Real Estate Crowdfunding Market Outlook:

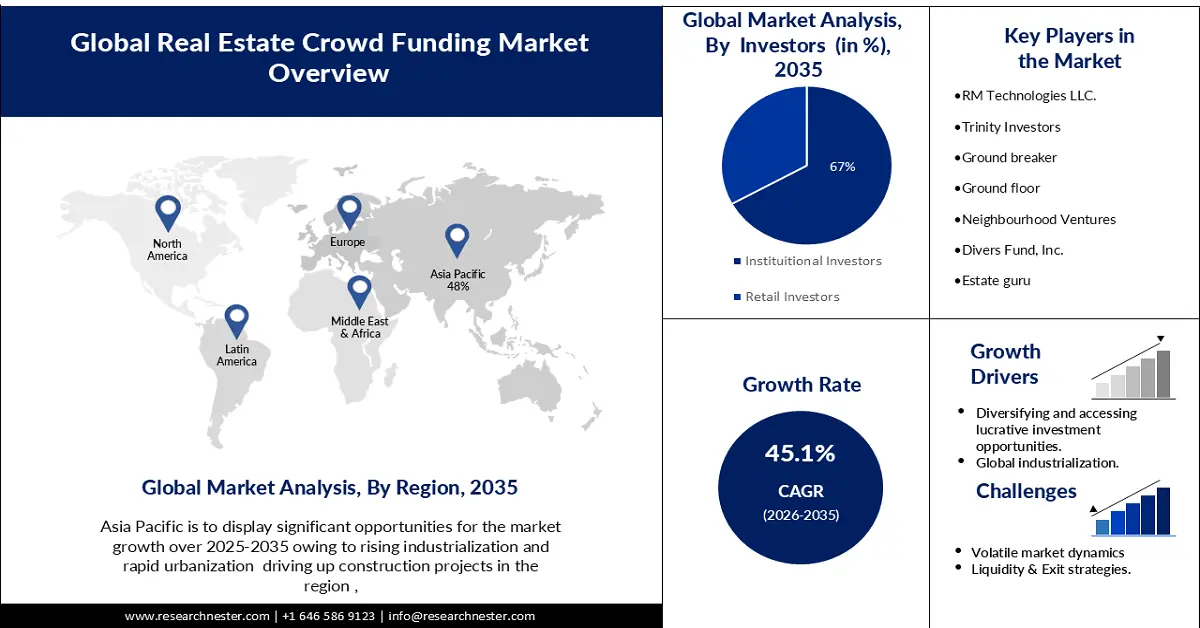

Real Estate Crowdfunding Market size was valued at USD 22.1 billion in 2025 and is likely to cross USD 914.25 billion by 2035, registering more than 45.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of real estate crowdfunding is assessed at USD 31.07 billion.

One of the main factors expected to drive market growth over the forecast period is global industrialization, which is driving commercial real estate activities, as well as favorable regulations on real estate crowdfunding in several countries around the world. Furthermore, growth in the market is expected to be driven by an increasing trend of bitcoin investment & cryptocurrencies. Bitcoin price is expected to increase to USD 1 billion by 2036, rendering more investments and driving the market forward.

Property crowdfunding platforms enable investors to be more transparent and in control of their investments and provide individuals with a diversified portfolio, with a success rate of 61%, which is expected to garner a significant market share over the forecast period.

Key Real Estate Crowdfunding Market Insights Summary:

Regional Insights:

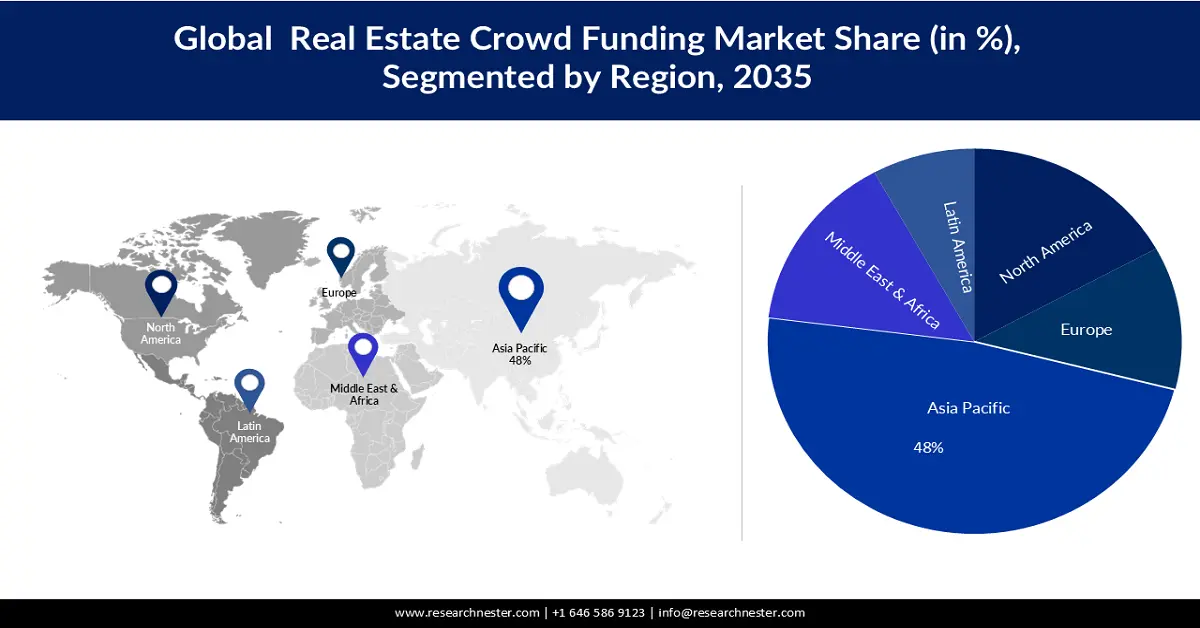

- By 2035, the Asia Pacific region is expected to secure a 48% share of the Real Estate Crowdfunding Market, sustained by rising industrialization, rapid urbanization, and increasing adoption of digital payment technologies.

