Property Management Software Market Outlook:

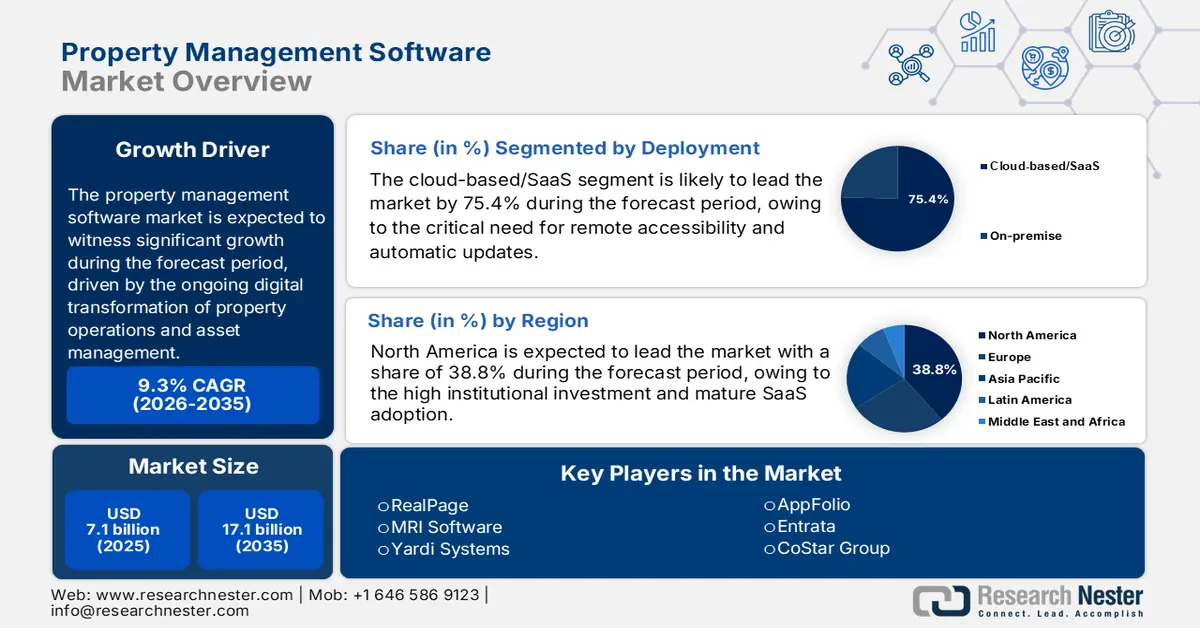

Property Management Software Market size was valued at USD 7.1 billion in 2025 and is projected to reach USD 17.1 billion by the end of 2035, rising at a CAGR of 9.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of property management software is assessed at USD 7.7 billion.

Based on the authoritative U.S. government and non-profit organization data, the property management software market is a significant and expanding sector within the broader real estate technology landscape. The market’s expansion is fundamentally driven by the ongoing digital transformation of property operations and asset management, a trend stimulated by the pandemic’s impact on remote work and tenant interaction models. This growth is the substantial scale of the managed real estate sector itself; for instance, the report from the Data.gov report in March 2024 indicates that the federally assisted multifamily housing portfolio encompasses over 1.4 million housing units, representing a vast operational base requiring compliance and management tools. The growth of the market is also driven by the stricter regulatory oversight and expanding public-sector digital modernization mandates.

Besides, the U.S. Department of Housing and Urban Development allocated USD 70.07 billion in 2024 toward rental assistance, public housing operations, and housing voucher programs, based on the NAHB March 2024 data, all of which require standardized reporting, income verification, and audit-ready documentation functions that favor digitized property management workflows. Similar things are witnessed in Europe, where some EU households live in rented dwellings, with the urban rental density highest in Germany, France, and the Netherlands, reinforcing the demand for scalable property administration platforms across the portfolios. These public-sector funding mechanisms and high-density rental economies create a stable, policy-driven demand floor for specialized software that ensures compliance and operational efficiency at scale.

