Short-Term Rental Market Outlook:

Short-Term Rental Market size was over USD 140.08 billion in 2025 and is poised to exceed USD 408.63 billion by 2035, witnessing over 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of short-term rental is estimated at USD 154.33 billion.

The primary growth driver of the short-term rental market is the increasing demand for diverse and personalized travel experiences. Travelers increasingly seek unique, home-like accommodations and local experiences that traditional hotels often cannot provide. Moreover, the proliferation of online booking platforms has made it easier for travelers to find and book short-term rentals and for hosts to list their properties. There is a growing preference for lodging away from home driving the short-term rental market. Short-term rentals offer a diverse array of property types from city apartments and suburban homes to unique stays. Travelers can immerse themselves in local neighborhoods and cultures, enhancing their overall experience.

The Consumer Price Index (CPI) which measures changes in the average prices paid by consumers for goods and services over time is a key indicator of inflation and can influence the short-term rental market. For instance, according to the U.S. Bureau of Labor Statistics, relative importance (percent of the CPI weight) was 1.338 as of December 2023 and the CPI for the current year is 189.209 (as of August 2024). Investors in short-term rentals may monitor CPI to gauge economic health and potential returns. A stable or low CPI might signal a favourable economic environment for investing in or managing short-term rentals.

Key Short-Term Rental Market Insights Summary:

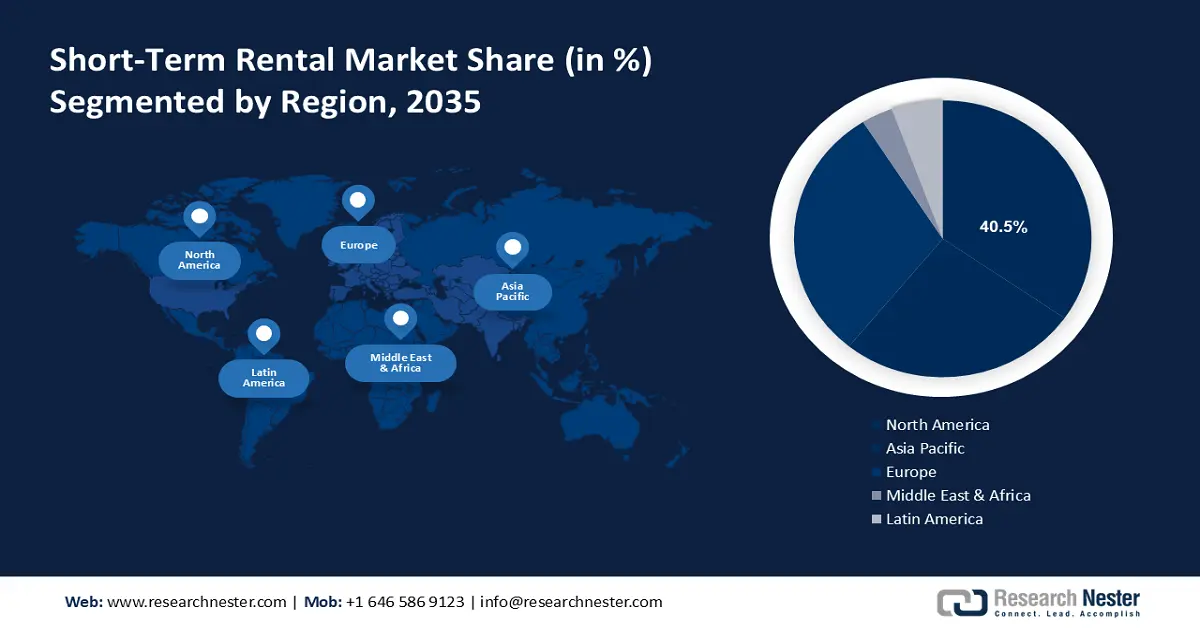

Regional Highlights:

- North America short-term rental market will account for 40.50% share by 2035, driven by a rise in travelers and start-up participation.

- Asia Pacific market will capture a 30.50% share by 2035, driven by rising tourism and digital platform adoption.

Segment Insights:

- The online/platform-based segment in the short-term rental market is expected to achieve a 65.50% share by 2035, influenced by the integration of AI and secure payment gateways in booking platforms.

- The home segment in the short-term rental market is anticipated to experience significant growth till 2035, driven by convenience, comfort, and cost-saving features for travelers.

Key Growth Trends:

- Profitable effect of remote work culture

- Effective role of artificial intelligence (AI) and machine learning (ML) in short-term rental platforms

Major Challenges:

- Rising competitiveness

- Economic uncertainty

Key Players: Airbnb, Inc., Booking Holdings Inc., Expedia Group, Inc., Vrbo (HomeAway), TripAdvisor, Inc., HomeToGo GmbH, Holidu GmbH, Sykes Holiday Cottages, Vacasa, Inc., Sonder Holdings Inc.

Global Short-Term Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 140.08 billion

- 2026 Market Size: USD 154.33 billion

- Projected Market Size: USD 408.63 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, France, Spain, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Short-Term Rental Market Growth Drivers and Challenges:

Growth Drivers

- Profitable effect of remote work culture: The emergence of remote work culture is driving high demand for rental properties in various locations, fuelling the use of online booking platforms. Remote jobs benefit employees to work from anywhere, as a result, they are no longer tied to cities and can choose their residence locations based on personal preferences such as climate and affordability. This shift in work culture is benefitting all customers, property owners, and short-term rental platform providers. Globally, the percentage of remote employees has increased dramatically in recent years, from 20% in 2020 to 28% by 2023.

