Simulation Learning Market Outlook:

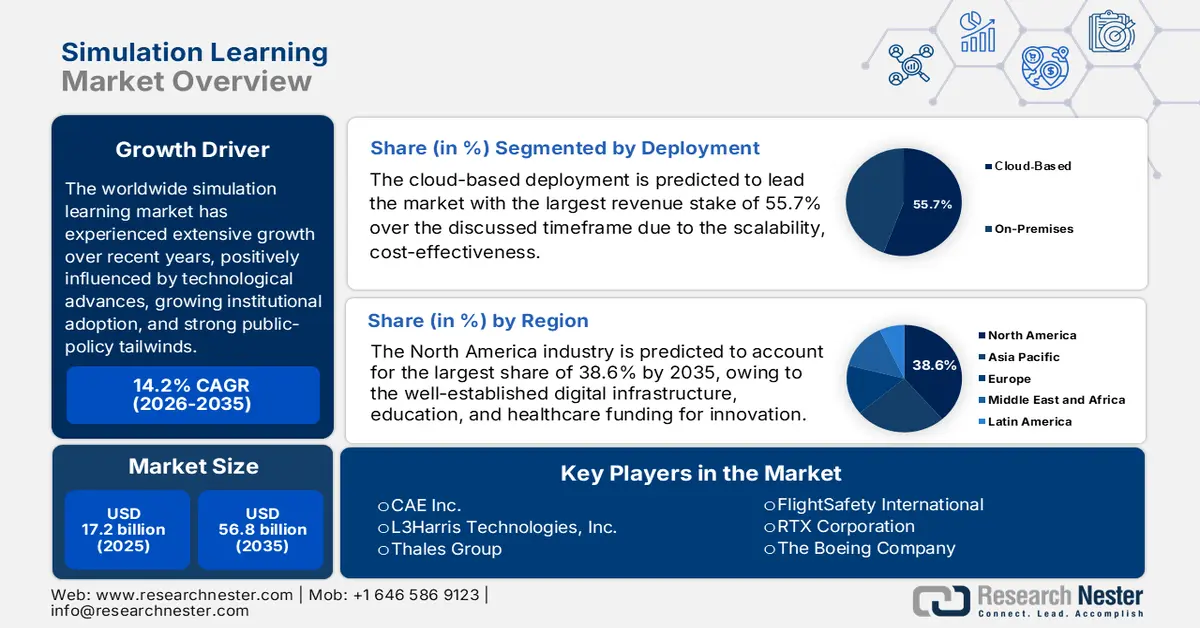

Simulation Learning Market size was valued at USD 17.2 billion in 2025 and is projected to reach USD 56.8 billion by the end of 2035, rising at a CAGR of 14.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of simulation learning is evaluated at USD 19.6 billion.

The worldwide simulation learning market has experienced extensive growth over recent years, positively influenced by technological advances, growing institutional adoption, and strong public-policy tailwinds. On the other hand, the international organizations, along with the governments, are strongly supporting the shift towards digital and simulation-based education. In this context, UNICEF states that the world is facing a deepening learning crisis, wherein around 272 million children are out of school, and most 10-year-olds in low- and middle-income countries are unable to read with comprehension. Through its Digital Education Strategy 2025-2030, UNICEF is emphasizing that AI, adaptive tools must be used smartly to transform learning rather than simply making digitized old methods. It also highlights that digital learning can be a lifeline for children in conflict zones, remote regions, and marginalized communities, which helps them to bridge persistent gender, disability, and linguistic divisions.

Furthermore, the simulation learning market also benefits from an inclusive approach of immersive training solutions, such as VR, AR, and MR. Simulation software is being leveraged across various sectors, such as aviation, healthcare, industry, and education, which are offering realistic environments for continuous learning. QA In October 2025, announced the launch of its SimuLabs, which is an AI-based immersive training platform especially designed to help modern teams build both technical and human skills through lifelike workplace simulations. Also, this is a blend of scenario-driven problem-solving with AI-enabled interactions, which addresses gaps in traditional training where learners often lack real-world adaptability and communication skills. Hence, this initiative positions the firm as a leading provider offering scalable, outcome-focused simulation learning.