Key Property Management Software Market Insights Summary:

Regional Highlights:

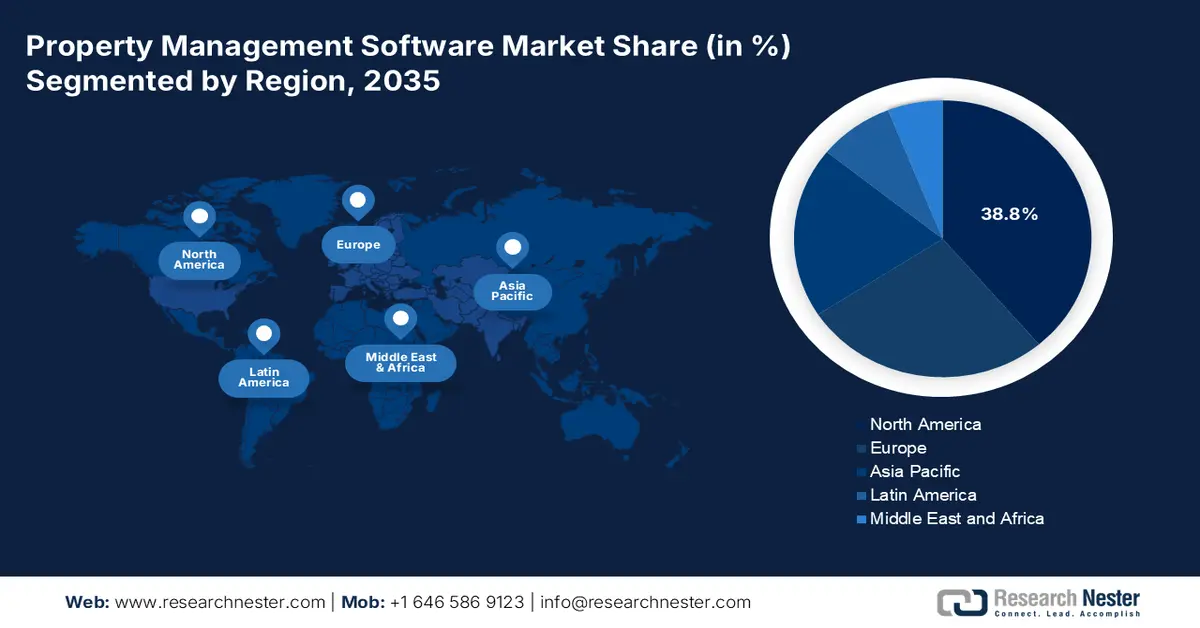

- North America is expected to hold a 38.8% share by 2035, driven by high institutional investment, mature SaaS adoption, and complex regulatory mandates.

- Asia Pacific is projected to grow at a CAGR of 10.2% during 2026–2035, impelled by rapid urbanization, government-led digitalization, and professionalization of real estate management.

Segment Insights:

- The cloud-based/SaaS sub-segment is projected to hold a 75.4% share by 2035, propelled by the critical need for remote accessibility, automatic updates, and lower total cost of ownership.

- The software/solution sub-segment is set to dominate the component segment by 2035, impelled by the expansion of integrated platforms combining property management with ancillary functions.

Key Growth Trends:

- Growth of institutional investment in residential real estate

- Rising urban rental density and multifamily construction

Major Challenges:

- High market consolidation and dominance of incumbents

- Data security, privacy, and regulatory compliance burden

Key Players: MRI Software (U.S.), Yardi Systems (U.S.), AppFolio (U.S.), Entrata (U.S.), CoStar Group (U.S.), Trimble (U.S.), SAP (Germany), Oracle (U.S.), IBM (U.S.), Accruent (U.S.), Planon (Netherlands), JLL (Juniper) (U.S.), RMS (Australia), Console (Australia), Property Tree (Australia), Sansan (Japan), Lefull (South Korea), Facilio (India), Tibil Solutions (Malaysia).

