDirect, Melanoma New Zealand, and NHS Foundation Trust

Key Skin Biopsy Market Players:

- Becton Dickinson (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics (Switzerland)

- Thermo Fisher Scientific (U.S.)

- Danaher (U.S.)

- Hologic (U.S.)

- Medtronic (Ireland)

- Siemens Healthineers (Germany)

- Qiagen (Germany)

- Agilent Technologies (U.S.)

- Cardinal Health (U.S.)

- Sonic Healthcare (Australia)

- SD BIOSENSOR (South Korea)

- Trivitron Healthcare (India)

- HLL Lifecare (India)

- BP Healthcare (Malaysia)

- F. Hoffmann-La Roche (Switzerland)

- Merck KGaA (Germany)

- GeneCentric Therapeutics (U.S.)

- CND Life Sciences (U.S.)

The competitive landscape of the skin biopsy market is intensified by the strong presence of several key players, who are individually focused on innovation, strategic partnerships, and portfolio expansion. Their commercial moves to strengthen such leadership acts as a roadmap for new entrants and investors. Moreover, the investments from these pioneers in extensive research and development improve accuracy and patient comfort, propelling the adoption rate and scalability in this sector. This dynamic environment fosters various opportunities, reinforcing the sector's competitiveness while supporting the integration of advanced technologies.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, GeneCentric raised an $8 million round of venture capital to launch and commercialize its novel liquid biopsy platform, GenomicsNext, for guiding precision cancer therapy. It provides thousands of gene-expression measurements and high-fidelity DNA variant detection from tumor DNA to diagnose genetic skin diseases.

- In March 2024, CND Life Sciences announced the release of promising results from an NIH-funded study on its Syn-One Test in the Journal of the American Medical Association (JAMA). The diagnostic tool has already been adopted by over 1.2 thousand neurologists in 46 states to aid the diagnosis of 20 thousand patients in the last few years.

- Report ID: 8056

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Skin Biopsy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.