Airline Route Profitability Software Market Outlook:

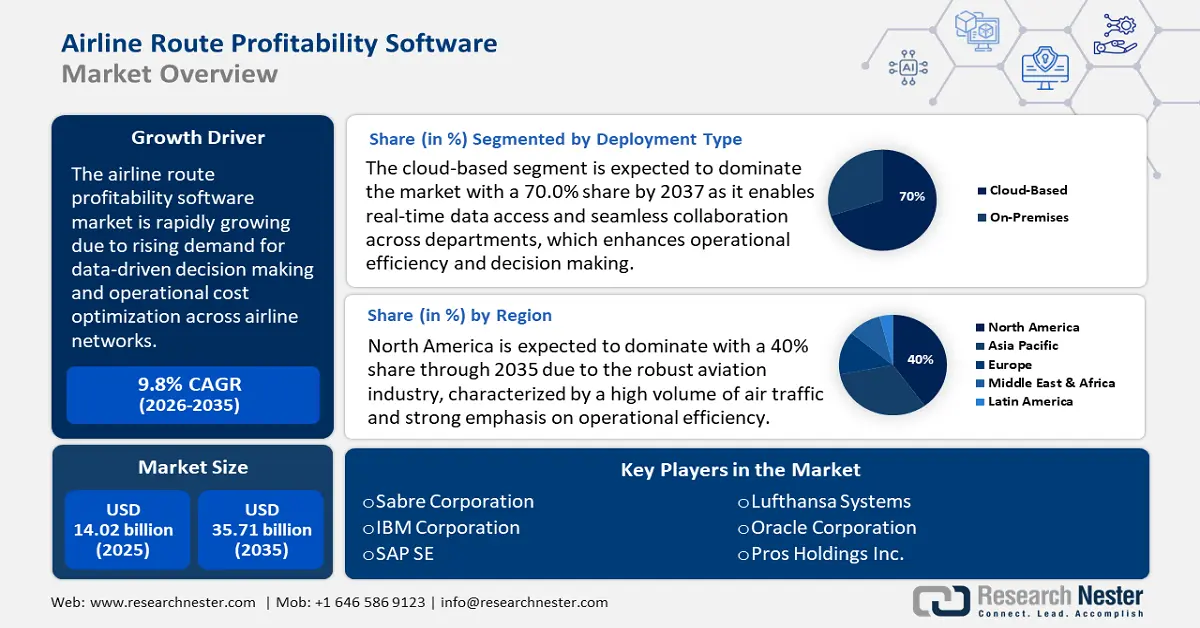

Airline Route Profitability Software Market size was valued at USD 14.02 billion in 2025 and is likely to cross USD 35.71 billion by 2035, expanding at more than 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airline route profitability software is estimated at USD 15.26 billion.

The market is primarily driven by a focus on operational cost optimization across airline networks. Airlines operate on thin margins, and misallocated costs on unprofitable routes can significantly erode profitability. Route profitability software enables detailed tracking of direct and indirect costs associated with each flight segment, including fuel consumption, crew utilization, maintenance, airport charges, and overhead allocations. With enhanced visibility into route-level profit and loss statements, airline CFO and route planners can restructure schedules, renegotiate airport fees, or eliminate loss-making operations. In July 2024, American Airlines revamped its transatlantic route network using an advanced route profitability engine that helped identify high-cost, low-yield sectors. As a result, the airline suspended underperforming routes to Berlin and Dubrovnik, reallocating capacity to more profitable North American and Caribbean markets.

The shift towards data-centric airline operations has pushed demand for software that integrates real time data from multiple sources such as flight operations, passenger systems, ATC data, and weather feeds. This allows for scenario modeling, route simulation and immediate identification of network disruptions or underperformance trends. Additionally, airlines using real time route optimization platforms are better positioned to respond to geopolitical events, weather volatility, and demand shocks by rerouting assets or reconfiguring schedules on short notice.

Key Airline Route Profitability Software Market Insights Summary:

Regional Highlights:

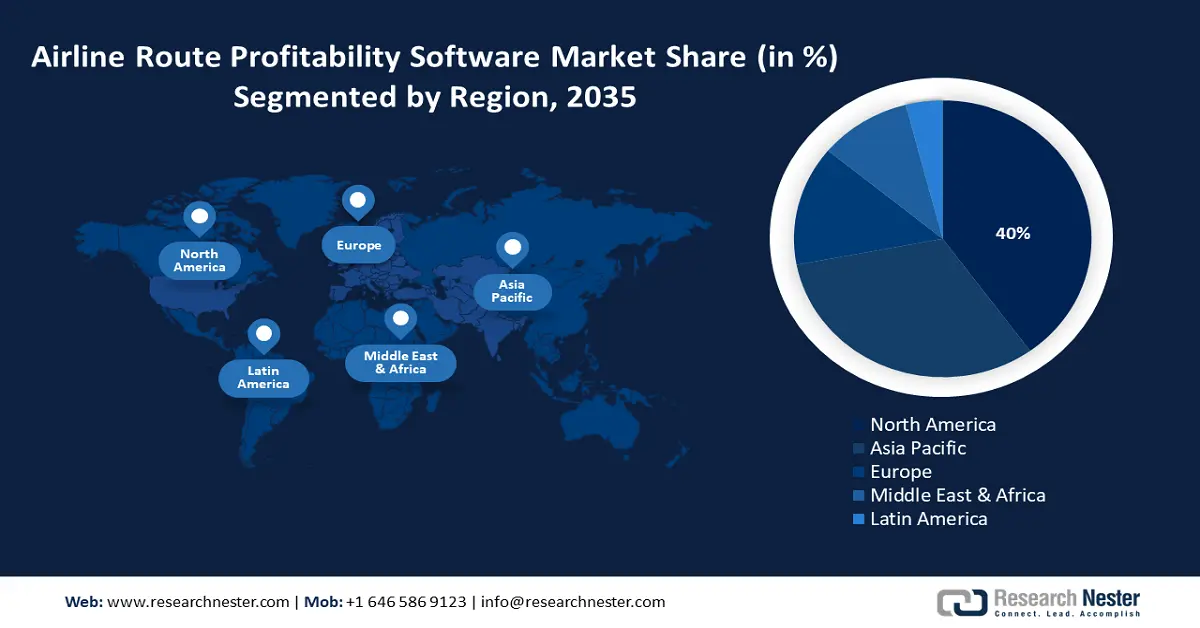

- North America airline route profitability software market will dominate over 40% share by 2035, driven by the robust aviation industry, high air traffic, and strong emphasis on operational efficiency.

- Asia Pacific market will secure significant revenue share by 2035, driven by rapid urbanization, a growing middle class, and increasing adoption of AI and machine learning in route planning.

Segment Insights:

- The cloud-based segment in the airline route profitability software market is projected to hold a 70% share by 2035, fueled by scalability, flexibility, and AI integration.

- The route planning & scheduling segment in the airline route profitability software market is projected to achieve a 45% share by 2035, influenced by its critical role in optimizing flight schedules and improving airline operational efficiency.

Key Growth Trends:

- Rising demand for data-driven decision making

- Increased focus on sustainable aviation and environmental efficiency

Major Challenges:

- Integration complexities with legacy airline systems

- Data quality and granularity constraints

Key Players: IBM Corporation, SAP SE, Lufthansa Systems, Oracle Corporation, General Electric Company, The Boeing Company.

Global Airline Route Profitability Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.02 billion

- 2026 Market Size: USD 15.26 billion

- Projected Market Size: USD 35.71 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 8 September, 2025

Airline Route Profitability Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for data-driven decision making: Advanced route profitability tools combine predictive analytics and machine learning to evaluate market demand, seasonal fluctuations, and have an idea competitor pricing. This helps airlines optimize load factors and passenger yields by dynamically adjusting capacity and pricing strategies for specific routes. For instance, in January 2025, Malaysia Airlines extended its long-standing partnership with PROS, a leading provider of AI-powered airline revenue management and pricing solutions. The collaboration aims to enhance the airline’s ability to forecast demand, optimize fares, and make more informed route-level decisions. By integrating with revenue management systems, route profitability software not only identifies profitable routes but also uncovers missed revenue opportunities by aligning capacity planning with real-time demand indicators.

- Increased focus on sustainable aviation and environmental efficiency: Environmental sustainability is emerging as a competitive differentiator. Airlines are under pressure to minimize their carbon footprint and adopt eco-efficient routes. Profitability software now includes environmental metrics such as fuel burn per seat kilometer and emissions per route, which aid in carbon reporting and green route planning. With global carbon offsetting regulations gaining traction, airlines are leveraging software tools to weigh route profitability against environmental impact, aligning financial goals with ESG strategies.

Challenges

- Integration complexities with legacy airline systems: Many airlines still use outdated IT systems for operations, accounting, and reservations that make it difficult to connect with modern route profitability software. This often requires complex customization and data cleanup. Additionally, this integration not only delays deployment timelines but can also impact the accuracy of profitability analytics if data silos remain unresolved. Thus, airlines must invest in modernization or choose vendors offering robust APIs and modular integration to mitigate this risk.

- Data quality and granularity constraints: Route profitability software relies heavily on accurate and detailed data. However, many airlines struggle to collect and organize high quality data from different parts of their businesses such as fuel costs, crew expenses, passenger spending, and other operating details. If the data is missing or inaccurate, the software may produce misleading results, which can lead to poor decisions like cutting a route that could have been profitable.