- Europe is anticipated to hold a 33% share by 2035, supported by its diverse mix of established and emerging real estate investment markets.

Segment Insights:

- By 2035, institutional investors are projected to account for a 67% share of the Real Estate Crowdfunding Market, propelled by expanding allocations from insurance companies and pension funds.

- The residential segment is set to retain a dominant revenue share by 2035, facilitated by lower investment risk and simplified market entry for participants.

Key Growth Trends:

- Prevalence of Blockchain Technology

- Increase in Construction Activities

Major Challenges:

- Platform risks and due diligence

Key Players: RM Technologies LLC., Trinity Investors, Groundbreaker, Groundfloor, Neighborhood Ventures, DiversyFund, Inc., Estateguru, AHP Servicing LLC, crowdestate.eu, Fundrise, LLC.

Global Real Estate Crowdfunding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.1 billion

- 2026 Market Size: USD 31.07 billion

- Projected Market Size: USD 914.25 billion by 2035

- Growth Forecasts: 45.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Brazil, United Arab Emirates, Singapore

Last updated on : 19 November, 2025

Real Estate Crowdfunding Market - Growth Drivers and Challenges

Growth Drivers

- Prevalence of Blockchain Technology - With the use of Blockchain technology, transactions in real estate have become more easy and rapid. In order to develop smart contracts and tokenization, blockchain technology is rapidly being used. The regulatory, decentralized listing of assets and property financing as well as the platform management are included in Blockchain real estate crowdfunding.

- Increase in Construction Activities - The sector of real estate has seen a substantial increase over the last few years, where there has been an increased number of business property developments including construction and other elements like clinics, apartments, or schools. The construction industry is estimated to constitute 13% of global GDP by 2030 as a result, it is becoming more and more necessary to set aside resources for promoting such events in order to promote the growth of crowdfunding platforms over the coming years.

- Diversifying and accessing lucrative investment opportunities- By investing in several real estate projects with a small amount of money, real estate crowdfunding allows investors to diversify their portfolios. Real estate crowdfunding platforms provides a platform for all individual irrespective of income, providing lucrative opportunities for all individuals

Challenges

- Platform risks and due diligence - There are a number of platforms available for financing real estate each with its own distinctive characteristics and features. However, there is uncertainty over the investment returns.

- Cyclical, and susceptible to a number of variables, including interest rates, and economic conditions.

- Lack of liquidity makes it difficult for investors to access their capital when needed.

Real Estate Crowdfunding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

45.1% |

|

Base Year Market Size (2025) |

USD 22.1 billion |

|

Forecast Year Market Size (2035) |

USD 914.25 billion |

|

Regional Scope |

|

Real Estate Crowdfunding Market Segmentation:

Investors Segment Analysis

Institutional investors are expected to hold 67% share of the global real estate crowdfunding market by 2035. Institutional investors continue to increase their investments in crowdfunding platforms, insurance companies, and pension funding, in particular. In recent years, institutional investors such as insurance companies and pension funds have become increasingly active in the global investment sector, accounting for 80% of the total market.

Real Estate Sector Segment Analysis

Real estate crowdfunding market from the residential segment is expected to hold a dominant revenue share 0ver the forecast period, covering properties that are mainly intended to be occupied for the purpose of housing, e.g. detached family homes, townhouses, duplexes, triplexes, and apartments with four or more occupants. This sector, as it enables investors to enter the market more easily and is less risky than others, has become one of the favorite sectors in the Crowdfunding Market for Real Estate.

Our in-depth analysis of the global market includes the following segments:

|

Investors |

|

|

Real Estate Sector |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Real Estate Crowdfunding Market - Regional Analysis

APAC Market Insights

The Asia Pacific region is expected to dominate the real estate crowdfunding market throughout the forecast period, accounting for a market share of 48%. Rising industrialization and rapid urbanization are driving up the number of construction projects undertaken by businesses in emerging countries in South Korea, India, and China. The market growth in the region is being driven by the adoption of new technologies like digital payment with a total transaction value of USD 4.7 trillion,

European Market Insights

The market for real estate crowdfunding is expected to garner a substantial market share over the forecast period. European countries offer a wide range of investment opportunities, from established real estate markets in Western Europe to emerging markets in Eastern Europe. This diversity leads to varying levels of adoption, accounting for 33% of real estate funding funding crowd-funding investments.

Real Estate Crowdfunding Market Players:

- Crowd Street, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RM Technologies LLC.

- Trinity Investors

- Ground breaker

- Ground floor

- Neighbourhood Ventures

- Divers Fund, Inc.

- Estate guru

- AHP Servicing LLC

- crowdestate.eu

- Undersell

Recent Developments

- Janaury, 2023- Neighbourhood Ventures, one of the largest real estate crowdfunding companies in the United States, announced the launch of N.V. REIT, an unprecedented national offering that enables qualified and nonaccredited investors with all levels of income to benefit from a new investment opportunity for their properties.

- October, 2022- Crowd Street, Inc., an award winning online real estate investment platform, announced that it has raised USD 43 million in equity and debt capital to support its growth and to make the market for online real estate investment.

- Report ID: 2874

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Real Estate Crowdfunding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.