- Effective role of artificial intelligence (AI) and machine learning (ML) in short-term rental platforms: AI and ML are core branches of computer science, and their integration in short-term rental platforms is set to offer a more customized and flexible advantage to both hosts and customers. The AI and ML algorithms analyze market trends, local events, seasonal demand, and historical booking to optimize pricing. This aids hosts in adjusting their rates in real-time and maximizing revenue while remaining competitive. For instance, a Berlin-based deep learning company AristanderAI uses AI and ML algorithms to aid short-term rental businesses in making effective pricing decisions.

Challenges

- Rising competitiveness: The proliferation of short-term rental platforms and the increasing number of service providers are making the market highly competitive. This saturation is expected to drive down the rental process and make it more difficult for new entrants to succeed. Also, several cities have strict regulations on short-term rentals such as zoning restrictions and registration requirements, which may hamper the short-term rental market growth to some extent.

- Economic uncertainty: Economic downturns such as inflation and unemployment have high impacts on travel budgets and discretionary spending of individuals, which can limit the demand for short-term rentals.

Short-Term Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 140.08 billion |

|

Forecast Year Market Size (2035) |

USD 408.63 billion |

|

Regional Scope |

|

Short-Term Rental Market Segmentation:

Booking Mode Segment Analysis

Online/platform-based segment is projected to hold short-term rental market share of more than 65.5% by 2035. Online short-term rental platforms offer a variety of options from budget-friendly to premium stays aiding customers to make informed decisions in real time. The integration of AI and other digital technologies is also expected to drive the adoption of advanced online short-term rental booking platforms.

Nowadays, several online booking platforms offer a secure payment gateway, which increases their reliability and goodwill in the short-term rental market. In March 2020, the European Commission signed an agreement with Booking, Expedia Group, Airbnb, and Tripadvisor, four major online collaborative economy platforms, allowing Eurostat to compare guest nights spent in short-stay accommodations offered via online platforms starting in 2018. In 2023, 719 million guest nights were spent in accommodation booked via the four online platforms, compared to 597 million in 2022 and 364 million in 2021.

Accommodation Type Segment Analysis

In short-term rental market, home segment is anticipated to account for revenue share of around 46.5% by 2035. Convenience, comfort, security, and privacy are major factors promoting the demand for short-term rental homes. The increasing number of family travelers is expected to push the demand for short-term rental homes in the coming years. Short-term rental homes come with kitchens that further help save on dining expenses, leading to their high adoption rates.

Our in-depth analysis of the global market includes the following segments:

|

Accommodation Type |

|

|

Booking Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Short-Term Rental Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 40.5% by 2035, owing to a rise in the number of travelers in the region. The emergence of start-up companies and the existence of established competitors are benefitting the market growth. For instance, PriceLabs is one of the popular cloud-based software solutions for vacation and short-term rentals.

The U.S. short-term rental market is expected to grow at halthy CAGR through 2035. The rise in social media influencers and travel bloggers in the U.S. is promoting short-term rental adoption. Experiences shared by these communities’ aid customers to make informed decisions and also promote the businesses of service providers owing to their positive reviews.

In Canada, particularly Vancouver, Toronto, and Montreal are major tourism hubs attracting visitors for leisure and business purposes, leading to high demand for short-term rental accommodations in the coming years. As per the analysis by Statistics Canada, short-term rentals play a vital role in driving the accommodation services subsector's growth in the country, the share revenues increased from 7% in 2017 to 15.2% by 2021.

APAC Market Insights

By the end of 2035, Asia Pacific short-term rental market is likely to account for more than 30.5% share, owing to rising tourism activities in the region. India, China, Japan, South Korea, and Australia are some of the most profitable marketplaces in the region. The Australian Bureau of Statistics revealed that till July 2024, around 6, 58,970 short-term visitors arrived in the country, a rise of 5.4% compared to the past year.

In India, the demand for vacation rentals is foreseen to increase at a CAGR of 4.5%. The advancements in digital platforms and online booking systems are making traveling and renting easy for tourists in India. India’s rich cultural heritage, diverse landscapes, and popular tourist destinations such as Goa, Jaipur, and Kerala are attracting both domestic and international travelers, fuelling the use of online short-term rental platforms. For instance, the vacation rental user penetration rate is estimated to rise from 3.8% in 2024 to 5.4% by 2029 in India.

Short-Term Rental Market Players:

- Airbnb, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Booking Holdings Inc.

- Expedia Group, Inc.

- 9flats.com PTE Ltd.

- Hotelplan Management AG

- MakeMyTrip Pvt. Ltd.

- Tripadvisor, Inc.

- Wyndham Destinations, Inc.

- NOVASOL A/S

- Oravel Stays Private Limited

- Meredith Hospitality Brands

- Arrived

Key players in the short-term rental market are adopting strategies such as digital marketing, advanced software tools, partnerships, and flexible booking policies to attract a wider consumer base and stay competitive in the market. Leading companies are building a strong online presence through social media, targeted advertisements, and engaging content. They are also collaborating with local businesses for cross-promotions and offering discounts and exclusive experiences to attract more bookings.

Some of the key players include:

Recent Developments

- In May 2023, MakeMyTrip announced its collaboration with Microsoft Corporation to make its platform more accessible to customers across India using generative AI. Customers now can initiate voice-assisted booking through any Indian language.

- In March 2022, Meredith Hospitality Brands, announced this week that its flagship brand, Meredith Lodging, acquired Mt Hood Vacation Rentals. This move by the company is set to expand its product folio, offering mountain homes and cabins to its customers.

- In December 2022, Arrived a real estate investment platform announced its entrance into the short-term vacation rental business. The growing demand by its customers for short-term rental accommodations grabbed the attention of Arrived to enter into this market.

- Report ID: 6437

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Short-Term Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.