Key Simulation Learning Market Insights Summary:

Regional Insights:

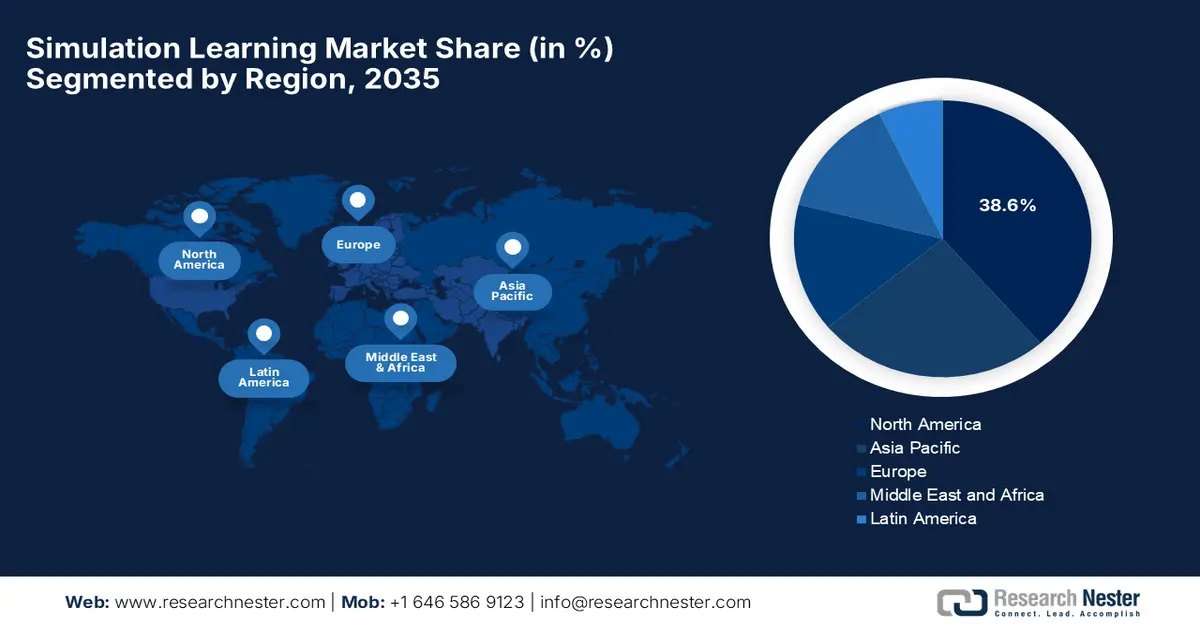

- North America is anticipated to hold a 38.6% share by 2035 in the simulation learning market, supported by its strong digital infrastructure and sustained funding for innovation.

- Asia Pacific is set to expand at the fastest pace by 2035, accelerated by widespread digitalization in education and healthcare sectors.

Segment Insights:

- The cloud-based deployment segment is projected to secure a 55.7% share by 2035 in the simulation learning market, propelled by its scalability, cost-efficiency, and collaborative learning capabilities.

- The academic institutions segment is expected to capture a significant share by 2035, facilitated by the broad integration of STEM programs and rising adoption of immersive VR and AR learning technologies.

Key Growth Trends:

- Rising demand for experiential and immersive training

- Government initiatives

Major Challenges:

- Limited technical expertise

- Accessibility, equity, and digital divide issues

Key Players: CAE Inc. (Canada), L3Harris Technologies, Inc. (U.S.), Thales Group (France), FlightSafety International (U.S.), RTX Corporation / Collins Aerospace (U.S.), The Boeing Company (U.S.), Lockheed Martin Corporation (U.S.), Saab AB (Sweden), Rheinmetall AG (Germany), BAE Systems plc (U.K.), Indra Sistemas, S.A. (Spain), General Dynamics Corporation (U.S.), Elbit Systems Ltd. (Israel), Frasca International, Inc. (U.S.), GSE Systems, Inc. (U.S.).