Airline Route Profitability Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 14.02 billion |

|

Forecast Year Market Size (2035) |

USD 35.71 billion |

|

Regional Scope |

|

Airline Route Profitability Software Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is expected to dominate the airline route profitability software market and hold a 70% share by 2035. The segment is set for rapid growth due to its scalability, flexibility, and cost efficiency. Cloud solutions enable real-time data access and seamless collaboration across departments which enhances operational efficiency and decision making. The integration of AI and machine learning with cloud platforms allows for advanced analytics, such as predictive maintenance and dynamic route optimization. A notable example is the partnership between Google Cloud and Air France-KLM, where AI technology is utilized to analyze passenger preferences and optimize flight operations, demonstrating the transformative impact of cloud-based solutions in the aviation industry.

Application Segment Analysis

The route planning and scheduling segment is predicted to gain a significant airline route profitability software market share of around 45% through 2035 due to its critical role in enhancing airline operational efficiency and reducing costs. By leveraging advanced analytics, airlines can optimize flight schedules, maximize aircraft utilization, and minimize ground time, leading to improved profitability. The increasing complexity of airline operations and the need for real-time decision making are driving the demand for sophisticated planning and scheduling solutions.

Our in-depth analysis of the global market includes the following segments:

|

Deployment Mode |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airline Route Profitability Software Market Regional Analysis:

North America Market Insights

North America is expected to dominate the airline route profitability software market with a 40% share through 2035 due to the region’s robust aviation industry, characterized by a high volume of air traffic and strong emphasis on operational efficiency. Airlines are increasingly adopting advanced software solutions to optimize route planning, manage costs, and enhance profitability. Additionally, technological advancements, such as AI-driven analytics and real-time data processing, have allowed airlines to better forecast demand and adjust routes accordingly.

The U.S. market is expanding rapidly, driven by the industry’s focus on optimizing operations and enhancing profitability. Airlines are increasingly adopting advanced software solutions to analyze route performance, manage costs, and make data-driven decisions. This growth is fueled by the need to adapt to changing travel patterns and competitive pressures. For instance, Southwest Airlines is under pressure to revamp its business model to address profitability challenges, highlighting the industry’s shift towards more sophisticated operational tools. Additionally, the resurgence in transatlantic travel demand presents opportunities for airlines to leverage profitability software to maximize revenue on high-demand routes.

The airline route profitability software market in Canada is growing as carriers such as Air Canada pursue ambitious revenue targets and network expansion plans. With a focus on increasing flights to Asia Pacific regions and capitalizing on robust leisure travel demand, airlines are investing in advanced analytics to optimize route performance and profitability. This strategic emphasis on data-driven decision-making supports consistent margin expansion and structural cash generation.

Asia Pacific Market Insights

Asia Pacific is anticipated to garner a significant market share from 2025 to 2035, driven by rapid urbanization and a burgeoning middle class. As air travel demand surges, airlines are investing in advanced analytics to optimize route planning and enhance profitability. The integration of AI and machine learning technologies enables carriers to forecast demand accurately and adjust routes dynamically, catering to the evolving needs of both business and leisure travelers.

In China, domestic airlines are expanding their international presence, capitalizing on strategic advantages such as access to Russian airspace, which reduces flight times and operational costs. This expansion necessitates sophisticated route profitability software to manage complex international networks and maintain competitive pricing. The top carriers in China are leveraging technology to identify profitable routes and optimize fleet utilization.

The airline route profitability software market in South Korea is expanding due to the consolidation of major carriers, notably Korean Air’s acquisition of Asiana Airlines. This merger necessitates sophisticated software solutions to manage the integrated network efficiently and ensure route profitability. Additionally, low-cost carriers like T’way Air are introducing long-haul routes, such as Seoul to Frankfurt, requiring advanced analytics to assess and optimize the financial viability of these new services. The government’s investment in airport infrastructure, including the expansion of Incheon International Airport, further supports the need for robust profitability software to manage increased air traffic and operational complexity.

Airline Route Profitability Software Market Players:

- Sabre Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- SAP SE

- Amadeus IT Group SA

- Lufthansa Systems

- Oracle Corporation

- SITA

- General Electric Company

- AIMS INTL DWC LLC

- The Boeing Company

- PROS Holdings, Inc.

The airline route profitability software market is highly competitive, with key players leading innovation through AI-driven analytics and modular platforms. These companies dominate by offering scalable solutions that integrate seamlessly with airline operations and legacy systems. Here are some leading players in the market:

Recent Developments

- In March 2025, Vietnam Airlines teamed up with Sabre Corporation to use its network planning and optimization technology. This move supports Vietnam Airlines' plans to grow internationally, with new routes already added to places such as the US, Germany, India, Italy, and the Philippines, and Europe, the US, Canada, Australia, and Asia.

- In March 2025, RDC Aviation and Awery Aviation Software formed a new partnership. RDC will provide airport charge data from over 3,000 airports through its AirportCharges platform, which will be linked with Awery’s business software platform.

- Report ID: 1649

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airline Route Profitability Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.