Silver Cyanide Market Outlook:

Silver Cyanide Market size was over USD 310.8 Million in 2025 and is poised to exceed USD 482.66 Million by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of silver cyanide is estimated at USD 323.39 Million.

The growth of the market can be attributed to the increasing demand for silver plating in various industries. Silver cyanide is the most important component in the silver plating process that enhances the durability, conductivity, and saves the product from corrosion & also makes them water resistant. Silver plating is a simple process of providing the coating of silver on a material. This process offers a variety of properties such as protection from corrosion to the base material, lower cost, and superior finish to the material. The application of silver cyanide in silver plating has been witnessed by multiple patents across the world. In 2021, a patent was filed for a silver plating process using silver cyanide and potassium hydroxide specifically designed for use in the manufacture of flexible electronics.

Additionally, silver cyanide is widely used in metal surface treatment and also in research activities that are estimated to propel the growth of this market in the forecast period. The main purpose of silver cyanide in the metal surface treatment process is to transform the chemical and physical properties of the product. Anyhow, owing to its highly toxic nature it is gradually being changed with other chemicals in metal plating applications. The metal surface treatment segment is expected to hold a revenue of USD 13 billion by the end of 2023.

Key Silver Cyanide Market Insights Summary:

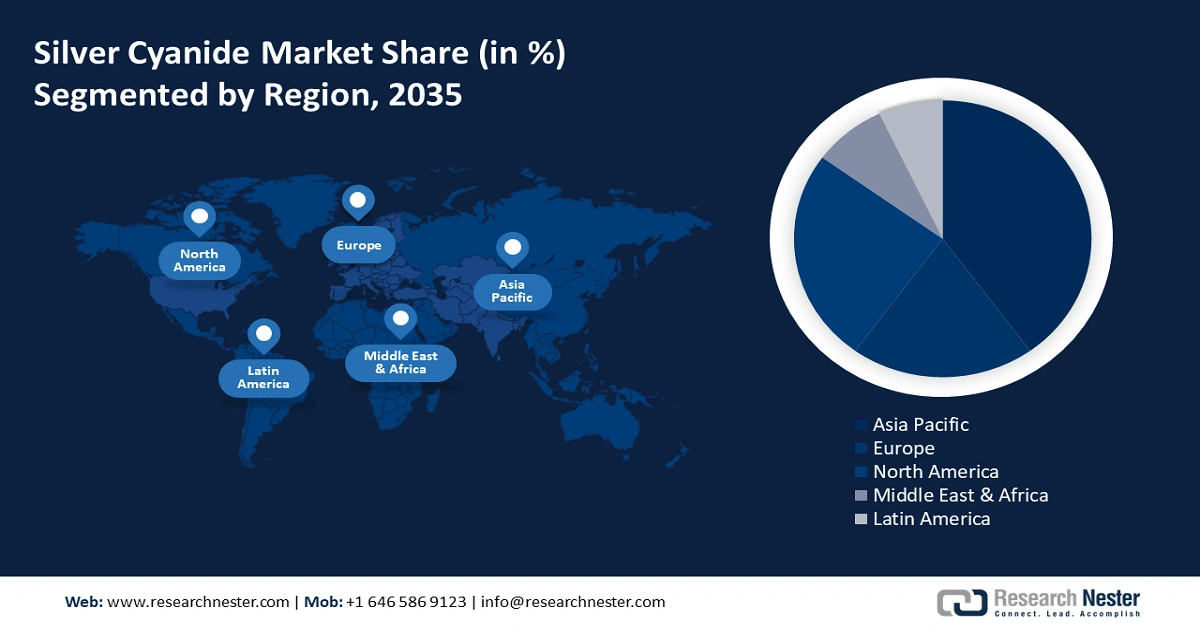

Regional Highlights:

- Asia Pacific’s silver cyanide market will dominate over 43% share by 2035, fueled by increasing demand for silver cyanide in electronics and chemicals industries.

- North America market will register significant growth during the forecast timeline, attributed to growing demand for silver cyanide in pharmaceutical and medical industries.

Segment Insights:

- The silver plating segment in the silver cyanide market is forecasted to achieve the highest market share by 2035, driven by the rising use of silver plating across electronics, jewelry, and manufacturing industries.

- The solid segment in the silver cyanide market is expected to hold the largest share by 2035, fueled by solid silver cyanide's diverse use in electronics and chemical manufacturing.

Key Growth Trends:

- Rise in Automotive Industry

- Expansion in Chemical Industry

Major Challenges:

- The highly Toxic Nature of the Chemical

- Increased Concern about Health Issues Owing to the Chemical

Key Players: American Elements, Umicore, Mahavir Expochem Ltd., Thermo Fisher Scientific, SAXONIA Edelmetallie GmbH, TANAKA Holdings Co., Ltd., Alfa Aesar, Anhul Shuguang Chemical Group, DuPont and Dow, Metalor Technologies SA.

Global Silver Cyanide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 310.8 Million

- 2026 Market Size: USD 323.39 Million

- Projected Market Size: USD 482.66 Million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Silver Cyanide Market Growth Drivers and Challenges:

Growth Drivers

- Rise in Automotive Industry – The usage of silver cyanide in silver plating of automotive parts provides numerous benefits such as excellent corrosion resistance to the base material, superior finish, and lower costs. The expansion of the automotive industry is thus estimated to fuel market growth. As per recent statistics, it was calculated that around 67 million units of vehicles were sold internationally in 2021, and around 56 million units were produced in 2020.