Global Simulation Learning Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.2 billion

- 2026 Market Size: USD 1.60 billion

- Projected Market Size: USD 19.6 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 10 December, 2025

Simulation Learning Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for experiential and immersive training: Both the learners and employers prefer hands-on, experience-based training over traditional classroom-based models, which is efficiently driving business in the simulation learning market. In April 2025, Virginia Tech reported that its Electric Service division is transforming workforce training through a combined digital-twin and virtual reality system, which will enable trainees to safely practice operating a live power substation in a fully immersive environment. Also, the initiative allows learners to interact with a digital replica of the Turner Street substation, flipping switches, observing real-time grid impacts, and gaining hands-on experience without operational risk. Furthermore, the firm notes that this approach helps modernize training for a workforce facing increasingly complex power-system technologies.

- Government initiatives: This is efficiently supporting digital and skill-based learning since they are proactively promoting simulation-based training, driving consistent business in the simulation learning market. In October 2024, the Ministry of Skill Development & Entrepreneurship announced that it had entered into a partnership with Meta to enhance the Skill India mission through the launch of an AI assistant and five centers of excellence in VR and MR at National Skill Training Institutes across India. In this context, MSDE also noted that these initiatives aim to democratize access to advanced technologies by providing personalized learning pathways and hands-on skill development experiences. Furthermore, the AI Assistant, powered by Meta’s open-source Llama model, will support multi-language interactive learning on the Skill India Digital Portal, whereas the CoEs will deliver realistic VR simulations to improve engagement, safety.

- Increased adoption of AI, VR, AR & digital twins: Advances in AI, generative AI, extended reality, and digital-twin technologies are transforming the growth dynamics in the simulation learning market. Also, these innovations are improving learning effectiveness, reducing training time, and attracting investments from enterprises across the globe. In October 2025, VR Vision Inc. announced its new intelligent training era platform, which combines AI with extended reality to create adaptive, data-driven simulations that continuously optimize workforce performance. It also stated that the system captures performance data via XR and uses AI to provide real-time feedback, predictive risk alerts, and personalized learning paths, enhancing onboarding, safety, and skill consistency, thereby accelerating competency development across large-scale workforce programs.

Market Opportunities in Simulation Learning (2025)

|

Company Name |

Activity |

Key Focus |

Simulation Learning Market Opportunity |

|

Varjo |

XR simulation for defense |

Military-grade VR & mixed reality headsets |

Scalable, realistic multi-user training for NATO and defense forces |

|

Fujitsu |

Molecular dynamics simulation |

AI-driven atomic-level battery interface modeling |

Advanced materials and energy sector training and R&D simulation |

|

Boeing / Bluedrop |

Aerospace simulation training |

Full-mission CV-22 simulators, crew training |

Aviation and defense training, global mission operations |

Source: Company Official Press Releases

Challenges

- Limited technical expertise: Integration complexities, coupled with the absence of skilled work professionals, are the major challenges hampering the growth of the simulation learning market. Institutions across the emerging nations are facing difficulties while integrating the simulation platforms with existing learning management systems, and the IT infrastructure is causing obstacles to widespread adoption. Also, most organizations lack trained personnel with in VR/AR technologies, instructional design for simulations, and troubleshooting complex immersive setups, which in turn increases reliance on specialized vendors, thereby raising operational costs and complicating scalability. In addition, aligning simulations with learning outcomes, industry standards, and assessment frameworks necessitates pedagogical and technical collaboration, which overall is reducing the return on investment and ultimately slowing adoption.

- Accessibility, equity, and digital divide issues: The simulation learning market has a transformative potential, but still faces learning risks, deepening inequities affected by unequal access to digital infrastructure. Most of the nations still do not have high-bandwidth internet, modern computing devices, and VR/AR hardware, especially in rural regions, low-income countries, or underfunded institutions, which hinders adaptability in this field. Also, there are learners with disabilities who may face accessibility barriers if simulations are not inclusively designed. In addition to language localization, cultural relevance and content adaptability remain inconsistent across global simulation learning markets, thereby limiting inclusiveness. Hence, the presence of these disparities reinforces the digital divide, preventing large sections of the workforce and student population from benefiting from immersive, experiential learning.