Global Property Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.1 billion

- 2026 Market Size: USD 7.7 billion

- Projected Market Size: USD 17.1 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, India, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 5 January, 2026

Property Management Software Market - Growth Drivers and Challenges

Growth Drivers

- Growth of institutional investment in residential real estate: The rise of the institutional landlords, such as the Real Estate Investment Trusts and large private equity funds, demands enterprise-grade software for portfolio scalability. The National Association for Real Estate Investment Trusts reports that the U.S. residential REITs alone held assets worth over USD 2.5 trillion in assets. Managing these vast geographically dispersed portfolios requires a centralized platform for financial consolidation, performance analytics, and standardized operations. This trend shifts the market from serving fragmented mom and pop owners to catering to advanced entities for whom software is a critical operational backbone, driving the demand for advanced integrated systems over basic tools.

- Rising urban rental density and multifamily construction: Urbanization-backed public infrastructure investment is increasing the concentration of multifamily rental properties, directly amplifying property management software demand. The report from the NAHB July 2025 indicates that 608,000 multifamily units were completed in 2024, the highest level, with 54% delivered in high-density buildings containing 50 or more units. Notably, 95% of these completions were built for rent, reinforcing long term administrative and compliance worlds. High-density rental portfolios significantly increase the need for scalable rent management, maintenance, coordination, regulatory reporting, and tenant data control, making software adoption a functional requirement rather than a discretionary efficiency tool.

- Expansion of build to rent and single-family rental sectors: The rapid institutionalization of single-family home rentals creates a new software-intensive asset class. These portfolios are physically dispersed, making centralized management impossible without robust mobile-enabled technology. The scale is significant according to the NHC in December 2023. Institutional investors owned approximately 3% of all single-family rentals in 2023, a share that is growing. This model demands specialized property management software features such as distributed maintenance coordination, decentralized leasing, and portfolio-wide performance dashboards customized to scattered site management, representing a high-growth niche for software providers. This necessitates specialized geospatial and workflow automation tools within the PMS, directly fueling the development of niche platforms designed explicitly for scattered-asset portfolio management.

Challenges

- High market consolidation and dominance of incumbents: New entrants face a market dominated by well-established integrated players in the market, such as RealPage and Yardi, which create significant barriers to entry in the market. For example, the MRI Software has grown via many acquisitions in the past decade to expand its suite and market share. This consolidation makes it difficult for new suppliers to gain a foothold without substantial capital. The top players in the property management software control the core market for the large multifamily properties, creating a highly concentrated competitive landscape.

- Data security, privacy, and regulatory compliance burden: Suppliers must navigate a complex web of regulations such as the GDPR, CCPA, and varying local housing laws, which increases the development costs and liability. Further, the Top companies invest heavily in dedicated compliance teams and SOC 2 Type II certifications to build trust. The intricate and evolving global regulatory landscape makes data security and compliance a foundational, non-negotiable cost of entry that disproportionately burdens the new market entrants.

Property Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 7.1 billion |

|

Forecast Year Market Size (2035) |

USD 17.1 billion |

|

Regional Scope |

|

Property Management Software Market Segmentation:

Deployment Segment Analysis

The cloud-based/SaaS sub-segment is the dominant one in the deployment segment in the property management software market and is projected to hold a share value of 75.4% by 2035. The segment is fueled by the critical need for remote accessibility, automatic updates, and lower total cost of ownership compared to on-premises solutions. The shift was massively stimulated by the pandemic, proving essential for property managers to operate off-site. A significant driver is the formal adoption of cloud-first policies by government entities, which validates the model’s security and efficiency. According to the report from the Urban Network in 2025, the IT spending on cloud computing is set to grow from 9.1% in 2020 to 14.2% by 2024. This data demonstrates a clear and stimulating trend that influences the broader market, including real estate technology partners.

Component Segment Analysis

Within the component segment, the software/solution sub-segment commands the largest revenue share in the market, consistently accounting for the majority of market value. The services, such as the implementation and support, are vital for deploying the core intellectual property, and recurring license or subscription fees from the software platform itself generate the primary revenue stream. The growth of this sub-segment is closely tied to the expansion of integrated platforms that combine property management with the ancillary functions, such as payment processing and smart home controls. The statistical evidence of this sector’s digital transformation can be seen in broader business trends. The businesses in real estate and the rental and leasing sector are actively utilizing digital transformation, which is a clear indicator of the foundational role software solutions now play in the industry’s operational backbone.