- Expansion in Chemical Industry – In 2021, a total of USD 2.2 billion value was generated from global chemical imports.

- Soaring Expenditure in Advanced Chemicals and Materials Industry – Growing spending on the research and development of the advanced chemicals and material industry is another factor estimated to propel the growth of this market in the upcoming times. In 2019, the global research and development expenditure spending on the advanced materials and chemicals industry was USD 42 billion in 2019.

- Rise in Disposable Personal Income – As the disposable personal income and salary of people tend to increase the demand for silver plating and metal plating increases which raises the market growth of the market. In 2021, the disposable personal income of Americans was approximately USD 16 trillion and the per capita income was calculated to be USD 47, 760.

Challenges

- The highly Toxic Nature of the Chemical – Silver cyanide application can be seen in multiple end-user industries. However, there are some limitations associated with silver cyanide that might pose restrictions on the growth of this market. Silver cyanide is highly toxic and restricts the market from growing in the forecast year. It is a harmful chemical compound that can cause harmful health issues such as serious allergies or acute poisoning.

- Increased Concern about Health Issues Owing to the Chemical

- Stringent Rules by the Government

Silver Cyanide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 310.8 Million |

|

Forecast Year Market Size (2035) |

USD 482.66 Million |

|

Regional Scope |

|

Silver Cyanide Market Segmentation:

Application Segment Analysis

The silver cyanide market is segmented and analyzed for demand and supply by application into electronic components, silver plating, metal surface treatment, chemicals & salts, and research. Out of these, the silver plating segment is expected to garner the highest revenue by 2035, owing to its increased usage of silver plating across diverse end-use industries such as electronics, manufacturing, laboratory, and chemicals. The growth of the global electronics industry is calculated to be 6% in 2020. They are increasingly used for silver plating of musical instruments, power generators, utensils, jewelry, and several other products. The revenue generated by the global musical instruments segment amounts to USD 39 billion in 2022.

Form Segment Analysis

The market is segmented and analyzed for demand and supply by form into solid, and powder. Amongst these, the solid segment is anticipated to hold the largest market share in the forecast period. This can be attributed owing to the wide range of applications of this segment in the end-user industries. Additionally, solid silver cyanide usage can be widely seen in the manufacturing of electrical components, chemicals, and other salts which is estimated to propel the growth of this segment in the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Purity |

|

|

By Form |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Silver Cyanide Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 43% by 2035. This can be ascribed owing to the increasing demand for silver cyanide for various applications, lax government regulations, and the presence of leading market players. Sales of silver cyanide are growing at a significant pace across countries like China and India owing to the rapid growth of end-use industries including electronics and chemicals. Silver cyanide application can be widely seen in the process of silver plating in automobiles component, jewelry, utensils, and other products in order to protect them from corrosion, increase their self-life, and improve their aesthetics. China was the largest market worldwide with electronic industry revenue of around 1.6 trillion euros in 2021. Further, the high investment of expenditure in research and development (R&D) in the region is another growth factor. Rising demand for silver coating from industries such as kitchen utensils, automotive, metal, jewelry, electronics, and home accessories is estimated to drive the growth of the market in the forecast period.

North American Market Insights

On the other hand, the market in the North American region is anticipated to witness significant market growth by the end of 2035. The growth of this market can be attributed owing to the growing demand for silver cyanide in the pharmaceutical and medical industries in this region. Additionally, the demand for silver cyanide in the industrial application is also expected to offer lucrative growth opportunities for the market in the North American region in the forecast period. Developed nations such as the United States and Canada are receiving strong demand for silver plating from across various industries this in turn is expected to propel the growth of the market in this region. As the disposable income of people is growing along with changing lifestyle patterns people in the region especially women are spending more on silver-coated ornaments and kitchen utensils, this further is giving rise to the demand for the silver cyanide market in this region.

Europe Market Insights

The market in Europe region is estimated to witness noteworthy market growth in the forecast period. The growth of this market can be attributed owing to the growing demand for silver cyanide in multiple end-user industries such as automotive, aerospace, pharmaceuticals, medical, and others. Similarly, increasing demand for silver cyanide in the ornaments and home accessories industry is estimated to drive the growth of this market in the European region in the forecast period.

Silver Cyanide Market Players:

- American Elements

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Umicore

- Mahavir Expochem Ltd.

- Thermo Fisher Scientific

- SAXONIA Edelmetallie GmbH

- TANAKA Holdings Co., Ltd.

- Alfa Aesar

- Anhul Shuguang Chemical Group

- DuPont and Dow

- Metalor Technologies SA

Recent Developments

- Thermo Fisher Scientific enters into a partnership with biotech incubator LabShares Newton to provide support to the biotech ecosystem in Boston. Through the collaboration, the partners will provide instruments, lab equipment, and consumables to help early-stage life sciences companies.

- DuPont and Dow inaugurated the new DuPont Liveo Healthcare Solutions. This new facility is expected to expand the capacity for biopharmaceutical tubing extrusion to meet increased demand from Liveo customers.

- Report ID: 4293

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Silver Cyanide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.