Simulation Learning Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 17.2 billion |

|

Forecast Year Market Size (2035) |

USD 56.8 billion |

|

Regional Scope |

|

Simulation Learning Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based deployment is predicted to lead the entire simulation learning market with the largest revenue stake of 55.7% over the discussed timeframe. The scalability, cost-effectiveness for widespread deployment, and the ability to support remote and collaborative learning are the key factors behind this leadership. As per the article published by UNESCO in September 2024, UNESCO revealed that digital innovation in education plays a pivotal role in ensuring inclusive, resilient learning, especially during times of crises, which has left about a third of students without any access to education. It also notes that by promoting digital literacy and open educational resources, UNESCO is supporting equitable access for marginalized groups, which include girls, low-income students, and people with disabilities. Its initiatives include guiding national policies, developing teacher competency frameworks, and fostering international collaboration to transform education systems in line with Sustainable Development Goal 4, hence making it suitable for overall market growth.

End user Segment Analysis

In terms of end user academic institutions segment is anticipated to garner a significant share in the simulation learning market by the conclusion of 2035. The growth in the segment is highly subject to the systemic integration of STEM and vocational training. Simultaneously increasing investments in immersive technologies such as VR, AR for labs and career technical education are topmost priorities in this field. In October 2024 Institute of Education Sciences stated that simulation technology enables students to engage in complex problem-solving by immersing them in realistic, risk-free scenarios, from public health outbreaks to budget management exercises. Also, the integration of generative AI allows simulations to adapt in real time, provide interactive feedback, and create dynamic learning experiences that are suitable for individual student needs, hence denoting a wider segment scope.

Application Segment Analysis

By the conclusion of the discussed timeframe, the healthcare & medical simulation sub-segment is expected to capture a lucrative revenue share in the simulation learning market. The imperative to improve patient safety and clinical competency without risk is the key factor propelling this growth. As per the article published by AHRQ in March 2023, it was observed that simulation training in healthcare allows clinicians to develop critical skills and teamwork in risk-free, realistic environments, from part-task trainers to high-fidelity and virtual or augmented reality setups. In addition, the evidence shows simulation improves knowledge, technical proficiency, patient safety, and reduces errors, by also supporting interprofessional collaboration and human factors testing. Furthermore, best-practice guidelines ensure effective facilitation and evaluation of simulations, making them a highly essential component of modern medical and nursing education.

Our in-depth analysis of the simulation learning market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

End user |

|

|

Application |

|

|

Component |

|

|

Delivery Modes |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Simulation Learning Market - Regional Analysis

North America Market Insights

North America is anticipated to lead the simulation learning market, capturing 38.6% of the total share by the end of 2035. The region’s leadership in this field is effectively fueled by a combination of well-established digital infrastructure, education, and healthcare funding for innovation. The region is incorporating simulation into various sectors such as military, aviation, and medicine training programs, which is the foundational factor for the broader aspect of institutional adoption. In December 2023, Transfr announced the launch of its new software development kit to expand XR and VR-based skills training, enabling creators to build immersive training simulations more efficiently by utilizing Unity-based low-code tools. Also, the kit possesses features such as state management, custom mechanics, interactive elements, and digital coaches, which provide personalized guidance and enhance learner engagement.

The U.S. is efficiently growing in the simulation learning market, backed by the presence of leading institutions and universities, which are integrating simulation, supported by the larger federal and private investments. The country also benefits from policies promoting competency-based learning and continuous professional development further encourage the adoption of simulation in both academic and corporate training settings. In April 2025, VRpatients announced that it had launched PhysioLogicAI, which is an adaptive healthcare simulation platform that enables realistic, real-time interactions with virtual patients for nurse educators and learners. It utilizes advanced AI, which also includes large language models, and offers dynamic, personalized simulation experiences that adapt based on user input and clinical decisions, enhancing training accuracy and engagement.