Organization Size Segment Analysis

The large enterprises are the primary revenue driver in the organization size segment in the property management software market. These entities, such as Real Estate Investment Trusts and national management firms, operate vast geographically dispersed portfolios, creating a complex need for centralized, scalable, and feature-rich software systems. Their substantial budget allows for investment in comprehensive enterprise-level platforms that integrate with other business systems. The economic weight and digital adoption of the large firms in this sector are substantiated by government data. The U.S. Bureau of Labor Statistics report for the real estate sector highlights that the larger establishments have consistently higher output and are more capital-intensive. The report form the Ascendix in February 2025 has indicated that the 88% of the of real estate firms plan to use digital tech for performance.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Application |

|

|

Component |

|

|

End user |

|

|

Organization Size |

|

|

Functionality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Property Management Software Market - Regional Analysis

North America Market Insights

The North America is dominating the property management software market and is expected to hold the revenue share of 38.8% by 2035. The market is driven by high institutional investment, mature SaaS adoption, and complex regulatory mandates. Dominant drivers include the scale of institutional landlords such as REITs, which demand enterprise-grade software for portfolio management and substantial federal housing subsidies requiring compliant, auditable digital systems. A key trend is the rapid growth of the single-family rental and build-to-rent sectors, which rely on specialized software for managing geographically dispersed assets. Further, the demand is fueled by the energy benchmarking laws and local rent control ordinances, making compliance automation essential. The market is defined by vendor consolidation and a shift towards integrated platforms that serve as central operating systems connecting the property management with smart home, IoT, payment processing, and advanced data analytics for asset performance.

U.S. market is being defined by the structural growth in the rental housing alongside policy-driven administrative complexity. The report from Congress.gov in June 2025 has indicated that the highest level of multifamily units was completed in 2024, with 54% delivered in the high-density building of 50 or more units and 95% built for rent, materially expanding the operational scale of rental portfolios. At the policy level, the 2026 HUD budget proposal, as analyzed by the Congressional Research Service, restructures federal rental assistance into a 36.2 billion state rental assistance program, shifting program design and reporting responsibilities to states and local agencies. This transition, combined with a 17% reduction in HUD management and administration funding, increases reliance on digital systems to manage tenant eligibility, rent flows compliance, and audit readiness with constrained staffing.

HUD FY2026 Budget Request

|

Account |

FY2025 Enacted (USD billion) |

FY2026 Request (USD billion) |

% Change |

|

Salaries & Expenses (Mgmt/Adm) |

2.449 |

2.034 |

-17% |

|

State Rental Assistance (new) |

0.000 |

36.212 |

NA |

|

Tenant-Based Rental Assistance |

36.041 |

0.000 |

-100% |

|

Public Housing Fund |

8.811 |

0.000 |

-100% |

|

Project-Based Rental Assistance |

16.890 |

0.000 |

-100% |

|

Community Development Fund (CDBG) |

3.430 |

0.000 |

-100% |

|

Homeless Assistance Grants |

4.051 |

4.024 |

-1% |

|

Native American Programs |

1.344 |

0.887 |

-34% |

|

Housing for Elderly |

0.931 |

0.000 |

-100% |

|

Housing for Disabilities |

0.257 |

0.000 |

-100% |

Source: Congress.gov 2025

Canada’s property management software market is being structurally reinforced by the federal government’s housing supply expansion and rental affordability agenda under the budget 2024 and Canada’s Housing Plan, which targets 3.87 million new homes by 2031, including at least 2 million net new homes above baseline construction, based on the Government of Canada's April 2024 report. A large share of these additions is expected to be purpose-built rental and affordable housing, supported by over CAD 55 billion in low-cost financing via the Apartment Construction Loan Program, CAD 4.4 billion via the Housing Accelerator Fund, and extensive use of public lands and nonprofit partnerships. These initiatives shift delivery responsibility to provinces, municipalities nonprofits and housing providers increasing the need for standardized systems to manage the tenant eligibility, rent controls, subsidy compliance, asset performance, and multi-level reporting.