The simulation learning market in Canada is growing exponentially on account of increasing investments across the educational and healthcare sectors. Also, the ever-increasing collaboration between technology companies, universities, and government initiatives is fostering continued innovation and the integration of cutting-edge simulation solutions. The country’s government announced in July 2024 that Bluedrop Training & Simulation Inc. is integrating generative AI into its virtual reality training programs to create more personalized and adaptive learning experiences for aerospace, defense, and emergency response sectors. Furthermore, this is supported by government investments through ACOA and focuses on enhancing mission training efficiency, thereby improving course content and expanding the market over the forecasted years.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the simulation learning market, primarily fueled by digitalization efforts in the education and healthcare sectors. Prominent countries in the region are continuously making investments in skill development programs, whereas the consumer base in this field is also vast. In July 2025, MTI Co., Ltd., along with several leading countries’ maritime organizations and universities have jointly launched the development of an integrated simulation platform for a sustainable and competitive maritime industry project, selected under Japan’s K Program by the Japan Science and Technology Agency. Besides, this initiative aims to develop advanced digital technologies for next-generation vessel design and high-precision environmental prediction to support stable and safe maritime operations. Furthermore, the project aligns with Japan’s strategic goal to maintain global leadership in shipbuilding and marine transportation through innovative research and cross-sector collaboration.

China has a strong scope to capitalize on the market owing to a huge focus on advanced technology adoption in education, defense, and industrial training. The country’s simulation learning market also benefits from strong government support for digital learning initiatives and a growing emphasis on competency-based education. For instance, in December 2022, Mentice AB, a global announced that Beijing Huanya Zhitong has placed an order for its VIST simulation systems. It also notes that this acquisition, made on behalf of the Chinese Medical Education Association, highlights the growing adoption of advanced medical simulation technology in the country. Furthermore, Mentice’s solutions aim to help healthcare professionals enhance procedural skills and improve outcomes across neurovascular, cardiovascular, and peripheral interventions, hence contributing to the overall market growth.

India is a leading player in the simulation learning market, fueled by the rising demand for skilled professionals in aviation, defense, healthcare, and industrial sectors. Organizations in the country are increasingly adopting virtual and augmented reality platforms, whereas the public and private investments in high-tech training infrastructure are enhancing workforce competencies. In June 2024, the prominent international pioneer Simaero announced that it is entering the India’s market with a USD 100 million investment to train up to 5,000 pilots over the next five years. The company is developing a training facility in Delhi NCR, which features eight full-flight simulators for aircraft types such as A320 NEO and B737NG, certified by DGCA and EASA. Hence, this expansion addresses the growing demand for pilots in India, where the current training infrastructure is limited, and airlines often send pilots overseas.

Europe Market Insights

Europe is considered to be the frontrunner in the international simulation learning market, positively influenced by the governments and academic institutions that are promoting competency-based education, whereas private companies are making investments in virtual and augmented reality tools. Simultaneously, cross-border collaborations and standardized training programs in the region are driving the integration of AI and data analytics is enabling more adaptive experiences across industries. As of November 2025, from European Commission the Digital Education Action Plan from 2021-2027 sets a strategic vision for high-quality, inclusive, and accessible digital learning across the region, aiming to modernize education systems. Besides, it promotes the use of digital tools, platforms, and virtual learning environments to enhance teaching, personalize learning, and build essential digital skills for students and educators.

In Germany, the simulation learning market is progressing since it has become integral to vocational training, medical education, and industrial skill development. The country’s simulation learning market also benefits from advanced engineering and manufacturing sectors that are leveraging virtual reality and digital twins to optimize workforce readiness, whereas universities and technical institutes are embedding simulations into the curriculum. In November 2025, Rockwell Automation and Eplan together announced that they had launched a digital twin-driven electrical simulation integration in the country, which allows engineers to virtually model, test, and optimize industrial systems before building hardware. Furthermore, the integration streamlines workflows, reduces and enhances overall accuracy in control system design, contributing to the market growth over the forecasted years.

In the U.K., the simulation learning market is growing due to the strong government initiatives in healthcare training, defense, and emergency response sectors. The country hosts universities and professional training organizations that are adopting VR and AR solutions and continuous professional development, along with constant investments in innovative learning technologies. In February 2025, Northumbria University showcased the SkillsFest programme as a best practice example in the country, which also allowed 500 nursing students to complete thousands of simulation sessions across diverse clinical scenarios, helping them develop practical skills in a safe, immersive environment. Furthermore, the programme has earned Northumbria University flagship status from Oxford Medical Simulation, encouraging other institutions to adopt similar approaches.