APAC Market Insights

Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 10.2% during the forecast period, 2026 to 2035. The market is driven by the unprecedented urbanization, massive government-led digitalization campaigns, and the rapid professionalization of real estate management. A core driver is the rise of institutional investment and the development of organized real estate investment trusts in markets such as India and Singapore, which demand transport, scalable, and audit-ready software platforms. In India, the Securities and Exchange Board of India has been actively reforming the REIT regulations to attract capital, directly increasing the demand for professional property management software. Further, the trend across the region is toward mobile-first, localized platforms that can handle complex lease structures, facilitate digital payments popular in each country, and integrate with smart building sensors for energy management.

The property management software market in China is dominated by the government-driven digitalization and the sheer scale of its real estate sector. The primary catalyst is the national Smart City and Digital China strategy, which mandates the integration of the technology into urban management and building operations. This creates compulsory demand for a platform that facilitates data collection, energy management, and community services. The report from the People’s Republic of China in October 2025 depicts that the real estate sector’s total output in 2024 reached 32.7 trillion yuan, representing a foundational economic activity that requires advanced management tools. Further, the leading platforms have evolved into comprehensive super apps merging property management with transaction services, smart home controls, and retail, creating a deeply integrated ecosystem that serves massive residential and commercial portfolios.

India’s market is experiencing explosive growth fueled by rapid urbanization, regulatory reform, and government-backed housing initiatives. The most significant demand driver is the Real Estate Act, which enforces project transparency, escrow accounting, and construction timelines, making a compliant software essential for developers. This regulatory push is amplified by the huge public investment in housing. According to the Government of India report in August 2025, Pradhan Mantri Awas Yojana dashboard, over 112.81 lakh houses are grounded, and 93.61 lakh are completed as of 2025. Managing this vast new affordable housing stock requires digital tools for allotment maintenance and community governance. The market trend is toward affordable, mobile-first SaaS solutions that cater to a fragmented base of developers and landlords, focusing on automation and RERA compliance.

Europe Market Insights

Europe market is poised for significant growth. This expansion is driven by the urban rental densities, robust regulatory compliance, and a wave of digital transformation in the real estate sector. A core demand driver is the substantial portion of the population living in rented accommodation, mainly in major economies such as France, Germany, and the Netherlands, which creates a vast, stable base for property administration platforms. Further, the European Union’s strong focus on data protection under the General Data Protection Regulation and various national energy efficiency directives compel the property owners and managers to adopt advanced software to ensure compliance, automate reporting, and manage smart building technologies. This market is also being defined by the professionalization of the rental sector and the entry of investors seeking a scalable, data-driven tool to manage the portfolio efficiently.

In the UK, the property management software market is propelled by the scale of operational identity of the rented housing sector, as indicated by the English Housing Survey report in July 2025. The data highlights that nearly 19% of the households in England live in rented accommodation, split between the private rented sector and social housing, together accounting for nearly 9 million households. The property management software alone accommodates nearly 4.9 million households characterized by shorter tenancies, higher tenant turnover, and frequent repair and compliance requirements. These conditions generate a continuous administrative workload across the rent collection, tenancy management, maintenance response tracking, and regulatory compliance. As landlords, housing associations, and managing agents scale portfolios amid tightening tenant protection and property standards, centralized digital systems become essential to manage volume, consistency, and audit readiness.

UK Rented Housing Segments

|

Rented Sector |

Estimated Size (Households) |

Market Relevance to Property Management Software |

|

Private Rented Sector (PRS) |

~4.9 million households |

High tenant turnover and landlord repair responsibility increase demand for automated leasing, maintenance, and workflow management |

|

Social Rented Sector |

~4.0 million households |

Regulated rents, long-term tenancies, and statutory reporting requirements drive adoption of structured, compliance-ready property data systems |

Source: Government of UK, July 2025

Germany represents Europe’s largest and most stable property management software market, fundamentally underpinned by its exceptionally high rental rate and institutional ownership structures. A key statistical driver is the market composition. The report from the Destatis in April 2025 indicated that nearlt 52.8% of the people in Germany live in rented accommodation in 2024. This creates an unparalleled addressable market for digitized management. The demand is heavily shaped by the rent index regulations and robust energy efficiency laws that require precise data reporting and tracking functions effectively handled by specialized software. The trend is toward advanced platforms that offer deep integrations for utility cost allocation, long-term maintenance planning, and digital communication portals to meet the high expectations of tenants and ensure the landlord's compliance with a complex legal framework.

Key Property Management Software Market Players:

- RealPage (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MRI Software (U.S.)

- Yardi Systems (U.S.)

- AppFolio (U.S.)

- Entrata (U.S.)

- CoStar Group (U.S.)

- Trimble (U.S.)

- SAP (Germany)

- Oracle (U.S.)

- IBM (U.S.)

- Accruent (U.S.)

- Planon (Netherlands)

- JLL (Juniper) (U.S.)

- RMS (Australia)

- Console (Australia)

- Property Tree (Australia)

- Sansan (Japan)

- Lefull (South Korea)

- Facilio (India)

- Tibil Solutions (Malaysia)

- RealPage is a dominant player in the property management software market, mainly for large-scale residential and multifamily operators. Its strategic initiative centers on creating an integrated AI-driven ecosystem that combines property management, leasing revenue management, and analytics. By leveraging vast datasets, RealPage provides predictive insights for pricing and operations, allowing clients to maximize profitability and resident retention via a single comprehensive platform.

- MRI Software holds a major global position in the property management software market, serving a diverse clientele across commercial, residential, and affordable housing sectors. Its strategic initiative is growth via strategic acquisition and open platform connectivity. MRI aggressively acquires data from accounting to occupancy analytics and integrates them into its flexible cloud-based ecosystem, enabling clients to connect best-in-class tools and create a custom tech stack.

- Yardi Systems is a foundational leader in the global property management software market, known for its deeply integrated end-to-end solutions for residential integration and investment in innovation. Yardi develops and controls its entire software suite from core property management and accounting to utility billing, payment processing, and procurement, ensuring seamless data flow and robust security through in-house R&D.

- AppFolio is a major disruptor in the property management software market, mainly targeting the residential and student housing sectors. Its core strategic initiative is leveraging intuitive design and automation to drive operational efficiency for property managers. AppFolio focuses on creating a user-friendly mobile-first platform that automates critical tasks, such as leasing, maintenance, and accounting, thereby reducing manual work, improving the tenant experience, and enabling managers to scale effectively. In 2024, the company made a cost of revenue of USD 282,067.

- Entrata is a leading integrated operating system within the property management software market with a strong focus on the multifamily industry. Its defining strategic initiative is platform unification and resident lifecycle management. The Entrata offers a fully native single long platform that connects every stakeholder from property staff to residents and owners, streamlining operations, payments, marketing, and communication into one cohesive system to enhance efficiency and resident satisfaction.

Here is a list of key players operating in the global market:

The global market is highly competitive and is fragmented, with the North America players such as RealPage and AppFolio holding significant market share due to the early SaaS adoption and scale. The landscape features a mix of large, integrated real estate technology suites and agile, niche-focused platforms. The key strategic initiatives include aggressive mergers and acquisitions to consolidate the market position and expand the product portfolios, heavy investment in AI and IoT for predictive maintenance and analytics, and a strong push toward vertical-specific solutions for residential, commercial, and vacation rentals. For example, in October 2025, MRI Software acquired Proptech Labs to deliver all-in-one property management solutions across Australia and New Zealand. The expansion into the international markets, mainly Europe and Asia Pacific, and strategic partnerships with payment processors and utility providers are also common tactics to enhance the platform stickiness and ecosystem value.

Corporate Landscape of the Property Management Software Market:

Recent Developments

- In September 2025, MagicDoor has closed a USD 4.5 million seed round, marking a major milestone in our mission to bring true AI automation to property management. This funding fuels for rapid growth and bold product innovation.

- In February 2025, CoStar Group announced that it has completed the acquisition of Matterport, ushering in a new era of 3D digital twins and AI-powered real estate, driving the growth of digital twin technology across the global commercial and residential real estate sector.

- In January 2025, Volaris Group, has announced that it has acquired agentOS Proptech Group, a leading provider of property management software solutions across the UK. This acquisition extends Volaris Group’s commitment to supporting long-term growth in property management technology.

- Report ID: 4404

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Property Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.