Key Simulation Learning Market Players:

- CAE Inc. (Canada)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (France)

- FlightSafety International (U.S.)

- RTX Corporation / Collins Aerospace (U.S.)

- The Boeing Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Saab AB (Sweden)

- Rheinmetall AG (Germany)

- BAE Systems plc (U.K.)

- Indra Sistemas, S.A. (Spain)

- General Dynamics Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Frasca International, Inc. (U.S.)

- GSE Systems, Inc. (U.S.)

- CAE Inc. is widely seen as the global leader in flight simulators and training solutions. The company has decades of experience and a large installed base worldwide. CAE delivers full‑flight simulators for virtually every major commercial aircraft type. The company’s business model increasingly emphasizes providing full training services, not only hardware, through global training centers and long-term contracts with airlines and defense agencies

- L3Harris Technologies is yet another major force in this field, which is offering a comprehensive portfolio spanning full‑flight simulators, rotorcraft and fixed‑wing simulators, and associated training systems for both military and civil applications. The company is best known for modular, maintainable designs and global support services. L3Harris also extends into after-sales services and lifecycle support, giving it strength beyond just manufacturing.

- Thales Group brings a strong regional and global presence to simulation and training, particularly in defense, civil aviation, and security sectors. The company is proactively making investments in advanced simulation solutions, often integrating high-fidelity visual systems and advanced training scenarios, which appeals to clients needing rigorous compliance and realism, such as military, defense, and regulatory aviation training.

- Boeing, beyond manufacturing aircraft it remains a significant player in simulation or training through its training services and simulator offerings. The company is leveraging strong domain expertise in commercial aviation and wide brand recognition. Also, Boeing’s simulators and training services are extensively utilized by airlines and training centers across the globe. Furthermore, the company’s involvement helps bridge actual aircraft design know-how with pilot training and readiness programs.

- FlightSafety International is the central player in this field, which stands out for high-fidelity training simulators and pilot training services. The company is emphasizing safety, regulatory compliance, and providing realistic, certified simulation environments, which is making it a preferred choice for airlines and training organizations that need reliable, certified pilot training, both for initial and recurrent training.

Below is the list of some prominent players operating in the global simulation learning market:

The global simulation learning market is witnessing intense competition among both specialized and niche entities, wherein major pioneers in this field, such as CAE Inc., L3Harris, and Thales, are leveraging extensive knowledge in aviation and defense simulators, ample global sales networks, and strong investments in high-fidelity, next-gen training systems. In this context, Ziplines Education in October 2024 reported that it had acquired Clicked to integrate its work simulations into its programs and university partner network. In this context, this strategic move is expected to enhance experiential, hands-on learning and upskill professionals with a prime focus on the upcoming Salesforce administration certificate course. Furthermore, the integration also aims to boost learner confidence efficiently and expand scalable career pathways, contributing to the growing demand for digital workforce training and simulation-based learning solutions.

Corporate Landscape of the Simulation Learning Market:

Recent Developments

- In November 2025, Boeing announced the launch of its virtual airplane procedures trainer, which is a training platform powered by Microsoft Azure and Microsoft Flight Simulator. The platform enables pilots and flight training teams to practice procedures in immersive, accessible, and customizable 3D simulations.

- In November 2025, Rheinmetall and Varjo announced that they had entered into a partnership to integrate Varjo’s XR-4 Series mixed reality technology into Rheinmetall’s deployable land training simulators, enabling scalable, high-fidelity training for NATO and Europe’s forces.

- In October 2025, TRU Simulation + Training Inc. announced an agreement with US Aviation Academy for the purchase of five Cessna Skyhawk Veris virtual reality simulators, marking TRU Simulation’s first fleet order, which are designed to meet FAA Level 7 Flight Training Device standards, offer immersive, realistic cockpit experiences.

- In August 2025, ABB and SimGenics declared a partnership to develop simulation-based training and engineering solutions for nuclear power operations in North America, covering conventional, small modular, and advanced modular reactors to create realistic simulators for testing, training, and validation.

- Report ID: 8298

- Published Date: Dec 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Simulation Learning Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.